Professional Documents

Culture Documents

Bankruptcy Court Reduces Foreclosure Fees

Uploaded by

drattyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bankruptcy Court Reduces Foreclosure Fees

Uploaded by

drattyCopyright:

Available Formats

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 1 of 15

IN THE UNITED STATES BANKRUPTCY COURT

EASTERN DISTRICT OF ARKANSAS

LITTLE ROCK DIVISION

IN RE: RAMON and LISA BURROW, Debtors

CASE NO. 3:09-bk-18876

CHAPTER 13

MEMORANDUM OPINION

AND

ORDER SUSTAINING OBJECTION TO PROOF OF CLAIM IN PART

On December 2, 2010, the Court heard Debtors Objection to Proof of Claim

(Objection to Claim) (docket #73) and the Response filed by PHH Mortgage Corporation

(docket #85).1 Joel Hargis appeared on behalf of the Debtors. Debtor Ramon Burrow was

also present. Sharon Fewell appeared on behalf of PHH Mortgage Corporation (PHH).

At the close of evidence, the Court took the matter under advisement.

This is a core proceeding under 28 U.S.C. 157(b)(2)(B). This Order shall constitute

findings of fact and conclusions of law pursuant to Bankruptcy Rule of Procedure 7052. To

the extent that any finding of fact is construed as a conclusion of law, it is adopted as such;

to the extent that any conclusion of law is construed as a finding of fact, it is adopted as such.

As explained herein, the Court sustains the Debtors objection to certain foreclosure

fees as unreasonable, and overrules the Debtors objection with respect to PHHs standing

to file a claim.

PHHs objection to confirmation of Debtors proposed Chapter 13 plan (docket #29)

was also set for hearing, but the parties chose to try the Objection to Proof of Claim first and

continue the objection to confirmation.

Entered On Docket: 03/22/2011

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 2 of 15

FACTS

These are the uncontested facts:

1.

Debtors filed a voluntary petition under Chapter 13 on December 3, 2009.

2.

Debtors filed their proposed Chapter 13 plan on February 17, 2010. Debtors

plan listed PHH as a long-term secured creditor with an arrearage of $6,500 and a regular

monthly payment of $375.

3.

PHH filed an objection to the confirmation of the Debtors proposed Chapter

13 plan on February 18, 2010, asserting that the correct arrearage amount was $14,255.11,

and that the ongoing regular mortgage payment was $439.94.

4.

PHH filed a proof of claim in Debtors bankruptcy case on February 18, 2010

(Original Proof of Claim), for a claim secured by a mortgage in the amount of

$69,145.77 which included mortgage arrears of $14,255.11.2

5.

Exhibit A to the Original Proof of Claim detailed PHHs $14,255.11 arrearage

claim which included missed payments of $4,752.41; $91.10 for appraisal fees; $145.75 for

property preservation fees; an escrow shortage of $1,720.61; a bankruptcy proof of claim fee

of $300; a bankruptcy objection to confirmation fee of $200; foreclosure fees of $450; and

$6,595.24 for foreclosure costs.

6.

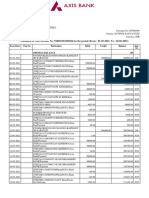

The $6,595.24 in foreclosure costs are further itemized as follows:

The Court took judicial notice of all filings and records in this case, including the proofs

of claim. See Fed.R.Evid. 201; In re Henderson, 197 B.R. 147, 156 (Bankr. N.D. Ala. 1996)

(The court may take judicial notice of its own orders and of records in a case before the court,

and of documents filed in another court.) (citations omitted); see also In re Penny, 243 B.R.

720, 723 n.2 (Bankr. W.D. Ark. 2000).

2

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 3 of 15

Date

Description

Amount

7/1/09

Court Required Mailing Cost

5/4/09

Posting

$2,550.00

5/4/09

Publication - Notice of Sale

$3,087.00

6/3/09

Recording - Assignment

5/20/09

Recording - Misc.

$180.00

2/27/09

Recording - Notice of Default

$480.00

Adjustment

-$20.00

3/24/09

Recording Substitution

3/5/09

Title Search

$40.00

$20.00

$225.00

Total

7.

$33.24

$6,595.24

Also attached to the Original Proof of Claim was a Note between GE Money

Bank as the lender and the Debtors as borrowers for the principal amount of $56,000 with

interest accruing at the rate of 6.786% dated April 5, 2007 (the Note).

