Professional Documents

Culture Documents

2010 CFTC Energy Rule Fact Sheet

Uploaded by

Houston ChronicleOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2010 CFTC Energy Rule Fact Sheet

Uploaded by

Houston ChronicleCopyright:

Available Formats

Commodity Futures Trading Commission

Office of Public Affairs

Three Lafayette Centre

1155 21st Street, NW

Washington, DC 20581

www.cftc.gov

Proposal to Set Position Limits in the Energy Futures and Options Markets

The Commodity Futures Trading Commission (CFTC) is proposing to set position limits for futures and option

contracts in the major energy markets. In addition, the proposal establishes consistent, uniform exemptions for

certain swap dealer risk management transactions while maintaining exemptions for bona fide hedging.

The CFTC is directed in its original 1936 statute to set position limits to protect against the

burdens of excessive speculation, including those caused by large concentrated positions.

Commodity Exchange Act, Section 4a(a): For the purpose of diminishing, eliminating, or preventing such burden [to

interstate commerce], the Commission shall, from time to time…proclaim and fix such limits on the amounts of trading which

may be done or positions which may be held by any person under contracts of sale of such commodity for future delivery on

or subject to the rules of any contract market or derivatives transaction execution facility, or on an electronic trading facility

with respect to a significant price discovery contract, as the Commission finds are necessary to diminish, eliminate, or prevent

such burden.

The CFTC currently sets position limits in certain agriculture markets. The CFTC sets limits for all-

months-combined (AMC), single-month and the spot-month in certain agriculture commodities. Limits apply to

aggregate positions in futures and options combined, plus mini-sized contracts in the same commodity. There are

exemptions for bona fide hedging transactions involving commodity inventory hedges and anticipatory purchases or

sales of the commodity.

Position limits existed in the energy markets until 2001. The New York Mercantile Exchange (NYMEX), with

CFTC approval set and enforced position limits in the energy futures markets until 2001. The position limits applied to AMC,

single-month and spot-month. In 2001, NYMEX substituted accountability levels for AMC and single-month limits and set

position limits only in the spot month.

The Commodity Exchange Act directs the CFTC to act prospectively, as necessary, to curb or prevent

excessive speculation that may burden interstate commerce. The CFTC need not demonstrate that there has been

excessive speculation in the regulated derivatives markets for the major energy commodities.

The proposed rulemaking leverages the CFTC’s experience setting position limits in the

agriculture markets.

The energy position limits proposal uses the same “open interest” formula as the one used in CFTC

guidance to exchanges. The proposal uses the same formula for the AMC position limits. The approach to setting the

level of the spot-month limit in the physical delivery contract also is the same.

The proposed energy position limits build upon the agricultural limits in several ways. The proposed energy

limits would be responsive to the size of the market and administratively reset on an annual basis, rather than change only with

a Commission rulemaking.

The proposed energy limits differ from the agriculture markets by establishing aggregated position limits. These limits

aggregate positions: across physically-settled and cash-settled contracts; across reporting markets; and at the owner

level. Rules for agricultural products permit disaggregation for independently controlled positions.

Commodity Futures Trading Commission ♦ Office of Public Affairs ♦ 202-418-5080

The Commission proposal would set position limits on four referenced energy commodities.

The proposed limits would cover Henry Hub natural gas, light sweet crude oil (such as West Texas

Intermediate or WTI), New York Harbor No. 2 heating oil and New York Harbor gasoline blendstock.

The proposed rulemaking sets reasonable limits in the energy markets to prevent burdens that

could arise from excessive concentration in the futures and options markets.

The proposed speculative position limits are intended to limit the concentration of positions and promote

fair and orderly markets. The CFTC’s proposed framework is designed to facilitate trading activity that promotes the

pricing and risk management functions of the covered contracts, while prohibiting the concentration of large positions in the

accounts of one or a few traders.

