Professional Documents

Culture Documents

Blaines Kitchenware

Uploaded by

vic1989vicOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blaines Kitchenware

Uploaded by

vic1989vicCopyright:

Available Formats

1

Blaines Kitchenware

Blaine kitchenware has occupied the industry for a over 80 years and continues to gain

control in the market it occupies. As the CEO of the company, Mr. Dubinski is faced with the

difficult decision of determining what is the best for the family company. The following

questions will address what decision is the optimal and why it is beneficial for BKI.

Do you believe Blaines current capital structure and payout policies are appropriate?

Why or why not?

The main dilemma in the case is whether Blaine Kitchenwares should choose to repurchase its own

shares or not. If Blaines Kitchenware does repurchase its shares, they must consider whether to partially

repurchase the market float or go for a complete buyback where Blaines family would become the owner

of all the remaining shares. They also have to consider of the effect of the repurchase on various factors

like the risks involved in raising a debt especially when they are large, very conservative and debt free.

They should also consider things such their acquisition plans, their earnings per share and their dividend

per share, ownership structure, capital structure and of course the reputation of the company in the market

after the buyback. With this in mind we can consider a few situations and then decide what Blaine should

do, keeping in mind the perspective of both the existing shareholders' as well as Blaine's c familys.

Since no debt is being raised, if all the cash & cash securities plus the market securities are used

for the buy-back, his family may like this option. Their management will have increased stakes, this will

reduce their chance of being acquired and this will provide more dividends to their remaining

shareholders.

There is a big question facing Blaine and that is why would their existing shareholders want to

sell their equity back to the company? Another scenario is to completely buy-back the market float.

Although this will involve the company raising a significant debt, this will also give them complete

control to the promoters. It is probable that their familys needs concerning the dividend amount and

2

growth can be better met through this option and the policy can be set according to their expectations. The

return on equity will increase which will aid the family in better realizing value for their stake. From the

point of view of the shareholders, they are getting a premium on the current market price if they go ahead

with the offer and since debt is being raised the WACC will come down. We think that this could

possibly be the best option for Blaines Kitchenware to make.

According to their current situation we do not think their current capital structure and payout

policies are appropriate. Blaine is currently over-liquid and under-levered and their shareholders are

suffering from the effects. Since Blaine Kitchenware is a public company with large portion of its shares

held by their family members, they have a financial surplus, which decreases the efficiency of its

leverage. In other words, Blaine does not fully utilize its funds. Since they are totally equity financed,

there is no tax shield. A surplus of cash lowers the return on equity and increases the cost of capital; also

large amount of cash may offer incentives to acquirer to and also decrease the enterprise value of Blaine.

Acquirers could pay way less than they originally expect to buy out the firm.

1

Regarding their payout policies, the managements goal is to maximize the shareholders value, rather

than paying dividend. The management should use the available cash and invest in attractive investments.

Although investors take dividend as an indicator for a company to succeed, they also expect dividend will

be paid continuously at either stable or growing rate. In summary, in order for Blaine to keep its current

payout policies, they must reduce numbers of outstanding shares throughout share repurchasing.

1

Capital Structure - Meaning and Factors Determining Capital Structure." Management Study

Guide - Free Training Guide for Students and Entrepreneurs.. N.p., n.d. Web. 29 Nov. 2012.

<http://www.managementstudyguide.com/capital-structure.htm

3

Should Dubinski recommend a large share repurchase to Blaines board? What are the

primary advantages and disadvantages of such a move?

Such a large move for the company can greatly affect a lot of aspects, and different interests

lie in different areas for shareholders and management. When stock repurchases occurs it lowers

the amount of stocks within the company, and eventually within time the E.P.S. would increase

in future. This company is facing an unbalanced capital structure and such a move of a share

repurchase, with the help of both cash and short/long term borrowing. Raising debt can have its

advantage within capital structure, replacing the equity within the firm can reduce WACC and

that can lead to a tax advantage. Covering the advantages and disadvantages of the repurchase,

we will recommend what Dubinski should do.

