Professional Documents

Culture Documents

Joo v. Cho - April 9, 2008

Uploaded by

jdep8312Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Joo v. Cho - April 9, 2008

Uploaded by

jdep8312Copyright:

Available Formats

Joo v Cho

2008 NY Slip Op 33648(U)

April 9, 2008

Sup Ct, New York County

Docket Number: 113591/05

Judge: Shirley Werner Kornreich

Republished from New York State Unified Court

System's E-Courts Service.

Search E-Courts (http://www.nycourts.gov/ecourts) for

any additional information on this case.

This opinion is uncorrected and not selected for official

publication.

ANNED ON 411412008

[* 1]

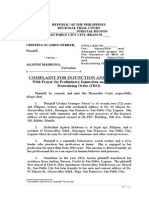

S U P R E M E COURT OF THE STATE OF NEW YORK - NEW YORK COUNTY

PART

c "I

index Number : 113591/2005

INDEX NO.

JOO, KONG WAN

ws.

CHO, NICOLE M.

I1

SEQUENCE NUMBER : 001

\ / I lo&

MOTION

DATE

MOTION

*Ea. NO.

MOTION CAL. NO.

-

SUMMARY JUDGMENT

this motion t o / f o r

1-

PAPERS NUMBERED

Notice of M o t i o n / Order t o Show Cause

Affidavits

Exhibits

...

Answering Affidavits - Exhibits

Replying Affidavits

Cross-Motion:

'7Yes

Upon t h e foregoing

-_

?-.I

+%

--\

-"

Check one:

I-:

Check if appropriate

FINAL DISPOSITION

WNON-FINAL DISPOSITION

17 DONOTPOST

REFERENCE

[* 2]

S J P W M E 01 T OF 'THE STATE 0

'OR

Indcx No.: I1 3 5 W 0 5

Plaintiffs,

11E C I SION

-against-

ER

NICOLE M.CI IO, individually and d/b/a Lot

Mortgage, BACK Cl IUL KIM, SOONA LEE, and

AMfRICAN GATEWAY ENERGY, L.L.C.,

APR 7 4

This action arises out ol'a loan made

iii

December 2003 by plaintiffs Dong Wan Jclo and

On Kyong .loo (thc Joos) to defcndants Back Chul Kim (Kim) and Soona Lec (Lee). As

collatcral for the loan, plaintifls obtained a mortgage on a condominium, allegedly owned by

Kim, located at 304 East 6Sh Street, Unit 3C, New York, N.Y. (Unit 3C). Defendant American

Gateway Energy, LLC (AGE), a liniitcd liability company owned and operated by non-party

Sandra Dyche (Dyche), Kim's sister, now moves for summary judgment dismissing the fifth and

sixth causes of action oi'thc verified complaint which allege that the sale of1Jnit ?C from Kim to

AGE on or about August 3 1,2004 was fraudulent. AGE claims that a notice of pendency filed

by Dyche in a prior action she commenced against Kiln lor title to Unit 3C cxtinguishes plaintiffs

mortgage on the propcrty. Plaintiffs oppose.

I.

Background

A.

Affiu'avil

..

oJ'Dnng Watt Joo

Plaintiff Dong Wan 300 avers the hllowing. He is an adjunct prolessor of sociology at

[* 3]

the New York Theological Seminary and the owner and opcrator of The Korean Rescarch Center

(the Center) in Queens. The Center is a iacility that helps local Korcan-Anicricans assimilate

into tlic community. For approximately five years ending in 2005, .loo sublet part or the Ccntcrs

office space to d e h d a n t Nicole Cho (Cho). Out ofthis space, Cho ran and operated a mortgagc

brokerage business entitled Lotte Mortgage.

