Professional Documents

Culture Documents

IVZ Morningstar

Uploaded by

Haohan XuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IVZ Morningstar

Uploaded by

Haohan XuCopyright:

Available Formats

Invesco Ltd IVZ

Quote

11 Analysis

15 Insiders

29 Performance

31 Financials

34 Valuation / Estimates

36 Key Ratios

39 Ownership

Release date 11-02-2014

Page 1 of 44

Morningstar Analyst Rating

Invesco Ltd IVZ

Last Price

Day Change

Open Price

Day Range

52-Week Range

Proj. Yield

Market Cap

Volume

Avg Vol.

Forward P/E

P/B

P/S

P/CF

$ 40.47

]0.79 | 1.99 %

$ 40.29

40.13-40.57

31.73-41.44

2.47

17.44 bil

4.0 mil

2.9 mil

14.22

2.07

3.48

14.7

Dividends

Stock Price 2014-01-01 - 2014-10-31

XNYS:IVZ: 4.07|11.18%

Declared Date

Ex-Dividend Date

Latest Indicated Dividend Amount

Projected Yield

45.00

30.00

10/30/2014

11/14/2014

0.25

2.47 %

15.00

2014

Morningstars Take

Invesco continues to impress us with its transformation,

reshaping itself into a much tighter organization capable

of not only generating profitability and cash flows on par

with the...

Fair Value Estimate

Consider Buying

Consider Selling

Fair Value Uncertainty

Economic Moat

Stewardship

Growth

Profitability

Morningstar Credit Rating

$ 40.00

$ 28.00

$ 54.00

Medium

Narrow

Standard

X

C

A-

Stock

Ind Avg

18.8

2.1

3.5

10

26.4

24

19.7

5.2

11.9

0.2

18

2

3.7

9.3

8.8

59.1

20.9

1.5

12.2

0.7

Relative to Industry

Cash Dividends

Cash Dividends

Cash Dividends

Cash Dividends

0.2500

0.2500

0.2250

0.2250

Purchase Options

Direct Investment

Dividend Reinvestment Plan

No

No

Competitors

Name

Price

% Chg

TTM Sales

$ mil

$40.47

$38.72

1.99 ]

1.98 ]

5,096

14,721

$341.11

$2.11

$55.61

$30.12

2.36 ]

-2.76 [

1.50 ]

1.21 ]

10,697

9,748

8,321

7,711

4.0

Total Analysts: 7

Avg

Quarterly

2013-12

2012-12

2011-12

2014-09

2013-09

4,645

1,120

940

2.10

448

4,177

872

677

1.49

454

4,092

898

730

1.57

465

1,311

330

256

0.59

435

1,172

286

228

0.51

449

4,463

14,807

19,270

3,738

10,878

8,393

3,908

13,585

17,492

2,713

9,176

8,317

3,834

15,513

19,347

2,974

11,228

8,119

4,231

15,850

20,081

8,870

11,657

8,424

5,638

13,126

18,764

3,669

10,233

8,531

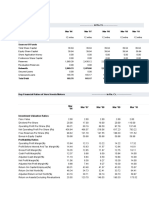

Balance Sheet

5.0

Buy

3.0

Hold

1.0

Sell

Ownership

Fund Owners

Annual

Current Assets

Non Current Assets

Total Assets

Current Liabilities

Total Liabilities

Stockholders' Equity

08/19/2014

05/14/2014

02/18/2014

11/15/2013

Wall St. Recommendations

Financials

Revenue

Operating Income

Net Income

Earnings Per Share

Shares Outstanding

Amount

Current

Income Statement

Type

Invesco Ltd

Bank of New York

Mellon Corp

BlackRock Inc

CaixaBank SA ADR

Franklin Resources Inc

Blackstone Group LP

Key Stats

Price/Earnings TTM

Price/Book

Price/Sales TTM

Rev Growth (3 Yr Avg)

Net Income Growth (3 Yr Avg)

Operating Margin % TTM

Net Margin % TTM

ROA TTM

ROE TTM

Debt/Equity

Recent Dividends &

Splits

Star

Rating

% Shares

Held

% Total

Assets

1.63

0.08

1.28

0.86

1.04

1.03

1.02

0.10

0.10

0.10

Vanguard Total Stock Mkt

Idx

T. Rowe Price Blue Chip QQQQQ

Growth

Vanguard 500 Index Inv QQQQ

QQQQ

SPDR S&P 500 ETF

QQQQ

Vanguard Institutional

Index I

Insiders

Karen Dunn Kelley

Martin L. Flanagan

Kevin M. Carome

Loren M. Starr

G. Mark Armour

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

% Change

TTM

% Shares

Outstanding

42,566

131,381

73,334

20,442

141,491

0.19

0.13

0.10

0.09

0.07

Release date 11-02-2014

Page 2 of 44

Morningstar Analyst Rating

Invesco Ltd IVZ

Last Price

Day Change

Open Price

Day Range

52-Week Range

Proj. Yield

Market Cap

Volume

Avg Vol.

Forward P/E

P/B

P/S

P/CF

$ 40.47

]0.79 | 1.99 %

$ 40.29

40.13-40.57

31.73-41.44

2.47

17.44 bil

4.0 mil

2.9 mil

14.22

2.07

3.48

14.7

Cash Flow

Cash From Operations

Capital Expenditures

Free Cash Flow

780

-88

692

819

-99

720

965

-107

858

467

-37

430

334

-27

308

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Release date 11-02-2014

Page 3 of 44

Invesco Ltd IVZ

Quote

Stock Type

Last Close 10/31/2014

Fair Value Estimate

Morningstar Rating TM

40.47

$ 40.00

QQQ

Industry Classification

NAICS

SIC

ISIC

Business Description

Portfolio Management (523920)

Other Financial Intermediaries N.E.C. (7499);Investment Advice (6282)

Other Financial Service Activities, Except Insurance and Pension Funding Activities,

N.E.C. (6499)

Operation Details

Fiscal Year Ends

CIK

Year Established

Employees (12/31/2013)

Full Time

Part Time

Auditor (12/31/2013)

Legal Advisor (12/31/2009)

Key Executives

2014-12-31

914208

5,932

Invesco Ltd. is an investment management company. The

Company provides a comprehensive range of enduring

solutions for its clients.

30-day Avg Volume

Market Cap

Net Income

Sales

Sector

Industry

Stock Style

Direct Investment

Dividend Reinvestment

3.4Mil

17.4Bil

1.0Bil

5.1Bil

Financial Services

Asset Management

4 Large Core

No

No

Ernst & Young LLP

APPLEBY

Karen Dunn Kelley/Senior Managing Director, Investments; Martin L. Flanagan/Director,

President and Chief Executive Officer; Kevin M. Carome/Company Secretary, Senior

Managing Director and General Counsel; Loren M. Starr/Senior Managing Director and

Chief Financial Officer; G. Mark Armour/Senior Managing Director and Head of EMEA;

Colin D. Meadows/Senior Managing Director and Chief Administrative Officer; Andrew

Tak Shing Lo/Senior Managing Director and Head of Invesco Asia Pacific; Philip A.

