Professional Documents

Culture Documents

Banco Filipino V Ybanez Digest2

Uploaded by

Kenny Robert's0 ratings0% found this document useful (0 votes)

235 views3 pagesIBANEZ CASE

Original Title

2. Banco Filipino v Ybanez Digest2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIBANEZ CASE

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

235 views3 pagesBanco Filipino V Ybanez Digest2

Uploaded by

Kenny Robert'sIBANEZ CASE

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

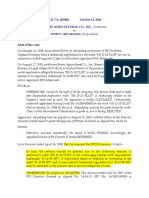

BANCO FILIPINO SAVINGS AND MORTGAGE BANK, petitioner, vs. JUANITA B. YBAEZ, CHARLES B. YBAEZ, JOSEPH B.

YBAEZ and JEROME B. YBAEZ, respondents.

FACTS:

On March 7, 1978, respondents obtained a loan secured by a Deed of Real Estate Mortgage over Transfer Certificate of Title (TCT)

from petitioner bank. The loan was used for the construction of a commercial building in Cebu City. On October 25, 1978,

respondents obtained an additional loan from the petitioner thus increasing their obligation to one million pesos. A corresponding

Amendment of Real Estate Mortgage was thereafter executed.

On December 24, 1982, the loan was again re-structured, increasing the loan obligation to P1,225,000 and the Real Estate Mortgage

was again amended. Respondents executed a Promissory Note for the sum of P1,225,000 payable in fifteen years, with a

stipulated interest of 21% per annum, and stipulating monthly payments.

Respondents total payment from 1983 to 1988 amounted to P1,455,385.07, However, From 1989 onwards, respondents did not pay

a single centavo. They aver that Banco Filipino had ceased operations and/or was not allowed to continue business, having been

placed under liquidation by the Central Bank.

On January 15, 1990, respondents lawyer wrote Special Acting Liquidator, Renan Santos, and requested that plaintiff return the

mortgaged property of the respondents since it had sufficiently profited from the loan and that the interest and penalty charges were

excessive. Petitioner bank denied the request.

Banco Filipino was closed on January 1, 1985 and re-opened for business on July 1, 1994. From its closure to its re-opening,

petitioner bank did not transact any business with its customers.

On August 24, 1994, respondents were served a Notice of Extra Judicial Sale of their property covered by TCT No. 69836 to

satisfy their indebtedness allegedly of P6,174,337.46 which includes the principal, interest, surcharges and 10% attorneys fees.

On September 19, 1994, respondents filed a suit for Injunction, Accounting and Damages, alleging that there was no legal and

factual basis for the foreclosure proceedings since the loan had already been fully paid. A restraining order was issued the following

day by the lower court enjoining petitioner to cease and desist from selling the property at a public auction.

Lower court rendered a Decision, directing defendant Banco Filipino Savings and Mortgage Bank to render a correct accounting of

the obligations of plaintiffs with it after eliminating interest from January 1, 1985 to July 1, 1994 when it was closed, and reducing

interest from 21% to 17% per annum, at the time it was in operation, and totally eliminating [the] surcharge of 1% per month,

within a period of fifteen (15) days from the time the judgment shall have become final and executory.

Not satisfied with the decision, both parties appealed the case to the Court of Appeals. The Court of Appeals rendered a Decision

affirming the decision of the trial court. Hence, this Petition.

ISSUE:

THE COURT OF APPEALS COMMITTED AN ERROR IN RULING THAT THE PLAINTIFFS-BORROWERS (HEREIN RESPONDENTS) CANNOT

BE CONSIDERED TO HAVE DEFAULTED IN THEIR PAYMENT SINCE DEFENDANT BANK CEASED OPERATION FROM 1985 TO 1991.

HELD:

To resolve the controversy we shall address the following pertinent question: (1) What is the effect of the temporary closure of

Banco Filipino from January 1, 1985 to July 1, 1994 on the loan?

In Banco Filipino Savings and Mortgage Bank v. Monetary Board, the validity of the closure and receivership of Banco Filipino was put

in issue. But the pendency of the case did not diminish the authority of the designated liquidator to administer and continue the

banks transactions. The Court allowed the banks liquidator to continue receiving collectibles and receivables or paying off creditors

claims and other transactions pertaining to normal operations of a bank. Among these transactions were the prosecution of suits

against debtors for collection and for foreclosure of mortgages. The bank was allowed to collect interests on its loans while under

liquidation, provided that the interests were legal.