Jon and his wifc sold thcir condominium in 2002 and subsequently began looking for a

short term investment opportunity. In November 2003, Cho approached Joo about loaning Lee

money to iinance a restaurant she owned called Pacific Sea World. As collateral, Joo would be

given a mortgage on IJnit 3C, a condo allegedly owned by Lees husband dcfcndant Kim. Joo

avers that Cho persuaded him this was a safe investment bccausc Kims equity in Unit 3C was

appraised at $500,000 and he had no mortgage or otlicr licn. Ihc loan amount was $88,000. loo

further avers that hc was told thc full amount of the loan, plus interest, would be paid back in

2004 once Cho helpcd Kiln obtain a mortgage on Unit 3C.

According to Joo, Cho handled all of the preparation leading up to the closing. He further

avcrs Cho told hitn she had hired an attorney to look over all of the docuincnts and also to appear

on the Joos behalf at the closing. On Decembcr 30, 2003, Cho, Kim, Lee, Joo and his wife met

at Joos office to execute the loan. Cho brought two documents with her - a Mortgage Note and

a Mortgage. However, no attorney was present. According to Joo, Cho assured him that sincc an

attorney had prepared and reviewed each document, there was no need fbr one at the closing.

Ihc partics cxccutcd the loan, and Joo made a check out to Kim for $88,000. Kin1 signcd thc

Moi-tgagc Notc and Mortgage purportedly giving the Joos a lien on Unit 3C. Each document

was notarizcd. Joo avcrs Cho was responsible for delivering the Mortgage to a titlc company for

[* 4]

recording.

Following the closing, Joo avcrs he bccame frustratcd with Cho due to her rcpealed

excuscs as to thc slatus of thc loan. In or about August 2004, Joo contacted the title company

rcsponsible (or recording thc Mortgage and discovered that it had not bccn recorded. The

rccording iirially was perhrmed o n Octobcr 14, 2004.

In or about Novcmbcr 2004, .loo avcrs he lcarned Kiin executed a Real lroperly

Transfer Rcport (the Rcal Property Transier) which sold IJnit 3C to AGE for only $25,000. Ihe

Joos subsequently demanded the loan be repaid in full. Whcn Cho and Kim relused, the Joos

commenced the instant action alleging: (1) breach of fiduciary duty against Cho; (2) fraud against

Cho, Kim and Ixe; (3) breach of contract against Kim; (4)money had and receivcd against Kim

and Lec; ( 5 ) presumptive fraudulcnt conveyancc regarding the Real Property Transfer against

Kim and AGE; and (6) actual fraudulent conveyance of the Real Properly Transfer against Kim

and AGE,.

R.

Dychc v. Kim Action

In support oithis motion, AGE submits Dychcs January 26 and February 23, 2004

afiidavits froin a prior lawsuit she brought against Kiin. In these affidavits, Dyche avers the

following. She was renting Unit 3C whcn her brother arrived from South Korea in 1996.

According to Dychc, she arrangcd for Kims citizenship and paid all of his rent and living

expenses. When she purchased Unit 3C in 1997, she decided to place it in Kims name, with the

understanding that Unit 3C would rernain hers, but Kim could use it to raisc capital for his

business and investment vcnlures. Kim cxecutcd a promissory notc for $300,000 to Dyche, and

she in turn filed a IJCC-1 financing statement on September 10, 2001. No money exchanged

[* 5]

hands in the deal.

In late 2003, Dyclic avers she learned K i m attempted to rc-finance Unit 3C without her

knowledge. According to Dyche, Kim apologized, but said he needed the money to hclp I c e

save her rcstaurant. Dyche and Kim, therelore, executed a Mortgage Financing and Stock

Investment Agreement (thc Agrccmcnt) on Decem bcr 29, 2003. The Agrccmcnt was designed

to allow Kim to obtain a $300,000 mortgage on Unit 3C to finance his wifes restaurant. The

Structure 01the Transaction was explained as follows:

KIM, as nominal owner of [Unit 3CJ shall make all arrangcmcnts ncccssary to obtain the

mortgaged financing. KIM hereby acknowledges that whatever interest he inay hold in

the mortgaged property is nominal and liniitcd to acting in the place of andlor on behalf

of SANDRA DYCHE, strictly for convenience in consummating this transaction. Back

C. Kim further agrees that, on demand of SANDRA DYCHG, he will execute any

document and/or perform any act necessary to clarify SANDRA DYCHES sole and

exclusivc ownership of [Unit 3C].

