Professional Documents

Culture Documents

San Miguel Vs Kahn - Navarro

Uploaded by

Coco Navarro0 ratings0% found this document useful (0 votes)

160 views1 pageCorp Law Digest for San Miguel vs Kahn; Doctrine: Requisites for a Derivative Suit

Original Title

San Miguel vs Kahn - Navarro

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCorp Law Digest for San Miguel vs Kahn; Doctrine: Requisites for a Derivative Suit

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

160 views1 pageSan Miguel Vs Kahn - Navarro

Uploaded by

Coco NavarroCorp Law Digest for San Miguel vs Kahn; Doctrine: Requisites for a Derivative Suit

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

the assumption of the loan and not the assumption of the loan per

se.

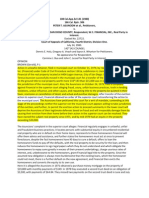

SAN MIGUEL v. KAHN

DOCTRINE:

3 requisites for a derivative suit:

5. He filed a derivative suit in behalf of SMC against 10 of the 15

members of the BOD.

a) party bringing suit should be a shareholder at the time of

the act/transaction complained of,

ISSUES:

b) he has exhausted intra-corporate remedies, i.e., has

made a demand on the board of directors for the appropriate

relief but the latter has failed or refused to heed his plea; and

Sub issues:

c) cause of action actually devolves on the corporation,

the ,wrongdoing or harm having been caused to the

corporation and not to .the particular stockholder bringing the

suit;

Whether or not de los Angeles can sue on behalf of SMC

Whether he has legal capacity to sue via a minority suit because a) PCGG merely imposed that he become a director; conflict of interest

issue

b) He holds only 20 shares and cannot adequately represent

HELD:

FACTS:

1.

Over 33 million shares of stock were owned by 14 different

corporations. Through its trustees and a subsidiary corporation

(Neptunia) who acquired loans for the purchase, SMC undertook to

buy the shares back.1

2. These shares were sequestered by the PCGG based on suspicion

that they were being held by Eduardo Cojuangco as dummy for the

Marcoses. This was later lifted after SMC made representations that

the owner corporations were owned by coconut farmers. Along with

the PCGG order however, SMC was forbidden to encumber any of

the shares of stock without PCGG authority.

3. SMC suspended payment of the instalments for the shares. The

seller corporations sued for rescission and damages. Nonetheless,

through a board resolution, SMC decided to assume the loans by

Neptunia (wholly owned by SMC).

4. This board resolution however was questioned by Eduardo de los

Angeles, a PCGG representative in the SMC board. He claimed that

what was resolved was the undertaking to assume further study for

1 This was how I understood the case in the simplest way I

could possibly summarize it

YES. (see doctrine)

YES:

a) While he seems to support PCGG position that shares are owned by

Marcoses, the current subject matter of this complaint is regarding

the assumption of Neptunia debt by SMC and nothing else, therefore

no conflict. Furthermore, he owned stocks in his own right and not

merely because of PCGG.

b) Bona fide ownership of stocks in his own right is enough to give a

stockholder standing to file a derivative suit. The law does not

support the argument that one needs to own a significant block of

stock as a requirement; number of shares is immaterial since he is

not suing in his own behalf but for the benefit of the corporation.

You might also like

- 92 - San Miguel Corporation v. KhanDocument1 page92 - San Miguel Corporation v. KhanJoshua RiveraNo ratings yet

- Corp - San Miguel Corp Vs Kahn Case DigestDocument3 pagesCorp - San Miguel Corp Vs Kahn Case DigestDyannah Alexa Marie RamachoNo ratings yet

- Case Digest From P 43 OnwardsDocument15 pagesCase Digest From P 43 OnwardsDiana DungaoNo ratings yet

- 25.quillopa vs. Quality Guards Services and Investigation AgencyDocument4 pages25.quillopa vs. Quality Guards Services and Investigation AgencyLord AumarNo ratings yet

- Gokongwei v. SEC DigestDocument8 pagesGokongwei v. SEC DigestJane Garcia-Comilang100% (1)

- National Labor Union Vs CIRDocument3 pagesNational Labor Union Vs CIRMartin RegalaNo ratings yet

- Secosa vs. FranciscoDocument2 pagesSecosa vs. FranciscoDNAANo ratings yet

- Collector v. FisherDocument1 pageCollector v. FisherMartin EspinosaNo ratings yet

- Assigned Labor CasesDocument9 pagesAssigned Labor CasesjingskyNo ratings yet

- The Great Eastern Life Insurance Co. vs. Hongkong & Shanghai Banking Corporation and Philippine National BankDocument2 pagesThe Great Eastern Life Insurance Co. vs. Hongkong & Shanghai Banking Corporation and Philippine National BankRobNo ratings yet

