Professional Documents

Culture Documents

Tudor Capital Europe LLP Pillar 3 Disclosure PDF

Uploaded by

etravoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tudor Capital Europe LLP Pillar 3 Disclosure PDF

Uploaded by

etravoCopyright:

Available Formats

Tudor Capital Europe LLP Pillar 3 Disclosure and Policy

Introduction

Regulatory context

The Pillar 3 disclosure of Tudor Capital Europe LLP (TCE) is set out below as required

by the FCAs Prudential Sourcebook for Banks, Building Societies and Investment

Firms (BIPRU), specifically BIPRU 11.3.3 R. This follows the introduction of the Capital

Requirements Directive (CRD) which represents the European Unions application of

the Basel Capital Accord. The regulatory aim of the disclosure is to improve market

discipline.

Frequency

TCE makes its Pillar 3 disclosure annually.

Media and location

The disclosure will be published on TCEs website.

Verification

The information contained in this document has not been audited by TCEs external

auditors and does not constitute any form of financial statement and must not be relied

upon in making any judgement on the Group

1

.

Summary

The CRD requirements have three pillars. Pillar 1 deals with minimum capital

requirements; Pillar 2 deals with the Internal Capital Adequacy Assessment Process

(ICAAP) undertaken by a firm and the Supervisory Review and Evaluation Process

through which the firm and regulator satisfy themselves on the adequacy of capital held

by the firm in relation to the risks it faces; and Pillar 3 which deals with public disclosure

of risk management policies, capital resources and capital requirements. The regulatory

aim of the disclosure is to improve market discipline.

TCE is an Investment Management Firm. It acts solely as investment manager, and

does not hold client money. TCEs greatest risks have been identified as business and

operational risk. TCE is required to disclose its risk management objectives and policies

for each separate category of risk which include the strategies and processes to manage

those risks; the structure and organisation of the relevant risk management function or

other appropriate arrangement; the scope and nature of risk reporting and measurement

systems; the policies for hedging and mitigating risk, and the strategies and processes

for monitoring the continuing effectiveness of hedges and mitigants.

TCE has assessed business and operational risks in its ICAAP and set out actions to

1

TCE is a member of the Tudor group (Tudor or the Group) of companies, and its ultimate

parent is Tudor Group Holdings LLC, a Delaware Limited Liability Company.

manage them where appropriate. A number of key operations are outsourced by TCEs

clients to third party providers such as administrators reducing the Firms exposure to

operational risk. TCE has a risk management framework (described below) in place to

mitigate risk.

TCEs main exposure to credit risk is the risk that management and incentive fees

cannot be collected. TCE holds all cash and incentive fee balances with top tier, major

institutions, with a global presence, strong operations and high credit ratings.

Market risk exposure has been assessed by TCE and is limited to the Firms non-trading

book exposure to any non-dollar denominated asset and liability balances.

Background to the Firm

TCE is organised and formed in the UK and is authorised and regulated by the FCA as

an Investment Management Firm. TCEs activities give it the BIPRU categorisation of a

Limited Licence and a BIPRU 50K firm.

TCE is a BIPRU Investment Firm without an Investment Firm Consolidation Waiver

deducting Material Holdings under (GENPRU 2 Annex 4).

BIPRU 11.5.1 R Disclosure: Risk management objectives and policies

Risk management objective

TCEs general risk management objective is to develop systems and controls to mitigate

risk to a level that does not require the allocation of Pillar 2 capital.

Governance framework

The UK Management Committee (UKMC) is the governing body of TCE and has

management and oversight responsibility. It meets quarterly or more frequently if

circumstances dictate and is composed of senior members of Tudor staff.

The UKMC is responsible for the process of risk management, as well as forming its

own opinion on the effectiveness of this process. In addition, the UKMC decides TCEs

risk appetite or tolerance for risk.

TCE Chief Executive Officer (TCE CEO) is accountable to the UKMC for designing,

implementing and monitoring the process of risk management and incorporating this into

the day-to-day business activities of TCE.

The UKMC is responsible for ensuring that the tools used to identify, assess, monitor

and escalate operational risk events, as designed by TCE CEO, are appropriate and are

being implemented effectively.

