Professional Documents

Culture Documents

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

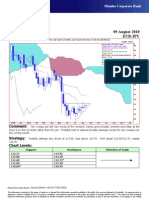

Weekly Technical Commentary 03 August 2009

Links: http://www.mizuho-sc.com/ Bloomberg Page: MIZH Website: http://www.mizuho-cb.co.uk/

GBP/USD Chart Levels: Support 1.6700..1.6500..1.6300..1.6000. Resistance 1.6850..1.7000..1.7100..1.7500.

GBP=D3, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Weekly

21Jun08 - 06Feb10 This week This month

Pr

GBP=D3 , Last Quote, Candle 2

09Aug09 1.6708 1.6851 1.6696 1.6830

GBP=D3 , Last Quote, Tenkan Sen 9

09Aug09 1.6327 1.95

GBP=D3 , Last Quote, Kijun Sen 26

09Aug09 1.5253

GBP=D3 , Last Quote, Senkou Span(a) 52 1.9

After ten weeks of ‘triangle’ consolidation, at

last! A weekly close higher than anything since

31Jan10 1.5790

GBP=D3 , Last Quote, Senkou Span(b) 52

31Jan10 1.6378

October so that we have now retraced 50% of

1.85

GBP=D3 , Last Quote, Chikou Span 26

15Feb09 1.6830

1.8 the losses since last summer. The measured

1.75

targets from this breakout are 1.7100 and then

1.7500, part of the ultra-long term trend to

1.7

generalised US dollar weakness. This may have

1.65 come as a surprise to some but other currencies

1.6

are also gaining against the US dollar so it’s a

dollar problem rather than sterling in vogue.

1.55

Futures volume has been good and though

1.5 running about half of the 2007/2008 peak open

interest is picking up. Note record volume in

Canadian dollar futures suggest the US investor

1.45

1.4 has grasped the threat of devaluation, at least

1.35

against its northern neighbour.

Jul08 Aug Sep Oct Nov Dec Jan09 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan10 Feb

EUR/GBP Chart Levels: Support 0.8400..0.8250..0.8200..0.8000. Resistance 0.8535..0.8600..0.8700..0.8750.

EURGBP=D3, Last Quote [Candle] EURGBP=R, Bid [Ichimoku 9, 26, 52, 26] Weekly

27Aug07 - 07Feb10 This week This month

Pr

0.98

0.96

After consolidating in a neat tiny range under

0.94

0.92

0.8700 for six weeks the large weekly Ichimoku

0.9 ‘cloud’ looks set to push the cross lower. A re-

0.88 test of this year’s low at 0.8400 looks imminent

0.86

and a weekly close below here should add to

0.84

current strong bearish momentum. A monthly

close below it completes a massive long term

top, so that sterling would be unlikely to move

0.82

0.8

above this area for many years to come. This

0.78 pivotal area for the currency pair, two standard

EURGBP=D3 , Last Quote, Candle 0.76 deviations from the very long term mean is so

important that we may hover around here for a

09Aug09 0.85350 0.85350 0.84620 0.84770

EURGBP=R, Bid, Tenkan Sen 9

0.74

09Aug09 0.8596

EURGBP=R, Bid, Kijun Sen 26

09Aug09 0.8946 0.72

whole month or more before we see a decisive

EURGBP=R, Bid, Senkou Span(a) 52

31Jan10 0.8771 downside break. Until then rallies, which will

probably struggle to move significantly above

EURGBP=R, Bid, Senkou Span(b) 52 0.7

31Jan10 0.8747

EURGBP=R, Bid, Chikou Span 26

15Feb09 0.8473 0.68

0.8600, are therefore selling opportunities.

Sep07 Oct Nov Dec Jan08 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan09 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan10 Feb

Produced by London Branch - Nicole Elliott +44-20-7786-2509 (email: Nicole.Elliott@mhcb.co.uk)

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- JYSKE Bank AUG 09 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 09 Corp Orates DailyMiir ViirNo ratings yet

- AUG-09-DJ European Forex TechnicalsDocument3 pagesAUG-09-DJ European Forex TechnicalsMiir ViirNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- ScotiaBank AUG 09 Daily FX UpdateDocument3 pagesScotiaBank AUG 09 Daily FX UpdateMiir ViirNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- AUG-09 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocument5 pagesJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Jyske Bank Aug 09 em DailyDocument5 pagesJyske Bank Aug 09 em DailyMiir ViirNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Fintech Insights Q2 2022 Quarterly: FT Partners ResearchDocument110 pagesFintech Insights Q2 2022 Quarterly: FT Partners ResearchngothientaiNo ratings yet