Taylor/Senior Managing Director and Head of the Americas; Roderick Ellis/Group

Controller and Chief Accounting Officer; Robert H. Rigsby/Managing Director, Corporate

Legal

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Release date 11-02-2014

Page 4 of 44

Invesco Ltd IVZ

Quote

Stock Type

Last Close 10/31/2014

Fair Value Estimate

Morningstar Rating TM

40.47

$ 40.00

QQQ

Industry Peers

Morningstar

Rating

Invesco Ltd

BlackRock Inc

Bank of New York Mellon Corp

CaixaBank SA

Franklin Resources Inc

QQQ

QQQ

QQQ

Blackstone Group LP

State Street Corp

CaixaBank SA

Investor AB

Investor AB

QQQQ

QQQ

Investor AB

KKR & Co LP

Ameriprise Financial Inc

T. Rowe Price Group Inc

Northern Trust Corp

QQQ

Market

Cap $Mil

Net

Income $Mil

P/S

P/B

P/E

Dividend

Yield%

5 Yr Rev

CAGR%

Med Oper.

Margin%

Interest

Coverage

D/E

17,435

56,620

43,815

35,793

34,772

1,005

3,135

2,772

510

2,252

3.5

5.5

3.0

3.5

4.2

2.1

2.1

1.2

1.1

3.1

18.8

18.8

16.4

53.8

15.5

2.4

2.2

1.7

2.2

0.9

7.0

15.0

2.0

16.7

5.8

20.8

35.8

24.6

12.1

36.0

8.5

19.8

11.8

0.9

65.5

0.2

0.3

0.6

0.1

0.2

34,738

31,958

29,656

27,119

26,436

1,575

2,078

510

51,801

51,801

2.3

3.4

2.9

9.7

9.4

3.2

1.6

0.9

0.8

0.8

11.5

16.4

44.4

3.8

3.7

6.4

1.5

2.1

2.4

2.7

-4.2

27.2

12.1

98.8

98.8

30.2

7.5

0.9

0.8

0.4

0.1

0.2

0.2

26,160

25,597

23,619

21,293

15,619

51,801

870

1,452

1,201

735

9.3

7.3

2.1

5.7

3.9

0.8

4.7

2.8

4.1

1.9

3.7

8.4

17.4

18.5

21.3

3.6

9.4

1.7

2.1

1.9

13,702

13,448

11,706

11,098

10,777

15,790

919

524

410

364

1.3

2.8

2.0

4.8

3.4

1.1

0.7

1.5

4.4

2.9

7.0

11.9

17.1

27.9

18.2

2.5

3.3

3.5

9,994

9,837

9,694

9,232

9,134

1,399

784

470

287

287

1.0

4.1

0.1

4.9

4.9

0.7

2.4

0.4

3.0

3.0

8,819

8,654

8,633

8,559

8,191

221

17,292

495

364

473

45.7

49.5

1.1

2.7

5.3

7,622

7,513

7,258

6,922

6,465

162

162

190

353

307

6,022

5,219

5,031

5,022

4,625

-1.6

16.7

26.5

9.6

10.5

-1.7

98.8

-181.3

14.1

44.7

27.2

2.9

50.1

38.3

3.6

13.6

14.1

42.3

21.2

12.7

28.5

24.1

7.3

14.2

16.4

17.1

16.9

0.1

5.0

0.8

2.1

4.0

0.2

111.6

20.2

20.2

2.9

38.6

4.8

30.6

30.6

1.3

11.6

11.3

0.8

3.6

2.3

4.8

1,000.0

3.7

6.8

14.5

19.5

6.8

2.4

2.3

3.6

3.7

13.3

13.1

9.9

12.7

5.4

20.9

20.6

13.3

7.7

5.2

29.4

29.0

10.0

19.1

21.9

309

262

331

534

809

2.3

2.7

2.6

4.9

0.7

1.3

-16.5

0.8

1.0

0.6

4,599

4,373

4,064

4,032

3,983

809

281

340

305

99

0.7

3.1

5.9

2.7

10.4

Sofina

Henderson Group PLC

CETIP SA Mercados Organizados

Ashmore Group PLC

Artisan Partners Asset Management Inc

3,955

3,738

3,722

3,572

3,535

198

245

388

130

43

China Everbright Ltd

3,436

2,139

China Resources Land Ltd

Groupe Bruxelles Lambert

Hal Trust

Affiliated Managers Group Inc

Schroders PLC

QQQQ

QQQ

QQQ

QQQ

QQQQ

Voya Financial Inc

IGM Financial Inc

EXOR Spa

Aberdeen Asset Management PLC

Aberdeen Asset Management PLC

The Carlyle Group L P

Kinnevik Investment AB

Apollo Global Management LLC

Schroders PLC

CI Financial Corp

Hargreaves Lansdown PLC

Hargreaves Lansdown PLC

Oaktree Capital Group LLC

Partners Group Holding

SEI Investments Company

Legg Mason Inc

Och-Ziff Capital Management Group LLC

Investec PLC

Ares Capital Corporation

First Pacific Co Ltd

First Pacific Co Ltd

Eaton Vance Corp

Challenger Ltd

Waddell & Reed Financial, Inc.

American Capital Ltd

QQQQ

QQQQQ

QQQQ

QQ

QQQ

QQQQ

QQQ

QQQQ

80.2

8.0

0.2

1.9

1.1

7.1

0.4

50.9

0.6

0.2

0.5

0.5

10.9

0.6

0.3

0.2

145.6

145.6

85.8

1.5

0.0

5.5

14.1

3.4

53.8

-6.2

-2.2

24.1

34.6

31.6

0.2

2.3

2.2

6.9

2.0

1.1

22.1

22.1

14.2

7.8

-2.0

61.5

61.5

-666.6

64.4

22.1

103.0

1.1

20.3

20.2

14.1

8.6

16.9

1.1

16.1

3.8

9.5

2.2

-4.0

25.7

2.5

29.7

8.6

13.3

-127.1

21.6

48.1

20.2

8.9

193.8

1.3

3.9

3.5

0.2

0.6

6.6

2.1

5.2

0.8

16.8

16.0

12.9

13.3

43.1

2.5

2.5

1.5

2.8

8.6

4.4

53.7

8.3

-14.3

20.2

32.9

-272.1

25.5

47.6

3.5

7.8

2.6

36.0

6.9

0.6

0.3

2.0

0.2

0.1

39.4

3.9

9.4

7.6

1.2

0.8

2.5

5.4

3.5

44.4

15.4

26.5

23.1

17.1

2.0

4.3

1.6

5.3

4.3

-6.9

11.2

59.5

3.7

123.1

14.9

53.5

66.3

17.0

59.2

10.5

190.2

-16.5

2.5

3.2

0.8

15.0

2.0

14.5

36.5

17.6

0.0

-27.5

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

2.5

814.8

0.7

0.6

0.2

0.2

Release date 11-02-2014

Page 5 of 44

Invesco Ltd IVZ

Quote

Stock Type

Last Close 10/31/2014

Fair Value Estimate

Morningstar Rating TM

40.47

$ 40.00

QQQ

Industry Peers

Morningstar

Rating

Market

Cap $Mil

Net

Income $Mil

P/S

P/B

P/E

Dividend

Yield%

3,424

3,360

3,302

3,284

53

161

53

319

3.4

6.7

3.3

4.0

1.5

11.4

1.5

0.9

66.7

64.1

9.0

4.8

1.1

4.2

13.8

3,270

3,270

3,144

2,998

2,788

150

184

2,139

159

146

3.7

2.1

3.0

6.6

3.0

5.5

5.5

0.8

3.7

1.8

20.9

19.1

13.7

14.9

19.4

3.2

4.0

2.5

3.3

2.0

-6.4

11.6

14.5

2,783

2,738

2,584

2,576

2,462

169

169

195

24,006

137

4.3

4.3

15.6

15.4

14.2

12.6

11.1

4.0

1.3

3.5

1.4

1.4

1.7

0.7

1.0

Ratos AB

Vontobel Holding AG

GAMCO Investors, Inc

Financial Engines Inc

Partners Value Fund Inc

2,280

2,243

2,137

2,063

2,005

-130

119

123

35

51

0.4

2.6

4.9

8.1

34.6

1.1

1.3

4.3

5.7

1.0

18.3

17.2

59.9

43.5

WisdomTree Investments Inc

Apollo Investment Corp

Cohen & Steers Inc

OM Asset Management PLC

Aker ASA

1,966

1,953

1,919

1,796

1,774

72

316

79

33

1,451

12.1

5.2

6.5

1.8

1.1

12.8

0.9

7.7

-43.1

0.4

28.4

6.3

24.5

72.5

Sun Hung Kai & Co Ltd

Moelis & Company

Tokai Tokyo Financial Holdings Inc.

