Professional Documents

Culture Documents

2011 ITR1 r10

Uploaded by

Akshay Kumar SahooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2011 ITR1 r10

Uploaded by

Akshay Kumar SahooCopyright:

Available Formats

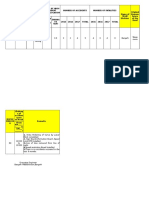

SAHAJ

FORM

ITR-1

INDIAN INCOME TAX RETURN

[For Individuals having Income from Salary / Pension / Income from One House Property (excluding

loss brought forward from previous years) /

Income from Other Sources (Excluding Winning from Lottery and Income from Race Horses)]

Assessment Year

Year

2011-12

FILING

STATUS

PERSONAL INFORMATION

(Please see rule 12 of the Income-tax Rules,1962) (Also see attached instructions)

First Name

AKSHAY

INCOME & DEDUCTIONS

Last Name

SAHOO

PAN

BMHPS3298E

Flat / Door / Building

QR. NO. D-1/2, PWD STORE PREMISES, SATYA NAGAR

Status

I - Individual

Road / Street

BEHIND BHUBANESWAR (R&B) SUBDIVISION NO-IX, SATYA NAGAR

Area / Locallity

Date of birth (DD/MM/YYYY)

BIG BAZAAR AREA, BHUBANESWAR

02/07/1980

Town/City/District

KHURDA

State

24-ORISSA

Email Address

akshay.sahoo@gmail.com

Income Tax Ward / Circle

WARD KENDRAPADA

Whether original or revised return?

Mobile no (Std code) Phone No

Employer Category (if in

9938177044

employment) GOV

Return filed under section

[Pl see Form Instruction] 16 - u/s 139(5)

R-Revised

Pin Code

751001

If revised, enter Receipt no / Date

225608170260611

Residential Status

RES - Resident

1 Income from Salary / Pension (Ensure to fill Sch TDS1)

Income from one House Property

2

3

TAX COMPUTATION

Middle Name

KUMAR

Sex (Select)

M-Male

Date

26/06/2011

1

2

Income from Other Sources (Ensure to fill Sch TDS2)

4 Gross Total Income (1+2c)

5 Deductions under Chapter VI A (Section)

a 80 C

5a

b 80 CCC

5b

c 80 CCD

5c

d 80 CCF

5d

e 80 D

5e

f 80 DD

5f

g 80 DDB

5g

h 80 E

5h

i 80 G (Eligible Amount)

5i

j 80 GG

5j

k 80 GGA

5k

l 80 GGC

5l

m 80 U

5m

6 Deductions (Total of 5a to 5m)

6

7 Total Income (4 - 6)

8 Tax payable on Total Income

9 Education Cess, including secondary and higher secondary cess on 8

10 Total Tax, Surcharge and Education Cess (Payable) (8 + 9)

11 Relief under Section 89

11

12 Relief under Section 90/91

12

13 Balance Tax Payable (10 - 11 - 12)

14 Total Interest Payable

15 Total Tax and Interest Payable (13 + 14)

For Office Use Only

Receipt No/ Date

271,267

3

4

0

24,153

24,153

0

0

0

0

0

0

0

0

0

0

48,306

271,267

System Calculated

0

24,153

24,153

0

0

0

0

0

0

0

0

0

0

6

48,306

7

222,961

8

6,296

9

189

10

6,485

0

0

13

6,485

14

0

15

6,485

Seal and Signature of

Receiving Official

23

Details of Tax Deducted at Source from SALARY [As per FORM 16 issued by

Employer(s)]

24

Tax Deduction

Income charg

Account Number

Name of the

Total tax

SI.No

eable under the

(TAN) of the

Employer

Deducted

head Salaries

Employer

(1)

(2)

(3)

(4)

(5)

1

BBNO00679A OFFICE OF

271,267

6,485

2

THE

ENGINEER3

IN-CHIEF

(Click + to add more rows to 23) TDS onCIVIL,ORIS

Salary above. Do not delete blank rows. )

SA

Details of Tax Deducted at Source on Income OTHER THAN SALARY [As per FORM

16 A issued by Deductor(s)]

SI.No

(1)

1

2

3

4

Tax Deduction

Account Number

(TAN) of the

Deductor

Name of the

Deductor

Total tax

Deducted

Amount out

of

(4) claimed

for

this year

(2)

(3)

(4)

(5)

(Click + to add more rows ) TDS other than Salary above. Do not delete blank rows. )

25

Sl No

Details of Advance Tax and Self Assessment Tax Payments

BSR Code

Date of Deposit

(DD/MM/YYYY)

Serial

Number of

Challan

Amount (Rs)

1

2

3

4

5

6

(Click '+' to add more rows ) Tax Payments. Do not delete blank rows. )

