Professional Documents

Culture Documents

Basel III and Counter Party Credit Risk

Uploaded by

Hassaan ZafarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basel III and Counter Party Credit Risk

Uploaded by

Hassaan ZafarCopyright:

Available Formats

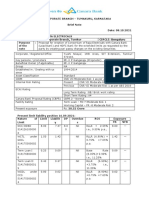

17 18 November 2014 | Mvenpick Hotel Karachi | 9:00 am to 5:00 pm

BASEL III AND TREATMENT OF

COUNTERPARTY CREDIT RISK

Clive Corcoran

FCA Registered Investment Adviser,

Financial trainer and Author

STRUCTURE OF THE COURSE

The two day course will consist of four sessions of ninety

minutes duration with coffee breaks in the morning and

afternoon and with a lunch break in the middle of the day.

BASEL III AND TREATMENT OF

COUNTERPARTY CREDIT RISK

AGENDA DAY-1

COFFEE BREAK

SESSION ONE

SESSION FOUR

Introductory Background to Basel III

Background to banking regulation and national banking

regulators

Original Basel Accord (1988) and purposes / weaknesses

Distinction between the Banking Book / Trading Book

Basel II background and purposes

Definitions of capital and return on equity, capital ratios, RWA

Market risk, Credit risk, Operational risk, Liquidity risk

The Three Pillars approach

Capital Rules under Basel II

Risk management and disclosure under Basel II

Basel Committees response to the financial crisis

New initiatives in Basel 2.5

Recognized need for liquidity standards and ratios

stable funding

Impact of Basel III

How will Basel III affect a banks business model?

Funding issues use of repo, interbank, deposits

Capital issues shortage of capital concerns

Hybrid capital issues Contingent Convertibles (CoCos)

and others

Impact on Return on Equity

Impact on lending businesses and trading businesses

Treatment of securitisation and re-securitization

Implications for SIFIs and G-SIBs

Will it change how banks are structured and managed?

Greater emphasis on role of central clearing parties (CCPs)

Implementation in US and EU - regulatory arbitrage possibilities

COFFEE BREAK

SESSION TWO

Overview of what is new in the Basel III Proposals

What are the fundamental new proposals under Basel III?

Revisions to minimum capital standards

Ratios between regulatory capital tiers

Capital Conservation buffer

New Liquidity framework short term and longer term

Treatment of Systemically Important Financial Institutions

(SIFIs)

Counter cyclical buffer

Leverage ratio back stop for capital charge for total non

RWA assets

Counter acting the regulatory arbitrage between trading

book/banking book

Increased focus on counter-party credit risk - CVA

Time Table for Basel III

What is the likely implementation time scale?

How will implementation be phased in?

What about firms which are not yet Basel II compliant?

Case Study

Examination of features of hybrid capital instruments

AGENDA DAY-2

SESSION ONE

Drivers of Counter-party Risk (CCR)

Separating market risk impact on trading positions from CCR

Pricing counterparty risk use of spreads, ratings

Probability of Default (PD) estimation of PD and Exposure

at Default (EAD)

Expected positive exposure (EPE)

Loss Given Default (LGD) and recovery rates

Counterparty risk in credit default swaps

Counterparty risk in interest rate swaps

Experience of AIG and mono-lines insurance companies

in financial crisis

The role of a central clearing house

Stress analysis and randomized stress scenarios

Market factors which drive counter-party credit deterioration

Case Study

Assessing counterparty risk and credit migrations with

Monte Carlo simulations

LUNCH BREAK

COFFEE BREAK

SESSION THREE

SESSION TWO

Basel III in More Details

Definitions of Regulatory Capital Tier 1, 2 and 3

Amount of capital increased base requirements,

stricter definition

Liquidity ratios the LCR, what are HQLA, Net Stable Funding

Ratio (NSFR)

Assessing counter-party risk CVA, DVA, collateralization

Wrong Way Risk

Pillar II issues

Capital modelling and planning

Pillar III issues

Greater risk disclosure

Transparency

To what extent do these go beyond Basel II?

