Professional Documents

Culture Documents

Running Head: Partnership 1: Assignment On Partnership Submitted by ABC Date

Uploaded by

Syed AliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Running Head: Partnership 1: Assignment On Partnership Submitted by ABC Date

Uploaded by

Syed AliCopyright:

Available Formats

Running Head: Partnership

Assignment On

Partnership

Submitted By

ABC

Date:

Partnership

Case overview:

Two friends of mine offered to develop a business of engineering consultancy firm as

partnership. They have already acquired a business contract, which will yield $50,000 plus daily

allowances for expenses. This $50,000 will be cumulated gain of all three of us, so we need to

divide these returns in three of us. If the daily allowances are ignored then this opportunity yields

us $16667 per month and $200,000 per year. I am working on a job in Engulf and Devour, with a

compensation of $150,000 per year, which spread as $12500 per month. Besides this, the growth

opportunities in the firm Engulf and Devour are limited. Therefore, it is better to think about the

opportunity brought by friends and to evaluate its outcomes with possible drawbacks (Sher &

Bromberg, 1958).

1. Issues that you must address before forming this relationship

Before entering into the consultancy business in partnership, there are some aspects of the

business to be clarified. These are including;

A. Understanding Partnership Basics

i.

Partnership

partnership is type of business which is having more than one owner, with this

there is also one condition applicable to partnership that they have not proceed

any formal documentation before the state to become a corporation or limited

liability company.

ii.

Different types of partnership

Different types of partnerships with their pros and cons are given as under.

Personal liability for owners:

Partnership

Partnership is simple and less costly business arrangements but there are

also some arrangements that you must consider before you enter into

partnership business. These are includes Personal liability of the owner. In

partnership all, the owners of the business are liable for the business. This

may include debt, judicial proceeding and obligations. It is supposed that

if the business is unable to pay for the liabilities of business then the

debtors or creditors can take legal penalties against any of the partners and

in case his belongings and possessions might be captured and auctioned.

There are some cases in personal liability arrangements, which limit the

liability of a partner. This may include;

Limited partnership:

In such form of partnership, it is notified that one of the partners having

only limited liability means limited partners have only passive investment

in the firm. The major loss in this type of partnership is just the investment

in the business.

General partnership

The general partner of a partnership is liable for the companys liabilities

and the creditors will probably pursue for him for their payments. In this

case, the risk of the person is high. This partner has investment in the firm

plus the liability authority so it is mostly observed that this partner has

major share in the companys earnings and sales.

Joint authority

Partnership

In this, any partner can make decision about the operation of the business,

and if the decision is proved wrong then the both parties has to bear the

loss. For example if the company has sign a contract to deliver a product

at low prices than market then it will be produced and the contract

fulfillment must be proceeded even business suffer a loss. This is because

the decision has to be made by an authority.

Joint liability

In this ever business partner can be pursued for the payment of the

business. The full amounts of the business can be collected from any one

of both, the mostly cases one who have the capability to pay, can be sued

by creditors.

iii.

Creation process of partnership

There is no any clear cut direction to develop a partnership, but it is

advisable to develop a written agreement between parties so that the

futures concerns could be protected.

iv.

Taxpaying criteria by partners

The profits and loss for income tax are reported on individual basis. for

example if you have earned a profit then you will pay the tax on your

personal filings in tax department.

v.

Partnership termination:

Partnership ends when one partner gives notice to leave the share of the

firm. Sometimes the partnership agreement in written describes the

process to end a partnership entailing the systematic criteria.

Partnership

Above all points trigger a much more important concern that is;

B. Consideration about the partners with whom you are going to start your

business

The partners with whom you are going to start your business, must be clearly understood.

This understanding may include;

Background of partner

Your previous history of dealing with them

their relation with you

C. Advantages of partnerships

More options to grow in your career

Easy to manage when there are two more friends

The collective thoughts can make business grow faster

D. Disadvantages of partnership

If partners are not faithful with the business then the investment will be ruined

The liability for the business payables

Actions taken from other partners against you

Distributive control over business, for example, you cannot implement your will

except asking other partners

E. Cost vs. opportunity analysis

If I leave the job, which is paying me now $12500 per month and a designation,

which is fair enough, then might it be better to start a partnership business.

The new opportunity payout $50000 to the new consultancy firm, and it will return

$16667 to each of three partners and the daily expenses allowances (Rosin, 1989).

