Professional Documents

Culture Documents

A Study On Cost and Cost Techniques at Reid Braids India - Hassan

Uploaded by

SureshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On Cost and Cost Techniques at Reid Braids India - Hassan

Uploaded by

SureshCopyright:

Available Formats

COST AND COST TECHNIQUES

1. INDUSTRY PROFILE

TEXTILE INDUSTRY INTRODUCTION

The textile industry is undergoing a major reorientation towards non-clothing

applications of textiles, known as technical textiles, which are growing roughly at twice

rate of textiles for clothing applications and now account for more than half of total textile

production. The processes involved in producing technical textiles require expensive

equipment and skilled workers and are, for the moment, concentrated in developed

countries. Technical textiles have many applications including bed sheets; filtration and

abrasive materials; furniture and healthcare upholstery; thermal protection and bloodabsorbing materials; seatbelts; adhesive tape, and multiple other specialized products and

applications. The Indian Textile industry has been undergoing a rapid transformation and is

in the process of integrating with the world textile trade and industry. This change is being

driven by the progressive dismantling of the MFA and the imperative of the recently signed

General Agreement Trade & Tariff. In this bold, new scenario, India has to move beyond its

role of being a mere quota satisfying country.

HISTORY

The term 'Textile' is aLatin word originating from the word 'texere' which means 'to

weave The history of textile is almost as old as that of human civilization. In India the

culture of silk was introduced in 400AD. Modern textile industry took birth in India in the

early nineteenth century the first cotton textile mill of Bombay was established in1854

during the year 1900 the cotton textile industry was in bad stateafter independence, the

cotton textile industry made rapid strides under the plans.

VVIMS- MBA Department, Mysore

COST AND COST TECHNIQUES

GLOBAL SCENARIO

According to statistics, the global textile market is worth of more than $400 billion

at present. In more liberalized environment, the industry is facing competition as well as

opportunities. It is predicted that Global textile production will grow up to 25% by the year

2010 and 50% by 2014. The world industry has gone into a phase of transformation since

the elimination of quota in the year 2005. Many new competitors as well as consumers have

entered the global market with their immense capabilities and the desire to grow.

It is expected that China will represent around 45% of global trade by 2010. In spite

of its significant growth trend, China's rising costs and perceived risks are creating more

opportunities for other low cost countries.

It is also expected that India will represent around 20% of global trade by 2010.

India is rapidly expanding its role with new capacity build-up in management control

of textile trades through vertical integration. Vertically integrated companies are organized

in a hierarchy and share a common owner. Usually each member of the hierarchy produces

a different product or service. The products are combined to achieve a common goal. The

advantage of vertical integration is that it avoids the hold-up problem.

Pakistan, Vietnam, Cambodia and Bangladesh are relying on their low

manufacturing costs due to cheap labor available there. Thus, they are building up more

capacity in textile manufacturing

THE INDUSTRY PROFILE IN INDIA

The Textile industry in India traditionally, after agriculture, is the only industry that

has generated huge employment for both skilled and unskilled labor in textiles. The textile

industry continues to be the second largest employment generating sector in India. It offers

direct employment to over 35 million in the country. India is the second producer but India

will lead in all. According to the Ministry of Textiles, the sector contributes about 14% to

industrial production, 4% to the country's gross domestic product (GDP) and 17% to the

country's export earnings. The share of textiles in total exports was 11.04% during April

July 2010, as per the Ministry of Textiles. It is estimated that India would increase its textile

and apparel share in the world trade to 8% from the current level of 4.5% and reach US$80

VVIMS- MBA Department, Mysore

COST AND COST TECHNIQUES

billion by 2020. During 2009-2010, Indian textiles industry was pegged at US$55 billion,

64% of which services domestic demand.

India textile industry is one of the leading in the world. Currently it is estimated to

be around US$52 billion and is also projected to be around US$115 billion by the year

2012. The current domestic market of textile in India is expected to be increased to US$60

billion by 2012 from the current US$ 34.6 billion. The textile export of the country was

around US$19.14 billion in 2006-07, which saw a stiff rise to reach US$22.13 in 2007-08.

The share of exports is also expected to increase from 4% to 7% within 2012. Following

are area, production and productivity of cotton in India during the last six decades.

Indian Textile Industry has Some Inherent Strength:

1. Tradition in Textiles and long operating experience

2. Large and growing domestic market

3. Strong raw material base

4. Production across entire textile value chain

5. Stable, low-risk economy, safe for business growth

6. Easy availability of abundant raw materials like cotton, wool, silk, jute

7. Widely prevalent social customs

8. Variety of distinct local culture

9. Constructive geographic and climatic conditions

VVIMS- MBA Department, Mysore

COST AND COST TECHNIQUES

CURRENT FACTS OF INDIAN TEXTILE INDUSTRY

1. Indian Textile sector grew by more than 5% in the last two fiscal years and is

projected to grow at 16% by 2012.

2. Being the second largest employer of Indians after agriculture, it currently employs

88 million people and is expected to generate another 17 million jobs by 2012.

3. The gross value is the third largest of textile to both USA and Europe and exports

grow by 24% in last fiscal year.

4. They are likely to grow by 25% in the next 5 years increasing the Indian Textile

Industrys share in world textile market from 3% to 7%.

5. Thus, the facts and figures speak for the prospects and potentials of Textile Industry.

However the textile sector is still in a nascent stage for the world market.

6. India retained its position as worlds second highest cotton producer.

MAJOR PLAYERS IN INDIA

1.

2.

3.

4.

5.

6.

7.

8.

9.

Bombay Dyeing

Fabindia

Grasim Industries

JCT Limited

Lakshmi Mills

Mysore Silk Factory

Arvind Mills

Raymonds

Reliance Textiles

VVIMS- MBA Department, Mysore

COST AND COST TECHNIQUES

CURRENT SCENARIO

India earns about 27% of its total foreign exchange through textile exports, which

plays major role in the economy of the country. Indian textile industry largely depends upon

the textile manufacturing and export. India is the world's 2nd largest cotton producing

country, after China.

The prices of Cotton Hank Yarn decreased by 26.1% and Cone yarn by 20.9% in

Jan.2012 in comparison to the prices of January.2011.The current prices of PSF decreased

by 2.6% and PFY (126 D) increased by 1.3% as compared to the prices of

January.2011.The prices of Textures yarn decreased by 3.1% as compared to January.2011.

The prices of imported merino wool are increased by 63.1 % during the same period.

There is no limit on foreign direct investment in the textile industry and hence 100%

direct investment can be done by the foreign capitalists in the Indian textile industry.

Foreign Investments done in the Indian Textile Industry through the automatic route offers

a hassle-free way of investing. These investments are not required to be approved by the

government or the apex bank of India, RBI. Still the sector is not attracting much and the

FDI has seen almost remained constant, but the future still looks bright as India has good

scope of becoming the global textile and apparel sourcing center in future.

VVIMS- MBA Department, Mysore

COST AND COST TECHNIQUES

FUTURE SCENARIO

The textile industry in India is substantial, and largely diversified. The Indian textile

industry roots thousands of years back. After, the European industry insurrection, Indian

textile sector also witnessed considerable development in industrial aspects. Textile

industry plays an important role in the terms of revenue generation in Indian economy. The

significance of the textile industry is also due to its contribution in the industrial

production, employment. Currently, it is the second largest employment provider after

agriculture and provides employment to more than 30mn people.

Considering the continual capital investments in the textile industry, the Govt. of

India may extend the Technology Upgradation Fund Scheme (TUFS) by the end of the 11th

Five Year Plan (till 2011-2012), in order to support the industry. Indian textile industry is

massively investing to meet the targeted output of $85bn by the end of 2010, aiming

exports of $50bn. There is huge development foreseen in Indian textile exports from the

$17bn attained in 2005-06 to $50bn by 2009-10. The estimation for the exports in the

current financial year is about $19bn. There is substantial potential in Indian exports of

technical textiles and home-textiles, as most European companies want to set up facilities

near-by the emerging markets, such as China and India.

