Professional Documents

Culture Documents

Secretary of State Ruth Johnson's Anti-Fraud Task Force Issues Recommendations

Uploaded by

Michigan NewsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Secretary of State Ruth Johnson's Anti-Fraud Task Force Issues Recommendations

Uploaded by

Michigan NewsCopyright:

Available Formats

Secretary of State Ruth Johnson's anti-fraud task force issues

recommendations

SEPTEMBER 17, 2014

Secretary of State, Michigan State Police, prosecutors,

state officials and industry leaders outline 17 proposals

to fight auto insurance scams, protect drivers

LANSING, Mich. A task force launched by Secretary of State Ruth Johnson to fight auto insurance

scams today released its recommendations, which include proposals to streamline prosecution of

offenders, assist law enforcement in verifying insurance during traffic stops and crack down on

unlicensed insurance agents.

Johnson, along with her partners in the effort, formally received the recommendations and

commended the work of theFAIR (Fighting Auto Insurance Rip-offs) Task Force.

These proposals are the tools needed to help stop criminals who are preying on unsuspecting

Michigan drivers and help reduce the number of uninsured drivers on the road something we all

pay for, said Johnson. One of the biggest benefits of this effort is that were seeing more

cooperation, more communication than ever before on a problem that must be addressed. Ive been

honored to fight for Michigan drivers and will continue to do everything I can to make sure that

criminals cant take advantage of them.

The Task Force included representatives from the Secretary of States Office, the Michigan State

Police, the Michigan Department of Insurance and Financial Services, insurance industry leaders

and prosecutors.

Fraudulent insurance documents are used to deceive not only police officers, but also court clerks,

Department of State personnel, insurance carriers, and in some cases citizens who purchase what

they believe to be legitimate insurance policies, said MSP Director Col. Kriste Kibbey Etue. We

appreciate the dialog and information sharing that was started as a result of this task force and we

look forward to continuing to work with the Department of State and the insurance industry to reduce

auto insurance fraud in our state.

Recommendations range from administrative changes to potential legislative solutions and

strengthening partnerships. They include:

Intra-agency sharing of data, improved communication.

Additional fraud detection training for police and Secretary of State staff.

Improved technology for data analysis and tracking.

Johnson announced the creation of the independent panel last year after supporting a change in

law, which required all insurance companies to send electronic insurance verification to her office

twice a month, helped expose a significant amount of invalid insurance.

A one-day snapshot in July 2013 found more than 16 percent of insurance certificates presented that

day were invalid or fraudulent. The issue was not an urban one, with fakes and forgeries turning up

in more than half of Michigans 83 counties.

But the number of fraudulent or invalid certificates dropped by more than half in the latest sampling.

Johnson credited more staff training, tough new policies on cancelling plates and a public awareness

campaign for discouraging some fraudulent activity. According to Johnson, criminals have been

surprisingly sophisticated in selling fake auto insurance, setting up fake websites and even bogus

help desks where agents pretend to verify insurance policies. Some are large-scale operations:

Johnsons office shut down one auto dealer in southeast Michigan which was selling fake

certificates.

In 2013, a Michigan woman who sold more than 300 fake auto insurance policies to drivers

was charged with several felonies after being identified by Johnsons staff.

Earlier this year, a woman was charged with selling fake policies out of a church-owned

building in southeast Michigan. Police said she was making at least $30,000 a month selling

fake car insurance.

Johnson said its clear some drivers knowingly purchase bad insurance but others purchase

fraudulent policies and believe they are covered until they are in an accident and file a claim. She

said every honest Michigan motorist, required by law to carry no-fault insurance, has to pay the

costs of having uninsured motorists on the road.

###

For media questions, please call Gisgie Dvila Gendreau at 517-373-2520.

Customers may call the Department of State Information Center

to speak to a customer-service representative at 888-SOS-MICH (767-6424).

