Professional Documents

Culture Documents

MBF Brochure PDF

Uploaded by

Martin VavrouchOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MBF Brochure PDF

Uploaded by

Martin VavrouchCopyright:

Available Formats

Masters Program in Banking and Finance

From Theory to Practice

2

WELCOME

Welcome to the Master's Program in

Banking and Finance - MBF!

The MBF program of the University of St.Gallen is a

high-quality Masters program that prepares you for a

successful career start with banks, insurance companies,

consulting agencies and the fnance departments of non-

fnancial corporations. Our graduates take up jobs in

private banking, asset management, investment banking

and risk management, among others, in Switzerland and

abroad. The MBF program also opens doors for further

academic studies, such as a PhD program.

The MBF is equally focused on theory and application.

We are convinced that sound theoretical and method-

ological fundamentals are essential for a higher education

in fnance. In addition, we support our students in the

application process and enable them to ask the relevant

questions in everyday work. The content of the MBF pro-

gram is considered to be highly relevant to the program

partnership with the CFA program, and our placement

record proves this.

The MBF program has a clear and fexible structure. All

three compulsory courses Financial Markets, Financial

Institutions and Quantitative Methods take place in the

frst semester and provide a solid basis for the core elec-

tives in the second and the third semesters.

The choice of elective courses is wide, with subjects

ranging from quantitative topics (Computational Finance)

to specifc instruments (Interest Rates and Energy Deriva-

tives) to asset management (Private Equity or Behavioral

Finance) and to corporate fnance (Corporate Financial

Management or Management of Insurance Companies).

All of our students write a research-based Masters the-

sis and participate in a research seminar.

The University of St.Gallen is EQUIS and AACSB

accredited and is consistently ranked among the top

business schools in Europe. With its 5th place in the

Financial Times Global Masters in Finance Ranking 2012,

the MBF program is ranked among the top fnance

programs in the world. Located close to Zurich in the

heart of Europe, St.Gallen offers a connection to an

international fnancial center as well as various leisure

opportunities nearby. In addition, we are able to offer a

truly international experience with our diverse faculty

as well as exchange opportunities in our network of

more than 150 partner universities.

We look forward to welcoming you in the MBF

program soon.

Prof. Dr. Manuel Ammann

Academic Director of MBF

Prof. Dr. Rico von Wyss

Executive Director of MBF

Prof. Dr. Manuel Ammann and Prof. Dr. Rico von Wyss

3

CONTENTS

Why an MBF Masters Degree? ..................................

The Program ...................................................................

Subject Tracks .................................................................

Faculty ...............................................................................

Internationality ...............................................................

Career Perspectives ......................................................

Career Services ..............................................................

Sponsorship .....................................................................

Events................................................................................

Alumni ..............................................................................

Admission Process .........................................................

Academic Calendar ........................................................

Studying at HSG .............................................................

Financial Information .....................................................

Living in Switzerland ......................................................

Living in St.Gallen ...........................................................

4

6

9

10

12

14

17

18

19

21

22

23

24

25

26

27

For more information visit: www.mbf.unisg.ch

Or contact us at: mbf@unisg.ch

3

4

WHY A MASTER'S IN BANKING AND FINANCE?

MBF at a Glance

A challenging experience with a rigorous curriculum, the Masters in Banking and Finance (MBF) program is one of

the leading international fnance programs. In the felds of fnancial markets, fnancial institutions, corporate fnance

and quantitative fnance, the program offers high-quality education in both theory and application. It is designed to

train our students in the critical refection of the different concepts and approaches used in fnancial theory and practice.

The high quality in teaching and education was confrmed by the Financial Times Global Masters in Finance Ranking

2012 (5th place among more than 200 business schools ranked worldwide).

Profle: Class of 2013

Class size: 130

Average age: 24

Average scores: GMAT - 710 points / GRE - 790 points

Gender

Nationalities represented: 31

International students: 47%

Snapshot

Start: Fall Semester (mid-September)

Duration: 90 ECTS. Full-time program with

time to completion of 3 semesters

Language: English (few additional German lectures)

Degree: Master of Arts (M.A. HSG) in

Banking and Finance

Tuition fees: Swiss Nationals: CHF 1,226

All Others: CHF 2,126 per semester

Financial Times Ranking

The MBF program is ranked 5th place in the

Financial Times Global Masters in Finance

Ranking 2012. Per criteria the MBF is ranked:

#1 for "Aims Achieved"

#1 for "Employed at Three Months"

#2 for "Value for Money"

#2 for "Placement Success"

Male - 75%

Female - 25%

Historical Stats

Job offers before graduation: 2.2

Average starting wage: CHF 97,000

5

Olga Kozjukova

MBF Student

The MBF is great for students who are interested in a fnance-related career because of

its excellent reputation and the high quality of the teaching faculty. Beyond its outstanding

content, the MBF offers various interactions with companies and MBF alumni. I especially

appreciate the opportunity to participate in international programs, which allows for

valuable experiences.

