Professional Documents

Culture Documents

Appealing BIR Assessment at The CTA

Uploaded by

henzencameroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Appealing BIR Assessment at The CTA

Uploaded by

henzencameroCopyright:

Available Formats

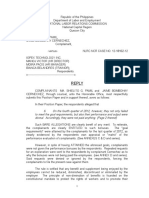

Appealing BIR assessment at the CTA by: Arnold P.

Supilanas

While the present administration is making good on its campaign promise not to impose new taxes nor increase existing tax

rates, the Bureau of Internal Revenue (BIR), as the countrys primary revenue-generating agency, is tasked to collect P1.066

trillion for the year 2012. Given this constraint, the BIR is still determined to achieve its collection goal through strict

enforcement and extensive tax investigation.

With this development, it would be prudent for the taxpayers to know their rights during tax examination and the remedies

against tax assessment. Knowing your rights involves understanding the assessment process, including, among others, the

counting of the periods within which to file a protest in case you disagree with the tax assessment.

To review the periods in protesting tax assessments, a taxpayer has the right to file an administrative protest to the tax

assessment by filing a request for reconsideration or reinvestigation within 30 days from the receipt of the final assessment

notice. Within 60 days from filing of the protest, taxpayers should submit the relevant supporting documents.

If the protest is denied or is not acted upon within 180 days from submission of documents, under Section 228 of the Tax

Code, the taxpayer adversely affected by the decision or inaction may appeal to the Court of Tax Appeals (CTA) within 30

days from the receipt of the said decision, or from the lapse of the 180-day period; otherwise, the decision shall become

final, executory and demandable.

Does the assessment become final and demandable if the taxpayer failed to timely file an appeal with the CTA after the

lapse of the 180-day reglementary period?

Last Feb. 2, 2012, the CTA en banc (EB) in CTA EB No. 672 denied a taxpayers petition for review for want of jurisdiction

because said petition was filed beyond the 180-day period. According to the CTA EB, the 30-day period to appeal set by

Section 228 of the National Internal Revenue Code (NIRC), as amended, should be reckoned from the 180-day period of

inaction and not from the receipt of the final decision on disputed assessment (FDDA).

However, in a recent separate case (G.R. No. 171251) dated March 5, 2012, the Supreme Court settled the issue when it

held that in case the Commissioner failed to act on the disputed assessment within the 180-day period from date of

submission of documents, a taxpayer can either: (1) file a petition for review with the CTA within 30 days after the expiration

of the 180-day period; or (2) await the final decision of the commissioner on the disputed assessments and appeal such final

decision with the CTA within 30 days after receipt of a copy of such decision.

This position is consistent with Section 3 (A)(2), Rule 4 of the Revised Rules of the CTA which provides, in part, that in case

of disputed assessment, the inaction of the Commission of Internal Revenue (CIR) within the 180-day period under Section

228 of the NIRC shall be deemed a denial for purposes of allowing the taxpayer to appeal his case to the Court and does

not necessarily constitute a formal decision of the CIR on the tax case; provided, further, that should the taxpayer opt to

await the final decision of the CIR on the disputed assessments beyond the 180-day period abovementioned, the taxpayer

may appeal such final decision to the Court.

According to the Supreme Court, when the law provided for the remedy to appeal the inaction of the CIR, it did not intend to

limit it to a single remedy of filing for an appeal after the lapse of the 180-day prescribed period. When a taxpayer protested

an assessment, he naturally expects the CIR to decide either positively or negatively. A taxpayer cannot be prejudiced if he

chooses to wait for the final decision of the CIR on the protested assessment; more so, because the law and jurisprudence

have always contemplated a scenario where the CIR will decide on the protested assessment.

It is clear from the above decision that the taxpa yers remedy to appeal the disputed assessment to the CTA will be

reckoned either from the 180-day inaction or receipt of the FDDA. These options according to the Supreme Court are

mutually exclusive and resort to one bars the application of the other.

Paying the right amount of taxes is a humble act of concern and love for our country. Knowing your rights and obligations as

taxpayers and remedies against tax assessment would somehow ensure that your tax payments are made in accordance

with the law.