Editors Note: The FAIR Task Force Report is available online.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Schuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetDocument1 pageSchuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetMichigan NewsNo ratings yet

- Tuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedDocument2 pagesTuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedMichigan NewsNo ratings yet

- To Our Customers: DuMouchellesDocument1 pageTo Our Customers: DuMouchellesMichigan NewsNo ratings yet

- MPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsDocument2 pagesMPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsMichigan NewsNo ratings yet

- Michigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesDocument3 pagesMichigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesMichigan NewsNo ratings yet

- Detroit Crime Blotter For Thursday, March 21, 2018Document18 pagesDetroit Crime Blotter For Thursday, March 21, 2018Michigan NewsNo ratings yet

- Massage Therapist Summarily Suspended For Criminal Sexual ConductDocument1 pageMassage Therapist Summarily Suspended For Criminal Sexual ConductMichigan NewsNo ratings yet

- Lincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsDocument2 pagesLincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsMichigan NewsNo ratings yet

- Schuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesDocument2 pagesSchuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesMichigan NewsNo ratings yet

- Schuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsDocument3 pagesSchuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsMichigan NewsNo ratings yet

- ShootingsDocument4 pagesShootingsMichigan NewsNo ratings yet

- Lt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderDocument2 pagesLt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderMichigan NewsNo ratings yet

- Shots FiredDocument2 pagesShots FiredMichigan NewsNo ratings yet

- Michigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysDocument1 pageMichigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysMichigan NewsNo ratings yet

- $18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsDocument2 pages$18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsMichigan NewsNo ratings yet

- West Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsDocument1 pageWest Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsMichigan NewsNo ratings yet

- State Police Motor Carrier Officers Join Forces To Fight Human TraffickingDocument1 pageState Police Motor Carrier Officers Join Forces To Fight Human TraffickingMichigan NewsNo ratings yet

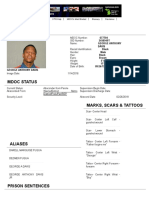

- Offender Tracking Information System (OTIS) - Offender ProfileDocument2 pagesOffender Tracking Information System (OTIS) - Offender ProfileMichigan NewsNo ratings yet

- Detroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDocument1 pageDetroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNo ratings yet

- 2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Document3 pages2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Michigan NewsNo ratings yet

- Southfield Physician's Controlled Substance License Summarily Suspended For OverprescribingDocument1 pageSouthfield Physician's Controlled Substance License Summarily Suspended For OverprescribingMichigan NewsNo ratings yet

- Detroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudDocument1 pageDetroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudMichigan NewsNo ratings yet

- DNR Deer Poaching Investigation Results in Sentencing of Allegan County ManDocument2 pagesDNR Deer Poaching Investigation Results in Sentencing of Allegan County ManMichigan NewsNo ratings yet

- Prosecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesDocument7 pagesProsecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesMichigan NewsNo ratings yet

- Livonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDocument2 pagesLivonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNo ratings yet

- Meijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseDocument2 pagesMeijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseMichigan NewsNo ratings yet

- West Nile Virus Found in Michigan Ruffed GrouseDocument6 pagesWest Nile Virus Found in Michigan Ruffed GrouseMichigan NewsNo ratings yet

- State Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Document2 pagesState Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Michigan NewsNo ratings yet

- Schuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionDocument2 pagesSchuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionMichigan NewsNo ratings yet

- Have You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawDocument3 pagesHave You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawMichigan NewsNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A.C. No. 5816Document2 pagesA.C. No. 5816Jumel John H. Valero100% (1)

- LEGAL ETHICS (Prob Areas) Digest CaseDocument3 pagesLEGAL ETHICS (Prob Areas) Digest Casewainie_deroNo ratings yet

- Pilots denied retirement benefits after illegal strikeDocument8 pagesPilots denied retirement benefits after illegal strikeChristopher Martin GunsatNo ratings yet