5

6

THE PROGRAM

SEMESTER 3

CORE STUDIES

CONTEXTUAL STUDIES

SEMESTER 2

SEMESTER 1

C

o

m

p

u

l

s

o

r

y

S

u

b

j

e

c

t

s

(

1

5

E

C

T

S

)

C

o

r

e

E

l

e

c

t

i

v

e

s

(

2

7

E

C

T

S

)

M

a

s

t

e

r

s

T

h

e

s

i

s

(

1

8

E

C

T

S

)

I

n

d

e

p

e

n

d

e

n

t

E

l

e

c

t

i

v

e

s

(

1

2

E

C

T

S

)

L

e

a

d

e

r

s

h

i

p

S

k

i

l

l

s

(

3

-

9

E

C

T

S

)

C

r

i

t

i

c

a

l

T

h

i

n

k

i

n

g

&

C

u

l

t

u

r

a

l

A

w

a

r

e

n

e

s

s

(

9

-

1

5

E

C

T

S

)

7

Educational Goals

The programs educational goals encompass three dimensions:

Functional Dimension

1. An understanding of the function and importance of fnancial intermediation in the context of the present and future

development of economic systems and its integration into the social, legal and political context.

Instrumental Dimension

2. Knowledge of the theory and application of fnancial markets, characteristics and implementation of modern fnancial

instruments, and the core functions of modern fnancial management.

Institutional Dimension

3. Knowledge of the core functions of the planning, steering and supervision of fnancial institutions and their strategic

business units.

Curriculum: Contents and Structure

The core studies are made up of compulsory courses and core electives, including a research seminar and the Master thesis.

The MBF program has been structured in such a way as to ensure that our students are able to acquire their basic knowledge

in the compulsory courses of the frst semester. In the second and third semesters, students select core electives according to

their individual preferences and thus determine the orientation of their studies themselves.

Compulsory Courses

The three compulsory courses Financial Markets,

Financial Institutions, and Quantitative Methods

must be attended in the frst semester.

Core Electives

In the second and third semesters, students may

design their individual curriculum according to their

preferences and choose to focus on fnancial markets,

corporate fnance, institutions or methods. Students

are free to combine courses from a long list of core

electives.

Research Seminar

In the research seminar, students are required to

write a seminar paper with a research focus and

have to present their fndings. In combination with

the Masters thesis, the MBF therefore provides a

thorough preparation for a PhD.

Independent Electives

Independent electives create additional choices: students

may either attend further core electives of the MBF or

courses of other Masters programs.

88

Viriya Plodpliew

MBF Student

One of the biggest advantages of the Master's in Banking and Finance

program in St.Gallen is the freedom of choice from a broad range of courses.

You might pick lectures and research seminars from four different tracks,

but there is also the possibility of a highly-focused study track. I also

appreciate the great variety of practical classes where you learn how to

deal with real-life problems.

9 9

SUBJECT TRACKS

Alternative Investments

Behavioural Finance

Commodity Markets

Derivatives

Empirical Real Estate

Finance

Energy Finance

Fixed Income Instruments

Institutional Asset

Management

International Finance

Market Microstructure

Pension Finance

Private Equity

Real Estate Finance

Asset Liability

Management

Commercial Banking

Financial Institution

Management

Financial Regulation &

Risk Management

Household Finance &

Consumer Credit

Insurance Operations

Investment Banking

Monetary Policy &

Financial Markets

Private Banking &

Wealth Management

Public Debt

Management

Theory of Risk &

Insurance

Asset Pricing & Portfolio

Choice

Computational Finance

Financial Econometrics

Financial Modeling

Workshop: Asset Alloc.

Financial Modeling

Workshop: Derivatives

Financial Risk Management

Mathematics & Statistics

Quantitative Aspects of

Financial Regulation

Quantitative Portfolio

Management

Time Series Econometrics

Advanced Corporate

Finance

Applied Corporate

Valuation

Corporate Financial

Management

Corporate Governance

Ethics of Financial

Services

Mergers & Acquisitions

There are four possible tracks within the MBF program from which you might choose core elective courses according to

your preferences. These tracks are just a suggestion how you might organize your MBF studies. You are able to switch freely

between the different tracks.

I

N

S

T

I

T

U

T

I

O

N

S

M

E

T

H

O

D

S

M

A

R

K

E

T

S

C

O

R

P

O

R

A

T

E

F

I

N

A

N

C

E

XXX

00000-000000

0000

Order/Customer Service (800) 325-3010 Fax (800) 325-5052

Technical Service (800) 325-5832 sigma-aldrich.com/techservice

Development/Custom Manufacturing Inquiries (800) 244-1173

Safety-related Information sigma-aldrich.com/safetycenter

2012 Sigma-Aldrich Co. LLC. All rights reserved. SIGMA, SAFC, SIGMA-ALDRICH, ALDRICH, and SUPELCO are trademarks of Sigma-Aldrich Co. LLC, registered in the US and other countries. FLUKA is a trademark

of Sigma-Aldrich GmbH, registered in the US and other countries. Sigma brand products are sold through Sigma-Aldrich, Inc. Purchaser must determine the suitability of the product(s) for their particular use.

Additional terms and conditions may apply. Please see product information on the Sigma-Aldrich website at www.sigmaaldrich.com and/or on the reverse side of the invoice or packing slip.