IP Group PLC

Virtus Investment Partners Inc

1,758

1,753

1,716

1,654

1,634

1,729

-33

23,397

87

87

2.8

3.5

2.1

8.8

3.8

0.8

24.7

1.3

2.0

3.2

10.7

8.1

10.3

18.6

Grenkeleasing AG

Main Street Capital Corporation

Value Partners Group Ltd

Acology Inc

Kenedix Inc.

1,452

1,425

1,298

1,272

1,261

60

106

518

-1

5,016

6.1

9.9

12.3

2.4

1.5

3.6

-3,333.3

4.6

1.6

19.1

12.0

19.3

Altisource Asset Management Corp

Encore Capital Group Inc

Brewin Dolphin Holdings PLC

Brederode SA

Luxempart SA

1,211

1,166

1,131

1,115

924

17

91

33

200

150

5.6

1.3

2.5

28.4

20.2

-2.9

2.1

3.1

0.7

0.7

82.6

13.6

21.3

4.5

4.9

917

906

815

789

775

68

67

57

70

56

1.3

4.4

7.4

6.9

1.9

1.2

3.3

1.1

0.8

0.9

12.9

13.8

13.1

11.6

16.4

7.4

8.6

10.9

Gluskin Sheff & Associates Inc

New Mountain Finance Corp

Dundee Corp

Allied Group Ltd

Pennant Park Investment Corporation

771

764

760

753

724

106

82

-38

3,037

134

3.5

6.3

3.2

1.1

5.2

9.4

1.0

0.6

0.2

1.0

8.1

8.6

2.8

9.3

4.9

5.4

4.4

10.3

Fifth Street Asset Management Inc

AF Ocean Investment Management Co

713

707

42

0

8.1

333.3

1,666.7

1,000.0

Man Group PLC

Ares Management LP

Man Group PLC

Prospect Capital Corporation

Federated Investors, Inc.

Fortress Investment Group LLC

China Everbright Ltd

Azimut Holding SPA

Janus Capital Group Inc

GAM Holding AG

GAM Holding AG

AllianceBernstein Holding L.P.

SBI HoldingsInc.

Intermediate Capital Group PLC

Piper Jaffray Cos

Noah Holdings Ltd

Golub Capital BDC Inc

Solar Capital Ltd.

AGF Management Limited

QQQQ

QQ

QQQQ

QQQ

QQQ

7.1

1.3

5.6

5 Yr Rev

CAGR%

Med Oper.

Margin%

Interest

Coverage

48.1

-22.6

-126.1

-22.6

56.0

3.5

2.6

3.5

3.5

-3.4

28.7

-91.3

36.5

53.7

27.4

103.1

17.6

60.4

5.8

-5.0

-5.0

7.6

7.6

-7.2

8.1

54.9

6.4

4.2

0.3

0.6

-0.6

2.3

10.1

27.4

0.4

9.7

2.0

0.2

9.9

6.7

4.8

3.0

0.6

10.4

6.6

19.2

33.1

15.8

19.4

8.9

51.6

35.2

-10.7

-24.3

D/E

43.7

0.7

0.4

0.4

0.0

0.3

0.0

0.0

2.9

6.2

0.5

0.7

47.5

18.5

0.2

4.9

0.8

0.6

0.9

0.5

15.7

143.2

16.9

46.7

9.9

14.4

72.7

6.8

0.4

6.2

1.9

7.2

46.8

13.0

39.4

59.3

73.8

2.1

5.8

3.0

0.3

-30.4

27.8

2.8

1.1

46.9

25.9

10.6

109.6

107.7

8.5

2.6

1,681.6

4.8

12.1

34.8

55.6

63.0

19.6

4.0

0.2

4.7

4.8

6.7

0.2

0.3

54.6

73.1

19.0

70.9

52.7

-8.9

10.8

7.0

0.2

0.2

0.6

56.3

-237.0

-15.3

27.9

3.6

1.7

2.6

24.8

7.8

12.3

0.5

-7.8

29.1

-30.4

8.2

27.0

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

5.3

0.4

0.0

0.0

156.9

202.7

Release date 11-02-2014

Page 6 of 44

Invesco Ltd IVZ

Quote

Stock Type

Last Close 10/31/2014

Fair Value Estimate

Morningstar Rating TM

40.47

$ 40.00

QQQ

Industry Peers

Morningstar

Rating

Market

Cap $Mil

Net

Income $Mil

P/S

P/B

P/E

Dividend

Yield%

5 Yr Rev

CAGR%

Med Oper.

Margin%

Interest

Coverage

D/E

TCP Capital Corp

BlackRock Kelso Capital Corporation

Pzena Investment Management, Inc.

702

657

655

73

104

7

6.6

7.1

6.3

1.3

0.9

40.3

9.6

7.1

87.0

8.5

10.7

3.5

-2.4

-1.2

81.3

60.4

48.7

54.9

5.4

0.5

0.5

Tricon Capital Group, Inc.

Pacific Century Regional Developments Ltd

Medley Capital Corp

Fonterra Shareholders Fund

Capital Southwest Corporation

654

639

607

587

565

32

75

58

20

122

6.3

99.0

4.8

-6.9

45.9

1.6

1.0

0.9

21.3

10.9

8.4

30.4

4.6

3.0

4.9

245.7

3.9

0.2

12.7

0.6

0.6

0.5

10.6

58.4

-1.6

27.0

Westwood Holdings Group Inc

TICC Capital Corp

The Intertain Group Ltd

Guardian Capital Group Ltd

Sprott Inc

559

528

523

521

506

27

63

0

45

-61

4.7

5.8

5.3

0.9

13.0

1.3

1.3

19.3

9.1

2.6

13.2

14.6

22.1

30.8

65.8

4.1

0.8

0.5

14.0

1.0

5.4

8.0

-7.1

13.4

27.3

35.1

Medley Management Inc

Diamond Hill Investment Group Inc

THL Credit Inc

Lai Sun Development Co Ltd

Safeguard Scientifics Inc

496

444

436

421

409

33

25

38

1,253

33

8.3

4.4

5.3

1.9

-14.9

6.1

1.0

0.2

1.5

10.9

26.8

16.9

11.3

2.7

12.6

56.2

163.4

-1,034.5

19.5

-7.3

Senvest Capital Inc

Clairvest Group Inc

GP Investments Ltd

Calamos Asset Management Inc

Dividend 15 Split Corp

344

335

308

281

266

134

35

45

18

45

1.0

5.9

1.9

1.0

16.3

0.6

0.9

0.3

1.4

1.1

3.0

10.6

7.3

14.2

5.0

KCAP Financial Inc

MVC Capital, Inc.

