Professional Documents

Culture Documents

CX Gen25 29

Uploaded by

శ్రీనివాసకిరణ్కుమార్చతుర్వేదులOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CX Gen25 29

Uploaded by

శ్రీనివాసకిరణ్కుమార్చతుర్వేదులCopyright:

Available Formats

1027

GENERAL EXEMPTION NO. 25& 26

V.

EXEMPTION TO GOODS CAPTIVELY CONSUMED.

GENERAL EXEMPTION NO. 25

Exemption to goods manufactured in a factory and captively consumed for the manufacture of final

products, subject to conditions of specified notifications.

[Notifn. No. 83/92-CE dt.16.9.1992 as amended by Notifn. Nos. 79/95 and 7/98].

In exercise of the powers conferred by sub-section (1) of section 5A of the Central Excises

and Salt Act, 1944 (1 of 1944), the Central Government, being satisfied that it is necessary in the

public interest so to do, hereby exempts all excisable goods manufactured in a factory and used

within the factory of production (hereinafter referred to as inputs) for the manufacture

of final products, cleared in accordance with the provisions contained in any of the notifications

mentioned in the Schedule to this notification, from the whole of the duty of excise leviable thereon

which is specified in the Schedule to the Central Excise Tariff Act, 1985 (5 of 1986).

Explanation - For the purpose of this notification inputs does not include(i)

machines, machinery, plant, equipment, apparatus, tools or appliances used for

producing or processing of any goods or for bringing about any change in any

substance in or in relation to the manufacture of the final products;

(ii)

packaging materials in respect of which any exemption to the extent of the duty

of excise payable on the value of the packaging materials is being availed of for

packaging any final products;

(iii)

packaging materials or containers the cost of which is not included in the

assessable value of the final products under section 4 of the Central Excises and

Salt Act, 1944 (1 of 1944);

SCHEDULE

1.

2.

3.

4.

No.164/87-Central Excises, dated the 10th June, 1987.

No.62/95-Central Excises, dated the 16th March, 1995 (only S.No.1).

No.63/95-Central Excises, dated the 16th March, 1995 (only S.No.2 and 11).

No.64/95-Central Excises, dated the 16th March, 1995 (only S.Nos. 3,5 and 8).

GENERAL EXEMPTION NO. 26

Exemption to capital goods and all goods (other than LDO, HSD and petrol) captively consumed

for manufacture of final products (other than matches).

[Notifn. 67/95-CE dt.16.3.1995 as amended by Notifn. Nos. 20/96, 11/97, 59/97, 32/00, 35/00, 31/

01, 35/01, 11/02, and 16/03].

In exercise of the powers conferred by sub-section (1) of section 5A of the Central Excises

and Salt Act, 1944 (1 of 1944), the Central Government, being satisfied that it is necessary in the

public interest so to do, hereby exempts (w.e.f. 1.4.03 for section 5A of the Central Excises and Salt

GENERAL EXEMPTION NO. 26

1028

Act, 1944 (1 of 1944) read) (section 5A of the Central Excise, Act, 1944 (1 of 1944), read with subsection (3) of section 3 of the Additional Duties of Excise (Goods of Special Importance Act, 1957

(58 of 1957), (herein after referred to as the said Special Importance Act),

(i)

capital goods as defined in CENVAT Credit Rules, 2002 manufactured in a

factory and used within the factory of production;

(ii)

goods specified in column (1) of the Table hereto annexed (hereinafter referred

to as "inputs") manufactured in a factory and used within the factory of

production in or in relation to manufacture of final products specified in column

(2) of the said Table;

from the whole of the duties of excise leviable thereon which is specified in the Schedules to the

Central excise Tariff Act, 1985 (5 of 1986) or additional duty of excise leviable thereon which is

specified in the First Schedule to the said Special Importance Act.

Provided that nothing contained in this notification shall apply to inputs used in or in

relation to the manufacture of final products which are exempt from the whole of the duty of excise

or additional duty of excise leviable thereon or are chargeable to nil rate of duty, other than those

goods which are cleared.