World Headquarters

3050 Spruce St.

St. Louis, MO 63103

(314) 771-5765

sigma-aldrich.com

Enabling Science to

Improve the Quality of Life

10

FACULTY

Prof. Dr. Manuel Ammann

Professor of Finance,

Academic Director of the MBF

Prof. Dr. Andreas Grner

Adjunct Professor of Corporate Finance

Prof. Dr. Martin Eling

Professor of Insurance

Prof. Dr. Francesco Audrino

Professor of Statistics

Prof. Dr. Christian Keuschnigg

Professor of Public Finance

Prof. Dr. Andreas Kck

Assistant Professor of Finance

Prof. Dr. Martin Brown

Professor of Banking

Prof. Dr. Marc Arnold

Assistant Professor of Corporate Finance

Prof. Dr. Matthias Fengler

Assistant Professor of Financial Econometrics

Prof. Dr. Karl Frauendorfer

Professor of Operations Research

Prof. Dr. Roland Fss

Professor of Real Estate Finance

Prof. Dr. Stefan Morktter

Assistant Professor of Banking

11

Prof. Dr. Angelo Ranaldo

Professor of Systemic Risk

Prof. Dr. Florentina Paraschiv

Assistant Professor of Computational Finance

Prof. Dr. David sch

Assistant Professor of Finance

Prof. Dr. Hato Schmeiser

Professor of Insurance

Prof. Dr. Markus Schmid

Professor of Corporate Finance

Prof. Dr. Paul Sderlind

Professor of Finance

Prof. Dr. Rico von Wyss

Assistant Professor of Finance

Prof. Dr. Stephan Sss

Assistant Professor of Finance

For more information on our faculty members

www.mbf.unisg.ch

12

The University of St.Gallen (HSG) encourages and enables its students to supplement their academic curriculum

with international experience. Double degrees, exchange programs, students from all over the world, an international

faculty, internationally orientated curriculum and networks give students the opportunity to experience foreign

cultures and perspectives at frst hand.

INTERNATIONALITY

International students and faculty

Double-degree Programs:

ESADE, Barcelona, Spain

HEC, Paris, France

RSM Erasmus University, Rotterdam, Netherlands

Universit Commerciale Luigi Bocconi, Milan, Italy

FGV, Fundaaozv Getulio Vargas, So Paulo, Brazil

of the faculty come from abroad.

The MBF has visiting professors from

well-known universities from around

the globe:

Prof. Yakov Amihud, PhD

Stern School of Business, New York University

Prof. Harrison Hong, PhD

Princeton University

Prof. David Yermack, PhD

Stern School of Business, New York University

of MBF students come

from 80 different nations.

48

%

34

%

principle for Double-degree Programs:

1 year at HSG 1 year at guest university

60 credits from HSG 60 credits from guest university

10 credits for the Masters thesis from HSG 10 credits from the guest university

50/50

13

Beijing University, Beijing, China

Duke University, Durham, USA

Hitotsubashi University, Tokyo, Japan

Fundaao Getulio Vargas, So Paulo, Brazil

Fudan University, Shanghai, China

Kellogg School of Management, Evanston, USA

LSE, London, United Kingdom

Melbourne Business School (University of Melbourne),

Melbourne, Australia

International exchange programs (a selection):

MBF students are offered an opportunity to participate in exchange programs with 150 partner universities worldwide:

Nanyang Technological University, Singapore

NYU Stern, New York, USA

Queens University, Ontario, Canada

Universidad del Pacifco, Lima, Peru

University of California - The Anderson School,

Los Angeles, CA, USA

Booth School of Business, Chicago, USA

Tsinghua University, Beijing, China

Networks:

The Global Alliance in Management Education

(CEMS)

Partnership in International Management (PIM)

Association of Professional Schools of International

Affairs (APSIA)

The HSG supports international

networking with:

Hubs in Singapore and So Paulo

Asia Research Center

The Sino-Swiss Management Training Program

Centro Latinoamericano-Suizo de la Universidad

de San Gallen

14

CAREER PERSPECTIVES

Labor Market

The labor market puts a premium on HSG degrees.

On average, graduates are able to choose from

2.2 job offers.

Search for employment: 100% of graduates

have a job offer 3 months after graduation.

The average salary of the frst permanent job for

holders of a Masters degree is CHF 97,000.

The quota of HSG alumni in Swiss top management

is outstanding. The HSG has the greatest placing

power in Business Administration.

(Source: Graduate Survey Report, 2010, University of St.Gallen)

Recruiting Companies

Bain

Barclays

Boston Consulting Group

Clariden Leu

Commerzbank

Credit Suisse

Deloitte

Deutsche Bank

EFG Financial Products

Ernst & Young

Goldman Sachs

HSBC

HSG

Johnson & Johnson

J.P. Morgan

Julius Br

LGT

KPMG

Maxwell Lync

McKinsey

Morgan Stanley

Nestl

Nomura

Oliver Wyman

Partners Group

Pensimo Management

PriceWaterhouseCoopers

RBC Dexia

Roland Berger

Royal Bank of Scotland

Sal. Oppenheim

SAM Private Equity

Shilk

Swiss Re

UBS

Unicredit Bank

15

SWITZERLAND

80%

ENGLAND

6% RUSSIA

1%

GERMANY

9%

AUSTRIA

2%

LIECHTENSTEIN

2%

20092011 MBF Graduate Job Placement

16

I chose the Master in Banking and Finance program due to

its rigorous standards in education. Combining theory with

practice is one of the main strengths of the MBF and has

provided me with a set of skills valuable in my everyday work

as a consultant. The MBF is more than just a program: it

offered a unique insight into diversity and interpersonal

skills and thereby prepared me in the best possible way for

the job market.