The global demand for apparel and woven textiles is likely to grow by 25 percent by

year 2010 to over 35mn tons, and Asia will be responsible for 85 percent output of this

growth. The woven products output will also rise in Central and Southern American

countries, however, at a reasonable speed. On the other hand, in major developed countries,

the output of woven products will remain stable. Weaving process is conducted to make

fabrics for a broad range of clothing assortment, including shirts, jeans, sportswear, skirts,

dresses, protective clothing etc., and also used in non-apparel uses like technical,

automotive, medical, etc...

It is been forecasted that the woven textile and apparel markets will sustain their

growth from current till 2010. The imports of apparel and textiles will rise from developed

VVIMS- MBA Department, Mysore

COST AND COST TECHNIQUES

Economies like the USA and the western countries of Europe and Japan, along with

some newly emerged economies, such as South Korea and Taiwan. Certainly, import

growth has been witnessed vertical rise in the previous year.

Apparel is the most preferred and important of all the other applications. Woven

fabrics are widely used in apparel assortments, including innerwear, outerwear, nightwear

and underwear, as well as in specialized apparels like protective clothing and sportswear.

Home textile also contributes considerably in woven fabric in products assortments like

curtains, furnishing fabrics, carpets, table cloths etc.

Special kind of woven fabrics are utilized in medical as well as industrial

applications. The medical applications include adhesives, dressing bandages, plasters etc.

Non-woven sector has great future in terms of global demand, thus major facilities

of cotton yarn are currently concentrating just on home textiles. It is mandatory, that the

peak management of the cotton yarn manufacturers analyze the future prospect and

growing graph of demand for non-woven products.

Anticipating massive growth in medical and automobile sectors, these sectors

assures substantial demand for non-woven facilities in India. Albeit, home textiles also will

lure higher demand, there are specific demands for home textile facilities also.

VVIMS- MBA Department, Mysore

COST AND COST TECHNIQUES

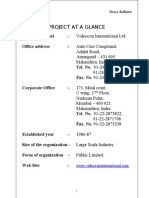

2. COMPANY PROFILE

2(a)BACKGROUND AND INCEPTION OF THE COMPANY

Reid Braids India (RBI) was incorporated in the year 2007. It is headed by Mr.

Rahul Sankhla Managing Director of Reid Braids India. The promoter of the company is

Mr. Rahul Sankhla. The unit is located at prime location in SEZ Textile Zone, H N Pura

Road, and Hassan. It is a medium scale industry carried out by two partners Rahul Sankhla

and Nitu Sankhla.

The founder Mr. Rahul Sankhla is a Director of four other companies namely. KTG

stores, KTG Enterprises Pvt Ltd, Sankhla Polymers and Shree Ji. These companies cater to

the Reid Braids India.

The management is having decades of experience in fabric production and quality

line which makes the company more reliable in terms of quality and delivery It has good

fabric source in strength to satisfy customer requirements as management as a working

experience of industry from end to end of retailing .

2(b)NATURE OF BUSINESS CARRIED

Reid Braids India (RBI) is the biggest Narrow Fabric manufacturing company in

India. It manufactures Trims for Garment industries, Shoelaces for Shoe Industries & Retail

products for its clients. Its products cater the requirements of households as well as

individual needs and ensure high quality.

VVIMS- MBA Department, Mysore

COST AND COST TECHNIQUES

2(c)VISION MISSION AND QUALITY POLICY

VISION

1. Our vision is to be the best Narrow Fabric Company in the world and we are

willing to work hard to achieve our goals.

2. We believe in creating new products, updating our technology and keep working

with positive attitude.

3. RBI is working hard as a Team to become a World Class Company with Innovative

Products

MISSION

1. To conduct our business activities in a professional and ethical manner at all times,

abiding with allapplicable safety, environmental and government legislated

regulations.

2. To share in the success of our customers by providing them with quality products

with economic advantages, while providing a fair return on the investment of our

shareholders.

3. To continually innovate within our company in order to improve operational

procedures, our products, and the working environment for our employees.

QUALITY POLICY

1. Supplying fabrics sand services which conform to all relevant performance and

certification requirements.

2. Delivering on-time and keeping promising lead-times.

3. Providing robust and professional customer support systems - responding

quickly and accurately to issues through our Technical Helpdesk Service.

4. Demonstrating class-leading innovation and Continuous Improvement in

products and services.

5. Compliance with all regulatory requirements of the ISO 9001 quality system

6. Developing and review our quality objective in line with the company Business

Plan and our Customer requirements - our target is to achieve zero defects.

VVIMS- MBA Department, Mysore

COST AND COST TECHNIQUES

We inspect our products for:

1.

2.

3.

4.

5.

6.

7.

Denier

Linear density

Breaking strength

Weight

Length

UV testing

Color shade

2(d) PRODUCT PROFILE

1. Wax coated shoe laces

2. Sports shoe laces

3. Round shoe laces

4. Draw cords

5. Nylon ropes

6. Kevlar ropes

7. Polypropylene ropes

8. Bungee cords

9. Knitted elastics

10. Ribbed elastics

11. Woven elastics

12. Cotton twill tapes

13. Satin ribbons

14. Nylon webbing

15. Polyester webbing

16. Covered rubber

VVIMS- MBA Department, Mysore

10

COST AND COST TECHNIQUES

2(e) AREA OF OPERATION GLOBAL/NATIONAL/REGIONAL

Reid braids India (RBI) has entered into global market. It exports finished product

to Australia, USA, and Sri Lanka.

2(f) OWNERSHIP PATTERN

Type: Partnership Firm

Nature of the industrial undertaking: Medium Scale

Partners/ Directors: Rahul Sankhla

Nitu Sankhla

Managing Director: Rahul Sankhla

2(g) COMPETITORS INFORMATION

1. M/S Balaji elastic Bangalore

2. M/S Jain narrow fabric New Delhi

3. M/S Modilal fabrics Kanpur

CUSTOMERS

1.

2.

3.

4.

5.

6.

7.

Birch Haberdashery and craft Australia

IX International USA

Himatsingka seide ltd India

Gokaldas Exports Ltd India

Karthik Exports Sri Lanka

Pony Needle India

Karle International India

VVIMS- MBA Department, Mysore

11

COST AND COST TECHNIQUES

2(h) INFRASTRUCTURAL FACILITY

SITTING FACILITIES

In the production department, workers have to stand for long hours while working.

Therefore the company provides sitting facilities. Reid braids India (RBI) have set up rest

rooms for employees. The working hours are fixed inReid braids India (RBI).

DRINKING WATER

The Factory Act, 1948 lies down that there should be drinking water near the place

of work. Reid braids India (RBI) has its,own water wells for drinking purposes. The company

provides fresh, healthy drinking water near the place so that the workers may feel fresh and

need not go to the canteen for drinking water. Company also provides cold water facilities

within the factory itself.

SAFETY

The important factor while handling the machinery, tools and

equipments is the

safety of workers. The company provides the worker, proper training program regarding the

use of safety apartments. The accidents problems are low in Reid braids India (RBI) because

of this training program of handling machines. If any accidents occur, the company bears

the hospital expenses.

CANTEEN FACILITY

It provides canteen facility within the factory itself. Contractor

Runs a canteen and charges half rate for food stuffs provided by them. The coupons are

supplied to all workers.

