Professional Documents

Culture Documents

BIR Form 0901 Back Up

Uploaded by

ChristianNicolasBetantosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Form 0901 Back Up

Uploaded by

ChristianNicolasBetantosCopyright:

Available Formats

Aaron Louise C.

Alminiana

CBET-01-701E

MH/ 6:00-7:30PM

BIR FORM 0901-O: TAX TREATY RELIEF

APPLICATION FOR OTHER INCOME EARNINGS

BIR Form 0901-O is for the Tax Treaty Relief Application for Other Income

Earnings. According to Punongbayan-Araullo.com, Tax treaty relief applications are

require whenever exemptions or preferential rates under tax treaties are applied when

making payments to non-residents. Without the application, the payment shall be

subjected to the regular tax rates.

A revised guideline on the processing of tax treaty application (TTRA) had been

issued by the Bureau of Internal Revenue (BIR). Below are significant features of the

guideline:

1.

Revised and updated tax treaty relief application forms shall be prescribed for

specific types of income.

2.

A minimum (general) set of documentary requirements shall be required for

submission and in addition, specific documentary requirements for each type of

income.

3.

The TTRA should be filed before the occurrence of first taxable event (i.e.,

when the income payor is required to withhold the income tax or time the income

payor is required withheld taxes had the transaction been subjected to tax or before

the due date for the DST in case of sale of shares of stock).

4.

5.

The ITAD shall be the sole office responsible for receiving TTRA.

Requests for ruling not accompanied by complete documents and based on

hypothetical transactions or future transactions shall not be accepted. These shall

be considered as no-ruling area.

6.

The withdrawal of application/documents already filed with ITAD shall not be

allowed.

7.

The ITAD ruling shall be issued after 60 days, or in case there is no issue on

income characterization30 days from the date of receipt of TTRA or submission of

complete documentary requirements, whichever comes later.

Page | 1

8.

Disclosure to any person, including the tax treaty relief applicant or his/its

representatives of the draft BIR ruling or recommended action on the TTRA shall be

prohibited while the same has not been signed by the proper signatory of the BIR.

9.

A ruling which is adverse to a non-resident income earner should be appealed

for review at the Department of Finance within 30 days from date of receipt

pursuant to Finance Department Order 23-01.

Form 0901-O with all necessary documents shall be submitted only to and

received by the International Tax Affairs Division of the Bureau of Internal Revenue.

Filing should always be made before the transaction, the occurrence of the first taxable

event.

The guidelines and instructions in filing Form 0901-O, as shown at the back of

the form itself, are as follows:

1. This form shall be duly accomplished in (3) three copies which must be signed by

the applicant who may either be the income earner or the duly authorized

representative of the income earner. All fields must be mandatorily filled-up. If

"NOT APPLICABLE" or "NONE" is/are the appropriate response, the same

has/have to be clearly indicated in the corresponding field.

2. This form together with all the necesary documents mentioned in Part VI shall be

submitted only to and received by the International Tax Affairs Division of the

Bureau of Internal Revenue. Filing should always be made BEFORE the

transaction. Transaction for purposes of filing the Tax Treaty Relief Application

(TTRA) shall mean before the occurrence of the first taxable event.

3. First taxable event shall mean the first or the only time when the income payor is

required to withhold the income tax thereon or should have withheld taxes

thereon had the transaction been subjected to tax.

4. Failure to properly file the TTRA with ITAD within the period prescribed herein

shall have the effect of disqualifying the TTRA under this RMO.

Page | 2

You might also like

- Lesson 12 CompensationDocument25 pagesLesson 12 CompensationChristianNicolasBetantosNo ratings yet

- Staffing: - International Assignments - Documentation of Employment Eligibility - New Trends in StaffingDocument30 pagesStaffing: - International Assignments - Documentation of Employment Eligibility - New Trends in StaffingChristianNicolasBetantosNo ratings yet

- COOPERATIVEDocument6 pagesCOOPERATIVEChristianNicolasBetantosNo ratings yet

- Scribd Upload SectionDocument1 pageScribd Upload SectionChristianNicolasBetantosNo ratings yet

- Scribd Trial Version ScreenshotDocument1 pageScribd Trial Version ScreenshotChristianNicolasBetantosNo ratings yet