You might also like

- Chapter 1 Cases RianoDocument479 pagesChapter 1 Cases RianoAnonymous 4WA9UcnU2XNo ratings yet

- PAMIL - ReplyDocument2 pagesPAMIL - ReplyGerald HernandezNo ratings yet

- Date - : RE: Notice of Returned Check With Demand To Settle Outstanding ObligationDocument1 pageDate - : RE: Notice of Returned Check With Demand To Settle Outstanding ObligationRomak TranceNo ratings yet

- Deed of Sale of Motor VehicleDocument1 pageDeed of Sale of Motor VehicleJhedz CartasNo ratings yet

- Sample OJT Acceptance LetterDocument2 pagesSample OJT Acceptance LetterSimond Caesar SemblanteNo ratings yet

- Complaint Filed: Administrative Complaint and Investigation Procedure For The Central OfficeDocument4 pagesComplaint Filed: Administrative Complaint and Investigation Procedure For The Central OfficeAngeline ChavesNo ratings yet

- People v. SandiganbayanDocument1 pagePeople v. SandiganbayananalynNo ratings yet

- Property Management Agreement: BackgroundDocument8 pagesProperty Management Agreement: BackgroundAdesinaNo ratings yet

- 209890-2017-Opulent Landowners Inc. v. Commissioner of PDFDocument29 pages209890-2017-Opulent Landowners Inc. v. Commissioner of PDFJobar BuenaguaNo ratings yet

- RR No. 03-98Document18 pagesRR No. 03-98fatmaaleahNo ratings yet

- 14 Training Costs AgreementDocument2 pages14 Training Costs AgreementJohna Mae Dolar EtangNo ratings yet

- Labor Standard Cases - 3rd SyllabusDocument155 pagesLabor Standard Cases - 3rd SyllabusLiz ZieNo ratings yet

- Preliminary Advice of Loss FormDocument1 pagePreliminary Advice of Loss FormWai Leong Edward Low0% (1)

- Release, Waiver and QuitclaimDocument1 pageRelease, Waiver and Quitclaimcoc dezmondNo ratings yet

- 6-Motion To Plead As IndigentDocument1 page6-Motion To Plead As IndigentAnob EhijNo ratings yet

- Group 5 ReportDocument11 pagesGroup 5 ReportmifajNo ratings yet

- Credit Memo PDFDocument1 pageCredit Memo PDFKateNo ratings yet

- Pag Ibig FundDocument3 pagesPag Ibig FundAwesomeworldNo ratings yet

- Retail Vendor Agreement Sample PDFDocument2 pagesRetail Vendor Agreement Sample PDFNafiz Bin HabibNo ratings yet

- BIR RMC No. 62-2005Document15 pagesBIR RMC No. 62-2005dencave1No ratings yet

- Tax Bulletin by SGV As of Oct 2014Document18 pagesTax Bulletin by SGV As of Oct 2014adobopinikpikanNo ratings yet

- Integrity PactDocument7 pagesIntegrity PactHarpreet SinghNo ratings yet

- Revenue Audit Memorandum 1-98Document5 pagesRevenue Audit Memorandum 1-98Nikos CabreraNo ratings yet

- CTA - 2D - CV - 09618 - M - 2022SEP21 - ASS - Motion To Release Cash BondDocument11 pagesCTA - 2D - CV - 09618 - M - 2022SEP21 - ASS - Motion To Release Cash BondFirenze PHNo ratings yet

- LA 011 14 Non InterferenceDocument2 pagesLA 011 14 Non InterferenceMykel BraggsNo ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasNo ratings yet

- Pbcom V CirDocument9 pagesPbcom V CirAbby ParwaniNo ratings yet

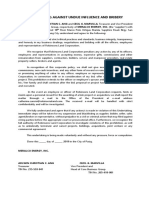

- Undertaking Against Undue Influence BriberyDocument2 pagesUndertaking Against Undue Influence BriberyjoyNo ratings yet

- 12.4. Antonio P. Salenga Vs CA, G.R. No. 174941, Feb 1, 2012Document17 pages12.4. Antonio P. Salenga Vs CA, G.R. No. 174941, Feb 1, 2012LawrenceAltezaNo ratings yet

- Position Paper JerusalemDocument13 pagesPosition Paper JerusalemFrancis DinopolNo ratings yet

