Professional Documents

Culture Documents

Ase 3902 - Ias

Uploaded by

Acid Al-Jauzy0 ratings0% found this document useful (0 votes)

104 views8 pagesacc

Original Title

ASE 3902 _IAS_

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentacc

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

104 views8 pagesAse 3902 - Ias

Uploaded by

Acid Al-Jauzyacc

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

ASE3902 Sample Paper Answers 2008 1

EDUCATION DEVELOPMENT INTERNATIONAL PLC

SAMPLE PAPER ANSWERS 2008

CERTIFICATE IN ACCOUNTING (IAS) ASE3902

LEVEL 3

_______________________________________________________________________________

QUESTION 1

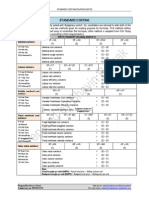

(a) Calculation of profit from operations $ $000

Accumulated profits (415 - 380) 35

Add:

Interim dividend 13

Proposed dividend 65

Debenture interest:

1 Jan - 30 June 60,000 x 6% x 50% 1,800

1 July - 31 Dec 40,000 x 6% x 50% 1,200

3

116

Less:

Investment income 4

Profit from operations 112

(4 marks)

(b)

Reconciliation of profit from operations to cash generated by operations

$000 $000

Profit from operations 112

Adjustment for:

Depreciation ([50+146+68] - [45+90+45] + 20 104

Profit on asset sale (2) 102

214

Operating cash flow before:

Movements in working capital

Decrease in receivables (220-198) 22

Increase in inventory (229-219)

(10)

(20)

Decrease in payables (200-180)

Cash generated by operations 8

206

(6 marks)

ASE3902 Sample Paper Answers 2008 2

QUESTION 1 CONTINUED

(c) Oriental Trading

Cash Flow Statement for year ended 31 December 2007

$000 $000

Cash generated by operations 206

Interest paid (3)

Net cash from operating activities 203

Investing activities

Investment income 4

Sale of assets (30 - 20 + 2) 12

Purchase of assets (50 + 90 + 30) (170)

Sale of investments (70 50) 20

Net cash from investing activities (134)

69

Financing Activities

Dividends paid (40 + 13) (53)

Issue of ordinary shares (650 + 20 600) 70

Redemption of debentures (60 40) (20)

Net cash used in financing activities 3

Net increase in cash 66

Cash at beginning of year 71

Cash at end of year 137

(15 marks)

(Total 25 marks)

ASE3902 Sample Paper Answers 2008 3

QUESTION 2

Walsham Profit Allocation

3 months 9 months

to 31 August 2006 to 31 May 2007

(Pre-incorporation) (Post incorporation)

$ $

Gross profit 20% 25,120 80% 100,480

Expenses:

Time apportioned (1:3)

Wages and sundry expenses 2,814 8,442

Rent and insurance 1,500 4,500

Depreciation [W1] 3,200 13,340

Apportioned according to sales

Bad debts (5,600 - 4,121) 1,479 (412,100 x 1%) 4,121

Commission (1:4) 5,494 21,976

Specific allocation

Partnership salaries 9,000

Interest on purchase price 1,500

Bank overdraft interest 500

Directors' fees and expenses 12,750

Audit fees

1,750

23,487 68,879

Net Profit 1,633 31,601

[W1]

01-Jun-06

Vehicles 30,000

Residual 3,000

27,000 x 40% x 25% 2,700 75% 8,100

Equipment 10,000 x 20% x 25% 500 75% 1,500

01-Sep-06

Vehicle 12,000

Residual 1,200

10,800 x 40% x 75% 3,240

01-Dec-06

Equipment 5,000 x 20% x 50% 500

3,200

13,340

(Total 25 marks)

ASE3902 Sample Paper Answers 2008 4

QUESTION 3

(a) 2006 2007

(i)

750,650 - 30,000 $0.36 910,300 - 30,000 $0.44

2,000,000 2,000,000

(ii)

200

5.56

times 300

6.82

times

36 44

(iii)

15 x 100 7.50% 20 x 100 6.67%

200 300

(iv)

750,650 - 30,000

2.40

times 910,300 - 30,000

2.20

times

300,000 400,000

(v)

800,650 x 100 17.40% 960,300 x 100 18.90%

4,600,400 5,080,700

(20 marks)

(b)

[1] In a highly geared company ordinary shareholders could be left

with little or no dividend payments because of the prior interest charges and

preferred dividends accounting for the majority of the profit. This

would be especially true during an economic downturn.

