Professional Documents

Culture Documents

Amit Stock Analysis Excel

Uploaded by

OmkarJoshi0 ratings0% found this document useful (0 votes)

163 views26 pagesresearch your stock

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentresearch your stock

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

163 views26 pagesAmit Stock Analysis Excel

Uploaded by

OmkarJoshiresearch your stock

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 26

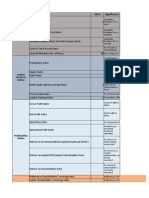

Parameters Details

Company Asian Paints

Industry Paints

Business (As you understand it, in simple words) XYZ

Current Stock Price (Rs) 4,665

Face Value (Rs) 10

No. of Shares (Crore) 10

Market Capitalization (Rs Crore) 44,747

Promoter Shareholding (Latest Quarter) 52.8%

Promoter Pledged Shareholding (Latest Quarter) 17.7%

Parameters Details

Sales Growth (10-Year CAGR) 20.4%

Gross Profit Growth (10-Year CAGR) 18.1%

Net Profit Growth (10-Year CAGR) 24.4%

Average Debt/Equity (x) 0.3

Average Return on Equity 35.4%

Note: Asian Paints' analysis in this excel is for representation purpose only.

Basic Company Details

Key Financials (Last 10-Years)

(Enter values only in red cells)

Warning!

Excel can be a wonderful tool to analyze the past. But it can be a weapon of

mass destruction to predict the future! So be very careful of what you are

getting into. Here, garbage in will always equal garbage out.

Remember!

Focus on decisions, not outcomes. Look for disconfirming evidence. Calculate.

Pray!

Please! It's your

money. Please don't blame me if results of this excel cause you to lose it all! I've

designed this excel to aid your own thinking, but you alone are responsible for

your actions. I want to live peacefully ever after! :-) I am not a

sadist who wants you to do the hard work by analyzing companies on your own.

But I'd rather give you a compass instead of a map, for you can confuse map

with territory and lose it all! All the best!

Warning!

Excel can be a wonderful tool to analyze the past. But it can be a weapon of

mass destruction to predict the future! So be very careful of what you are

getting into. Here, garbage in will always equal garbage out.

Remember!

Focus on decisions, not outcomes. Look for disconfirming evidence. Calculate.

Pray!

Please! It's your

money. Please don't blame me if results of this excel cause you to lose it all! I've

designed this excel to aid your own thinking, but you alone are responsible for

your actions. I want to live peacefully ever after! :-) I am not a

sadist who wants you to do the hard work by analyzing companies on your own.

But I'd rather give you a compass instead of a map, for you can confuse map

with territory and lose it all! All the best!

Parameter

Consumer monopoly or commodity?

Understand how business works

Is the company conservatively financed?

Are earnings strong and do they show an upward trend?

Does the company stick with what it knows?

Has the company been buying back its shares?

Have retained earnings been invested well?

Is the companys return on equity above average?

Is the company free to adjust prices to inflation?

Buffett Checklist - Read, Remember, Follow!

Source - Buffettology by Mary Buffett & David Clark

Does the company need to constantly reinvest in capital?

Conclusion

Never Forget

Explanation

Seek out companies that have no or less competition, either due to a patent or brand name or

similar intangible that makes the product unique. Such companies will typically have high gross

and operating profit margins because of their unique niche. However, don't just go on margins as

high margins may simply highlight companies within industries with traditionally high margins.

Thus, look for companies with gross, operating and net profit margins above industry norms. Also

Try to invest in industries where you possess some specialized knowledge (where you work) or

can more effectively judge a company, its industry, and its competitive environment (simple

products you consume). While it is difficult to construct a quantitative filter, you should be able to

identify areas of interest. You should "only" consider analyzing those companies that operate in

areas that you can clearly grasp - your circle of competence. Of course you can increase the size

of the circle, but only over time by learning about new industries. More important than the size of

Seeks out companies with conservative financing, which equates to a simple, safe balance sheet.

Such companies tend to have strong cash flows, with little need for long-term debt. Look for low

debt to equity or low debt-burden ratios. Also seek companies that have history of consistently

Rising earnings serve as a good catalyst for stock prices. So seek companies with strong,

consistent, and expanding earnings (profits). Seek companies with 5/10 year earnings per share

growth greater than 25% (alongwith safe balance sheets). To help indicate that earnings growth is

still strong, look for companies where the last 3-years earnings growth rate is higher than the last

10-years growth rate. More important than the rate of growth is the consistency in such growth.

So exclude companies with volatile earnings growth in the past, even if the "average" growth has

Like you should stock to your circle of competence, a company should invest its capital only in

those businesses within its circle of competence. This is a difficult factor to screen for on a

quantitative level. Before investing in a company, look at the companys past pattern of

acquisitions and new directions. They should fit within the primary range of operations for the firm.