Garrison Capital Inc

Mesabi Trust

China Merchants China Direct Invts Ltd

257

255

247

244

243

17

-20

33

18

37

4.9

12.8

5.5

12.2

4.5

1.0

0.7

0.9

56.2

0.5

14.8

7.5

13.0

6.5

13.1

4.8

9.5

12.3

3.8

Capitala Finance Corp

CorEnergy Infrastructure Trust Inc

Fidus Investment Corp

CIFC Corp

Manning & Napier Inc

238

237

233

231

217

22

7

15

19

2

3.2

5.4

5.5

47.2

0.6

0.9

1.1

1.1

1.5

1.3

6.6

29.0

14.6

12.1

77.5

11.1

6.8

9.0

4.4

4.0

PennantPark Floating Rate Capital

Firsthand Technology Value Fund Inc

Treasury Group Ltd

Gladstone Investment Corporation

Resource America Inc

209

204

200

194

194

23

7.3

24

125.0

13 -5,000.0

3

5.3

8

1.1

1.0

0.8

3.6

0.9

1.2

8.7

7.8

17.0

52.4

22.7

7.7

Gladstone Capital Corp

WhiteHorse Finance Inc

GSV Capital Corp

Silvercrest Asset Management Group Inc

Alcentra Capital Corp

192

192

187

182

180

16

23

38

5

13

5.6

5.2

1,250.0

1.5

14.7

1.1

0.8

0.7

4.4

11.4

8.1

5.2

19.7

9.1

11.0

Solar Senior Capital Ltd

CM Finance Inc

Noranda Income Fund

Stellus Capital Investment Corp

Clarke Inc

174

172

170

169

167

14

16

32

14

135

8.1

8.2

0.3

5.3

1.6

0.8

0.9

2.7

1.0

0.8

Yellow Brick Road Holdings Ltd

MCG Capital Corporation

Tern Properties Co Ltd

161

155

147

-8

-41

250

4.3

-97.1

12.9

7.3

0.8

0.3

3.7

4.2

0.7

18.5

0.5

11.5

10.6

3.1

0.4

3.8

10.3

5.3

9.8

2.2

-14.5

-33.6

-7.2

5.9

-0.4

-4.4

-8.9

37.0

-38.1

86.2

52.2

-78.0

36.7

66.8

78.0

48.0

18.9

0.3

0.2

56.9

4.4

57.2

97.2

76.3

2.7

6.5

4.6

0.7

0.3

0.9

51.8

26.3

49.4

-527.4

24.8

4.4

3.7

4.9

20.7

3,743.1

1.2

0.3

0.7

74.8

54.0

-469.1

0.7

7.6

58.0

24.1

0.4

26.9

-2.9

3.2

3.9

56.2

72.8

-3,338.8

29.4

64.7

4.6

28.7

44.2

70.8

12.3

10.6

5.9

11.4

3.3

9.3

6.8

10.0

10.8

4.3

-15.2

60.8

80.5

9.7

48.4

2.8

10.9

7.6

14.4

6.6

9.6

4.6

10.3

1.6

57.4

-34.4

6.2

-29.6

50.0

540.5

-5.6

1.1

105.3

0.2

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

0.7

0.3

0.2

10.3

0.2

0.6

0.2

0.6

0.1

0.0

0.1

0.0

Release date 11-02-2014

Page 7 of 44

Invesco Ltd IVZ

Quote

Stock Type

Last Close 10/31/2014

Fair Value Estimate

Morningstar Rating TM

40.47

$ 40.00

QQQ

Industry Peers

Morningstar

Rating

Market

Cap $Mil

Net

Income $Mil

HFA Holdings Ltd

TriplePoint Venture Growth BDC Corp

147

142

11

0

City of London Investment Group PLC

Horizon Technology Finance Corp

OHA Investment Corp

American Capital Senior Floating, Ltd.

Point Capital Inc

139

135

133

131

124

5

6

1

Signature Group Holdings Inc

CapMan Oyj

OFS Capital Corp

Hennessy Advisors Inc

StoneCastle Financial Corp.

121

114

112

110

110

-5

0

4

6

3.4

3.2

7.8

3.4

2.4

1.4

0.8

3.2

Urbana Corp

Urbana Corp

Harris & Harris Group, Inc.

Canadian Banc Corp

Saratoga Investment Corp

101

96

90

86

81

17

17

-11

24

9

40.2

38.0

1,111.1

17.6

4.6

Harvest Capital Credit Corp

Charlemagne Capital Ltd

Acheron Portfolio Corp Luxemburg SA

Fifth Street Senior Floating Rate Corp

Full Circle Capital Corp

79

75

74

72

71

6

4

1

7.3

1.9

11.0

-7

4.7

Proxama PLC

Marret Resource Corp

SWK Holdings Corp

Mesa Royalty Trust

Vapir Enterprises Inc

71

62

56

53

48

-6

8

15

5

0

43.3

10.2

4.5

9.4

7.6

0.7

1.1

12.2

-2,500.0

BDCA Venture Inc

US Global Investors Inc

Precious Metals and Mining Trust

Gleacher & Co Inc

Australian Ethical Investment Ltd

47

47

47

43

40

-4

0

26

-86

2

526.3

4.2

222.2

18.1

5.2

0.7

1.4

0.7

0.5

4.8

InterCore Inc

Tanfield Group PLC

Universal Capital Management Inc

Wright Investors Service Holdings Inc

Equus Total Return, Inc.

39

36

30

29

27

-5

7

-1

-2

3

555.6

24.3

434.8

5.3

58.8

-15.7

0.6

-51.3

1.6

0.7

Spotlight Innovation Inc

Rand Capital Corp

Kobex Capital Corp

Energy Income Fund

Soellingen Advisory Group Inc

20

19

19

18

15

-7

3

0

7

Aberdeen International Inc

Global Diversified Investment Grade Income Trust II

Medwell Capital Corp

Millennium India Acquisition Corporation

Rubicon Financial Inc

14

11

10

6

6

-18

2

0

-203

0

-1.8

2.4

0.5

4.1

0.9

0.2

13.7

6

5

5

4

-24

0

-4

1

0.9

0.2

0.7

2.7

0.6

0.6

2.1

4.0

49 North Resources Inc

Ascendant Solutions Inc

Diversa Ltd

Mackenzie Master LP

P/S

3.1

4.0

5.6

0 10,000.0

10.4

17.2

P/B

P/E

Dividend

Yield%

1.1

1.0

18.1

7.3

4.9

6.3

1.0

0.8

0.9

59.5

15.2

19.5

85.5

7.5

9.8

9.9

5.6

5 Yr Rev

CAGR%

3.9

33.3

45.2

48.7

-6.1

1,000.0

Interest

Coverage

D/E

2.3

0.3

1.5

2.2

0.2

-11,517.8

27.1

15.9

4.1

11.6

0.8

4.3

0.7

0.6

0.7

1.1

0.7

6.6

6.3

2.6

2.8

24.6

24.6

3.6

8.1

5.6

1.2

0.9

2.6

0.5

0.7

1.0

12.6

18.9

44.6

10.5

5.8

-3.4

0.7

0.6

0.6

38.3

Med Oper.