The aggregate limits are set by formula based on open interest. The all-months-combined position limit would be

10 percent of the first 25,000 contracts of open interest and 2.5 percent of open interest beyond 25,000 contracts. The single-

month position limit is set at two thirds of the AMC position limit. The spot-month limit in the physical delivery contract is

25 percent of the estimated deliverable supply.

To promote competition, for a small reporting market, the AMC limit would be up to 30 percent of a

contract’s total open interest on that exchange. The single-month limit that would apply to a small exchange would

be equal to two thirds of that value – or as much as 20 percent – of the total open interest on that exchange. For new

reporting markets, a de minimis AMC limit would be the greater of 5,000 contracts or one percent of all open interest in a

referenced energy commodity contract.

A trader holding cash-settled contracts would be subject to a spot-month position limit of five times the

level fixed for the cash-settled contract’s physically-settled counterpart if the trader holds no physically-

settled contracts in the spot month. Otherwise, traders would be subject to the same limit fixed for a contract’s

physically-settled counterpart. Pursuant to recently adopted exchange rules, this is the same methodology for spot-month

speculative position limits that applies to cash-settled Henry Hub natural gas contracts on NYMEX and ICE, beginning with

the February 2010 contract months.

In addition to exempting bona fide hedgers from position limits, the proposed rule establishes a

consistent framework for certain swap dealer risk management exemptions.

The proposed rulemaking maintains exemptions for entities using the futures markets to hedge

commercial risks. Those traders, such as an airline purchasing futures contracts to hedge the cost of fuel, would qualify for

a bona fide hedging exemption from the proposed position limits.

The proposed rulemaking brings uniformity to swap dealer exemptions; exemptions would be consistent,

and the names of the exempted dealers would be publicly disclosed. Swap dealers establishing positions to offset

customer initiated swap positions could qualify for a limited risk management exemption for positions held outside the spot

month. The limited risk management exemption for swap dealers would be administered by the CFTC and capped at two

times an otherwise applicable proposed position limit (i.e., an AMC or single-month limit).

To qualify for a swap dealer risk management exemption, the dealer must file an exemption application and update

the application annually. The swap dealer also must provide monthly reports of their actual risk management needs

and maintain records that demonstrate their net risk management needs. The CFTC would publicly disclose the

names of swap dealers that have filed for an exemption after a six-month delay.

The CFTC’s proposal treats bona fide hedgers and swap dealers similarly to the practice of certain

exchanges that independently administer an agricultural speculative position limit framework. The

proposed regulations would count bona fide hedging transactions against a trader’s ability to hold speculative positions. For

example, a trader holding bona fide hedging positions greater than a proposed Federal speculative position limit would not be

able to simultaneously hold a speculative position. Further, a trader’s swap risk management position also would count against

a trader’s ability to hold speculative positions.

Commodity Futures Trading Commission ♦ Office of Public Affairs ♦ 202-418-5080

You might also like

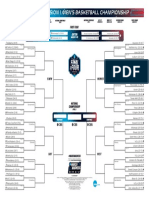

- Printable 2024 March Madness NCAA Men's Basketball Tournament BracketDocument1 pagePrintable 2024 March Madness NCAA Men's Basketball Tournament BracketHouston Chronicle100% (1)

- HISD 2023 School Accountability RatingsDocument10 pagesHISD 2023 School Accountability RatingsHouston ChronicleNo ratings yet

- Corporate Finance Theory and Practice 10th EditionDocument674 pagesCorporate Finance Theory and Practice 10th EditionrahafNo ratings yet

- PL Qa FinalDocument3 pagesPL Qa FinalMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument2 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- PL Factsheet FinalDocument2 pagesPL Factsheet FinalMarketsWikiNo ratings yet

- Futures Industry AssociationDocument23 pagesFutures Industry AssociationMarketsWikiNo ratings yet

- 26598MGEXDocument4 pages26598MGEXMarketsWikiNo ratings yet

- PL FactsheetDocument1 pagePL FactsheetMarketsWikiNo ratings yet

- Marcus StanleyDocument11 pagesMarcus StanleyMarketsWikiNo ratings yet

- 08.17.09 Gensler Senate LetterDocument33 pages08.17.09 Gensler Senate LetterbenprotessNo ratings yet