Risk framework

TCE has a conservative approach to risk. Risk within TCE is managed by use of the

following:

TCE has in place an internal control framework to govern its processes and

procedures and to mitigate any risks, made up of the following components:

o statement of responsibilities;

o baseline assumptions;

o risk appetite statement;

o risk identification and documentation;

o scenario analyses and stress tests;

o event data collection; and

o risk reporting.

The risks identified by TCE have been recorded in an Organisational Risk

Register;

The Organisational Risk Register is reviewed at meetings of UKMC; and

Scenario analysis and stress testing have been undertaken on the most relevant

risks to TCE in order to assist in the process of risk management and capital

planning.

BIPRU 11.5.4 R Disclosure: Compliance with BIPRU 3, BIPRU 4, BIPRU 6, BIPRU 7

and the overall Pillar 2 rule.

BIPRU 3

For its Pillar 1 regulatory capital calculation of credit risk, under the credit risk capital

component, TCE has adopted the standardised approach (BIPRU 3.4) and the simplified

method of calculating risk weights (BIPRU 3.5).

TCE holds sufficient capital to meet its credit risk requirement, which is marginally under

$6m.

BIPRU 4

TCE does not adopt the internal ratings based approach and hence this is not

applicable.

BIPRU 6

TCE, being a limited licence firm is not subject to the Pillar 1 operational risk

requirement and, therefore, this is not applicable.

BIPRU 7

TCE has non-trading book potential exposure only (BIPRU 7.4 & 7.5).

Overall Pillar 2 rule

TCE has adopted the Structured approach to the calculation of its ICAAP capital

resources requirement as outlined in the Committee of European Banking Supervisors

Paper, 25 J anuary 2006.

The UKMC typically undertakes an annual assessment of the ICAAP to ensure that the

statement of risk appetite and the stress testing remain appropriate. This review is also

undertaken whenever there is a material change to the business. As mentioned above,

the UKMC performs a quarterly review of the Organisational Risk Register.

BIPRU 11.5.8 R Disclosure: Credit risk and dilution risk

TCE is primarily exposed to credit risk from the risk of non-collection of management

fees. It holds all cash and incentive fee balances with top tier, major institutions, with a

global presence, strong operations and high credit ratings

A financial asset is past due when a counterparty has failed to make a payment when

contractually due.

Impairment is defined as a reduction in the recoverable amount of a fixed asset or

goodwill below its carrying amount.

BIPRU 11.5.12 R Disclosure: Market risk

TCE has non-trading book potential exposure only (BIPRU 7.4 & 7.5).

TCE holds a sufficient surplus of capital to meet its market risk requirement, which is

less than $1m.

BIPRU 11.5.2 R Disclosure: Scope of application of directive requirements

TCE is subject to the disclosures under the Banking Consolidation Directive.

BIPRU 11.5.3 R Disclosure: Capital Resources

TCE is a BIPRU Investment Firm without an Investment Firm Consolidation Waiver

deducting Material Holdings under (GENPRU 2 Annex 4). Tier 1 capital comprises of

partners capital and audited reserves.

As of posting TCE holds over $30m in capital.

BIPRU 11.5.5 R

This disclosure is not required as TCE has not adopted the internal ratings based

approach to credit risk and therefore is not affected by BIPRU 11.5.4 R (3).

BIPRU 11.5.6 R

This disclosure is not required as TCE has not adopted the internal ratings based

approach to credit risk and therefore is not affected by BIPRU 11.5.4 R (3).

BIPRU 11.5.7 R

This disclosure is not required as TCE does not have a trading book.

BIPRU 11.5.9 R

This disclosure is not required as TCE does not make value adjustments and provisions

for impaired exposures that need to be disclosed under BIPRU 11.5.8 R (9).

BIPRU 11.5.10 R Disclosure: Firms calculating risk weighted exposure amounts in

accordance with the standardised approach

This disclosure is not required as TCE uses the simplified method of calculating risk

weights (BIPRU 3.5).

BIPRU 11.5.11 R Disclosure: Firms calculating risk weighted exposure using the IRB

approach

This disclosure is not required as TCE has not adopted the internal ratings based

approach to credit risk and therefore is not affected by BIPRU 11.5.4 R (3).

BIPRU 11.5.13 R Disclosure: Use of VaR model for calculation of market risk capital

requirement

This disclosure is not required as TCE does not use a VaR model for calculation of

market risk capital requirement.

BIPRU 11.5.14 R Disclosure: Operational risk

TCEs fixed overheads requirement (FOR) is disclosed as a proxy for the Pillar 1

operational risk capital calculation.