8.

A recorded mortgage identifying GE Money Bank as the lender and the

Debtors as borrowers (the Mortgage) was also attached to the Original Proof of Claim

indicating that the Note was secured by certain real property at 3202 Case Street, Paragould,

Arkansas, and that the mortgagee was Mortgage Electronic Registration Systems, Inc.

(MERS), a separate corporation acting solely as a nominee for the lender and the lenders

successors and assigns.

9.

PHH filed an amended proof of claim on May 26, 2010 (First Amended

Proof of Claim) reducing the claimed arrearage amount from $14,255.11 to $12,873.07.

The itemized costs attached to the claim showed that PHH reduced the May 4, 2009 posting

3

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 4 of 15

fee from $2,550 to $1,167.96, to arrive at a total foreclosure cost figure of $5,213.20 instead

of $6,595.24. No explanation was provided as to why this figure was reduced. No

documents other than the itemization of fees and costs were attached to the First Amended

Proof of Claim.

10.

On December 1, 2010 (the day before the hearing in this matter), PHH filed a

another amended proof of claim (the Second Amended Proof of Claim) further reducing

the arrearage claim and attaching the Mortgage and a different copy of the Note that included

an indorsement from GE Money Bank to PHH, and a blank indorsement by PHH. On the

Second Amended Proof of Claim, PHH increased the posting fee from $1,167.96 to $1,300,

and reduced the publication notice of sale fee from $3,087 to $2,304.96, for total

foreclosure costs of $4,563.20 and a total arrearage of $12,223.07. No additional information

was provided as to why these figures were changed.

11.

Paragraph 9 of the Mortgage titled, Protection of Lenders Interest in the

Property and Rights Under this Security Instrument, provides, in part:

If (a) borrower fails to perform the covenants and agreements contained

in this security agreement; (b) there is a legal proceeding that might

significantly affect lenders interest in the property and/or rights under this

security instrument, such as a proceeding in bankruptcy, probate, for

condemnation or forfeiture, for enforcement of a lien which may attain priority

over its security instrument, or to enforce laws or regulations, or (c) Borrower

has abandoned the Property, then Lender may do and pay for whatever is

reasonable or appropriate to protect Lenders interest in the Property and rights

under this Security Instrument, including protecting and/or assessing the value

of the Property, and security and/or repairing the Property. Lenders actions

can include, but are not limited to: (a) paying any sums secured by a lien

which has priority over this Security Instrument; (b) appearing in court; and

paying reasonable attorneys fees to protect its interest in the Property and/or

4

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 5 of 15

rights under this Security Instrument, including its secured position in a

bankruptcy proceeding. . . .

Any amounts disbursed by Lender under this Section 9 shall become

additional debt of Borrower secured by this Security Instrument. These

amounts shall bear interest at the Note rate from the date of disbursement and

shall be payable, with such interest, upon notice from Lender to Borrower

requesting payment.

12.

Paragraph 14 of the Mortgage, titled Loan Charges, provides:

Lender may charge borrower fees for services performed in connection

with the borrowers default for the purpose of protecting lenders interest in

the property and rights under this security instrument, including, but not

limited to, attorneys fees, property inspection, and valuation fees. In regard

to any other fees, the absence of expressed authority in this security instrument

to charge a specific fee to borrower shall not be construed as a prohibition on

the charging of such fee. Lender may not charge fees that are expressly

prohibited by this security instrument or by applicable law.

13.

Paragraph 22 of the Mortgage, titled Acceleration; Remedies, provides, in

part:

. . . Lender shall be entitled to collect all expenses incurred in pursuing

the remedies provided in this Section 22, including, but not limited to,

reasonable attorneys fees and costs of title evidence.

14.

PHH initiated non-judicial foreclosure proceedings with respect to the

mortgage on the Debtors home on at least three different occasions during the year

preceding the Debtors bankruptcy filing.

15.

Jan Griffith, Greene County Circuit Clerk, testified as to the process of filing

a non-judicial foreclosure under the Arkansas Statutory Foreclosure Act.3 She said that the

Although not specifically relevant to this case, it is informative to note that Ms. Griffith

testified that for the year 2010, there had been 173 non-judicial foreclosure postings in Greene

County as of November 30, 2010.