Vincent Aebi

McKinsey & Company

16

17

CAREER SERVICES

It pays to plan your career early on. The clearer

you are about your competencies, values, interests

and goals, the more focused you can be when

developing job ideas, researching job opportunities,

making contacts, using various offers on campus

and discussing your career-related questions

with company representatives.

The experts of the Career Services Center support

you in different stages of your career planning from

taking stock of your career and doing research (Assess)

to setting goals and applying for jobs (Act) to starting

your job and further developing your career (Achieve).

Furthermore, we assist you with specifc information

about the work permit regulations in Switzerland

for your respective nationality. While international

students can work part-time during their studies,

the regulation foresees a priority to Swiss and EU

nationals after graduation. The Career Management

Team would be glad to speak to you to move you

closer to your career objectives.

Manage your career with us

Career Management International Students

Career Services Center (CSC-HSG)

University of St.Gallen (HSG)

Dufourstrasse 50

CH-9000 St.Gallen

Phone: +41 (0)71 224 29 23

E-Mail: csc@unisg.ch

www.csc.unisg.ch

Our Career Management Services at a Glance

Career Counselling

One-on-one assistance on all career related topics

Career Events

HSG TALENTS Business Insights, seminars,

workshops and training on career related topics

Recruiting Events

HSG TALENTS Conference

HSG TALENTS Banking Days

HSG TALENTS Online: CV publication, event sign-up,

jobs and internship postings, company profles,

newsletter subscription

Career Management Handbook

Consolidated know-how and practical support for your

career planning process

Career Library

Career Management literature

HSG Career Event

18

Industry Partners

The MBF is in close contact with its industry partners

in order to maintain and guarantee a solid foundation

in practice.

The MBF encourages the exchange between students,

faculty and the fnancial industry. The Partners of

the MBF guarantee an early contact with potential

employers and support the MBF in many ways. Our

industrial partners award fellowships for the best

students entering the program. At the end of the

program they award prizes.

Thanks to their ongoing support, the MBF is able to

invite professors from internationally renowned univer-

sities on a regular basis (e.g. Prof. Yakov Amihud, Stern

School of Business, New York University; Prof. Harrison

Hong, Princeton University). Doing internships and col-

laborating with the fnancial industry when writing the

Masters thesis is simplifed thanks to the Partners of

the MBF.

Cooperation with CFA Institute

The MBF program is an offcial

Program Partners of the CFA Institute,

which acknowledges that the MBF program covers

more than 70% of the candidate body of knowledge for

all three levels of the CFA program. Additionally, this

partnership enables the MBF to award CFA fellowships

each year to fve outstanding MBF students who embark

on the program.

SPONSORSHIP

UBS, Zurich

Deutsche Bank, Frankfurt

Credit Suisse, Zurich

Zrcher Kantonalbank

19

EVENTS

19

MBF Graduation: Jeanette Rusch from UBS, Martin Beck

(best Master thesis), Stefanie Hasse (best MBF degree)

and Prof. Dr. Manuel Ammann

MBF-Apero

Prof. Dr. Manuel Ammann & Dr. Patrick Raafaub

(Director FINMA) at the MBF start event

MBF Graduation

Prof. Dr. Manuel Ammann handing out a fellowship A dinner event in Zurich after visiting a trading foor

20

Christoph Doebelt

MBF Student

The Master's in Banking and Finance is a great program because it offers

a broad range of lectures and seminars and because it allows us to design

our individual curriculum accordingto our interests. The program fosters

the exchange between students, faculty, and fnancial institutions. This

guarantees a focus of our lectures on practitioners' needs and leads to an

optimal preparation for a professional career.

20

21

MBF ALUMNI

HSG Alumni is the offcial organization of former

students of the University of St.Gallen. With more than

19,000 members and 100 Alumni Clubs on 5 continents,

it is one of Europes leading associations of this type.

It reinforces the alumnis lifelong bondswith the

University, as well as the networks among its members,

by means of numerous events and information

platforms, www.alumni.unisg.ch.

MBF Alumni

The MBF Alumni association builds a closer network

within the HSG alumni

Knowledge transfer to and from the program

Additional access to the job market

Regular meetings in Zrich, London, and New York

President's Welcome

Prof. Dr. Markus Menz

President, MBF Alumni

21

The knowledge acquired in lectures such as

Derivatives, Corporate Financial Management

and Pension Finance affects essential parts

of my daily business. I am convinced that the

conceptual content of the lessons taught at the

HSG is absolutely in step with current practice.

I am glad that I was able to enjoy such an

effective education.

Danielle Brassel

Associate, Aeris Capital AG

21

As a graduate of the MBF Program

you will be entitled to join the MBF

Alumni Club. The MBF Alumni

Club was founded by the frst MBF

graduates in May 2006. Since then,

it has continuously grown and today

has about 200 members. The club

organizes various activities such

as monthly lunch and dinner events in Zurich. This

exclusive network of HSG graduates working in banking

and fnance or in closely related sectors has proven to

be very valuable for our members, particularly during

the recent fnancial crisis. We invite you to join our

club following your graduation!

22

MBF admission requirements

Bachelor degree in Business or Economics

GMAT (> 680) or GRE (> 160)

Proof of profciency in English

Motivation letter

CV

Admission to the MBF with at least

Deadline April 30th

ADMISSION PROCESS

Admission criteria Score (max)

GMAT or equivalent GRE

(e.g. 680 is 35 pts)

50

GPA of previous degree

(e.g. Bachelor)

30

Motivation Letter 10

Extracurricular activities,

exchange semester, etc.

