Professional Documents

Culture Documents

FM Recollected Questions

Uploaded by

mevrick_guyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM Recollected Questions

Uploaded by

mevrick_guyCopyright:

Available Formats

FINANCIAL MANAGEMENT (CAIIB)

Recollected

CTDI

RECOLLECTED QUESTIONS BASED ON

FINANCIAL MANAGEMENT

1) The Yield to Maturity of a bond is the same as:

a) The present value of the bond

b) The bonds internal rate of return

c) The future value of the bond

d) None of these

2) Choose from the following a symptom which is not

relating to Over Trading.

a) Cash shortage

b) Low inventory turnover ratio

c) Low current ratio

d) High inventory turnover ratio

3) The formula to calculate the present value of a single

cash flow is given by:

a) CF1 / (1+r)n

b) C2 / (1+r)

c) C0 + C (1+r)n

d) None of these

4) The effect of purchasing power or inflation on present

value is important because _____:

a) It increases the real value of cash flows received in the

future

b) It reduces the real value of cash flows received in the

future

c) It has no effect on real value of cash flow received in the

future

d) None of these

5) An Asset is _______:

a) Sources of funds

b) Use of funds

c) Inflow of funds

d) None of these

6) If a company revaluates its fixed assets, the current

ratio of the company will:

a) Improve if assets are revalued upward

b) Remain unaffected

c) Improve if assets are revalued downwards

d) Undergo change only if liabilities are remaining constant

7) If we were studying a sample of 100 students and their

examination performance and if the standard deviation of

the list of results was say 14, then we could calculated

the standard error by ____:

a) Dividing the square root of the number of items in the

sample by the mean

b) Dividing standard deviation by number of items in the

sample

c) Dividing the standard deviation by the square root of the

number of items in the sample

d) We cannot calculate standard error on account of

inadequacy of information

8) Rule of 72 as a short cut method is explained by the

formula:

a) 72 divided by the annual interest rate

b) Annual interest rate dividend by 72

c) 72 divided by (annual interest rate multiplied by discount

factor)

d) None of these

9) Tangible net worth is calculated as:

a) Capital + Reserves

CTDI ,

b) Capital + Reserves Intangible Assets

c) Capital + Fictitious Assets + Reserves Intangible assets

d) Capital + Reserves Fictitious Assets and intangible

assets

10) A researcher chooses a Sample by using a Sampling

frame and taking the item that corresponds to the nth

number in the list. This procedure is called:

a) Simple Random Sampling

b) Systematic Sampling

c) Stratified Sampling

d) Quota Sampling

11) A uniform discount rate cannot be applied for

comparing different type of investments e.q. building

property v/s PPF because of:

a) Return difference

b) Risk

c) Liquidity

d) None of these

12) Cash can be conserved by resorting to:

a) Maximum quantity of stock

b) Minimum level of creditors

c) Best credit terms with suppliers

d) None of these

13) Choose a sentence which speaks inappropriately

about earning per share (EPS).

a) It indicates the net profit earned per share

b) It influences dividend policy of the firm

c) It does not influence the market price of the share

d) It does not influence the share holding pattern of the

company.

14) Sources of financing project cost excludes:

a) Leasing

b) Subsidy

c) Deferred Credit

d) Trade Credit

15) Under Cash Budget System method employed for

construction activities the working capital is determined

by:

a) Ascertaining level of current assets

b) Ascertaining level of current liabilities

c) Finding cash gap after taking into account projected

periodical cash inflows and outflows

d) All of the above

16) Which of the following statements is true?

a) A Cash Credit is a running account

b) Cash Credits may become long term in nature due to

repeated rollovers

c) Overdrafts are allowed only against the security of

inventories

d) Both a and b above

17) A project is more acceptable for finance:

a) Break even point is high

b) IRR is higher than the cost of capital

c) Both a and b above

d) None of these

18) Term Loans are provided for:

a) Meeting capital cost of the project

b) Funding promoters contribution

c) Meeting working capital needs of the enterprise

d) None of these

SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH, PH. 0172-2708961-62

FINANCIAL MANAGEMENT (CAIIB)

Recollected

CTDI

19) A company is offered discount of 2% on its suppliers

if payment is made within 10 days, as against no

discount for a credit period of 45 days. If cost of capital

is 18%, Company should ____:

a) Avail of the discount

b) Pay the creditors on 45th day

c) Pay the creditors between 11th and 45th day

d) None of these

20) Raw material consumed is equal to:

a) Opening Stock + Purchases

b) Opening Stock+PurchasesClosing Stock of raw material

c) Purchasing Closing stocks

d) None of these

21) How do profits made from normal operations retained

in business appear in the balance sheet?

a) Under Capital

b) Under capital, reserves & surplus

c) Under cash in hand, at bank

d) None of these

22) Debentures are classified as:

a) Long Term Debt

b) Short Term Loan

c) Owned funds

d) Owned funds if raised from

shareholders

23) Working Capital Gap means:

a) Excess of Current Assets over Current Liabilities

b) Excess of Current Assets over Current Liabilities other

than bank borrowings

c) Excess of Current Assets over Current Liabilities including

working Capital term loan

d) None of these

24) Choose the order which indicates the working capital

cycle of a manufacturing firm:

a) Cash raw material work in progress finished

goods sales debtors cash

b) Cash Debtors raw material work in progress

sales finished goods cash

c) Raw material work in progress finished goods

cash sales debtors cash

d) Cash finished goods raw material work in

progress sales debtors cash

25) C-V-P analysis contribution means:

a) Excess of selling price over variable costs

b) Fixed cost plus profit (or minus loss)

c) Both a and b above

d) None of these

26) If you were to choose to receive Rs. 15,000/- today or

Rs. 18,000/- four years from now or Rs. 19,000/- seven

years from new, which option would you choose based

on the time value concept? Assume the current interest

rate is 4%:

a) Rs. 15,000/- today

b) Rs. 18,000/- four years from now

c) Rs. 19,000/- seven years from now

d) I would be indifferent

27) What is the present value of Rs. 10,000/- to be

received three years from now at a interest rate of 4.5%?