Partnership

2. Future of partnerships

Once all the information about the issue related to partnership are collected then the second

stage consists of taking the decision about the future of our participation. This includes the

following consideration (Edwards, 1992).

A. Rules of partnerships

Partnership could be managed by formal or psychological contract between partners.

Different rules for partnership are considered, and it is necessary to take some legal

partnership practices to secure your future. The written agreement is helpful to make

decision like rules to draw salary form business account, losses sharing and liability

dependency or independency. The decision about either partnership will be evaluated

by internal auditors or from external firms. The important concepts in partnership

laws are including

Partnership agreement: it includes how partnership will be managed,

ownership interest shared, decision control, partner business leaving policy

etc.

These rules will consists of UPA (Uniform Partnership Act) (16100-16962),

comprise of each partner share in profit loss, control in business operations,

and ways of terminations of partnership.

Under state agency law, business will be registered, which will administer

business evolution, organizing and dissolution.

B. Form of agreement

Partnership

Agreement should be either written document or a psychological contract between

my friends and me. The most favorable type is written document legalize by formal

authority of federation under partnership act.

C. My liability assessment

This includes the variety of partnership, and entails the type of partnership agreement

I have to sign; this depends upon the selected form of partnership. If I want minimum

liability in business then limited liability partnership would be a better option. This

section will be managed by ULPA (Uniform Limited Partnership Act) if I want

limited liability in business (Das & Teng, 1998 ).

D. Dispute resolution

If in the partnership business any dispute arise then which way should be used to

resolve the issue. Everything including roles, responsibilities and liability of

individual is written then the dispute can be eradicated instantly.

3. Developing plan

When future concern with issue related with partnership are addressed and the decision for

the partner is made then we will move forward to developing business plan. The will

encompasses the operational feasibility of the business in order to make flow of operation

smooth. Planning a business plan a critical step in initial stage. It will include steps as under.

A. Know your abilities

The experience I had gain through the existing job at E&D would be good for my

business decision making, as I will be able to take critical business decisions quickly

and effectively. The further addition of my friends experience will add value to the

firm. Their ability to attract project will be beneficial, as they had pulled a project

Partnership

even they did not have a company. I have been working at a well designation in

E&D; it will help in consultancy business as a edge.

B. Goals

The goals of the business will be provide our customers a good and perfect

consultancy services based on our engineering expertise. Provided with experiences it

will also flourish my ability to grow in my field and provide growing ground. The

aim is to become a well reputed in my field (Cornell University Law School;, 2014).

C. Plan design

Design of the business will be developed in these steps. In this step, we will chart out

whole business goals

Goals of the business will be documented in a proper to which we will strive to

achieve.

Opportunities

Opportunities of the business will be in terms of our experiences and their benefits to

consultancy business.

Responsibilities

Responsibilities of the partners, including the control rights and decisionmaking criteria, will be discussed in this section. The decisions about the

critical projects in consultancy will be taken by whom and what variables will

justify that result.

document the processes

Partnership

This document will entail a roadmap for our set goals. In the time of difficulty, it will

guide us to take necessary actions. It will also include how business operations will

be carried and how it will be evaluated.

Bibliography

Cornell University Law School;. (2014, October). Partnership. Retrieved October 17, 2014,

from Partnership law: an overview: http://www.law.cornell.edu/wex/partnership

Das, T. K., & Teng, B.-S. (1998 ). Between Trust and Control: Developing Confidence in

Partner Cooperation in Alliances. ACAD MANAGE REV , 491-512.

Edwards, H. T. (1992). The Growing Disjunction between Legal Education and the Legal

Profession. Michigan Law Review , 34-78.

Rosin, G. S. (1989). Entity-Aggregate Dispute: Conceptualism and Functionalism in Partnership

Law. HeinOnline .

Sher, B. D., & Bromberg, A. R. (1958). Texas Partnership Law in the 20th Century - Why Texas

Should Adopt the Uniform Partnership Act. HeinOnline , 263 .