Margin%

-6.3

11.2

41.8

26.6

-4.2

19.1

12.0

2.0

6.2

2.0

20.0

18.2

4.6

-4.4

64.7

23.0

57.9

5.0

-0.9

-47.5

-2.0

54.1

-1.8

0.3

-395.6

-116.7

66.0

-79.1

-18.6

67.0

95.5

-2,180.3 -84,033.2

0.1

-37.9

-25.4

-57.5

6.8

0.6

6.5

54.1

14.2

1.0

0.0

-34,093.2

-37.9

-1,732.4

-1,519.2

-585.2

172.0

-8.0

-7.7

16.3

14.9

2.7

2.4

-9,363.3

5.0

-770.1

-10.4

-238.0

-13.7

-62.5

6.3

0.7

218.0

218.0

-65.9

7.3

3.2

3.3

13.2

0.2

0.5

-52.9

-52.9

-1,694.0

65.5

48.6

9.2

13.8

7.9

3.5

9.7

-1.5

-7.7

93.4

-48.9

-74.9

0.0

35.1

13.0

-33.5

-7.5

4.0

-19.7

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

74.8

41.5

-699.2

-9.8

-3.7

-26.8

-1.7

-0.7

0.3

0.4

57.1

0.3

-90.6

92.8

-11.8

7.7

-4.3

1.6

0.3

Release date 11-02-2014

Page 8 of 44

Invesco Ltd IVZ

Quote

Stock Type

Last Close 10/31/2014

Fair Value Estimate

Morningstar Rating TM

40.47

$ 40.00

QQQ

Industry Peers

Morningstar

Rating

Market

Cap $Mil

Net

Income $Mil

P/S

Invent Ventures Inc

-5

19.1

Viking Investments Group Inc

WestMountain Alternative Energy Inc

Enterra Corp

Rockshield Capital Corp

Innocap Inc

4

2

2

2

1

0

0

0

3

0

Southern Trust Securities Holding Corp

NetMed Inc

Halo Companies Inc

Enviro Serv Inc

Global Vision Holdings Inc

1

0

0

0

0

0

0

-1

-1

0

GreenBank Capital Inc

Formosa Liberty Corp

Q Lotus Holdings Inc

Resinco Capital Partners Inc

Carrus Capital Corp

0

0

0

0

0

-2

0

0

Ampal-American Israel Corp

Fortitude Group Inc

Esstra Industries Inc

Ameritrans Capital Corporation

Uni Core Holdings Corporation

0

0

0

0

0

-274

-1

0

-8

14

Conversion Industries Inc

Forum National Investments Ltd

Hbancorporation Inc

Intersecurity Holdings Corp

Intrepid Capital Corp

Yora International Inc

Champion Investments Inc

Redwood Group International

Single Source Investment Group Inc

Epic Corp

Conihasset Captial Partners Inc

Oceania Capital Partners Ltd

Elementone Ltd

General Finance & Development Inc

Westmountain Co

Aston Hill Financial Inc

Cathay Financial Holding Co Ltd

JAFCO Co., Ltd.

FFP SA

Landmark Global Financial Corp

Brait S.E.

Industrivarden AB

Platcom Inc

Corporacion Financiera Colombiana SA

National Investment Managers Inc

Morgan Financial Corp

First Eagle

MLP AG

727 Communications Inc

AMEN Properties Inc

-33

0

70.4

P/B

5 Yr Rev

CAGR%

Med Oper.

Margin%

Interest

Coverage

0.8

-421.8

-4.7

-889.2

31.1

-206.5

-9.6

14.8

-20.4

-112,246.9

-16,736.5

1.4

-2.5

-1.0

0.3

0.0

0.7

-0.2

-0.0

-0.6

0.5

0.1

-16.4

0.4

-0.0

0.1

0.4

-10.9

0.1

0.0

Dividend

Yield%

-9.7

6.3

-0.0

0.2

-30.5

0.7

0.0

P/E

-0.0

-0.2

0.1

-0.0

-0.0

D/E

0.6

8.4

3.0

-43.0

73.8

-148.1

-1.7

-67.5

31.0

110.2

-15.5

-2.1

-24.2

6.1

-426.6

-26.9

0.5

0.0

43.9

-84.7

3.2

0.9

-340.6

-4

323

8.5

0.2

4.9

29.1

4.4

24.0

0

42,194

16,199

-723

-1

3.2

0.7

5.6

2.9

1.4

1.6

263.2

14.6

14.8

-54.9

2,615

6,958

5.1

1.0

-1

0.0

0.1

5.7

3.3

-230.7

3.0

-77.8

92.9

-37.7

0.1

2.0

3.3

22.4

1.0

0.3

0.1

0.1

-35.9

4.1

2.7

0.4

54.3

66.6

-20.1

18.1

91.6

14.7

-891.6

-35.0

4.1

58.2

39.0

95.4

99.2

-3.6

-2.1

0.2

0.5

0.0

5.9

0.1

2.0

25

0

1.5

1.9

27.2

10.3

-2.8

6.9

69.5

9.8

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Release date 11-02-2014

Page 9 of 44

Invesco Ltd IVZ

Quote

Stock Type

Last Close 10/31/2014

Fair Value Estimate

Morningstar Rating TM

40.47

$ 40.00

QQQ

Industry Peers

Morningstar

Rating

CVF Technologies Corp

Global Capital Partners Inc

Detwiler Fenton Group Inc

Alerus Financial Corporation

AmTrust Financial Group Inc

CGrowth Capital Inc

Principal Capital Group Inc

MEDIA GLOBO Corp

Bancpro Inc

Centra Capital Corp

Queen City Investment

Renaissance Capital Group

Market & Research Corp

FNB Financial Corp

Firebrand Financial Group Inc

Market

Cap $Mil

Net

Income $Mil

P/S

P/B

-2

-45

0

0.1

-1.4

Tonawanda Share Corp

Close Brothers Group PLC

Dadongnan Holding Co

Nanostart AG

3i Group PLC

Interest

Coverage

-27.5

-85.9

-33.0

-2.2

-12.6

27.6

1.5

-8.2

-40.6

-307.0

-20.8

14.9

1.0

24.4

0.1

1.8

-151.0

-18.8

6.3

5.6

0.6

6.3

0.6

0.0

0.0

4.0

1.6

0.0

-1

1

-19

20

Sigma Capital Group PLC

Teuza a Fairchild Technology Venture Ltd

Myanmar Investments International Ltd

Kilimanjaro Cap Limited

Schroders PLC

Med Oper.

Margin%

D/E

0.8

Pyne Gould Corp Ltd

Wall Street Strategies

Olympia Financial Group Inc

Ackermans & Van Haaren NV

Renta 4 Banco SA

Global Investments Ltd

Atlantic Investment CO

World Organics Inc

PT Sinar Mas Multiartha Tbk

Absolute Invest AG

5 Yr Rev

CAGR%

-2

-4

-3

0

0

8

Ackermans & Van Haaren NV

Grupo de Inversiones Suramericana SA

Remgro Ltd

Quilvest SA

Ichigo Group Holdings Co., Ltd.

Dividend

Yield%

1.8

Envit Capital Group Inc

Protek Capital Inc

Gundaker/Jordan American Holdings Inc

Winmill & Co Inc

F&C Asset Management PLC

Tarpon Investimentos S.A.