a) Rs. 10920.25

b) Rs. 9157.30

c) Rs. 8762.97

d) Rs. 11411.65/-

CTDI ,

28) Minimum Stock level is calculated as:

a) Re-order level (Average usage x Average Lead Time)

b) Re-order level + (Average usage + Average Lead Time)

c) Re-order level (Average usage + Average Lead Time)

d) None of these

29) Find the interest rate, if the present value is Rs. 100/and future value becomes Rs. 115.76 in three years:

a) 4%

b) 5%

c) 6%

d) 7%

30) Choose the statement which speaks appropriately

about the feature of net present value (NPV).

a) It has no application in mutually exclusive projects.

b) It assumes that cash flows resulting during the life cycle of

project have an opportunity cost equal to the discount rate

used

c) It assumes that cash flows resulting during the life cycle of

project have an opportunity cost equal to the IRR which

generated them

d) It provides a percentage figure

31) Which of the following will cause a decrease in the

net operating cycle of a firm?

a) Increase in work-in-process period

b) Increase in the raw material storage period

c) Increase in the average payment period

d) Increase in the average collection period

32) The impact of the inflation on working capital is

direct. As a result, the amount of sales, the value of

sundry debtors and closing stock etc:

a) Increase

b) Decreases

c) No Effect

d) Difficult to say

33) Separate limits of working capital for Peak and

normal non-peak level periods was recommended by

______

a) Tandon Committee

b) Naik Committee

c) Chore Committee

d) None of these

34) What is the future value of Rs. 10,000 to be received

at a savings interest rate of 4.5% after 3 years?

a) Rs. 11411.66

b) Rs. 11920.25

c) Rs. 8762.97

d) Rs. 4157.30

35) Which one of the following sentence speaks aptly

about liquidity ratio?

a) It indicates the relationship between debt and equity

b) It measures the efficiency of asset management

c) It measures earning capacity of an enterprise

d) It measures the short term slabs of an enterprise

36) Calculate the present value of 6 years bond with 9%

coupon rate and maturity value of Rs. 1000/-. If the

current interest rate is 12%.

a) Rs. 843.83

b) Rs. 1025.57

c) Rs. 876.66

d) Rs. None of these

37) Money has time value because:

a) The individual prefer future consumption to present

consumption

b) A rupee today is worth more than a rupee tomorrow in

terms of purchasing power

c) A rupee today can be productive, deployed to generate

real returns tomorrow

SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH, PH. 0172-2708961-62

FINANCIAL MANAGEMENT (CAIIB)

Recollected

CTDI

d) Both b and c above

38) Which one of the following sentence relating to

dividend per share (DPS) is not correct.

a) DPS represent what the equity share holders are

theoretically entitled to receive as dividend from a company

b) DPS represents dividend per equity share paid to the

share holders

c) DPS is paid on the paid up value of shares

d) DPS is in respect of equity shares

39) Vipin owns an infrastructure bond which pays a semi

annual coupon of Rs. 45/-. The bond will mature in seven

years and will repay the principal of Rs. 1000/- at

maturity, if the yield curve shows that 7 year

Infrastructure Bonds have 6 monthly yield of 4% at the

current time how much is Vipins bond worth?

a) Rs. 1052.82

b) Rs. 1042.82

c) Rs. 1045.00

d) Rs. 1000.00

40) Narinder wishes to have Rs. 10,000 in his bank

account to buy a car for his 35th birth day which is two

years away. He can invest his money in a two year Fixed

Deposit which pays an annually compounded rate of 6%.

How much must he put into the fixed deposit now to

achieve his goal?

a) Rs. 8900.96

b) Rs. 9000.90

c) Rs. 8899.96

d) Rs. 8890.90

41) Balance sheet of a company indicated that its

Current Ratio is 1.5. Companys net working capital is

Rs. 1 crore. The current assets would amount to____:

a) Rs. 3 crores

b) Rs. 1.5 crores

c) Rs. 2.5 crores

d) None of these

42) Mohan is 23 and has started his first job in CTDI he

plans to put aside Rs. 5000/- per year so that he can

make nice down payment for a car in six years, if he

deposits this amount at the end of each year and earns

8% on his money, how much will he have accumulated at

the end of 6 years?

a) Rs. 36000/b) Rs. 36666/c) Rs. 36679/d) None of these

43) Current Assets are either cash or cash equivalents or

those which can be converted into the cash between

____:

a) 2 years to 3 years

b) 1 day to 365 days

c) 1 year to 3 years

d) 3 years to 5 years

44) Choose a correct sentence which describes

accurately

about High Assets Turnover Ratio.

a) It indicates of under utilization of assets

b) It indicates an efficient and effective utilization of assets

c) It indicates presence of Idle capacity

d) None of these

45) Which of the following statements is false?

a) Investments in shares and advances to other firms, not

connected with the business is included in current assets

b) Investments in shares and advances to other firms, not

connected with the business is excluded from current assets

c) Advances to other firms connected with the business

included in the loans and advances

CTDI ,

d) Investments in shares of other firms is included in

investments and shown in Balance Sheet at assets side

46) Interest on loan capital is:

a) A deductible expenditure for the purpose of ascertaining

taxable income

b) A non-deductible expenditure for the purpose of

ascertaining taxable income

c) A capital expenditure and as such no tax shield is available

d) None of these

47) Choose from following Ratios, a ratio which gives an

insight into how efficiently the long term funds raised

from owners and lenders are employed.

a) Return on Equity (ROE)

b) Return on Assets (ROA)

c) Return on Capital Employed (ROCE)

d) None of these

48) Which of the following statements is true?

a) Taking term loan from bank is treated as revenue receipt

and credited to profit and loss account

b) Instalment of term loan payable is treated as revenue

expenditure and is changed to profit and loss account

c) Installment of term loans payable within 12 months from

the date of the balance sheet is classified under current

liabilities

d) Installment of term loans payable within 12 months from

the date of the balance sheet is classified under secured

loans.