TCEs Pillar 1 capital resources requirement is the FOR which is higher than the sum of

the market risk and credit risk requirement.

The FOR is approximately $10m.

BIPRU 11.5.15 R Disclosure: Non-trading book exposures in equities

This disclosure is not required as TCE does not have a non-trading book exposure to

equities.

BIPRU 11.5.16 R Disclosure: Exposures to interest rate risk in the non-trading book

Although TCE has substantial cash balances on its balance sheet, there is currently no

significant exposure to interest rate fluctuations.

BIPRU 11.5.17 R Disclosure: Securitisation

This disclosure is not required as TCE does not securitise its assets.

BIPRU 11.5.18 R Disclosure: Remuneration

TCE has adopted a remuneration policy that complies with the requirements of chapter

19A of the FCA's Senior Management Arrangements, Systems and Controls

Sourcebook ("SYSC"), as interpreted in accordance with the FCA's guidance publication

entitled "General Guidance on Proportionality: The Remuneration Code (SYSC 19A) &

Pillar 3 Disclosures on Remuneration (BIPRU 11)" and subsequent items of guidance

issued by the FCA, including its document entitled "Frequently Asked Questions on the

Remuneration Code".

As a BIPRU limited licence firm, TCE falls within proportionality tier 3. TCE has

concluded, on the basis of its size and the nature scale and complexity of its legal

structure and business that it does not need to appoint a remuneration committee.

Instead, the UKMC sets, and oversees compliance with, the Firm's remuneration policy

including reviewing the terms of the policy at least annually.

As at the date of posting, TCE currently sets the variable remuneration of its staff in a

manner which takes into account staff and firm performance, by reference to:

individual employee performance;

performance of the individuals business unit or department; and

the overall results of the LLP.

As permitted for firms falling within proportionality tier 3, TCE takes into account the

specific nature of its own activities (including the fee based nature of its revenues) in

conducting any ex-ante risk adjustments to awards of variable remuneration and, given

the nature of its business, has disapplied the requirement under the Remuneration Code

to make ex-post risk adjustments.

TCE only has one "business area", namely its investment management business. All of

TCE's Code Staff fall into the "senior management" category of Code Staff (rather than

the "risk taker" category) for the purposes of the Remuneration Code. The aggregate

"remuneration" (as defined in the FSA Rules) awarded to TCE's Code Staff during the

financial year ending on 31 March 2013 was GBP17,048,026.

You might also like

- FTP Treasurer LetterDocument9 pagesFTP Treasurer LetterealinushNo ratings yet

- Apple Case ReportDocument2 pagesApple Case ReportAwa SannoNo ratings yet

- Amazon Go ReportDocument3 pagesAmazon Go ReportkatyaNo ratings yet

- Trust Bank ICAAP ReportDocument16 pagesTrust Bank ICAAP ReportG117100% (2)

- ISO 22301: 2019 - An introduction to a business continuity management system (BCMS)From EverandISO 22301: 2019 - An introduction to a business continuity management system (BCMS)Rating: 4 out of 5 stars4/5 (1)

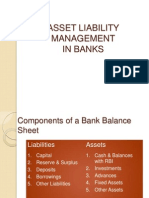

- Asset Liability ManagementDocument18 pagesAsset Liability Managementmahesh19689No ratings yet

- Risk Management and Basel II: Bank Alfalah LimitedDocument72 pagesRisk Management and Basel II: Bank Alfalah LimitedtanhaitanhaNo ratings yet

- The Children's Investment Fund - TCI Pillar 3 Disclosure - 2017Document7 pagesThe Children's Investment Fund - TCI Pillar 3 Disclosure - 2017Beverly TranNo ratings yet

- ICAAP - DeereDocument12 pagesICAAP - DeereSumiran BansalNo ratings yet

- Ava Trade EU Limited Pillar 3 Disclosure 2020Document7 pagesAva Trade EU Limited Pillar 3 Disclosure 2020OlopoloNo ratings yet

- Pillar 3 Disclosure 2021Document13 pagesPillar 3 Disclosure 2021Khadim HussainNo ratings yet

- Risk Management & Basel IIIDocument31 pagesRisk Management & Basel IIIsatishNo ratings yet

