Professional Documents

Culture Documents

Atlas Accounts Payable User Guide - Day 2

Uploaded by

Bhupendra KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Atlas Accounts Payable User Guide - Day 2

Uploaded by

Bhupendra KumarCopyright:

Available Formats

Accounts Payable

Atlas Finance Accounts Payable Training up to date as of R3.4 P7 2014

Accounts Payable

Accounts Payable

Accounts Payable

Accounts Payable

Accounts Payable

Accounts Payable

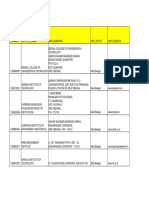

SAP contains a report to list purchase orders by vendor to compare

goods receipt quantities against invoice receipt quantities thus

showing the variance between the two and the amount sitting on

GRIR.

This report should be used in conjunction with analysis carried out in

the G/L to investigate uncleared items on GRIR accounts.

The report is a good tool to identify where old supplier invoices are

either outstanding and also where goods receipts have perhaps not

been entered

Accounts Payable

Use this report to check goods and invoice receipts when the purchasing

documents show some discrepancy

Drill down is available to review the individual documents (goods receipt,

purchase order/service entry, or invoice)

Those items in red should be investigated, where the Invoiced quantity >

Received quantity. This means that budgets have not yet been charged for

amounts

Accounts Payable

Information Systems>General Report Selection>Materials

Management>Inventory Management

Accounts Payable

The GRIR account only relates to quantity booked for the goods receipt and

the invoice

Any quantity differences between Goods Receipt and Invoice Receipt need

to be cleared from the GRIR account

A process for GRIR clearing should be designed by Units but the account

should be checked EVERY Period. This process should include the

following items as examples:

Who is responsible for clearing the GRIR?

Who is responsible for highlighting GRIR difference?

When will GRIR clearing take place each Period?

Is there a certain age of item where the GRIR will be cleared

automatically?

How is regular checking of the GRIR account built into the AP Role?

10

Accounts Payable

This slide shows an example where a goods receipt has been posted

but there is no invoice

The PO is for a quantity of 5 and this quantity can be seen on the GR

on the Purchase Order History tab

The screenshots come from MR11 and ME23N

11

Accounts Payable

If this good receipt was perhaps done in error it can be cleared

through GRIR Maintenance referred to as Account Maintenance in

the system

Account Maintenance posts a KP document and can be seen in the

PO history tab. In this view there will be no value just a quantity

booking

When account maintenance takes place in the scenario where the

goods receipt is greater than the invoice the following posting takes

place in FI:

DR GRIR Account

CR P&L expense account (this is dependent on the type of PO

and the account assignment

In Controlling the P&L Expense CR will also be posted to a Cost

Centre or an alternative object depending on the account assignment

of the PO

Effectively this posting reverses the GR posting to overcome the

delivery surplus

12

Accounts Payable

This slide shows a more complicated scenario where there are

multiple invoices and goods receipts

In this case a quantity of 12 has been goods receipted and a quantity

of 4 has been invoiced

The quantity difference on the GRIR account is therefore 8

The screenshots come from MR11 and ME23N

13

Accounts Payable

If account maintenance was to take place against this PO what would

happen:

What document type would be posted?

What quantity would be posted?

What value would be posted?

Which account would be debited?

Which account would be credited?

Why?

14

Accounts Payable

This slide shows the posting that takes place based on the example

shown on the previous slides

When the GRIR clearing is posted the same postings take place in

FI:

DR GRIR Account for quantity of 8 and a value of 2,640

CR P&L expense account for quantity of 8 and a value of 2,640

In controlling this is also posted to a Cost Centre, which is

determined by the account assignment on the PO

To answer the questions on the previous slide:

What document type would be posted? KP

What quantity would be posted? 8

What value would be posted? 2640

Which account would be debited? GRIR

Which account would be credited? P&L Expense

Why? Effectively the P&L has been overcharged

15

Accounts Payable

This slide shows an example where an invoices has been posted but

the PO is awaiting a goods receipt

The PO is for a quantity of 1 and this quantity can be seen on the

invoice posting on the Purchase Order History tab

The screenshots come from MR11 and ME23N

16

Accounts Payable

In order to effectively post a goods receipt and clear the GRIR

account, Account Maintenance can be carried out

Account Maintenance posts a KP document and can be seen in the

PO history tab. In this view there will be no value just a quantity

booking

When account maintenance takes place in the scenario where the

invoice is greater than the goods receipt the following posting takes

place in FI:

CR GRIR Account

DR P&L expense account (this is dependent on the type of PO

and the account assignment

In Controlling the P&L Expense DR will also be posted to a Cost

Centre or an alternative object depending on the account assignment

of the PO

Effectively this posting creates a GR posting to overcome the invoice

surplus

17

Accounts Payable

Account Maintenance is posted using MR11

This should be used when there is an outstanding balance in the GRIR

account and it will cannot be automatically cleared

MR11 reads the MM purchase order history table (EKBE) to allow

maintenance of the GRIR account

The PO history table stores all of the events which have occurred to the

PO/Schedule Agreement during its life including the two most important

events: goods receipt and invoice receipt

GRIR maintenance is another type of event in the purchase order history

GRIR maintenance is used to complete the purchase order history only if

there are quantity (not amount) differences in the purchase order

Any GRIR imbalance stemming from quantity difference between PO and

Invoice can be cleared through MR11 if:

The quantity received is larger than the quantity invoiced and no more

invoices are to be received

The quantity invoiced is larger than the quantity received and no more

goods are to be received

Goods have been received, but invoice has been yet to received and no

invoice is expected any more

18

Accounts Payable

Logistics>Materials Management>Logistics Invoice Verification>GRIR

Account Maintenance

19

Accounts Payable

If an account maintenance posting is posted in error with MR11 and needs

to be cancelled transaction MR11SHOW can be used

When the document is reversed:

The account maintenance document is cancelled

The account maintenance document is updated in the purchase order

history

As a result, the original difference on the GRIR clearing account is

restored

The GRIR clearing account will need to be cleared again by means of more

goods receipts, invoices or by clearing it manually again

20

Accounts Payable

Logistics>Materials Management>Logistics Invoice Verification>GRIR

Account Maintenance

21

Accounts Payable

22

Accounts Payable

23

Accounts Payable

24

Accounts Payable

There are two ways to enter an AP invoice into SAP, the selection of which

is dependent on whether the invoice relates to a PO or not.