49) The Ratio which throw light on the operating

efficiency or effective use of the facilities and resources,

are calculated on the basis of:

a) Financial data take from profit and loss account

b) Financial data take from profit and loss a/c and balance

sheet

c) Financial data taken from balance sheet

d) None of these

50) Which one of the following statements does not

speak appropriate about net working capital?

a) Excess of current assets over current liability is called net

working capital (NWC)

b) The greater the amount of net working capital (NWC), the

more would be the liquidity of the enterprise

c) The greater the amount of bank borrowing for financing

current assets, the more would be the liquidity of the

enterprise

d) Net working capital is financed through equity as well as

debt sources.

51) The relationship between the owned funds and the

borrowed funds of the enterprises is depicted by:

a) Current Ratio

b) Proprietary Ratio

c) Debt Equity Ratio

d) None of these

52) A company is having sales of Rs. 1,00,000/-, Fixed

Cost of Rs. 20,000/-, Break Even Point at Rs. 80,000/- The

profit would be:

a) Rs. 5000/b) Rs. Nil

c) Rs. (-) 10,000

d) Rs. 10,000/-

SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH, PH. 0172-2708961-62

FINANCIAL MANAGEMENT (CAIIB)

Recollected

CTDI

53) When the business is dependent heavily upon

borrowed money and trade creditors the situation is

called_____:

a) Over capitalization

b) Under capitalization

c) High gearing

d) None of these

54) Which of the following action results in a decrease in

the total working capital of the firm?

(I) Changing the method of packing the product. The new

method results in a more attractive packet. The time required

for packing one unit of finished goods and the inventory level

of packing material remains the same.

(ii) Changing the method of depreciation

(iii) Decrease in wage rates

a) Both i and ii

b) Both ii and iii

c) Both I and iii

d) None of these

55) Choose the correct formula for the calculation of debt

service coverage ratio from the following:

a) [PAT + Interest on Term Loans Lease Rental] -:[Repayment of instalments of Term Loan + Interest on Term

Loans + Lease Rentals].

b) [Pat + Depreciation + Interest on Term Loans + Lease

Rentals] -:- [Interest on Term Loans + Lease Rentals].

c) [PAT + Depreciation + interest on Term Loans + Lease

Rentals] -:- [Repayment of instalments of Term Loan +

Interest on Term Loans + Lease Rentals]

d) None of these

56) If the price earning ratio is 25 and the market price is

Rs. 40/- and the number of share are 100000. What is the

amount of total earnings after tax?

a) Rs. 1,00,000

b) Rs. 40,00,000/c) Rs. 1,60,000/d) None of these

57) An inventory turnover Ratio is respect of finished

goods of less than 1 will indicate.

a) That the finished goods could be sold during the year

b) That the sale of finished goods could take more than a

year

c) That the finished goods could not be sold any time.

d) None of these

58) If net worth is Rs. 7 lac and intangibles assets are Rs.

2 lac then the tangible net worth will be _______:

a) Rs. 4 lac

b) Rs. 5 lac

c) Rs. 9 lac

d) None

Answer Questions No. 5960 based on the following

information. Data is available in respect of HMT Ltd.

31-3-2005

31-3-2004

PAT

800

720

Interest

1200

800

Dividend

550

550

Tax

250

220

59) What does the above data signify to the lenders in

2005?

a) Happy signal to the lenders

b) No happy signal to the lenders

c) Wait and watch signal to the lenders

d) None of these

60) Find out the interest coverage ratio for 2004-05 and

2003-04?

a) 0.66 and 0.90

b) 0.87 and 2.17

c) 0.88 and 1.90

d) None of these

Q. 61-62 are based on the following balance sheet of

ABC Ltd. as on 31-3-2005 is as follows:

(Rs. in 000s)

Liabilities

Assets

Share capital

50 Fixed Assets

70

Long term loans

40 Inventories

20

Rs. 5,000 payable in

Work in progress

10

July 2004

Sundry Creditors

10 Sundry Debtors

20

Tax payable

10 Cash

15

Bills Payable

5

Expenses Payable

12

Provision for dividend

8

Total

135

135

61) What is working capital?

a) Rs. 15,000

b) Rs. 20,000

c) Rs. 25,000

d) Rs. 30,000

62) What is the current ratio of ABC Ltd.

a) 1.4

b) 1.30

c) 1.48

d) 1.36

Q. 63-64: The Balance Sheet of XYZ Ltd., as on 31-3-2006

is as follows:

(Rs. in lacs)

Liabilities

Assets

Equity Shares of Rs.

200 Fixed Assets

500

10 each

Retained Earnings

200 Current Assets

11% Debentures

300 Inventory

Public Deposits

100 Raw Material

100

Trade Creditors

80 W.I.P.

150

Bills Payable

100 Finished Goods

75

Debtors

100

Cash / Bank

55

Total

980

980

63) As per 2nd Method of lending as per Tandon

Committee the XYZ Ltd. a firm can avail working capital

facility of:

a) Rs. 180 lacs

b) Rs. 200 lacs

c) Rs. 285 lacs

d) Rs. 80 lacs

64) As per 1st Method of lending as per Tandon

Committee the XYZ Ltd., a firm can avail working capital

facility of:

a) Rs. 150 lacs

b) Rs. 285 lacs

c) Rs. 75 lacs

d) Rs. 225 lacs

Questions Nos. 65 and 66 based on the following data:

Unit A (Rs.)