Orion Diversified Holding Co Inc

Skajaquoda Group Inc

Intercorp Peru Ltd

Argo Group Ltd

P/E

-5.6

2.0

-45.9

0.4

-0.2

6.2

35

295

13

0.7

5.0

-1.8

9.1

13.2

21.9

62

84.7

69.6

11.4

18.5

18.6

2.0

0.5

295

849,701

6,917

67

4,282

5.2

0.8

9.3

2.9

0.1

0.7

0.0

26

3.5

0.5

-3.6

-12.9

11.1

1.4

5.0

-4.4

47.6

0.5

28.2

-7.0

13.2

9.0

3.6

23.8

11.2

11.6

0.6

4.3

10.6

-8.6

76.9

66.3

1.5

10.7

24.5

4.6

-7.4

14.1

24.1

4.8

29.6

2.4

0.0

27,722.2

73.5

4.0

10.4

0.3

0

30

0

6.2

18.0

364

149

3.4

2.2

15.2

3.3

0 10,000.0

517

4.3

2.8

0.9

32.8

14.6

0.8

Bookkeeper International Equities Corp

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Release date 11-02-2014

Page 10 of 44

Invesco Ltd IVZ

Quote

Stock Type

Last Close 10/31/2014

Fair Value Estimate

Morningstar Rating TM

40.47

$ 40.00

QQQ

Industry Peers

Morningstar

Rating

Market

Cap $Mil

Reinet Investments SCA

Teton Advisors, Inc.

Leone Asset Management Inc

Alpine Management Sy

Net

Income $Mil

P/S

P/B

P/E

92

12.3

0.8

36.1

Dividend

Yield%

5 Yr Rev

CAGR%

Med Oper.

Margin%

Interest

Coverage

-14.1

84.6

10.6

0.3

0

Grupo de Inversiones Suramericana SA

Alpha Lujo Inc

Cathay Financial Holding Co Ltd

US Guaranty of America Inc

Brookfield Soundvest Equity Fund

-4,232.0

849,701

-1

42,194

3.9

0.7

37.0

27.7

1.0

-4.4

66.6

9.0

-1,966.0

91.6

0.0

3.3

5.6

0.3

1.2

0.0

62.6

38.9

Kenedix Inc.

SPARX Group Co., Ltd.

Psg Group Ltd

eQ Oyj

Remgro Ltd

5,016

1,699

1,176

4

6,917

4.0

7.0

6.1

4.7

4.4

1.2

4.0

1.2

1.2

1.6

22.1

31.1

10.6

25.5

15.6

-30.4

1.1

45.2

25.9

27.8

-17.3

54.3

32.1

3.6

2.8

124.4

Sawada Holdings Co., Ltd.

Idb Holding Corp Ltd

Hotung Investment Holdings Ltd

West Suburban Bancorp Inc

PLM Equip Growth FND III

7,717

-630

338

4

2.8

1.1

1.7

1.9

1.0

34.1

34.2

-1.1

36.6

12.8

Sun Hung Kai & Co Ltd

Gendis Inc

IFG Group PLC

IOOF Holdings Ltd

Common Splendor International Health Industry Group

Ltd

Self Storage Group Inc

Questus Global Capital Market Ltd

CanBanc Income Corp

ICON ECI Fund Fifteen LP

Hitachi Capital Corp

1,729

14

3

101

0

1.9

7.5

1.8

0.5

0.7

1.8

8.4

32.8

41.0

10.4

14.9

-4.4

22.9

10.8

46.7

36.0

8.1

12.2

86.7

5.3

249.2

8.4

44.3

4,513.5

3.5

24.4

32.8

22.9

-299.0

12.2

43.9

44.3

-1.8

-4.7

3.3

53.7

60.4

-1,175.1

-273.9

0.8

1.3

3.8

1.8

6.6

1.8

1.9

0.3

1.1

0.2

0.5

71.4

0.0

1.6

6.7

1.8

0.4

0.1

0.0

3.4

3.1

23,902

Perpetual Ltd

IOOF Holdings Ltd

Automotive Resource Network Holdings Inc

Impax Energy Services Income Trust

Bergamo Acquisition Corp

81

101

BAVARIA Industries Group AG

Azimut Holding SPA

Finance Company of Penn

Aventura Equities Inc

Sunburst Alliance Inc

134

159

2.3

0.9

-63

14.1

0.8

0.0

0.2

7.5

0.9

4.2

1.0

16.9

4.9

0.4

3.8

-3

Metropolitan Royalty Corp

Conduit Capital Ltd

Spackman Equities Group Inc

EME Reorganization Trust

Aurelius AG

I B I Investment House Ltd

ADC African Development Corporation AG

China Cinda Asset Management Co Ltd

GSD Holding AS

Industry Average

D/E

3,642

0.6

2.9

0.2

0.2

112

1

-1.1

11.6

-23.1

54

33.0

4.3

2.5

16.1

14.3

28.0

18.2

1.6

2.6

0.1

8.0

-639.3

-383.9

0.7

-23

10,443

34

0.7

0.4

7.8

7,237

3.7

2.0

18.0

3.5

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

0.0

Release date 11-02-2014

Page 11 of 44

Invesco Ltd IVZ

Analysis

Analyst Note | 30 Oct 2014 | Greggory Warren, CFA,

Investment Thesis | 14 Oct 2014 | Greggory Warren,

Senior Analyst

CFA, Senior Analyst

With narrow-moat-rated Invesco reporting preliminary AUM data for the September quarter earlier

this month, we had a good idea of what thirdquarter earnings would look like. Although the

firm's total AUM decreased $12.8 billion to $789.6

billion during the period, the decline was driven far

more by market losses (of $5.1 billion) and adverse currency exchange (of $9.7 billion) than fund

flows, with Invesco reporting $2 billion in net inflows during the quarter. More important, the company generated $6.0 billion in positive flows from

active equity, balanced, and alternative products,

which helped to offset $3.2 billion in outflows

from its PowerShares ETF operations.

Invesco continues to impress us with its transformation, reshaping itself into a much tighter organization capable of not only generating profitability

and cash flows on par with the higher-quality

names in our asset manager coverage, but enabling it to overcome any hurdles that might be

thrown in its way. This will be critical in the back

half of 2014, as the firm will be negatively affected by the turmoil in the global equity markets

(leading us to reduce our forecast for end-of-year

assets under management to $775 billion-$800 billion from more than $825 billion previously). While

the company was able to navigate the departure of

Neil Woodford from Invesco Perpetual, which had

been a big concern for investors in the first half of

the year, it will have difficulty avoiding the impact

of declining equity markets in the back half of

2014. Even though we expect organic growth to be

stymied in the near term, we believe Invesco

should be able to generate annual organic growth

of 3%-4% longer term, with market gains fueling

the rest of the 6%-7% annual growth we are forecasting for its AUM. Invesco is one of the few asset managers we cover with solid equity and fixedincome franchises that can benefit from changing

investor behavior over the long run. With a heavier presence in the retail channel, more equity exposure than fixed-income, and better investment

performance than many of its peers, the firm

should benefit from a continued move toward

equities, especially with five-year performance

numbers for most active managers improving as

their funds roll off poor results from the 2008-09

financial crisis. While PowerShares is a smaller

player in the ETF market, accounting for just 5% of

the domestic market (and 4% of the global

market), it is far more focused on niche products

(which have so far been less susceptible to the pricing pressure we've seen in the core/index-based

ETF market) and has been the driving force behind

much of Invesco's passive flows. With most of its

operations firing on all cylinders, and the firm continuing to improve its profitability, we believe Invesco is not only a more complete firm but a much

While average AUM was up 10% year over year,

Invesco reported a 12% increase in third-quarter

revenue, primarily due to an improved realization

rate. Revenue growth of 13% through the first nine

months of the year was just above our current revenue forecast for 2014, but we still think the firm

will close out the year at the lower end of a 10%15% projected range. While we are encouraged by

the firm's ability to generate solid organic growth

in the near-to-medium term, we're sticking with

our forecast for somewhat more muted revenue

growth in fiscal 2015, believing that flows will be

more difficult to come by as long as the equity and

credit markets are volatile.