5

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 6 of 15

process begins when her office receives a Notice of Default and Intent to Sell from one of

the attorneys offices in Arkansas that is authorized to proceed with non-judicial

foreclosures. A $160 fee is filed with the Notice of Default and Intent to Sell which includes

a $140 fee for opening the case (with $25 going to the State Crime Laboratory and $15 going

to the states law schools), and a $20-25 fee for recording the instrument ($15 for the first

page and $5 for each subsequent page).

16.

Receipts from Ms. Griffith as Greene County Circuit Clerk were entered into

evidence as Debtors Exhibit 1 and showed that the non-judicial foreclosure fees were paid

by Shapiro and Kirsh, LLP (PPHs counsel) on three occasions in these amounts: $160 on

March 2, 2009; $180 on June 4, 2009; and $180 on September 8, 2009. Each included the

$160 filing fee for a Notice of Default and Intent to Sell, and the latter two included a $20

charge for canceling a foreclosure sale. Another receipt shows a $50 fee for an affidavit filed

on July 27, 2009.

17.

A file-marked copy of a Mortgage Notice of Default and Intention to Sell dated

February 27, 2009, was introduced as Debtors Exhibit 4. Mrs. Griffith testified that it was

filed on March 2, 2009.

18.

Ms. Griffith testified that an Assignment of Mortgage executed on May 19,

2009, was recorded on June 11, 2009. The Assignment states that GE Money Bank assigned

the mortgage on the Debtors home to PHH. The Assignment was accepted into evidence

as Debtors Exhibit 5.

19.

Ms. Griffith further testified that to meet the posting requirement of the

6

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 7 of 15

Arkansas Statutory Foreclosure Act, Notices of Default and Intent to Sell are tacked onto a

bulletin board approximately 15 feet from the front doors of the Greene County Courthouse.

A photograph of the bulletin board was submitted into evidence as Debtors Exhibit 2.

20.

A breakdown of fees and costs charged by the third party performing

foreclosure services for PHH in connection with the attempted foreclosures was stipulated

to by PHH and accepted as Debtors Exhibit 3 (hereinafter referred to as Third Party

Fees/Costs). The Third Party Fees/Costs indicates that $425 was charged for posting on

three different occasions. The Third Party Fees/Costs also indicate that a refund of certain

charges, including one of the $425 charges, was to be given. The total fees/costs reflected

on the Third Party Fees/Costs was $5,613.20 which is $400 more than the total fees listed on

the First Amended Proof of Claim but does not exactly match the foreclosure costs on any

of the three proofs of claim.

21.

The Third Party Fees/Costs shows that $175 was charged for postponing or

cancelling a foreclosure sale on three occasions. Ms. Griffith testified that her office charged

$20 for postponing or canceling a sale. There was no explanation as to why the foreclosures

were cancelled. Again, the Third Party Fees/Costs shows that one of these $175 amounts

was to be refunded.

PARTIES POSITIONS AND ISSUE PRESENTED

In objecting to PHHs proofs of claim (both the original and amended proofs of

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 8 of 15

claim), Debtors assert that certain foreclosure costs4 claimed by PHH are unreasonable and

that PHH lacks standing to enforce the Note secured by a mortgage on Debtors home.

Debtors assert that the foreclosure costs charged by a third party for posting foreclosure

notices and for canceling two foreclosures were unreasonable in light of how much work it

actually takes to perform such services, and Debtors assert that the first of at least three

foreclosure suits on their property was not in compliance with the Arkansas Statutory

Foreclosure Act, and therefore, any fees associated with the first foreclosure are

unreasonable. Debtors argue that PHH lacks standing to enforce the Note because it attached

an unindorsed copy of the Note to its first proof of claim, and only attached a copy of the

indorsed Note to the Second Amended Proof of Claim which was filed the day before the

hearing.

PHH contends that it has no control over what the third party foreclosure entity5 it

used to perform the foreclosure services charges, that it contacted said third party, and that

the third party reduced some of its fees as reflected on the Second Amended Proof of Claim

but refused to send a witness to the hearing to testify as to the reasonableness of any fees

charged. On the issue of standing, PHHs counsel asserted that PHH had the indorsed Note

all along but attached a copy of the original Note to its first proof of claim by mistake.

The Debtors concede that the $450 charge for attorneys fees relating to the foreclosures

are reasonable.

5

PHH explained that the Arkansas non-judicial foreclosure statutes require it to involve a

neutral third party in the posting and publication process. See generally Ark. Code Ann. 1850-105.

8

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 9 of 15

PHHs counsel also contended they had sent Debtors counsel a copy of the indorsed Note

some time ago.