Credit Value adjustment (CVA) and collateral

Definition Credit value adjustment (CVA)

Pricing formula for CVA John Hulls approach

Defining credit exposure in relation to market risk impact

on derivatives

Expected positive exposure and worst case exposure

Nature of collateralization ISDA treatment

Benefits of effective collateral management

Impact of netting on CVA

Impact of collateral on CVA

Hedging and credit default swaps

Eligible hedging instruments no nth to default structures

Bilateral counterparty risk and collateral

Over-collateralized positions and risk of counterparty default

Case Study

Stressed VaR Excel model to explain Expected Shortfall

Case Study

How effective collateralization strategies offset CVA in credit

exposure

BASEL III AND TREATMENT OF

COUNTERPARTY CREDIT RISK

LUNCH BREAK

SESSION THREE

Correlation factors, DVA and Wrong Way Risk

Basel III focus on correlation risk between counter parties

Linkages in market factors impacting portfolio values

Cross-sectional market correlations and liquidity risks

Definition of Wrong Way Risk (WWR)

Treatment of WWR in Basel III

Examples of counter-party arrangements where WWR is present

What is Debit Value Adjustment (DVA)?

Examples of DVA deterioration of credit spreads for banks,

swap dealers

Basel Committee approach to DVA

How does DVA offset CVA?

Effective EPE with stressed parameters to address general

wrong-way risk

John Hulls treatment of Wrong Way Risk

COFFEE BREAK

SESSION FOUR

Basel III Focus on Moving Away from OTC Clearing

Basel III treatment of OTC clearing versus CCP clearing

Different capital charges for OTC and CCP

Examination of traditional role of CCPs

Novation as replacement for original OTC bilateral agreements

Nature of Swap Execution Facilities (SEFs)

Role of Chicago Mercantile Exchange (CME) in swap clearing

Emphasis on CCPs in Dodd Frank

How margin works in CCPs initial margin and variation margin

Comparison of collateral requirements for OTC versus CCPs

Forecast that in future clearing will be 75% via CCPs 25%

via OTC

Inter-operability across CCPs overall margin requirements

How safe are CCPs

Case Study

Excel spreadsheet model for explanation of initial margin

and variation margin in CCP clearing

WHO SHOULD ATTEND

The course is aimed at those working in liquidity management

within banks and other financial institutions. Specific job titles

may include but are not limited to:

Directors, VPs, Division Heads, GMs, Specialists and

Senior Managers of:

Credit and Risk Management

Credit Control

Finance

Audit & Compliance

Portfolio Management

Risk Analysis & Controlling

Treasury

Basel II Reporting

Basel III Reporting

Asset and Liability Management

Regulatory

About

Clive Corcoran

FCA Registered Investment Adviser, Financial Trainer and Author

Clive Corcoran is an FCA registered

investment adviser, financial trainer

and author. During the past five years

he has been primarily engaged in

executive education on a global basis

for finance professionals. He has

conducted workshops on a variety of

topics including risk management, asset

allocation techniques and trading strategies (especially

with regard to the FX market). The clients for whom he

has recently provided in house training have included the

Saudi Investment Bank in Riyadh, a central bank in North

Africa, a sovereign wealth fund in the Gulf, an asset

management company in Beijing, a global banking group

domiciled in the Netherlands, a central bank in South

America, a public/private partnership in project finance

based in Washington D.C. and the European Investment

Bank (EIB).

In his earlier career he was co-founder and CEO of a business

management company with offices in the USA, UK, Canada

and Germany. Based in the USA during the 1980s and 90s

his responsibilities included asset management,

international tax planning, fiduciary responsibilities and

providing strategic financial advice to high net worth

individuals. Since re-locating to the UK in 2000, he has

continued to be engaged in providing wealth management

services to private clients and pension funds.

As an author he has written several titles on finance and

investment management. His most recent book entitled

Systemic Liquidity Risk and Bipolar Markets was published

by Wiley Finance in February 2013, and looks at new

challenges facing asset allocators and risk managers in the

post financial crisis environment. An earlier book entitled

Long/Short Market Dynamics: Trading Strategies for

Todays Markets (Wiley, 2007) dealt primarily with

alternative asset management strategies. He was also

commissioned by the London based Chartered Institute

for Securities and Investment (CISI), to write three

textbooks, Securities (Level 4) for those seeking the

Investment Advice Diploma, and Financial Markets, and

Portfolio Construction Theory and Wealth Management,

which are foundation items for those seeking the Masters

qualification from the CISI.