[2] Ordinary shareholders would also be more at risk in the event of a company

insolvency as secured loans and preferred shares are always a prior charge

when it comes to the liquidation of a company

(5 marks)

(Total 25 marks)

ASE3902 Sample Paper Answers 2008 5

QUESTION 4

(a)

$000

$000

Cost of investment 24,000

Share capital 30,000

General reserve 500

Accumulated profits 1,500

32,000 x 70% 22,400

Goodwill 1,600

(2 marks)

(b)

White

Consolidated Income Statement for the year ended 31 October 2007

$000 $000

Revenue (245,000 + 95,000 - [12,000 x 1.4]) 323,200

Cost of sales (140,000 + 52,000 - [12,000 x 1.4] + 1,440 - note 1) 176,640

Gross Profit 146,560

Distribution costs (12,000 + 10,000) 22,000

Administrative expenses (55,000 + 13,000) 68,000

Goodwill amortisation (1,600 x 10%) 160

90,160

Profit on ordinary activities 56,400

Minority interest (20,000 x 30%) 6,000

50,400

Dividends 20,000

Retained profit for the year 30,400

(8 marks)

Note 1

* Unrealised profit in inventory (12,000 x 1.4 x 0.30 x 0.40/1.4) = 1,440

ASE3902 Sample Paper Answers 2008 6

QUESTION 4 CONTINUED

(c)

White

Consolidated Balance Sheet at 31 October 2007

$000 $000

Non current assets

Tangible - net book value (110,000 + 40,000) 150,000

Intangible - unamortised goodwill (1,600 - [160 x 5]) 800

150,800

Current Assets

Inventory (13,360 + 3,890 - 1,440) 15,810

Receivables (14,640 + 6,280 - 7,000 (note 2) - 1,200) 12,720

Bank (3,500 + 2,570) 6,070

34,600

185,400

Capitals and Reserves

Ordinary shares of $1 each 100,000

General reserves (4,400 + [1,000 - 500 x 70%]) 4,750

Accumulated profits (note 3) 35,306

Minority interest (40,280 x 30%) 12,084

152,140

Current liabilities

Payables 10,260

Dividends payable to minority interests (10,000 x 30%) 3,000

Dividends 20,000

33,260

185,400

(15 marks)

Note 2

Exclusion of inter group dividend (10,000 x 70%) = 7,000

Note 3

White 32,100

Less: unrealised profit 1,440

30,660

Add:

Power 9,280

Pre-acquisition 1,500

7,780 x 70% 5,446

36,106

Less: amortised goodwill (160 x 5) 800

35,306

(Total 25 marks)

ASE3902 Sample Paper Answers 2008 7

QUESTION 5

(a)

Breakeven

Fixed costs (500,000 units x 0.60) 300,000 = 187,500 barrels

Contribution (5.00 - [1.20 + 1.50 + 0.70]) 1.60

(3 marks)

(b)

Fixed costs (450,000 + required profit 700,000) 1,150,000 = 718,750 barrels

Contribution (5.00 - [1.20 + 1.50 + 0.70]) 1.60

(3 marks)

(c)

Project

A

$

Investment 60,000

Net annual cash inflows

Year 1 15,000

Year 2 15,000

Year 3 15,000

45,000

15,000

Year 4 20,000 x 75% = 15,000 (75% of a year is 9 months)

nil

Project

B

$

Investment 60,000

Net annual cash inflows

Year 1 15,000

Year 2 15,000

Year 3 20,000

50,000

10,000

Year 4 20,000 x 50% 10,000 (50% of a year is 6 months)

nil

Payback therefore Project A is 3 years 9 months

Project B is 3 years 6 months

(6 marks)

ASE3902 Sample Paper Answers 2008 Education Development International plc 2008 8

QUESTION 5 (continued)

(d)

Project

A Project B

$ $ $ $ $ $

Investment 60,000 60,000

Factor Inflow Inflow

Year 1 0.909 15,000 13,635 15,000 13,635

Year 2 0.826 15,000 12,390 15,000 12,390

Year 3 0.751 15,000 11,265 20,000 15,020

Year 4 0.683 20,000 13,660 20,000 13,660

Year 5 0.621 10,000 6,210 5,000 3,105

Year 5 (scrap) 0.621 5,000 3,105 10,000 6,210

60,265 64,020

Net present value 265 Net present value 4,020

(8 marks)