2(i)ACHEIVMENTS AND AWARDS

1. Best supplier award- 2009

2. Best entrepreneur- 2011

3. India manufacturing show 2010

VVIMS- MBA Department, Mysore

12

COST AND COST TECHNIQUES

2(j)WORKFLOW MODEL

RW

K

nai

iwn

td

tMi

ian

ntg

ge

r

ii

a

l

s

2(k)FUTURE GROWTH AND PROSPECTUS

1. Establishing new unit

2. To expand the unit to a large unit

3. To install new technology to accept the global challenges.

VVIMS- MBA Department, Mysore

13

COST AND COST TECHNIQUES

3. MCKINSEYS 7SFRAMEWORK

Origin of the 7s framework:

The 7s framework of McKinsey's is a management model that describes 7 factors to

organize a company in a holistic and effective way. Together these factors determine the

way in which a corporation operates. Management should take into account all 7 of these

factors to be sure of successful implementation of a strategy for large or small organization.

Benefits of McKinseys 7sModel:

1.

2.

3.

4.

Diagnostic tool for understanding organizations that is ineffective.

Guides organizational change

Combines rational and hard elements with emotional and soft elements..

Managers must act as all S's in parallel and all S's are interrelated.

MC KINSEY'S 7s MODEL

}

}

Hard S

Soft S

VVIMS- MBA Department, Mysore

14

COST AND COST TECHNIQUES

3.1 STRUCTURE

The way in which the organizations units relate to each other is called as structure.

Organization structure and authority and responsibility relationship are included in the

structure. There are many functional departments in RBI headed by department of general

manager. Organization structure mainly explains how the authority and responsibility flows

from the top to the bottom.

SMAF ai d na l m rna k ua i negf tai isn c n t tg r

geuanD s,trc i ier o n e n gc t o r

3.2 STRATEGY

Strategy is the plan of action an organization prepares in response to, or anticipation of,

changes in its external environment. Strategy is differentiated by tactics or operational

actions by its nature of being premeditated, well thought through and often practically

rehearsed.

1. The maximum expansion to untapped geographical areas

2. Improvement in the existing products.

3. Attain utmost customer satisfaction in order to attain a respectable position

4. Introduction of cost effective substitutes

VVIMS- MBA Department, Mysore

15

COST AND COST TECHNIQUES

VVIMS- MBA Department, Mysore

16

COST AND COST TECHNIQUES

3.3 SYSTEM

Every organization has some systems or internal processes to support and

implement the strategy and run day-to-day affairs. Traditionally the organizations have

been following a bureaucratic-style process model where most decisions are taken at the

higher management level and there are various and sometimes unnecessary requirements

for a specific decision to be taken.

The company uses the Management information system in order to maintain

accounts.

3.4 SKILL

Skill refers to the fact that employees have the skills needed to carry out companys

strategy, training and development - ensuring people know how to do their jobs and stay

up-to date with the latest techniques and technology.

Basic/General skills:

1. Knowledge about quality, environmental policies and occupational health and

safety.

2. Knowledge of housekeeping practices.

3. Knowledge of first aid and fire emergency plan.

Behavioral skills:

1. Planning ability and execution efficiency

2. Creativity, innovation and initiative

3. Discipline and commitment.

3.5 STYLE

All organizations have their own distinct culture and management style. It includes

the dominant values, beliefs and norms which develop over time and become relatively

enduring features of the organizational life. It also entails the way managers interact with

the employees and the way they spend their time.

VVIMS- MBA Department, Mysore

17

COST AND COST TECHNIQUES

Top Down:

1. General Managers address all executives at least twice a year to Share Companys

vision, mission, values, policy and strategies, business scenario, performance and

companys overall perspective.

2. Divisional/Department heads meet all employees at least once in a month to share

common issues of interest and concern.

Authoritarian:

The company follows Benevolent Authoritative style of leadership. There is usually down

flow of communication and the BOD alone determines policies and makes plans.

Thus, this style of functioning increases the efficiency, saves time and gives quick result in

emergency situation.

3.6 STAFF

Organizations are made up of humans and it's the people who make the real

difference to the success of the organization in the increasingly knowledge-based society.

The importance of human resources has thus got the central position in the strategy of the

organization, away from the traditional model of capital and land.

Managing director:

He manages all the company's administration activities and gives all types of

information regarding product, price, promotion and sales. He makes decisions regarding

avoidance of wastage and losses arising in the company.

General Manager of finance and administration:

They look after financial and administration issues of the company and place

control over activities of the senior finance manager and administration staff.

Senior Manager of finance:

He looks after the accounts of the company and maintains books of accounts

containing profit and losses, balance sheet etc.

VVIMS- MBA Department, Mysore

18

COST AND COST TECHNIQUES

VVIMS- MBA Department, Mysore

19

COST AND COST TECHNIQUES

The staffs of the company are:

Category

Men

Women

Total

No. Of employees

100

200

300

There are Skilled as well as unskilled employees:

Skilled

Unskilled

Total

120

180

300

3.7 SHARED VALUES

Shared Values of an organization refers to a set of values and aspiration that goes

beyond the conventional, formal statement of corporate observes. Shared values are the

fundamental ideas around which business is built, in RBI employees share the same guiding

values and responsibilities for particular tasks provided to them.

Customer focus

1. Delivering customer satisfaction by listening to and exceeding customer

expectations

2. Adding value for our customers through our services

3. Seeking innovative solutions to help our customers achieve their goals.

4. Competences and Team Spirit

5. Employing a team of talented and competent staff

6. Investing in training and creating good career opportunities

7. Recognizing and encouraging outstanding performance.

8. Integrity

9. Behaving ethically in all our business and financial activities

10. Demonstrating respect towards our customers and our staff

11. Operating responsible environmental policies.

4. SWOT ANALYSIS

INTRODUCTION

VVIMS- MBA Department, Mysore

20

COST AND COST TECHNIQUES

The SWOT analysis tool is great for developing an understanding of an organization

or situation and decision-making for all sorts of situations in business, organizations and for

individuals.

The SWOT analysis headings provide a good framework for reviewing strategy,

position and direction of a company, product, project or person (career).

Doing a SWOT analysis can be very simple, however its strengths lie in its flexibility and

experienced application.

Aim of a SWOT Analysis:

1. Reveal your competitive advantages

2. Analyze your prospects for sales, profitability and product development

3. Prepare your company for problems

4. Allow for the development of contingency plans

VVIMS- MBA Department, Mysore

21

COST AND COST TECHNIQUES

STRENGTHS

1.

2.

3.

4.

5.

6.

7.

8.

Continuous production and continuous process in all departments.

Availability of labor at low cost

Automated quality control and production units

Support and encouragement by the management

Competitive and enough supplier base - raw materials

Recent government efforts to promote the industry

High quality products with lower cost

High motivated work force

9. Better time management

WEAKNESSES

1. Company not having promotional measure.

2. Slow in decision making

3. Lack of flexibility in the system

4. Cost of production is high

5. The machineries in the Production Department are outdated. Therefore, it leads to

low and poor production

6. Training and development programs for employees cost high and implementation

of the programs takes more time

7. Labor turnover rate is high.

VVIMS- MBA Department, Mysore

22

COST AND COST TECHNIQUES

OPPORTUNITIES

1. Integrated computerization will result in better systems management/ efficiency

level and better customer satisfaction

2. Huge demand for value added goods in all major countries.

3. Large and relatively untapped domestic market

4. An opportunity to deal with international clients and handle high end projects

5. An opportunity to take up new venture in other fields

THREATS

1. Resistance to change

2. The export-import policy of India changes too frequently due to which it becomes

very difficult for importers to import goods

3. Availability of duplicate products

4. High competition in domestic market

5. Fast changing market condition.

6. High competition by capital rich MNCs

7. Frequent changes of global competitors

VVIMS- MBA Department, Mysore

23

COST AND COST TECHNIQUES

5. ANALYSIS OF FINANCIAL STATEMENT

The focus of financial analysis is on key figures in the financial statements and the

significant relationship that exists between them. The analysis of financial statements is a

process of evaluating the relationship between component parts of financial statements to

obtain a better understanding of the firm's position and performance.

Finance is the foundation stone of every business firm in the present day setup. No

business can be started without adequate finance nor can it be developed. The success of

every business depends upon adequate source of finance.