15

Total possible admission score 105

80

Visit MBF admissions online at:

www.admissions.unisg.ch

22

23

ACADEMIC CALENDAR

JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC

Semester Mid-Semester break

Apply

B

r

e

a

k

B

r

e

a

k

B

r

e

a

k

2

S

e

m

e

s

t

e

r

Semester holidays

n

d

3

S

e

m

e

s

t

e

r

rd

1

S

e

m

e

s

t

e

r

s

t

Fall Semester Spring Semester

Application

Deadline

April 30th

Start of

Semester

calendar week 38 calendar week 8

Mid-semester

break

calendar weeks 44/45 calendar weeks 14/15

End of semester calendar week 51 calendar week 21

Please note, the mid-semester breaks may

be reserved for special seminars.

University's Open Day

Each semester, the University organizes

two open days for prospective Master's

students. Dates are published on our

homepage: www.infotag.unisg.ch

24

Graduate School of Business, Economics,

Law and Social Sciences

Since its founding in 1898, the education and training

offered by the University of St.Gallen have been

characterized by a close affnity to the working world

and an integrative approach. We currently educate

more than 5,000 students in business administration,

economics, law, and the social sciences. According to

current rankings, the HSG is one of Europes leading

business universities. Its holistic education of the

highest academic standards has earned it the EQUIS

and AACSB accreditations by way of an international

seal of approval. The HSG aims to develop students

both in professional and personal areas by providing

them with an education along humanist lines. Its

international orientation is strengthened by students

and faculty coming from all continents, 150 partner

universities and membership in international networks.

Research

Research at the University of St.Gallen is centered around

30 institutes and research centers, which are an integral

part of the University. All institute directors are simul-

taneously also HSG professors. By combining theory

with practice, the institutes provide an important input

for teaching at the University and play a signifcant role

in furthering the careers of young academics. Our 80

tenured professors, 60 assistant professors and senior

lecturers, more than 300 lecturers and 300 assistants,

as well as distinguished visiting professors, nurture

the scientifc discourse with our students.

STUDYING AT THE UNIVERSITY OF ST.GALLEN - HSG

Unique Academic Structure

The HSGs course structure consists of three pillars

and three levels. The three levels are the Assessment

Level, the Bachelors Level and the Masters Level. In

addition to these three academic levels, courses belong

to one of three didactic, subject-related pillars: contact

studies, independent studies and contextual studies.

With this model, the University of St.Gallen satisfes

the demands of society and the economy for graduates

with intellectual fexibility and intercultural qualifcations.

Contact Studies

Contact studies consist of lectures and seminars

in small groups. Students attend program specifc

compulsory courses, core electives and independent

electives. Independent electives may be selected from

the students own Masters program or from other

programs. Thus students have the opportunity to

acquire further knowledge in additional felds

of interest.

Independent Studies

Independent studies place emphasis on students'

personal responsibilities, and are supported by

electronic resources. In terms of subject matter,

they complement contact studies.

Contextual Studies

Contextual studies consist of courses in the areas of

cultural awareness, leadership skills and critical thinking.

They supplement specialized education with oppor-

tunities for well-founded and broad-based personal

development.

25

FINANCIAL INFORMATION

Traveling

In Switzerland, traveling by public transport is very

convenient and encouraged. Students are advised to

obtain the Swiss Federal Railway Half-Fare travelcard

in order to save 50% on all tickets. It is available for

CHF 165 and valid for one year.

Scholarships

The Swiss State Secretariat for Education and Research

offers scholarships to students from abroad based on

performance and study objectives.

Fellowships

Every fall the MBF awards fellowships to the ten

best new entrants. These fellowships are intended to

inspire students who have already an excellent record

in university studies or professional life to attend the

MBF program. Moreover, the fellowships are meant

to provide an incentive for constantly good results

in the program.

Each of these fellowships amounts to CHF 5,000,

with CHF 2,000 being paid at the beginning of the

programme, CHF 3,000 after passing the compulsory

course examinations with a minimum grade of 5.0 in

all of them. All students who have been admitted to the

MBF will be automatically considered for these fellow-

ships. The decision about awarding the fellowship will

be communicated to the most successful applicants in

the letter of admission.

Work-Study Opportunities

As an international student, you are allowed to work

15 hours a week. The University and its institutes are

regularly looking for students to do project work.

Students from outside the EU/EFTA area need a work

permit in order to work in Switzerland.

Living Costs in St.Gallen

The University of St.Gallen recommends students to

budget 2,000-2,500 Swiss Francs (CHF) per month for

basic needs, including fees and study material.

Monthly expenses:

Housing CHF 600

Living Expenses CHF 1,000

Health Insurance CHF 200

Fees

Switzerlands most important resource is its highly

skilled workforce. The country therefore invests in

excellent undergraduate and graduate education at

its universities that is highly subsidized by the state.

Thus the University of St.Gallen is in the convenient

situation to charge its students a fee of CHF 1,226

(Swiss nationals) and CHF 2,126 (all others) per

semester. Text books and other teaching material

are not included.