- Fabricator Phil v. EstolasDocument5 pagesFabricator Phil v. EstolasGilbertNo ratings yet

- 96 Franciso Vs GSISDocument2 pages96 Franciso Vs GSISJeric M. CuencaNo ratings yet

- Rural Bank of Salinas vs. CA (210 SCRA 510)Document1 pageRural Bank of Salinas vs. CA (210 SCRA 510)Rivera Meriem Grace MendezNo ratings yet

- Heirs of Medrano Vs de VeraDocument3 pagesHeirs of Medrano Vs de VeraAldrin TangNo ratings yet

- Miranda V Tarlac Rice MillDocument2 pagesMiranda V Tarlac Rice MillRoland OliquinoNo ratings yet

- Retirement - Salomon Vs Assoc of Intl Shipping LinesDocument1 pageRetirement - Salomon Vs Assoc of Intl Shipping LinesAlexis Ailex Villamor Jr.No ratings yet

- Divine Word High School Vs NLRCDocument3 pagesDivine Word High School Vs NLRCVince LeidoNo ratings yet

- Hager vs. BryanDocument2 pagesHager vs. Bryanmitsudayo_No ratings yet

- Vda de Torres v. EncarnacionDocument3 pagesVda de Torres v. EncarnacionCLark Barcelon100% (1)

- Corpo CasesDocument1 pageCorpo CasesHenry M. Macatuno Jr.No ratings yet

- 306 Reliance Surety V NLRCDocument2 pages306 Reliance Surety V NLRCAyesha Alonto MambuayNo ratings yet

- CMS Logging V CADocument2 pagesCMS Logging V CAKim EspinaNo ratings yet

- The Board of Directors and Election Committee of The SMB Workers Savings and Loan AssociationDocument1 pageThe Board of Directors and Election Committee of The SMB Workers Savings and Loan AssociationErikha AranetaNo ratings yet

- Corpo Finals OT 1Document5 pagesCorpo Finals OT 1Anonymous VQ4CjQBTeNo ratings yet

- 239 Atlantic Mutual Insurance Vs Cebu Stevedoring (Consing)Document1 page239 Atlantic Mutual Insurance Vs Cebu Stevedoring (Consing)Christine Ang CaminadeNo ratings yet

- Ever Electrician Manufacturing vs. Smahan NG Mga Manggagawa NG Ever ElectricianDocument20 pagesEver Electrician Manufacturing vs. Smahan NG Mga Manggagawa NG Ever ElectricianLea Angelica RiofloridoNo ratings yet

- 33 Zaragoza vs. Tan, 847 SCRA 437, G.R. No. 225544 December 4, 2017Document7 pages33 Zaragoza vs. Tan, 847 SCRA 437, G.R. No. 225544 December 4, 2017ekangNo ratings yet

- 1 MENDOZA v. PALDocument2 pages1 MENDOZA v. PALKathrine TingNo ratings yet

- Mirant Vs CaroDocument3 pagesMirant Vs CaroRowela Descallar100% (2)

- Asian Terminals Inc Vs VillanuevaDocument2 pagesAsian Terminals Inc Vs VillanuevaakosibatmanNo ratings yet

- Reynaldo Valdez vs. NLRC G.R. No. 125028, February 9, 1998 FactsDocument2 pagesReynaldo Valdez vs. NLRC G.R. No. 125028, February 9, 1998 FactsJing DalaganNo ratings yet

- Fuller v. KroghDocument1 pageFuller v. KroghkitakatttNo ratings yet

- Chiang Kai Shek School V CADocument2 pagesChiang Kai Shek School V CAAnonymous KPol14SZNo ratings yet

- 17 Lanuza Vs BF CorpDocument30 pages17 Lanuza Vs BF CorpJanine RegaladoNo ratings yet

- Jurisprudence On Authority of President On Behalf of CorporationDocument2 pagesJurisprudence On Authority of President On Behalf of CorporationAndres SoguilonNo ratings yet

- Guerrero - Corpo - Cagayan Fishing Development Co., Inc., vs. Teodoro SandikoDocument2 pagesGuerrero - Corpo - Cagayan Fishing Development Co., Inc., vs. Teodoro SandikoGillian GuerreroNo ratings yet

- Tan v. SEC (Jore)Document2 pagesTan v. SEC (Jore)mjpjoreNo ratings yet

- Labor1 Digest Part7Document113 pagesLabor1 Digest Part7cmv mendoza100% (1)

- Lowe Inc Vs CADocument2 pagesLowe Inc Vs CAsharmine_ruizNo ratings yet

- Deoferiovs. Intel Technology Philippines, IncDocument2 pagesDeoferiovs. Intel Technology Philippines, IncAnonymous 5MiN6I78I0No ratings yet