PO Related can be posted using:

Park Logistics Invoice Verification - MIR7

Logistics Invoice Verification MIRO

Non-PO Related can be posted using:

Park Vendor Invoice - FV60

Vendor Invoice Posting - FB60

25

Accounts Payable

Invoice postings without reference to a PO should only happen in a

few exceptional circumstances

Normal business process requires that purchases are made using

purchase orders to maintain the appropriate controls

FI postings can therefore only made in a few exceptions for example:

Government Mandatory Payments

Purchasing Card spend at allowed levels in allowed categories

Invoices approved by auxiliary systems where the approval

process has been signed off by Finance and limited to:

- Travel Expenses

- Payroll

- Trade Expenditure,

- Serengeti Legal Expenses

These exceptions are highlighted in the AP golden Process Section

P-150-150

26

Accounts Payable

Preliminary posting or parking allows Users to enter data and store it without posting it. This

allows you time to ensure that the analysis for the charge is correct.

A document is parked when a user cannot finish the document (invoice or credit memo) or

needs to gather further information before posting the document

Parking a document assigns a document number to the transaction without updating the

account transactions or totals

Parked documents can have any field on the document changed or updated, which allows

for another user to verify that the right accounts were being used, etc. Parked documents

can be changed as often as required

When no further changes are required, it is possible to post the parked document. Only

then does the system carry out the normal account movements and make the necessary

updates

Parked documents must be posted in order to update the accounts balance

When a parked document is posted, the document number does not change.

Parking a document should not be confused with holding a document. If you hold a

document it is simply suspended and no accounting or other update takes place. Held

documents are assigned a manual document reference.

The advantage of parking documents is that you can evaluate the data in the documents

online for reporting purposes from the moment they are parked, rather than having to wait

until they have been completed and posted.

The preliminary posting function can be of great advantage if:

Users are interrupted when entering an invoice, this saves duplicate data entry

Users wish to clear up some questions before you post an invoice.

Users wish to split the invoice authorisation process. One employee can, for

example, park an invoice without checking it, while another carries out the actual

checks and posts the document after making any necessary corrections

Depending on the G/L account it may require a cost object assignment e.g.; Cost

Centre, Internal order

27

Accounts Payable

To post a parked document, select the parked document from the list of

documents, then the parked transaction is displayed.

To make changes and re-park the document, types the changes and select

the Save as Completed button.

To post the document, select the Post button. Once the document is posted,

the amounts are update the account balances.

A posted document has the same document number as the parked

document.

Select the Simulate button to see the entire document before posting.

28

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>Document

Entry>Document Parking

29

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>Document

Entry>Document Parking

30

Accounts Payable

FBV3 can be used to display one or many documents.

If the document number, company code, and year of the parked document

is known, select Enter to open the document for completion

If the document number of the parked document is not know, select the List

button and use the search criteria. This search report is used to find the

document number of the parked document

From the list of parked documents, users can review, alter, and post each

document individually.

To display a document double click to move to the Display Parked

Document screen FV60.

31

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>

Document>Parked Documents

32

Accounts Payable

FBV0 can be used to post one or many documents.

If the document number, company code, and year of the parked document

is known, select Enter to open the document for completion.

If the document number of the parked document is not know, select the List

button and use the search criteria.

The search report is used to find the document number of the parked

document

Status of the document can be checked using the Check icon status then

appears in the status column

Parked documents can be highlighted/selected to be posted

From the list of parked documents, Users can review, alter, and post each

document individually.

33

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>

Document>Parked Documents

34

Accounts Payable

Transaction Select either Invoice or Credit Memo to indicate the type of transaction.

Header:

Basic Data tab fields:

Company Code - SAP remembers the last used company code; you must verify this field.

If the wrong company code is displayed, select the Company Code button or use the menu path: Edit > Change Company

Code and type the new company code.

Vendor The organization that sent the invoice.

Invoice date The date on the invoice. This date, in conjunction with the vendors payment terms (on the vendor master)

determine the payment due date for this invoice. The Automatic Payment program uses the Invoice Date field to determine which

payment run the invoice will be included in.

Posting Date - Determines the period to post the invoice to and defaults to system date (required).

Reference The vendors invoice number is entered in this field (required).

Amount The total amount of the invoice including taxes into this field.

Currency This field is not labeled but is to the right of the Amount field. Indicate the currency that the payment is to be issued in.

Tax amount The amount of the taxes for this invoice.

Tax code This field is not labeled, but is to the right of the Tax Amount field. The tax code controls whether or not the item is to

be taxed and at what rate. For VAT type taxes, the tax code entered assists in calculating the tax amount and control where it is

posted in the GL.

Text Enter a description of the invoice.

Details tab fields:

Exchange Rate enter a specific exchange rate for foreign currency journal entries. Leave blank to default the rate from the

exchange rate table.

Translation Date used to select a specific exchange rate from the exchange rate table.

Calculate Tax - select this check box to have taxes calculated automatically at the time of posting.

Line Item Fields:

Status (first column) indicates the status of the line. A checkmark () the line is ok.

G/L Acct The General Ledger account to use in recording the expense portion for the vendor invoice.

Debit/Credit Indicator This determines how the item posts to the expense account. For AP invoices, the default is debit. When

entering a credit memo, the default is credit.

Amount The amount for this line (required). SAP enters an amount to balance the entry

Tax Code - Use this field to indicate if the transaction is tax relevant. Required only if a tax category has been specified for the

vendors master record (optional).

Tax Jurisdiction - This field represents how the taxes are calculated for the US by indicating the state and local tax areas

(optional).

Value Date - used for Foreign Currency valuation date (optional).

Text This field is used to enter an explanation of the line entry about the transaction. This helps when trying to follow an auditing

trail at a later date.

Type + to copy the last text entered.

Additional Accounting Information Cost Center, Internal Order, or Profitability Segment fields are to be completed as required.

35

Accounts Payable

Payment tab fields:

Baseline date this date is used with the payment terms to calculate the due

date.

Due on This date is a function of the baseline date and payment terms and

controls when this invoice will be paid by the Automatic Payment program.

Payment terms Payment terms are agreed upon with the vendor and entered

into the vendor master record. However, this field can be overwritten and new

one time payment terms entered that are only good for this document.

Payment Method A code to indicate the form the payment is to be issued. If a

vendor accepts multiple forms of payment (check, wire, etc.) then a particular

method can be selected for this item. If the field is blank, the vendor is paid

based on a valid payment run using a payment method acceptable to the

vendor. For example if the vendor can be paid by check or wire and this field is

left blank, the payment run that is run first (check or wires) will pick up the item

and pay it.