WHEREFORE, the Decision of the Regional Trial Court, which was sustained by the Court of Appeals, is hereby MODIFIED as

follows: (1) the interest rate at 21% per annum is hereby declared VALID; (2) the 3% monthly surcharge is NULLIFIED for being

violative of the Usury Law at the time; and (3) respondents are ORDERED to pay petitioner the amount of P2,581,294.93 within 30

days from receipt of this Decision.

[G.R. No. 148163. December 6, 2004]

BANCO FILIPINO SAVINGS AND MORTGAGE BANK, petitioner, vs. JUANITA B. YBAEZ, CHARLES B. YBAEZ, JOSEPH B.

YBAEZ and JEROME B. YBAEZ, respondents.

QUISUMBING, J.:

In this petition for review, Banco Filipino Savings and Mortgage Bank seeks the reversal of the Decision dated April 17, 2001 of the

Court of Appeals in CA-G.R. CV No. 57927 affirming the Decision dated July 16, 1997 of the Regional Trial Court, Branch 13 of Cebu

City in Civil Case No. CEB-16548.

The facts of this case are as follows:

On March 7, 1978, respondents obtained a loan secured by a Deed of Real Estate Mortgage over Transfer Certificate of Title (TCT)

No. 69836 from petitioner bank. The loan was used for the construction of a commercial building in Cebu City. On October 25,

1978, respondents obtained an additional loan from the petitioner thus increasing their obligation to one million pesos. A

corresponding Amendment of Real Estate Mortgage was thereafter executed.

On December 24, 1982, the loan was again re-structured, increasing the loan obligation to P1,225,000 and the Real Estate Mortgage

was again amended. Respondents executed a Promissory Note for the sum of P1,225,000 payable in fifteen years, with a

stipulated interest of 21% per annum, and stipulating monthly payments of P22,426. The first payment was payable on January 24,

1983, and the succeeding payments were due every 24

th

of each month thereafter. The note also stipulated that in case of default in

the payment of any of the monthly amortization and interest, respondents shall pay a penalty equivalent to 3% of the amount due

each month.

Respondents total payment from 1983 to 1988 amounted to P1,455,385.07, broken down as follows:

1983 247,631.54

1984 81,797.24

1985 173,875.77

1986 284,364.82

1987 380,000.00

1988 287,715.70

From 1989 onwards, respondents did not pay a single centavo. They aver that Banco Filipino had ceased operations and/or was not

allowed to continue business, having been placed under liquidation by the Central Bank.

On January 15, 1990, respondents lawyer wrote Special Acting Liquidator, Renan Santos, and requested that plaintiff return the

mortgaged property of the respondents since it had sufficiently profited from the loan and that the interest and penalty charges were

excessive. Petitioner bank denied the request.

Banco Filipino was closed on January 1, 1985 and re-opened for business on July 1, 1994. From its closure to its re-opening,

petitioner bank did not transact any business with its customers.

On August 24, 1994, respondents were served a Notice of Extra Judicial Sale of their property covered by TCT No. 69836 to

satisfy their indebtedness allegedly of P6,174,337.46 which includes the principal, interest, surcharges and 10% attorneys fees. The

public auction was scheduled on September 22, 1994 at 2:00 in the afternoon.

On September 19, 1994, respondents filed a suit for Injunction, Accounting and Damages, alleging that there was no legal and

factual basis for the foreclosure proceedings since the loan had already been fully paid. A restraining order was issued the following

day by the lower court enjoining petitioner to cease and desist from selling the property at a public auction.

On July 16, 1997, the lower court rendered a Decision, disposing as follows:

WHEREFORE, judgment is hereby rendered directing defendant Banco Filipino Savings and Mortgage Bank to render a correct

accounting of the obligations of plaintiffs with it after eliminating interest from January 1, 1985 to July 1, 1994 when it was closed,

and reducing interest from 21% to 17% per annum, at the time it was in operation, and totally eliminating [the] surcharge of 1%

per month, within a period of fifteen (15) days from the time the judgment shall have become final and executory.

Plaintiffs are directed to pay the bank within a period of thirty (30) days from the time they will receive defendant banks true and

correct accounting, otherwise the order of injunction will be lifted/dissolved.