Accommodation

Prices for accommodation vary greatly depending on

location, size, standard and amenities. In a typical

shared apartment the price for a single bedroom starts

at approx. CHF 400 per month. Rental prices for small

private studios range from CHF 600 upwards per month.

Insurance

Students are required to obtain a Swiss health insurance

(unless granted an exemption by the Swiss authorities). The

costs are approximately CHF 200 per month.

26

As a federal republic with a system of direct

democracy, Switzerland enjoys a high degree of

political stability. Its standing as a neutral country

allows it to play an important humanitarian role in

world affairs and to act as a mediator between

conficting parties. Switzerland is home to various

international organizations, such as the International

Committee of the Red Cross, the United Nations

and the World Trade Organization.

Switzerlands economy is based on a highly qualifed

and skilled labor force. Swiss companies are extremely

competitive in the global markets. Whilst the best-

known export items include watches, chocolate and

cheese; mechanical and electrical engineering, as well

as the life sciences account for over half of Swiss export

revenues. Other signifcant business areas include

consulting, banking, insurance and tourism.

Switzerland benefts from political stability and a

fourishing economy which allow for a high standard

of living at affordable prices. Switzerlands international

reputation as a research center is beyond dispute.

LIVING IN SWITZERLAND

Highlights

Switzerland has four national languages:

German, French, Italian and Romansh

Large international population: 21% of people living

in Switzerland are foreign nationals

One of the highest annual per capita GDPs worldwide:

USD 54,466 (at current prices)

Very low unemployment rate: 3.2% (March 2012)

Country ranked frst in the Travel and Tourism

Competitiveness Report 2011

An increasingly large number of companies are

moving their European headquarters to Switzerland

to take advantage of the favorable business and

living environment

27

LIVING IN ST.GALLEN

St.Gallen offers its approximately 75,000 inhabitants

a historically unique old town with a great number of

shops, street cafs, bars and clubs. The Abbey District

with its baroque cathedral and the Abbey Library is a

UNESCO World Heritage site and thus of international

signifcance.

Further cultural highlights are provided by perfor-

mances in the city theater, the concert hall and

the St.Gallen festivals, as well as by exhibitions in

numerous museums and private galleries. An event

that is particularly popular with many students is the

St.Gallen Open Air music festival, during which the

Sitter Valley is transformed into Switzerlands largest

tent city for three days.

The citys optimal situation between the Alps and

Lake Constance provides opportunities for various

leisure and sports activities, such as skiing, rock

climbing or sailing. St.Gallens Three Ponds are

only a few minutes walking distance from the city

center. These three small lakes situated on a hill on

the outskirts of the city serve as public swimming

pools in the summer and as ice rinks in cold winters.

The Peter and Paul Wildlife Park is situated close to

the University and is popular with students as an

idyllic setting for running or walking.

Settling in St.Gallen The Visa Process

Most individuals who come to Switzerland to study

must obtain a visa prior to entering the country.

Students from the EU/EFTA area, Japan, or Singapore

do not need a visa and must only apply for a residence

permit. On average, visa applications take about eight

weeks to process. Planning ahead is therefore essential.

Students can apply for the visa as soon as they have

received their letter of (conditional) acceptance from

the University and secured fnancing for their studies.

For regular students it is preferable to be issued a B

permit that can be renewed annually. All international

applicants are provided with detailed information

concerning visa application by the university administration.

Housing

The University of St.Gallen does not offer on campus

housing. However, you can easily fnd a place on your

own in St.Gallen over the internet. International

students receive support during the process and, upon

request, are assigned a MBF buddy who can help them.

St.Gallen offers a good selection of apartments, rooms

in shared apartments (called Wohngemeinschaft or WG),

and houses at varying prices.

University of St.Gallen

Swiss Institute for Banking and Finance

Rosenbergstrasse 52

CH-9000 St.Gallen

Switzerland

Phone +41 71 224 70 05

Fax +41 71 224 70 88

mbf@unisg.ch

www.mbf.unisg.ch

D

e

s

i

g

n

C

o

n

c

e

p

t

:

w

w

w

.

i

c

o

n

-

w

o

r

l

d

w

i

d

e

.

c

o

m

You might also like

- The Berkeley MFE - Recruiting GuideDocument6 pagesThe Berkeley MFE - Recruiting GuidechienNo ratings yet

- MSC - Finance - Brochure - PDF Imperial College of LondonDocument8 pagesMSC - Finance - Brochure - PDF Imperial College of Londonwahajbond007No ratings yet

- Corporate Debt Value, Bond Covenants, and Optimal Capital Structure ModelDocument36 pagesCorporate Debt Value, Bond Covenants, and Optimal Capital Structure Modelpedda60100% (1)

- IMD MBA 2008 Class Profile: 90 Future Global LeadersDocument16 pagesIMD MBA 2008 Class Profile: 90 Future Global LeadersShuai Yan0% (1)

- Spring Week GuideDocument32 pagesSpring Week Guidevimanyu.tanejaNo ratings yet

- MbaMission Personal Statement GuideDocument30 pagesMbaMission Personal Statement GuideAndy Nuñez GonzalesNo ratings yet

- Vault Fund Venture Studio Structure AnalysisDocument6 pagesVault Fund Venture Studio Structure AnalysisKleber Bastos Gomes JuniorNo ratings yet

- IBIS Capital - A European Perspective On E-Learning PDFDocument57 pagesIBIS Capital - A European Perspective On E-Learning PDFtitulaNo ratings yet