- Core Principles and Other Requirements For Designated Contract MarketsDocument15 pagesCore Principles and Other Requirements For Designated Contract MarketsMarketsWikiNo ratings yet

- STMTGensler Gary CFTC0Document12 pagesSTMTGensler Gary CFTC0MarketsWikiNo ratings yet

- LTR Factsheet FinalDocument1 pageLTR Factsheet FinalMarketsWikiNo ratings yet

- Chris YoungDocument61 pagesChris YoungMarketsWikiNo ratings yet

- Via Electronic SubmissionDocument15 pagesVia Electronic SubmissionMarketsWikiNo ratings yet

- CR FactsheetDocument2 pagesCR FactsheetMarketsWikiNo ratings yet

- Re: Blackrock Comments On Proposed Margin Requirements For Uncleared SwapsDocument5 pagesRe: Blackrock Comments On Proposed Margin Requirements For Uncleared SwapsMarketsWikiNo ratings yet

- Defs QaDocument3 pagesDefs QaMarketsWikiNo ratings yet

- Submitted Via Agency WebsiteDocument7 pagesSubmitted Via Agency WebsiteMarketsWikiNo ratings yet

- MSP Ecp Factsheet FinalDocument7 pagesMSP Ecp Factsheet FinalMarketsWikiNo ratings yet

- I. Summary of CommentsDocument5 pagesI. Summary of CommentsMarketsWikiNo ratings yet

- For Ex Final Rule FactsheetDocument2 pagesFor Ex Final Rule Factsheetkristash71No ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument4 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- Schiff Hardin Derivatives & Futures Update (May 2012)Document12 pagesSchiff Hardin Derivatives & Futures Update (May 2012)mfearonNo ratings yet

- Via Electronic Mail: Chief Executive OfficerDocument5 pagesVia Electronic Mail: Chief Executive OfficerMarketsWikiNo ratings yet

- Re: Aggregation of Positions For Position Limit Purposes: IA Lectronic SubmissionDocument8 pagesRe: Aggregation of Positions For Position Limit Purposes: IA Lectronic SubmissionMarketsWikiNo ratings yet

- SB FactsheetDocument2 pagesSB FactsheetMarketsWikiNo ratings yet

- C A S G F C R M: Ommittee On GricultureDocument12 pagesC A S G F C R M: Ommittee On GricultureJohn J. LothianNo ratings yet

- Stuart KaswellDocument12 pagesStuart KaswellMarketsWikiNo ratings yet

- MSP Ecp Qa FinalDocument6 pagesMSP Ecp Qa FinalMarketsWikiNo ratings yet

- Via Agency WebsiteDocument13 pagesVia Agency WebsiteMarketsWikiNo ratings yet

- Over-The-Counter Markets. Using These Principles As A Guide, The Association Seeks To Work With Congress, Regulators andDocument5 pagesOver-The-Counter Markets. Using These Principles As A Guide, The Association Seeks To Work With Congress, Regulators andMarketsWikiNo ratings yet

- By Electronic Mail (Rule-Comments@sec - Gov)Document21 pagesBy Electronic Mail (Rule-Comments@sec - Gov)MarketsWikiNo ratings yet

- Three Lafayette Centre 1155 21st Street, NW, Washington, DC 20581 Telephone: (202) 418-5000Document6 pagesThree Lafayette Centre 1155 21st Street, NW, Washington, DC 20581 Telephone: (202) 418-5000QUALITY12No ratings yet

- Joanne MederoDocument9 pagesJoanne MederoMarketsWikiNo ratings yet

- Block Factsheet FinalDocument2 pagesBlock Factsheet FinalMarketsWikiNo ratings yet