(i)

(ii)

(iii)

(iv)

(v)

(vi)

to a unit in a Free Trade Zone, or

to a hundred percent Export Oriented Undertaking or

to a unit in an Electronic Hardware Technology Park, or

to a unit in a Software Technology Park, or

under notification No. 108/95-Central Excise dated the 28th August, 1995, or

by a manufacturer of dutiable and exempted final products, after discharging the

obligation prescribed in rule 6 of the CENVAT Credit Rules, 2001

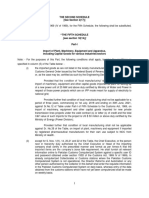

Table

Description

Inputs

Description of final products

(1)

(2)

All goods falling under the First Schedule

to the Central to the Central Excise Tariff Act, 1985

other than the (5 of 1986), other than light diesel oil high speed

diesel oil and motor spirit, commonly known as petrol.

the

than

All goods falling under the First Schedule

Excise Tariff Act, 1985 (5 of 1986),

following namely:(i) matches;

(ii) fabrics of cotton or man made fibres

falling under

Chapter 52, Chapter 54 or Chapter 55 of

First Schedule

to the said Act;

(iii) fabrics of cotton or man-made fibres

falling under

heading No.58.01, 58.02, 58.06 (other

goods falling

under sub-heading No.5806.20), 60.01 or

following namely:-60.02 (other than goods

falling under sub-heading No.6002.10) of

1029

GENERAL EXEMPTION NO. 27

(1)

(2)

the First Schedule to the said Act.w.e.f. 1.4.03, description of Final Product

may be rea as [ All goods falling under the

First Schedule to the

Central Excise Tariff Act, 1985, other

matches ].

than

GENERAL EXEMPTION NO. 27

Exemption to all the excisable goods captively consumed for the manufacture of specified goods.

[Notifn. 10/96-CE dt.23.7.1996, as amended by Notifn. Nos. 11/00, 41/04, 18/06, 48/06, 39/11].

In exercise of the powers conferred by sub-section (1) of section 5A of the Central Excises

and Salt Act, 1944 (1 of 1944), the Central Government being satisfied that it is necessary in the public

interest so to do, hereby exempts all goods falling within the Schedule to the Central Excise Tariff

Act, 1985 (5 of 1986), from the whole of the duty of excise leviable thereon which is specified in the

said Schedule, subject to the condition that the said goods are consumed within the factory of their

production in the manufacture of goods specified in column (3) of the Table hereto annexed and

falling under Chapter, heading No. or sub-heading No. of the said Schedule as specified in the

corresponding entry in column (2) of the said Table.

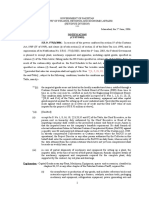

TABLE

________________________________________________________________________________________________________

S.No.

Chapter or Heading No. or

(1)

(2)

1.

2.

3.

4.

5.

6.

7.

15 (except 1517 10 22,

1520 00 00, 1521 and 1522)

21

2202

23

2845 10 00

2853 00 30

3003, 3004

8.

9.

31

4011, 4012

10.

4701 to 4706

11.

12.

4801

64

13.

14.

15.

71

7319

7321 or 7418 19 0r 7419 99

Description

sub-heading No.

(3)

All goods

All goods

Fruit pulp based beverages

Animal feed

Heavy water

Compressed air

Medicaments (including veteri

nary medicaments)

Fertilisers

Pneumatic tyres of a kind used on

bicycles, cycle-rickshaws

and three wheeled powered cyclerickshaws

Wood pulp and pulp of other fi

brous cellulosic materials

News print

Footwear of retail sale price not

exceeding Rs.250 per pair

and hawai chappal (other than of

leather) that is to say,

chappals known commercially as

"hawai chappals".

Rough synthetic gem stones

Sewing needles

Kerosene burners, kerosene

GENERAL EXEMPTION NO. 28

(1)

(2)

16.

8539

17.

9021

18.

9608

19.

1030

(3)

1905 31 00 or 1905 90 20

stoves and wood buring stoves,

or iron or steel copper or copper

alloy.

Vacuum and gas filled bulbs of

value not exceding Rs.10

per bulb.

Artificial limbs and rehabilita

tion aids for the handicapped

Ball point pens including refills

for ball point pens and parts

thereof

Biscuits cleared in packaged form with

per kg retail sale price equivalent not

exceeding Rs. 100.

Explanation.- retail sale price

shall have the same meaning as

defined in column (3) against S.

No. 18A of notification no.3/

2006-Central Excise dated 1st

March,2006 published vide G.S.R.

93 (E), dated the 1st March, 2006

2. Nothing contained in this notification shall apply to any inputs or intermediate goods other

than sugar syrup or cream used in the manufacture of goods mentioned at S. No. 19.