- Fundamentals Course Outline OfferDocument21 pagesFundamentals Course Outline Offerlizzie111No ratings yet

- INSEAD MBAbrochureDocument38 pagesINSEAD MBAbrochureEddie HuangNo ratings yet

- Studymaster PitchbookDocument17 pagesStudymaster Pitchbookapi-241338805No ratings yet

- Essay Robo-AdvisorDocument14 pagesEssay Robo-AdvisorPerezNo ratings yet

- HEC Starter PackDocument13 pagesHEC Starter PackHenderson ElizabethNo ratings yet

- Estimating Cash Flows with Aswath DamodaranDocument15 pagesEstimating Cash Flows with Aswath Damodaranthomas94josephNo ratings yet

- BTL Marketing in BangladeshDocument7 pagesBTL Marketing in BangladeshNazmus SaadatNo ratings yet

- FinQuiz ScheduleDocument1 pageFinQuiz SchedulePriyesh ThakkerNo ratings yet

- Registered Prep Provider of CFA InstituteDocument18 pagesRegistered Prep Provider of CFA InstituteSergiu CrisanNo ratings yet

- Oliver Wyman 2019 - The Brazilian Investment Landscape A New Era For Brazilian InvestorsDocument22 pagesOliver Wyman 2019 - The Brazilian Investment Landscape A New Era For Brazilian InvestorsThomaz FragaNo ratings yet

- Think Smarter TogetherDocument1 pageThink Smarter TogetherKi KiNo ratings yet

- Graduate investment banking CV templateDocument1 pageGraduate investment banking CV templateChristopher HoNo ratings yet

- Masters in Financial Analysis Employment: Graduating Class of 2018Document9 pagesMasters in Financial Analysis Employment: Graduating Class of 2018Jeet SharmaNo ratings yet

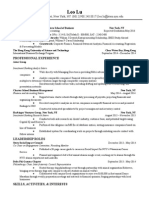

- Lu Leo ResumeDocument2 pagesLu Leo ResumeLeo LuNo ratings yet

- Equity Research ExplainedDocument16 pagesEquity Research ExplainedbhaskkarNo ratings yet

- IEUK22 IBD - Work Sample Brief and DebriefDocument15 pagesIEUK22 IBD - Work Sample Brief and DebriefChia-Ju ChengNo ratings yet

- Describe What You Learned From This Experience, How Your Skills As ADocument2 pagesDescribe What You Learned From This Experience, How Your Skills As AInkNo ratings yet

- Fin 4303 Chapter 8 ContentDocument10 pagesFin 4303 Chapter 8 Contentsxsy8124100% (1)

- IMVDocument8 pagesIMVAzril InzaghiNo ratings yet

- MbaMission's LBS Program Guide 2019-2020Document28 pagesMbaMission's LBS Program Guide 2019-2020Keren CherskyNo ratings yet

- TTS Turbo Macros v14!0!2Document11 pagesTTS Turbo Macros v14!0!2Jack JacintoNo ratings yet

- Railway Capacity OverviewDocument4 pagesRailway Capacity OverviewJamie MooreNo ratings yet

- Mba Harvard Business School Resume Book4Document2 pagesMba Harvard Business School Resume Book4natashaNo ratings yet

- Masters in Finance Employment Report 2017Document9 pagesMasters in Finance Employment Report 2017RABI KUMAR SAHUNo ratings yet

- Resume - Rishabh WadhawanDocument2 pagesResume - Rishabh WadhawanYash WadhawanNo ratings yet

- BCG InsideSherpa Task X Past Email ExampleDocument1 pageBCG InsideSherpa Task X Past Email ExampleSai Swaroop MandalNo ratings yet

- 0417 Forward QuestionsDocument1 page0417 Forward QuestionsTạNgọcMaiNo ratings yet

- Equity Research.Document4 pagesEquity Research.Rohit VermaNo ratings yet

- InseadDocument32 pagesInseadliviu_iordache_4No ratings yet

- WSO Resume 47Document1 pageWSO Resume 47John MathiasNo ratings yet

- Micro Finance As BusinessDocument58 pagesMicro Finance As BusinessAndy Nii AdjeteyNo ratings yet

- Cover Letter TicketmasterDocument1 pageCover Letter TicketmasterJohanna WongNo ratings yet

- LBS Mim Employment ReportDocument12 pagesLBS Mim Employment ReportVidushi SinghalNo ratings yet

- Financial Modeling in ExcelDocument32 pagesFinancial Modeling in ExcelMd AtifNo ratings yet

- CVBK (LSE)Document178 pagesCVBK (LSE)vincentyouNo ratings yet

- SQL - PDF SolutionDocument12 pagesSQL - PDF SolutionJayant Chaudhari36% (11)

- En ROADS Short Student Assignment v5Document3 pagesEn ROADS Short Student Assignment v5AmamahNo ratings yet

- An Analysis of Indicators Disclosed in Corporate Sustainability Reports PDFDocument16 pagesAn Analysis of Indicators Disclosed in Corporate Sustainability Reports PDFRahul PramaniNo ratings yet

- CFA Level II Mock Exam 6 - Questions (PM)Document32 pagesCFA Level II Mock Exam 6 - Questions (PM)Sardonna FongNo ratings yet

- Fisher College Final Group Case AnalysisDocument5 pagesFisher College Final Group Case AnalysisstellaNo ratings yet