Dyche avcrs the mortgage contemplated under the Agreement became impossible for Kim to

obtain due to unforscen circumstanccs. 1 lowever, Kiln persisted in using Unit 3C as collateral to

obtain financing lor Lee and her restaurant. As a result, Dyche decided she needed to re-structure

her arrangement with Kim so that title to Unit 3C was solely in her name. Accordingly, she filcd

suit on or about January 26,2004, subsequent to the Joos December 2003 loan but prior to tlic

recording of thcir mortgage on October 14, 2004. She sought a declaratory judgment naming her

as the owner olUnit 3C or for specific performance of the Agreement. On January 27, 2004,

Dyche obtained

;1

notice of pendency against Kin1 for Unit 3C and was granted a temporary

restraining order on January 30, 2004, preventing Kim from taking any action with regard io Unit

3C.

[* 6]

O n or about April 16, 2004, Dyche was granted a preliminary injunction by the Hon.

Marcy lriedman restraining Kim from rcfhancing, transferring, encumbering, or otherwise

disposing of IJnit 3C during the pendency of the action. The action was discontinued by Dyche

on .lune 24, 2004. On or about August 3 1, 2004, Kiln executed a Kea1 Property Transfer selling

Unit 3C to AGE for $25,000.

II.

C'onclusions oj'Luw

It is well established that summary judgment may be granted only whcn it is clear that no

triable issucs of fact exist, Alvurez

17,

Prospect Hosp., 68 N.Y.2d 320, 325 ( 1 986). The burden is

upon the moving party to makc a prima fhcie showing of cntitlcincnt to summary judgmcnt as a

matter of law. Zuckuman v. City oJ'New York, 49 N . Y .2d 557, 562 (1 980); Friends ofAnimals,

Inc. v. AssocialedFur Mfis.,

Inc., 46 N.Y.2d 1065, 1067 (1979). A failure to make aprima facie

showing requires a denial ol-the suininary judgmcnt motion, regardless of the sufficiency of the

opposing papcrs. Ayotte v. Gewasio, 8 1 N.Y .2d 1062, 1063 (1 993). If a primaji-rcie showing

has bcen made, the burden shifts to the opposing party to producc evidentiary proof sufficicnt to

cstablish the cxistcncc of material issues or [act. Alvarez, supra, 68 N.Y.2d at 324; Zuckerman,

supm, 49 N.Y.2d at 562. The papers submitted in support of and in opposition to a summary

judgment motion are examined in a light most favorablc to the party opposing the motion.

Martin u. tlriggs, 235 A.D.2d 192, 196 ( l q tDept 1997). Mere ~ o t i ~ I ~ ~ iunsubstantiated

ons,

allegations, or expressions of hope are insuflicient to defeat a suininary judgement motion.

Zuckervzan, supra, 49 N.Y.2d at 562. Upon the completion of thc court's examination of all the

documents submitted in connection with a summary judgmcnt motion, the motion must be

denied if there is any doubt as to the existencc of a triablc issuc of fact. Rotuhlr Exkuders, Inc. v.

[* 7]

Ceppos, 46 N.Y.2d 223, 23 1 (1 978).

Here, AGE has not met its burden. It argues that plaintiffs mortgage interest in Unit 3C

is precluded by the noticc of pendency Dychc filcd on January 27,2004. When a notice of

pendency is liled, a purchaser is charged with constructive notice of the litigation ilhe fails to

record prior to the notice being filed. Golds/ein v. tiold, 106 A.D.2d 100, 102 (2Dcpt 1984).