________________________________________________________________________________________________________

GENERAL EXEMPTION NO. 28

Exemption to goods manufactured in a workshop and used within the factory for repairs and

maintenance of machinery installed therein.

[Notifn. No.65/95-CE dt.16.3.1995.].

In exercise of the powers conferred by sub-section (1) of section 5A of the Central Excises

and Salt Act, 1944 (1 of 1944), the Central Government, being satisfied that it is necessary in the

public interest so to do, hereby exempts excisable goods falling within the Schedule to the Central

Excise Tariff Act, 1985 (5 of 1986), if they are manufactured in a workshop within a factory

(hereinafter referred to as the said factory), from the whole of the duty of excise leviable thereon

which is specified in the said Schedule.

Provided that the excisable goods are used within the said factory, for repairs or

maintenance of machinery installed therein.

Reference:

For exemption to goods of sub-heading No. 2106.00 and Chapter 24 and

captively consumed for the manufacture of final goods of Chapter 24 please see

Notfn. No. 52/02-CE., dt. 17.10.2002 under Chapter 24

GENERAL EXEMPTION NO. 29

1031

GENERAL EXEMPTION NO. 29

Exemption from Additional duty of excise leviable under Sec. 85 of Finance Act 2005 in respect

of goods captively consumed.

[Notfn. No. 23/05-CE., dated 13.5.2005]

In exercise of the powers conferred by sub-section (1) of section 5A of the Central Excise

Act, 1944 (1 of 1944) read with sub-section (3) of section 85 of the Finance Act, 2005 (18 of 2005),

the Central Government, on being satisfied that it is necessary in the public interest so to do,

hereby exempts all goods, produced and used within the factory of their production in the

manufacture of final product on which additional duty of excise is leviable under sub-section (1)

of section 85 of the said Finance Act, from the whole of the additional duty of excise, leviable

under said sub-section (1) of section 85 of the said Finance Act.

You might also like

- Industrial Machinery World Summary: Market Values & Financials by CountryFrom EverandIndustrial Machinery World Summary: Market Values & Financials by CountryNo ratings yet

- Ix. Exemption To Certain Goods and IndustriesDocument7 pagesIx. Exemption To Certain Goods and IndustriesManish GautamNo ratings yet

- Section-XXI Chapter-98Document10 pagesSection-XXI Chapter-98శ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- IV. Job Work Notifications General Exemption No. 23Document6 pagesIV. Job Work Notifications General Exemption No. 23Samy JainNo ratings yet

- CENVAT and Special Duty Rates on Excisable GoodsDocument2 pagesCENVAT and Special Duty Rates on Excisable GoodsKrishna Kumar VermaNo ratings yet

- Notification No. 115 75 CEDocument1 pageNotification No. 115 75 CEpatelpratik1972No ratings yet

- CH 98Document4 pagesCH 98dkhatri01No ratings yet

- Cex0606 PDFDocument19 pagesCex0606 PDFbravoswagatNo ratings yet

- An Import Is Any Good or Service Brought Into One Country From Another Country in A Legitimate FashionDocument21 pagesAn Import Is Any Good or Service Brought Into One Country From Another Country in A Legitimate FashionsolankikavitaNo ratings yet

- Circular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedDocument10 pagesCircular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedNitesh RawatNo ratings yet

- Personal DutyDocument13 pagesPersonal DutyEarwineNo ratings yet

- 1995 PurchaseDocument3 pages1995 PurchaseDilip SinghNo ratings yet

- Fifth Schedule PDFDocument56 pagesFifth Schedule PDFAkber LakhaniNo ratings yet

- Section XXI Chapter-98: ITC (HS), 2012 Schedule 1 - Import PolicyDocument4 pagesSection XXI Chapter-98: ITC (HS), 2012 Schedule 1 - Import Policysbos1No ratings yet

- Duty Drawback Feb 2020Document192 pagesDuty Drawback Feb 2020AkashAgarwalNo ratings yet

- CENVAT Credit Rules GuideDocument21 pagesCENVAT Credit Rules GuideHimanshu SawNo ratings yet

- SCH 2 3Document16 pagesSCH 2 3mahabalu123456789No ratings yet

- Notification: S.R.O. 1012 (I) /2011.-In Exercise of The Powers Conferred by Clause (C) of Section 4 ReadDocument7 pagesNotification: S.R.O. 1012 (I) /2011.-In Exercise of The Powers Conferred by Clause (C) of Section 4 ReadYasir MasoodNo ratings yet