Buffett prefers that firms reinvest their earnings within the company, provided that profitable

opportunities exist. When companies have excess cash flow, Buffett favours shareholder-

enhancing maneuvers such as share buybacks. While we do not screen for this factor, a follow-up

examination of a company would reveal if it has a share buyback plan in place.

Seek companies where earnings have risen as retained earnings (earnings after paying

dividends) have been employed profitably. A great way to screen for such companies is by looking

at those that have had consistent earnings and strong return on equity in the past.

Consider it a positive sign when a company is able to earn above-average (better than

competitors) returns on equity without employing much debt. Average return on equity for Indian

companies over the last 10 years is approximately 16%. Thus, seek companies that earn atleast

That's what is called "pricing power". Companies with moat (as seen from other screening metrics

as suggested above (like high ROE, high grow margins, low debt etc.) are able to adjust prices to

inflation without the risk of losing significant volume sales.

Buffett Checklist - Read, Remember, Follow!

Source - Buffettology by Mary Buffett & David Clark

Companies that consistently need capital to grow their sales and profits are like bank savings

account, and thus bad for an investor's long term portfolio. Seek companies that don't need high

capital investments consistently. Retained earnings must first go toward maintaining current

operations at competitive levels, so the lower the amount needed to maintain current operations,

the better. Here, more than just an absolute assessment, a comparison against competitors will

Sensible investing is always about using folly and discipline - the discipline to identify excellent

businesses, and wait for the folly of the market to drive down the value of these businesses to

attractive levels. You will have little trouble understanding this philosophy. However, its successful

implementation is dependent upon your dedication to learn and follow the principles, and apply

Focus on decisions, not outcomes. Look for disconfirming evidence. Pray!

Year / Rs Crore L-9 L-8 L-7 L-6

SOURCES OF FUNDS / EQUITY & LIABILITIES

Share Capital 64 96 96 96

Reserves & Surplus 413 434 471 550

Shareholder's Funds / Equity 478 529 567 646

Minority Interest 75 70 64 60

Non-Current Liabilities

Long-Term Borrowings 197 160 240 261

Current Liabilities 514 581 618 705

Short-Term Borrowings - 9 - -

Trade Payables 232 272 295 330

Other Current Liabilities 177 163 206 249

Short-Term Provisions 105 136 117 126

APPLICATION OF FUNDS / ASSETS

Non-Current Assets 35 34 37 41

Tangible Assets 20 22 24 27

Intangible Assets 5 6 6 7

Capital Work-in-Progress 5 1 1 1

Non-Current Investments 5 6 6 7

Current Assets 737 772 950 1,120

Current Investments - 12 27 75

Inventories 322 318 455 489

Trade Receivables 256 265 296 348

Cash and Bank Balance 68 70 61 73

Short-Term Loans and Advances 55 76 80 74

Other Current Assets 35 31 32 61

Asian Paints - Balance Sheet

(Enter values only in red cells)

L-5 L-4 L-3 L-2 L-1 L

96 96 96 96 96 96

682 886 1,107 1,614 2,092 2,653

778 982 1,203 1,710 2,187 2,749

60 57 76 94 110 137

180 179 152 104 147 148

979 1,248 2,517 3,315 2,081 2,771

126 96 157 125 - -

449 572 554 718 1,087 1,297

339 414 461 661 703 1,107

66 166 1,345 1,810 290 367

45 49 54 59 65 72

29 32 35 39 43 47

7 8 9 10 11 12

1 1 1 1 1 1

7 8 9 10 11 12

1,406 1,692 2,966 3,871 3,068 3,560

114 198 - 532 367 285

598 714 769 956 1,305 1,599

421 460 572 543 573 781

105 111 210 106 626 624

98 153 1,365 1,670 106 186

69 56 50 65 90 84

Asian Paints - Balance Sheet

(Enter values only in red cells)

Year / Rs Crore L-9 L-8 L-7 L-6 L-5

Net Sales 1,817 2,373 2,574 3,021 3,670

Expenditure

Increase/Decrease in Stock (38) 2 (61) (10) (70)

Raw Material Consumed 975 1,290 1,563 1,803 2,269

Employee Cost 120 183 199 219 257

Other Manufacturing Expenses 66 74 86 96 112

General and Administration Expenses 60 84 87 99 122

Selling and Distribution Expenses 301 358 297 345 411

Miscellaneous Expenses 56 85 68 79 85

Total Expenditure 1,540 2,076 2,239 2,630 3,187

Gross Profit 815 1,007 985 1,133 1,358

Operating Profit / EBITDA 278 297 335 391 483

Other Income 11 27 32 32 40

Depreciation 49 71 69 68 61

Profit Before Interest & Tax (PBIT) 240 253 298 354 462

Interest 14 15 11 11 24

Exceptional Income / Expenses - - - - (8)