(e)

The payback period of Project A is three months longer than that of Project B

The present value of cash inflows exceeds the present value of cash outflows by $265 in

the case of Project A and $4,020 in the case of Project B

In both cases, therefore, Project B is a better financial prospect than Project A

Recommendation: Adopt Project B

(5 marks)

(Total 25 marks)

You might also like

- ASE 3012 Revised Syllabus - Answers To Specimen Paper 2008Document8 pagesASE 3012 Revised Syllabus - Answers To Specimen Paper 2008luckystar2013No ratings yet

- AFE 5008 Model Answers for Final ExamsDocument10 pagesAFE 5008 Model Answers for Final ExamsDiana TuckerNo ratings yet

- Solution Far450 UITM - Jan 2013Document8 pagesSolution Far450 UITM - Jan 2013Rosaidy SudinNo ratings yet

- 7110 s12 Ms 21Document7 pages7110 s12 Ms 21mstudy123456No ratings yet

- Tutor 1Document6 pagesTutor 1Elaine LimNo ratings yet

- Consolidated Financial Statements of Prather Company and SubsidiaryDocument7 pagesConsolidated Financial Statements of Prather Company and SubsidiaryImelda100% (1)

- 9706 Accounting: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of TeachersDocument5 pages9706 Accounting: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of TeachersSaad MansoorNo ratings yet

- Further Issues in Basic ConsolidationDocument49 pagesFurther Issues in Basic ConsolidationmustaqimNo ratings yet

- 7110 w12 Ms 22Document7 pages7110 w12 Ms 22mstudy123456No ratings yet

- FAC2602 Assignment 2Document5 pagesFAC2602 Assignment 2SibongileNo ratings yet

- Tutorial 1 Presentation of FS (A)Document7 pagesTutorial 1 Presentation of FS (A)fooyy8No ratings yet

- D.1. Financial Statement AnalysisDocument4 pagesD.1. Financial Statement AnalysisCode BeretNo ratings yet

- Corporate Reporting - ND2020 - Suggested - Answers - Review by SBDocument13 pagesCorporate Reporting - ND2020 - Suggested - Answers - Review by SBTamanna KinnoreNo ratings yet

- Adv Level Corporate Reporting (CR)Document24 pagesAdv Level Corporate Reporting (CR)FarhadNo ratings yet

- Corporate Finance - Exercises Session 1 - SolutionsDocument5 pagesCorporate Finance - Exercises Session 1 - SolutionsLouisRemNo ratings yet

- Solution Far450 - Jan 2013Document9 pagesSolution Far450 - Jan 2013aielNo ratings yet

- LCCI ACCOUNTING TITLEDocument9 pagesLCCI ACCOUNTING TITLEmappymappymappyNo ratings yet

- Financial Accounting n 6 Test Mg 2nd Semester 2017 (1)Document8 pagesFinancial Accounting n 6 Test Mg 2nd Semester 2017 (1)professional accountantsNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- Rs. in 000: Ans.6 (A) Hadi Limited Statement of Comprehensive Income For The Year Ended 31 December 2016Document4 pagesRs. in 000: Ans.6 (A) Hadi Limited Statement of Comprehensive Income For The Year Ended 31 December 2016Sameen KhanNo ratings yet

- 7110 w11 Ms 21Document10 pages7110 w11 Ms 21mstudy123456No ratings yet

- Excel Academy Financial StatementsDocument5 pagesExcel Academy Financial Statementsfaith olaNo ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- Far Situational Solution-1Document6 pagesFar Situational Solution-1Baby BearNo ratings yet

- Answers To Week 1 HomeworkDocument6 pagesAnswers To Week 1 Homeworkmzvette234No ratings yet

- Cash Flow 8 AprilDocument17 pagesCash Flow 8 AprilMayank MalhotraNo ratings yet

- FR Mock Exam 4 - SolutionsDocument13 pagesFR Mock Exam 4 - Solutionsiram2005No ratings yet

- D.1. Financial Statement AnalysisDocument3 pagesD.1. Financial Statement AnalysisIrfan PoonawalaNo ratings yet