With regards to profitability, Invesco's adjusted

operating margins of 26% through the first nine

months of the year were in line with our full-year

forecast. The company also continues to use its

free cash flow to repurchase stock, spending $50

million in the third quarter to pick up 1.3 million

shares. This brings year-to-date repurchases to 6.2

million shares (at a cost of $220 million). Having

already reduced our fair value estimate to $40 per

share from $42 earlier this month (to reflect a

more sanguine near-term outlook for equity and

credit markets), we do not anticipate making any

changes to our valuation.

stronger competitor.

Economic MoatTM | 14 Oct 2014

The publicly traded asset managers tend to have

economic moats, with switching costs and intangible assets being the most durable sources of

competitive advantage for firms in the asset-management industry. Although the switching costs

might not be explicitly large, the benefits of

switching from one asset manager to another are

at times so uncertain that many investors take the

path of least resistance and stay where they are.

As a result, money that flows into asset-management firms tends to stay there--borne out by an average annual redemption rate for long-term mutual funds of around 30% during the last five-, 10-,

15-, 20-, and 25-year time frames. We believe asset managers can improve on the switching cost

advantage inherent in the business with structural

attributes (such as product mix, distribution channel concentration, and geographic reach) and intangible assets (such as strong brands and entrenched sales relationships), which provide them

with a level of differentiation. Although the barriers to entry are not significant for the industry, it

takes time and skill to gather the level of assets

necessary to build scale. This provides large, established asset managers with an advantage over

smaller players, especially when it comes to gaining cost-effective access to distribution platforms.

Asset stickiness (the degree to which assets remain with a manager over time) tends to be a bigger distinguisher between wide- and narrow-moat

firms, in our view. Companies that have shown an

ability to gather and retain investor assets during

different market cycles have tended to produce

more stable levels of profitability, with returns exceeding their cost of capital for longer periods.

While more broadly diversified asset managers are

structurally set up to hold on to assets regardless

of market conditions, it has been firms with both

solid product sets across asset classes and singular corporate cultures dedicated to a common purpose that have tended to thrive. Asset managers

offering niche products with significantly higher

switching costs--such as retirement accounts,

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Release date 11-02-2014

Page 12 of 44

Invesco Ltd IVZ

Analysis

funds with lock-up periods, and tax-managed

strategies--have also been able to hold on to assets longer.Invesco, in our view, has a narrow economic moat. With $789.6 billion in total AUM at

the end of September, the company has the size

and scale necessary to be competitive in the asset-management industry. Invesco's AUM is

broadly diversified across its equity (49% of managed assets), balanced (6%), fixed-income (23%),

alternative investment (12%), and money market

(10%) offerings, and the firm has a meaningful

presence outside the U.S., with close to one third

of its total AUM sourced from Canada (4%), the

U.K. (13%), continental Europe (9%), and Asia

(7%). Invesco provides investment management

services to retail (68% of AUM) and institutional

(32%) clients under the Invesco, Trimark, Perpetual, PowerShares, and W.L. Ross banners. The company's U.S. retail business (which includes PowerShares ETF operations) is one of the 10 largest

non-proprietary fund complexes in the United

States. In Canada, the firm is a top 10 competitor

for long-term assets with its Invesco, Trimark, and

PowerShares fund offerings, and its Perpetual operations are one of the largest retail fund providers in the U.K. Invesco also has a fairly strong

presence in Asia, with about $55 billion in total

AUM and operations in 12 countries in the region

(including one of the first joint ventures in Greater

China). If there has been a single issue that has

kept Invesco from carving out more than just a narrow moat around its operations, it has been the

lack of consistency in the firm's profitability. Much

this was due to the decentralized nature of the

firm's operations, which prevented Invesco from

developing a common, scalable global platform for

all of its brands, limiting its ability to gather and

retain assets and diminishing many of the scale

advantages that come with running an asset-management business. We believe much of that has

changed since Marty Flanagan took the helm in

2005, with the firm squarely focused on developing a singular culture, putting a greater focus on

improving the competitive positioning of its funds,

and increasing the overall profitability of the firm.

We think the 2009 acquisition of Morgan Stanley's

retail fund operations, which in many ways complemented Invesco's product lineup, not only improved the firm's competitive positioning, but also

put it in a position to increase its profitability to

the same levels being generated by many of its

peers. At this point, the company has all of the

tools that it needs to continue expanding the narrow economic moat that already exists around its

operations.

Valuation | 14 Oct 2014

We've lowered our fair value estimate for Invesco

to $40 per share from $42 to reflect changes in our

assumptions about the firm's AUM, revenue, and

profitability since our last update. This new fair

value estimate implies a P/E multiple of 16.3 times

our 2014 earnings estimate and 14.3 times our

2015 earnings estimate. We expect the firm to

continue to trade at a discount to BlackRock, its

most comparable peer, as Invesco works toward

more consistent performance and profitability.

Having expected to see a slight uptick in Invesco's

managed assets (from $811.8 billion at the end of

August), we were disappointed to see the firm

close out the third quarter with $789.6 billion in

total AUM. As a result, we now expect the company to close out 2014 with $775 billion-$800 billion in total AUM (down from our previous forecast of more than $825 billion). This also reduces

our forecast for revenue growth this year to 10%11%, at the lower end of our original 10%-15%

forecast range for 2014. We still believe that Invesco has a portfolio capable of generating organic growth in the near term (even with the market

expected to be a bit more volatile) and expect

AUM to expand to $850 billion-$900 billion in

2015, with revenue growing at a high-single-digit

rate. We should note, though, that this is down

from our previous forecast of 10%-11% top-line

growth for next year. After 2015, we expect more

moderate AUM growth to translate into 7% average annual top-line growth in the final years of our

five-year projection period, with the net result being an 8.3% CAGR for revenue from 2013 to 2018.

With regards to profitability, adjusted operating

margins should exceed 26% of revenue this year,

as the firm benefits from ongoing cost controls and

the ever increasing size and scale of its operations. We expect Invesco to continue to move toward a level of profitability that is more on par

with its peers, with adjusted operating margins exceeding 29% by the end of our five-year forecast.

We use a 10% cost of equity in our valuation.

Risk | 14 Oct 2014

With about 80% of annual revenue coming from

management fees earned on its AUM, dramatic

market movements or significant changes in fund

flows can have a meaningful impact on revenue,

profitability and cash flows. Shifts away from

equity strategies would also have an adverse effect on revenue, as management fees tend to be

lower for fixed-income and money market funds

than they are for equity-based funds. Invesco

tends to earn higher fees on its global/international offerings than it does on its domestic funds, but

its operations and investments in these overseas

markets expose the firm to a myriad of cultural,

economic, political, and currency risks. The company is also exposed to key person risk with some

of its investment management professionals, who

are vital to Invesco's ability to attract and retain

clients, and the loss of which could lead to a

meaningful reduction in the firm's AUM.

Management | 14 Oct 2014

Marty Flanagan has been president and CEO of Invesco since August 2005. Rex Adams has served

as nonexecutive chairman since April 2006.

Flanagan was lured away from Franklin Resources,

where he had been co-CEO with Greg Johnson.

