Professional Documents

Culture Documents

Worksheet (Word Document)

Uploaded by

newtonokewoye0 ratings0% found this document useful (0 votes)

25 views2 pagesAnswer all question . For the sake of convenience, the sa,e worksheet has been provided in both PDF format and as a Word Document. You can also read it directly from the blog.

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAnswer all question . For the sake of convenience, the sa,e worksheet has been provided in both PDF format and as a Word Document. You can also read it directly from the blog.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views2 pagesWorksheet (Word Document)

Uploaded by

newtonokewoyeAnswer all question . For the sake of convenience, the sa,e worksheet has been provided in both PDF format and as a Word Document. You can also read it directly from the blog.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

.

State intervention in the Brazilian

Economy

A 2007 report which commented on the ease of doing business

in 175 countries placed Brazil 121st. The average rm in the countr!

ta"es 2#$00 hours to process its ta%es# a world record. The government

imposes a considerable amount of regulation on the countr!&s rms.

The ta% burden is also high with most ta% revenue coming from sales

ta%. 'n 200$# Brazilian ta% revenue was e(uivalent to )5* of +,-. This

compared with 22 in Argentina and 1.* in /e%ico. The high level of

ta%ation and regulation is thought to be discouraging investment.

The Brazilian government spends the ta% revenue on three main

items. 0ne is generous pensions for Brazilian government wor"ers

and state pensions which are paid to ever!one who has

contributed to the s!stem for )5 !ears regardless of their age.

Another is public sector wor"ers1 pa! and the third is on

transfers to the regional authorities of the countr!1s 27 states

which spend the mone! mainl! on health# education and

administration.

-ublic sector wor"ers# on average# earn more than twice as

much as wor"ers in the private sector and have better wor"ing

conditions. /ost of those receiving the countr!1s minimum wage

are private sector wor"ers.

a. ,oes Brazil receive most of its ta% revenue from direct or

indirect ta%es2

3%plain !our answer. 425

b. ,escribe two wa!s in which ta%es place a burden on Brazilian

rms. 465

c. 3%plain one advantage and one disadvantage of regulations.

465

d. 'dentif! from the passage three reasons wh! a Brazilian

would probabl! prefer to wor" for the government than a private

sector rm. 4)5

e. 7ou are a Brazilian government minister. ,iscuss

whether !ou would recommend that the government

should cut ta%es. 475

8tructured

(uestions

1. a. 3%plain the

di9erence

between income ta% and a sales ta%.

465

b

.

c.

:hat are the

(ualities

3%plain the

of a good ta%2 4$5

between a progressive and a

regressive ;.

4)

5

IS

d. ,i

.

scuss whether

a government should shift the burden of

ta%ation from direct ta%es to indirect ta%es. 475

2. a.

:hat

.

the

di9

erence

between a minimum price and a

ma%imum price2 4)5

b. 3%plai

.

n w

h

! a gov

ernment ma! impose price controls.

465

:h! does the government produce some products2 455

..

c. ld assess whether an industr! should

be privatised. ,iscuss how !ou wou

4.5

You might also like

- Plot Summary of Atlas ShruggedDocument2 pagesPlot Summary of Atlas ShruggedDillip Kumar MahapatraNo ratings yet

- 2000 AP Micro Test 1Document13 pages2000 AP Micro Test 1newtonokewoye75% (4)

- Ang Tibay Vs CIRDocument2 pagesAng Tibay Vs CIRNyx PerezNo ratings yet

- John F. Kennedy's Speeches 1947-1963Document934 pagesJohn F. Kennedy's Speeches 1947-1963Brian Keith Haskins100% (1)

- IGCSE Economics Self Assessment Exam Style Question's Answers - Section 4Document5 pagesIGCSE Economics Self Assessment Exam Style Question's Answers - Section 4Desre0% (1)

- Philippine Constitution TimelineDocument39 pagesPhilippine Constitution TimelineMo PadillaNo ratings yet

- 5 - Divine Word University of Tacloban Vs Secretary of Labor and Employment and Divine Word University Employees UNIONALU CONSOLIDATEDDocument15 pages5 - Divine Word University of Tacloban Vs Secretary of Labor and Employment and Divine Word University Employees UNIONALU CONSOLIDATEDGoodyNo ratings yet

- IGCSE Economics Self Assessment Chapter 25 AnswersDocument2 pagesIGCSE Economics Self Assessment Chapter 25 AnswersDesreNo ratings yet