A person whose conveyance or incumbrance is I-ccorded after the filing of the notice is bound by

all proccedings taken in the action after such filing to the same extent as if he were a party. Id,

quoting CPLR 6501. Here, plaintiffs mortgage was recorded on October 14, 2004, well after the

notice of pendency was filcd. Legally, the noticc of pendency has priority over the Joos

mortgage. However, questions of fact exist as to the value of Unit 3C, who owns it, and the

reason, purpose and effect of the Real Property Transfer.

Regarding value, two sections of the transfer call for the total value of the property, but

are left blank. Although Dyche contcnds Kiln owed hcr $300,000, Joo avers Cho told him Kims

equity in Unit 3C was $500,000. The Real Property Transfer lists the sale price from Kim to

AGE as $25,000. Clearly, an issue of fact exists as to how much the property is worth.

Concerning ownership, Kim is listed as the owner/seller on the Real Property Transfer,

yet Dyche avcrrcd in 1icr court action that she owned Unit 3C and claims shc is the sole owner

The Agreement statcs that Kim has only a nominal interest in Unit 3C and that he will execute

any document needed to clarify that Dyche is tlic sole and exclusive owncr of the property. Here,

AGE, who is no1 a party to the Dyche Action and was not named on the notice of pendency,

claims ownership.

In referencc to tlic reason, purpose and effect of the transfer, Dyche, while purportedly

6

[* 8]

owning LJnit 3C, admittedly was complicit in her brothcrs use of the condo as collateral.

Scveral times, Kim represented to banks, individuals, and othcr lenders that he in fact was thc

owncr. Kim signed the Agrectnent with llychc on Dccember 29, 2003 stating that his intcresl in

Unit 3C was nominal. lhe next day, he used the entire property as collateral to get a $88,000

loan from the Joos. Conscyueiitly, issues of fraud exist involving Dychc, AGE, her admitted

altcr ego, and Kim during thc execution of thc Agrcement and by Kim to the Joos during the

execution of the loan.

In claiming that thc Real Propcrly Iransfer was in some fashion used to end the Dyche

Action, AGE admits that it and Ilyche are one in the same. lheir names are used

interchangcably throughout this motion. The New Ynrk State Division of Corporations Entity

Information Shcet states that AGE was formed on Fcbruary 2, 2004 and lists Unit 3C as the

address. Tlic Real Property Transkr, which took placc on August 31, 2004, lists Unit 3C as

AGES tax billing address. Dyche and AGE are both listed as buycrs. As a result, it is not clear

from the rccord whcther Dyche was using Unit 3C as AGES address prior to executing the Real

Propcrty Iransfer. I n addition, AGE offers no documents or testimony to connect the Rcal

Property Traiisfcr lo the discontinuance of the Dyche Action. Accordingly, it is

ORDERED that d

judgment is denied.

DATE: April 9, 2008

New York, NY

7

You might also like

- OSU - CS 225 Midterm Review Winter2016Document4 pagesOSU - CS 225 Midterm Review Winter2016jdep8312No ratings yet

- USAdvisors Due Diligence Mandarin 2Document1 pageUSAdvisors Due Diligence Mandarin 2jdep8312No ratings yet

- Byung Chul An. v. Dyche - April 5, 2011Document46 pagesByung Chul An. v. Dyche - April 5, 2011jdep8312No ratings yet

- McCallion v. DycheDocument6 pagesMcCallion v. Dychejdep8312No ratings yet

- McCallion & Assoc., LLP v. Dyche - August 20, 2014Document6 pagesMcCallion & Assoc., LLP v. Dyche - August 20, 2014jdep8312No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Nicolas-Lewis v. Commission On Elections PDFDocument7 pagesNicolas-Lewis v. Commission On Elections PDFMarion Yves MosonesNo ratings yet

- Cognition Exploring The Science of The Mind 6th Edition Reisberg Test BankDocument25 pagesCognition Exploring The Science of The Mind 6th Edition Reisberg Test BankAmySimonmaos100% (50)

- GFR 29Document2 pagesGFR 29qaisranisahib100% (5)