Payment Method Supplement This field controls the grouping of payments

into specific categories that may have additional checks assigned to it. For

example, a company could want checks over $100,000 to be printed separately

from lesser amount checks so they can be routed for an additional signature.

Payment block Select this field to prevent payment of this invoice. A payment

block must be removed from an invoice before it can be paid.

Details tab fields:

G/L the reconciliation account for this vendor. This is the GL account where

the transaction figures are recorded.

The other fields on this tab are not used at this time.

Tax tab fields:

Tax doc currency The amount of the tax on the invoice that was entered on

the Basic Data tab. This tab allows the user to actually divide the tax amount

over multiple line items of an invoice (provided they have the same tax code).

Tax code The tax code that was specified on the Basic Data tab.

36

Accounts Payable

Notes tab fields:

Item Long text A free-form text area for additional information about the

invoice. The text fields on the Basic Data tab, and the Line Item tab are limited

in the number of characters that can be entered. More text can be entered

here, including text which has been cut and pasted from Word.

36

Accounts Payable

If this message appears, the user review the indicated document number

and verify that the invoice is not being entered again.

There is an internal review mechanism to warn a user invoice entry matches

with an existing entry

37

Accounts Payable

When an FI invoice is posted the following posting takes place in FI:

CR AP Reconciliation Account 953001

DR P&L Expense

In Controlling the P&L expense posting will be against a controlling

object such as a Cost Centre, IO or WBS

The CR against the AP reconciliation account is simultaneously

posted to the AP subledger

An FI invoice has a document type of KN

38

Accounts Payable

It is possible to enter an invoice (or a credit memo) without posting it and simply

"park" it. The system does not in this case make any postings

A parked document can be changed as often as required. When data is added or

changed, the changes are noted by the system. When no further changes are

required, it is possible to post the parked document. Only then does the system

carry out the normal account movements and make the necessary updates

Once the documents are posted GL Accounts and Vendor Line Items are updated

39

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>Document

Entry

40

Accounts Payable

Mass upload of FI invoices

Mars Add Ons>Finance>Accounts Payable

41

Accounts Payable

When an FI credit memo is posted the following posting takes place

in FI:

CR P&L Expense

DR AP Reconciliation Account 953001

In Controlling the P&L expense posting will be against a controlling

object such as a Cost Centre, IO or WBS

The DR against the AP reconciliation account is simultaneously

posted to the AP subledger

An FI Credit memo has a document type of KG

42

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>Document

Entry

43

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>Account

44

Accounts Payable

Posted documents are completed documents that have a document number

and that update the transaction figures and account amounts in SAP

Only a few fields can be changed of a posted document

Need the document number, company code, and year; can search for

document number by Document Type (Vendor Invoice) and/or user ID

To view the original document, select the menu path: Environment >

Document environment > Original document

To view additional accounting documents, select the menu path:

Environment > Document environment > Accounting documents

To edit the Document Header, choose Extras > Document Header > Goto >

Document header.

You can only change two Document Header fields: Reference and

Document header text.

45

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>Document

46

Accounts Payable

If an invoice is posted that has a blocking reason, the field Payment block is filled

in the vendor line item of the invoice document. Financial Accounting is then

unable to settle the invoice

A blocked invoice must be released for payment in a separate step, possibly after

verifying with the purchasing department or vendor

In this step, the payment block A is deleted using FB02

47

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>Document

48

Accounts Payable

See the before and after field values for a specific document

Must know company code, year, and document number (no list button)

Use the Display a Document (FB03) screen to find the document number

49

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>Document

50

Accounts Payable

The document type classifies the accounting documents. It is noted in the

document header.

The document type specifies the following, among other things:

Which account types can be posted in a document

Whether cash discounts are to be taken into account (for vendor

postings). The cash discount percentage rate is managed in the general

terms of payment in the vendor or customer master in Financial

Accounting.

Documents can be viewed, sorted and archived by document type.

51

Accounts Payable

Once an entry has been posted in the system, the only way to change

critical fields, is to reverse the document

The system generates a reversing document that posts the proper reversing

debit and credit amounts.

If you do not make an entry in the Reverse document posting date field or

Reverse Document Posting Period field, the system uses today's date or the

current posting period.

The program generates a list of all the documents which can or cannot be

reversed or have already been reversed.

The period of the original document must be open to post a reversing

document. If the period is not open, you can overwrite the Posting Date field

using a date in the current period.

52

Accounts Payable

Accounting>Financial Accounting>Accounts

Payable>Document>Reverse

53

Accounts Payable

54

Accounts Payable

55

Accounts Payable

56

Accounts Payable

After the invoice has been posted, the document appears as an open item on the

vendor account

This means that the open item, once it becomes due for payment, can be picked

for the payment proposal list and the subsequent payment run

The payment run therefore:

Selects invoices for payment based on the payment terms in the vendor

master or purchase order

Generates payment for released invoices.

Updates accounting information

57

Accounts Payable

The payment program has the following functions:

Automatically selects the open items to be paid and the exceptions, such as

blocked items

Creates payment lists and logs

Carries out payment using the proposal list.

There are 3 steps in the Payment Program Flow:

1. Proposal Run

The proposal run checks the accounts and documents specified in the

parameters for due items

The proposal list reviews Vendor open items that are due to be paid and

proposes them for the payment run

2. Payment Run

The payment run includes only the open items contained in the proposal

list.

The payment program posts documents

3. Generation of payment transfer medium:

The payment program provides the data for the form printout and for

creating the data carriers, the payment advice notes and the payment

summaries.

58

Accounts Payable

Before the payment program can be used the following items need to

be defined:

Vendor bank accounts details

The required payment methods are completed on the Vendor

Master Data

The necessary payment forms are set up

59

Accounts Payable

The payment proposal is run first, in order to generate proposal data that can be

edited before the actual payment run.

The proposal can be executed by the AP Clerk

The payment proposal can be run in the background or immediately.

The following parameters need to be entered for the payment proposal. The

parameters represent the selection criteria of the vendors to be paid:

Run Date = today's date

Identification = Payment Run ID usually includes the day

The payment status shows you the current state of the payment proposal job.

Document entered to = the date in which you want to pay vendors up to

Company Code = Company Code to be included in the payment run

Payment Methods = payment methods to be included in the proposal list

Next posting date = next payment run

Vendors Vendor to be included in the payment proposal

The Document Entered To field and the Next P/Date field determine which

invoices are selected for payment by the proposal run

The due date of the items is always determined via the baseline date and the

terms of payment in the open items.