- 130 Grain Exchange Building 400 South 4th Street Minneapolis, MN 55415-1413 612.321.7169 Fax: 612.339.1155 Equal Opportunity EmployerDocument5 pages130 Grain Exchange Building 400 South 4th Street Minneapolis, MN 55415-1413 612.321.7169 Fax: 612.339.1155 Equal Opportunity EmployerMarketsWikiNo ratings yet

- Alch 59cookDocument3 pagesAlch 59cookVanessa AbhishekNo ratings yet

- Tara HairstonDocument6 pagesTara HairstonMarketsWikiNo ratings yet

- Via On-Line SubmissionDocument7 pagesVia On-Line SubmissionMarketsWikiNo ratings yet

- Clearing and Execution Release")Document17 pagesClearing and Execution Release")MarketsWikiNo ratings yet

- Impllementation Qa FinalDocument2 pagesImpllementation Qa FinalMarketsWikiNo ratings yet

- Via Agency WebsiteDocument9 pagesVia Agency WebsiteMarketsWikiNo ratings yet

- Federalregister 022411 BDocument38 pagesFederalregister 022411 BMarketsWikiNo ratings yet

- William HenleyDocument3 pagesWilliam HenleyMarketsWikiNo ratings yet

- Dealers") For Their Dealing Activities in Swaps and Security-Based Swaps (Collectively, "Swaps")Document6 pagesDealers") For Their Dealing Activities in Swaps and Security-Based Swaps (Collectively, "Swaps")MarketsWikiNo ratings yet

- Jiri KrolDocument5 pagesJiri KrolMarketsWikiNo ratings yet

- AN20171109-856 Mexican Energy Trading RegDocument8 pagesAN20171109-856 Mexican Energy Trading Regishika vishwasNo ratings yet

- Metlife: Re: Rin 3038 - Adt8 Core Principles and Other Requirements For Swap Execution FacilitiesDocument7 pagesMetlife: Re: Rin 3038 - Adt8 Core Principles and Other Requirements For Swap Execution FacilitiesMarketsWikiNo ratings yet

- Neal WolkoffDocument5 pagesNeal WolkoffMarketsWikiNo ratings yet

- Federal Register / Vol. 76, No. 182 / Tuesday, September 20, 2011 / Proposed RulesDocument12 pagesFederal Register / Vol. 76, No. 182 / Tuesday, September 20, 2011 / Proposed RulesMarketsWikiNo ratings yet

- Metlife 3Document5 pagesMetlife 3MarketsWikiNo ratings yet

- Proposed Rules: I. BackgroundDocument18 pagesProposed Rules: I. BackgroundMarketsWikiNo ratings yet

- By Commission Website: Futures Industry AssociationDocument6 pagesBy Commission Website: Futures Industry AssociationMarketsWikiNo ratings yet

- Layne CarlsonDocument2 pagesLayne CarlsonMarketsWikiNo ratings yet

- Via On-Line SubmissionDocument17 pagesVia On-Line SubmissionMarketsWikiNo ratings yet

- Adaptation of Regulations To Incorporate Swaps, RIN Number 3038-AD53Document4 pagesAdaptation of Regulations To Incorporate Swaps, RIN Number 3038-AD53MarketsWikiNo ratings yet

- MgexDocument8 pagesMgexMarketsWikiNo ratings yet

- Craig Do No HueDocument8 pagesCraig Do No HueMarketsWikiNo ratings yet

- Regulation On Over-the-Counter Derivatives and Market Infrastructures - Frequently Asked QuestionsDocument8 pagesRegulation On Over-the-Counter Derivatives and Market Infrastructures - Frequently Asked QuestionsdileepNo ratings yet

- MFA3Document8 pagesMFA3MarketsWikiNo ratings yet

- R4 Tee TimesDocument2 pagesR4 Tee TimesHouston ChronicleNo ratings yet

- NCAA Women's BracketDocument1 pageNCAA Women's BracketHouston Chronicle100% (1)