- Paki Check BiDocument5 pagesPaki Check BiAusan AbdullahNo ratings yet

- GR10 Accounting Practice Exam Memorandum November Paper 1Document7 pagesGR10 Accounting Practice Exam Memorandum November Paper 1morukakgothatso5No ratings yet

- Cpa 8Document13 pagesCpa 8justinorchidsNo ratings yet

- Financial Management Economics For Finance 2023 1671444516Document36 pagesFinancial Management Economics For Finance 2023 1671444516RADHIKANo ratings yet

- Group FinancialDocument8 pagesGroup FinancialNever GonondoNo ratings yet

- Magsino Hannah Florence Activity 5 Discounted Cash FlowsDocument36 pagesMagsino Hannah Florence Activity 5 Discounted Cash FlowsKathyrine Claire Edrolin100% (1)

- AFE3871 Assingment 2 Memo 1Document45 pagesAFE3871 Assingment 2 Memo 1SoblessedNo ratings yet

- GR 11 Accounting P1 (English) November 2022 Possible AnswersDocument9 pagesGR 11 Accounting P1 (English) November 2022 Possible Answersphafane2020No ratings yet

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex SchuldinerNo ratings yet

- 9 BBDocument5 pages9 BBIlesh DinyaNo ratings yet

- Financial Performance Evaluation of Smithson PlcDocument5 pagesFinancial Performance Evaluation of Smithson PlcAyesha SheheryarNo ratings yet

- MENG 6502 Financial ratios analysisDocument6 pagesMENG 6502 Financial ratios analysisruss jhingoorieNo ratings yet

- AP-5906Q ReceivablesDocument3 pagesAP-5906Q Receivablesjhouvan100% (1)

- Upsa 2019 CFS Tutorial Questions 2 - Some Soulutions and AnswersDocument9 pagesUpsa 2019 CFS Tutorial Questions 2 - Some Soulutions and AnswersLaud ListowellNo ratings yet

- Lesson 2Document5 pagesLesson 2kabaso jaroNo ratings yet

- Consolidated financial statements of Pal CorporationDocument5 pagesConsolidated financial statements of Pal CorporationfebbiniaNo ratings yet

- Mid Semester Assignment: Course Code: FIN - 254 Section: 08Document8 pagesMid Semester Assignment: Course Code: FIN - 254 Section: 08Fahim Faisal 1620560630No ratings yet

- Tugas Chapter 5: Persentase Kepemilikan Pay Corporation 75%Document6 pagesTugas Chapter 5: Persentase Kepemilikan Pay Corporation 75%Iche IcheNo ratings yet

- Management Accounting: Page 1 of 6Document70 pagesManagement Accounting: Page 1 of 6Ahmed Raza MirNo ratings yet

- FM Assignment SolutionDocument18 pagesFM Assignment SolutionumeshNo ratings yet

- ROCE, profit margin and financial analysis of Enn LtdDocument7 pagesROCE, profit margin and financial analysis of Enn LtdKccc siniNo ratings yet

- Solutions Ch07Document15 pagesSolutions Ch07KyleNo ratings yet

- P6Document3 pagesP6Jessica HutabaratNo ratings yet

- Lobrigas - Week6 Ia3Document18 pagesLobrigas - Week6 Ia3Hensel SevillaNo ratings yet

- BT Chương 3Document8 pagesBT Chương 3trangnguyen.31221021691No ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2013 SeriesDocument7 pages9706 Accounting: MARK SCHEME For The October/November 2013 SeriesCambridge Mathematics by Bisharat AliNo ratings yet

- 9706 w10 Ms 41Document5 pages9706 w10 Ms 41kanz_h118No ratings yet

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Cost Accounting: Level 3Document18 pagesCost Accounting: Level 3Hein Linn KyawNo ratings yet

- ASE2007 Revised Syllabus - Specimen Paper Answers 2008Document7 pagesASE2007 Revised Syllabus - Specimen Paper Answers 2008WinnieOngNo ratings yet

- Cost Accounting l3 s3 121212070758 Phpapp01 - 2Document18 pagesCost Accounting l3 s3 121212070758 Phpapp01 - 2WinnieOngNo ratings yet

- Cost Accounting/Series-4-2011 (Code3017)Document17 pagesCost Accounting/Series-4-2011 (Code3017)Hein Linn Kyaw100% (2)

- Cost Accounting l3 s3 121212070758 Phpapp01 - 2Document18 pagesCost Accounting l3 s3 121212070758 Phpapp01 - 2WinnieOngNo ratings yet