- Central Excise Act 1944, Central Excise Rule 2002 and Goods and Sales Tax (GST)Document42 pagesCentral Excise Act 1944, Central Excise Rule 2002 and Goods and Sales Tax (GST)kushal patilNo ratings yet

- Scoial Welfare Surcharge 11-2018-Cus Dated 02.12.2018Document4 pagesScoial Welfare Surcharge 11-2018-Cus Dated 02.12.2018DRI HQ CINo ratings yet

- 2008SRO549Document5 pages2008SRO549Aakash RoyNo ratings yet

- Central VATDocument13 pagesCentral VATBharat ChoudharyNo ratings yet

- LBT Rates NagpurDocument15 pagesLBT Rates NagpurPankaj GoyenkaNo ratings yet

- Sro 575 Updated 200313Document40 pagesSro 575 Updated 200313Asaad ZahirNo ratings yet

- Notification No 8 2002Document6 pagesNotification No 8 2002Dhananjay KulkarniNo ratings yet

- Notification No. 95 of 2018 CUSTOMS N.T PDFDocument176 pagesNotification No. 95 of 2018 CUSTOMS N.T PDFARJUNNo ratings yet

- Valuation of GoodsDocument46 pagesValuation of Goodsshreyansh120No ratings yet

- Notification No. 04/2015-Customs (ADD)Document3 pagesNotification No. 04/2015-Customs (ADD)ashly_099No ratings yet

- DBK Rate 2018 PDFDocument176 pagesDBK Rate 2018 PDFmahen aryaNo ratings yet

- Second Schedule (Fifth Schedule)Document95 pagesSecond Schedule (Fifth Schedule)Adnan KhanNo ratings yet

- Court Cases Customs 1995-2010 enDocument329 pagesCourt Cases Customs 1995-2010 enmipetreNo ratings yet

- Sez Rules2006Document94 pagesSez Rules2006bighnesh_nistNo ratings yet

- TN Vat RatesDocument57 pagesTN Vat RatesdeepadeepadeepaNo ratings yet

- Government of India Ministry of Finance (Department of Revenue)Document5 pagesGovernment of India Ministry of Finance (Department of Revenue)patelpratik1972No ratings yet

- Gazette Notification SummaryDocument151 pagesGazette Notification SummarySivakumar AmbikapathyNo ratings yet

- Notification No.249 1985 CEDocument2 pagesNotification No.249 1985 CEpatelpratik1972No ratings yet

- Notification No.103 93 C.EDocument1 pageNotification No.103 93 C.Epatelpratik1972No ratings yet

- Sro 575 (I) 2006Document38 pagesSro 575 (I) 2006sehrish23No ratings yet

- Notification No. 9/2013-Customs (ADD)Document3 pagesNotification No. 9/2013-Customs (ADD)stephin k jNo ratings yet

- Find Export PolicyDocument40 pagesFind Export PolicyMukaram Irshad NaqviNo ratings yet

- Chapter 01 Free Movement of GoodsDocument110 pagesChapter 01 Free Movement of GoodsVitalina SimerețchiiNo ratings yet

- Overview of Central ExciseDocument31 pagesOverview of Central ExciseMadhuree PerumallaNo ratings yet

- Notification No.248 1985 CEDocument1 pageNotification No.248 1985 CEpatelpratik1972No ratings yet

- Sub: Technology Upgradation Fund Scheme (TUFS)Document5 pagesSub: Technology Upgradation Fund Scheme (TUFS)palanisamyannurNo ratings yet

- Comprehensive Manual On 4ad RefundsDocument50 pagesComprehensive Manual On 4ad RefundshaamaNo ratings yet

- Commodity CodesDocument55 pagesCommodity CodesjesuswithusNo ratings yet

- Rules for cost records and audits under Companies ActDocument8 pagesRules for cost records and audits under Companies Actbhuban020383No ratings yet

- COP5 discusses tobacco manufacturing equipmentDocument3 pagesCOP5 discusses tobacco manufacturing equipmentsham javedNo ratings yet

- Parts Thereof Other Than Tractors,: GazetteDocument25 pagesParts Thereof Other Than Tractors,: GazetteMandar BahadarpurkarNo ratings yet

- Central Excise JK ExemptDocument33 pagesCentral Excise JK Exemptadi_vijNo ratings yet

- Non-Levy/Short Levy of Additional DutyDocument5 pagesNon-Levy/Short Levy of Additional Dutybiko137No ratings yet