- Final Limited IEQ & Lead in Drinking Water Report-Various HISD Education FacilitiesDocument18 pagesFinal Limited IEQ & Lead in Drinking Water Report-Various HISD Education FacilitiesHouston ChronicleNo ratings yet

- Houston Astros 2024 Spring Training RosterDocument1 pageHouston Astros 2024 Spring Training RosterHouston Chronicle100% (1)

- 2024 2025 Proficiency Screening Teachers 20 Feb 2024Document31 pages2024 2025 Proficiency Screening Teachers 20 Feb 2024Houston ChronicleNo ratings yet

- 2023 Preseason All-Big 12 Football TeamDocument1 page2023 Preseason All-Big 12 Football TeamHouston ChronicleNo ratings yet

- Rachel Hooper InvoicesDocument35 pagesRachel Hooper InvoicesHouston ChronicleNo ratings yet

- Astroworld Tragedy Final Report (Redacted)Document1,266 pagesAstroworld Tragedy Final Report (Redacted)Houston ChronicleNo ratings yet

- Blacklock Dissent On Crane vs. McLaneDocument4 pagesBlacklock Dissent On Crane vs. McLaneHouston ChronicleNo ratings yet

- Media Release For Free and Reduced-Price MealsDocument2 pagesMedia Release For Free and Reduced-Price MealsHouston ChronicleNo ratings yet

- NFL Statement On Denzel PerrymanDocument1 pageNFL Statement On Denzel PerrymanHouston ChronicleNo ratings yet

- Ed Anderson TranscriptDocument53 pagesEd Anderson TranscriptHouston ChronicleNo ratings yet

- FB23 TDECU Stadium Pricing MapDocument1 pageFB23 TDECU Stadium Pricing MapHouston ChronicleNo ratings yet

- Houston Astros 2023 Spring Training ScheduleDocument1 pageHouston Astros 2023 Spring Training ScheduleHouston ChronicleNo ratings yet

- TDECU Stadium Pricing MapDocument1 pageTDECU Stadium Pricing MapHouston ChronicleNo ratings yet

- Hecht Dissent On Crane vs. McLaneDocument16 pagesHecht Dissent On Crane vs. McLaneHouston ChronicleNo ratings yet

- Davis EmailDocument3 pagesDavis EmailHouston ChronicleNo ratings yet

- 2023 NCAA Tournament BracketDocument1 page2023 NCAA Tournament BracketHouston Chronicle100% (1)

- Liberty Center's 2020 Tax ReturnDocument14 pagesLiberty Center's 2020 Tax ReturnHouston ChronicleNo ratings yet

- HISD Board of Managers ApplicantsDocument4 pagesHISD Board of Managers ApplicantsHouston Chronicle100% (1)

- Sally Yates Report To U.S. Soccer FederationDocument319 pagesSally Yates Report To U.S. Soccer FederationHouston ChronicleNo ratings yet

- Steven Hotze's 2022 DepositionDocument23 pagesSteven Hotze's 2022 DepositionHouston ChronicleNo ratings yet

- Davis Response To MintonDocument2 pagesDavis Response To MintonHouston ChronicleNo ratings yet

- Beard Notice of TerminationDocument1 pageBeard Notice of TerminationHouston ChronicleNo ratings yet

- Houston Astros Preliminary 2023 Spring Training RosterDocument1 pageHouston Astros Preliminary 2023 Spring Training RosterHouston ChronicleNo ratings yet

- Mark Stephens' 2020 Report On Voter Fraud InvestigationDocument84 pagesMark Stephens' 2020 Report On Voter Fraud InvestigationHouston ChronicleNo ratings yet

- Minton Letter To TexasDocument2 pagesMinton Letter To TexasHouston ChronicleNo ratings yet

- NBA Phoenix Suns/Robert Sarver ReportDocument43 pagesNBA Phoenix Suns/Robert Sarver ReportHouston ChronicleNo ratings yet

- Solved Rollo and Andrea Are Equal Owners of Gosney Company DuringDocument1 pageSolved Rollo and Andrea Are Equal Owners of Gosney Company DuringAnbu jaromiaNo ratings yet