Covering the advantages of share repurchase first, and focus on what advantages Blaine can

gain from repurchasing the shares. A first advantage of a share repurchase can be the tax

implications involved with it, and the benefit that arises from it. The more a company is

leveraged by debt affects the capital structure, which in turn lowers the amount of taxed income.

This is one beneficial form of stock repurchase.

2

The second benefit arising from a stock repurchase is the increase in earnings per share. If

earnings were to remain stable, and the number of shares decrease than the earnings per share

2

Buckwold, B.; Kitunen, J. A. (2012) Canadian income taxation: Planning and decision

making (2012-2013 ed.)

4

will increase. When an efficient market reacts to information such as this, the price of the stock

will increase because the price of the share increased.

3

When investors are alerted about a new stock repurchase the price of the stock generally

increases which is also beneficial for Blaine Kitchenware. Advantages in stock repurchase also

occur to the outside market, where it alerts them on how healthy cash flows are within the firm.

Float is also decreased in the firm, where outside shareholders have less share of the company.

An increase in buying back the equity can be beneficial for any company that has the power to

do so.

Although there are several beneficial advantages to stock repurchasing, their also is a few

disadvantages that come with it. Announcement of the share repurchase, and the actual

repurchase have a big effect from the timing of the events. Although stock prices might increase

initially, they might decrease once the actual stock repurchase is finalized. Disadvantages in

stock repurchasing is largely involved with timing, and what the markets might think of the

purchase. It can manipulate earnings and overstate them in a way that is not as good for the

company. Manipulating earnings can overstate the actual company value.

Stock repurchase can be incredibly beneficial, especially for a company like BKI that has the

power to perform a buyback. If company has healthy cash-flows matched with a need to increase

debt within the company, this can be beneficial for BKI. Increasing earnings per share, is

important in repurchasing shares but also the tax advantages (even if they might be lower) they

3

Subject. "JSTOR: An Error Occurred Setting Your User Cookie." JSTOR: An Error Occurred

Setting Your User Cookie. N.p., n.d. Web. 28 Nov. 2012.

<http://www.jstor.org/stable/2601008?seq=2>.

5

are still advantageous. If a firm has extra cash, with a healthy cash flow and a reduction of tax

and possibly an increase in firm value. Dubinski should make a large share repurchase , and BKI

should recover some its shares in hopes of gaining the advantages of tax, and a stronger EPS.

The company has the assets (cash) and can take the restructuring of debt to take advantage of this

share repurchase.

Consider the following share repurchase proposal: Blaine will use $209 million of cash

from its balance sheet and $50 million in new debt-bearing interest at the rate of 6.75% to

repurchase 14.0 million shares at a price of $18.50 per share. How would such a buyback

affect Blaine? Consider the impact on, among other things, BKIs earnings per share and

ROE, its interest coverage and debt ratios, the familys ownership interest, and the

companys cost of capital.

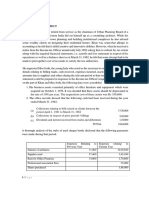

Calculations

4

EPS

EPS= EBIT/CSO

Repurchase of shares Interest = 6.75%(50,000,000)

259 million in cash = 3,375,000

50 million in new-debt bearing interest

To repurchase 14,000,000

CSO = 59,052,000 - 14,000,000

CSO = 45,052,000

4

Ross, Westerfield, Jordan, Roberts(2010): Fundamentals of Corporate Finance, Seventh Canadian Edition,

Toronto: McGraw Hill Ryerson.

6

EBIT = 63,946,000 - 3,375,000

EBIT = 60,571,000

EPS = 60,571,000/ 45,052,000

EPS = 1.34

Change in EPS = 1.34 - 0.91

0.91

Change in EPS = 0.4725

= 47.25%

ROE

ROE = Net Income

CSO

ROE = 53,630/45,052

ROE = 1.19

Interest Coverage

Interest Coverage = EBIT/Interest Expense

7

Interest Coverage = 63,946,000/3,375,000

Interest Coverage = 18.95

Debt Ratio

Debt Ratio = Total Debt/Total Assets

Debt Ratio = 103 890 000/592 253 000

Debt Ratio = 0.1753

Family's Ownership Interest

62%(59,052,000 CSO)