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018From EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018No ratings yet

- Case Digest Tano v. Socrates G.R. No. 110249. August 21 1997Document2 pagesCase Digest Tano v. Socrates G.R. No. 110249. August 21 1997Winnie Ann Daquil Lomosad100% (5)

- Wage Subsidies: A Multi-Trillion Dollar Market Distortion That America Cannot AffordDocument13 pagesWage Subsidies: A Multi-Trillion Dollar Market Distortion That America Cannot AffordJason PyeNo ratings yet

- Downsizing The Federal Government, Cato Policy Analysis No. 515Document68 pagesDownsizing The Federal Government, Cato Policy Analysis No. 515Cato InstituteNo ratings yet

- CBO Minimum Wage ReportDocument55 pagesCBO Minimum Wage Reportgerald brittNo ratings yet

- PR Kelas Pengantar Ekonomi-2Document3 pagesPR Kelas Pengantar Ekonomi-2Blabla TambunanNo ratings yet

- Brazil's Economy and Two-Wheeler IndustryDocument6 pagesBrazil's Economy and Two-Wheeler Industryyash sharmaNo ratings yet

- Research Paper Unemployment PhilippinesDocument6 pagesResearch Paper Unemployment Philippinesgvzcrpym100% (1)

- Economic Recovery ViewDocument2 pagesEconomic Recovery ViewStuart Elliott100% (2)

- CEI: "Ten Thousand Commandments 2014"Document89 pagesCEI: "Ten Thousand Commandments 2014"Jason PyeNo ratings yet

- Democratic Budget Framework: A Balanced, Pro-Growth, and Fair Deficit Reduction PlanDocument4 pagesDemocratic Budget Framework: A Balanced, Pro-Growth, and Fair Deficit Reduction PlanInterActionNo ratings yet

- MCQs - Answer KeyDocument7 pagesMCQs - Answer KeyNikhil AdhavanNo ratings yet

- ILO Report Examines Global WagesDocument7 pagesILO Report Examines Global WagesmadhuriNo ratings yet

- A Note On Recent Growth and Austerity.05.14Document2 pagesA Note On Recent Growth and Austerity.05.14Red Labour/ Momentum Tyne & Wear & Wider RegionNo ratings yet

- Unemployment Q2a Ans (Pg26)Document3 pagesUnemployment Q2a Ans (Pg26)HuYimingNo ratings yet

- Flanagan Wages PaperDocument12 pagesFlanagan Wages PaperJody MacPhersonNo ratings yet

- AD and FP ProblemsDocument5 pagesAD and FP ProblemsK61 NGUYỄN THỊ THÙY LINHNo ratings yet

- (Microsoft Word - Capital Formation and P&P SectorDocument4 pages(Microsoft Word - Capital Formation and P&P Sectorrvaidya2000No ratings yet

- Appeco - Reaction PaperDocument1 pageAppeco - Reaction Paperreyesmicaella68No ratings yet

- Macroeconomics (From The Greek Prefix Makro-Meaning "Large" and Economics) Is A Branch ofDocument9 pagesMacroeconomics (From The Greek Prefix Makro-Meaning "Large" and Economics) Is A Branch ofParth Mashrani100% (1)

- Ecn 101 Principles of EconomicsDocument6 pagesEcn 101 Principles of EconomicsThomas Jonathan KNo ratings yet

- ECON 201 12/9/2003 Prof. Gordon: Final ExamDocument23 pagesECON 201 12/9/2003 Prof. Gordon: Final ExamManicks VelanNo ratings yet

- Sponsorship Speech On GSIS Members Rights and Benefits Act of 2011Document10 pagesSponsorship Speech On GSIS Members Rights and Benefits Act of 2011Ralph RectoNo ratings yet

- GROUP 10 Micro ProjectDocument13 pagesGROUP 10 Micro Projectnhiuyen147No ratings yet

- Chapter 4 MacroeconomicsDocument11 pagesChapter 4 MacroeconomicsEveNo ratings yet

- Quiz 547Document7 pagesQuiz 547Haris NoonNo ratings yet

- Providing Employee Benefits ChapterDocument75 pagesProviding Employee Benefits ChapterstramieNo ratings yet

- Comparing Wealth in Retirement: State-Local Versus Private Sector WorkersDocument16 pagesComparing Wealth in Retirement: State-Local Versus Private Sector Workersjon_ortizNo ratings yet