Fixed Cost

CTDI ,

SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH, PH. 0172-2708961-62

1,50,000

Unit B (Rs.)

2,00,000

FINANCIAL MANAGEMENT (CAIIB)

Recollected

CTDI

Variable Cost (Per Unit)

80

60

Sale Price (Per Unit)

100

100

Units per month

12,500

10,000

Capital Utilization

100%

100%

65) Break Even Point in terms of capacity utilization in

case of Unit B in the above question is:

a) 60%

b) 50%

c) 40%

d) 25%

66) Break Even Point in terms of capacity utilization in

case of unit A in above question is:

a) 60%

b) 50%

c) 25%

d) 40%

67) Working capital is the finance required for meeting

current needs of any business concern or industry and

represents the funds invested in

a) Raw material, work in progress & finished goods

b) Stores & spares

c) Debtors & receivables

d) All of these

68) Based on the operating cycle of the unit, the working

capital requirement is computed by ascertaining the

amount of money required for smooth conduct of the

business on the following factors ..

a) months stock of RM, WIP, FG, Consumable stores &

spares

b) months debtors representing credit sales

c) One months expenses

d) All of these

69) Based on the operating cycle of the unit, the working

capital requirement is computed by ascertaining the

amount of money required for smooth conduct of the

business on the following factors ..

a) Months stock of RM, WIP, FG, Consumable stores &

spares

b) Months debtors representing credit sales

c) One months expenses

d) All of these

70) Following is one of the methods in Discounted Cash

Flow Technique

a) Payback Period

b) Average rate of return

c) Discount to sales ratio

d) Net present value

71) Acid Test Ratio establishes relationship between

a) Cash in hand and at bank to term liabilities

b) Book debts to current liabilities

c) Quick assets to current liabilities

d) None of these

72) Banks generally prefer debt equity ratio

a) 1 : 1

b) 2 : 1

c) 3 : 1

d) 4 : 1

73) As per the recommendations of Chore Committee

banks have been asked to ensure

a) Borrowers deposit 50% of their net profit in time deposits

b) Relax norms prescribed by Tandon Committee

c) Adopt 2nd Method of lending

d) Borrowers do not contribute more than 25% as margin

CTDI ,

74) The quantum of working capital to be given to an

industrial unit would depend upon

a. Sales volume

b. Purchases to be made

c. Operating cycle

d. Current assets needed to execute the projected sales

and production levels

75) Normally the maximum amount that can be granted

as working capital to an industrial unit should not

exceed

a) Total current assets

b) Total of current assets less liquid surplus

c) Total of current assets less liquid surplus and creditors

d) Total of current assets less all current liabilities

76) Mean value of weekly income of 40 families is 265.

But while calculation income of one family was read as

150 instead of 115. The correct mean is:

a) Rs.264

b) Rs.264.11

c) Rs.264.15

d) Rs.264.12

77) A time series consists of data arranged ______.

a) Tidely

b) Chronologically

c) Haphazard

d) None of these

78) While drawing a scatter diagram if all points appear

to form a straight line going downward from left to right,

then it is said, there is:

a) (+) ve correlation

b) () ve correlation

c) Perfect () ve correlation

d) No correlation

79) Limit against Current Assets 584, CreditorsGoods

70, Creditors-others 78, Unpaid expenses 34,

Provisions ( Tax-26, Bonus-9, Dividend-12), Loan against

Capital Goods,- 133, Inventory 383, Investments 221,

Cash 22, Marketable Securities 67, Receivables 243,

Debtors 147, Disputed Receivables 15, Stagnant

Finished Goods 21. What is the Current Ratio..

a) 1.02

b) 1.06

c) 1.11

d) 1.22

80) Limit against Current Assets 584, CreditorsGoods

70, Creditors-others 78, Unpaid expenses 34,

Provisions ( Tax-26, Bonus-9, Dividend-12), Loan against

Capital Goods,- 133, Inventory 383, Investments 221,

Cash 22, Marketable Securities 67, Receivables 243,

Debtors 147, Disputed Receivables 15, Stagnant

Finished Goods 21. What is the Quick Ratio..

a) 0.53

b) 0.55

c) 0.57

d) 0.59

81) Limit against Current Assets 584, CreditorsGoods

70, Creditors-others 78, Unpaid expenses 34,

Provisions ( Tax-26, Bonus-9, Dividend-12), Loan against

Capital Goods,- 133, Inventory 383, Investments 221,

Cash 22, Marketable Securities 67, Receivables 243,

Debtors 147, Disputed Receivables 15, Stagnant

Finished Goods 21. What is the Working Capital

Gap..

a) 13

b) 49

c) 597

d) 633

82) Capital 232, Reserves (Revaluation 140,

Investment 33, Depreciation 160, General 60),

Advances outstanding ( Against Fixed Assets 325,

Against Current Assets 491, Unsecured Term Loans

SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH, PH. 0172-2708961-62

FINANCIAL MANAGEMENT (CAIIB)

Recollected

CTDI

154), Patents 23, Accumulated Losses 189. What is

Debt-Equity Ratio.

a) 0.77

b) 1.16

c) 1.55

d) 2.35

83) Sales 6857, Gross Profit 1097, Net Profit 165,

Depreciation 30, Cost of Production 4457, Cost of

Sales 4704, Raw Material Consumed 3743. What is

Cost of Goods Sold Ratio

a) 55%

b) 65%

c) 69%

d) 84%

84) Sales 6857, Gross Profit 1097, Net Profit 165,

Depreciation 30, Cost of Production 4457, Cost of

Sales 4704, Opening Stock 310, Closing Stock - 367.