= 36,612,000 shares

After repurchase of 14,000,000 shares

36,612,000/45,052,000

= 81.27%

With the calculations made we can see that not only can BKI afford to

repurchase their shares, but they will benefit from it. After calculating EPS there

would be a 47.25% increase in the earnings per share after

8

recapitalization. Another positive number would be the 1.19 ROE, this number

shows that after the shares are repurchased that there will be a positive return on

equity. This number means they will turn a 119% return on their equity after the

shares are repurchased. Interest Coverage and the debt ratio is another

interesting number. With the 18.95:1 ratio for interest income, and a 0.1754 debt

ratio, we see that BKI has a large amount of assets built up and will be easily

able to afford the price of buying back these shares. This was one of the main

concerns, where they did not want to borrow money and potentially have a large

interest expense. As for the family's ownership interest, under the new proposal,

they would now own 81.27% of the company, giving them even more power then

they would have before. All of these calculations indicate that it would be greatly

beneficial to BKI to repurchase their shares, where they can afford it and they will

benefit from it in the long run.

9

As a member of Blaines controlling family, would you be in favor of this proposal?

Would you be in favor of it as non-family shareholder?

When a company is owned and maintained by a family that maintains it in a strong

family setting, it is important for them to maintain a certain percentage of ownership.

Eliminating external owners is important in gaining a better advantage for the company, and

in this instance the family Is looking to gain a larger ownership of the company. The

proposal would have to examine a number of factors, and some main questions were asked

on would it sap financial strength, or prevent the company from making future acquisitions.

Before examining the perspective of the family, and the shareholder it is important to

examine what an external financial party would insists on behalf of a structured financial

argument. A company with a healthy cash flow, matched with a stable Net income can be a

candidate for a stock repurchase. It is important to examine the current debt obligations

within the company, which are far less weighted compared to Liabilities and Shareholders

equity. The firms choice will ultimately lie on BKIs financial perspective and needs on

liquidity, capital structure, dividend policy, and ownership structure.

As a member of the family I would be in favor for the stock repurchase for a number of

reasons. Members of the family were welcoming the idea of the possible effects of the share

repurchase, one main attraction of the repurchase would be the fact that ownership percentage

would rise. This attraction is key to the family who maintain this a more family company, and a

larger ownership in the company would allow them to own more of it. Looking back on the

history of the company, it is important to realize the intangible effect the company has, and how

advantageous it would be for them to have a buyback. It would also give the board more

10

flexibility in setting future dividends per share, and give them more control of the company. As a

member of the family I would want the share repurchase because of the amount of control I

would obtain, along with the knowledge of my company having healthy cash flows. Although I

would approve of the share repurchase I would be skeptical about the debt factor within the

repurchase, the interest rate could be detrimental to the company and the interest payments could

incur more cost than benefit. It is also the third time since its inception, that the company seeked

debt financing which proved to be a large decision for the company. As a member of the family I

would approve of the repurchase, and there is no new trends that indicate that the company will

see future bad financial performance.

As a shareholder of the company you could be reluctant to receive a payment from the

buyback at market price, or you can be a shareholder who retains their shares. It is beneficial in

both cases, both shareholders who continue to own shares will see a rise in EPS in shares after

the repurchase which will benefit the shareholders. The shareholders could see a significant rise

for a short time, however it is important to realize the amount of control they will lose when the

family gains more control. Although stock price might increase for a short period of time, the

ownership percentage can decrease which is detrimental to shareholders. Shareholders should

accept the proposal cause it can increase the companies value, and stocks which can increase the

value of selling the stocks which is beneficial for shareholders.

A stock repurchase for any company is based on timing, and certain financial and non

financial factors need to be met in order for the purchase to realize any benefit. BKI has a strong

and healthy cash flow, matched with an optimal need for debt restructuring that could benefit the

company. The benefits that are realized from this repurchase can be very beneficial for BKI, and

because of the financial position it is in, along with a family favoring of the repurchase BKI

11

should perform the repurchase. In all the short and long term benefits arising from the stock

repurchase greatly outweigh the costs of not performing any capital restructuring.