- cs12 2012 PDFDocument141 pagescs12 2012 PDFDipesh Chandra BaruaNo ratings yet

- The Customs Tariff Act, 1975: EctionsDocument1,116 pagesThe Customs Tariff Act, 1975: EctionsAndrea RobinsonNo ratings yet

- csnt77-2023 - Applicable 30-Oct-23Document159 pagescsnt77-2023 - Applicable 30-Oct-23Sumit ChhuganiNo ratings yet

- I Direct TaxDocument155 pagesI Direct TaxRajnish ShastriNo ratings yet

- HighLights ST FEDocument34 pagesHighLights ST FEShakir MuhammadNo ratings yet

- Compendium of Law&Regulations For-MailDocument281 pagesCompendium of Law&Regulations For-MailAmbuj SakiNo ratings yet

- Commercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryFrom EverandCommercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryNo ratings yet

- QTR Return Reg DealersDocument1 pageQTR Return Reg Dealersశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Ait ActDocument93 pagesAit Actశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Budget Highlights 2014 Central ExciseDocument11 pagesBudget Highlights 2014 Central Exciseశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- 8638 EPCG SchemeDocument2 pages8638 EPCG SchemePriyank KohliNo ratings yet

- UserManual Ver1.4 Employers New PDFDocument41 pagesUserManual Ver1.4 Employers New PDFAmitKumarNo ratings yet

- Form E.R.-8 Original/DuplicateDocument4 pagesForm E.R.-8 Original/Duplicateశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Invoice: Original Duplicate Triplicate QuadruplicateDocument2 pagesInvoice: Original Duplicate Triplicate Quadruplicateశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- PF E-Return ManualDocument24 pagesPF E-Return Manualchirag bhojakNo ratings yet

- Invoice: Original Duplicate Triplicate QuadruplicateDocument2 pagesInvoice: Original Duplicate Triplicate Quadruplicateశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- 45 Cash Flow FormatDocument1 page45 Cash Flow FormatSunil MehtaNo ratings yet

- Proforma of b1 BondDocument1 pageProforma of b1 Bondశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- CT-1 Certificate for EOU ProcurementDocument3 pagesCT-1 Certificate for EOU ProcurementPrassanna KumariNo ratings yet

- Are 1Document5 pagesAre 1kal74No ratings yet

- QTR Return Reg DealersDocument1 pageQTR Return Reg Dealersశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Before The Customs and Central Excise Settlement Commission - Bench at - Form of Application For Settlement of A Case Under Section 32EDocument3 pagesBefore The Customs and Central Excise Settlement Commission - Bench at - Form of Application For Settlement of A Case Under Section 32Eశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Manual CINDocument41 pagesManual CINkrishna_1238No ratings yet

- Registration Form: Dr. Radha RaghuramapatruniDocument2 pagesRegistration Form: Dr. Radha Raghuramapatruniశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- 5 Eou Compliance Check ListDocument4 pages5 Eou Compliance Check ListPrassanna Kumari100% (1)

- Mothers Name On PAN CardDocument2 pagesMothers Name On PAN Cardశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Formats & Procedures for STP/EHTP UnitsDocument16 pagesFormats & Procedures for STP/EHTP Unitsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Cenvat Credit PDFDocument38 pagesCenvat Credit PDFsaumitra_mNo ratings yet

- Cenvat Credit PDFDocument38 pagesCenvat Credit PDFsaumitra_mNo ratings yet

- Central ExciseDocument157 pagesCentral ExciseDilip SinghNo ratings yet

- Materials ManagementDocument3 pagesMaterials Managementశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Cenvat Credit and Tax Credit System ExplainedDocument44 pagesCenvat Credit and Tax Credit System Explainedశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- CLM-Logistics at LargeDocument21 pagesCLM-Logistics at Largeశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Cold ChainDocument7 pagesCold Chainశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Explanation of CBEC and Non-CBEC Currency CalculationsDocument28 pagesExplanation of CBEC and Non-CBEC Currency Calculationsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Survey explores consumer preferences for wrist watchesDocument14 pagesSurvey explores consumer preferences for wrist watchessyainsiNo ratings yet

- Elastic Tape ManufacturingDocument8 pagesElastic Tape ManufacturingNand SinghNo ratings yet

- DT Textiles Gcse Coursework Examples AqaDocument6 pagesDT Textiles Gcse Coursework Examples Aqaxdqflrobf100% (2)