DISCUSSION

Legal Standard and Burden of Proof

A filed proof of claim is prima facie evidence of its validity and amount if it is

executed and filed in accordance with the Federal Rules of Bankruptcy Procedure. Fed. R.

Bankr. P. 3001(f). Rule 3001(a)-(c) provides that a proof of claim must be in writing, be

executed by the creditor or its authorized agent, and, when based on a writing, be filed with

the original or a duplicate of that writing. Fed. R. Bankr. P. 3001(a)-(c). Rule 3001(d)

requires that, if the creditor claims a security interest in the debtor's property, the proof of

claim shall be accompanied by evidence that the security interest has been perfected.

Pursuant to 11 U.S.C. 502(a), a claim is deemed allowed, unless a party in interest . . .

objects.

Claim objectors carry the initial burden to produce some evidence to overcome the

rebuttable presumption of validity. In re Koontz, 2010 WL 5625883, 7-8 (Bankr. N.D. Ind.

2010) (quoting In re Vanhook, 426 B.R. 296, 298-99 (Bankr. N.D. Ill. 2010) (citations

omitted)). See also In re Consumers Realty & Development Co., Inc., 238 B.R. 418, 422-423

(B.A.P. 8th Cir. 1999) (citing Gran v. Internal Revenue Serv. (In re Gran), 964 F.2d 822, 827

(8th Cir. 1992)). Once the objecting party produces evidence rebutting the claim, the burden

of proof shifts to the claimant to produce evidence establishing the validity of the claim. [In

re Gran.] Thus, once an objection is made to the proof of claim, the ultimate burden of

9

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 10 of 15

persuasion as to the claim's validity and amount rests with the claimant. In re Consumers

Realty & Development Co., Inc., 238 B.R. at 423 (citing In re Allegheny Int'l, Inc., 954 F.2d

167, 173-74 (3rd Cir.1992); In re Harrison, 987 F.2d 677, 680 (10th Cir.1993)).

PHHs Standing to File Proof of Claim

The Court first addresses the Debtors objection to PHHs claim based on its alleged

lack of standing to file such claim. Specifically, in their objection to PHHs claim, the

Debtors questioned whether PHH was the proper party to file such claim because every

document filed by PHH, including the Note and the Mortgage, showed that GE Money Bank

is the lender, and that MERS acts as nominee for the lender. After PHH attached a copy of

the Note indorsed to it by GE Money Bank the day before the hearing,6 the Debtors then

sought disallowance of PHHs claim in its entirety in their closing argument, and asked that

the creditor be required to prove that the indorsements existed prior to the filing of the

bankruptcy in the event it filed another proof of claim.7

The Court finds it is unnecessary to require PHH to file yet another claim and produce

6

In order to enforce a negotiable instrument payable to an identified person, the

instrument must be indorsed by the holder and possession transferred as provided by Ark. Code

Ann. 4-3-201(b), or if there is no indorsement, a transferee may prove the transaction through

which it acquired possession of the unindorsed instrument. See Ark. Code Ann. 4-3-203. PHH

made no attempt to prove the transaction through which it acquired possession of the Note, but

instead, relied on its production of the indorsed note.

7

The Court notes that some bankruptcy courts apply Fed. R. Bankr. P. 7015 to amended

proofs of claim, and require a creditor to seek leave of court before filing an amended proof of

claim. See e.g., In re DePugh, 409 B.R. 84, 90 (Bankr. S.D. Tex. 2009) ([I]n order to prevent

future violations of Bankruptcy Rule 3001 and to foster judicial efficiency and economy, . . . ,

this Court issued a written notice and order in all of its Chapter 13 cases requiring creditors to

seek leave of court or written consent of the debtor before amending a deficient proof of claim

after the debtor has lodged a claim objection.). This Court has no such practice or similar rule.