Defendants are enjoined from foreclosing the real estate mortgage on the property of plaintiffs, unless the latter fail to pay in

accordance with the [preceding] paragraph.

You might also like

- Assignment On Analysis of Annual Report ofDocument9 pagesAssignment On Analysis of Annual Report oflalagopgapangamdas100% (1)

- Entrepreneurship Simulation The Startup Game - Wharton University of PennsylvaniaDocument46 pagesEntrepreneurship Simulation The Startup Game - Wharton University of PennsylvaniaMetin ReyhanogluNo ratings yet

- AFP Final AssignmentDocument12 pagesAFP Final AssignmentDanTanNo ratings yet

- Acc117 Group AssignmentDocument15 pagesAcc117 Group AssignmentMUHAMMAD HIFZHANI AZMANNo ratings yet

- Banco Filipino Vs YbanezDocument3 pagesBanco Filipino Vs YbanezAllen Jeil GeronaNo ratings yet

- Gateway v. Asianbank & Equitable v. RCBCDocument4 pagesGateway v. Asianbank & Equitable v. RCBCAika MontecilloNo ratings yet

- Pal vs. CaDocument1 pagePal vs. CaattymaryjoyordanezaNo ratings yet

- 010 ADocument37 pages010 AmrpowerplusNo ratings yet

- Mirant Vs CaroDocument3 pagesMirant Vs CaroRowela Descallar100% (2)

- BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Document2 pagesBANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Dave Lumasag CanumhayNo ratings yet

- Fidelity Savings and Mortgage Bank v. Hon. Cenzon and Sps SantiagoDocument2 pagesFidelity Savings and Mortgage Bank v. Hon. Cenzon and Sps SantiagoJackie ArenasNo ratings yet

- Digest CorpoDocument5 pagesDigest CorpoPayumoNo ratings yet

- 112 Villar Vs TrajanoDocument6 pages112 Villar Vs TrajanoYen YenNo ratings yet

- Corpo Case Digests 2Document41 pagesCorpo Case Digests 2Marshan GualbertoNo ratings yet

- Citibank v. Chua PDFDocument3 pagesCitibank v. Chua PDFKara SolidumNo ratings yet

- Estate of Reyes v. CIRDocument31 pagesEstate of Reyes v. CIRCon ConNo ratings yet

- Tantongco Until PNB Case DigestsDocument8 pagesTantongco Until PNB Case DigestschristimyvNo ratings yet

- GEORG vs. HOLY TRINITY COLLEGE, INC.Document2 pagesGEORG vs. HOLY TRINITY COLLEGE, INC.Maria Francheska GarciaNo ratings yet

- PROTECTOR'S SERVICES, INC., V CA ET. AL. G.R. No 118176, April 12, 2000Document3 pagesPROTECTOR'S SERVICES, INC., V CA ET. AL. G.R. No 118176, April 12, 2000Suzanne Pagaduan CruzNo ratings yet

- General Insurance V NG HuaDocument2 pagesGeneral Insurance V NG HuaMorgana BlackhawkNo ratings yet

- Lingayen Gulf Electric Power, Inc., vs. BaltazarDocument3 pagesLingayen Gulf Electric Power, Inc., vs. BaltazarSha SantosNo ratings yet

- Red Line Transportation Co. vs. Rural Transit Co. GR No. 41570 - Sept. 6, 1934 FactsDocument10 pagesRed Line Transportation Co. vs. Rural Transit Co. GR No. 41570 - Sept. 6, 1934 FactsBasri JayNo ratings yet

- Shell Oil Workers' v. Shell Company of The PhilippinesDocument16 pagesShell Oil Workers' v. Shell Company of The PhilippinesAnisah AquilaNo ratings yet

- Dy vs. CA 204 SCRA 878Document6 pagesDy vs. CA 204 SCRA 878Marco ArponNo ratings yet

- Simex International Vs Court of AppealsDocument4 pagesSimex International Vs Court of AppealsLouisse Anne FloresNo ratings yet

- Central Bank of The Philippines v. CA (1992)Document2 pagesCentral Bank of The Philippines v. CA (1992)Masterbolero100% (1)

- BPI V. BPI EMPLOYEES DigestDocument1 pageBPI V. BPI EMPLOYEES DigestRobertNo ratings yet