Profit Before Tax 226 238 287 343 430

Provision for Tax 86 94 106 132 147

Profit After Tax 140 144 181 211 283

Minority Interest (1) (3) (7) 2 (2)

Share of Associate - 4 0 (1) (0)

Consolidated Profit After Tax (PAT) 139 145 174 212 281

Diluted EPS (Rs) 14.5 15.1 18.1 22.1 29.3

Interim Equity Dividend 29 34 38 67 115

Proposed Equity Dividend 42 48 53 53 10

Total Equity Dividend 70 82 91 120 125

Asian Paints - P&L Account

(Enter values only in red cells)

L-4 L-3 L-2 L-1 L CAGR

4,407 5,464 6,681 7,722 9,632 20.4%

(36) (27) (102) (151) (173)

2,613 2,866 3,227 3,906 5,099

301 365 433 454 526

122 682 797 922 1,073

145 167 200 206 269

535 646 801 969 1,207

63 91 89 85 120

3,743 4,790 5,445 6,391 8,122 20.3%

1,708 1,943 2,758 3,045 3,633 18.1%

664 674 1,236 1,331 1,510 20.7%

60 51 141 68 108

59 74 84 113 121

665 651 1,293 1,286 1,497 22.6%

26 32 37 26 43

(7) (1) 1 - -

631 617 1,257 1,260 1,454 23.0%

203 197 373 378 434

428 419 884 881 1,021 24.7%

(19) (22) (48) (38) (32)

- - - - -

409 398 836 843 989 24.4%

42.7 41.5 87.1 87.9 103.1

62 62 82 82 91

101 106 177 225 293

163 168 259 307 384 20.8%

Asian Paints - P&L Account

(Enter values only in red cells)

Year / Rs Crore L-9 L-8 L-7

Net cash (used in) / generated from operating activities 154 249 111

Payment for purchase of fixed assets (40) (44) (97)

Free Cash Flow 114 205 14

Net cash (used in) / generated from investing activities (70) (113) (74)

Net cash (used in) / generated from financing activities (59) (134) (42)

Net increase in cash and cash equivalents 24 2 (5)

Asian Paints - Cash Flow Statement

(Enter values only in red cells)

MINUS

Sample Cash Flow Statement (from Annual

L-6 L-5 L-4 L-3 L-2 L-1 L

179 258 480 389 1,063 762 826

(87) (82) (308) (310) (395) (156) (673)

92 176 172 79 668 606 153

(125) (109) (335) (270) (299) (440) (512)

(42) (111) (134) (230) (332) (334) (327)

12 38 11 (111) 432 (12) (12)

Asian Paints - Cash Flow Statement

(Enter values only in red cells)

Remember!

Cash flow, not reported earnings, is what determines

a company's long-term value.

Sample Cash Flow Statement (from Annual Report)

Remember!

Cash flow, not reported earnings, is what determines

a company's long-term value.