- Philippines ECC - EMIGRATION CLEARANCE CERTIFICATEDocument1 pagePhilippines ECC - EMIGRATION CLEARANCE CERTIFICATEmichaelNo ratings yet

- BIR LOA Required For A Valid AssessmentDocument2 pagesBIR LOA Required For A Valid Assessmentalmira halasanNo ratings yet

- Landlord Rental Increase LetterDocument2 pagesLandlord Rental Increase LetterNellie LennieNo ratings yet

- Payroll: Total 23,340.00 9,336.00 4,052.50 5,283.50Document13 pagesPayroll: Total 23,340.00 9,336.00 4,052.50 5,283.50Ann DumlaoNo ratings yet

- Debt Collection OfficerDocument2 pagesDebt Collection OfficerGregory Kagooha100% (1)

- Pool Reservation FormDocument2 pagesPool Reservation Formadmin9696No ratings yet

- Promissory Note - Off SetDocument1 pagePromissory Note - Off SetalaricelyangNo ratings yet

- Letter of ConformityDocument1 pageLetter of ConformityAlfred FranciscoNo ratings yet

- SCENARIO 3: Voluntary Dissolution Shortening Corporate Term (Sec 136)Document1 pageSCENARIO 3: Voluntary Dissolution Shortening Corporate Term (Sec 136)Summer FreniereNo ratings yet

- Republic of The Philippines Department of Transportation Land Transportation Franchising and Regulatory Board Regional OfficeDocument3 pagesRepublic of The Philippines Department of Transportation Land Transportation Franchising and Regulatory Board Regional OfficeAtty. Cca MagallanesNo ratings yet

- GATT - WTO (General Agreement On Tariffs and Trade - World Trade Organization)Document5 pagesGATT - WTO (General Agreement On Tariffs and Trade - World Trade Organization)dylankirbyNo ratings yet

- Cadigal - Nda - Awol-Interoffice MemoDocument1 pageCadigal - Nda - Awol-Interoffice MemoAnonymous FQTgjfNo ratings yet

- Waiver, Release and QuitclaimDocument2 pagesWaiver, Release and QuitclaimHans ChuaNo ratings yet

- Consumer Protection and Market Conduct Office (Cpmco) Complaints/Inquiry/Follow-Up/Rejoinder FormDocument3 pagesConsumer Protection and Market Conduct Office (Cpmco) Complaints/Inquiry/Follow-Up/Rejoinder FormRocel Uy Alanan100% (1)

- MOADocument7 pagesMOAKaye RoxasNo ratings yet

- Anti-Sexual Harassment Policy-TemplateDocument5 pagesAnti-Sexual Harassment Policy-TemplateDefendcov Pocket WebinarsNo ratings yet

- COMPROMISE AGREEMENT - Antonio EstebanDocument3 pagesCOMPROMISE AGREEMENT - Antonio EstebanGigi De LeonNo ratings yet

- Employment Contracts: Non-Competition RestrictionsDocument3 pagesEmployment Contracts: Non-Competition RestrictionsRutvik DangarwalaNo ratings yet

- Demand Letter - Renato Gonzales To MoralesDocument5 pagesDemand Letter - Renato Gonzales To MoralesMJane PerezNo ratings yet

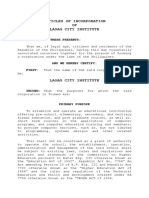

- Articles of Incorporation OF Laoag City Institute: Know All Men by These PresentsDocument9 pagesArticles of Incorporation OF Laoag City Institute: Know All Men by These PresentsEj LabradoNo ratings yet

- OJT FormsDocument9 pagesOJT FormsJohn ValenciaNo ratings yet

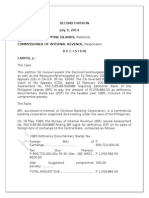

- Decision: Rizal Commercial G.R. No. 168498 Banking CorporationDocument6 pagesDecision: Rizal Commercial G.R. No. 168498 Banking CorporationLien PatrickNo ratings yet

- Notice To Explain EmployeeDocument1 pageNotice To Explain EmployeeJa VillamonteNo ratings yet