TAXES PAID

16 Taxes Paid PLEASE NOTE THAT CALCULATED FIELDS (IN WHITE) ARE PICKED UP FROM

OTHER SCHEDULES AND ARE NOT TO BE ENTERED. For ex : The taxes paid figures below

will get filled up when the Schedules linked to them are filled.

a Advance Tax (from item 25)

b TDS (Total from item 23 + item 24)

16a

16b

6,485

REFUND

0

c Self Assessment Tax (item 25)

16c

6,485

17 Total Taxes Paid (16a+16b+16c)

17

0

18 Tax Payable (15-17) (if 15 is greater than 17)

18

0

19 Refund (17-15) if 17 is greater than 15

19

20 Enter your Bank Account number

30068043205

(Mandatory )

21 Select Yes if you want your refund by direct deposit into your bank account, Select No

No if you want refund by Cheque

22 In case of direct deposit to your bank account give additional details

MICR Code

751002006

Type of Account(As applicable)

Savings

26 Exempt income for reporting purposes only (from Dividends, Agri. income < 5000)

VERIFICATION

I, (full name in block letters),

AKSHAY KUMAR

SAHOO

son/daughter of

SHREENIBAS

H SAHOO

solemnly declare that to the best of my knowledge and belief, the information given in the return thereto is

correct and complete and that the amount of total income and other particulars shown therein are truly

stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable

to Income-tax for the previous year relevant to the Assessment Year 2011-12

Place

BHUBANESWAR

Date

07/02/2015

Sign here ->

PAN

BMHPS3298E

27 If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No of TRP

Name of TRP

Counter Signature of TRP

28

If TRP is entitled for any reimbursement from the Government, amount thereof (to be

filled by TRP)

You might also like

- Osou 1572822082 PDFDocument2 pagesOsou 1572822082 PDFAkshay Kumar SahooNo ratings yet

- 3.web App Server:-Hardware and System Software SpecificationDocument1 page3.web App Server:-Hardware and System Software SpecificationAkshay Kumar SahooNo ratings yet

- Office of The Engineer-In-Chief (Civil), Odisha, Nirman Soudha, BhubaneswarDocument2 pagesOffice of The Engineer-In-Chief (Civil), Odisha, Nirman Soudha, BhubaneswarAkshay Kumar SahooNo ratings yet

- Tentative Depth - Local NallahDocument1 pageTentative Depth - Local NallahAkshay Kumar SahooNo ratings yet

- NOTE SheetDocument2 pagesNOTE SheetAkshay Kumar SahooNo ratings yet

- Grade Card Pgddm1820012Document1 pageGrade Card Pgddm1820012Akshay Kumar SahooNo ratings yet

- Result Monitoring Framework of ISAP ComponentsDocument17 pagesResult Monitoring Framework of ISAP ComponentsAkshay Kumar SahooNo ratings yet

- A Brief Presentation On Status of ISAP ActionsDocument2 pagesA Brief Presentation On Status of ISAP ActionsAkshay Kumar SahooNo ratings yet

- Application Form For Re-Evaluation of Term-End Examination Answer ScriptsDocument1 pageApplication Form For Re-Evaluation of Term-End Examination Answer ScriptsAkshay Kumar SahooNo ratings yet

- Name of Road . Name of (R&B) DivisionDocument24 pagesName of Road . Name of (R&B) DivisionAkshay Kumar SahooNo ratings yet

- 0.1 0.5 3 2 4 9 4 0 4 8 Bargarh Mdr-33 Pipalimu Nda Chhhak Turning Steep CurveDocument2 pages0.1 0.5 3 2 4 9 4 0 4 8 Bargarh Mdr-33 Pipalimu Nda Chhhak Turning Steep CurveAkshay Kumar SahooNo ratings yet

- Monthly Progress Report For Road Safety ProformaDocument1 pageMonthly Progress Report For Road Safety ProformaAkshay Kumar SahooNo ratings yet

- College of India", For Training Programme On "Environmental Impact Assessment For Projects"Document1 pageCollege of India", For Training Programme On "Environmental Impact Assessment For Projects"Akshay Kumar SahooNo ratings yet

- NCCBM PaymentDocument1 pageNCCBM PaymentAkshay Kumar SahooNo ratings yet

- Ndvi KBKDocument3 pagesNdvi KBKAkshay Kumar SahooNo ratings yet

- Office of The Engineer-In-Chief (Civil), Odisha, Nirman Soudha, Keshari Nagar, Unit-V, BhubaneswarDocument2 pagesOffice of The Engineer-In-Chief (Civil), Odisha, Nirman Soudha, Keshari Nagar, Unit-V, BhubaneswarAkshay Kumar SahooNo ratings yet