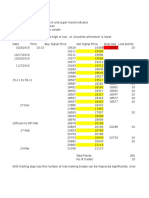

Operational & Financial Ratios L-9 L-8 L-7 L-6 L-5 L-4

Diluted Earnings Per Share (Rs) 14.5 15.1 18.1 22.1 29.3 42.7

Diluted Book Value Per Share (Rs) 49.8 55.2 59.1 67.4 81.1 102.4

Tax Rate (%) 38% 40% 37% 39% 34% 32%

Dividend Per Share (Rs) 7.3 8.5 9.5 12.5 13.0 17.0

Dividend Pay Out Ratio (%) 50% 56% 52% 57% 44% 40%

Profitability Ratios L-9 L-8 L-7 L-6 L-5 L-4

Gross Margin (%) 45% 42% 38% 38% 37% 39%

EBITDA Margin (%) 15% 13% 13% 13% 13% 15%

EBIT Margin (%) 13% 11% 12% 12% 13% 15%

Net Profit Margin (%) 8% 6% 7% 7% 8% 9%

Performance Ratios L-9 L-8 L-7 L-6 L-5 L-4

Return on Equity (%) 29% 27% 31% 33% 36% 42%

Return on Capital Employed (%) 60% 70% 52% 49% 66% 93%

Return on Invested Capital (%) 24% 25% 26% 29% 35% 47%

Sales/Working Capital (x) 8.2 12.4 7.8 7.3 8.6 9.9

Efficiency Ratios L-9 L-8 L-7 L-6 L-5 L-4

Receivable Days 51 41 42 42 42 38

Inventory Days 65 49 64 59 59 59

Payable Days 47 42 42 40 45 47

Growth Ratios L-9 L-8 L-7 L-6 L-5 L-4

Net Sales Growth (%) 31% 8% 17% 21% 20%

EBITDA Growth (%) 7% 13% 17% 24% 37%

PBIT Growth (%) 6% 18% 19% 30% 44%

PAT Growth (%) 4% 20% 22% 32% 46%

Financial Stability Ratios L-9 L-8 L-7 L-6 L-5 L-4

Total Debt/Equity (x) 0.4 0.3 0.4 0.4 0.4 0.3

Debt Burden (x) 1.7 0.8 16.7 2.8 1.0 1.0

Current Ratio (x) 1.4 1.3 1.5 1.6 1.4 1.4

Quick Ratio (x) 0.8 0.8 0.8 0.9 0.8 0.8

Interest Cover (x) 17.5 16.6 27.5 31.0 19.3 25.2

Asian Paints - Key Ratios

(Don't touch any cell on this sheet, as all are calculated figures)

L-3 L-2 L-1 L

41.5 87.1 87.9 103.1

125.4 178.3 228.0 286.5

32% 30% 30% 30%

17.5 27.0 32.0 40.0

42% 31% 36% 39%

L-3 L-2 L-1 L

36% 41% 39% 38%

12% 18% 17% 16%

12% 19% 17% 16%

7% 13% 11% 10%

L-3 L-2 L-1 L

33% 49% 39% 36%

90% 150% 86% 124%

34% 70% 67% 53%

12.2 12.0 7.8 12.2

L-3 L-2 L-1 L

38 30 27 30

51 52 62 61

37 39 51 49

L-3 L-2 L-1 L

24% 22% 16% 25%

1% 83% 8% 13%

-2% 99% -1% 16%

-3% 110% 1% 17%

L-3 L-2 L-1 L

0.3 0.1 0.1 0.1

1.9 0.2 0.2 1.0

1.2 1.2 1.5 1.3

0.9 0.9 0.8 0.7

20.0 35.2 49.5 34.5

Remember! What

counts in the long run is the increase in "per

share value", not overall growth or size of a

business.

Remember!

Gross margins suggest pricing power. Higher =

Better, but also invites competition. So watch out

for consistency.

Remember!

ROE = Efficiency in allocating capital, which is a

CEO's #1 job. Higher = Better. Look for

consistency.

Asian Paints - Key Ratios

(Don't touch any cell on this sheet, as all are calculated figures)

Remember! What

counts in the long run is the increase in "per

share value", not overall growth or size of a

business.

Remember!

Gross margins suggest pricing power. Higher =

Better, but also invites competition. So watch out

for consistency.

Remember!

ROE = Efficiency in allocating capital, which is a

CEO's #1 job. Higher = Better. Look for

consistency.

Initial Cash Flow 476

Years 1-5 6-10

FCF Growth Rate 15% 12%

Discount Rate 12%

Terminal Growth Rate 2%

Shares Outstanding (Crore) 10

Net Debt Level (762)

Year FCF Growth Present Value

1 547 15% 489

2 629 15% 502

3 724 15% 515

4 832 15% 529

5 957 15% 543

6 1,072 12% 543

7 1,200 12% 543

8 1,345 12% 543

9 1,506 12% 543

10 1,687 12% 543

Terminal Year 1,720

PV of Year 1-10 Cash Flows 5,292

Terminal Value 5,539

Total PV of Cash Flows 10,831

Number of Shares 10

DCF Value / Share (Rs) 1,209

Asian Paints: 2-Stage DCF

Final Calculations

Figures in Rs Crore | Enter values only in red cells

Why DCF?

The value of a business is simply the

present value of cash that investors

can take out of the business over its

lifetime.

Date of Analysis: 30/Oct/14

Price: 4,665.0 Return on Equity:

EPS: 103.1 Payout Ratio:

DPS: 40.0 P/E Ratio-High:

BVPS: 286.5 P/E Ratio-Low:

P/E: 45.3 P/E Ratio:

Earnings Yield: 2.2% Sustainable Growth

Dividend Yield: 0.9%

P/BV: 16.3

Govt. Bond Yield: 8.0%

Historical Company Data

Year EPS DPS BVPS High Low High

L-9 14.5 7.3 49.8 324 221 22.4

L-8 15.1 8.5 55.2 361 225 23.9

L-7 18.1 9.5 59.1 471 327 26.0

L-6 22.1 12.5 67.4 862 449 39.0

L-5 29.3 13.0 81.1 972 683 33.2

L-4 42.7 17.0 102.4 1,316 1,043 30.8

L-3 41.5 17.5 125.4 1,264 715 30.5

L-2 87.1 27.0 178.3 2,545 1,640 29.2

L-1 87.9 32.0 228.0 3,017 2,040 34.3

L 103.1 40.0 286.5 3,762 2,802 36.5

Annually Compounded Rates of Growth

Factor EPS DPS BVPS High Price Low Price

10-Year Growth 24.4% 20.8% 21.5% 31.3% 32.6%

5-Year Growth 28.6% 25.2% 28.7% 31.1% 32.6%

Projected Company Data Using Historical Earnings Growth Rate

Year EPS DPS

L (Current) 103.1 46.2 911.5 Earnings after 10 years

L+1 128.2 57.5 1,896.4 Sum of dividends paid over 10 years

L+2 159.4 71.4

L+3 198.2 88.8 23,170 Projected price (Average P/E * EPS)