What is Stocks Turnover Ratio

a) 16.34

b) 17.02

c) 19.45

d) 20.26

85) Sales 6857, Gross Profit 1097, Net Profit 165,

Depreciation 30, Cost of Production 4457, Cost of

Sales 4704, Opening Finished Goods 126, Closing

Finished Goods - 151. What is Finished Goods Holding

Period

a) 10.75 days

b) 11.34 days

c) 11.83 days

d) 12.49 days

86) Sales 6857, Gross Profit 1097, Net Profit 165,

Depreciation 30, Cost of Production 4457, Cost of

Sales 4704, Opening Debtors (Total-243, Bad-15),

Closing Debtors (Total-327, Bad-14). What is Debt

Collection Period

a) 14.40 days

b) 15.17 days

c) 20.99 days

d) 22.11 days

87) Sales 6857, Gross Profit 1097, Net Profit 165,

Depreciation 30, Cost of Production 4457, Cost of

Sales 4704, Raw Material Consumed 3743. Opening

Stock 184, Closing Stock 159, Opening Creditors

129, Closing Creditors 70. What is the Creditors

Turnover Ratio..

a) 37.62

b) 37.37

c) 44.79

d) 47.28

88) An SSI unit has been sanctioned Cash Credit (Hypo.)

limit of Rs.20 Lac with 20% margin. What should be the

value of security so that the borrower can utilize the limit

fully .:

a) Rs.15 Lac

b) Rs.20 Lac

c) Rs.25 Lac

d) Rs.30 Lac

89) An SSI unit has been sanctioned Cash Credit (Hypo.)

limit of Rs. 20 Lac with 25% margin against paid stocks.

Borrower has submitted the stock statement which

indicates the stocks as Rs. 24 Lac with sundry creditors

to the extent of Rs. 8 Lac. What is the drawing

power

a) Rs.9 Lac

b) Rs.12 Lac

c) Rs.18 Lac

d) Rs.20 Lac

90) Fixed Assets 70000, Non Current Assets 20000,

Total Liabilities 200000, Current Liabilities 88000,

Inventory 21000. On the basis of above figures

a) Net worth is 60000

b) Term Loan is 70000

c) Owned funds are 90000 d) Current Assets are 110000

91) Paid-up Capital 80, Reserves & Surplus 30,

Sundry Creditors 90, Term Loan from Banks 40, Profit

& Loss (Debit balance) 10. What is the Tangible Net

Worth

CTDI ,

a) Rs.100 Lac

b) Rs.110 Lac

c) Rs.120 Lac

d) Rs.140 Lac

92) A low Current Ratio may imply

a) Shortage of Working Capital

b) Surplus of Working Capital

c) Sufficient Working Capital

d) Threshold Working Capital

93) As per Nayak Committee, the margin contribution of

the SSI unit is _____ % of the annual projected

turnover.

a) 5%

b) 10%

c) 20%

d) 25%

94) Sale Price is Rs.10 per unit, Variable Cost is Rs.6 per

unit, Fixed Cost is Rs.60000/-. What is the contribution

per unit.

a) Rs.1.67

b) Rs.4.00

c) Rs.6.00

d) Rs.16.00

95) Sale Price is Rs.10 per unit, Variable Cost is Rs.6 per

unit, Fixed Cost is Rs.60000/-. What is the Break Even

Point in terms of units..

a) 3750

b) 10000

c) 15000

d) 35928

96) Sale Price is Rs.12 per unit, Variable Cost is Rs.8 per

unit, Fixed Cost is Rs.120000/-.What is the level of sales

at BEP..

a) Rs.180000/b) Rs.240000/c) Rs.360000/d) Rs.960000/97) Sale Price is Rs.10 per unit, Variable Cost is Rs.6 per

unit, Fixed Cost is Rs. 60000/-. What level of sales be to

achieve profits of Rs.20000/-

a) Rs.80000/b) Rs.133330/c) Rs.200000/d) Rs.479000/98) The Current Ratio of a company is constant for the

last two years but the Quick Ratio increased from 1.00 to

1.60. Which of the following conclusions is certainly true

about this company.

a) Recovery of dues is difficult

b) Stocks in absolute terms have declined

c) Stocks as a %age of Current Assets have declined

d) Sales have declined

99) An SSI unit has been sanctioned Working Capital

limit of Rs.60 Lac. What is the annual projected turnover

of the unit..

a) Rs.2.40 Cr.

b) Rs.3.00 Cr.

c) Rs.4.00 Cr.

d) Rs.5.00 Cr.

100) Debt Service Coverage Ratio (DSCR) indicates.

a) Excess of Current Assets over Current Liabilities

b) Number of times fixed assets cover borrowed funds

c) Number of times surplus covers interest & instalments of

Term Loans

d) Effective utilization of assets

SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH, PH. 0172-2708961-62

FINANCIAL MANAGEMENT (CAIIB)

Recollected

CTDI

Yesterday is history, tomorrow is

mystery, and today is a gift. Thats

why.. it is called the present.

God never closes a door without

opening a window. He always gives

us something better when he takes

something away.

Vipin Sharma

CTDI ,

SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH, PH. 0172-2708961-62

FINANCIAL MANAGEMENT (CAIIB)

Recollected

CTDI

ANSWER FINANCIAL MANAGEMENT

(RECOLLECTED )

1

6

11

16

21

26

31

36

41

46

51

56

61

66

71

76

81

86

91

96

B

B

A

D

B

B

C

C

A

B

C

C

B

A

C

D

C

A

A

C

2

7

12

17

22

27

32

37

42

47

52

57

62

67

72

77

82

87

92

97

B

D

C

B

A

C

A

D

C

C

A

B

B

D

B

B

B

B

A

C

3

8

13

18

23

28

33

38

43

48

53

58

63

68

73

78

83

88

93

98

A

A

C

A

B

A

C

A

B

C

B

B

A

D

C

B

D

C

A

C

4

9

14

19

24

29

34

39

44

49

54

59

64

69

74

79

84

89

94

99

B

D

D

A

A

B

A

A

B

A

C

B

D

D

D

A

B

B

B

B

5

10

15

20

25

30

35

40

45

50

55

60

65

70

75

80

85

90

95

100

B

B

C

B

C

C

D

C

A

C

C

D

B

D

C

C

B

D

C

C

CTDI WISHES YOU ALL THE BEST.