60

Accounts Payable

To create the proposal run click on the proposal button

The proposal run:

Checks the accounts and documents specified in the parameters for due items

Groups due items for payment

Selects the relevant payment methods, house banks, and partner banks

The box that follows shows that the payment proposal can be started immediately

If the Create Payment Medium check box is not displayed, the Printout/Data Medium tab was not completed

during the Parameters step.

Press the Enter key and to receive two messages: Parameters have been entered and Proposal is running.

Continue to press the Enter key or select the Status button to monitor the status of the payment proposal. When

the message Payment Proposal has been created displays, the proposal is completed.

The main screen of the Automatic Payment Transactions program is the Status screen. It indicates the status of

each step: not yet started, created, in process, or completed.

The first step involves maintaining the parameters, additional log values, and payment medium values.

The selection criteria fields on are on the Parameters tab. The parameters define which vendors and

invoices the payment program includes in the automatic payment run.

The Additional Log tab allows you to determine what information is printed on the log. The log is

useful in troubleshooting why an invoice was or was not selected for a specific payment run.

The Printout/Data Medium tab is used to specify the specific print program variants for the payment

printout portion of this process.

Parameters tab key fields:

Run Date The date on which the payments process is to be run (required).

Identification - A user-defined identifier, typically your initials for the payment run (required).

Additional Log key fields:

Select the Due Date check box - List all invoices for the due date check

Select the Payment Method Selection In All Cases check box Lists all invoices that are selected

based on the payment method of the payment run; this check box is usually only used when testing the

payment run

Select the Payment Method Selection If Not Successful check box Lists invoices that will not be paid

in this proposal run because of the payment method of the payment run

Select the Line Items Of The Payment Documents check box - All posted documents in the log are

printed with the items

Type in the account numbers for the vendors or customers that you want displayed in the log.

Data Medium tab key fields:

For the payment programs indicate the variants specific for the company code.

To view the variant, click the variant name and then click the MAINTAIN VARIANTS button

Indicates printer, paying company code, payment method, etc.

61

Accounts Payable

When the payment proposal is created, the system creates the

proposal list detailing the payments proposed.

In addition to the proposal list the exception list can be displayed,

which displays blocked items and all open items which the payment

program did not propose for payment

Any required editing can then take place

The Payment proposal should be reviewed and checked to ensure

the payments are appropriate

62

Accounts Payable

The logs of the payment proposal can be run and reviewed as part of

ongoing AP maintenance to ensure that invoices are unblocked in a timely

manner

63

Accounts Payable

It is possible to make changes when editing the payment proposal

The following items can be changed:

- Payment method

- Bank details

- Items paid - adding payment blocks

All changes made affect only the payment proposal

No changes should be made to the source documents and the

payment block should not be released. Releasing the payment block

should only take place after the standard approval process take place

64

Accounts Payable

The Payment Porposal can be checked and edited

To review the proposal, select Edit > Proposal > Display Proposal

The Payment Type icon indicates, by vendor, the items which will be paid in

the Payment Proposal/Run

The Exception Type icon indicates, by vendor, the items which will not be

paid in the Payment Proposal/Run

To open exception items, double click exception vendor row

To view error message, double click exception item

If the Proposal Run is not correct, delete it, change the parameters, and rerun the proposal run

To delete the proposal, select Edit > Proposal > Delete

65

Accounts Payable

Once the payment proposal has been accepted the payment run can

be scheduled

During the payment run, the system:

Create and posts the payment documents.

Matches the payment document to the open item and clears the

open items. Each open item is marked as paid/closed.

Prepares the data for the printing of payment media.

The payment log is created showing the list of payments made by the

run

Several programs are used in creating the payments:

The payment program creates the payment documents and

prepares the data for printing the forms

Various payment medium programs use the data prepared by the

payment program to create forms or files for the data media

During the payment proposal run, the accounts of the selected

vendors are locked until the payment process is completed for this

proposal run. Any selected vendors are excluded from any other

payment proposal runs to avoid duplicate payments

66

Accounts Payable

When the payment run is completed the following posting in made in

FI:

DR AP reconciliation account 953001

CR Bank Account

In Controlling the credit against the Bank account is posted the a

generic profit centre in PCA

The AP Subledger is debited as the Vendor is simultaneously posted

to at the same time as the AP reconciliation account

This effectively clears the open item on the Vendor

A Payment Run uses document type ZP

67

Accounts Payable

The Payment Program uses documents (open items) and Master data

(Vendor/Customer Records) information to generation various datasets including:

REGUH - Data on the payee or payment method is, for example, to be found in

REGUH.

REGUP - Information from the individual documents is to be found in REGUP.

REGUD - The complete bank data and the amount specifications are to be found

in REGUD.

The print program creates the payment media, payment advice notes as well as the

payment summary from the information contained in REGUH, REGUP, and REGUD.

Information can also be taken from the payment tables

The payment media can include:

The payment media (checks) are printed.

IDocs are generated for EDI.

The payment data is sent to DME administration

68

Accounts Payable

An invoice will not be selected for the Payment Proposal or Payment Run if:

It has been selected by another proposal run

It has been manually fully cleared

It has been blocked for payment

If the vendor has been blocked for payment

69

Accounts Payable

By default Credit memos are due immediately for payment

If the amount due from the vendor (credit memos) is greater than the

amount owed to the vendor (invoices), the invoices will not be paid via

payment run - this occurs even if the invoices are due

For the payment run to pay the due invoices without taking the credit memo

into account:

Block the credit memo

Run the payment run to pay the due invoices

Unblock the credit memos for the next payment run, if applicable

70

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>Periodic

Processing

71

Accounts Payable

72

Accounts Payable

73

Accounts Payable

74

Accounts Payable

ERS stands for Evaluated Receipt Settlement

This is the procedure used for settling goods receipts automatically

without waiting to receive an invoice from the vendor

Instead, the system posts the invoice document automatically on the

basis of the data in the PO and GR.

This means that a Vendor invoice is no longer required and invoice

variances are eliminated

Settlement documents created can automatically be sent to the

vendors for verification

The invoice amount is determined from the prices entered in the

order, the terms of payment, the tax information and the delivery

quantity entered in the goods receipt

75

Accounts Payable

ERS should only be used when we have a clear agreement on the

conditions with the vendor.

It can be used where there is a regular flow of goods such as:

- Raw materials

- Packaging materials

- Logistics Costs

POs in the system can be regularly updated

Credit memos can also be created using ERS: if an invoice has

already been posted for a goods receipt and goods have since been

returned, the system automatically generates a credit memo for the

returned quantity during the next ERS run.