- PTA Vs Philippine GolfDocument2 pagesPTA Vs Philippine Golfrm2803No ratings yet

- Affidavit Discrepancy Name SpellingDocument2 pagesAffidavit Discrepancy Name Spellingheirarchy100% (1)

- CRPC ProjectDocument13 pagesCRPC ProjectThakur Prashant Singh0% (1)

- Academic freedom in the PhilippinesDocument2 pagesAcademic freedom in the PhilippinesalmorsNo ratings yet

- Final Moot Court Diary by Prateek AryaDocument121 pagesFinal Moot Court Diary by Prateek Aryaprateek aryaNo ratings yet

- Distribution Agreement Signed Between XX and YYDocument6 pagesDistribution Agreement Signed Between XX and YYofelia_cc5426No ratings yet

- Meralco Vs Wilcon BuildersDocument2 pagesMeralco Vs Wilcon BuildersBAROPSNo ratings yet

- Fihfc Kyc Aml Policy March 2020Document23 pagesFihfc Kyc Aml Policy March 2020HarpreetNo ratings yet

- Legal Research On The Imprescriptibility of The Torrens TitleDocument2 pagesLegal Research On The Imprescriptibility of The Torrens Titlenoorlaw0% (1)

- Boracay CaseDocument2 pagesBoracay CaseyenNo ratings yet

- Valenzuela v. CA - G.R. No. 115024Document9 pagesValenzuela v. CA - G.R. No. 115024VeniceAbuzmanBrualNo ratings yet

- IRR On RA 6727-MWF PDFDocument14 pagesIRR On RA 6727-MWF PDFChristian AnresNo ratings yet

- Evidence: July 2004, Question 4Document1 pageEvidence: July 2004, Question 4Zviagin & CoNo ratings yet

- Uy v. CADocument6 pagesUy v. CAnakedfringeNo ratings yet

- Babst vs. Court of Appeals (GR 99398, 26 January 2001) Doctrine: FactsDocument2 pagesBabst vs. Court of Appeals (GR 99398, 26 January 2001) Doctrine: FactsAgie MarquezNo ratings yet

- 3 People Vs TabacoDocument25 pages3 People Vs TabacoCherrylyn CaliwanNo ratings yet

- Credit Cases CompilationDocument65 pagesCredit Cases CompilationCyrusNo ratings yet

- Complaint: Plaintiff, Through The Undersigned Counsel, Unto This Honorable Court, Hereby Respectfully Avers ThatDocument6 pagesComplaint: Plaintiff, Through The Undersigned Counsel, Unto This Honorable Court, Hereby Respectfully Avers ThatRoan HabocNo ratings yet

- John W. Salmond. Jurisprudence or The Theory of The LawDocument26 pagesJohn W. Salmond. Jurisprudence or The Theory of The Lawzac mankirNo ratings yet

- R V WAKEFIELD (2019) NZHC 1629 (12 July 2019)Document14 pagesR V WAKEFIELD (2019) NZHC 1629 (12 July 2019)Stuff NewsroomNo ratings yet

- Dr Batiquin Liability for Rubber Glove Piece in PatientDocument1 pageDr Batiquin Liability for Rubber Glove Piece in PatientLang Banac LimoconNo ratings yet

- Supreme Court On Delay NCDRCDocument5 pagesSupreme Court On Delay NCDRCPiyushNo ratings yet

- JK Pay SysDocument3 pagesJK Pay SysMir Mudasir RehmanNo ratings yet

- Romera v. People, 434 SCRA 467Document2 pagesRomera v. People, 434 SCRA 467Michael A. BerturanNo ratings yet

- Student Declaration FormDocument2 pagesStudent Declaration FormAryan AsijaNo ratings yet

- Legal Research II MidtermsDocument3 pagesLegal Research II MidtermsvincentNo ratings yet

- Sppulaw Question BankDocument82 pagesSppulaw Question Banksony dakshuNo ratings yet