- 09.07.12 JPM Fiscal Cliff White PaperDocument16 pages09.07.12 JPM Fiscal Cliff White PaperRishi ShahNo ratings yet

- ECO372 Week 1 Discussion QuestionsDocument4 pagesECO372 Week 1 Discussion QuestionsWellThisIsDifferentNo ratings yet

- Crowding Out What MattersDocument10 pagesCrowding Out What MattersZachary JanowskiNo ratings yet

- Why Our Government Should Raise Minimum WageDocument1 pageWhy Our Government Should Raise Minimum WageMichael MoldesNo ratings yet

- Problem Set 1Document7 pagesProblem Set 1Adela Casanovas RevillaNo ratings yet

- Government Macroeconomic Policy ObjectivesDocument13 pagesGovernment Macroeconomic Policy ObjectivesalphaNo ratings yet

- Labor Markets and Health Care Refor M: New Results: Executive SummaryDocument6 pagesLabor Markets and Health Care Refor M: New Results: Executive Summaryapi-27836025No ratings yet

- Chapter 3Document8 pagesChapter 3Jimmy LojaNo ratings yet

- Unemployment and Its Natural Rate: Solutions To Textbook ProblemsDocument12 pagesUnemployment and Its Natural Rate: Solutions To Textbook ProblemsMainland FounderNo ratings yet

- Felicia Irene - Week 4Document36 pagesFelicia Irene - Week 4felicia ireneNo ratings yet

- Chile: Standing at A Turning Point: November 6, 2013Document12 pagesChile: Standing at A Turning Point: November 6, 2013sm7914No ratings yet

- Government and The Cost of Living: Income-Based vs. Cost-Based Approaches To Alleviating PovertyDocument28 pagesGovernment and The Cost of Living: Income-Based vs. Cost-Based Approaches To Alleviating PovertyCato InstituteNo ratings yet

- EconomicsDocument3 pagesEconomicsChantelle ONo ratings yet

- Markscheme q1 Unit 2.11Document7 pagesMarkscheme q1 Unit 2.11anamNo ratings yet

- Replacing The SequesterDocument6 pagesReplacing The SequesterCenter for American ProgressNo ratings yet

- Fiscal YearDocument3 pagesFiscal Year22bsaf005No ratings yet

- Eco208 Assignment p2Document7 pagesEco208 Assignment p2Yash AgarwalNo ratings yet

- Federal Government's Fiscal Health: An Unsustainable PathDocument12 pagesFederal Government's Fiscal Health: An Unsustainable PathJacquesVacaNo ratings yet

- WichitaEast HaRa Neg 01 Washburn Rural FinalsDocument30 pagesWichitaEast HaRa Neg 01 Washburn Rural FinalsEmronNo ratings yet

- International Trade System: Tariffs and RegulationsDocument5 pagesInternational Trade System: Tariffs and Regulationsromand2308No ratings yet

- Tsa 95 V 477Document58 pagesTsa 95 V 477Ramón GutiérrezNo ratings yet

- Adverse Effects of Automatic Cost of Living Adjustments To Entitlement and Other PaymentsDocument20 pagesAdverse Effects of Automatic Cost of Living Adjustments To Entitlement and Other PaymentsCato InstituteNo ratings yet

- CEI Planet - May-June 2011Document12 pagesCEI Planet - May-June 2011Competitive Enterprise InstituteNo ratings yet

- Macro Effects of IRADocument21 pagesMacro Effects of IRAmuhammad.nm.abidNo ratings yet

- Kinnaras Capital Management LLC: July 2010 Market CommentaryDocument4 pagesKinnaras Capital Management LLC: July 2010 Market Commentaryamit.chokshi2353No ratings yet

- Macroeconomics Chapter 15Document12 pagesMacroeconomics Chapter 15Sultan AnticsNo ratings yet

- Strengthening America’S Resource & Revitalizing American Workforce LeadershipFrom EverandStrengthening America’S Resource & Revitalizing American Workforce LeadershipNo ratings yet

- Production PossibilityDocument33 pagesProduction PossibilitynewtonokewoyeNo ratings yet

- Macroeconomics IntroDocument2 pagesMacroeconomics IntronewtonokewoyeNo ratings yet

- MicroDocument12 pagesMicronewtonokewoyeNo ratings yet

- Worksheet 10th GradeDocument1 pageWorksheet 10th GradenewtonokewoyeNo ratings yet