76

Accounts Payable

There are certain pre-requisites for ERS to take place:

The Vendor must agree to the conditions for ERS

The Vendor Master record must be flagged as ERS: The system

then sets the ERS indicator as a default in each item when a PO

is created for the Vendor

77

Accounts Payable

Other pre-requisites include:

Goods-receipt-based Invoice Verification must be defined for the

PO item

The order price of the materials may not be an estimated price

A tax code must have been maintained in the PO item

Output Type and Layout must be defined for the company code

How often the self bill invoice documents will be created should

be defined. The unit should decide at implementation how often

the batch job will execute to create the self billing invoice

document. It should not exceed 7 days which is the life cycle of

the service PO document

78

Accounts Payable

The screenshot on the slide shows the evaluated receipt settlement

posting

The following options can be set for the creation of invoice

documents:

One invoice document per vendor

One invoice document per purchase order

One invoice document per purchase order item

One invoice document per goods receipt document

79

Accounts Payable

Logistics>Materials Management>Logistics Invoice

Verification>Automatic Settlement

80

Accounts Payable

This slide shows an example of the output generated by selfbilling

81

Accounts Payable

Logistics>Materials Management>Logistics Invoice

Verification>Further Processing

82

Accounts Payable

Consignment Materials are stored at Mars premises but actually

belong to a Vendor

The Vendor supplies these goods so that they are available at any

time, but does not initially invoice for the goods.

Mars only take ownership when the goods are called off to the factory

Consignment selfbilling is used to carry out the generation of selfbilling documents to represent supplier invoices for consignment

stock once it has been withdrawn from consignment stock held by the

Vendor.

83

Accounts Payable

Only when materials have been withdrawn from stock to be used

does payment become due for the quantities used.

Mars do not expect vendor invoices for goods withdrawn from

consignment stocks. Instead posted withdrawals are settled and a

statement of the settlement is sent to the Vendor as a consignment

self bill invoice

A 501k movement is used to move stock from the Supplier to the

Warehouse. At this point it is still consignment stock under the

ownership of the Vendor

Once a 901k movement is complete (101k may also be used if POs

are used for consignment) this brings the stock into Mars Ownership

This stock is then ready for consumption in the factory

84

Accounts Payable

When consignment stock is issued to Mars stock, the system makes

a posting based on the consignment price

In FI the following posting takes place:

DR Stock

CR Consignment Vendor Control account 953020

The document type used is WA

85

Accounts Payable

When the consignment withdrawals are settled, the liability created at

the time of the withdrawal is cleared

In FI the following postings is made:

DR Consignment Vendor Control account 953020

CR AP reconciliation Account 953001

Once the AP reconciliation account 953001 is posted to there is a

simultaneously posting to the AP subledger against the Vendor

The stock posting is also posted to PCA using the Profit Centre

contained in the Material Master Record

The document type posted is RE

86

Accounts Payable

This screen shows the result of the consignment settlement process

It shows in the information text column that a document has been

created

87

Accounts Payable

Logistics>Materials Management>Logistics Invoice

Verification>Automatic Settlement

88

Accounts Payable

This slide shows an example of the output generated by consignment

selfbilling process

89

Accounts Payable

Not on SAP menu

90

Accounts Payable

91

Accounts Payable

92

Accounts Payable

93

Accounts Payable

The requirement for downpayments is becoming more common, especially for

capital purchases.

A down payment is a payment on account before the business transaction is

concluded.

Down payments are often used for short or medium-term financing. For example,

a down payment may be used if a manufacturer is unable to finance the production

of goods alone because of a long production period. Down payments will generally

be made before production begins or after partial completion.

Down payments must not be balanced with other receivables or payables and

must be displayed separately on the balance sheet. On the balance sheet, down

payments made are displayed on the assets side and down payments received on

the liabilities side.

Once the goods or services for which the down payment was made have been

received, payment for the final settlement will be cleared either manually or using

the payment program. The down payment will then no longer be displayed as

such.

After the invoice amount outstanding has been paid, it can be cleared taking into

account the down payment.

The process for downpaymetns is as follows:

1. Create a Down Payment Request (F-47) to indicate the need for

advance payment (optional)

2. The downpayment can be paid in two ways:

- Using the Payment Program F110

- Directly through F-48, in this case F-47 is not required

94

Accounts Payable

3. Payment for the down payment is issued to the Vendor

4. The Vendor sends a closing invoice for the activity and this is entered

into the system

5. The downpayment should be cleared against the invoice using F-54

6. The final payment settlement is processed

94

Accounts Payable

A Down payment request does not update the GL, instead when a down

payment request is posted the system records the line item in a special G/L

account.

Via this account, an overview of all down payments due at any time can be

seen.

It also impacts Treasury regarding Cash Flow and Liquidity Forecast reports

To enter the down payment request the following information is required:

Vendor account

Amount

Target Special GL indicator - This will correspond to the down payment

later in the cycle. This specification cannot be changed later. This value

determines which type of account (vendor, fixed assets, or project) can

be used when entering the down payment request.

Due date - used as the baseline date for cash discounts and payment

terms.

There is not an offsetting entry to the downpayment request and it does not

appear on the PO

95

Accounts Payable

Accounting>Financial Accounting>Accounts Payable> Document

Entry>Down Payment

96

Accounts Payable

A Down payment request does not need to exist before creating a down

payment

Posting a Down Payment to a Down Payment Request:

To post a down payment made against a down payment request,

select the down payment request during the posting of the down

payment.

The system only needs the Vendor's account number, bank account

number, and special G/L indicator to complete the posting.

The system takes all other data, such as amount or tax code, from

the down payment request.

To post a Down Payment without reference to a Down Payment Request

the down payment can be posted directly.

All necessary data including the vendor's account number, the bank

account number, the special G/L indicator, amount, and due date are

entered.

97

Accounts Payable

Accounting>Financial Accounting>Accounts Payable> Document

Entry>Down Payment

98

Accounts Payable

The down payment can be cleared against the paid invoice in 2 ways:

Manually using F-54 - transfers down payment to the payables account

and takes account of this transfer when posting the payment

Automatically using the payment run (F110), matching down payment

with the invoice when the outgoing payment is made

Clearing the downpayment transfers the amount from the Alternative

Reconciliation account to the Vendors reconciliation account

A document number for the cleared vendor down payment is displayed after

saving.