You might also like

- FM SolutionDocument11 pagesFM SolutionBilal Naseer100% (4)

- Blaine Kitchenware Business Case AnalysisDocument8 pagesBlaine Kitchenware Business Case Analysisjen18612100% (2)

- Finance Case - Blaine Kitchenware - GRP - 11Document4 pagesFinance Case - Blaine Kitchenware - GRP - 11Shona Baroi100% (3)

- Blaine Kitchenware Case Study SolutionDocument5 pagesBlaine Kitchenware Case Study SolutionMohan Kumar89% (37)

- Blaine Kitchenware Case Study SolutionDocument5 pagesBlaine Kitchenware Case Study SolutionFarhanie Nordin100% (2)

- Blaine Kitchenware Case Study SolutionDocument5 pagesBlaine Kitchenware Case Study SolutionMuhammad Shariq Siddiqui100% (3)

- Case #1: Blaine Kitchenware, IncDocument6 pagesCase #1: Blaine Kitchenware, IncKenyaYetu100% (1)

- Blaine Kitchenware IncDocument4 pagesBlaine Kitchenware IncUmair ahmedNo ratings yet

- Blaine Kitchenware Inc. Written Case AnalysisDocument1 pageBlaine Kitchenware Inc. Written Case AnalysisomirNo ratings yet

- Blain Kitchenware CF CaseDocument25 pagesBlain Kitchenware CF CaseAnurag Chandel67% (3)

- Blaine Kitchenware CaseDocument4 pagesBlaine Kitchenware Caseskyhannan80% (5)

- Finance Case - Blaine KitchenwareDocument8 pagesFinance Case - Blaine KitchenwareodaiissaNo ratings yet

- Blaine Kitchenware 3Document8 pagesBlaine Kitchenware 3Chris100% (1)

- Blain Kitchenware Inc.: Capital StructureDocument7 pagesBlain Kitchenware Inc.: Capital StructureRoy Lambert100% (4)

- Blaine Kitchenware IncDocument9 pagesBlaine Kitchenware Incnandyth100% (3)

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Question 1Document9 pagesQuestion 1Minh HàNo ratings yet

- Introduction To The CaseDocument48 pagesIntroduction To The CaseRohit Jain100% (5)

- Blaine-Kitchenware Case CalculationsDocument6 pagesBlaine-Kitchenware Case CalculationsDennis Alexander Guerrero100% (1)

- Blaine Kitchenware ExcelDocument1 pageBlaine Kitchenware ExcelRoderick Jackson JrNo ratings yet

- Exhibits of Blaine Kitchenware, Inc - CaseDocument6 pagesExhibits of Blaine Kitchenware, Inc - CaseSadam Lashari100% (3)

- Group 5 PresentationDocument73 pagesGroup 5 PresentationSourabh Arora100% (4)

- Blaine Kitchenware Inc.Document13 pagesBlaine Kitchenware Inc.vishitj100% (4)

- Calculation of Blain Kitchenware CaseDocument2 pagesCalculation of Blain Kitchenware CaseAsad Bilal67% (3)

- Blaine Kitchenware: Case Exhibit 1Document15 pagesBlaine Kitchenware: Case Exhibit 1Fahad AliNo ratings yet

- Blaine SolutionDocument4 pagesBlaine Solutionchintan MehtaNo ratings yet

- Case 2 - Question 1Document8 pagesCase 2 - Question 1justin_zelin100% (1)

- Blaine KitchenwareDocument1 pageBlaine KitchenwareSam Skf100% (1)

- Blaine KitchenwareDocument23 pagesBlaine Kitchenwaresweenie796% (25)

- Final FMDocument53 pagesFinal FMSourabh Arora80% (5)

- Case: Blaine Kitchenware, IncDocument5 pagesCase: Blaine Kitchenware, IncWilliam NgNo ratings yet