- 8.digested BPI vs. Sarabia Manor Hotel Corp. GR. No. 175844 July 29 2013Document3 pages8.digested BPI vs. Sarabia Manor Hotel Corp. GR. No. 175844 July 29 2013Arrianne ObiasNo ratings yet

- Sta. Maria vs. Hongkong and Shanghai, 89 PHIL 780Document4 pagesSta. Maria vs. Hongkong and Shanghai, 89 PHIL 780VINCENTREY BERNARDONo ratings yet

- Government Service Insurance System v. CADocument1 pageGovernment Service Insurance System v. CAMan2x SalomonNo ratings yet

- Alert Security V Pasaliwan G.R.182397Document3 pagesAlert Security V Pasaliwan G.R.182397Sjden TumanonNo ratings yet

- Veraguth Vs Isabela Sugar DigestDocument3 pagesVeraguth Vs Isabela Sugar DigestcrapshoxNo ratings yet

- Garcia vs. Lim Chu Sing, 59 PHIL. 562, NO. 39427 FEBRUARY 24, 1934Document1 pageGarcia vs. Lim Chu Sing, 59 PHIL. 562, NO. 39427 FEBRUARY 24, 1934mark gil alpasNo ratings yet

- Perlas Madrigal Co. vs. ZamoraDocument2 pagesPerlas Madrigal Co. vs. ZamoraAllenNo ratings yet

- Ietts Vs CA DigestDocument2 pagesIetts Vs CA DigestoabeljeanmoniqueNo ratings yet

- PHIVIDEC v. Court of Appeals, 181 SCRA 669 (1990)Document11 pagesPHIVIDEC v. Court of Appeals, 181 SCRA 669 (1990)inno KalNo ratings yet

- Fidelity Savings and Mortgage Bank Vs CenzonDocument1 pageFidelity Savings and Mortgage Bank Vs Cenzoncmv mendozaNo ratings yet

- Santiago Vs PioneerDocument2 pagesSantiago Vs PioneerKaye Patrice Andes ApuyanNo ratings yet

- 124 Piccard v. Sperry Corporation (Garcia)Document1 page124 Piccard v. Sperry Corporation (Garcia)ASGarcia24No ratings yet

- Queensland-Tokyo Commodities, Inc., Et Al. vs. Thomas GeorgeDocument2 pagesQueensland-Tokyo Commodities, Inc., Et Al. vs. Thomas GeorgeRoland MarananNo ratings yet

- RP V Cortez and AMA Land V Wack-WackDocument9 pagesRP V Cortez and AMA Land V Wack-WackAlan BuenaventuraNo ratings yet

- GENERAL CREDIT CORP v. ALDEVINCODocument2 pagesGENERAL CREDIT CORP v. ALDEVINCOJued CisnerosNo ratings yet

- 2 Republic Vs Security Credit and Acceptance Corp.Document3 pages2 Republic Vs Security Credit and Acceptance Corp.BOEN YATOR100% (1)

- D.R. CATC Services v. Ramos, 477 SCRA 18 (2005)Document14 pagesD.R. CATC Services v. Ramos, 477 SCRA 18 (2005)inno KalNo ratings yet

- P.C. Javier & Sons vs. CA 462 SCRA 36Document1 pageP.C. Javier & Sons vs. CA 462 SCRA 36Lea AndreleiNo ratings yet

- 96 Franciso Vs GSISDocument2 pages96 Franciso Vs GSISJeric M. CuencaNo ratings yet

- Oscar Reyes vs. Hon. RTC of Makati (Case Digest)Document4 pagesOscar Reyes vs. Hon. RTC of Makati (Case Digest)Patricia GumpalNo ratings yet

- 92 - San Miguel Corporation v. KhanDocument1 page92 - San Miguel Corporation v. KhanJoshua RiveraNo ratings yet

- Kwok Vs Phil Carpet 457 SCRA 465Document17 pagesKwok Vs Phil Carpet 457 SCRA 465Abigael DemdamNo ratings yet

- Case Digest Berris Agricultural v. Abyadang (G.R. 183404Document3 pagesCase Digest Berris Agricultural v. Abyadang (G.R. 183404Charity RomagaNo ratings yet

- F & S Velasco Company v. MadridDocument7 pagesF & S Velasco Company v. MadridnathNo ratings yet