The methodology adopted for the Analysis of financial statement may vary from

one situation to another. However, the following are some of the common techniques of the

Analysis of financial statement:

1. Comparative financial statements

2. Common-size financial statements

3. Trend percentage analysis, and

4. Ratio analysis.

The last technique, i.e., Ratio analysis is the most common, comprehensive and

powerful tool of the Analysis of financial statement. An attempt has been made here to

know the financial performance on the basis of Ratio Analysis. The analysis of financial

statements is, thus, an important aid to financial analysis.

RATIO ANALYSIS

The ratio analysis is one of the tools of financial analysis. It is the process of

establishing and interpreting various ratios quantitative relationship between figure and

group of figures. It is with the help of ratios that the financial statements can be analyzed

more clearly and decision can be made from such analysis.

VVIMS- MBA Department, Mysore

24

COST AND COST TECHNIQUES

Liquidity Ratio:

The term liquidity refers to the ability of a firm to pay its short term obligation of as

and when they become due. Liquidity ratio measures the ability of the firm to meet its

current obligations (liabilities). It is extremely essential for a firm to be able to meet its

obligations as they become due. Short term creditor's main interest is in the liquidity

position or the short term solvency of the firm.

The most common ratios which indicate the extent of liquidity are:

1. Current Ratio

2. Quick Ratio

1. Current Ratio:

Current ratio is the ratio which explains the relationship between current assets. and

current liabilities. Current ratio can be expressed as follows

Current Ratio =

Current Assets

Current Liabilities

Table 5.1: Current ratio:

Year

Current Assets

Current Liabilities

Current Ratio

2011

1945682

2251097

1.010

2012

2261648

2211872

1.022

Interpretation:

The current ratio should be at least 2:1.This is a good position for the firm to be in.

It can meet its short-term debt obligations without difficulties. If the current ratio is less

than 2 then the firm will have a problem meeting its expenses. So, usually, a higher current

ratio is better than a lower current ratio with regard to maintaining liquidity. The liquidity

ratio of both years is less than 2 it depicts the poor position of the company.

VVIMS- MBA Department, Mysore

25

COST AND COST TECHNIQUES

2. Debt equity ratio:

The debt equity ratio is the measure of contribution of owners to the long term

finances of the concern as compared to the contribution of the long term creditors on an

enterprise. Further it indicates the stake of the long term creditors as against the owners. It

is the test of long term solvency of the concern.

Debt equity ratio=

Totaldebt

Share holders equity ( paid up capital +reserve fund)

Table 5.2: Debt equity ratio:

Year

Total Debt

Shareholders Equity

Debt Equity Ratio

2011

131803

7147672

0.84

2012

860182

4189060

0.12

Interpretation:

The debt equity ratio should be1:2.Lower values of debt-to-equity ratio are

favorable indicating less risk. Higher debt-to-equity ratio is unfavorable because it implies

the businessdependency more on external lenders thus it is at higher risk, especially at

higher interest rates. In this the debt equity ratio is less than 1 that is 0.84 and 0.12 and it

indicates less risk to the company

3. Net profit ratio:

This ratio is also known as net margin. This measures the relationship between net

profits and sales of a firm. It is calculated as follows:

Net profit ratio=

Profit after tax

Net sales

Table 5.3: Net profit ratio:

Year

Profit after tax

Net Sales

N/P Ratio (%)

2011

6132567

524757

1.16

2012

1634786

395629

1.43

VVIMS- MBA Department, Mysore

26

COST AND COST TECHNIQUES

Interpretation:

The net profit of Reid Braids India is 1.43% for 2012 when compared to 2011

which was 1.16% so this depicts a very good profitability position.

4. Stock turnover ratio:

Stocks turnover ratio and inventory turnover ratio are the same. This ratio is a

relationship between the cost of goods sold during a particular period of time and the cost

of average inventory during a particular period. It is expressed in number of times. Stock

turnover ratio/Inventory turnover ratio indicates the number of time the stock has been

turned over during the period and evaluates the efficiency with which a firm is able to

manage its inventory. This ratio indicates whether investment in stock is within proper limit

or not.

Stock

turn Net sales

=

ratio Inventory

Table No. 5.4: Stock turnover ratio:

Year

2011

2012

Net sales

4676122

5080867

Inventory

2625745

3068852

Stock turnover Ratio

8.5

9.5

Interpretation:

The stock turnover ratio should be around 8 10 times. It means that the company

is efficiently managing and selling its finished products. The faster the inventory sells the

fewer funds the company has tied up. Companies have to be careful if they have a high

inventory turnover as they are subject to stock outs. The stock turnover ratio in 2011 is 8.5

and in 2012 are 9.5 which indicate that the company is efficiently managing and selling its

finished products.

VVIMS- MBA Department, Mysore

27

COST AND COST TECHNIQUES

6. LEARNING EXPERIENCE

I had the honor to work in Reid Braids India to do my project work. Everyone was

very friendly and cooperative. They taught me lots of knowledge including sourcing goods

through the Internet, contacting the suppliers. I learned time management in the

organization and also the functioning of various departments. This gave me an opportunity

to have a better understanding of the whole purchasing cycle.

I gained a lot through participating in the Project work. I realized the importance of

flexibility while working under the real business environment. It was really a valuable

learning experience.

As soon as I entered, I was asked to register my name as well as details about the

college and project in a book in which they keep a record of each and every person who

enters and exits the company.

I went to the administrative block they asked for the permission letter and asked me

to meet my internal guide Mr.Jagananth. He spoke very gently and with a smiling face he

gave me a lot of information regarding the company and guided me how to undergo a

project work.

This project work has enhanced my knowledge regarding the working of the

different areas of management. I experienced a great pleasure in visiting the company,

manufacturing plant and communicating with the people working in the company. It has

given me both theoretical and practical knowledge regarding the administration of the

company.

VVIMS- MBA Department, Mysore

28

COST AND COST TECHNIQUES

1. GENERAL INTRODUCTION

COSTING TECHNIQUES

Costing is defined as the application of costing and cost accounting principles,

methods and techniques to the science art and practice of cost control and the ascertainment

of profitability. It includes the presentation of information derived there from the purpose of

managerial decision making.

Costing system helps in:

Proper classification, allocation and utilization of cost.

Estimating selling price

Estimating profitability

The organization can increase its margin of profit either by decreasing the cost of

manufacturing of products or by increasing the benefits in the product or services to the

customers. This approach called as cost-benefit approach. According to this approach, the

company can earn high return either by achieving low cost or adding high customer value

in the products. Every company cannot have both cost and customer value depending upon

the products.

In industries like steel, aluminum, were scope for innovation and new development

in products are very less. In such industries, cost reduction is the only way to achieve high

rate of profits.

COST

Cost is the amount of expenditure, actual or notional, relating to a specific thing or

activity. The specific thing or activity may be a product, job, service, process or any other

activity.

Cost is defined as the value of the sacrifice made to acquire goods/services,

measured in monetary terms by the acquisition of assets or incurrence of liabilities at the

time the benefits are acquired.

VVIMS- MBA Department, Mysore

29

COST AND COST TECHNIQUES

COSTING

Cost accounting and costing have distinctly different meanings. The institute of cost

and management accountants, London, has defined costing as the ascertainment of costs.

Costing includes the techniques and process of ascertaining costs. The technique refers

to principles and rules which are applied for ascertaining costs of products manufactured

and services rendered. There are mainly two methods of costing known as job costing and

process costing. The process includes the day to day routine of determining costs within

the method of costing (either job or process) adopted by a business enterprise. Within such

a process, there could be historical costing, marginal costing absorption costing standard

costing etc.

COST ACCOUNTING

Cost accounting, as a tool of management, provides management with detailed

records of the costs relating to products, operations or functions. Cost accounting refers to

the process of determining and accumulating the cost of some particular product or activity.