While Invesco has had a long history of squandering its competitive advantages, many improvements have been made since Flanagan took the

helm. Aside from cleaning up the clutter that kept

the firm from being anywhere near as profitable as

its peers, Flanagan has spearheaded acquisitions

and divestitures that have put Invesco in the position to continue improving its AUM, revenue, and

profitability. He has had the firm squarely focused

on developing a singular culture, putting a greater

focus on improving the competitive positioning of

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Release date 11-02-2014

Page 13 of 44

Invesco Ltd IVZ

Analysis

its funds, and increasing overall profitability. Part

of this process involved rebranding all of the company's offerings under the Invesco banner and

changing the firm's name from AMVESCAP to Invesco in 2007. Flanagan also spearheaded the acquisition of PowerShares (a pioneer in the exchange-traded fund market) and W.L. Ross (a

private-equity firm) in 2006, as well as the 2009

purchase of Morgan Stanley's retail fund operations, which included the Van Kampen family of

funds. The purchase of PowerShares was important because it provided the firm with access to the

fast-growing ETF market, just as interest in passive investment vehicles (and ETFs in particular)

was about to take off in the aftermath of the 200809 financial crisis. Rather than compete with other larger players offering core/index-based ETF

products, Invesco has been far more focused on

niche offerings, like its PowerShares S&P 500 Low

Volatility and PowerShares S&P 500 High Beta

funds. And unlike PowerShares in its early days,

Invesco has adopted a more-robust vetting process before product launches by putting new ETF

ideas through the same product development process the firm uses for its open-end funds, which

has led to a decline in the pace of ETF launches,

but has also kept the firm from offering funds that

fail to gather assets. At the end of the third

quarter of 2014, the PowerShares business had

$98.7 billion in managed assets, accounting for

13% of Invesco's total AUM. We continue to believe that the company's purchase of Morgan

Stanley's retail fund operations was transformational for Invesco, making it not only a more complete firm, but a stronger competitor. Van

Kampen's brand recognition and distribution clout

made it a prized acquisition. With Invesco strong

in the defined-contribution and defined-benefit

channels and Van Kampen strong in the

broker/dealer channel, the combined firms have

been able to cross-sell the best products from

each of the fund families through these different

distribution networks. On top of that, the deal improved Invesco's lineup of equity value and municipal bond funds, and provided it with more exposure to closed-end funds and unit investment trusts.

Invesco did an exemplary job of merging the Van

Kampen funds into its lineup. While manager

changes and fund mergers can be disruptive, Invesco was swift and efficient, clearly communicating its intentions to both employees and investors.

The net result is a product lineup that is better balanced and easier for investors to navigate.One

thing that has raised some concern, though, has

been the amount of manager turnover at the firm.

Manager retention has been relatively low when

compared to similarly sized peers over the last five

years, a byproduct of the fund mergers following

the Van Kampen deal, as well as some of the ongoing changes within the organization that led to

changes among existing management teams. The

most recent high-profile departure was that of Neil

Woodford, who oversaw $48 billion for Invesco

Perpetual in the U.K. and left the firm in April 2014

to run his own shop. This kind of departure is disruptive to the firm, as it not only leads to outflows

from investors that were wed to the exiting manager, but can lead to future performance and flow

issues once the manager is gone. From a capital

allocation perspective, management has been

fairly frugal, sticking to a strategy of reinvesting in

the business (including making select

acquisitions), while still maintaining financial

strength and flexibility, and returning a substantial portion of earnings to shareholders through dividends and common stock repurchases. Although

Flanagan continues to talk about acquisitions as a

way to plug holes in Invesco's product mix or geographic reach, we expect any future deals to be

limited to small, bolt-on acquisitions. We expect

debt (which is now more long-dated) to be paid

down as it matures, with the firm dedicating cash

to share repurchases and dividend increases as it

sees opportunities to do so.

At the end of the second quarter of 2014, 72%,

80%, and 80% of Invesco's actively managed

AUM was outperforming peers on a one-, three-,

and five-year time frame, respectively.

Invesco's solid investment performance over the

last couple of years has sparked a progression of

long-term inflows across its different product platforms.

Bears Say

Even with $789.6 billion in AUM at the end of

September, Invesco is a second-tier asset manager compared with industry giants like BlackRock,

Fidelity, and Vanguard--each of which has $2 trillion or more in assets.

Invesco continues to trail peers on a profitability

basis, with the firm expected to close out 2014

with adjusted operating margins of 26%-27%, below the group average of 32% for the asset managers.

With a higher percentage of fixed costs in its operating structure, Invesco tends to have more operating leverage than its peers, which can be a negative in declining markets.

Overview

Invesco provides investment management services under the Invesco, Trimark, Perpetual,

PowerShares, and W.L. Ross banners. At the end

of September, the firm had $789.6 billion in total

AUM spread out among equity (49% of managed

assets), balanced (6%), fixed-income (23%), alternative investment (12%), and money market (10%)

funds. Distribution is weighted more toward retail

investors (68% of AUM) than institutional (32%)

clients. The company sources close to one third of

its total AUM from outside of the United States.

Bulls Say

Invesco's AUM has more than doubled since the

equity markets bottomed in March 2009, with the

Van Kampen deal and strong equity and fixed-income inflows putting it on more equal footing with

firms like Franklin Resources and T. Rowe Price.

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Release date 11-02-2014

Page 14 of 44

Invesco Ltd IVZ

Analysis

Competitors

Name

Invesco Ltd

Bank of New York

Mellon Corp

BlackRock Inc

CaixaBank SA ADR

Franklin Resources Inc

Blackstone Group LP

Price

% Chg

TTM Sales

$ mil

$40.47

$38.72

1.99 ]

1.98 ]

5,096

14,721

$341.11

$2.11

$55.61

$30.12

2.36 ]

-2.76 [

1.50 ]

1.21 ]

10,697

9,748

8,321

7,711

Analyst

Price 10-31-2014

Fair Value Estimate

Uncertainty

Consider Buy

Consider Sell

Economic Moat

Stewardship Rating

40.47 USD

40 USD

Medium

28 USD

54 USD

Narrow

Standard

Quantitative

Price 10-31-2014

Quantitative Fair Value

Quantitative Uncertainty

Quantitative Moat

As of 10-31-2014

40.47 USD

38.71 USD

Low

Narrow

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Release date 11-02-2014

Page 15 of 44

Invesco Ltd IVZ

Insiders

Total Executive Compensation

2013 Executive Compensation

34.44 mil

32.16 mil

39.00

34.48 mil

33.56 mil

24.14 mil

Total Compensation

1-Year % Change

26.00

Compensation vs. Performance

13.00

2009

$34,480,018

2.75 %]

2010

2011

2012

2013

CEO Compensation

Stock Return

Revenue

Return on Equity

Net Income

1-Year % Change

8.59%

42.77%

14.67%

36.53%

38.85%

Stock Price

40.00

20.00

2009

2010

2011

2012

2013

Total Return

30.0

0

2009

2010

2011

2012

2013

Revenue

0.00

-1.00

2009

2010

2011

2012

2013

Return of Equity

0.00

-1.00

2009

2010

2011

2012

2013

Net Income

0.00

-1.00

2009

2010

2011

2012

2013

2014 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

Release date 11-02-2014

Page 16 of 44

Invesco Ltd IVZ

Insiders

Key Executive Compensation

Key Executive Compensation

Salary

Bonus

Annual Other Income

Restricted Stock Award

Securities Options

LTIP Payout

Non-Equity Compensation

Other Compensation

Total

Martin L. Flanagan / President and Chief Executive Officer

2009

2010

2011

2012

2013

2,202,863

0

0

9,584,970

0

0

5,737,138

1,141,078

2,256,374

0

0

15,284,432

0

0

8,125,000

1,212,502

2,331,035

0

0

17,674,919

0

0

8,180,409

1,144,411

2,319,403

0

0

17,424,877

0

0

7,215,501

1,414,039

2,788,632

2,191,742

0

16,863,416

0

0

10,818,721