99

Accounts Payable

Accounting>Financial Accounting>Accounts Payable> Document

Entry>Down Payment

100

Accounts Payable

A report is available to display a list of open down payments of a specific

date, by special G/L reconciliation account

The special G/L Accounts indicate the general ledger account for the

corresponding alternative reconciliation account

101

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>Information

System>Reports for Accounts Payable Accounting>Vendors: Items

102

Accounts Payable

103

Accounts Payable

104

Accounts Payable

105

Accounts Payable

Accounts Payable Period Closing process is required to:

- Recognize all vendor liabilities

- Clear open items

- Transfer values to different modules

- Revalue open items in foreign currency

If these AP processes are not completed there is the risk that:

- Balance sheet and P&L Statements are incorrect

- Incorrect values are extracted to FPPS and HFM

- Liabilities may be understated

106

Accounts Payable

107

Accounts Payable

108

Accounts Payable

Most Units have a cut off at Period Close for invoice processing.

After this time no further invoices in the period will be process

This is normally Wednesday or Thursday of Week 4

Budgetholders should be aware of the cutover to drive some accountability

and to ensure that all their invoices are processed or accrued as necessary.

This cut off also ensures that Finance Analysts in different areas can begin

to check postings move mispostings and have earlier visibility of outstanding

accruals

109

Accounts Payable

110

Accounts Payable

Parked documents must be reviewed at Period Close to:

Check if they can be posted

Check if they should be deleted

Check if they are still outstanding and require an accrual

To display Parked Invoices use the following transactions:

PO Invoices MIR5

Non PO Invoices FBV3

111

Accounts Payable

112

General Ledger

GL accounts that require clearing are called open item managed accounts.

The Open Item Management check box on the GL account master record

must be selected.

For accounts that have Post Automatic only flagged in their GL account

master data the automatic clearing program is the only way to perform

clearing for these accounts.

Open items are incomplete transactions, such as an invoice for which goods

or services have not yet been received or a goods receipt that is awaiting an

invoice

In order for an open item transaction to be considered complete, the

transaction must be cleared. A transaction is considered cleared when an

offset value is posted to it, so that the resulting balance of the items is zero

Examples of posting with clearing depicted above:

A goods receipt is posted to the GRIR account. This is regarded as an

open item, because at this point the corresponding invoice has not been

received

The invoice is received and the Goods Receipt set off against it

The transaction is now cleared and the resulting balance is zero

There is an impact to performance if items are not cleared (reporting &

inability to archive data)

GRIR accounts should be cleared each Period

113

Accounts Payable

Automatic Clearing is performed by a program that analyzes the individual

open items in a G/L account and finds the corresponding open items

To do this successfully, the open items must share some common data,

which is usually stored in the Assignment field

The information in this field must match exactly and the values of the items

must net to zero in order for the program to attempt to clear the items

together

114

Accounts Payable

Use this procedure to automatically clear items on GRIR accounts

If matching entries are found that net to 0 the items are marked as cleared

When clearing, the program inserts a clearing document number and a

clearing date into the line items

Any quantity differences that remain on the GRIR account will need to be

posted using MR11.

115

Accounts Payable

Run daily to clear customer, vendor, and G/L accounts (particularly GRIR

clearing accounts) open items

Selects all accounts described by value quantities for which there are debit

and credit postings

Clearing is only carried out if the balance in local currency is zero

The system automatically clears them and creates clearing documents

The system will not clear items that balance in another currency

If clearing needs to be performed in a currency that is different from your

local currency you may need to use transaction F13E where you can specify

the clearing currency in order to clear transactions

The date of clearing is the date specified in the clearing parameters; the

default is todays date

When the program is running, all the accounts for which clearing can be

carried out are blocked

They are released again after the completion of clearing

After clearing, a clearing document number is given

This clearing may be processed in General Accounting rather than AP

116

General Ledger

There are pre-defined criteria used when doing automatic clearing:

Vendor accounts = purchasing document

G/L accounts = assignment field

If the balance, in local currency, of the items within a group are zero-valued,

the system automatically clears them and creates clearing documents

If multiple currencies exist, use transaction F13E and specify the clearing

currency in order to clear transactions.

117

Accounts Payable

Accounting>Financial Accounting>General Ledger>Periodic

Processing>Automatic Clearing

118

Accounts Payable

Accounting>Financial Accounting>General Ledger>Periodic

Processing>Automatic Clearing

119

Accounts Payable

GRIR accounts should be reclassified for accounting closing purposes

The entries should be reclassified so that credits (goods receipts awaiting

invoice) and debits (invoices for goods not yet received) are not netting off

in the GRIR accounts.

Entries are reclassified as follows:

- Goods delivered, but not invoiced

- Goods invoiced, but not delivered

All open items in the GRIR accounts that do not balance out to zero are

adjusted

120

Accounts Payable

GRIR credit balances represent items that have been goods receipted but

not yet invoiced

These should be classified as a liability on the Balance Sheet

When the GRIR reclassification transaction is run the following postings

take place in FI:

DR GRIR Adj 953078 this is a manual entry account

CR Goods not yet invoices 953081

In PCA the Profit centre from Material Master or the cost centre is used

depending on the type of PO involved

121

Accounts Payable

GRIR debit balances represent items that have been invoiced but not yet

goods receipted

These should be classified as a other current assets on the Balance Sheet

When the GRIR reclassification transaction is run the following postings

take place in FI:

CR GRIR Adj 953078 this is a manual entry account

DR Goods not yet delivered 913081

In PCA the Profit centre from Material Master or the cost centre is used

depending on the type of PO involved

122

Accounts Payable

This slide gives an example of the process

At period close there is a overall credit of 5000 on the GRIR account which

represent delivered but not yet invoiced. As the balances of goods receipts

(credits) and invoices (debits) do not balance they cannot be cleared

When the GRIR reclassification transaction is executed at Period Close:

10000 is debited to the GRIR adjustment account and then credited to

the goods not yet invoiced account as a liability

5000 is debited to the invoiced not yet delivered account and then

credited to the GRIR adjustment account as other current assets

These journals are automatically posted

This reclassification may be processed in General Accounting rather than

AP

123

Accounts Payable

Accounting>Financial Accounting>General Ledger>Periodic

Processing>Closing>Reclassify

124

Accounts Payable

125

General Ledger

Before creating financial statements, Receivables and Payables must be

classified according to their type - Receivable or Payable - so they can be

displayed correctly

Adjustment postings are necessary under following circumstances to restate

a customers or vendors account balance to the proper side of the balance

sheet:

Customer accounts with credit balances - display as a payable

Vendor accounts with debit balances - display as a receivable

The system generates a list of key date-based open items per business

partner

If, at the key date, a given business partner is a customer with a credit

balance or a vendor with a debit balance, the open items are displayed in

local currency per reconciliation account and company code. In addition, the

total amount to be reclassified is displayed at the end of the list

On the basis of these amounts reclassification postings are made to the

general ledger

For every transfer posting created, a reverse posting is also created in the

session. For customer or vendor reconciliation accounts, postings are also

made to an adjustment account. For Vendors with the reconciliation account

953001 accounts 913008 (A/P to A/R Regrouping < 12 months) and 953041

(A/P Regrouping Correction Account) will be used for the reclassifying entry

The posting list displays the postings that have been entered in the batch

126

Accounts Payable

input session.