- Chapter 3 RISK IN FINANCIAL SERVICES CISI Notes 3Document32 pagesChapter 3 RISK IN FINANCIAL SERVICES CISI Notes 3Maher G. BazakliNo ratings yet

- Standard Chartered p3 2010 Final PublishedDocument52 pagesStandard Chartered p3 2010 Final PublishedlmferlaNo ratings yet

- Financial Disclosures Annual Report 2022Document20 pagesFinancial Disclosures Annual Report 2022WalterNo ratings yet

- Imp Base Lop Risk Doc 2006Document14 pagesImp Base Lop Risk Doc 2006r.jeyashankar9550No ratings yet

- Standard Chartered Pillar 3 2011Document55 pagesStandard Chartered Pillar 3 2011ohmygodNo ratings yet

- Rba Module PracticalDocument16 pagesRba Module PracticalJosef ArnoNo ratings yet

- Appendix ADocument17 pagesAppendix AKhalid KunariNo ratings yet

- Components of Assets & Liabilities in Bank'S Balance SheetDocument7 pagesComponents of Assets & Liabilities in Bank'S Balance SheetAnonymous nx6TUjNP4No ratings yet

- Ebrd Risk AppetiteDocument16 pagesEbrd Risk AppetiteleonciongNo ratings yet

- Final White Paper Version ThreeDocument30 pagesFinal White Paper Version ThreeMarketsWikiNo ratings yet

- Treasury MGMT PracticesDocument17 pagesTreasury MGMT PracticesRubishNo ratings yet

- Risk Assessment: Overlooked and Under Tested : Robert J. Bradley, CAMSDocument12 pagesRisk Assessment: Overlooked and Under Tested : Robert J. Bradley, CAMSAleAleNo ratings yet

- Basel PDFDocument24 pagesBasel PDFGaurav0% (1)

- Risk Management: Capital Management & Profit PlanningDocument25 pagesRisk Management: Capital Management & Profit Planningharry2learnNo ratings yet

- Op Risk RulesDocument14 pagesOp Risk Rulesapi-3807149No ratings yet

- HLBANK-Page 45 To ProxyForm (1.5MB) PDFDocument246 pagesHLBANK-Page 45 To ProxyForm (1.5MB) PDFNickyYongChiaChiNo ratings yet

- Corporate Finance Assignment 1 July To Sep BatchDocument9 pagesCorporate Finance Assignment 1 July To Sep BatchMadhu Patil G TNo ratings yet

- Module 1-Internal Control Frameworks: Introduction To COSODocument3 pagesModule 1-Internal Control Frameworks: Introduction To COSODaljeet SinghNo ratings yet

- RiskDocument10 pagesRiskSanath FernandoNo ratings yet

- CamelsDocument4 pagesCamelsWaseem KhanNo ratings yet

- Pra Decision Notice CitigroupDocument44 pagesPra Decision Notice CitigroupBokulNo ratings yet

- RAROCDocument22 pagesRAROCchelsea1989No ratings yet

- Treasury Management PracticesDocument34 pagesTreasury Management PracticesRubishNo ratings yet

- What Is A Risk-Based Capital Requirement?Document3 pagesWhat Is A Risk-Based Capital Requirement?Dilawar Kamran-17No ratings yet

- Practical Ifrs 09Document10 pagesPractical Ifrs 09Farooq HaiderNo ratings yet

- Operational Risk - An Assessment at International LevelDocument9 pagesOperational Risk - An Assessment at International LevelAlex OlteanuNo ratings yet

- Basel II Norms: Sunday, March 02, 2014Document23 pagesBasel II Norms: Sunday, March 02, 2014Amit Kumar JhaNo ratings yet

- Assigment On Capital RequirementDocument10 pagesAssigment On Capital RequirementDilawar Kamran-17No ratings yet

- Chapter 16 MGT of Equity CapitalDocument29 pagesChapter 16 MGT of Equity CapitalRafiur Rahman100% (1)

- CB AssignmentDocument6 pagesCB AssignmentVaishnavi khotNo ratings yet

- Basel Prime BankDocument10 pagesBasel Prime BankHabib UllahNo ratings yet

- Sec Icfr GuidanceDocument77 pagesSec Icfr GuidanceMatthew GopezNo ratings yet

- Risk Management Framework: by Prof Santosh KumarDocument30 pagesRisk Management Framework: by Prof Santosh KumarAYUSH RAVINo ratings yet