- 4052 Xls Eng Prof BLAINE KITCHENWAREDocument11 pages4052 Xls Eng Prof BLAINE KITCHENWAREMafernanda GR67% (6)

- Formula:: (No of Shares Outstanding Before The Buy Back)Document5 pagesFormula:: (No of Shares Outstanding Before The Buy Back)Bushra Syed0% (1)

- Blaine Kitchenware Inc PDFDocument13 pagesBlaine Kitchenware Inc PDFpatriciolivares3009No ratings yet

- Blaine Kitchenware CalculationDocument11 pagesBlaine Kitchenware CalculationAjeeth71% (7)

- Blaine Excel HWDocument5 pagesBlaine Excel HWBoone LewisNo ratings yet

- Case Study Que of Blaine KitchenwareDocument1 pageCase Study Que of Blaine KitchenwareSimran Malhotra50% (2)

- Blain Kitchenware VenkatDocument19 pagesBlain Kitchenware Venkatgvsfans50% (2)

- Blaine Kitchenware, Inc. - Capital Structure DATADocument5 pagesBlaine Kitchenware, Inc. - Capital Structure DATAShashank Gupta100% (1)

- BBB Case Write-UpDocument2 pagesBBB Case Write-UpNeal Karski100% (1)

- AirThread G015Document6 pagesAirThread G015Kunal MaheshwariNo ratings yet

- KOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedDocument30 pagesKOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedmanjeetsrccNo ratings yet

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- Case BBBYDocument7 pagesCase BBBYgregordejong100% (1)

- Airthread Excel SolutionDocument18 pagesAirthread Excel SolutionRiya ShahNo ratings yet

- Section I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeDocument11 pagesSection I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeclendeavourNo ratings yet

- Blaine Kitchenware IncDocument4 pagesBlaine Kitchenware IncChrisNo ratings yet

- Blain Kitchenware Solution PDFDocument10 pagesBlain Kitchenware Solution PDFRui TrindadeNo ratings yet

- MS 5241 Financial ManagementDocument5 pagesMS 5241 Financial ManagementAbhishek GuptaNo ratings yet

- Unit VI SonndDocument7 pagesUnit VI SonndsonndNo ratings yet

- Stock and Debt.": IbidDocument18 pagesStock and Debt.": IbidRakshita BissaNo ratings yet

- Corporate Finance - Unit II - Cao My Duyen - HOM59Document10 pagesCorporate Finance - Unit II - Cao My Duyen - HOM59Duyên CaoNo ratings yet

- Hill Country Snack Foods Case AnalysisDocument5 pagesHill Country Snack Foods Case Analysisdivakar62No ratings yet

- DcosDocument4 pagesDcosAbhishek BharteNo ratings yet

- Linear Technology Payout Policy Case 3Document4 pagesLinear Technology Payout Policy Case 3Amrinder SinghNo ratings yet

- Corporate RestructuringDocument4 pagesCorporate RestructuringSwathi AshokNo ratings yet

- B .What Isthe Retention Rateor Retention Ratio? (Be Sure To Provide An Equation)Document7 pagesB .What Isthe Retention Rateor Retention Ratio? (Be Sure To Provide An Equation)Daniel GabrielNo ratings yet

- Kitchen Ware SolutionDocument6 pagesKitchen Ware SolutionIrfan ShaikhNo ratings yet

- Case Presentation-McKenzie Corporations Capital BudgetingDocument17 pagesCase Presentation-McKenzie Corporations Capital Budgetingpragati bora67% (3)

- Coperate FinanceDocument17 pagesCoperate Financegift lunguNo ratings yet

- Transferable Letters of CreditDocument12 pagesTransferable Letters of CreditSudershan ThaibaNo ratings yet

- Jal Kal Vibhag, AgraDocument1 pageJal Kal Vibhag, AgraNeeraj gargNo ratings yet

- Globalization - Definition: According To Ritzer (2011)Document5 pagesGlobalization - Definition: According To Ritzer (2011)ARNOLD II A. TORRESNo ratings yet