L+4 246.5 110.5 25,066 Total gain (Projected Price + Dividends)

10-Year Averages

Asian Paints - Buffett Valuation Spreadsheet

P/E Ratio Price

Source - Buffettology by Mary Buffett & David Clark | (Enter values only in red cells)

Current Stock Data

L+5 306.5 137.4

L+6 381.2 170.8 18.3% Projected return using historical EPS growth rate

L+7 474.0 212.5 [(Total Gain / Current Price) ^ (1/10)] - 1

L+8 589.5 264.2

L+9 733.0 328.5

L+10 911.5 408.5

Projected Company Data Using Sustainable Growth Rate

Year BVPS EPS DPS

L (Current) 286.5 101.5 45.5 605.2 Earnings after 10 years (BVPS * ROE)

L+1 342.6 121.3 54.4 1,426.1 Sum of dividends paid over 10 years

L+2 409.5 145.1 65.0

L+3 489.6 173.4 77.7 15,383 Projected price (Average P/E * EPS)

L+4 585.2 207.3 92.9 16,809 Total gain (Projected Price + Dividends)

L+5 699.6 247.8 111.1

L+6 836.4 296.3 132.8 13.7% Projected return using sustainable growth rate

L+7 999.9 354.2 158.8

L+8 1,195.3 423.4 189.8

L+9 1,429.0 506.2 226.9

L+10 1,708.3 605.2 271.2

35.4%

44.8%

30.6

20.3

25.4

19.5%

Low ROEPayout Ratio

15.2 29.1% 50.5%

14.9 27.4% 56.3%

18.0 30.7% 52.3%

20.3 32.8% 56.5%

23.3 36.1% 44.4%

24.4 41.7% 39.8%

17.2 33.1% 42.2%

18.8 48.9% 31.0%

23.2 38.5% 36.4%

27.2 36.0% 38.8%

Earnings after 10 years

Sum of dividends paid over 10 years

Projected price (Average P/E * EPS)

Total gain (Projected Price + Dividends)

Warning! Past is

no predictor of the future. So be careful using

numbers in this sheet - that are based on past

numbers - into your fair value calculations. Of course

past can give some indications of the future, but the

future is never always the same.

10-Year Averages

Asian Paints - Buffett Valuation Spreadsheet

P/E Ratio

Source - Buffettology by Mary Buffett & David Clark | (Enter values only in red cells)

Projected return using historical EPS growth rate

[(Total Gain / Current Price) ^ (1/10)] - 1

Earnings after 10 years (BVPS * ROE)

Sum of dividends paid over 10 years

Projected price (Average P/E * EPS)

Total gain (Projected Price + Dividends)

Projected return using sustainable growth rate

Warning! Past is

no predictor of the future. So be careful using

numbers in this sheet - that are based on past

numbers - into your fair value calculations. Of course

past can give some indications of the future, but the

future is never always the same.

Year L-9 L-8 L-7 L-6 L-5 L-4 L-3

Diluted EPS (Rs) 14.5 15.1 18.1 22.1 29.3 42.7 41.5

Stock Price - High (Rs) 324 361 471 862 972 1,316 1,264

High P/E (x) 22.4 23.9 26.0 39.0 33.2 30.8 30.5

Stock Price - Low (Rs) 221 225 327 449 683 1,043 715

Low P/E (x) 15.2 14.9 18.0 20.3 23.3 24.4 17.2

Average P/E (x) 18.8 19.4 22.0 29.6 28.2 27.6 23.9

Graham Number 773

Avg P/E Ratio Valuation 2,356

EPV 859

DCF 1,209

Historical Earnings Growth 7,460

Sustainable Earnings Growth 4,953

High End 2,935

Low End 1,578

Margin of Safety (MoS) 50%

Fair Value after MoS 1,128

Current Mkt. Price (CMP, Rs) 4,665

Premium / (Discount) 313.5%

Fair Value Range (Rs/Share)

Valuation - Different Methods (Rs)

Asian Paints - Fair Value Calculation

(Enter values only in red cells)

Remember!

Give importance to a stock's fair value only "after" you have answered

in "Yes" to these two questions - (1) Is this business simple to be

understood? and (2) Can I understand this business?