In 2013 he developed a distance learning course on the

Mechanics of Risk Management which is now up and

running and leads to a Post Graduate Certificate (PGC)

awarded by Middlesex University in London, and he is now

completing the process for a similar PGC on The Mechanics

of Financial Derivatives as well as a fully-fledged Online

MBA in Banking & Finance for the same university.

He has also been a regular analyst/contributor to CNBC

Europe and other broadcast outlets, a columnist for several

print and online publications, and has been a featured

speaker at international investment and trading expos.

BASEL III AND TREATMENT OF

COUNTERPARTY CREDIT RISK

Is Basel III the answer?

These questions are yet to be answered but Basel III is gradually rolling out as planned...

It is no secret that regulation has been scrutinised heavily in light of the credit crisis. The collapse of

Lehmans, the credit crunch and ongoing financial crises such as euro zone sovereign debt, have prompted

a radical overhaul of global banking regulation by the Basel Committee on Banking Supervision (BCBS).

These reforms recently announced are known generally as Basel III and are extensions of the previous

Basel Accord (1988) and the more recent Basel II (2007). Collectively, they will have a major effect on the

way banks structure themselves and their businesses, as well as the way they measure and manage risk.

It is crucial to stay abreast of these proposed changes in order to be prepared for what the future holds.

In this course we will look at the development of the Basel Accords and specifically the proposed changes

under Basel III. We will look at how these changes will affect current practices and the organisation of

business and its controls. This course will emphasise the practical impacts of the Basel III proposals and

consider how these can be best implemented.

Why this course is timely

There is no doubt these changes will have a dramatic impact on you and your business and the only way

to make sure that you continue to succeed despite of them, is to stay informed and be prepared. Book

on this course now and make sure you are fully equipped when the time comes!

Registration Details

Another Course by Clive

Corcoran

Regular Tuition Fee: Rs. 89,000 per participant

*Group Discount: 15% Discount

on 2 or more nominations from the same organization

Includes courseware, certificate, lunch, refreshments and business networking.

For registration(s), send us your

Name, Designation, Organization, Mobile, E-Mail and Postal Address

to register@terrabizgroup.com

For further information please contact

Talha Shabbir at +92 321 8747 595 and +92 333 0200 333

Phones: +92 21 3455 0319 & 3455 8539 Facsimile: +92 21 3455 7264

Strictly limited seating to ensure value added to all Participants - so book early!

Comprehensive course materials will be provided.

Terrabiz Cancellation Policy: For cancellations made in the 7 working days to the workshop,

no refunds will be given. Cancellations must be confirmed by email. Substitutions may be made at any time.

Attend both the Course

s and Avail

Special Discount!

For details please write

us

info@terrabizgroup.comat

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Credit Risk ManagementDocument4 pagesCredit Risk ManagementHassaan ZafarNo ratings yet

- Goods & Services Tax - December 2014Document2 pagesGoods & Services Tax - December 2014Hassaan ZafarNo ratings yet

- World Class Organizations & TeamsDocument4 pagesWorld Class Organizations & TeamsHassaan ZafarNo ratings yet

- Special Management Program by DR Malcolm McDonald (Detailed) PDFDocument4 pagesSpecial Management Program by DR Malcolm McDonald (Detailed) PDFHassaan ZafarNo ratings yet

- Special Management Program by DR Malcolm McDonald (Detailed) PDFDocument4 pagesSpecial Management Program by DR Malcolm McDonald (Detailed) PDFHassaan ZafarNo ratings yet

- Gitex Ad 2014Document1 pageGitex Ad 2014Hassaan ZafarNo ratings yet

- IUAdmission FormDocument5 pagesIUAdmission FormHassaan ZafarNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Co-Operative Banks Preservation of Records RulesDocument4 pagesCo-Operative Banks Preservation of Records Rulessherry j thomasNo ratings yet

- IFM Module 6 ProblemsDocument7 pagesIFM Module 6 ProblemsAlissa BarnesNo ratings yet