It also covers classification, analysis and Interpretation: of costs. The costs so determined

and accumulated may be the estimated future costs for planning purposes, or actual

(historical) costs for evaluating performance. cost accounting as the process of accounting

for Cost from the point at which expenditure is incurred or committed to the establishment

of its ultimate relationship with cost centers and cost units. In its widest usage it embraces

the preparation of statistical data, the application of cost control methods and the

ascertainment of the profitability of activities carried out or planned.

COST ACCOUNTANCY

Cost accounting has been differentiated from cost accountancy. The institute of cost

and management accountants, London, has defined cost accountancy as the application of

costing and cost accounting principles, methods and techniques to the science, art and

practice of cost control and ascertainment of profitability as well as presentation of

information for the purpose of managerial decision-making. According to this definition

the term cost accountancy includes costing, cost accounting, budgetary control, cost

control and cost audit.

VVIMS- MBA Department, Mysore

30

COST AND COST TECHNIQUES

ELEMENTS OF COST:

1. Direct material:

All materials which becomes an integral part of the finished products and which can

be conveniently assigned to specific physical units is termed as Direct Material.

2. Direct labor:

Human effort, both physical and mental, used for conversion of materials into

finished products is labor. Labor which takes an active and direct part in the production of a

particular commodity is called as direct labor.

3. Overheads:

The term overhead includes indirect material, indirect labor and indirect expenses.

Thus all indirect costs are overheads. Overhead also includes all indirect expenses i.e.

miscellaneous expenses which cannot be directly or wholly allocated to cost centre of cost

units. Example: expenses like rent, lights, and insurance charges etc. overheads can

beclassified depending on the convenience of the organization like factory overhead, stores

overhead etc.

4. Indirect material:

All materials which are used for purpose ancillary to the business and which cannot

be conveniently assigned to specific physical units is termed as Indirect Materials.

Example: consumable stores, oils etc.

5. Indirect labor:

Labor employed for the purpose of carrying out tasks incidental to goods produced

or service provided is indirect labor. Such labor does not alter the construction, composition

or condition of the product. It cannot be practically traced to specific unit of output.

Example: wages of storekeeper, foreman etc.

6. Indirect expenses:

The expenses which cannot be directly, conveniently and wholly allocated to

specific cost units/ centers are treated as indirect expenses.

1. Manufacturing production expenses.

2. Office and administrative expenses.

3. Selling and distribution expenses.

VVIMS- MBA Department, Mysore

31

COST AND COST TECHNIQUES

7. Indirect manufacturing expenses:

These are incurred in the factory. Included in these are expenses relating to

production management, such as rent, rates and insurance of factory premises, power used

in factory depreciation of plant, machinery, and so on.

8. Office and administrative expenses:

These pertain to management of business and include office rent, lighting and

heating, posting, telephone, fax and other charges, depreciation of office furnitures and

equipments, legal charges, audit fee, and so on.

9. Selling and distribution charges:

These are incurred for marketing of products, dispatching goods solid, and Etc.

METHODS OF COSTING

There are two methods of costing:

Job costing

Job costing is used in those business concerns where production is carried out as per

specific order and customers specifications. Each job is separate and distinct from the other

jobs or products. The method is popular in enterprises engaged in house-building, shipbuilding, machinery production and repair. Job costing has the following variants:

1. Batch costing

2. Contract or terminal costing

3. Multiple or composite costing

Process costing

This costing method is used in those industries where production is done

continuously, such as motor cars, aero planes, etc. it is difficult to trace the costs to specific

units and the total cost is averaged for the number of units manufactured. Sometimes, total

cost and per unit cost is calculated at each stage of production for control purposes. Process

costing has the following variants:

1. Unit or single output costing

2. Operating (service)costing

3. Operation costing

TECHNIQUES OF COSTING

VVIMS- MBA Department, Mysore

32

COST AND COST TECHNIQUES

1. Historical costing

Historical costing is system of costing under which costs are determined after they

have been incurred.

2. Standard costing

Under standard costing, standard costs are determined and used, and then compared

with the actual costs to determine the extent of variances so that remedial action can be

taken. Standard costs are the predetermined costs in conformity with the most efficient

operation and use of the resources within the film.

3. Absorption or Full costing

Under this costing method, all manufacturing cost, fixed and variable, are charged

to products, jobs, process, etc. and are included in total cost.

4. Variable or Marginal costing

Variable costing method charges only variable production costs to products or jobs,

and thus the cost of the products or jobs consists of only variable production and not fixed

production costs. The fixed production, administration, selling and distribution costs are

written off against profits in the periods in which they arise.

5. Uniform costing

Truly speaking, uniform costing is not a technique of costing, but is an attempt by

several undertakings and organizations to use similar costing principles and /or practices.

VVIMS- MBA Department, Mysore

33

COST AND COST TECHNIQUES

1.1

STATEMENT OF THE PROBLEM

A study on Cost and Cost Techniques at Reid Braids (India), Hassan

Costing techniques and cost sheet is essential to ascertain cost of various projects in

detail in order to evaluate whether the project under taken is profitable to the organization

or it will lead to loss in future.

This study is conducted therefore to create awareness in the organization for

optimum utilization of costs.

Hence the study helps the management to closely examine the utilization of cost and

eliminate the waste full expenditure, which is directly involved in the production and also

help in proper control over the cost as expenditure incurred is identified against each

department and recorded in cost sheet.

1.2

SCOPE OF THE STUDY

This study helps in knowing, identifying, classifying and ascertaining cost for each

department and how effectively and the management can control cost and fix selling price.

This study also helps us to know the present status and the cost accounting technique

methods, system followed by the company, which leads to better utilization of cost.

1.3

OBJECTIVES

The objectives of the study are to:

1. Find out what type of costing method is being followed in Reid braids India.

2. Identify requirement of cost for each department for producing a product.

3. Classify and ascertain the costs which are directly involved in production and to

closely examine the utilization of cost and elimination of wasteful expenditure.

4. Know the proper control over the cost as expenditure is identified against

Departments.

VVIMS- MBA Department, Mysore

34

COST AND COST TECHNIQUES

1.4

METHODOLOGY

RESEARCH DESIGN: DESCRIPTIVE RESEARCH

It is a type of research, which depicts the presentation of facts as it is. It is an Exfacto research. There is no chance of manipulation from the researcher point of view.

Descriptive research involves gathering data that describe events and then organizes,

tabulates, depicts, and describes the data collection. It often uses visual aids such as graphs

and charts to aid the reader in understanding the data distribution.

COLLECTION OF DATA

In this study secondary data were collected through the costing section in Reid

Braids India, cost sheets, costing manuals, annual reports, and company website.

1.5

LIMITATIONS OF THE STUDY:

1. The study being a research project of the descriptive and analytical nature, maybe

limited in scope and nature in understanding the different dimensions of production

and manufacturing.

2. It was not possible to formulate a hypothesis.

3. Limited coverage of the data, as the company was reluctant to disclose confidential

data.

4. The study is restricted to the available information from the statements and records

5. The study is confined only to research in Reid Braids India and not applicable to

other companies.