10

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 11 of 15

evidence that it held the Note at the time of the Debtors bankruptcy filing because the

evidence before the Court shows PHH was the proper party to file the claim. A chain of title

to the Note was lacking until PHH filed its Second Amended Proof of Claim, and PHHs

filing the indorsed Note the day before the hearing is not well-taken.8 The sudden

appearance of an indorsement to PHH might be suspicious if it were not for the fact that other

evidence in the record shows that the mortgage had already been assigned to PHH prior to

the Debtors bankruptcy petition. Specifically, the assignment executed on May 19, 2009,

and recorded on June 11, 2009, states that GE Money Bank assigned the mortgage on the

Debtors home to PHH. The Note indorsed to PHH along with the assigned mortgage, and

the fact that the Debtors listed PHH as their mortgage creditor on their schedules, is enough

to establish that PHH had standing on the day of filing. In sum, although PHH offered no

evidence to prove its chain of title other than attaching the indorsed Note to its Second

Amended Proof of Claim the day before trial, the Debtors suspicions regarding when these

indorsements to the Note were executed are not sufficient to rebut the prima facie validity

afforded PHHs Second Amended Proof of Claim.

Reasonableness of Foreclosure Fees

The Court has the authority to review the portion of the arrearage claim for prepetition

The last minute filing of the Second Amended Proof of Claim with the indorsed Note

would be more problematic had counsel for PHH not explained that she had previously sent

Debtors counsel a copy of the indorsed note and did not believe PHHs standing was still an

issue. Debtors counsel did not refute that he had received the indorsed Note but argued that

standing had been an issue since their initial objection was filed.

11

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 12 of 15

foreclosure fees for reasonableness pursuant to the loan documents in this case.9

Specifically, Paragraph 9 of the Mortgage provides that Lender may do and pay for

whatever is reasonable or appropriate to protect Lenders interest in the Property and rights

under this Security Instrument. (Emphasis added.) Additionally, under Arkansas law,

contract provisions calling for an award of attorney fees are subject to court review for

reasonableness. See generally Troutt v. First Federal Sav. & Loan Ass'n of Hot Springs, 280

Ark. 505, 507, 659 S.W.2d 183, 184 (Ark. 1983) (stating that customary provisions in notes

calling for a 10% attorneys fee upon default should not lead to the arbitrary setting of fees

based on fixed percentages. . . . Fees in such cases should not exceed an amount that is

reasonable in each case.) (Emphasis added).10

In connection with their objection to the reasonableness of the fees charged by PHH

Although Debtors counsel cited 11 U.S.C. 506(b) as the basis for the Courts review

of the reasonableness of the foreclosure fees at issue, there is ample authority holding that

506(b) does not apply to pre-petition interest, fees or costs, which are instead allowed as part of

the underlying claim but may be subject to review under the controlling loan documents and

state law. See e.g., In re Woods Gallery, Inc., 379 B.R. 875, 882 (Bankr. W.D. Mo. 2007), and

cases cited therein.

10

The Court did not find an Arkansas case regarding the award of fees for foreclosure

services. Rather, the case law focuses on the award of attorney fees. The Eighth Circuit has

explained that Arkansas law once disfavored attorney fee awards even if provided for in a note

or related instrument, but in 1951, the Arkansas legislature passed Act 350 which allowed for a

provision in a promissory note for the payment of reasonable attorneys fees not to exceed 10%

of the principal amount due for services actually rendered. In re Morris, 602 F.2d 826, 828 (8th

Cir. 1979).

Arkansas later enacted Ark. Code Ann. 16-22-308 which provides: [i]n any civil

action to recover on an open account, statement of account, account stated, promissory note, bill,

negotiable instrument, or contract relating to the purchase or sale of goods, wares, or

merchandise, or for labor or services, or breach of contract, unless otherwise provided by law or

the contract which is the subject matter of the action, the prevailing party may be allowed a

reasonable attorney's fee to be assessed by the court and collected as costs.

12

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 13 of 15

for the three foreclosures initiated by PHH, the Debtors successfully rebutted the prima facie

claim of PHH as to all fees incurred in connection with the first foreclosure, the fees for

assigning the mortgage, and those fees charged for posting and cancellation in connection

with the second and third foreclosures.

With respect to the first foreclosure, the Debtors submitted the assignment of

mortgage from GE Money Bank to PHH with an effective date of May 19, 2009. PHH

introduced no evidence as to when GE Money Bank actually indorsed the note to PHH. The

assignment of mortgage is effective May 19, 2009, and accordingly, that is the only evidence

before the Court showing that any interest in the Note or mortgage was transferred to PHH.

Because PHH initiated the first foreclosure no later than February 27, 2009 (with the first

Notice of Foreclosure), and there is no evidence that PHH was the mortgagee before May

19, 2009, the first foreclosure would have been invalid under the Arkansas Statutory

Foreclosure Act.11

Accordingly, all fees associated with the first foreclosure are

unreasonable and should not be charged to the Debtor.