- Cost Accounting: Level 3Document18 pagesCost Accounting: Level 3Hein Linn KyawNo ratings yet

- 2006 Lcci Level 3 Series 2answer 120418031555 Phpapp02 121212070927 Phpapp02Document18 pages2006 Lcci Level 3 Series 2answer 120418031555 Phpapp02 121212070927 Phpapp02WinnieOngNo ratings yet

- Standard Costing: SUPER SUMMARY (Reading Method 1) Material VarianceDocument5 pagesStandard Costing: SUPER SUMMARY (Reading Method 1) Material VarianceWinnieOngNo ratings yet

- InventoryDocument70 pagesInventoryWinnieOngNo ratings yet

- Award in Computerised Accounting Skills Syllabus Level 3 April 2012 - V2Document12 pagesAward in Computerised Accounting Skills Syllabus Level 3 April 2012 - V2WinnieOngNo ratings yet

- Sample Paper For Professional Ethics in Accounting and FinanceDocument6 pagesSample Paper For Professional Ethics in Accounting and FinanceWinnieOngNo ratings yet

- RetailManager FactsheetDocument2 pagesRetailManager FactsheetWinnieOngNo ratings yet

- 02 Navitas English Pretest - Business EnglishDocument12 pages02 Navitas English Pretest - Business EnglishWinnieOngNo ratings yet

- Support Pack - Level 2 Computerised Book-Keeping Skills Level 3 Computerised Accounting V2 - 2Document30 pagesSupport Pack - Level 2 Computerised Book-Keeping Skills Level 3 Computerised Accounting V2 - 2ဇမ္ဗူ ဟိန်းNo ratings yet

- Syllabus Certificate in Applied Business Economics Level 4 April 2012Document16 pagesSyllabus Certificate in Applied Business Economics Level 4 April 2012WinnieOngNo ratings yet

- Accounting For Business 1234103659261919 3Document100 pagesAccounting For Business 1234103659261919 3WinnieOngNo ratings yet

- Computerised Accounting FlyerDocument6 pagesComputerised Accounting FlyerWinnieOngNo ratings yet

- BusinessAdministrationandITQualifications 000Document24 pagesBusinessAdministrationandITQualifications 000WinnieOngNo ratings yet

- Accounting 3v2Document19 pagesAccounting 3v2WinnieOng100% (1)

- Certificate in Managing Business Performance Level 4 April 2012Document24 pagesCertificate in Managing Business Performance Level 4 April 2012WinnieOngNo ratings yet

- Level 3 Certifiate in AccountingDocument16 pagesLevel 3 Certifiate in Accountingဇမ္ဗူ ဟိန်းNo ratings yet

- 2009 Annual Qualification Review L3 Cost AccountingDocument14 pages2009 Annual Qualification Review L3 Cost AccountingWinnieOngNo ratings yet

- Book-Keeping 1 Finalised Syllabus JAN 2007Document21 pagesBook-Keeping 1 Finalised Syllabus JAN 2007WinnieOngNo ratings yet

- ASE20084 SAMPLE Finance and Banking September 23 FormattedDocument5 pagesASE20084 SAMPLE Finance and Banking September 23 FormattedWinnieOngNo ratings yet

- ASE20050A Practice PaperDocument6 pagesASE20050A Practice PaperMyo NaingNo ratings yet

- Cost Accounting/Series-3-2007 (Code3016)Document18 pagesCost Accounting/Series-3-2007 (Code3016)Hein Linn Kyaw50% (6)

- Cost Accounting Level 3: LCCI International QualificationsDocument20 pagesCost Accounting Level 3: LCCI International QualificationsHein Linn Kyaw33% (3)

- Cost Accounting L3 Finalised Syllabus - Updated September 2008Document12 pagesCost Accounting L3 Finalised Syllabus - Updated September 2008WinnieOngNo ratings yet

- Award in English For Accounting Level 3 April 2012Document18 pagesAward in English For Accounting Level 3 April 2012WinnieOngNo ratings yet

- PMCI AD Regional Supply Chain Manager PDFDocument2 pagesPMCI AD Regional Supply Chain Manager PDFVictorine KOUEKAMNo ratings yet

- Case 5 Thoughtful Forecasting FIN 635Document3 pagesCase 5 Thoughtful Forecasting FIN 635jack stauberNo ratings yet