6. The recommendations and suggestions given is based only on the findings of this

study and limited in scope and application

VVIMS- MBA Department, Mysore

35

COST AND COST TECHNIQUES

2. DATA ANALYSIS &INTERPRETRATION

Table No 2.1 Cost Sheet for Shoe Laces for 2008-2010

2008-2009

2009-2010

Particulars

Units

Amount (Rs)

Units

Amount (Rs)

Direct material

991.62

110802.896

930.23

111114.69

Direct Labor

105.34

11770.831

101.59

12135.13

1096.9

Prime cost

122573.73

1031.83 123249.82

Factory overhead

96.99

10837.32

81.57

9743.01

Work cost

1193.95 133411.05

1113.40

132992.83

Administrative overhead

21.96

2453.82

26.40

3153.88

135864.87

1139.80 136146.71

135864.87

111739

1139.80 136146.71

119448

1215.9

Cost of production

1215.9

Total

Quantity

VVIMS- MBA Department, Mysore

36

COST AND COST TECHNIQUES

Table No 2.2 Cost Sheet for Shoe Laces for 2010-2012

2010-2011

2011-2012

Particulars

Units

Amount (Rs)

Units

Amount (Rs)

Direct material

Direct Labor

1010.75

90.70

116577.443

10460.75

922.78

123.89

140899.46

18916.98

Prime cost

1101.45

127038.19

1046.67

159816.44

Factory overhead

94.49

10897.77

63.54

9701.88

Works cost

1195.94

137935.96

1110.21

169518.32

Administrative overhead

37.10

4278.680

31.19

4762.31

Cost of production

1233.04

142214.64

1141.39

174280.63

Total

1233.04

142214.64

1141.39

174280.63

Quantity

VVIMS- MBA Department, Mysore

115337

37

152691

COST AND COST TECHNIQUES

Table 2. 3 Direct Material Cost

Years

Direct Material Cost

2008-09

110802.896

2009-10

111114.69

2010-11

116577.443

2011-12

140899.46

Graph 2.3 Direct Material Costs of Shoe Laces

DIRECT MATERIAL COST

160000

140000

120000

100000

AMOUNT(Rs.)

80000

60000

40000

20000

0

2008-09

2009-10

YEAR

VVIMS- MBA Department, Mysore

38

2010-11

2011-12

COST AND COST TECHNIQUES

Interpretation:

Direct Material is which becomes an integral part of the product which can be

conventionally assigned to specific physical unit is termed as direct material.

In Reid Braids India direct material are the raw material used by cost centers within

the geographical areas of manufacturing work order shops.

The above graph shows a comparative picture of direct material cost for 4 years

from 2008-09 to 2011-12. In the year 2008-09, direct materials cost are Rs.110803 and

here the direct material is 78.25% of total cost. In the year 2009-10 the direct material cost

is Rs.111115, which is increased compared to previous year. And the direct material cost is

about 78.67% of total cost. In the year 2010- 11 the direct material cost is Rs.116577, and

the direct material is 79.37% of total cost. Similarly in the year 2011-12 follows the upward

movement the cost of direct material increased because of the fluctuations in cost of raw

material. The direct material is Rs.140899. And the direct material cost is about 80.48% of

total cost.

The increase in direct material is due to changes in purchase price of materials.

Price variance can be attributed to the non-availability of cash discounts which was

originally anticipated at the time of setting the price standards. Changes in transportation

costs and storekeeping costs contributing to material price variance.

VVIMS- MBA Department, Mysore

39

COST AND COST TECHNIQUES

Table: 2.4 Direct Labor

Years

Direct Labor Cost

2008-09

11770.8

2009-10

12135.13

2010-11

10460.75

2011-12

18916.98

Graph 2.4 Direct Labor Costs of Shoe Laces

DIRECT LABOUR COST

20000

15000

AMOUNT(Rs.)

10000

5000

0

2008-09

2009-10

YEAR

VVIMS- MBA Department, Mysore

40

2010-11

2011-12

COST AND COST TECHNIQUES

Interpretation:

Labor that is used actively and as raw materials in the primary production process of

a particular commodity is called as direct labor. Direct labor costs are therefore specifically

and conventionally traceable to specific products.

Direct labor is captured through the biometric and manually attendance system.

The time office captures the names of direct labor hours. Usually direct labor cost is above

8% of unit cost. The product processes is having state of the art of technology with high

level of automation and learn man power strength.

The above graph shows a compared analysis of direct labor cost for 4 years from

2008-09 to 2011-12. In the year 2008-09, direct labor cost is Rs.11771 here the direct

material is 8.3% of total cost. In the year 2009-10 the direct labor cost is Rs.12135, which

is increased by 364 as compared to previous year. And the direct labor cost is about 8.59%

of total cost.

In the year 2010-11 the direct labor cost is Rs.10461, which is decreased by Rs.1674 as

compared to the previous year. And the direct material cost is about 7.11% of total cost.

Similarly in the year 2011-12 the cost of direct labor follows the upward movement it is

increased to an extent because of the fluctuations in cost. The direct labor is Rs.18917. And

the direct material cost is about 10.80% of total cost.

The labour cost is increased due to increasing labour turnover, increasing idle time

Forgery names in wage sheet. To provide training to employees new as well as existing

employees to upgrade themselves to changing technologies.

VVIMS- MBA Department, Mysore

41

COST AND COST TECHNIQUES

Table 2.5 Factory Overhead

Years

Factory Overhead Cost

2008-09

10837.32

2009-10

9743.01

2010-11

10897.77

2011-12

9701.89

Graph 2.5 Factory Overhead of Shoe Laces

FACTORY OVERHEAD COST

11000

10800

10600

10400

10200

AMOUNT(Rs.)

10000

9800

9600

9400

9200

9000

2008-09

2009-10

YEAR

VVIMS- MBA Department, Mysore

42

2010-11

2011-12

COST AND COST TECHNIQUES

Interpretation:

The above graph shows the comparative analysis of factory overhead cost for 4

years from 2008-09 to 2011-12. In the year 2008-09 the factory overhead cost is Rs.10837

and it is 7.65% of total cost. In the year 2009-10 the factory overhead cost reduced to a

certain extent. The Factory overhead cost is Rs.9743 and is 6.89% of the total cost .During

the year 2010-11 the factory overhead cost further increased to a certain extent compared to

the previous year. Here the factory overhead cost is Rs.10898 is 7.42% of the total cost.

During the year 2011-12 the factory overhead cost is reduced to certain extent. Here the

factory overhead cost is Rs.9702 and is 5.54% of the total cost.

The factory overhead cost is high in 2008-09 and 2010-11 compared to other years. This is

due increased production in these years. This may be due to lack of training to employees

which result in more wastages and which incur extra expenses to the company. Increase in

electricity charges, increase in wages rising by the year.

VVIMS- MBA Department, Mysore

43

COST AND COST TECHNIQUES

Table 2.6 Administration Overhead

Years

Administration Overhead Cost

2008-09

2453.82

2009-10

3153.88

2010-11

4278.680

20011-12

4762.31

Graph 2.6 Administrative Overhead of Shoe Laces

ADMINISTRATION OVERHEAD

6000

5000

4000

AMOUNT(Rs.)

3000

2000

1000

0

2008-09

2009-10

YEAR

VVIMS- MBA Department, Mysore

44

2010-11

2011-12

COST AND COST TECHNIQUES

Interpretation::

Administrative overhead pertains to management of business and include office

rent, lighting and heating, posting, telephone, fax and other charges, depreciation of office

furnitures and equipments, legal charges, audit fee, and so on. The administration cost is

increased from year to year. It has increased from 1.73% to 2.72%.The above graph shows

the comparative analysis of administration overhead cost for 4 years from 2008-09 to 201112. In the year 2008-09 the administration overhead cost is Rs.2454. The Administration

overhead cost is 1.73%of total cost.

In the year 2009-10 the administration overhead cost has increased by Rs.700 when

compared to previous year. The administration overhead cost is Rs.3154. The

Administration overhead cost is 2.23% of total cost.In the year 2010-11 the administration

overhead cost has increased by Rs.1125 when compared to the previous year. The

administration overhead cost is Rs.4279. The administration overhead cost is 2.91% of total

cost.

Similarly in the year 2011-12 the administration overhead cost follow upward

movement, the cost has increased by Rs.483 compared to the previous year. The

administration overhead cost is Rs.4762. The administration overhead cost is 2.72% of total

cost.

There is rise in administrative overhead year by year due to increase in rent of

building, increase in cost of raw materials, increase in cost of living lead to increase in

salary.