- Essential MS Apps and Shortcut KeysDocument3 pagesEssential MS Apps and Shortcut KeysChristianNicolasBetantosNo ratings yet

- New Centrl Bank ActDocument5 pagesNew Centrl Bank ActChristianNicolasBetantosNo ratings yet

- Google Incognito ScreeshotDocument1 pageGoogle Incognito ScreeshotChristianNicolasBetantosNo ratings yet

- Bookmark and ShareDocument7 pagesBookmark and ShareChristianNicolasBetantosNo ratings yet

- Intellectual Property LawDocument4 pagesIntellectual Property LawChristianNicolasBetantosNo ratings yet

- 2009-SEC Form ExA-001-Renewal External AuditorDocument2 pages2009-SEC Form ExA-001-Renewal External AuditorRheneir MoraNo ratings yet

- Request release of checkbooksDocument1 pageRequest release of checkbooksChristianNicolasBetantosNo ratings yet

- Sources of ObligationsDocument1 pageSources of ObligationsChristianNicolasBetantosNo ratings yet

- Search Box ScribdDocument1 pageSearch Box ScribdChristianNicolasBetantosNo ratings yet

- Accounting, Business Law and Tax TutorialDocument1 pageAccounting, Business Law and Tax TutorialChristianNicolasBetantosNo ratings yet

- Risks of Partner Assignments and Third Party ProfitsDocument1 pageRisks of Partner Assignments and Third Party ProfitsChristianNicolasBetantosNo ratings yet

- Application for Accounting Teacher AccreditationDocument2 pagesApplication for Accounting Teacher AccreditationRommel RoyceNo ratings yet

- Applied Auditing 2017 Updates and Errata As of August 1 2017Document3 pagesApplied Auditing 2017 Updates and Errata As of August 1 2017Aira ButligNo ratings yet

- Kaloob 2015Document25 pagesKaloob 2015ChristianNicolasBetantosNo ratings yet

- ObligationsDocument1 pageObligationsChristianNicolasBetantosNo ratings yet

- Dti Form 010101Document3 pagesDti Form 010101ChristianNicolasBetantosNo ratings yet

- Partnership IntroDocument1 pagePartnership IntroChristianNicolasBetantosNo ratings yet

- Job Aid For The Use of Offline eBIRForms Package PDFDocument36 pagesJob Aid For The Use of Offline eBIRForms Package PDFMarjorie Calantog BergadoNo ratings yet

- AaaaDocument1 pageAaaaChristianNicolasBetantosNo ratings yet

- Test Bank Law 1 CparDocument26 pagesTest Bank Law 1 CparJoyce Kay Azucena73% (22)

- Vacant Position - 16 January 2017 - Accountant II (FAS)Document1 pageVacant Position - 16 January 2017 - Accountant II (FAS)ChristianNicolasBetantosNo ratings yet

- Withholding Tax RatesDocument35 pagesWithholding Tax RatesZonia Mae CuidnoNo ratings yet

- Nbi Step by Step GuidelinesDocument16 pagesNbi Step by Step GuidelinesHenry Biyo Malones Jr.No ratings yet

- Business Law Testbanks / ReviewersDocument32 pagesBusiness Law Testbanks / ReviewersPutoy Itoy100% (1)

- PWC Global Automotive Tax Guide 2015Document571 pagesPWC Global Automotive Tax Guide 2015ChristianNicolasBetantos100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Illuh Asaali, Hatib Abdurasid, Ingkoh Bantala, Basok Ingkin, and Mohammad BANTALLA, Petitioners, The Commissioner of Customs, RespondentDocument4 pagesIlluh Asaali, Hatib Abdurasid, Ingkoh Bantala, Basok Ingkin, and Mohammad BANTALLA, Petitioners, The Commissioner of Customs, RespondentJen CastroNo ratings yet

- Salma Afidah,: Acceptance LetterDocument4 pagesSalma Afidah,: Acceptance LetterSalma AfidahNo ratings yet

- HDGP Personal Bias PaperDocument4 pagesHDGP Personal Bias Paperapi-328741177No ratings yet