CTDI ,

SCO 1-2-3, 4TH FLOOR, SECTOR 17-D, CHANDIGARH, PH. 0172-2708961-62

You might also like

- Generate Multiple Demand Drafts from Deposit AccountDocument40 pagesGenerate Multiple Demand Drafts from Deposit Accountmevrick_guyNo ratings yet

- Corporate Finance MCQDocument11 pagesCorporate Finance MCQsinghsanjNo ratings yet

- Pages 55 Capital Market Operation FinalDocument38 pagesPages 55 Capital Market Operation FinalAakash SharmaNo ratings yet

- Question Bank-MCQ FM&CF (KMBN, KMBA 204)Document27 pagesQuestion Bank-MCQ FM&CF (KMBN, KMBA 204)Amit ThakurNo ratings yet

- Financial Management Preliminary Exam ReviewDocument6 pagesFinancial Management Preliminary Exam ReviewJken OrtizNo ratings yet

- AdFAR.701 - Partnership Accounting - OnlineDocument6 pagesAdFAR.701 - Partnership Accounting - OnlineMikaela Lapuz Salvador100% (2)

- Financial Statement Analysis MCQs With AnswerDocument5 pagesFinancial Statement Analysis MCQs With AnswerHamza Khan Yousafzai100% (1)

- Buad 804 Sourced MCQ LQADocument21 pagesBuad 804 Sourced MCQ LQAAbdulrahman Adamu AhmedNo ratings yet

- IBPS Interview PrepDocument33 pagesIBPS Interview Prepmevrick_guyNo ratings yet

- 01.13 ClearingDocument38 pages01.13 Clearingmevrick_guy0% (1)

- MCQs On Capital StructureDocument7 pagesMCQs On Capital Structuremercy100% (1)

- 01.20 Government BusinessDocument48 pages01.20 Government Businessmevrick_guyNo ratings yet

- 01.14 Maker Checker FunctionalitiesDocument19 pages01.14 Maker Checker Functionalitiesmevrick_guyNo ratings yet

- MCQ of Corporate Valuation Mergers AcquisitionsDocument19 pagesMCQ of Corporate Valuation Mergers AcquisitionsNuman AliNo ratings yet

- B&a - MCQDocument11 pagesB&a - MCQAniket PuriNo ratings yet

- 306 FIn Financial System of India Markets & ServicesDocument6 pages306 FIn Financial System of India Markets & ServicesNikhil BhaleraoNo ratings yet

- Corporate Finance MCQDocument35 pagesCorporate Finance MCQRohan RoyNo ratings yet

- Paper+1 2+ (Questions+&+Solutions)Document13 pagesPaper+1 2+ (Questions+&+Solutions)jhouvanNo ratings yet

- Deposit Accounts - Joint Accounts and NomineesDocument30 pagesDeposit Accounts - Joint Accounts and Nomineesmevrick_guyNo ratings yet

- Assessing Engie's capital structure and financing strategiesDocument8 pagesAssessing Engie's capital structure and financing strategiesNabila Haque KhanNo ratings yet

- Currency Chest Operations GuideDocument10 pagesCurrency Chest Operations Guidemevrick_guyNo ratings yet

- Mba ProjectDocument77 pagesMba Projectrahul pandeyNo ratings yet

- 0810 FM (Cfa540)Document26 pages0810 FM (Cfa540)CAVIENCRAZY10No ratings yet

- Financial Management Mcqs With AnswersDocument53 pagesFinancial Management Mcqs With Answersviveksharma51No ratings yet

- Ratio Analysis Financial StatementDocument2 pagesRatio Analysis Financial Statementsatya100% (2)

- 01.03-Deposit Accounts OpeningDocument38 pages01.03-Deposit Accounts Openingmevrick_guy0% (1)

- 01 02-CifDocument25 pages01 02-Cifmevrick_guyNo ratings yet

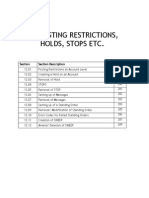

- 01.12 Posting RestrictionsDocument14 pages01.12 Posting Restrictionsmevrick_guyNo ratings yet

- C.A IPCC Ratio AnalysisDocument6 pagesC.A IPCC Ratio AnalysisAkash Gupta100% (2)

- 01.19 Safe CustodyDocument9 pages01.19 Safe Custodymevrick_guyNo ratings yet

- Transaction Processing: Cash, Cheques, TransfersDocument23 pagesTransaction Processing: Cash, Cheques, Transfersmevrick_guyNo ratings yet

- CAIIB Bank Financial Management - Questions and AnswersDocument15 pagesCAIIB Bank Financial Management - Questions and Answerssuperman1293No ratings yet

- Funds Flow Statement MCQs Schedule of Changes in Financial Position Multiple Choice Questions and AnDocument7 pagesFunds Flow Statement MCQs Schedule of Changes in Financial Position Multiple Choice Questions and Anshuhal Ahmed33% (3)

- FM - 30 MCQDocument8 pagesFM - 30 MCQsiva sankarNo ratings yet

- FinanceDocument86 pagesFinanceJawed AhmedNo ratings yet

- Risk Management and Insurance Solved MCQs Set 3Document7 pagesRisk Management and Insurance Solved MCQs Set 3Gauresh NaikNo ratings yet