- Phil Trust Vs RiveraDocument1 pagePhil Trust Vs Riveragianfranco0613No ratings yet

- GR 195580Document2 pagesGR 195580Marifel Lagare100% (1)

- de Los Santos v. Republic & McGrathDocument2 pagesde Los Santos v. Republic & McGrathRuth TenajerosNo ratings yet

- Labor Law Case DigestsDocument2 pagesLabor Law Case Digestsjury jasonNo ratings yet

- Taiwan Kolin Corporation, Ltd. vs. Kolin Electronics Co., IncDocument8 pagesTaiwan Kolin Corporation, Ltd. vs. Kolin Electronics Co., IncRomy Ian LimNo ratings yet

- Commissioner of Internal Revenue vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, August 09, 2005Document4 pagesCommissioner of Internal Revenue vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, August 09, 2005idolbondocNo ratings yet

- Lorcom Thirteen (Pty) LTD V Zurich Insurance Company South Africa LTD (54 - 08) (2013) ZAWCHC 64 2013 (5) SA 42 (WCC) (2013) 4 All SA 71 (WCC) (29 April 2013)Document21 pagesLorcom Thirteen (Pty) LTD V Zurich Insurance Company South Africa LTD (54 - 08) (2013) ZAWCHC 64 2013 (5) SA 42 (WCC) (2013) 4 All SA 71 (WCC) (29 April 2013)sdfoisaiofasNo ratings yet

- 107 - Queensland-Tokyo Commodities, Inc. v. George G.R. No. 172727, (2010)Document3 pages107 - Queensland-Tokyo Commodities, Inc. v. George G.R. No. 172727, (2010)November Lily OpledaNo ratings yet

- Razon V IAC (Gaspar)Document2 pagesRazon V IAC (Gaspar)Maria Angela GasparNo ratings yet

- 2 - Van Twest Vs CADocument9 pages2 - Van Twest Vs CAJesi CarlosNo ratings yet

- Banco Filipino Vs Ybanez Full Text and DigestsDocument21 pagesBanco Filipino Vs Ybanez Full Text and DigestsMikhail TignoNo ratings yet

- G.R. No. 148163 - Banco Filipino Savings and Mortgage Bank v. YbañezDocument6 pagesG.R. No. 148163 - Banco Filipino Savings and Mortgage Bank v. YbañezlckdsclNo ratings yet

- Obli Con Case A.1226-1233Document23 pagesObli Con Case A.1226-1233Kennith G. C. DillenaNo ratings yet

- New CDO Activity Log Template Ver March 2023Document3 pagesNew CDO Activity Log Template Ver March 2023Kenny Robert'sNo ratings yet

- In The Regional Trial Court: Reply To Plaintiffs' Comment/OppositionDocument3 pagesIn The Regional Trial Court: Reply To Plaintiffs' Comment/OppositionKenny Robert'sNo ratings yet

- 1affdavit of DiscrepancyDocument1 page1affdavit of DiscrepancyKenny Robert'sNo ratings yet

- Affidavit of Loss - Pawn TicketsDocument1 pageAffidavit of Loss - Pawn TicketsKenny Robert's100% (1)

- Bar Exam Study Plan: Monday To FridayDocument4 pagesBar Exam Study Plan: Monday To FridayKenny Robert'sNo ratings yet

- Ching vs. RodriguezDocument2 pagesChing vs. RodriguezKenny Robert'sNo ratings yet

- Expressing Clearly and Distinctly The Facts and The Law On Which It Is Based SufficientDocument1 pageExpressing Clearly and Distinctly The Facts and The Law On Which It Is Based SufficientKenny Robert'sNo ratings yet

- Digested CasesDocument4 pagesDigested CasesKenny Robert'sNo ratings yet

- Ralla v. UntalanDocument2 pagesRalla v. UntalanKenny Robert'sNo ratings yet

- Ching Vs Rodriguez, GR No. 192828, 28 Nov 2011Document13 pagesChing Vs Rodriguez, GR No. 192828, 28 Nov 2011Kenny Robert'sNo ratings yet

- Ching v. RodriguezDocument3 pagesChing v. RodriguezKenny Robert'sNo ratings yet