Don't try to quantify everything. In stock research, the less non-

mathematical you are, the more simple, sensible, and useful will be

your analysis and results. Great analysis is generally "back-of-the-

envelope".

Also, your calculated "fair value" will be proven wrong in the future, so

don't invest your savings just because you fall in love with it. Don't

look for perfection. It is overrated. Focus on decisions, not outcomes.

Look for disconfirming evidence. Pray!

L-2 L-1 L

87.1 87.9 103.1

2,545 3,017 3,762

29.2 34.3 36.5

1,640 2,040 2,802

18.8 23.2 27.2

24.0 28.8 31.8

Asian Paints - Fair Value Calculation

(Enter values only in red cells)

Remember!

Give importance to a stock's fair value only "after" you have answered

in "Yes" to these two questions - (1) Is this business simple to be

understood? and (2) Can I understand this business?

Don't try to quantify everything. In stock research, the less non-

mathematical you are, the more simple, sensible, and useful will be

your analysis and results. Great analysis is generally "back-of-the-

envelope".

Also, your calculated "fair value" will be proven wrong in the future, so

don't invest your savings just because you fall in love with it. Don't

look for perfection. It is overrated. Focus on decisions, not outcomes.

Look for disconfirming evidence. Pray!

You might also like

- Options Trading Strategies For ADocument25 pagesOptions Trading Strategies For Aaryalee100% (2)

- ITC Financial ModelDocument123 pagesITC Financial ModelNareshNo ratings yet

- Valuation - PepsiDocument24 pagesValuation - PepsiLegends MomentsNo ratings yet

- Safal Niveshaks Stock Analysis ExcelDocument26 pagesSafal Niveshaks Stock Analysis ExcelKrishnamoorthy SubramaniamNo ratings yet

- DR Vijay Malik Screener Excel Template V2.0Document45 pagesDR Vijay Malik Screener Excel Template V2.0Ramesh Reddy100% (1)

- SweeGlu Fibonacci CalculatorDocument3 pagesSweeGlu Fibonacci CalculatorSasiGanapathy RNo ratings yet

- LIQUIDITY AND SOLVENCY RATIOSDocument26 pagesLIQUIDITY AND SOLVENCY RATIOSDeep KrishnaNo ratings yet

- Stock Analysis Excel Revised March 2017Document26 pagesStock Analysis Excel Revised March 2017Sangram Panda100% (1)

- Safal Niveshak Stock Analysis Excel Version 3.0Document32 pagesSafal Niveshak Stock Analysis Excel Version 3.0SivaRamanNo ratings yet

- Trading Journal BRODocument21 pagesTrading Journal BROjobertNo ratings yet

- Safal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetDocument32 pagesSafal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetRavi RanjanNo ratings yet

- Safal Niveshak Stock Analysis Excel InstructionsDocument49 pagesSafal Niveshak Stock Analysis Excel Instructionsajujk123No ratings yet

- 11 Stocks You Must OwnDocument17 pages11 Stocks You Must OwnPGM5HNo ratings yet

- Trade Data SummaryDocument310 pagesTrade Data SummaryJose GuzmanNo ratings yet

- Strategy BookDocument25 pagesStrategy BookjustshubhamsharmaNo ratings yet

- 52 Essential Metrics For The Stock MarketDocument10 pages52 Essential Metrics For The Stock Marketzekai yangNo ratings yet

- Top 10 stock valuation ratios for fundamental analysisDocument3 pagesTop 10 stock valuation ratios for fundamental analysisAtanas KosturkovNo ratings yet

- Stock AnalysisDocument5 pagesStock AnalysisArun Kumar GoyalNo ratings yet

- Wave CalculatorDocument2 pagesWave CalculatorArun VinodNo ratings yet

- Stock ValuationDocument17 pagesStock Valuationsankha80No ratings yet

- Cash ManagementDocument30 pagesCash ManagementankitaNo ratings yet

- Investor Diary Stock Analysis Excel: How To Use This Spreadsheet?Document57 pagesInvestor Diary Stock Analysis Excel: How To Use This Spreadsheet?anuNo ratings yet

- Fibonacci CalculatorDocument90 pagesFibonacci Calculatorakathrecha100% (1)

- DCF Valuation-BDocument11 pagesDCF Valuation-BElsaNo ratings yet

- Options Open Interest AnalysisDocument27 pagesOptions Open Interest Analysisgkrishnan59No ratings yet

- Rakesh Jhunjhunwala Portfolio - October 2011Document1 pageRakesh Jhunjhunwala Portfolio - October 2011neo269No ratings yet

- 13th Motilal Oswal Wealth Creation StudyDocument48 pages13th Motilal Oswal Wealth Creation StudySwamiNo ratings yet

