Professional Documents

Culture Documents

A More Ethical and Profitable Approach To Corporate Finance

Uploaded by

willy_setiadi7429Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A More Ethical and Profitable Approach To Corporate Finance

Uploaded by

willy_setiadi7429Copyright:

Available Formats

Electronic copy available at: http://ssrn.

com/abstract=2032815

1

A More Ethical and Profitable Approach to Corporate Finance

By

Robert Ashford

Professor of Law

Syracuse University College of Law

Syracuse, New York 13244

(Tel.) (w) (315) 443-1111

(Tel.) (c) (315) 677-4680

rhashford@aol.com

2012

I. INTRODUCTION

This paper provides a brief summary of a little-understood approach to corporate finance

that the chief executive officer a major credit-worthy company could undertake to enable his/her

company to operate in a more ethical way while enhancing corporate profitability. It covers

only the highlights. A fuller explication of the analysis underlying this approach is provided in

other writings.

1

.

The approach involves a process of learning, teaching, and implementation:

1. learning the more profitable and ethical means of financing the employment of capital

and labor,

2. teaching that means to a critical mass of leaders in business, government, labor

organizations, and other social institutions,

3. promoting the implementation of modest changes in the present system of corporate

finance that would enable credit-worthy companies to enhance their profitability and

share value by enhancing the earning capacity of their employees and customers, and

4. including some implementation of the modified system of corporate finance within the

business planning of CEOs company.

The implementation of the modified system of corporate finance would require no taxes,

redistribution, or government command. With the modified system of corporate finance,

companies would be free to continue to meet their capital requirements as before, but they would

have an additional, more ethical and profitable, market means to satisfy their capital

requirements. If widely understood by market participants, this additional means could be

voluntarily employed to:

1

Broadening the Right to Acquire Capital with the Earnings of Capital: The Missing

Link to Sustainable Economic Recovery and Growth, ( 39 Forum for Social-Economics. 89

(2009). (Earlier version available on SSRN). Binary Economics: the New Paradigm, (1999) with

Rodney Shakespeare (University Press of America)

Electronic copy available at: http://ssrn.com/abstract=2032815

2

1. enhance the earning capacity of the participating companies, their employees and their

customers,

2. promote more sustainable, environmentally friendly, and more broadly shared growth and

prosperity,

3. reduce poverty, welfare dependence and the need for government expenditures, taxes,

and other transfer payments,

4. enhance the value of equity investments and reduce the risk of borrowing, and

5. enhance the credit worthiness of national governments and their ability to raise revenue.

If the CEO of a major corporation were to initiate and maintain its leadership in this

process of learning, teaching and implementation, that CEO and that major corporation would be

widely credited with leading the world out of the present economic crisis and into a sustainable

future of greater and more broadly shared prosperity, ecological harmony, distributive justice,

and reduced strife.

II. A MORE PROFITABLE APPROACH TO CORPORATE FINANCE, THE

DISTRIBUTION OF EARNING CAPACITY AND ECONOMIC GROWTH:

The more ethical and profitable approach to corporate finance begins with several

propositions that are not controversial:

1. Profitable, competitive business practice employs a mix of labor and capital according to

their relative contribution to production.

2. By reason of technological advance, one goal of profit maximizing is to produce more

with more productive capital and less labor.

3. With technological advance, production becomes increasingly more capital intensive.

4. Profitable business planning requires investing in capital that pays for itself (i.e.,

returns the financial investment needed to acquire it) in a competitive time period.

5. The purpose of corporate finance is to enable corporations to acquire capital before they

have earned the money to pay for it.;

6. The choice of financing sources is among retained earnings (approximately 70 +%),

borrowing (approximately 25 +%, or sale of stock (usually less than 5% and in some

years negative).

7. Almost all capital of any nations major corporations and of the worlds corporations is

acquired with the earnings of capital and very little is acquired with the earnings of labor.

The more ethical and profitable approach to corporate finance continues with several

propositions that are true, but not as widely recognized, and that may prove controversial

because they seemingly defy widely shared preconceptions. First consider two ways of

understanding the role of capital and labor in production, distribution and growth: Although

(beginning with Adam Smith and continuing through J ohn M. Keynes to the present day), most

people believe that the primary role of capital in contributing to per-capita economic growth is to

increase the productivity of labor, there is another way to understand the primary role of capital:

namely to do an increasing portion of the total work done. Thus, according to a widely shared

perception, per capita growth might be understood by the example of a person sawing ten boards

Electronic copy available at: http://ssrn.com/abstract=2032815

3

per hour with a hand saw and one hundred boards per hour with a machine saw. Thus, human

productivity has increased tenfold. Alternatively, however, per capita growth might be

understood by the example of a person hauling a sack one mile on his back, and leading a horse

that is hauling ten sacks, or a driving a truck that is hauling one thousand sacks the same distance

in a fraction of the time. Thus, in one important sense, per-capita growth can be understood as

capital increasing labor productivity; but in another important sense, per-capita growth can be

understood as capital doing an ever increasing portion of the total work done and as being

capable of distributing an increasing portion of the income derived from production.