- Ruben G. Tecson, CPA: Independent Auditor'S ReportDocument3 pagesRuben G. Tecson, CPA: Independent Auditor'S Reportfranchesca marie t. uyNo ratings yet

- Promissory Note For The City TreasurerDocument1 pagePromissory Note For The City Treasurerfaith rollanNo ratings yet

- Demand To Vacate and Demolish Illegal SettlerDocument1 pageDemand To Vacate and Demolish Illegal SettlerLezl GusayNo ratings yet

- Tax Update RR 18-2012Document32 pagesTax Update RR 18-2012johamarz6245No ratings yet

- Due Process On Tax AssessmentDocument3 pagesDue Process On Tax AssessmentJbNo ratings yet

- Lascona vs. CIR (TAX)Document4 pagesLascona vs. CIR (TAX)Teff QuibodNo ratings yet

- BIR AssessmentDocument2 pagesBIR AssessmentambonulanNo ratings yet

- Political Law 2020 - Citizenship CasesDocument11 pagesPolitical Law 2020 - Citizenship CaseshenzencameroNo ratings yet

- Basbas vs. Sayson, 2011 - Judgment On The Pleadings - Summary JudgmentDocument19 pagesBasbas vs. Sayson, 2011 - Judgment On The Pleadings - Summary JudgmenthenzencameroNo ratings yet

- China Banking Corporation vs. Court of Appeals, 2000 - Equity Investment in Shares of Stock Capital AssetDocument7 pagesChina Banking Corporation vs. Court of Appeals, 2000 - Equity Investment in Shares of Stock Capital AssethenzencameroNo ratings yet

- Building Care Corp. vs. Myrna Macaraeg, 2012 - Doctrine of Finality of JudgmentDocument8 pagesBuilding Care Corp. vs. Myrna Macaraeg, 2012 - Doctrine of Finality of JudgmenthenzencameroNo ratings yet

- Fisher vs. Trinidad, 1922 - Stock Dividends Not Income Subject To TaxDocument20 pagesFisher vs. Trinidad, 1922 - Stock Dividends Not Income Subject To TaxhenzencameroNo ratings yet

- PP vs. Arcillas, 2012 - Qualified RapeDocument13 pagesPP vs. Arcillas, 2012 - Qualified RapehenzencameroNo ratings yet

- Political Law PrinciplesDocument1 pagePolitical Law PrincipleshenzencameroNo ratings yet

- CIR Vs United Salvage 2014Document17 pagesCIR Vs United Salvage 2014henzencameroNo ratings yet

- Catungal vs. Rodriguez, 2011 - Mixed Condition - Condition - Perfection - PerformanceDocument20 pagesCatungal vs. Rodriguez, 2011 - Mixed Condition - Condition - Perfection - PerformancehenzencameroNo ratings yet

- Limpo vs. CA, 2000 - Rules 19, 39, ROC - Right of Redemption - Writ of PossessionDocument11 pagesLimpo vs. CA, 2000 - Rules 19, 39, ROC - Right of Redemption - Writ of PossessionhenzencameroNo ratings yet

- Taganito Vs CIR RefundDocument4 pagesTaganito Vs CIR RefundhenzencameroNo ratings yet

- Addition Hills Mandaluyong vs. Megaworld, 2012 - Doctrine of Primary Jurisdiction - Exhaustion of Administrative RemediesDocument8 pagesAddition Hills Mandaluyong vs. Megaworld, 2012 - Doctrine of Primary Jurisdiction - Exhaustion of Administrative RemedieshenzencameroNo ratings yet

- Fort Bonifacio Development vs. CIR, 2014 - Transitional - Presumptive Input TaxDocument43 pagesFort Bonifacio Development vs. CIR, 2014 - Transitional - Presumptive Input TaxhenzencameroNo ratings yet

- CIR vs. Primetown Property Group, 2007 - Legal Periods in TaxationDocument10 pagesCIR vs. Primetown Property Group, 2007 - Legal Periods in TaxationhenzencameroNo ratings yet

- Camacho vs. CA, 1998 - 5-Year Period To Execute A Judgment by MotionDocument5 pagesCamacho vs. CA, 1998 - 5-Year Period To Execute A Judgment by MotionhenzencameroNo ratings yet