- Nifty & Bank Nifty Daily Aanalysis - SmmryDocument8 pagesNifty & Bank Nifty Daily Aanalysis - SmmryPrashantPatilNo ratings yet

- BCI Covered Call Stock Evaluation Worksheet: Option Month: Date: Fundamental Analysis Technical AnalysisDocument2 pagesBCI Covered Call Stock Evaluation Worksheet: Option Month: Date: Fundamental Analysis Technical Analysislramadur1No ratings yet

- Trading Qty Decider Based On Money Management RuleDocument15 pagesTrading Qty Decider Based On Money Management RulexenonvideoNo ratings yet

- Vijay MalikDocument4 pagesVijay MalikJerry LouisNo ratings yet

- The Fidelity Guide to Equity InvestingDocument16 pagesThe Fidelity Guide to Equity Investingmandar LawandeNo ratings yet

- Bank Nifty Technical Analysis: Image Taken From ORANGE Facebook AccountDocument29 pagesBank Nifty Technical Analysis: Image Taken From ORANGE Facebook AccountektapatelbmsNo ratings yet

- How to analyze stocks using Safal Niveshak's Excel templateDocument49 pagesHow to analyze stocks using Safal Niveshak's Excel templatehareshpkNo ratings yet

- Trade Log Planner Oct2011Document3 pagesTrade Log Planner Oct2011Heading Heading Ahead AheadNo ratings yet

- Vinati Organics - ResearchDocument10 pagesVinati Organics - ResearchjackkapuparaNo ratings yet

- Hero Motocorp Balance Sheet AnalysisDocument23 pagesHero Motocorp Balance Sheet AnalysisabchbvNo ratings yet

- Safal Niveshak Stock Analysis Excel (Ver. 4.0) : How To Use This SpreadsheetDocument35 pagesSafal Niveshak Stock Analysis Excel (Ver. 4.0) : How To Use This SpreadsheetSivakumar KandasamyNo ratings yet

- Safal Niveshak's Stock Analysis Excel Template ExplainedDocument47 pagesSafal Niveshak's Stock Analysis Excel Template ExplainedDhrupal TripathiNo ratings yet

- Safal Niveshak Stock Analysis Excel Version 5 0Document47 pagesSafal Niveshak Stock Analysis Excel Version 5 0Yati GargNo ratings yet

- 14th Annual Wealth Creation Study Motilal OswalDocument59 pages14th Annual Wealth Creation Study Motilal Oswalsankap11100% (1)

- Hester Bio-Sciences StockDocument2 pagesHester Bio-Sciences Stockdrsivaprasad7No ratings yet

- Morningstar® Portfolio X-Ray: H R T y UDocument5 pagesMorningstar® Portfolio X-Ray: H R T y UVishal BabutaNo ratings yet

- Total Amount To Invest:: Moderate Risk ToleranceDocument3 pagesTotal Amount To Invest:: Moderate Risk ToleranceElaineNo ratings yet

- Valuation WorksheetDocument1 pageValuation WorksheetbogatishankarNo ratings yet

- Investor Diary Beginner Stock Analysis Excel (V-1) : How To Use This Spreadsheet?Document56 pagesInvestor Diary Beginner Stock Analysis Excel (V-1) : How To Use This Spreadsheet?SumitNo ratings yet

- Accord Capital Equities Corporation:: First Philippine Holdings, Inc (Pse: FPH)Document1 pageAccord Capital Equities Corporation:: First Philippine Holdings, Inc (Pse: FPH)JC CalaycayNo ratings yet

- The Power Lantern Jackpot Nifty Trade - 2.5Document11 pagesThe Power Lantern Jackpot Nifty Trade - 2.5pmg3067No ratings yet

- Safal Niveshak Stock Analysis Excel (Ver. 5.0) - How To Use This SpreadsheetDocument38 pagesSafal Niveshak Stock Analysis Excel (Ver. 5.0) - How To Use This SpreadsheetThamsNo ratings yet

- Velluri Strategy Nifty FiftyDocument15 pagesVelluri Strategy Nifty FiftyPrajan JNo ratings yet

- Bengali Ebook 191011Document3 pagesBengali Ebook 191011bhaskar2000_inNo ratings yet

- Alkyl Amines Chemicals Ltd financial analysis and key metricsDocument32 pagesAlkyl Amines Chemicals Ltd financial analysis and key metricsManu GuptaNo ratings yet

- Highlights of The May'21 Edition: Sectors in Order of Their Premium/discount To Their Historical AveragesDocument38 pagesHighlights of The May'21 Edition: Sectors in Order of Their Premium/discount To Their Historical AveragesSAM SMITHNo ratings yet

- Stock Portfolio TemplateDocument1 pageStock Portfolio Templateapi-314985362No ratings yet