- Mathematical Literacy Paper 2 JuneDocument22 pagesMathematical Literacy Paper 2 JuneziphonjinganaNo ratings yet

- Marketing - q2 - Mod3 - The PlaceDocument24 pagesMarketing - q2 - Mod3 - The PlaceReagan Digal50% (4)

- SG Cowen - New Recruits - DarpanDocument1 pageSG Cowen - New Recruits - DarpanDarpan ChoudharyNo ratings yet

- Client Acquisition Strategies for Zolo StaysDocument19 pagesClient Acquisition Strategies for Zolo StaysAksh EximNo ratings yet

- Midterm Principles LSCM 2021-2022Document4 pagesMidterm Principles LSCM 2021-2022Ngo HieuNo ratings yet

- TYPES OF BUSINESS PLAn g9Document15 pagesTYPES OF BUSINESS PLAn g9Jhaymie NapolesNo ratings yet

- Group Project CB IMC Group 2 YP62 PDFDocument50 pagesGroup Project CB IMC Group 2 YP62 PDFGarick MuhammadNo ratings yet

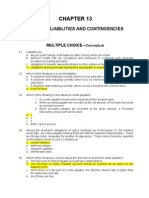

- Intermediate Accouting Testbank ch13Document23 pagesIntermediate Accouting Testbank ch13cthunder_192% (12)

- MC Substantive TestsDocument5 pagesMC Substantive TestsHeinie Joy PauleNo ratings yet

- Employee Quality Awareness Training: Presented byDocument11 pagesEmployee Quality Awareness Training: Presented byJayant Kumar JhaNo ratings yet

- Elective 10 - Entrep Quarter 3 Module 1 (Caligdong)Document10 pagesElective 10 - Entrep Quarter 3 Module 1 (Caligdong)vanngodolieveNo ratings yet

- Cosmopolitan Magazine AnalysisDocument12 pagesCosmopolitan Magazine AnalysisImmy Parslow67% (3)

- COVID-19 and The Indian Textiles Sector: Issues, Challenges and ProspectsDocument5 pagesCOVID-19 and The Indian Textiles Sector: Issues, Challenges and Prospectsgizex2013No ratings yet

- Francesca Taylor Mastering The Commodities PDFDocument342 pagesFrancesca Taylor Mastering The Commodities PDFjujubi100% (5)

- Example Cover Letter For Internal Job PostingDocument5 pagesExample Cover Letter For Internal Job Postingtbrhhhsmd100% (1)

- WFISD Agenda April 12, 2022, at Noon - Special SessionDocument73 pagesWFISD Agenda April 12, 2022, at Noon - Special SessionDenise NelsonNo ratings yet

- Service Encounter StageDocument2 pagesService Encounter StageNoman Basheer100% (1)

- Identifying Market Segments and TargetsDocument4 pagesIdentifying Market Segments and TargetsolmezestNo ratings yet

- Xola's Curriculum VitaeDocument2 pagesXola's Curriculum VitaeqhogwanaNo ratings yet

- FSC CoC GP01 Description of Certification Process Rev 7.3Document22 pagesFSC CoC GP01 Description of Certification Process Rev 7.3udiptya_papai2007No ratings yet

- Delivering Service Through Intermediaries and Electronic ChannelsDocument10 pagesDelivering Service Through Intermediaries and Electronic ChannelssangitaNo ratings yet

- Rajnikant Makwana - MISDocument3 pagesRajnikant Makwana - MISRajnikant MakwanaNo ratings yet

- A Project Report On HRDDocument51 pagesA Project Report On HRDMuskan TanwarNo ratings yet

- GST Laws & Procedure On Death of ProprietorDocument7 pagesGST Laws & Procedure On Death of ProprietorChandramouli AtmakuriNo ratings yet

- FULLTEXT01Document254 pagesFULLTEXT01Mohit ChoudharyNo ratings yet

- Biffa Modern Slavery Statement 2023Document13 pagesBiffa Modern Slavery Statement 2023feresteanu.florin1977No ratings yet

- Q4 Arts 6 - Module 2Document12 pagesQ4 Arts 6 - Module 2Dan Paolo AlbintoNo ratings yet

- Effect of Globalization On United Arab Emirates Marke1Document6 pagesEffect of Globalization On United Arab Emirates Marke1bodyyyyy100% (1)