You might also like

- Establishing a BusinessDocument11 pagesEstablishing a BusinessWilliam MushongaNo ratings yet

- Final Legal Term PaperDocument14 pagesFinal Legal Term PaperAfroza Khan100% (1)

- BusinessDocument4 pagesBusinessYhamNo ratings yet

- Partnership BusinessDocument4 pagesPartnership BusinessQueenel MabbayadNo ratings yet

- Partnership BusinessDocument5 pagesPartnership BusinessFaiq AlekberovNo ratings yet

- ACC003 Partnership DefinitionDocument2 pagesACC003 Partnership DefinitionRochelle Joyce CosmeNo ratings yet

- Advantages and Disadvantages of PartnershipDocument2 pagesAdvantages and Disadvantages of Partnershipsilent_pray786No ratings yet

- Concept of PartnershipDocument6 pagesConcept of PartnershipShweta AgrawalNo ratings yet

- Acyava Reflection PaperDocument6 pagesAcyava Reflection PaperJustin AciertoNo ratings yet

- 17 Key Lessons For Entrepreneurs Starting A BusinessDocument3 pages17 Key Lessons For Entrepreneurs Starting A BusinessP SssNo ratings yet

- Quiz. FPDocument3 pagesQuiz. FPJOHNERROL CARCELLARNo ratings yet

- Partnership FirmDocument11 pagesPartnership FirmDHIKASH NNo ratings yet

- Lecture 2Document28 pagesLecture 2Modest DarteyNo ratings yet

- Advantages and Types of Business StructuresDocument3 pagesAdvantages and Types of Business Structureslaur33nNo ratings yet

- Partnership Accounting by Principles of Accounting, Volume 1 - Financial AccountingDocument30 pagesPartnership Accounting by Principles of Accounting, Volume 1 - Financial AccountingLeilyn Mae D. AbellarNo ratings yet

- Company Structure: Post NavigationDocument6 pagesCompany Structure: Post NavigationHimal AcharyaNo ratings yet

- Differentiate business entitiesDocument13 pagesDifferentiate business entitiesNaeem JafriNo ratings yet

- Acc 2-ContentDocument13 pagesAcc 2-ContentSP SanjayNo ratings yet

- Math 12 ABM BESR Q1 Week 1Document40 pagesMath 12 ABM BESR Q1 Week 1AÑORA, Princess Aeyah M.No ratings yet

- Lecture 14.organizational Plan 709 13Document76 pagesLecture 14.organizational Plan 709 13bakerNo ratings yet

- Case Study On Types of Business Organizations: Section: 1 BUS 503 MBA Program, BRAC Business School (Fall, 2020)Document6 pagesCase Study On Types of Business Organizations: Section: 1 BUS 503 MBA Program, BRAC Business School (Fall, 2020)KAZI THASMIA KABIRNo ratings yet

- Cours 6 PartnershipsDocument4 pagesCours 6 PartnershipsAchraf SabbarNo ratings yet

- Introduction To Corporate FinanceDocument5 pagesIntroduction To Corporate FinanceToru KhanNo ratings yet

- Founder's AgreementDocument6 pagesFounder's AgreementJyoti SinghNo ratings yet

- PartnershipDocument3 pagesPartnershipLilly HernandezNo ratings yet

- Law Firm Partnership AgreementsDocument7 pagesLaw Firm Partnership Agreementsgivamathan100% (2)

- 5 Ways RevampDocument4 pages5 Ways RevampAmlann MohantyNo ratings yet

- Partnership and Partnership DeedDocument11 pagesPartnership and Partnership DeedHaider AliNo ratings yet

- Introduction To Business and Accounting TheoryDocument24 pagesIntroduction To Business and Accounting TheoryUmrah AamirNo ratings yet

- Elective 1 Entrepreneurship Chapter on Business FormsDocument33 pagesElective 1 Entrepreneurship Chapter on Business FormsCelito-Jose MacachorNo ratings yet

- What is a partnership? Types, formation, liability, taxesDocument3 pagesWhat is a partnership? Types, formation, liability, taxesCHARMAINE ROSE CABLAYANNo ratings yet

- Legal Forms and Partnership AdvantagesDocument6 pagesLegal Forms and Partnership AdvantagesJayb WatuaNo ratings yet

- Chapter 14 IMSMDocument43 pagesChapter 14 IMSMZachary Thomas CarneyNo ratings yet

- Starting a Business FormsDocument6 pagesStarting a Business FormsgiuseppeNo ratings yet

- Accounting for Partnership BasicsDocument51 pagesAccounting for Partnership BasicsArunima RaiNo ratings yet

- 1ConsMeth Legal Forms of Business OrganizationDocument5 pages1ConsMeth Legal Forms of Business OrganizationFranz Anfernee Felipe GenerosoNo ratings yet