- Pot-Holes by Supreme Court Committee Reply Version-2Document5 pagesPot-Holes by Supreme Court Committee Reply Version-2Akshay Kumar SahooNo ratings yet

- Monthly Progress Report On Road Safety ActivitiesDocument17 pagesMonthly Progress Report On Road Safety ActivitiesAkshay Kumar SahooNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Integrating SDGsDocument24 pagesIntegrating SDGsRuwandi KuruwitaNo ratings yet

- O&M Module PDF File-1Document177 pagesO&M Module PDF File-1Strewbary BarquioNo ratings yet

- CHED TrustsDocument26 pagesCHED TrustsyrrenNo ratings yet

- Netflix Activity MapDocument6 pagesNetflix Activity Mapbharath_ndNo ratings yet

- Consumer QuestionnaireDocument3 pagesConsumer QuestionnairepriyankaNo ratings yet

- Single EntryDocument5 pagesSingle Entrysmit9993No ratings yet

- Sime Darby BerhadDocument16 pagesSime Darby Berhadjue -No ratings yet

- Joint Venture AgreementDocument4 pagesJoint Venture AgreementDefit Archila KotoNo ratings yet

- XII STD - Economics EM Combined 11.03.2019 PDFDocument296 pagesXII STD - Economics EM Combined 11.03.2019 PDFMonika AnnaduraiNo ratings yet

- Oberoi Realty Annual Report 2018-19Document220 pagesOberoi Realty Annual Report 2018-19yashneet kaurNo ratings yet

- Justdial SWOTDocument2 pagesJustdial SWOTweedemboy9393No ratings yet

- Fox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Document27 pagesFox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Chapter 11 DocketsNo ratings yet

- Digital India in Agriculture SiddhanthMurdeshwar NMIMS MumbaiDocument4 pagesDigital India in Agriculture SiddhanthMurdeshwar NMIMS MumbaisiddhanthNo ratings yet

- CV Lungu Adelina enDocument4 pagesCV Lungu Adelina enrealllNo ratings yet

- Guidance Note On Accoounting For LeasesDocument22 pagesGuidance Note On Accoounting For LeasesANUSHA DAVENo ratings yet

- Curicculum Vitae Dhanesh Chandmal Chopda: Candidate ProfileDocument4 pagesCuricculum Vitae Dhanesh Chandmal Chopda: Candidate ProfileAngel RiaNo ratings yet

- SESSION:-2021-22 Subject: - Social Science Topic: - Consumer Awareness Submitted By: - Sakshi Rathore Submitted To: - Mr. Kartikeswar PatroDocument8 pagesSESSION:-2021-22 Subject: - Social Science Topic: - Consumer Awareness Submitted By: - Sakshi Rathore Submitted To: - Mr. Kartikeswar PatroYash RathoreNo ratings yet

- Capital Adequacy (Test)Document25 pagesCapital Adequacy (Test)Kshitij Prasad100% (1)

- Grp15 Entrep ReflectionDocument9 pagesGrp15 Entrep ReflectionFaker MejiaNo ratings yet

- Nhlanhla Ngcobo Wilmonts Organization ChartDocument1 pageNhlanhla Ngcobo Wilmonts Organization ChartNHLANHLA TREVOR NGCOBONo ratings yet

- Telling Price: Ditempel Di Buku B. Inggris Kelas 5Document1 pageTelling Price: Ditempel Di Buku B. Inggris Kelas 5Ely AwatiNo ratings yet

- Institute of Business Management and Research, Ips Academy, Indore Lesson PlanDocument5 pagesInstitute of Business Management and Research, Ips Academy, Indore Lesson PlanSushma IssacNo ratings yet

- Projects Evaluation MethodsDocument87 pagesProjects Evaluation MethodsEmmanuel PatrickNo ratings yet

- Cash Flow ProjectDocument85 pagesCash Flow ProjectUsman MohammedNo ratings yet

- Business Cycles (BBA BI)Document19 pagesBusiness Cycles (BBA BI)Yograj PandeyaNo ratings yet

- PS2 ECGE 1113 Economics IDocument2 pagesPS2 ECGE 1113 Economics Isouha mhamdiNo ratings yet

- The IMC PlanDocument76 pagesThe IMC PlanNoha KandilNo ratings yet

- This Agreement, Was Made in 24/02/2021 Between:: Unified Employment ContractDocument9 pagesThis Agreement, Was Made in 24/02/2021 Between:: Unified Employment ContractMajdy Al harbiNo ratings yet

- HMRC 6Document86 pagesHMRC 6cucumucuNo ratings yet

- Table of Content: Part 1 Socialism and CapitalismDocument5 pagesTable of Content: Part 1 Socialism and CapitalismAnshul SinghNo ratings yet