- Presentation - MKT209m - Ao Dai Dan Phuong - FinalDocument24 pagesPresentation - MKT209m - Ao Dai Dan Phuong - FinalQuân NgôNo ratings yet

- Summer Training Report On Nakoda LTDDocument82 pagesSummer Training Report On Nakoda LTDSanup SimonNo ratings yet

- Project Report On GarmentsDocument3 pagesProject Report On GarmentsEIRI Board of Consultants and PublishersNo ratings yet

- Construction of The CorsetDocument142 pagesConstruction of The CorsetRolin Monica100% (4)

- Appendix G: Common ErrorsDocument22 pagesAppendix G: Common ErrorsTabitha HowardNo ratings yet

- Production of Glass Fiber-972223 PDFDocument71 pagesProduction of Glass Fiber-972223 PDFمحمد قديشي100% (2)

- Whirlpool Washing Machine Repair Manual 4GWTW4740YQ1 4GWTW4800YQ1 4GWTW4800YQ2 4GWTW4740YQ2Document64 pagesWhirlpool Washing Machine Repair Manual 4GWTW4740YQ1 4GWTW4800YQ1 4GWTW4800YQ2 4GWTW4740YQ2fugaperuNo ratings yet

- Hoang Anh Tuan. Silk For Silver PDFDocument334 pagesHoang Anh Tuan. Silk For Silver PDFAnonymous rib7Yf0LNk100% (3)

- Almond Shell As A Natural ColorantDocument6 pagesAlmond Shell As A Natural ColorantAnne CalyxNo ratings yet

- Etymology, Terminology & StyleDocument57 pagesEtymology, Terminology & StyleSushant BarnwalNo ratings yet

- MARZOLI BLOWROOM LINE OPTIMIZED FOR HIGH PRODUCTIVITY AND QUALITYDocument28 pagesMARZOLI BLOWROOM LINE OPTIMIZED FOR HIGH PRODUCTIVITY AND QUALITYDINKER MAHAJANNo ratings yet

- ID - 20200106282. Ahnaf Tahmid (C)Document6 pagesID - 20200106282. Ahnaf Tahmid (C)Mustafiz RahmanNo ratings yet

- Spatial Strategies For Interior DesignDocument192 pagesSpatial Strategies For Interior DesignLuMa100% (9)

- Gurgaon MSME LIST PDFDocument90 pagesGurgaon MSME LIST PDFSaptarshi RoyNo ratings yet

- Planning Process and Capacity Calculations in Clothing ManufactureDocument11 pagesPlanning Process and Capacity Calculations in Clothing ManufactureSivakumar KNo ratings yet

- Amigurumi Atashi Pattern for Chobits DollDocument3 pagesAmigurumi Atashi Pattern for Chobits DollLourdes Lacerda Buril100% (1)

- NIFT Design Sutra competition encourages students to use traditional craftsDocument4 pagesNIFT Design Sutra competition encourages students to use traditional craftsVidushi GuptaNo ratings yet

- Knitting Action of Tricot Warp Knitting MachineDocument2 pagesKnitting Action of Tricot Warp Knitting Machineila03No ratings yet

- Bangladesh RMG Sector AnalysisDocument14 pagesBangladesh RMG Sector AnalysisRafid PrantoNo ratings yet

- Crescon Projects and Services Private Limited: Goods Receipt NoteDocument2 pagesCrescon Projects and Services Private Limited: Goods Receipt Notecrescon ITC PanchlaNo ratings yet

- Executive SummaryDocument10 pagesExecutive SummarySumedha Kane100% (1)

- Nishat Annual Report 2022Document255 pagesNishat Annual Report 2022fizzaNo ratings yet

- Bse 20171024Document53 pagesBse 20171024BellwetherSataraNo ratings yet

- Garment EngineeringDocument29 pagesGarment EngineeringILLANGOVAN SIVANANDAMNo ratings yet

- Quality management standards for aerospace industryDocument1 pageQuality management standards for aerospace industryAirtech AeroNo ratings yet

- Matilda Leggings Spit Up Sewing PatternDocument21 pagesMatilda Leggings Spit Up Sewing PatternLauren Nichole Serafini100% (5)

- 4.4 Site Ppe Distribution Form Cotton Hand GlovesDocument1 page4.4 Site Ppe Distribution Form Cotton Hand GlovesJunard Lu HapNo ratings yet