- AssignmentDocument7 pagesAssignmentMona VimlaNo ratings yet

- Biotechusa KFT Beu24008891Document1 pageBiotechusa KFT Beu24008891peicivek5No ratings yet

- E StatementpdfDocument3 pagesE StatementpdfgarrettloehrNo ratings yet

- BIR RULING NO. 100-17: SGV & CoDocument10 pagesBIR RULING NO. 100-17: SGV & CoThe GiverNo ratings yet

- Payback Period Year IC FC TVC TC Gross Benefits Net Benefits YearsDocument2 pagesPayback Period Year IC FC TVC TC Gross Benefits Net Benefits YearsIzhiel Mai PadillaNo ratings yet

- Financial Risk SystemDocument2 pagesFinancial Risk SystembezbraNo ratings yet

- Priti Black BookDocument71 pagesPriti Black Book13- AA PRITI JOHARAPURAMNo ratings yet

- Momo Statement ReportDocument2 pagesMomo Statement ReportHolybabyNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Lai Inc Had The Following Investment Transactions 1 Purchased Chang CorporationDocument1 pageLai Inc Had The Following Investment Transactions 1 Purchased Chang CorporationMiroslav GegoskiNo ratings yet

- 3304 GWCH 17 Updated SolutionsDocument6 pages3304 GWCH 17 Updated SolutionsMohitNo ratings yet

- My FRP REPORTDocument61 pagesMy FRP REPORTsetiaricky100% (1)

- Impact of Financial Performance On Stock Price of Non Bank Financial Institutions Nbfi in Bangladesh Dynamic Panel ApproachDocument4 pagesImpact of Financial Performance On Stock Price of Non Bank Financial Institutions Nbfi in Bangladesh Dynamic Panel Approachucok rakaNo ratings yet

- Invoice IXITRS185875952789718Document1 pageInvoice IXITRS185875952789718PatriotNo ratings yet

- Yes BankDocument9 pagesYes Bankरायटर लेखनवालाNo ratings yet

- Dtaa AnnexureDocument4 pagesDtaa AnnexureAkansha SharmaNo ratings yet

- Accounting Standards and Company Audit AnswersDocument9 pagesAccounting Standards and Company Audit AnswersrinshaNo ratings yet

- Problems Chapter 6-7 International Parity ConditionsDocument12 pagesProblems Chapter 6-7 International Parity Conditionsarmando.chappell1005No ratings yet

- Challan Form Allahabad UP Gramin Bank PDFDocument2 pagesChallan Form Allahabad UP Gramin Bank PDFAmit GuptaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ch04 Harrison 8e GE SMDocument73 pagesCh04 Harrison 8e GE SMMuh BilalNo ratings yet

- Prepare The Following Based On This Topic: Inflation and Juan Dela Cruz. Statement of The ProblemDocument4 pagesPrepare The Following Based On This Topic: Inflation and Juan Dela Cruz. Statement of The ProblemFrencis A. EsquierdoNo ratings yet

- Is LM2Document8 pagesIs LM2samu123djghoshNo ratings yet

- The Fed's Dual Mandate Responsibilities and Challenges Facing U.S. Monetary Policy - Federal Reserve Bank of ChicagoDocument5 pagesThe Fed's Dual Mandate Responsibilities and Challenges Facing U.S. Monetary Policy - Federal Reserve Bank of ChicagoAlvaroNo ratings yet

- InvoiceDocument1 pageInvoicejhilikNo ratings yet

- DIY Discharge Debt GuideDocument4 pagesDIY Discharge Debt GuideAnthony VinsonNo ratings yet

- Lecture Sheet 07Document10 pagesLecture Sheet 07Rj Aritro SahaNo ratings yet

- Errata Sheet Financial DerivativesDocument2 pagesErrata Sheet Financial DerivativesmasniahmakmurNo ratings yet

- InvoicemmDocument1 pageInvoicemmankithmallelaNo ratings yet

- Macro Exam 2018Document4 pagesMacro Exam 2018Vignesh BalachandarNo ratings yet

- Correct?Document29 pagesCorrect?Hong Anh NguyenNo ratings yet

- To Explain the World: The Discovery of Modern ScienceFrom EverandTo Explain the World: The Discovery of Modern ScienceRating: 3.5 out of 5 stars3.5/5 (51)