- Models of Corporate Governance: Different Approaches ExplainedDocument25 pagesModels of Corporate Governance: Different Approaches Explainedvasu aggarwalNo ratings yet

- International GCSE History Scheme of WorkDocument18 pagesInternational GCSE History Scheme of WorkAnwar EldalliNo ratings yet

- Arrest Remand and Torture in BangladeshDocument24 pagesArrest Remand and Torture in BangladeshAbir N ZainNo ratings yet

- Why Is Everyone Playing Games With MuslimsDocument4 pagesWhy Is Everyone Playing Games With MuslimsMoinullah KhanNo ratings yet

- Civil Procedure OutlineDocument25 pagesCivil Procedure OutlineElNo ratings yet

- Appeals Court-Reply To Response To Irs Brief To Appeals Court-4!14!12Document38 pagesAppeals Court-Reply To Response To Irs Brief To Appeals Court-4!14!12Ask MeforitNo ratings yet

- Statement On Sheriff's Comments 12.17.20Document2 pagesStatement On Sheriff's Comments 12.17.20Jeff NelsonNo ratings yet

- Agustin vs. Intermediate Appellate Court 187 SCRA 218, July 05, 1990Document7 pagesAgustin vs. Intermediate Appellate Court 187 SCRA 218, July 05, 1990juan dela cruzNo ratings yet

- Abolition of Zamindar System & Introduction to UPZA & LR ActDocument15 pagesAbolition of Zamindar System & Introduction to UPZA & LR ActVaishnavi Pandey0% (1)

- Criminal Law 2 MidtermDocument53 pagesCriminal Law 2 MidtermMitch Tinio100% (1)

- Law of ContractsDocument3 pagesLaw of Contractsyuvasree talapaneniNo ratings yet

- Executive Order 66Document5 pagesExecutive Order 66Hyman Jay BlancoNo ratings yet

- Resolution On Road and Brgy Hall Financial AssistanceDocument6 pagesResolution On Road and Brgy Hall Financial AssistanceEvelyn Agustin Blones100% (2)

- Silongan CaseDocument3 pagesSilongan CaseShim-b Tiu100% (1)

- The Four Fold TestDocument4 pagesThe Four Fold TestGeneva Bejasa Arellano100% (3)

- Divorce BillDocument23 pagesDivorce BillRowena M. BeceiraNo ratings yet

- Please Take Notice That The Court en Banc Issued A Resolution Dated JANUARYDocument10 pagesPlease Take Notice That The Court en Banc Issued A Resolution Dated JANUARYAnonymous gG0tLI99S2No ratings yet

- Men of Freedom: A Review of T. H. Breen and Stephen Innes' "Myne Owne Ground"Document5 pagesMen of Freedom: A Review of T. H. Breen and Stephen Innes' "Myne Owne Ground"Senator FinkeNo ratings yet

- MLK Interview on Nonviolent ResistanceDocument10 pagesMLK Interview on Nonviolent ResistanceFarook IbrahimNo ratings yet

- 072 City of Manila v. SerranoDocument2 pages072 City of Manila v. SerranoIris GallardoNo ratings yet

- God39s Century Resurgent Religion and Global Politics SparknotesDocument3 pagesGod39s Century Resurgent Religion and Global Politics SparknotesScottNo ratings yet

- 3M's Commitment to Diversity, Inclusion and EquityDocument5 pages3M's Commitment to Diversity, Inclusion and EquitySri VastavNo ratings yet

- WW 1Document8 pagesWW 1hunaiza khanNo ratings yet

- MarxismDocument16 pagesMarxismKristle Jane VidadNo ratings yet

- Butler Judith Deshacer El Genero 2004 Ed Paidos 2006Document23 pagesButler Judith Deshacer El Genero 2004 Ed Paidos 2006Ambaar GüellNo ratings yet

- Philippine High Court Rules on Forum ShoppingDocument21 pagesPhilippine High Court Rules on Forum ShoppingGabriel AdoraNo ratings yet

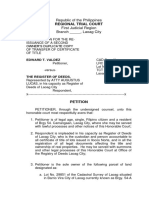

- Petition Lost TitleDocument3 pagesPetition Lost TitleEdward Tolentino ValdezNo ratings yet