- CH 1 Cost Volume Profit Analysis Absorption CostingDocument21 pagesCH 1 Cost Volume Profit Analysis Absorption CostingNigussie BerhanuNo ratings yet

- MCQ Problems On Marginal Costing: Q.1 (D) (V) AnsDocument1 pageMCQ Problems On Marginal Costing: Q.1 (D) (V) AnsHasim SaiyedNo ratings yet

- Objective Questions and Answers of Financial ManagementDocument22 pagesObjective Questions and Answers of Financial ManagementGhulam MustafaNo ratings yet

- Multiple Choice Questions: Marginal CostingDocument6 pagesMultiple Choice Questions: Marginal CostingSatyam JainNo ratings yet

- Financial Management MCQsDocument27 pagesFinancial Management MCQsYogesh KamraNo ratings yet

- CF McqsDocument44 pagesCF McqsManish GuptaNo ratings yet

- CH 6 Cost Volume Profit Revised Mar 18Document84 pagesCH 6 Cost Volume Profit Revised Mar 18beccafabbriNo ratings yet

- MCQ-Financial Account-SEM VDocument52 pagesMCQ-Financial Account-SEM VVishnuNadarNo ratings yet

- WCM Finance MCQDocument28 pagesWCM Finance MCQMosam AliNo ratings yet

- MCQ On FM PDFDocument28 pagesMCQ On FM PDFharsh snehNo ratings yet

- Capital MArket MCQDocument11 pagesCapital MArket MCQSoumit DasNo ratings yet

- MCQs (50) - Ratio AnalysisDocument9 pagesMCQs (50) - Ratio AnalysisAriyan ShantoNo ratings yet

- LeasingDocument6 pagesLeasingSamar MalikNo ratings yet

- Chapter 4 - Time Value of MoneyDocument5 pagesChapter 4 - Time Value of MoneyLayla MainNo ratings yet

- Finance 16UCF620-MANAGEMENT-ACCOUNTINGDocument27 pagesFinance 16UCF620-MANAGEMENT-ACCOUNTINGAkhil rayanaveniNo ratings yet

- Banker Customer Relationship - Exam1 PDFDocument3 pagesBanker Customer Relationship - Exam1 PDFrahulpatel1202No ratings yet

- MCQ CH 12 - Set-Off and Carry Forward of Losses - Nov 23Document10 pagesMCQ CH 12 - Set-Off and Carry Forward of Losses - Nov 23NikiNo ratings yet

- (Answer All Questions. Each Question Carries 1 Mark) : Set - 1 15 Uco 461.1: Project FinanceDocument1 page(Answer All Questions. Each Question Carries 1 Mark) : Set - 1 15 Uco 461.1: Project FinanceTitus Clement100% (1)

- Financial Management MCQs 35: Maximizing Firm ValueDocument6 pagesFinancial Management MCQs 35: Maximizing Firm Valuekhan50% (2)

- 9 MCQ On Third Party Products With Ans.Document4 pages9 MCQ On Third Party Products With Ans.Nitin MalikNo ratings yet

- FIN203 Tutorial 1 QDocument4 pagesFIN203 Tutorial 1 Q黄于绮100% (1)

- Ratio Analysis ObjectiveDocument5 pagesRatio Analysis ObjectiveAnjali AgarwalNo ratings yet

- Accounting McqsDocument16 pagesAccounting McqsAsad RehmanNo ratings yet

- Asset Allocation and Portfolio Selection ReviewDocument5 pagesAsset Allocation and Portfolio Selection ReviewDivya chandNo ratings yet

- Xii Mcqs CH - 16 Cash FlowDocument6 pagesXii Mcqs CH - 16 Cash FlowJoanna GarciaNo ratings yet

- CH 12. Risk Evaluation in Capital BudgetingDocument29 pagesCH 12. Risk Evaluation in Capital BudgetingN-aineel DesaiNo ratings yet

- Chapter 3 MCQs On DepreciationDocument14 pagesChapter 3 MCQs On DepreciationGrace StylesNo ratings yet

- Strategic Cost ManagementDocument5 pagesStrategic Cost ManagementBharat BhojwaniNo ratings yet

- Corporate Finance Exam GuideDocument8 pagesCorporate Finance Exam Guideneilpatrel31No ratings yet

- Accounting Concepts MCQsDocument6 pagesAccounting Concepts MCQsUmar SulemanNo ratings yet

- MCQ On Central BankDocument2 pagesMCQ On Central Bankabhilash k.bNo ratings yet

- Primary and Secondary Markets ChapterDocument3 pagesPrimary and Secondary Markets ChapterLeonard CañamoNo ratings yet

- Calculating Goodwill Using Capitalization MethodDocument9 pagesCalculating Goodwill Using Capitalization MethodMital ParmarNo ratings yet

- EOQ Is A Point Where: Select Correct Option: Ordering CostDocument5 pagesEOQ Is A Point Where: Select Correct Option: Ordering CostKhurram NadeemNo ratings yet

- Income Tax MCQ on Capital Gains & DeductionsDocument6 pagesIncome Tax MCQ on Capital Gains & DeductionsDurai ManiNo ratings yet

- Final Exam, R Financial ManagementDocument9 pagesFinal Exam, R Financial Managementsamuel kebedeNo ratings yet

- C. Update Valid Vendor File: Multiple-Choice Questions 1Document8 pagesC. Update Valid Vendor File: Multiple-Choice Questions 1DymeNo ratings yet

- Fundamentals of Management AccountingDocument20 pagesFundamentals of Management AccountingSatisthkavita Nanhu100% (1)