- EntrepreneurshipDocument11 pagesEntrepreneurshipappcode senseNo ratings yet

- Form of Ownership PartnershipDocument3 pagesForm of Ownership PartnershipAaron Jolo AlcantaraNo ratings yet

- 3.3 The Organization and Its EnvironmentDocument19 pages3.3 The Organization and Its EnvironmentClaire GarciaNo ratings yet

- Claint AssignmentDocument13 pagesClaint AssignmentMuhammadWaseemNo ratings yet

- Class WorkshopDocument4 pagesClass WorkshopGAMER12 LIGHT FIRENo ratings yet

- Lesson 1-2 (What Is Business)Document3 pagesLesson 1-2 (What Is Business)Mari Carreon TulioNo ratings yet

- Selecting A Form of Business OwnershipDocument30 pagesSelecting A Form of Business Ownershipberat_28854279No ratings yet

- SVFC Management Consultancy Midterm ExamDocument3 pagesSVFC Management Consultancy Midterm ExamRannah RaymundoNo ratings yet

- Lesson 01 - Business EthicsDocument20 pagesLesson 01 - Business EthicsGDATOR QUEENNIE H.No ratings yet

- Abm 12 BesrDocument23 pagesAbm 12 BesrVictoria Quebral Carumba100% (1)

- Manisha Kumari BBA. 40029.19 End Sem E&SBDocument14 pagesManisha Kumari BBA. 40029.19 End Sem E&SBUjjwal kumarNo ratings yet

- Chapter 12Document42 pagesChapter 12Ivo_Nicht100% (4)

- Contractor Business Structures and Accounting MethodsDocument3 pagesContractor Business Structures and Accounting MethodsAngelie UmambacNo ratings yet

- Slide 1Document17 pagesSlide 1Vishal BhadaneNo ratings yet

- Business Corporation: Advantages, Disadvantages and RisksDocument6 pagesBusiness Corporation: Advantages, Disadvantages and Risksgilly tooNo ratings yet

- Partnership Firm: Legal Agreement ProfitDocument11 pagesPartnership Firm: Legal Agreement ProfitShlok KulkarniNo ratings yet

- 11.university of Nueva CaceresDocument6 pages11.university of Nueva CaceresNina Sarah Bulanga JamitoNo ratings yet

- UNIT - 3Document22 pagesUNIT - 3naveennanni988No ratings yet

- Forms of Business Organization (1)Document4 pagesForms of Business Organization (1)Marissa ClementNo ratings yet

- JV ContratcDocument6 pagesJV Contratcnesrinakram100% (1)

- Accounting For Special TransactionsDocument9 pagesAccounting For Special Transactionsprodiejigs36No ratings yet

- Preparing Buying PlansDocument4 pagesPreparing Buying PlansSyed AliNo ratings yet

- M.farooq JavedDocument6 pagesM.farooq JavedSyed AliNo ratings yet

- Constitution International Society For Criminology: Article 1 Name and SeatDocument6 pagesConstitution International Society For Criminology: Article 1 Name and SeatSyed AliNo ratings yet

- Homework PDFDocument3 pagesHomework PDFSyed AliNo ratings yet

- Deere Logistics Recommendations to Improve FedEx RelationshipDocument1 pageDeere Logistics Recommendations to Improve FedEx RelationshipSyed AliNo ratings yet

- Security Report 2014Document41 pagesSecurity Report 2014Syed AliNo ratings yet

- SSRNDocument53 pagesSSRNSyed AliNo ratings yet

- Deere Logistics Recommendations to Improve FedEx RelationshipDocument1 pageDeere Logistics Recommendations to Improve FedEx RelationshipSyed AliNo ratings yet

- Martyrs R Pride of NationDocument2 pagesMartyrs R Pride of NationSyed AliNo ratings yet

- Mails From HMSNDocument1 pageMails From HMSNSyed AliNo ratings yet

- Preface: The Islamia University of BahawalpurDocument5 pagesPreface: The Islamia University of Bahawalpursyed_ali_375No ratings yet

- Sales Codal Reviewer PDFDocument18 pagesSales Codal Reviewer PDFERZZAHC SETERNo ratings yet

- Sri Lanka Insurance Institute Diploma in Insurance Document TitleDocument48 pagesSri Lanka Insurance Institute Diploma in Insurance Document TitleUtharan ThavaNo ratings yet

- Contract of Purchase and SaleDocument6 pagesContract of Purchase and SaleEtihan Hekim100% (1)