- University of The Philippines College of Law - Corporation Law - D2021Document1 pageUniversity of The Philippines College of Law - Corporation Law - D2021Maria AnalynNo ratings yet

- 38 - Ranara Vs NLRCDocument1 page38 - Ranara Vs NLRCJel LyNo ratings yet

- Ryuichi Yamamoto v. Nishino Leather IndustriesDocument4 pagesRyuichi Yamamoto v. Nishino Leather IndustriesbearzhugNo ratings yet

- 02 CFI of Rizal, Br. IX vs. Court of AppealsDocument8 pages02 CFI of Rizal, Br. IX vs. Court of AppealsATRNo ratings yet

- Asionics Philippines v. NLRCDocument4 pagesAsionics Philippines v. NLRCbearzhugNo ratings yet

- Republic Planters Bank Vs AganaDocument2 pagesRepublic Planters Bank Vs AganaLeica Jayme100% (1)

- ObananaDocument2 pagesObananamgenota100% (1)

- 2 - Marshall-Wells V ElserDocument2 pages2 - Marshall-Wells V ElserNicole PTNo ratings yet

- 2) Torres vs. Court of Appeals, G.R. No. 120138, 5 September 1997Document6 pages2) Torres vs. Court of Appeals, G.R. No. 120138, 5 September 1997SGOD HRDNo ratings yet

- Dreamland Vs JohnsonDocument13 pagesDreamland Vs JohnsonheymissrubyNo ratings yet

- Reflections On Delos Santos Vs McGrath CaseDocument2 pagesReflections On Delos Santos Vs McGrath CaseMiharu TachibanaNo ratings yet

- Philippine Airlines, Inc. v. NLRC, 225 SCRA 301 (1993)Document1 pagePhilippine Airlines, Inc. v. NLRC, 225 SCRA 301 (1993)astig79No ratings yet

- Confederation vs. NorielDocument6 pagesConfederation vs. NorielMichelleNo ratings yet

- Garcia V Lim Chu SingDocument1 pageGarcia V Lim Chu SingLykah HonraNo ratings yet

- Prince Transport, Inc. Vs Garcia, Et AlDocument1 pagePrince Transport, Inc. Vs Garcia, Et AlEl G. Se ChengNo ratings yet

- National Exchange Vs IB DexterDocument2 pagesNational Exchange Vs IB DexterdarklingNo ratings yet

- San Miguel vs. Khan (Valera)Document2 pagesSan Miguel vs. Khan (Valera)ASGarcia24No ratings yet

- SMC Vs KhanDocument2 pagesSMC Vs KhanRy ChanNo ratings yet

- Albert v. University Publishing CoDocument6 pagesAlbert v. University Publishing CoGrace AvellanoNo ratings yet

- 2 - Lim Tay v. CADocument18 pages2 - Lim Tay v. CAQuennie DisturaNo ratings yet

- National Tractor Pullers Association v. Watkins DigestDocument2 pagesNational Tractor Pullers Association v. Watkins DigestCoco Navarro100% (2)

- Lowell Vs Lewis Case BriefDocument3 pagesLowell Vs Lewis Case BriefCoco NavarroNo ratings yet

- Iron Grip Barbell Vs USA Sports IncDocument4 pagesIron Grip Barbell Vs USA Sports IncCoco NavarroNo ratings yet

- Orthokinetics Inc. Vs Safety Travel Chairs: 806 F.2d 1565 (Fed. Cir. 1986)Document2 pagesOrthokinetics Inc. Vs Safety Travel Chairs: 806 F.2d 1565 (Fed. Cir. 1986)Coco NavarroNo ratings yet

- Dominancy Vs Holistic Test: Legal Timeline in The PhilippinesDocument10 pagesDominancy Vs Holistic Test: Legal Timeline in The PhilippinesCoco NavarroNo ratings yet

- Cagayan de Oro City Landless Residents V Court of Appeals (d2017)Document1 pageCagayan de Oro City Landless Residents V Court of Appeals (d2017)Coco NavarroNo ratings yet

- Encarnacion V Amigo DigestDocument2 pagesEncarnacion V Amigo DigestCoco Navarro100% (2)

- Benefits of An Inquisitorial SystemDocument2 pagesBenefits of An Inquisitorial SystemCoco Navarro100% (7)

- Criminal Law DigestsDocument15 pagesCriminal Law DigestsCoco Navarro100% (1)

- Tan Vs CA (& Singson) 1989: Article 1990-1192 (Resolutory Condition, Remedies, Effects Of, Offset Equitably)Document1 pageTan Vs CA (& Singson) 1989: Article 1990-1192 (Resolutory Condition, Remedies, Effects Of, Offset Equitably)Coco NavarroNo ratings yet

- Estrada Vs Escritor Case Digest - NavarroDocument1 pageEstrada Vs Escritor Case Digest - NavarroCoco Navarro100% (1)