- CIR Vs BurroughsDocument4 pagesCIR Vs BurroughsKenny Robert'sNo ratings yet

- 58.golden Thread Knitting Industries, Inc Et Al. v. NLRCDocument2 pages58.golden Thread Knitting Industries, Inc Et Al. v. NLRCKenny Robert'sNo ratings yet

- Tata MindolaDocument1 pageTata MindolaKenny Robert'sNo ratings yet

- Ateneo 2007 Provrem-1Document13 pagesAteneo 2007 Provrem-1Ljg BarondaNo ratings yet

- Wealth Management Services of HDFC BankDocument63 pagesWealth Management Services of HDFC BankSURYA100% (1)

- DepositoryDocument29 pagesDepositoryChirag VaghelaNo ratings yet

- Banco CompartamosDocument4 pagesBanco Compartamosarnulfo.perez.pNo ratings yet

- Difference Between IMF and World BankDocument4 pagesDifference Between IMF and World BankSourabh ShuklaNo ratings yet

- Banking Industry - Cygnus 1 June 09Document18 pagesBanking Industry - Cygnus 1 June 09Asad khanNo ratings yet

- Resident Representative:: International Banking Section - A Introduction To International BankingDocument3 pagesResident Representative:: International Banking Section - A Introduction To International BankingNimisha BhararaNo ratings yet

- Wholesale Juice Business PlanDocument26 pagesWholesale Juice Business PlanPatrick Cee AnekweNo ratings yet

- Contract of LeaseDocument2 pagesContract of LeaseElain OrtizNo ratings yet

- Security Analysis and Portfolio Management Mba Project Report PDFDocument31 pagesSecurity Analysis and Portfolio Management Mba Project Report PDFvishnupriya0% (1)

- Summary of "Contemporary Strategy"Document12 pagesSummary of "Contemporary Strategy"MostakNo ratings yet

- Types of StrategiesDocument15 pagesTypes of Strategiesmayaverma123pNo ratings yet

- Avoiding Fraudulent TransfersDocument8 pagesAvoiding Fraudulent TransfersNamamm fnfmfdnNo ratings yet

- Financial Statement Theory Notes PDFDocument6 pagesFinancial Statement Theory Notes PDFAejaz MohamedNo ratings yet

- Preventing Sickkness and Rehabilitation of Business UnitsDocument46 pagesPreventing Sickkness and Rehabilitation of Business Unitsmurugesh_mbahit100% (13)

- Asx Announcement: Wednesday 26 August 2009Document105 pagesAsx Announcement: Wednesday 26 August 2009aspharagusNo ratings yet

- Salary Packaging - Smart SalaryDocument9 pagesSalary Packaging - Smart SalaryraogongfuNo ratings yet

- By Bakampa Brian Baryaguma : Real Property, 5 Ed, Stevens & Sons LTD, p.913)Document11 pagesBy Bakampa Brian Baryaguma : Real Property, 5 Ed, Stevens & Sons LTD, p.913)Real TrekstarNo ratings yet

- FICA Configuration Step by Step - SAP Expertise Consulting PDFDocument35 pagesFICA Configuration Step by Step - SAP Expertise Consulting PDFsrinivaspanchakarla50% (6)

- Preparation of Monthly Transcripts of A SelfDocument4 pagesPreparation of Monthly Transcripts of A SelfEsther Akpan100% (2)

- Jim Cramers 10 Rules of InvestingDocument15 pagesJim Cramers 10 Rules of Investing2008cegs100% (2)

- Topic2 Part1Document16 pagesTopic2 Part1Abdul MoezNo ratings yet

- Nova Chemical CorporationDocument28 pagesNova Chemical Corporationrzannat94100% (2)

- Real Estate AppraiserDocument2 pagesReal Estate Appraiserapi-77241843No ratings yet

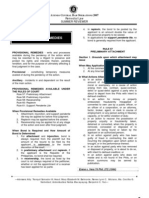

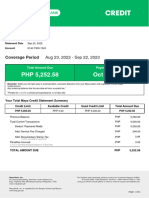

- MayaCredit SoA 2023SEPDocument3 pagesMayaCredit SoA 2023SEPjepoy palaruanNo ratings yet

- Responsibility Accounting LNDocument7 pagesResponsibility Accounting LNzein lopezNo ratings yet

- Laporan Keuangan Tahunan Good - 2020Document148 pagesLaporan Keuangan Tahunan Good - 2020angelina chandraNo ratings yet