Based on the less widely understood, conception of per-capita growth, three important

propositions can be advanced:

1. Both labor and capital do work.

2

2. Although advancing technology may be understood as making labor more productive,

advancing technology may also be understood as invariably making capital more

productive than labor in task after task (which explains why profitable corporations

continually employ capital to replace and vastly supplement the work of labor).

3. The prospect of a broader distribution of capital acquisition with the earnings of capital

carries with it the prospect of more broadly distributed earning capacity in future years,

which in turn will provide the market incentives to profitably employ more capital and

labor in earlier years. In other words, the more broadly capital is acquired with the

earnings of capital, the more an economy will grow.

It is important to understand that the foregoing third proposition is relatively new in the

history of economic thought. It is not found in the works of Adam Smith, Karl Marx, Alfred

Marshall, J ohn M. Keynes, Milton Friedman, J ohn K. Galbraith or any of their followers. It

identifies a distinct cause of economic growth uniquely premised on the distribution of capital

acquisition with the earnings of capital. The closest correlative drawn from the foregoing

authors is the Keynesian analysis that holds that a broader distribution and/or redistribution of

income may promote growth. But unlike the Keynesian analysis, the analysis underlying the

growth principle based on the broader distribution of capital with the earnings of capital requires

no government redistribution, taxation, borrowing, command, or other market intervention. It

materializes as a direct result of corporations voluntarily deciding to operate in a potentially

more profitable manner by ethically including their employees and customers in the process by

which they acquire capital with the earnings of capital. Moreover, for reasons explained in the

references in footnote 1, there is reason to believe that the resultant growth from broadening

capital acquisition with the earnings of capital would be substantial indeed much greater than

the incremental growth that might be obtained by increased reliance on the present left- or right-

wing growth strategies or any mix of the two.

2

The assertion that capital does work does not negate the fact that both capital and labor are

generally needed to complete specific kinds of work, or the fact that labor is needed to invent, build,

install, operate, maintain, store, repair, manage, and finance capital. But the labor work involved in

inventing, building, creating, installing, operating, maintaining, storing, repairing, managing, and

financing capital is not the work of the capital itself.

4

III. THE PRESENT GLOBAL FINANCIAL CRISIS:

The foregoing analysis has an important but little-understood bearing on the present

global financial crisis. Among the aspects of the crisis are recession, sluggish growth, business

failure, excessive private and sovereign debt, high unemployment, poverty, and (hovering in the

background) environmental degradation. During recessions, periods of sluggish growth and

even in times of modestly robust growth, credit-worthy corporations experience a reduced rate of

return in large part for the following reason: At diminishing unit costs, most of these companies

could profitably produce much more of the goods and services that people would purchase if

they had the earning capacity to do so; and if they could do so, the market value of the shares of

these companies would substantially increase. One transcendent antidote to these troubling

financial aspects would be the rational prospect of sustainable, economic growth, which in turn

would be justified by the broadening distribution of sustainable consumer earning capacity.

The mainstream strategy for promoting economic recovery is a composite left- and right-

wing mix of government policies and subsidies that promote (1) capital acquisition with the

earnings of capital primarily for corporations and well-capitalized persons (generally in

proportion to their existing wealth), and (2) primarily jobs (but by no means the best or highest

paying jobs) and various forms of welfare redistribution for poor and middle class people. If the

understanding of production, distribution, and growth advanced in this paper has validity, then it

follows that in a market economy in which production is becoming ever more capital intensive,

sufficient earning capacity to purchase all that can be produced cannot be distributed by jobs and

welfare alone. The missing element in these strategies (that could easily be added without extra

cost to anyone) is to distribute earning capacity by broadening the distribution of capital

acquisition with the earnings of capital i.e., to provide poor and middle class people with

practical, competitive access to the same institutions of corporate finance, banking, insurance,

loans and guaranties, and favorable tax and monetary policy (presently routinely provided to

people primarily in proportion to their existing wealth ) so that poor and middle class people can

also enhance their earning capacity by acquiring capital with the earnings of capital and thereby

enhance the prospects of sustainable economic recovery and growth. Major credit-worthy

companies are uniquely positioned to provide this access in an ethical and profitable way.