- Capital and Risk Management Report 31 December 2011Document103 pagesCapital and Risk Management Report 31 December 2011Miki BasarovNo ratings yet

- Fiaglobal CCP Risk Position PaperDocument13 pagesFiaglobal CCP Risk Position PaperMarketsWikiNo ratings yet

- Treasury Management Practices 2022/23: Appendix 2Document45 pagesTreasury Management Practices 2022/23: Appendix 2markngare investmentdataNo ratings yet

- Capital Capital FundsDocument12 pagesCapital Capital FundsDrKhalid A ChishtyNo ratings yet

- On Operational Risk at UbsDocument23 pagesOn Operational Risk at UbsSai KrishnaNo ratings yet

- Glossary PDFDocument8 pagesGlossary PDFkumarsanjeev.net9511No ratings yet

- Commercial Banking Assignment: Dhruti Bhatia Roll No: 062 Specialization-Finance MMS - 2020Document8 pagesCommercial Banking Assignment: Dhruti Bhatia Roll No: 062 Specialization-Finance MMS - 2020Dhruti BhatiaNo ratings yet

- Operational Risk Management Guidelines RBIDocument65 pagesOperational Risk Management Guidelines RBINirjhar DuttaNo ratings yet

- Capital Capital FundsDocument11 pagesCapital Capital FundsSantosh Kumar BarikNo ratings yet

- Basel 3Document18 pagesBasel 3adnan04No ratings yet

- The New Basel Capital Accord: Glossary of TermsDocument6 pagesThe New Basel Capital Accord: Glossary of TermsNevena BebićNo ratings yet

- Corporate GovernanceDocument7 pagesCorporate GovernanceSoon Mei QiNo ratings yet

- Chapter 3 Risk AssessmentDocument17 pagesChapter 3 Risk AssessmentArizal Zul Lathiif100% (1)

- Economics Glossary PDFDocument9 pagesEconomics Glossary PDFSK PNo ratings yet

- Module 4 Prudential Supervision, Basel Accords & Capital ManagmentDocument9 pagesModule 4 Prudential Supervision, Basel Accords & Capital ManagmentAnna-Clara MansolahtiNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- Option NoteDocument2 pagesOption NoteetravoNo ratings yet

- Consent Form FCC ParagonDocument1 pageConsent Form FCC ParagonetravoNo ratings yet

- Symbol Sectors 1m 3m 6m 1yDocument13 pagesSymbol Sectors 1m 3m 6m 1yetravoNo ratings yet

- Ntro To-Options 2012Document53 pagesNtro To-Options 2012etravoNo ratings yet

- Ratings CriteriaDocument1 pageRatings CriteriaAakash KhandelwalNo ratings yet

- Credit Default Swap Valuation IDocument35 pagesCredit Default Swap Valuation ISharad Dutta0% (1)

- Chart Implied Volatility Data in Real-TimeDocument2 pagesChart Implied Volatility Data in Real-TimeetravoNo ratings yet

- L 1-R Credit Spread D (0, T - Years) SP Cumul: PDF CumDocument5 pagesL 1-R Credit Spread D (0, T - Years) SP Cumul: PDF CumetravoNo ratings yet

- Was Senior Management at Barings Aware That There Was A Problem at BFS? ExplainDocument4 pagesWas Senior Management at Barings Aware That There Was A Problem at BFS? ExplainetravoNo ratings yet

- Capital Guaranteed Notes Ba Rrier Reverse Convertibles: Example: Autocallable NoteDocument4 pagesCapital Guaranteed Notes Ba Rrier Reverse Convertibles: Example: Autocallable NoteetravoNo ratings yet

- Symbol Sectors 1m 3m 6m 1yDocument13 pagesSymbol Sectors 1m 3m 6m 1yetravoNo ratings yet

- Business ValuationDocument7 pagesBusiness ValuationetravoNo ratings yet

- XRTrading Cover LetterDocument1 pageXRTrading Cover LetteretravoNo ratings yet

- Equity Index Fair Value MonitorDocument2 pagesEquity Index Fair Value MonitoretravoNo ratings yet

- FT WordDocument1 pageFT WordetravoNo ratings yet

- Assignement DerivativesDocument4 pagesAssignement DerivativesetravoNo ratings yet