- NPC vs. Prov of Bataan, 2014-Tax-Indispensable PartyDocument5 pagesNPC vs. Prov of Bataan, 2014-Tax-Indispensable PartyhenzencameroNo ratings yet

- Creba vs. Romulo - MCITDocument1 pageCreba vs. Romulo - MCIThenzencameroNo ratings yet

- CEPALCO vs. City of CDO - Gross Annual ReceiptsDocument13 pagesCEPALCO vs. City of CDO - Gross Annual ReceiptshenzencameroNo ratings yet

- Navia vs. Pardico, 2012 - Writ of AmparoDocument13 pagesNavia vs. Pardico, 2012 - Writ of AmparohenzencameroNo ratings yet

- CIR vs. United Salvage and Towage, 2014 - CTA - Technical Rules of Evidence - PAN - FANDocument16 pagesCIR vs. United Salvage and Towage, 2014 - CTA - Technical Rules of Evidence - PAN - FANhenzencameroNo ratings yet

- Bañas vs. CA, 2000 - Installment Method of AccountingDocument15 pagesBañas vs. CA, 2000 - Installment Method of AccountinghenzencameroNo ratings yet

- Limpo vs. CA, 2000 - Rules 19, 39, ROC - Right of Redemption - Writ of PossessionDocument11 pagesLimpo vs. CA, 2000 - Rules 19, 39, ROC - Right of Redemption - Writ of PossessionhenzencameroNo ratings yet

- BPI vs. CIR, 2014 - DST - PrescriptionDocument9 pagesBPI vs. CIR, 2014 - DST - PrescriptionhenzencameroNo ratings yet

- Villanueva vs. Malaya, 2000 - Sec. 29, Rule 39 - Right To Redeem - Successor-In-InterestDocument13 pagesVillanueva vs. Malaya, 2000 - Sec. 29, Rule 39 - Right To Redeem - Successor-In-InteresthenzencameroNo ratings yet

- Valientes vs. Judge Ramas, 2010 - Imprescriptibility of Quieting of Title - Laches - RJDocument13 pagesValientes vs. Judge Ramas, 2010 - Imprescriptibility of Quieting of Title - Laches - RJhenzencameroNo ratings yet

- Disini vs. Secretary of Justice, 2014Document12 pagesDisini vs. Secretary of Justice, 2014henzencameroNo ratings yet

- GSIS vs. Lopez, 2009 - Stages of Contract of SaleDocument16 pagesGSIS vs. Lopez, 2009 - Stages of Contract of SalehenzencameroNo ratings yet

- Hemedes vs. CA, 1999 - Donation With Usufructuary RightsDocument16 pagesHemedes vs. CA, 1999 - Donation With Usufructuary RightshenzencameroNo ratings yet

- Braza vs. City Registrar and Titular, 2009 - Jurisdiction To Nullify Marriages - Rule On Legitimacy and FiliationDocument6 pagesBraza vs. City Registrar and Titular, 2009 - Jurisdiction To Nullify Marriages - Rule On Legitimacy and FiliationhenzencameroNo ratings yet

- Addition Hills Mandaluyong vs. Megaworld, 2012 - Doctrine of Primary Jurisdiction - Exhaustion of Administrative RemediesDocument8 pagesAddition Hills Mandaluyong vs. Megaworld, 2012 - Doctrine of Primary Jurisdiction - Exhaustion of Administrative RemedieshenzencameroNo ratings yet

- Arthur Hinman, How A British Subject Became President of The United StatesDocument46 pagesArthur Hinman, How A British Subject Became President of The United StatesSunYatSenBiography100% (1)

- No SellingDocument5 pagesNo SellingLemuel CayabyabNo ratings yet

- United States v. American Library Assn., Inc., 539 U.S. 194 (2003)Document39 pagesUnited States v. American Library Assn., Inc., 539 U.S. 194 (2003)Scribd Government DocsNo ratings yet

- Agila Bacolod Constitution and By-LawsDocument10 pagesAgila Bacolod Constitution and By-LawsJohn Dyrick DormisNo ratings yet

- International Shoe Co Vs WashingtonDocument13 pagesInternational Shoe Co Vs WashingtonMp CasNo ratings yet