This transaction will not be executed by AP but the team should be aware

that it takes place

126

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>Periodic

Processing>Closing>Reclassify

127

Accounts Payable

128

Controlling Period-End Course

Balance sheet items denominated in foreign currency need to be revalued

each period to accurately reflect economic value

Foreign currency revaluation revalues the foreign currency open items and

foreign currency account balances and:

Calculates difference between local currency value at the time of entry

and as at Period Close

Creates a posting to a revaluation adjustment account (953010); no

posting to the reconciliation

If processing is successful, a list of the items to be reevaluated is displayed

Use Foreign Currency Revaluation (F.05) for open item account valuation

and adjustment postings

F.05 is normally run on Monday of Week 1 by General Accounting

Although not run by AP it is important to know what activities takes place

against Vendors

129

Controlling Period-End Course

3 postings are made in foreign currency at 3 different posting rates:

Debit posting of 1000

This posting is at 1.6 giving a local currency posting of 1600

Credit posting of 100

This posting is at 1.5 giving a local currency posting of 150

Debit posting of 2000

This posting is at 1.4 giving a local currency posting of 2800

Total balance in foreign currency is 2900 and in local currency 4250

At Period Close the valuation rate is 1.3

Using this rate the foreign currency balance is recalculated to local currency

- 2900 *1.3 = 3770

This is then compared to the total balance in local currency of 4250

This difference of 480 in local currency is then posted to an adjustment

account and the exchange rate gains or losses account

130

Accounts Payable

Accounting>Financial Accounting>General Ledger>Periodic

Processing>Closing>Valuate

131

Accounts Payable

132

Controlling Period-End Course

Some Balance Sheet accounts are not assigned to cost objects during

postings therefore not all entries are transferred to Profit Center Accounting

PCA

AP Balance Sheet accounts (reconciliation account for example 953001)

are not transferred at the time of posting and require further processing in

PCA

AP accounts are transferred to PCA using 1KEK - PCA: Transfer AR/AP

1KEK is often run by the General Accounting Team but it is important for AP

to be aware of this process as well

Business Segment Profit center is determined by either:

Material on the AP invoice

Cost Center on the outstanding AP invoice

133

Accounts Payable

Accounting>Controlling>Profit Centre Accounting>Actual

Postings>Period End Closing

134

Accounts Payable

135

Accounts Payable

136

Accounts Payable

137

Accounts Payable

The Account Balance display provides a list of the debits, credit and overall

balance for a Vendor by Period

Double clicking into any of the fields gives line item display information for

that balance

Double clicking again will take users to the Source Document

Line layouts in these lists can be set up to provide information important to

the Unit. Users can include additional fields in the layout or choose a

different layout variant.

There is also a Special G/L tab which shows the debits or credits made to

the Vendor. The downpayment items are kept separate from the standard

line time for accounting purposes.

138

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>Account

139

Accounts Payable

One of the most widely used report is Display Vendor Line Items

This allows Users to view Vendor:

Open items unpaid items which are open as at the date indicated in the

Open at Key Date field

Cleared Items - paid items as of the date indicated in the Open at Key

Date field. Use the Clearing Date fields to indicate a date range for

viewing paid items.

All items both paid and unpaid items as of the date range indicated in

the Posting Date fields.

Allows the ability to view the following types of items against the Vendor:

Normal Items

Special GL Transactions

Noted Items

Parked Items

The report includes the following useful columns which can be used to

analyse a Vendor Account:

Status Column - Indicates whether the item is open (unpaid), cleared

(paid), or parked (not posted).

Due Date Column and symbol - Indicates if the invoice is due to be paid:

overdue (late), due, or not due

Line Item drill down - Double click on a line item to drill down to the original

SAP invoice document.

140

Accounts Payable

Accounting>Financial Accounting>Accounts Payable>Account

141

Accounts Payable

These reports are useful to show Purchase Order by different criteria

including:

Vendor Number

Material Number

Account Assignment such as Cost Centre or IO

Project/WBS Element

The reposts also show the remaining amount to be delivered and invoiced

against the PO

142

Accounts Payable

ME2L, ME2M - Logistics>Material Management>Purchasing>Purchase

Order>List Displays

ME2K, ME2J - Logistics>Material Management>Purchasing>Purchase

Order>List Displays>By Account Assignment

143

Accounts Payable

Creates a list of invoices based on entry type selection criteria including:

EDI

BAPI

ERS

Invoicing Plan

Held/Parked

The report output format uses List Viewer functions to sort, filter, total, and

export report results

144

Accounts Payable

Logistics>Materials Management>Logistics Invoice

Verification>Further Processing

145

Accounts Payable

There is also a BW report that shows the age of the AP open balance per

Vendor

The report is split into the following age brackets:

1-30 days

31-60 days

61-90 days

91-120 days

121+ days

The overall Vendor open balance is split between these age brackets

The report can be found by typing AP Aging in the BW search function

146

Accounts Payable

Other useful reports include:

Open Item Due Date Forecast - S_ALR_87012084

Shows open items due in 8 days, in 30 days and over 30 days

Vendor Balances - S_ALR_87012082

Shows balance by reconciliation account which can be compared to

the Trial balance for reconciliation purposes

Shows movements for a period of time

Vendor Business - S_ALR_87012083

Shows Vendor, reconciliation account, Vendor Address, Purchases

by posting date

Vendor List - S_ALR_87012086

Vendor Master Data information

Invoice Numbers Allocated Twice - S_ALR_87012341

Shows any duplicate invoices posted

147

Accounts Payable

148

Accounts Payable

Who should create and change Vendor Master data - by the central Data

Administrator CVT or Regional Master data team

The distinction between a PO and FO:

PO = specific one off purchase

FO = recurring where one factor is uncertain

149

Accounts Payable

How to reclassify the GRIR accounts Reposts balances to Assets and

Liabilities

What does ERS stand for Evaluated receipt settlement

150

Accounts Payable

151

Accounts Payable

153

You might also like

- Atlas Accounts Payable User Guide - Day 1Document158 pagesAtlas Accounts Payable User Guide - Day 1Bhupendra KumarNo ratings yet