- Tan Vs CADocument2 pagesTan Vs CACoco NavarroNo ratings yet

- Criminal Law Case Digests - NavarroDocument15 pagesCriminal Law Case Digests - NavarroCoco NavarroNo ratings yet

- Tank (Contrary To Its Title, It Was A Product of Pure Artistic Genius) But It Was AlsoDocument2 pagesTank (Contrary To Its Title, It Was A Product of Pure Artistic Genius) But It Was AlsoCoco NavarroNo ratings yet

- Hand Out 1 Practice SetDocument6 pagesHand Out 1 Practice SetLayka ResorezNo ratings yet

- Francisco Vs MejiaDocument11 pagesFrancisco Vs MejiaLeomar Despi LadongaNo ratings yet

- Pre 27 SampleDocument3 pagesPre 27 SampleDesmond ValerieNo ratings yet

- 360 Contract 1Document15 pages360 Contract 1Digital Music News100% (7)

- TortsDocument16 pagesTortsShyaambhavi NsNo ratings yet

- Civil Law Bar Examination 2010-2019Document124 pagesCivil Law Bar Examination 2010-2019Justine SisonNo ratings yet

- Company Law AssignmentDocument14 pagesCompany Law AssignmentMohammad IrfanNo ratings yet

- BG GuidelinesDocument1 pageBG GuidelinesPHPL VijayawadaNo ratings yet

- DEED OF SALE BernardinoDocument3 pagesDEED OF SALE BernardinoLegal Office BulacanNo ratings yet

- Poliand V NDCDocument3 pagesPoliand V NDCFrancis Xavier SinonNo ratings yet

- MCQ's On IPR - 4Document3 pagesMCQ's On IPR - 4Anubha Kabra100% (1)

- Esign of Lated Tructures: Darko Beg Ulrike Kuhlmann Laurence Davaine Benjamin BraunDocument0 pagesEsign of Lated Tructures: Darko Beg Ulrike Kuhlmann Laurence Davaine Benjamin BraunwearplayNo ratings yet

- Web Site Design ContractDocument5 pagesWeb Site Design ContractTonya 'Cheffy' MorrisNo ratings yet

- 087-Padgett vs. Babcock & Templeton, Inc. 59 Phil 232Document2 pages087-Padgett vs. Babcock & Templeton, Inc. 59 Phil 232wewNo ratings yet

- Hda PDFDocument11 pagesHda PDFJonathan ChongNo ratings yet

- 08 Great Asian V CADocument4 pages08 Great Asian V CANicole KalingkingNo ratings yet

- (Sales) Roque Vs AguadoDocument3 pages(Sales) Roque Vs AguadoWendell Leigh OasanNo ratings yet

- Athlete WaiverDocument1 pageAthlete WaiverRonan MurphyNo ratings yet

- Baritua v. CA DigestDocument2 pagesBaritua v. CA DigestAnit Emerson100% (1)

- Partnership FormationDocument41 pagesPartnership Formationillustra7No ratings yet

- Project Topic For Family law-II-FINAL 2019-20Document5 pagesProject Topic For Family law-II-FINAL 2019-20Naveen PandeyNo ratings yet

- Registered Agent & Trustee Licensing Act Chapter 105 of The Revised Laws of Saint Vincent and The Grenadines, 2009Document21 pagesRegistered Agent & Trustee Licensing Act Chapter 105 of The Revised Laws of Saint Vincent and The Grenadines, 2009Logan's LtdNo ratings yet

- LABOR LAW REVIEW FLJ Codal-3Document212 pagesLABOR LAW REVIEW FLJ Codal-3Anonymous 2sd4G2RwNo ratings yet

- Demand Letter - Refund Security DepositDocument2 pagesDemand Letter - Refund Security DepositRaysun Arellano100% (1)

- HW 2 11-15Document5 pagesHW 2 11-15Tey TorrenteNo ratings yet

- Artist Management ContractDocument9 pagesArtist Management ContractPatrick Diamitani100% (1)

- Lease DeedDocument5 pagesLease DeedPreethi SureshNo ratings yet

- Amadora vs. Court of AppealsDocument4 pagesAmadora vs. Court of AppealsAmber Anca100% (1)

- TWO IMPORTANT APPEAL DECISIONS FOR CALIFORNIANS IN UD - Ascuncion V Superior Court of San Diego 1980 & THE MEHR DECISIONDocument9 pagesTWO IMPORTANT APPEAL DECISIONS FOR CALIFORNIANS IN UD - Ascuncion V Superior Court of San Diego 1980 & THE MEHR DECISION83jjmack100% (3)

- Section 51-59 of PD 1529Document4 pagesSection 51-59 of PD 1529Manu SalaNo ratings yet