To acquire capital with the earnings of capital, well capitalized people use

1. the pre-tax earnings of capital,

2. collateral,

3. non-recourse corporate credit,

4. market and insurance mechanisms to diversify and reduce risk, and

5. a monetary policy intended to protect private property.

The same institutions and practices that work profitably for well-capitalized people can also

work profitably for all people. Moreover, in an economy operating at less than full capacity, if

capital can competitively pay for its acquisition costs out of its future earnings primarily for

existing owners, it can do so even more profitably if all people are included in the acquisition

process.

5

Because present demand for the employment of capital and labor is dependent on demand

for consumer goods in a future period, a voluntary pattern of steadily broadening capital

acquisition promises more production-based consumer demand in future years and therefore

more demand for a fuller employment of labor and capital in earlier years. Thus, if the

techniques of corporate finance (presently used to for the benefit corporations and their existing

share owners to acquire capital with the earnings of capital) were opened competitively to all

people then, the present demand for capital investment and employment would increase in

anticipation of the broadening distribution of capital income to poor and working people with

unsatisfied consumer needs and wants. Accordingly, a broader distribution of capital acquisition

and income strengthens the promise of capital to pay for itself with its future earnings, makes

profitable the employment of more capital and labor, and enhances the prospects of sustainable

economic recovery and enhanced growth. It will also therefore increase the market value of

well run corporations and their shareholders within the growing economy

IV WHAT CAN A WELL-MEANING CEO OF A MAJ OR CREDIT-WORTHY DO TO

ENABLE HIS/HER COMPANY TO OPERATE IN A MORE ETHICAL WAY WHILE

ENHANCING CORPORATE PROFITABILITY?

Even with complete corporate authority based on fully informed shareholder ratification,

a CEO could not profitably or ethically initiate a corporate capital acquisition business plan

structured to include its employees and customers until the laws underlying the system of

corporate finance were modified to allow for their profitable inclusion. Although the necessary

modifications are modest and could easily be obtained once the underlying logic is understood,

the modifications would require national legislation of the sovereign in which the corporation is

incorporated. Nor could the CEO profitably or ethically proceed under such a modified system

without a critical number of other participating companies and other market participants

proceeding with the same understanding.

These facts prompt a return to several of the points made in the Introduction. One way a

CEO can operate his company more ethically and yet profitably (indeed, more profitably) is to

include its employees, customers, and neighbors in the corporate finance process whereby the

corporation acquires capital with the earnings of capital. This ethical choice (of including, rather

than continuing to exclude, those people) can be realized, but only if a process of learning,

teaching, and implementation as briefly outlined above is first undertaken.

V, BENEFITS

The benefits to be derived from the successful process of learning, teaching, and

implementation fall into two categories: systemic and company specific. The systemic benefits

include the benefits listed in the five categories listed in the Introduction. In addition, to the

extent participating companies include employees in their capital acquisition plans, they may

experience benefits by way of greater productivity and loyalty and lower wage demands.

Moreover, to the extent participating companies include customers in their capital acquisition

plans, they may experience greater customer allegiance. Further, to the extent participating

companies include employees and customers in their capital acquisition plans, they may be given

6

tax credits to the extent that dividends paid on employee and customer shares are either taxed to

the recipients or used to reduce welfare payments.

VI. COSTS

The educational process to achieve the understanding of the critical number of managers

of other companies, and leaders in business, labor, and government would also be relatively

small a fraction of expenditures already devoted to company advertising and public relations

and perhaps not an incremental expense, but rather a substitute for expenditures already planned

regarding the dissemination of other information.

Once the ownership-broadening concepts are understood by a critical number of people,

it would also be necessary to persuade governments such as those of the USA and the UK to

make modest changes in the existing institutions of corporate finance that they maintain. The

changes would not involve increased taxation, government market intervention, compulsory

actions on the part of citizens or private companies, or increased government spending. With

sufficient breadth of understanding, the modest governmental changes would not be difficult to

achieve. Once the changes were made, the companies would be able to finance their capital

requirements in a profitable way that would enhance the earning capacity of their customers and

enrich their shareholders. There would be costs of implementation, primarily by way of

fiduciaries acting for the benefit of the new owners, but these world be far outweighed by the

increase in profitability of all participating companies.