VVIMS- MBA Department, Mysore

45

COST AND COST TECHNIQUES

Table 2.7 Cost Sheet of Elastics from 2008-2012

2008-2009

2009-2010

Particulars

Units

Amount (Rs)

Units

Amount (Rs)

Direct material

1100.00

4620.000

1170.00

6786.000

Direct Labor

142.00

596.400

126.00

730.800

Prime cost

1242.00

5216.40000

1296.00

7516.80000

Factory overhead

96.99

407.349

81.57

473.088

1338.99

5623.74878

1377.57

7989.88822

Administrative overhead

21.96

92.233

26.40

153.142

Cost of production

1360.95

5715.98210

1403.97

8143.03027

Total

1360.95

5715.98210

1403.97

8143.03027

Work cost

Quantity

VVIMS- MBA Department, Mysore

4200

46

5800

COST AND COST TECHNIQUES

Table 2.8 Cost Sheet of Elastics from 2010-2012

2010-2011

2011-2012

Particulars

Units

Amount(Rs)

Units

Amount(Rs)

Direct material

1190.00

7854.000

1200.00

9360.000

Direct Labor

130.00

858.000

132.00

1029.600

Prime cost

1320.00

8712.00000

1332.00

10389.60000

Factory overhead

94.49

623.610

63.54

495.606

Work cost

1414.49

9335.60984

1395.54

10885.20640

Administrative overhead

37.10

244.842

31.19

243.276

Cost of production

1451.58

9580.45138

1426.73

11128.48217

Total

1451.58

9580.45138

1426.73

11128.48217

Quantity

6600

VVIMS- MBA Department, Mysore

47

7800

COST AND COST TECHNIQUES

Table 2.9 Direct Material

Years

Direct Materials Cost

2008-09

4620.00

2009-10

6786.00

2010-11

7854.00

2011-12

9360.00

Graph-2.9 Direct Material Cost of Elastics

DIRECT MATERIAL

10000

9000

8000

7000

6000

AMOUNT(Rs.)

5000

4000

3000

2000

1000

0

2008-09

2009-10

YEAR

VVIMS- MBA Department, Mysore

48

2010-11

2011-12

COST AND COST TECHNIQUES

Interpretation::

Direct Material is which becomes an integral part of the product which can be

conventionally assigned to specific physical unit is termed as direct material. In Reid Braids

India direct material are the raw material used by cost centers within the geographical areas

of manufacturing work order shops.

The above graph shows the comparative analysis of direct material cost for 4 years

from 2008-09 to 2011-12 in the year 2008-09 the direct material cost is Rs. 4620. The direct

material is about 77.90% of total cost. In the year 2009-10 there is an increase in the direct

material cost of about Rs. 2166 compared to the previous year. The direct material cost is

Rs.6786 and is 80.88% of total cost. In the year 2010-11 there is an increase in the direct

material cost of about Rs.1068 compared to the previous year. The direct material cost is

Rs.7854 and is 79.76% of total cost. Similarly in the year 2011-12 there is an upward

movement in the direct material cost of about Rs.1506 compared to the previous year. Here

the direct material cost is Rs.9360 and is 83.80% of total cost.

The increase in direct material is due to changes in purchase price of materials.

Price variance can be attributed to the non-availability of cash discounts which was

originally anticipated at the time of setting the price standards. Changes in transportation

costs and storekeeping costs contributing to material price variance.

VVIMS- MBA Department, Mysore

49

COST AND COST TECHNIQUES

Table 2.10Direct Labor

Years

Direct Labor Cost

2008-09

596.400

2009-10

2010-11

730.800

858.000

2011-12

1029.600

Graph-2.10Direct Labor Cost Of Elastics

LABOUR COST

1200

1000

800

AMOUNT(Rs.)

600

400

200

0

2008-09

2009-10

YEAR

VVIMS- MBA Department, Mysore

50

2010-11

2011-12

COST AND COST TECHNIQUES

Interpretation:

The labor takes an active and direct part in production of a particular commodity is

called as direct labor. Direct labor costs are therefore specifically and conventionally

traceable to specific products. Direct labor is captured through the biometric and manually

attendance system. The time office captures the names of direct labor hours. Usually direct

labor cost is above 8% of unit cost. The product processes is having state of the art of

technology with high level of automation and learn man power strength.

The above graph is showing a compared analysis of direct labor cost for 4 years

from 2008-09 to 2011-12. In the year 2008-09 the direct labor cost is Rs.596 here the direct

material is 10.05% of total cost. In the year 2009-10 direct labor is increased by Rs.135 as

compared to previous year. And the direct labor cost is Rs.731 and is about 8.70 % of total

cost. In the year 2010-11 the direct labor is increased by Rs.127 as compared to the

previous years. And the direct material cost is 858 and is about 8.71% of total cost.

Similarly in the year 2011-12 follows the upward movement the cost of direct labor

increased by Rs172 to an extent because of the fluctuations in cost. The direct labor is

Rs.1030 and is about 9.22% of total cost.

The labour cost is increased due to increasing labour turnover, increasing idle time

Forgery names in wage sheet. To provide training to employees new as well as existing

employees to upgrade themselves to changing technologies.

VVIMS- MBA Department, Mysore

51

COST AND COST TECHNIQUES

Table 2.11 Factory Overhead

Years

Factory Overhead Cost

2008-09

407.349

2009-10

2010-11

473.088

623.610

2011-12

495.606

Graph-2.11 Factory Overhead Cost Of Elastics

FACTORY OVERHEAD

700

600

500

400

AMOUNT(Rs.) 300

200

100

0

2008-09

2009-10

YEAR

VVIMS- MBA Department, Mysore

52

2010-11

2011-12

COST AND COST TECHNIQUES

Interpretation:

The above graph shows the comparative analysis of factory overhead cost from

2008-09 to 2011-12.In the year 2008-09 the factory overhead cost is Rs.407 and is 6.86%

of total cost.In the year 2009-10 there is an increase in the factory overhead cost by Rs.66

compared to the previous year. The factory overhead cost is Rs.473 and is 5.64% of total

cost. In the year 2010- 11 there is an increase in the factory overhead cost of about 471

compared to the previous year. The factory overhead cost is Rs. 623 and is 6.34% of total

cost.In the year 2011-12 the factory overhead cost is Rs.495 and is 4.43% of total cost.

The factory overhead cost is high in 2008-09 and 2010-11 compared to other years.

This is due increased production in these years. This may be due to lack of training to

employees which result in more wastages and which incur extra expenses to the company.

Increase in electricity charges, increase in wages rising year by year. s

VVIMS- MBA Department, Mysore

53

COST AND COST TECHNIQUES

Table 2.12 Administration Overhead

Years

Administration Overhead Cost

2008-09

92.233

2009-10

153.142

2010-11

2011-12

244.842

243.276

Graph-2.12 Administration Overhead Cost Of Elastics

ADMINISTRATION OVERHEAD

300

250

200

AMOUNT(Rs.)

150

100

50

0

2008-09

2009-10

YEAR

VVIMS- MBA Department, Mysore

54

2010-11

2011-12

COST AND COST TECHNIQUES

Interpretation:

These pertain to management of business and include office rent, lighting and

heating, posting, telephone, fax and other charges, depreciation of office furnitures and

equipments, legal charges, audit fee, and so on. The administration cost is increased from

year to year. It has increased from 1.55% to 2.17%.The above graph shows the comparative

analysis of administration overhead cost for 4 years from 2008-09 to 2011-12.In the year

2008-09 Administration overhead cost is Rs.92 and it is 1.55 % of total cost. In the year

2009-10 the administration overhead cost has increased by Rs.61 when compared to

previous year. The administration overhead cost is Rs 153 and it is 1.82% of total cost. In

the year 2010-11 the administration overhead cost has increased by Rs.92 when compared

to the previous year. The administration overhead cost is Rs.245 and it is 2.49% of total

cost. Similarly in the year 2011-12 the administration overhead cost is Rs.243 and it is

2.17% of total cost.