- Zorach vs. ClausonDocument1 pageZorach vs. ClausonLeft Hook OlekNo ratings yet

- 07 - Quasha V SECDocument4 pages07 - Quasha V SECRaphael PangalanganNo ratings yet

- Chapter - 1 Introduction of Social JusticeDocument48 pagesChapter - 1 Introduction of Social JusticeGobind RanaNo ratings yet

- Complaint Against Doctors Before Lokayukta of BiharDocument15 pagesComplaint Against Doctors Before Lokayukta of Biharanon_968573480No ratings yet

- Major 4 PS Question Paper 3rd SemDocument8 pagesMajor 4 PS Question Paper 3rd SemChandra MouliNo ratings yet

- Labor Serrano Vs GallantDocument1 pageLabor Serrano Vs GallantCamille GrandeNo ratings yet

- GR No. 100150: Simon Vs CHRDocument7 pagesGR No. 100150: Simon Vs CHRteepeeNo ratings yet

- USMAF Cont BylawDocument25 pagesUSMAF Cont BylawartiemaskNo ratings yet

- Republic Vs VeraDocument2 pagesRepublic Vs VeraaaaNo ratings yet

- Moldex Realty V HlurbDocument3 pagesMoldex Realty V Hlurbtrish bernardoNo ratings yet

- Cabenet of Ministeries of IndiaDocument8 pagesCabenet of Ministeries of IndiaAmit KumarNo ratings yet

- Keith Fulton & Sons, Inc. v. New England Teamsters and Trucking Industry Pension Fund, Inc., 762 F.2d 1137, 1st Cir. (1985)Document21 pagesKeith Fulton & Sons, Inc. v. New England Teamsters and Trucking Industry Pension Fund, Inc., 762 F.2d 1137, 1st Cir. (1985)Scribd Government DocsNo ratings yet

- Rimando v. Naguilian Emission Testing Center, Inc.Document1 pageRimando v. Naguilian Emission Testing Center, Inc.GR100% (1)

- Atty. Vargas - DLSU Persons Outline August 2018Document37 pagesAtty. Vargas - DLSU Persons Outline August 2018pyriadNo ratings yet

- Peter J. Coruzzi v. State of New Jersey, Administrative Office of The State of New Jersey, 705 F.2d 688, 3rd Cir. (1983)Document6 pagesPeter J. Coruzzi v. State of New Jersey, Administrative Office of The State of New Jersey, 705 F.2d 688, 3rd Cir. (1983)Scribd Government DocsNo ratings yet

- Kompetenz-Kompetenz (ADR Research Paper)Document14 pagesKompetenz-Kompetenz (ADR Research Paper)Karthik RanganathanNo ratings yet

- The Lyttleton Constitution of 1954 - Main Features, Merits and Demerits - OldNaijaDocument1 pageThe Lyttleton Constitution of 1954 - Main Features, Merits and Demerits - OldNaijaSamuel Nwabueze67% (3)

- Senate Vs Ermita - G.R. 169777, April 20, 2006Document2 pagesSenate Vs Ermita - G.R. 169777, April 20, 2006DyanNo ratings yet

- Resolution Approving The Barangay Devolution Transition PlanDocument2 pagesResolution Approving The Barangay Devolution Transition PlanVirgo Cayaba88% (25)

- The Nexus Between Autonomy and Religious Identity of Parsi WomenDocument14 pagesThe Nexus Between Autonomy and Religious Identity of Parsi WomenkaumudiNo ratings yet

- TISS 2015 GK Preparation Civics and PoliticsDocument6 pagesTISS 2015 GK Preparation Civics and Politicsfree lanceNo ratings yet

- Land Titles and Deeds Outline 2012.0516Document10 pagesLand Titles and Deeds Outline 2012.0516keith105No ratings yet

- Alyansa para Sa Bagong Pilipinas, Inc. (Abp) vs. Energy Regulatory CommissionDocument41 pagesAlyansa para Sa Bagong Pilipinas, Inc. (Abp) vs. Energy Regulatory Commissionpot tpNo ratings yet

- Commission On Audit of The PhilippinesDocument9 pagesCommission On Audit of The PhilippinesMicho DiezNo ratings yet

- Sansadiya Shabdavali09Document241 pagesSansadiya Shabdavali09Janardan PrasadNo ratings yet