- Analyze Historical Data Trends to Predict Future PerformanceDocument3 pagesAnalyze Historical Data Trends to Predict Future PerformanceMahesh SavaliyaNo ratings yet

- Daily Straddle RulesDocument11 pagesDaily Straddle Rulessatz2007No ratings yet

- Bank Nifty Strategy Using Heiken Ashi and Super TrendDocument2 pagesBank Nifty Strategy Using Heiken Ashi and Super TrendDebapriya GhoshNo ratings yet

- Vijay Malik Template v2Document38 pagesVijay Malik Template v2KiranNo ratings yet

- Gss Sheet - Goela Stock Selector: Fact ListDocument9 pagesGss Sheet - Goela Stock Selector: Fact ListRakesh BehuriaNo ratings yet

- Fundamental Analysis PDFDocument7 pagesFundamental Analysis PDFMonil BarbhayaNo ratings yet

- StockDelver CalculatorDocument11 pagesStockDelver CalculatorAhtsham AhmadNo ratings yet

- Asian Paints Balance Sheet Key FinancialsDocument25 pagesAsian Paints Balance Sheet Key FinancialsJuan G ScharffenorthNo ratings yet

- Safal Niveshaks Stock Analysis ExcelDocument26 pagesSafal Niveshaks Stock Analysis ExcelUmesh KamathNo ratings yet

- Safal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetDocument32 pagesSafal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This Spreadsheetdivya mNo ratings yet

- Final ExamDocument6 pagesFinal ExamOnat PNo ratings yet

- EsmaDocument16 pagesEsmamikekvolpeNo ratings yet

- Law & TaxDocument13 pagesLaw & TaxrylNo ratings yet

- Week Seven - Translation of Foreign Currency Financial StatementsDocument28 pagesWeek Seven - Translation of Foreign Currency Financial StatementsCoffee JellyNo ratings yet

- Port-Folio Management: Module Code: MBA 721Document31 pagesPort-Folio Management: Module Code: MBA 721RabiaChaudhryNo ratings yet

- Big Picture: MetalanguageDocument25 pagesBig Picture: MetalanguageANGEL ROSALNo ratings yet

- PP ACF AssignmentDocument22 pagesPP ACF AssignmenttatekNo ratings yet

- Financial Aspects in RetailDocument31 pagesFinancial Aspects in RetailPink100% (4)

- An Empirical Estimation & Model Selection of The Short-Term Interest RatesDocument24 pagesAn Empirical Estimation & Model Selection of The Short-Term Interest RatesGary BirginalNo ratings yet

- FCB Records Summarized 20-22Document8 pagesFCB Records Summarized 20-22Eric HopkinsNo ratings yet

- Set B Quiz 2 Final Basic Earning and Diluted Earning Per ShareDocument1 pageSet B Quiz 2 Final Basic Earning and Diluted Earning Per ShareMega MindNo ratings yet

- Merger and Consolidation of TechnipfmcDocument8 pagesMerger and Consolidation of TechnipfmcIvanLeeNo ratings yet

- Chapter - 13, Substantive Procedures - Key Financial Statements FiguresDocument7 pagesChapter - 13, Substantive Procedures - Key Financial Statements FiguresSakib Ex-rccNo ratings yet

- Practice QuestionsDocument4 pagesPractice QuestionsDimple PandeyNo ratings yet

- MF Study on Need for Financial AdvisorsDocument80 pagesMF Study on Need for Financial AdvisorsVinayPawar100% (1)

- Paper 7 - Financial MarketsDocument52 pagesPaper 7 - Financial MarketsBogey PrettyNo ratings yet

- Redemption FormDocument2 pagesRedemption FormSalman ArshadNo ratings yet

- Project Finance Tools and TechniquesDocument104 pagesProject Finance Tools and Techniqueskapenrem2003No ratings yet

- M&M Annual ReportDocument21 pagesM&M Annual ReportThakkar GayatriNo ratings yet

- AAA - Revision Material: Dec 2011 Q3 - BeechDocument4 pagesAAA - Revision Material: Dec 2011 Q3 - BeechDee AnnNo ratings yet

- Title IX Merger and ConsolidationDocument3 pagesTitle IX Merger and ConsolidationJave MagsaNo ratings yet

- SyllabusDocument2 pagesSyllabusNoviani Mira SariNo ratings yet

- TB - Chapter05 - RISK AND RATES OF RETURNDocument86 pagesTB - Chapter05 - RISK AND RATES OF RETURNĐặng Văn TânNo ratings yet

- Antiquee ReportDocument51 pagesAntiquee ReportanushkakiranNo ratings yet

- Financial Accounting-I Sem-1 (GU-DEC-2014)Document12 pagesFinancial Accounting-I Sem-1 (GU-DEC-2014)Ekta RanaNo ratings yet