- Sexuality Assignment PDFDocument20 pagesSexuality Assignment PDFJoey Wong0% (2)

- Court Action #001 For Navy Federal Credit UnionDocument3 pagesCourt Action #001 For Navy Federal Credit Unionhoward avigdor rayford lloyd elNo ratings yet

- Manila Surety and Fidelity Company Inc V TeodoroDocument5 pagesManila Surety and Fidelity Company Inc V TeodoroAtty Ed Gibson BelarminoNo ratings yet

- 2009OpinionNo09 17Document4 pages2009OpinionNo09 17Paolo Ervin PerezNo ratings yet

- North Farmington Parent LetterDocument2 pagesNorth Farmington Parent LetterWXYZ-TV Channel 7 DetroitNo ratings yet

- 30 EDCA Publishing V Spouses LeonorDocument7 pages30 EDCA Publishing V Spouses LeonorGie CortesNo ratings yet

- Legal EthicsDocument12 pagesLegal EthicsJoanna MandapNo ratings yet

- Presentation1FORMATION OF A CONTRACTS OFFERDocument30 pagesPresentation1FORMATION OF A CONTRACTS OFFERDAWA JAMES GASSIM100% (2)

- Nardone V USDocument2 pagesNardone V USarrhadeleon0% (1)

- A1972-53 0 PDFDocument85 pagesA1972-53 0 PDFEbin Ks byndoorNo ratings yet

- Custom As A Source of Law - MP Singh-2Document25 pagesCustom As A Source of Law - MP Singh-2Jhasha KorraNo ratings yet

- Barrett V Sutherland Motors LTDDocument7 pagesBarrett V Sutherland Motors LTDJustin TetreaultNo ratings yet

- Tama Vail Baran Esq.Document3 pagesTama Vail Baran Esq.Tama BaranNo ratings yet

- OSH Committee MinutesDocument3 pagesOSH Committee Minutesjmmos207064100% (2)

- Junta de Supervisión Fiscal Apoya Petición de La AEEDocument16 pagesJunta de Supervisión Fiscal Apoya Petición de La AEEMetro Puerto RicoNo ratings yet

- Torcuator vs. BernabeDocument15 pagesTorcuator vs. BernabeBelle ConcepcionNo ratings yet

- What Is CybercrimeDocument4 pagesWhat Is CybercrimeKartik Mehta SEC-C 2021No ratings yet

- Maharashtra Land Revenue MANUALDocument182 pagesMaharashtra Land Revenue MANUALAdv. Ibrahim DeshmukhNo ratings yet

- Land Possession by Mere Tolerance CanDocument2 pagesLand Possession by Mere Tolerance Canyurets929No ratings yet

- MPU-6050 ImplementationDocument4 pagesMPU-6050 ImplementationМилан ПејковићNo ratings yet

- Topic 6 - Charges (Part 1) PDFDocument19 pagesTopic 6 - Charges (Part 1) PDFJ Enn WooNo ratings yet

- Special Proceedings DigestDocument21 pagesSpecial Proceedings DigestNorvie Aine Caalem PasiaNo ratings yet

- Today's Supreme Court Decision on Securities RegulationDocument10 pagesToday's Supreme Court Decision on Securities RegulationJM CruzNo ratings yet

- Abang Lingkod Party-List v. ComelecDocument1 pageAbang Lingkod Party-List v. ComelecMan2x SalomonNo ratings yet

- II. Public Documents As Evidence and Proof of Notarial Documents Section 23Document2 pagesII. Public Documents As Evidence and Proof of Notarial Documents Section 23RaffyLaguesmaNo ratings yet

- 10 N - I U M C C, 2018: in The Matter BetweenDocument18 pages10 N - I U M C C, 2018: in The Matter BetweenRISHANK TIWARINo ratings yet

- Final COF Complaint - InjunctionDocument5 pagesFinal COF Complaint - InjunctionAppasan Kipas Padkiw100% (1)