- AP Aging Report InstructionsDocument18 pagesAP Aging Report InstructionsBhupendra KumarNo ratings yet

- Sap IcbDocument9 pagesSap IcbBhupendra KumarNo ratings yet

- Sap SD 1Document3 pagesSap SD 1Bhupendra KumarNo ratings yet

- Problem Management RolloutDocument3 pagesProblem Management RolloutBhupendra KumarNo ratings yet

- Change Process - QuotolateDocument1 pageChange Process - QuotolateBhupendra KumarNo ratings yet

- Sap SD 1Document3 pagesSap SD 1Bhupendra KumarNo ratings yet

- Java Programming On LinuxDocument732 pagesJava Programming On Linuxapi-3839016100% (1)

- Ielts Writing: DR - HasibDocument20 pagesIelts Writing: DR - Hasibwael3000w100% (1)

- Change Request FormDocument2 pagesChange Request FormBhupendra Kumar100% (1)

- ABAP Program Tips v3Document158 pagesABAP Program Tips v3Constantine KiriakopoulosNo ratings yet

- English GrammerDocument72 pagesEnglish GrammerBhupendra Kumar100% (1)

- Change ManagementDocument14 pagesChange ManagementBhupendra KumarNo ratings yet

- IELTS BOOK - Test 8Document22 pagesIELTS BOOK - Test 8Bhupendra Kumar50% (2)

- General Writing Task 1 - Examples Ielts-SimonDocument13 pagesGeneral Writing Task 1 - Examples Ielts-SimonBhupendra Kumar100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- LM2576/LM2576HV Series Simple Switcher 3A Step-Down Voltage RegulatorDocument21 pagesLM2576/LM2576HV Series Simple Switcher 3A Step-Down Voltage RegulatorcgmannerheimNo ratings yet

- PDF Chapter 5 The Expenditure Cycle Part I Summary - CompressDocument5 pagesPDF Chapter 5 The Expenditure Cycle Part I Summary - CompressCassiopeia Cashmere GodheidNo ratings yet

- Final Project Strategic ManagementDocument2 pagesFinal Project Strategic ManagementMahrukh RasheedNo ratings yet

- Advanced Chemical Engineering Thermodynamics (Cheg6121) : Review of Basic ThermodynamicsDocument74 pagesAdvanced Chemical Engineering Thermodynamics (Cheg6121) : Review of Basic ThermodynamicsetayhailuNo ratings yet

- ASHRAE Journal - Absorption RefrigerationDocument11 pagesASHRAE Journal - Absorption Refrigerationhonisme0% (1)

- EqualLogic Release and Support Policy v25Document7 pagesEqualLogic Release and Support Policy v25du2efsNo ratings yet

- John L. Selzer - Merit and Degree in Webster's - The Duchess of MalfiDocument12 pagesJohn L. Selzer - Merit and Degree in Webster's - The Duchess of MalfiDivya AggarwalNo ratings yet

- Ccoli: Bra Ica Ol A LDocument3 pagesCcoli: Bra Ica Ol A LsychaitanyaNo ratings yet

- Cummin C1100 Fuel System Flow DiagramDocument8 pagesCummin C1100 Fuel System Flow DiagramDaniel KrismantoroNo ratings yet

- CV Augusto Brasil Ocampo MedinaDocument4 pagesCV Augusto Brasil Ocampo MedinaAugusto Brasil Ocampo MedinaNo ratings yet

- Sample Resume For Supply Chain Logistics PersonDocument2 pagesSample Resume For Supply Chain Logistics PersonAmmar AbbasNo ratings yet

- WBDocument59 pagesWBsahil.singhNo ratings yet

- Heimbach - Keeping Formingfabrics CleanDocument4 pagesHeimbach - Keeping Formingfabrics CleanTunç TürkNo ratings yet

- The cardioprotective effect of astaxanthin against isoprenaline-induced myocardial injury in rats: involvement of TLR4/NF-κB signaling pathwayDocument7 pagesThe cardioprotective effect of astaxanthin against isoprenaline-induced myocardial injury in rats: involvement of TLR4/NF-κB signaling pathwayMennatallah AliNo ratings yet

- JIS G 3141: Cold-Reduced Carbon Steel Sheet and StripDocument6 pagesJIS G 3141: Cold-Reduced Carbon Steel Sheet and StripHari0% (2)

- Sem4 Complete FileDocument42 pagesSem4 Complete Fileghufra baqiNo ratings yet

- Mechanical Production Engineer Samphhhhhle ResumeDocument2 pagesMechanical Production Engineer Samphhhhhle ResumeAnirban MazumdarNo ratings yet

- ISO 27001 Introduction Course (05 IT01)Document56 pagesISO 27001 Introduction Course (05 IT01)Sheik MohaideenNo ratings yet

- Guyana and The Islamic WorldDocument21 pagesGuyana and The Islamic WorldshuaibahmadkhanNo ratings yet

- PMP Assesment TestDocument17 pagesPMP Assesment Testwilliam collinsNo ratings yet

- Microsmart GEODTU Eng 7Document335 pagesMicrosmart GEODTU Eng 7Jim JonesjrNo ratings yet

- Speech On Viewing SkillsDocument1 pageSpeech On Viewing SkillsMera Largosa ManlaweNo ratings yet

- PSA Poster Project WorkbookDocument38 pagesPSA Poster Project WorkbookwalliamaNo ratings yet

- Measurement Assignment EssayDocument31 pagesMeasurement Assignment EssayBihanChathuranga100% (2)

- Week 4 - Theoretical Framework - LectureDocument13 pagesWeek 4 - Theoretical Framework - LectureRayan Al-ShibliNo ratings yet

- Cable To Metal Surface, Cathodic - CAHAAW3Document2 pagesCable To Metal Surface, Cathodic - CAHAAW3lhanx2No ratings yet

- QSP 04bDocument35 pagesQSP 04bakrastogi94843No ratings yet

- FIRST SUMMATIVE EXAMINATION IN ORAL COMMUNICATION IN CONTEXT EditedDocument3 pagesFIRST SUMMATIVE EXAMINATION IN ORAL COMMUNICATION IN CONTEXT EditedRodylie C. CalimlimNo ratings yet

- Illustrating An Experiment, Outcome, Sample Space and EventDocument9 pagesIllustrating An Experiment, Outcome, Sample Space and EventMarielle MunarNo ratings yet

- Cambridge IGCSE™: Information and Communication Technology 0417/13 May/June 2022Document15 pagesCambridge IGCSE™: Information and Communication Technology 0417/13 May/June 2022ilovefettuccineNo ratings yet