- 42728711ACST828ASS1Document17 pages42728711ACST828ASS1etravoNo ratings yet

- Finacial TimesDocument2 pagesFinacial TimesetravoNo ratings yet

- Finacial TimesDocument2 pagesFinacial TimesetravoNo ratings yet

- Dispersion Trading Reference For StartingDocument1 pageDispersion Trading Reference For StartingetravoNo ratings yet

- Group Assignment Strategic ManagementDocument2 pagesGroup Assignment Strategic ManagementetravoNo ratings yet

- Bain and Company Global Private Equity Report 2012 PDFDocument72 pagesBain and Company Global Private Equity Report 2012 PDFLinus Vallman JohanssonNo ratings yet

- Gem Global Report 2010revDocument85 pagesGem Global Report 2010revRafael Martins VieiraNo ratings yet

- Finacial TimesDocument2 pagesFinacial TimesetravoNo ratings yet

- RMD IntroDocument11 pagesRMD IntroFaiz Ismadi50% (2)

- Khilafat Movement 1919-1924Document17 pagesKhilafat Movement 1919-1924Grane FrameNo ratings yet

- Bhuri Nath v. State of J&K (1997) 2 SCC 745Document30 pagesBhuri Nath v. State of J&K (1997) 2 SCC 745atuldubeyNo ratings yet

- Professional Cloud Architect Journey PDFDocument1 pageProfessional Cloud Architect Journey PDFPraphulla RayalaNo ratings yet

- Indian Contract Act 1972Document37 pagesIndian Contract Act 1972Ashutosh Saraiya100% (2)

- Internship ReportDocument44 pagesInternship ReportRAihan AhmedNo ratings yet

- Kickstart RequirementsDocument4 pagesKickstart Requirements9466524546No ratings yet

- Transfer: One Page Guide: Ear P Ourself and Hole Eartedly Mbrace TheDocument1 pageTransfer: One Page Guide: Ear P Ourself and Hole Eartedly Mbrace TheRAHUL VIMALNo ratings yet

- Dharma DuraiDocument3 pagesDharma Duraivsection managerNo ratings yet

- US Internal Revenue Service: Irb04-43Document27 pagesUS Internal Revenue Service: Irb04-43IRSNo ratings yet

- Cement SegmentDocument18 pagesCement Segmentmanish1895No ratings yet

- Fashion OrientationDocument7 pagesFashion OrientationRAHUL16398No ratings yet

- Salesforce - Service Cloud Consultant.v2021!11!08.q122Document35 pagesSalesforce - Service Cloud Consultant.v2021!11!08.q122Parveen KaurNo ratings yet

- Journal Jul Dec14 Art4Document16 pagesJournal Jul Dec14 Art4paromita bhattacharjeeNo ratings yet

- Cost of Preferred Stock and Common StockDocument20 pagesCost of Preferred Stock and Common StockPrincess Marie BaldoNo ratings yet

- Finals Week 12 Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Document6 pagesFinals Week 12 Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesNo ratings yet

- Taqwa (Pıety) Beıng Conscıous of Maıntaınıng Allah's PleasureDocument1 pageTaqwa (Pıety) Beıng Conscıous of Maıntaınıng Allah's PleasuretunaNo ratings yet

- Midterm ExamDocument3 pagesMidterm ExamRafael CensonNo ratings yet

- 07 Chapter1Document19 pages07 Chapter1zakariya ziuNo ratings yet

- BrochureDocument10 pagesBrochureSaurabh SahaiNo ratings yet

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.100% (3)

- Jazzed About Christmas Level 2-3Document15 pagesJazzed About Christmas Level 2-3Amanda Atkins64% (14)

- Community-Based Health Planning Services: Topic OneDocument28 pagesCommunity-Based Health Planning Services: Topic OneHigh TechNo ratings yet

- The Six Day War: Astoneshing Warfear?Document3 pagesThe Six Day War: Astoneshing Warfear?Ruben MunteanuNo ratings yet

- MultiCultural Counseling Competencies and StandardsDocument10 pagesMultiCultural Counseling Competencies and StandardsIrwan J S100% (1)

- Motion For Re-RaffleDocument3 pagesMotion For Re-RaffleJoemar CalunaNo ratings yet

- Journey of BhaavaDocument5 pagesJourney of BhaavaRavi GoyalNo ratings yet

- Criticism On Commonly Studied Novels PDFDocument412 pagesCriticism On Commonly Studied Novels PDFIosif SandoruNo ratings yet