- Prudential Bank vs. Don A. Alviar & Georgia B. AlviarDocument3 pagesPrudential Bank vs. Don A. Alviar & Georgia B. AlviarJenine QuiambaoNo ratings yet

- IDirect NCC ConvictionIdeaDocument8 pagesIDirect NCC ConvictionIdeaVivek GuptaNo ratings yet

- Foreign Exchange Management Act - WikipediaDocument29 pagesForeign Exchange Management Act - WikipediaMoon SandNo ratings yet

- Tally PracticeDocument16 pagesTally PracticeArko Banerjee100% (3)

- 1 Working CapitalDocument63 pages1 Working CapitalDeepika Mittal50% (2)

- This Study Resource Was: Philippine School of Business AdministrationDocument6 pagesThis Study Resource Was: Philippine School of Business AdministrationGab IgnacioNo ratings yet

- US Internal Revenue Service: Irb98-02Document44 pagesUS Internal Revenue Service: Irb98-02IRSNo ratings yet

- You Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalDocument28 pagesYou Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalSamima KhatunNo ratings yet

- HDFC Amc PDFDocument8 pagesHDFC Amc PDFRahul JaiswalNo ratings yet

- CH 08Document51 pagesCH 08Daniel NababanNo ratings yet

- 02 Financing Decisions - Leverages - Practice SheetDocument22 pages02 Financing Decisions - Leverages - Practice SheetPatrick LoboNo ratings yet

- Central Banking and Financial RegulationsDocument9 pagesCentral Banking and Financial RegulationsHasibul IslamNo ratings yet

- STAFF WELFARE SCHEME - 01012016-Latest-1-1 PDFDocument13 pagesSTAFF WELFARE SCHEME - 01012016-Latest-1-1 PDFArchana HarishankarNo ratings yet

- Pmec ChallanDocument1 pagePmec ChallanSubhendu BarisalNo ratings yet

- Unit 5 Iapm CapmDocument11 pagesUnit 5 Iapm Capmshubham JaiswalNo ratings yet

- Special Purpose Vehicle (SPV)Document10 pagesSpecial Purpose Vehicle (SPV)Daksh TayalNo ratings yet

- Tutorial - Chapter 11 - Monetary Policy - QuestionsDocument4 pagesTutorial - Chapter 11 - Monetary Policy - QuestionsNandiieNo ratings yet

- Chapter 10 - Risk Response Audit Strategy Approach and Program - NotesDocument9 pagesChapter 10 - Risk Response Audit Strategy Approach and Program - NotesSavy DhillonNo ratings yet

- NCDDP Af Sub-Manual - CBFM, Aug2021Document142 pagesNCDDP Af Sub-Manual - CBFM, Aug2021Michelle ValledorNo ratings yet

- Pifra Business Finance ProjectDocument17 pagesPifra Business Finance ProjectWaqas AhmedNo ratings yet

- Econ282 F11 PS5 AnswersDocument7 pagesEcon282 F11 PS5 AnswersVishesh GuptaNo ratings yet

- Fall FIN 254.10 Mid QuestionsDocument2 pagesFall FIN 254.10 Mid QuestionsShariar NehalNo ratings yet

- 1 Introduction To BankingDocument8 pages1 Introduction To BankingGurnihalNo ratings yet

- World Bank: Developing A Comprehensive Strategy To Access To Micro-FinanceDocument129 pagesWorld Bank: Developing A Comprehensive Strategy To Access To Micro-FinanceGiai CuNo ratings yet

- Modern BankingDocument15 pagesModern BankingRavi ChavdaNo ratings yet

- Jean Keating and Jack SmithDocument10 pagesJean Keating and Jack SmithStephen Monaghan100% (2)

- Problem 1-1 To 1-3 Intermediate Accounting (Vol 1)Document8 pagesProblem 1-1 To 1-3 Intermediate Accounting (Vol 1)Margarette TumbadoNo ratings yet