- Prep Investment Banking - Online Tests Sample QuestionsDocument59 pagesPrep Investment Banking - Online Tests Sample QuestionsLorenzo MarsicanoNo ratings yet

- Cover-Letter BCGDocument1 pageCover-Letter BCGVermeireNo ratings yet

- Fs App BibleDocument28 pagesFs App Bibleroy064No ratings yet

- IMD Class2009.ProfileDocument12 pagesIMD Class2009.ProfiledutchgermanNo ratings yet

- Career Guides - Leveraged Finance & Credit Risk Management Free GuideDocument9 pagesCareer Guides - Leveraged Finance & Credit Risk Management Free GuideRublesNo ratings yet

- Libor Market Model JoshiDocument2 pagesLibor Market Model JoshiquarkcharmerNo ratings yet

- Finance Interview Questions For Financial AnalystDocument3 pagesFinance Interview Questions For Financial Analystnishi100% (1)

- Rethinking Capitalism BASC0037 Syllabus 2019Document29 pagesRethinking Capitalism BASC0037 Syllabus 2019FelipeNo ratings yet

- PDF Advanced Valuation Erasmus CompressDocument7 pagesPDF Advanced Valuation Erasmus CompressannaNo ratings yet

- 8 CFA Exam Mistakes You Could Be MakingDocument2 pages8 CFA Exam Mistakes You Could Be Makingrajah2No ratings yet

- Brochure Banking and FinanceDocument20 pagesBrochure Banking and FinanceDiego RezendeNo ratings yet

- Exercises 1.2.Document2 pagesExercises 1.2.Rita MorenoNo ratings yet

- Traders Checklist PDFDocument17 pagesTraders Checklist PDFJay Sagar0% (1)

- Multiple Choices 1Document2 pagesMultiple Choices 1ssg2No ratings yet

- Bursa Malaysia Sector ClassificationsDocument1 pageBursa Malaysia Sector ClassificationsNeo4u4433% (3)

- Audit Report by Four MusketeersDocument12 pagesAudit Report by Four MusketeersIubianNo ratings yet

- Gaudreau v. R. Tax Residency CaseDocument13 pagesGaudreau v. R. Tax Residency CaseCiera BriancaNo ratings yet

- Anuj Verma's asset allocation notesDocument23 pagesAnuj Verma's asset allocation notesSweta HansariaNo ratings yet

- Guide To US AML Requirements 5thedition ProtivitiDocument474 pagesGuide To US AML Requirements 5thedition ProtiviticheejustinNo ratings yet

- Questionnaire ActDocument6 pagesQuestionnaire ActLorainne AjocNo ratings yet

- Regular Output Vat 1Document39 pagesRegular Output Vat 1Samantha Tayone100% (1)

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Blcok-4 MCO-7 Unit-1 PDFDocument24 pagesBlcok-4 MCO-7 Unit-1 PDFSoitda BcmNo ratings yet

- Personal Finance 1e Ch02Document20 pagesPersonal Finance 1e Ch02drcalypsojellyfingerNo ratings yet

- Tata Motors Ratio AnalysisDocument12 pagesTata Motors Ratio Analysispurval1611100% (2)

- Dunlop India Limited 2012 PDFDocument10 pagesDunlop India Limited 2012 PDFdidwaniasNo ratings yet

- Income from Business or Profession GuideDocument24 pagesIncome from Business or Profession GuideRahulMalikNo ratings yet

- How The Market Really WorksDocument81 pagesHow The Market Really WorksSana Agarwal100% (11)

- Binus Financial Analyst Academy CFA Program Level 1 Semester 2 Batch 34 2018 V4eDocument5 pagesBinus Financial Analyst Academy CFA Program Level 1 Semester 2 Batch 34 2018 V4eBudiman SnowieNo ratings yet

- Nss 577Document390 pagesNss 577jay.kumNo ratings yet

- Au Small Finance BankDocument27 pagesAu Small Finance BankRuhi Rana100% (2)

- Risk and Return PDFDocument14 pagesRisk and Return PDFluv silenceNo ratings yet

- Consumption and Savings-Lesson 4 (Repaired) - NewDocument7 pagesConsumption and Savings-Lesson 4 (Repaired) - NewMerry Rosalie AdaoNo ratings yet

- Public Private Partnership (PPP) On InfrastructureDocument25 pagesPublic Private Partnership (PPP) On Infrastructuresenthil929No ratings yet

- Incident Report - Mehmet Soner Calis - 800357651Document4 pagesIncident Report - Mehmet Soner Calis - 800357651api-403222332No ratings yet

- Padma Oil Jamuna Oil Ratio AnalysisDocument17 pagesPadma Oil Jamuna Oil Ratio AnalysisMd.mamunur Rashid0% (2)

- TAX CARD 2019Document1 pageTAX CARD 2019Kinglovefriend100% (1)

- Chapter 2 HWDocument4 pagesChapter 2 HWFarah Nader GoodaNo ratings yet

- QUIZDocument74 pagesQUIZmabelpal4783100% (2)

- Treasury and Cash Management EssentialsDocument44 pagesTreasury and Cash Management EssentialsSukumar100% (5)

- Case Analysis Massey Ferguson 1980Document7 pagesCase Analysis Massey Ferguson 1980Muhammad Faisal Hayat100% (2)