There is rise in administrative overhead year by year due to increase in rent of

building, increase in cost of raw materials, increase in cost of living lead to increase in

salary.

VVIMS- MBA Department, Mysore

55

COST AND COST TECHNIQUES

3. FINDINGS

1. From the analysis it was clear to know that most of the expenses have been

mounting when compared to the previous year.

2. It is found that, the company is not following certain cost control techniques.

3. It is found that direct material cost of both the products has risen proportionately in

4 years.

4. It is found that direct labor cost of shoe laces has increased in all the years but with

slight decrease in 2010-11. Where as in elastics the labor cost is high in 2011-12

compared to previous years.

5. It is found that factory overhead costs of both the products are fluctuating.

6. From the analysis it was understood that, the company is not preparing and

following costing principles and cost statements as per absorption costing. Instead

they are following principles and statement as per historical costing and standard

costing.

7. It is found that there is an upward movement in administration overhead cost of

both the products.

VVIMS- MBA Department, Mysore

56

COST AND COST TECHNIQUES

4. RECOMMENDATIONS AND CONCLUSIONS

RECOMMENDATIONS

1. It is better to follow costing principles and cost statements as per absorption costing

as all manufacturing costs are fully absorbed into finished goods.

2. The company should conduct an effective cost audit which helps on adding

reliability to cost statement and cost data. It helps in detection of errors, Frauds and

irregularities, so management can make sound decisions on the basis of correct and

reliable cost data.

3. The company should follow certain cost control techniques which helps in

formulation of standards and budgets that incorporate objectives and goals to be

achieved and also helps in formulation of corrective measured to eliminate and

reduce unfavorable variable.

4. It is suggested that cost center could be more clearly distinguish into productive,

unproductive and mixed. This helps in allocating of direct and indirect pools.

5. Utilize the on-line facilities more to reduce paper work and to save time in other

work.

6. Effective training to be given to all unskilled operators at all the stages. (Based on

their competency records)

7. If the company maintains appropriate level of inventory, the chances of disruption

in the process can be reduced

VVIMS- MBA Department, Mysore

57

COST AND COST TECHNIQUES

CONCLUSIONS

Reid Braids India (RBI) is the biggest Narrow Fabric manufacturing company in

India. It manufactures Trims for Garment industries, Shoelaces for Shoe Industries & Retail

products for its clients.RBI has entered into global market. It exports finished product to

Australia, USA, and Sri Lanka

Costing techniques and cost sheet is essential to ascertain cost of various projects in

detail in order to evaluate whether the project under taken is profitable to the organization

or it will lead to loss in future.This study is conducted therefore to create awareness in the

organization for optimum utilization of costs.

The objective of the study is to prepare to classify and ascertain the costs which are

directly involved in production and to closely examine the utilization of cost and

elimination of wasteful expenditure. Find out what type of costing method is being

followed in Reid braids India.Identify requirement of cost for each department for

producing a product.

The methodology followed to collect the data is primary and secondary that is direct

interview with finance manager and data from the company financial records and websites.

From the analysis it was came to know that most of the expenses have been

mounting when compared to the previous year. From the analysis it was understood that,

the company is not preparing and following costing principles and cost statements as per

absorption costing. Instead they are following principles and statement as per historical

costing and standard costing.

It is better to follow costing principles and cost statements as per absorption costing

as all manufacturing costs are fully absorbed into finished goods. They should conduct an

effective cost audit which helps on adding reliability to cost statement and cost data. It

helps in detection of errors, Frauds and irregularities, so management can make sound

decisions on the basis of correct and reliable cost data

The experience in project work at Reid Braids India will surely enrich knowledge

on industrial practicalities.

VVIMS- MBA Department, Mysore

58

You might also like

- Indian Textile Industry Evaluation and Future OpportunitiesDocument45 pagesIndian Textile Industry Evaluation and Future OpportunitiesVikram RattaNo ratings yet

- Project Report On Indian Textile Industry FinalDocument78 pagesProject Report On Indian Textile Industry Finalsudhakar kethanaNo ratings yet

- Textile IndustryDocument80 pagesTextile Industryankitmehta23No ratings yet

- Comparative Financial Analysis of Tata Steel and SAILDocument53 pagesComparative Financial Analysis of Tata Steel and SAILManu GCNo ratings yet

- Final Sip Report (Company Copy)Document111 pagesFinal Sip Report (Company Copy)Diksha Neha100% (1)

- Infrastructure and Project FinanceDocument37 pagesInfrastructure and Project FinanceAmira zainab khanumNo ratings yet

- Aditya Birla Fashion and Retail Ltd. overviewDocument85 pagesAditya Birla Fashion and Retail Ltd. overviewLiza SethyNo ratings yet

- Summer Training Report-Textile IndustryDocument79 pagesSummer Training Report-Textile IndustryArpit JakhmolaNo ratings yet

- Comparative Analysis of Working Capital Management of Different Companies in Textile SectorDocument39 pagesComparative Analysis of Working Capital Management of Different Companies in Textile SectorMahmudul Hassan100% (1)

- Chapter 1Document67 pagesChapter 1satseehraNo ratings yet

- Customer Satisfaction and AwarenessDocument63 pagesCustomer Satisfaction and Awarenessdeepika90236No ratings yet

- Muskan 123 PDFDocument62 pagesMuskan 123 PDFDiksha TomarNo ratings yet

- Project Report: Jecrc University, JaipurDocument65 pagesProject Report: Jecrc University, Jaipuryash sharmaNo ratings yet

- Textile IndustryDocument37 pagesTextile IndustryArun_Shankar_K_5239No ratings yet

- CAPITAL ASSET PRICING MODEL - A Study On Indian Stock MarketsDocument78 pagesCAPITAL ASSET PRICING MODEL - A Study On Indian Stock MarketsnikhinccNo ratings yet

- Financial Literacy Project Final FileDocument70 pagesFinancial Literacy Project Final Fileaddusaiki9999No ratings yet

- Reportsudipa PaulDocument65 pagesReportsudipa Paulnaman99No ratings yet

- Minor Project Report On Air Pollution in Delhi NCR Causes and Solutions.Document21 pagesMinor Project Report On Air Pollution in Delhi NCR Causes and Solutions.Gopesh kumar Acharya100% (1)

- Role of Insurance Sector in Financial MarketsDocument50 pagesRole of Insurance Sector in Financial MarketsKaran MorbiaNo ratings yet

- Virendra Final Project Print PDFDocument92 pagesVirendra Final Project Print PDFVeekeshGuptaNo ratings yet

- RATIO ANALYSIS INTRODocument53 pagesRATIO ANALYSIS INTROGuru Murthy D R0% (1)

- Data Analysis and InterpretationDocument7 pagesData Analysis and InterpretationATS PROJECT DEPARTMENTNo ratings yet

- Videocon International Ltd-MBA Project Report Prince DudhatraDocument84 pagesVideocon International Ltd-MBA Project Report Prince DudhatrapRiNcE DuDhAtRaNo ratings yet

- Project Report On Crypto CurrencyDocument54 pagesProject Report On Crypto CurrencyRajesh BathulaNo ratings yet

- Introduction of TEXTILE IndustryDocument16 pagesIntroduction of TEXTILE IndustryJimmy Patel20% (5)

- Growth in IT SectorDocument15 pagesGrowth in IT Sectorjeet_singh_deepNo ratings yet

- FDI in Indian Retail Sector: An AnalysisDocument144 pagesFDI in Indian Retail Sector: An AnalysisShebin Mathew0% (1)

- Credit Rating Agencies in IndiaDocument23 pagesCredit Rating Agencies in Indiaanon_315460204No ratings yet

- How COVID-19 impacted bank operationsDocument3 pagesHow COVID-19 impacted bank operationsAtia KhalidNo ratings yet

- Capital MarketDocument101 pagesCapital MarketRavi TejaNo ratings yet