VII. CONCLUSION

If the CEO of a major corporation were to initiate and maintain its leadership in this

simple educational process, that CEO and that major corporation would become widely credited

with leading the world out of its present economic nightmare and into a sustainable future of

prosperity, ecological harmony, distributive justice, and relative peace (excluding religious and

racial based conflict). The public relations benefits would be enormous.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Assignment HRADocument22 pagesAssignment HRACHIRAG V VYASNo ratings yet

- II-ResearchTemplatev1 20Document301 pagesII-ResearchTemplatev1 20'Izzad AfifNo ratings yet

- Engineering Economy QuestionsDocument134 pagesEngineering Economy QuestionsJE Genobili100% (4)

- 1-Ravi Kishore Manual (MYRAO)Document402 pages1-Ravi Kishore Manual (MYRAO)Ahsan RazaNo ratings yet

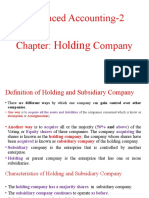

- Advanced Accounting-2 Company: HoldingDocument20 pagesAdvanced Accounting-2 Company: HoldingTB AhmedNo ratings yet

- C14 - Tutorial Answer PDFDocument5 pagesC14 - Tutorial Answer PDFJilynn SeahNo ratings yet

- GDV: TDC:: Per PeriodDocument9 pagesGDV: TDC:: Per PeriodM. HfizzNo ratings yet

- Mindspace Business Parks REIT IPODocument4 pagesMindspace Business Parks REIT IPOKUNAL KISHOR SINGHNo ratings yet

- Fs ExerciseDocument6 pagesFs ExerciseDIVINE GRACE ROSALESNo ratings yet

- Detailed Report On Investment AnalysisDocument4 pagesDetailed Report On Investment AnalysisRadha MaheshwariNo ratings yet

- NBFC DataDocument15 pagesNBFC DataAman mishraNo ratings yet

- Investment Journey: Building Wealth Through Quality Companies and Long-Term HoldingDocument8 pagesInvestment Journey: Building Wealth Through Quality Companies and Long-Term HoldingSripathy ChandrasekarNo ratings yet

- Econ 261: Principles of Finance Quiz 2-40 Marks: InstructionsDocument2 pagesEcon 261: Principles of Finance Quiz 2-40 Marks: InstructionsRehan HasanNo ratings yet

- Executive Summary HydroponicsDocument8 pagesExecutive Summary HydroponicsArmando Sanso100% (1)

- Global FinanceDocument5 pagesGlobal FinanceJean AlburoNo ratings yet

- CHINA HUANENG GROUP CONTROL PERFORMANCE EVALUATIONDocument15 pagesCHINA HUANENG GROUP CONTROL PERFORMANCE EVALUATIONYouJianNo ratings yet

- Long StrangleDocument2 pagesLong StrangleAKSHAYA AKSHAYANo ratings yet

- Taxpnl FY2023 2024Document31 pagesTaxpnl FY2023 2024sumitthakur17No ratings yet

- SMEs - TOA - VALIX 2018 PDFDocument17 pagesSMEs - TOA - VALIX 2018 PDFHarvey Dienne Quiambao100% (1)

- FinanceDocument17 pagesFinancejackie555No ratings yet

- Tesla'S Valuation & Financial ModelingDocument7 pagesTesla'S Valuation & Financial ModelingElliNo ratings yet

- Partnership Dissolution - Practice ExercisesDocument5 pagesPartnership Dissolution - Practice ExercisesVon Andrei Medina0% (2)

- Compound Financial InstrumentsDocument10 pagesCompound Financial Instrumentskrisha milloNo ratings yet

- Innovative Lesson PlanDocument8 pagesInnovative Lesson PlanbinsurachelbabyNo ratings yet

- FAR Review Course Pre-Board - FinalDocument17 pagesFAR Review Course Pre-Board - FinalROMAR A. PIGA100% (1)

- Di OutlineDocument81 pagesDi OutlineRobert E. BrannNo ratings yet

- Sify AcquisitionDocument11 pagesSify AcquisitionvinaymathewNo ratings yet

- Law Final GauriDocument10 pagesLaw Final GauriPoonam KhondNo ratings yet

- Harish S N - Impact of FIIs On Indian Stock MarketDocument22 pagesHarish S N - Impact of FIIs On Indian Stock MarketHarish SNNo ratings yet

- Mr. Loqueloque Will Contribute The Amount 3,795,250Document6 pagesMr. Loqueloque Will Contribute The Amount 3,795,250John ManatadNo ratings yet