- Paper8 - PendingDocument9 pagesPaper8 - PendingApooNo ratings yet

- Tavant Mortgage Brochure PDFDocument4 pagesTavant Mortgage Brochure PDFRavikumar YadavNo ratings yet

- Accounts HeadDocument17 pagesAccounts Headrizashaan100% (1)

- 3iv. Bil U MobileDocument5 pages3iv. Bil U MobileTeruna ImpianNo ratings yet

- Abhijeit Bhosle 812 Karan Mitrani Pankaj Salve 852Document43 pagesAbhijeit Bhosle 812 Karan Mitrani Pankaj Salve 852coolspanky_227053No ratings yet

- Ubs Interest RatesDocument115 pagesUbs Interest RatesThorHollisNo ratings yet

- Personal Finance-Final - AttributedDocument470 pagesPersonal Finance-Final - AttributedAlfonso J Sintjago100% (1)

- Vice President Finance in San Francisco Bay CA Resume Linda WrightDocument3 pagesVice President Finance in San Francisco Bay CA Resume Linda WrightLindaWright1No ratings yet

- De Los Santos V AbejonDocument1 pageDe Los Santos V AbejonAllen Windel Bernabe100% (1)

- StressTesting Guidelines by SBPDocument21 pagesStressTesting Guidelines by SBPkrishmasethiNo ratings yet

- Raja Electricals Consortium Brief Note 08 10 2021Document3 pagesRaja Electricals Consortium Brief Note 08 10 2021MSME SULABH TUMAKURUNo ratings yet

- What Is ConsortiumDocument2 pagesWhat Is ConsortiumJitendra KumarNo ratings yet

- Disclosure No. 376 2014 Annual Report For Fiscal Year Ended December 31 2013 SEC FORM 17 ADocument380 pagesDisclosure No. 376 2014 Annual Report For Fiscal Year Ended December 31 2013 SEC FORM 17 ARanShibasakiNo ratings yet

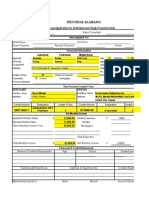

- Hyundai Alabang: Auto Loan Application For Individual and Single ProprietorshipDocument4 pagesHyundai Alabang: Auto Loan Application For Individual and Single ProprietorshipXierylleAngelicaNo ratings yet

- Tax Cases - 1 - 49Document165 pagesTax Cases - 1 - 49KennethMacawiliRagazaNo ratings yet

- Eros 1Document7 pagesEros 1pakistanNo ratings yet

- New Commercial Company Law in Uae PDFDocument7 pagesNew Commercial Company Law in Uae PDFAli AdnanNo ratings yet

- Chapter 5 - Statement of Cash FlowsDocument4 pagesChapter 5 - Statement of Cash FlowsArman100% (1)

- 51198bos40905 cp4 PDFDocument41 pages51198bos40905 cp4 PDFShubham VyasNo ratings yet

- Eureka Forbes Limited: Your Friend For LifeDocument7 pagesEureka Forbes Limited: Your Friend For Lifeastha mittalNo ratings yet

- Capital Structure ArbitrageDocument241 pagesCapital Structure Arbitragepakhom100% (1)

- Sample SBA Valuation Eng LTR PDFDocument3 pagesSample SBA Valuation Eng LTR PDFDhaval JobanputraNo ratings yet

- Loan Appraisal Format For Limits Less Than One CroreDocument14 pagesLoan Appraisal Format For Limits Less Than One Croresidh09870% (1)

- Case 3 Lehman BrothersDocument19 pagesCase 3 Lehman BrothersYusuf UtomoNo ratings yet

- Abaya vs. Ebdane-CasDocument3 pagesAbaya vs. Ebdane-CasJose Emmanuel Carodan100% (2)

- Chapter 4Document37 pagesChapter 4Harshit MasterNo ratings yet

- City Limits Magazine, March 1985 IssueDocument24 pagesCity Limits Magazine, March 1985 IssueCity Limits (New York)No ratings yet

- Advantages and Disadvantages of Incorporation of A CompanyDocument3 pagesAdvantages and Disadvantages of Incorporation of A Companysaqib nisarNo ratings yet