Debtor also objects to being charged for the fees associated with GE Money Bank

assigning the mortgage to PHH. PHHs counsel made no argument in defense of these

charges, and the portions of the Mortgage (paragraphs 9, 14 and 22 recited in the facts of this

11

See Ark. Code Ann. 18-50-103 (providing that a mortgagee may not conduct a

foreclosure sale unless the mortgage is filed for record with the recorder of the county in which

the trust property is situated); Ark. Code Ann. 18-50-116 (providing that a claim or defense of

a person or entity asserting his or her or its legal and equitable rights shall be asserted before the

sale or it is forever barred and terminated, except that the mortgagor may assert the following

against either the mortgagee or trustee: (i) Fraud; or (ii) Failure to strictly comply with the

provisions of this chapter.) (Emphasis added.)

13

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 14 of 15

Opinion) she had read into evidence do not support a charge for anything other than

something related to Debtors default. An assignment from one creditor to another is not due

to the Debtors default and should not be charged to the Debtors. Accordingly, PHH has not

met its burden to show that these charges are reasonable, and therefore, any charges for

assignment of the Mortgage are disallowed.

With respect to the second and third foreclosures, the Debtors put on ample evidence

to rebut the prima facie validity of some of these fees. Through the testimony of Ms.

Griffith, Debtors showed that they were charged $425 for someone to walk inside the

courthouse and thumbtack a foreclosure notice onto a bulletin board, and that they were

charged $175 for canceling a foreclosure even though the clerks office only charges a $20

recording fee. While the third party agent providing these services most certainly incurs

greater costs than those charged by the Clerks office and can reasonably charge for the

services it provides, PHH offered no evidence to explain why these charges were as high as

they are. PHH merely claimed it was required to use a third party agent to conduct the

foreclosure related services, and that it had no control over what that third party charged.

PHHs counsel said that PHH invited the third party agent to testify as to the reasonableness

of its fees but it declined to do so. If PHH wanted to be reimbursed for these fees, at the very

least, it should have subpoenaed the third party agent. Given absolutely no explanation for

what appears to be exorbitant charges for the services performed, the Court finds that the

Debtors have rebutted the reasonableness of the fees charged for posting and cancellation of

sale, and PHH did not subsequently meet its burden to show that such fees are valid, and

14

3:09-bk-18876 Doc#: 120 Filed: 03/22/11 Entered: 03/22/11 14:05:32 Page 15 of 15

these fees are therefore disallowed.

CONCLUSION

For the foregoing reasons, the Court concludes that although PHH did not initially

attach an indorsed note to its proof of claim, it ultimately produced and filed the indorsed

Note. The indorsed Note together with a recorded Assignment of Mortgage executed and

recorded prior to the Debtors bankruptcy, and the fact that Debtors listed PHH as their

mortgage creditor, shows that PHH had standing to file its claim. Further, the Debtors have

rebutted the reasonableness of the fees charged for the first foreclosure proceeding, the fees

for assigning the mortgage, and the fees for posting and cancellation of foreclosure sales, and

PHH did not subsequently meet its burden to show that such fees are valid. Accordingly,

those fees are disallowed. It is hereby

ORDERED that the Objection to Proof of Claim is SUSTAINED in part, and

OVERRULED in part; and it is further

ORDERED that PHH has 21 days in which to file an amended claim in accordance

with this Opinion and Order; if PHH fails to file an amended claim, its claim will be

disallowed.

IT IS SO ORDERED.

cc:

Debtors

Joel Hargis, attorney for Debtors

Sharon Fewell, attorney for PHH

Mark T. McCarty, Trustee

U.S. Trustee

03/22/2011

15

You might also like

- ROWLAND Et Al v. OCWEN LOAN SERVICING, LLC. Et Al Notice of RemovalDocument6 pagesROWLAND Et Al v. OCWEN LOAN SERVICING, LLC. Et Al Notice of RemovalACELitigationWatchNo ratings yet

- 50CENT Bankruptcy DocumentDocument22 pages50CENT Bankruptcy DocumentThe Verge100% (1)

- Plaintiffs Fail to Prove Authenticity of AllongesDocument14 pagesPlaintiffs Fail to Prove Authenticity of AllongesBeth Stoops Jacobson100% (1)

- Lori Wigod v. Wells FargoDocument75 pagesLori Wigod v. Wells FargoForeclosure Fraud100% (1)