- Bodhanwala, R. J. (2014) - Testing The Efficiency of Price-Earnings Ratio in Constructing Portfolio. IUP Journal of Applied Finance, 20 (3), 111-118.Document9 pagesBodhanwala, R. J. (2014) - Testing The Efficiency of Price-Earnings Ratio in Constructing Portfolio. IUP Journal of Applied Finance, 20 (3), 111-118.firebirdshockwaveNo ratings yet

- Assignment - 1 Marks - 25 Answer Any One of The Question Given Below in 1000 Words EachDocument3 pagesAssignment - 1 Marks - 25 Answer Any One of The Question Given Below in 1000 Words EachManibalanNo ratings yet

- HRM-Mountain Lodge Case StudyDocument15 pagesHRM-Mountain Lodge Case StudyMadhur Mehta100% (1)

- Sukhwinder Kaur - Office ManagerDocument4 pagesSukhwinder Kaur - Office ManagerAbhishek aby5No ratings yet

- E Payment SystemDocument47 pagesE Payment SystemNamrata KshirsagarNo ratings yet

- The Banking and Financial Institutions (Disclosure) Regulation 2014Document12 pagesThe Banking and Financial Institutions (Disclosure) Regulation 2014Michael MwambangaNo ratings yet

- Basic Cash Flow Management NotesDocument125 pagesBasic Cash Flow Management NotesJeam Endoma-ClzNo ratings yet

- Defining Business Ethics Chapter SummaryDocument4 pagesDefining Business Ethics Chapter SummarySeng TheamNo ratings yet

- International Business: by Charles W.L. HillDocument31 pagesInternational Business: by Charles W.L. HillFahad KhanNo ratings yet

- 1030120969session 2015-16 Class Xi Accountancy Study Material PDFDocument189 pages1030120969session 2015-16 Class Xi Accountancy Study Material PDFharshika chachan100% (1)

- Tenant App Form 2Document2 pagesTenant App Form 2api-26508830No ratings yet

- By Laws-SheDocument25 pagesBy Laws-SheSherilyn CastilloNo ratings yet

- Cryptocurrency - A New Investment Opportunity - Google FormsDocument7 pagesCryptocurrency - A New Investment Opportunity - Google Formsadityasharma8970No ratings yet

- M1-The Reality of Dynamism and Hypercompetition: A Strategic Management ModelDocument55 pagesM1-The Reality of Dynamism and Hypercompetition: A Strategic Management ModelMetch ApphiaNo ratings yet

- Quess CorpDocument22 pagesQuess CorpdcoolsamNo ratings yet

- Marketing StrategyDocument3 pagesMarketing Strategyakakaka2402No ratings yet

- Ch. 1 Globalization IBDocument18 pagesCh. 1 Globalization IBnikowawaNo ratings yet

- Marketing Plan For Aski Ausaid Agri CenterDocument7 pagesMarketing Plan For Aski Ausaid Agri CenterLey Anne PaleNo ratings yet

- BBPW3203 BiDocument303 pagesBBPW3203 BiYEENo ratings yet

- TCS-Recruitment and SelectionDocument17 pagesTCS-Recruitment and SelectionChirag PatelNo ratings yet

- Solved Todd and Elaine Purchased For 300 000 A Building That WasDocument1 pageSolved Todd and Elaine Purchased For 300 000 A Building That WasAnbu jaromiaNo ratings yet

- Latif Khan PDFDocument2 pagesLatif Khan PDFGaurav AroraNo ratings yet

- Hand Out NO 11 Clearing and SettlementDocument9 pagesHand Out NO 11 Clearing and SettlementAbdul basitNo ratings yet

- 2018 - GAR Annual ReportDocument211 pages2018 - GAR Annual ReportKirstie ImeldaNo ratings yet

- Preboard 1 Plumbing ArithmeticDocument8 pagesPreboard 1 Plumbing ArithmeticMarvin Kalngan100% (1)

- Running Head: Business Ethics - Week 5 Assignment 1Document4 pagesRunning Head: Business Ethics - Week 5 Assignment 1MacNicholas 7No ratings yet

- HRM Assignment 1Document5 pagesHRM Assignment 1Laddie LMNo ratings yet