- Sales of Goods ActDocument1 pageSales of Goods ActSerena JamesNo ratings yet

- Facts and Legal OpinionDocument7 pagesFacts and Legal OpinionAldrin LeynesNo ratings yet

- International Financial Management: by Jeff MaduraDocument48 pagesInternational Financial Management: by Jeff MaduraBe Like ComsianNo ratings yet

- Hedging of Financial Derivatives and Portfolio Insurance: E-Mail: Gasper@aims - Ac.za, Gmlangwe@yahoo - Co.ukDocument13 pagesHedging of Financial Derivatives and Portfolio Insurance: E-Mail: Gasper@aims - Ac.za, Gmlangwe@yahoo - Co.ukpostscriptNo ratings yet

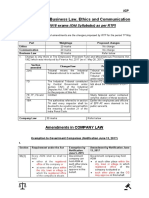

- Amendments in Business Law, Ethics and Communication: (For May 2018 Exams (Old Syllabubs) As Per RTP)Document3 pagesAmendments in Business Law, Ethics and Communication: (For May 2018 Exams (Old Syllabubs) As Per RTP)Neha jainNo ratings yet

- Real Estate Mortgage Investment Conduits (Remics) Reporting InformationDocument63 pagesReal Estate Mortgage Investment Conduits (Remics) Reporting Informationhg202No ratings yet

- Personal Auto Declaration: Policy Premium Total $1,314.00Document2 pagesPersonal Auto Declaration: Policy Premium Total $1,314.00Albenys AlonsoNo ratings yet

- SRC protects investors interestsDocument5 pagesSRC protects investors interestsMarion JossetteNo ratings yet

- Chapter 3 (Section 3) AGCAOILIDocument3 pagesChapter 3 (Section 3) AGCAOILILeinard AgcaoiliNo ratings yet

- wk3 Tutorial 3 SolutionDocument4 pageswk3 Tutorial 3 SolutionStylez 2707No ratings yet

- IC - 33 Question BankDocument28 pagesIC - 33 Question BankHemant Dhande40% (10)

- 4 Kinds of Defective ContractsDocument2 pages4 Kinds of Defective ContractsAndrea Ellis73% (11)

- Mercantile Law Answer KeyDocument2 pagesMercantile Law Answer KeyJam RockyouonNo ratings yet

- Loan Document1Document2 pagesLoan Document1benNo ratings yet

- Case Study 1Document4 pagesCase Study 1Ernie Batayola100% (1)

- 10 IntroduccionDocument13 pages10 Introduccionvictor.ciudad.carpelNo ratings yet

- Article 1815Document1 pageArticle 1815Alexandria Evangelista100% (1)

- KINDS OF COMPANIESDocument4 pagesKINDS OF COMPANIESMuhammad UsamaNo ratings yet

- Actual &V Constructive Legal NoticeDocument2 pagesActual &V Constructive Legal NoticeDarrell Wilson100% (2)

- Tuatis VS SPS Escol DigestDocument3 pagesTuatis VS SPS Escol DigestJJ CaparrosNo ratings yet

- A) +lsë CK/FW, HFN FHL / Clgoldttf Ps LJZN) If0F: Ljifo K - J) ZMDocument11 pagesA) +lsë CK/FW, HFN FHL / Clgoldttf Ps LJZN) If0F: Ljifo K - J) ZMdevi ghimireNo ratings yet

- LML4806 Study Unit 10Document2 pagesLML4806 Study Unit 10kitchenNo ratings yet

- Deed of Assignment of Shares and Subscription Rights - SampleDocument2 pagesDeed of Assignment of Shares and Subscription Rights - SampleFelot100% (2)

- دور المشتقات المالية في أزمة الرهن العقاري-دراسة تحليليةDocument20 pagesدور المشتقات المالية في أزمة الرهن العقاري-دراسة تحليليةLotfi ĶhNo ratings yet

- 13-316MR ASIC's Next Generation Market Surveillance System Commences - ASIC - Australian Securities and Investments CommissionDocument2 pages13-316MR ASIC's Next Generation Market Surveillance System Commences - ASIC - Australian Securities and Investments CommissionbankamitNo ratings yet

- Iiap Reviewer NewDocument18 pagesIiap Reviewer Newcindy100% (3)

- Consumer Dispute Over Insurance ClaimDocument28 pagesConsumer Dispute Over Insurance ClaimKunwarbir Singh lohatNo ratings yet