- Worksheet 10th GradeDocument1 pageWorksheet 10th GradenewtonokewoyeNo ratings yet

- Worksheet (Word Document)Document2 pagesWorksheet (Word Document)newtonokewoyeNo ratings yet

- Syllabus: Cambridge IGCSE EconomicsDocument20 pagesSyllabus: Cambridge IGCSE EconomicsnewtonokewoyeNo ratings yet

- PA Law Grants Promotions in Rank To Terrorist Prisoners From PA Security ServicesDocument4 pagesPA Law Grants Promotions in Rank To Terrorist Prisoners From PA Security ServicesKokoy JimenezNo ratings yet

- The Doctrine of EclipseDocument12 pagesThe Doctrine of EclipseKanika Srivastava33% (3)

- The Legal Services Authority Act, 1987Document75 pagesThe Legal Services Authority Act, 1987AbhiiNo ratings yet

- Background For Conflict Greece, Turkey, and The Aegean Islands, 1912-1914 PDFDocument29 pagesBackground For Conflict Greece, Turkey, and The Aegean Islands, 1912-1914 PDFIwannınaNo ratings yet

- Jurisprudence June 2016Document11 pagesJurisprudence June 2016Trishia Fernandez GarciaNo ratings yet

- Pío Valenzuela's role in the Katipunan revolutionDocument2 pagesPío Valenzuela's role in the Katipunan revolutionKylie OndevillaNo ratings yet

- Deemed Export BenefitDocument37 pagesDeemed Export BenefitSamNo ratings yet

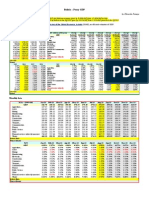

- Bolivia - Proxy GDPDocument1 pageBolivia - Proxy GDPEduardo PetazzeNo ratings yet

- Military Review August 1967Document116 pagesMilitary Review August 1967mikle97No ratings yet

- S. Taylor Force ActDocument7 pagesS. Taylor Force ActAnonymous GF8PPILW5No ratings yet

- KCS - Revised Pay - Rules, 2012 PDFDocument28 pagesKCS - Revised Pay - Rules, 2012 PDFNelvin RoyNo ratings yet

- Australia's Economic Freedom Score of 82 Ranks It 3rdDocument2 pagesAustralia's Economic Freedom Score of 82 Ranks It 3rdjacklee1918No ratings yet

- Institusi Wazir, Ceteria Dan Menteri Pada Abad Ke-19: Struktur Dan Kuasa Elite Dalam Pentadbiran Di Kesultanan Melayu BruneiDocument36 pagesInstitusi Wazir, Ceteria Dan Menteri Pada Abad Ke-19: Struktur Dan Kuasa Elite Dalam Pentadbiran Di Kesultanan Melayu BruneiAyahanda Ultraman TaroNo ratings yet

- Boyscout ScriptDocument26 pagesBoyscout Scriptdonna clataNo ratings yet

- Almario Vs Alba 127 SCRA 69Document6 pagesAlmario Vs Alba 127 SCRA 69MykaNo ratings yet

- First International (International Workingmen's Association)Document2 pagesFirst International (International Workingmen's Association)Sudip DuttaNo ratings yet

- Political Affairs Sample 2004Document2 pagesPolitical Affairs Sample 2004zephyr14No ratings yet

- Final Report Mapping Update 2015-En PDFDocument63 pagesFinal Report Mapping Update 2015-En PDFImran JahanNo ratings yet

- Contemporary Period in The PhilippinesDocument2 pagesContemporary Period in The PhilippinesFRosales, Althea G.No ratings yet

- Balance Budget Sim Lesson PlanDocument5 pagesBalance Budget Sim Lesson Planapi-245012288No ratings yet

- National Committee On United States-China Relations - Annual Report 2008Document33 pagesNational Committee On United States-China Relations - Annual Report 2008National Committee on United States-China RelationsNo ratings yet

- Introduction To Political Science First Lecture BbaDocument13 pagesIntroduction To Political Science First Lecture BbaAfzaal Mohammad100% (1)

- Ch-8. Internal Economies of Scale and Trade (Krugman)Document12 pagesCh-8. Internal Economies of Scale and Trade (Krugman)দুর্বার নকিবNo ratings yet

- Minutes of The Meeting - 2ND Regular MeetingDocument3 pagesMinutes of The Meeting - 2ND Regular MeetingMarienel Odacrem Orrapac100% (1)