- MCQsDocument9 pagesMCQsNareshNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Questions Based On F Inancial Managem EntDocument21 pagesQuestions Based On F Inancial Managem EntHemant kumarNo ratings yet

- Financial Management - SmuDocument0 pagesFinancial Management - SmusirajrNo ratings yet

- NIOS Culture NotesDocument71 pagesNIOS Culture Notesmevrick_guy0% (1)

- Banking Glossary 2011Document27 pagesBanking Glossary 2011Praneeth Kumar NaganNo ratings yet

- Top 10 Economic Challenges for Modi GovtDocument17 pagesTop 10 Economic Challenges for Modi Govtmevrick_guyNo ratings yet

- Yuva Savings Bank AccountDocument1 pageYuva Savings Bank Accountmevrick_guyNo ratings yet

- A StudyDocument12 pagesA Studymevrick_guyNo ratings yet

- 01 21-RBIremittanceDocument11 pages01 21-RBIremittancemevrick_guyNo ratings yet

- 2nd Issue E-Gyan, October-2013Document28 pages2nd Issue E-Gyan, October-2013mevrick_guyNo ratings yet

- BOD EOD ProcessesDocument25 pagesBOD EOD Processesmevrick_guy100% (1)

- 47-Corporate Salary Package - CSPDocument3 pages47-Corporate Salary Package - CSPmevrick_guyNo ratings yet

- State Bank Learning Centre e-gyan Vol 1 Key HighlightsDocument13 pagesState Bank Learning Centre e-gyan Vol 1 Key Highlightsmevrick_guyNo ratings yet

- BOD EOD ProcessesDocument25 pagesBOD EOD Processesmevrick_guy100% (1)

- 8 To 8 Functionality: Section Section DescriptionDocument7 pages8 To 8 Functionality: Section Section Descriptionmevrick_guyNo ratings yet

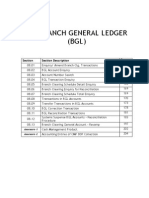

- 01 08-BGLDocument40 pages01 08-BGLmevrick_guy100% (2)

- 01.09-User System ManagementDocument12 pages01.09-User System Managementmevrick_guyNo ratings yet

- Manage cash workflow and transactionsDocument21 pagesManage cash workflow and transactionsmevrick_guyNo ratings yet

- 01.01 IntroductionDocument16 pages01.01 Introductionmevrick_guyNo ratings yet

- 00.01 PrefaceDocument1 page00.01 Prefacemevrick_guyNo ratings yet

- MBAT 401 - Project Management - Unit-3 Part 1Document32 pagesMBAT 401 - Project Management - Unit-3 Part 1Sheikh IrfanNo ratings yet

- Equity Analysis With Reference To Automobile IndustryDocument79 pagesEquity Analysis With Reference To Automobile Industrysmartway projectsNo ratings yet

- Financial Ratios ExplainedDocument60 pagesFinancial Ratios ExplainedSandeep Soni100% (1)

- FM Unit1.Document166 pagesFM Unit1.shaik masoodNo ratings yet

- ACG2071 Managerial AccountingDocument40 pagesACG2071 Managerial AccountingJadeNo ratings yet

- Industry Profile of Financial Service IndustryDocument7 pagesIndustry Profile of Financial Service IndustryMedha SinghNo ratings yet

- Exam QA - Corporate Finance-1Document38 pagesExam QA - Corporate Finance-1NigarNo ratings yet

- Human Capital (Blue)Document18 pagesHuman Capital (Blue)harit_ec100% (1)

- Lecture 3.1.2 - Equity CapitalDocument34 pagesLecture 3.1.2 - Equity CapitalvaishnaviNo ratings yet

- Paper - 8: Financial Management & Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument32 pagesPaper - 8: Financial Management & Economics For Finance Part A: Financial Management Questions Ratio AnalysisVarun MurthyNo ratings yet

- Pankaj Internship ProjectDocument26 pagesPankaj Internship ProjectPankajNo ratings yet

- Long Term Finance SourcesDocument28 pagesLong Term Finance SourcesShalini Jain0% (1)

- Winter Internship: A Project Repoprt On "A Study of Loan Procedure of Consumer Durable Product On EMI Card"Document38 pagesWinter Internship: A Project Repoprt On "A Study of Loan Procedure of Consumer Durable Product On EMI Card"Abhishek VermaNo ratings yet

- LONG TERM FINANCING OPTIONSDocument10 pagesLONG TERM FINANCING OPTIONSmeenasarathaNo ratings yet

- Working Capital On BEMLDocument103 pagesWorking Capital On BEMLAjay Karthik100% (2)

- Accounting and Finance Exit Model Exam Attempt Review11 1Document41 pagesAccounting and Finance Exit Model Exam Attempt Review11 1Ayana Giragn AÿøNo ratings yet

- Titanium Dioxide ExhibitsDocument7 pagesTitanium Dioxide Exhibitssanjayhk7No ratings yet

- Turbo Bearing ProjectDocument55 pagesTurbo Bearing ProjectDesai KrutikNo ratings yet

- 3 Revision Summary of Income TaxDocument22 pages3 Revision Summary of Income TaxJitendra VernekarNo ratings yet

- Financial Management in Current Operations and Expansion of Capital in IndiaDocument40 pagesFinancial Management in Current Operations and Expansion of Capital in IndiaSan Deep SharmaNo ratings yet

- Finon Week2 Financial SystemDocument27 pagesFinon Week2 Financial SystemAebilTaskari RNo ratings yet

- Maximize value with optimal capital structure mixDocument8 pagesMaximize value with optimal capital structure mixKalpit JainNo ratings yet

- Eddie DukemanDocument3 pagesEddie DukemaneddiedukemanNo ratings yet

- MindmapDocument6 pagesMindmapapi-302359373No ratings yet