- United States Court of Appeals, Fifth CircuitDocument7 pagesUnited States Court of Appeals, Fifth CircuitScribd Government DocsNo ratings yet

- Order Granting Defendant's Motion To DismissDocument7 pagesOrder Granting Defendant's Motion To DismissKarl Denninger100% (2)

- United States Court of Appeals, Fourth CircuitDocument10 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Lillie B. Cowan, Counter-Defendant v. Miles Rich Chrysler-Plymouth, Counter-Claimant, 885 F.2d 801, 11th Cir. (1989)Document5 pagesLillie B. Cowan, Counter-Defendant v. Miles Rich Chrysler-Plymouth, Counter-Claimant, 885 F.2d 801, 11th Cir. (1989)Scribd Government DocsNo ratings yet

- USA Sentencing Recommendation For Jeremy JohnsonDocument36 pagesUSA Sentencing Recommendation For Jeremy JohnsonBen WinslowNo ratings yet

- Trust Company of Columbus v. United States, 776 F.2d 270, 11th Cir. (1985)Document4 pagesTrust Company of Columbus v. United States, 776 F.2d 270, 11th Cir. (1985)Scribd Government DocsNo ratings yet

- Brief, Objections To ComplaintDocument7 pagesBrief, Objections To ComplaintNeil KrumNo ratings yet

- Motion To Show CauseDocument8 pagesMotion To Show CauseForeclosure FraudNo ratings yet

- Winterhalter OpinionDocument137 pagesWinterhalter OpinionGary SeitzNo ratings yet

- Lucerne Investment Company v. Estate Belvedere, Inc., 411 F.2d 1205, 3rd Cir. (1969)Document4 pagesLucerne Investment Company v. Estate Belvedere, Inc., 411 F.2d 1205, 3rd Cir. (1969)Scribd Government DocsNo ratings yet

- Debtor's Application To Employ Appraiser, National Realty ConsultantsDocument5 pagesDebtor's Application To Employ Appraiser, National Realty ConsultantsjaxstrawNo ratings yet

- In Re Electronic Metal Products, Inc., A/K/A Advanced MacHining Co., Debtor. Electronic Metal Products, Inc., A/K/A Advanced MacHining Co. v. Howard Bittman, 916 F.2d 1502, 10th Cir. (1990)Document8 pagesIn Re Electronic Metal Products, Inc., A/K/A Advanced MacHining Co., Debtor. Electronic Metal Products, Inc., A/K/A Advanced MacHining Co. v. Howard Bittman, 916 F.2d 1502, 10th Cir. (1990)Scribd Government DocsNo ratings yet

- Motion For SJDocument9 pagesMotion For SJGervais R. BrandNo ratings yet

- Kenneth Pasternak Filling in VPW Inc./Hrazanek BankruptcyDocument8 pagesKenneth Pasternak Filling in VPW Inc./Hrazanek BankruptcyWatershed PostNo ratings yet

- Andy Powers Communiclique Chapter 7 Riling ExtensionDocument6 pagesAndy Powers Communiclique Chapter 7 Riling ExtensionGlen HellmanNo ratings yet

- ARS Brook, LLC v. Jalbert, 382 F.3d 68, 1st Cir. (2004)Document9 pagesARS Brook, LLC v. Jalbert, 382 F.3d 68, 1st Cir. (2004)Scribd Government DocsNo ratings yet

- U.S. v. Michael T. Flynn: Plea AgreementDocument10 pagesU.S. v. Michael T. Flynn: Plea AgreementPete Madden100% (1)

- DemurrerDocument19 pagesDemurrerbhawna_22b100% (4)

- 2017-04-22 Margarita Mares - Complaint Effective Rescission Rev4Document11 pages2017-04-22 Margarita Mares - Complaint Effective Rescission Rev4api-360769610No ratings yet

- Ekerson v. MERS, CitiMortgage Inc., Et AlDocument12 pagesEkerson v. MERS, CitiMortgage Inc., Et AlForeclosure FraudNo ratings yet

- PublishedDocument16 pagesPublishedScribd Government DocsNo ratings yet

- Rivelli v. Twin City Fire Ins. Co., 10th Cir. (2009)Document14 pagesRivelli v. Twin City Fire Ins. Co., 10th Cir. (2009)Scribd Government DocsNo ratings yet

- Bestwall - Order Granting Eleventh Interim Application of Robinson, Bradshaw & HinsonDocument3 pagesBestwall - Order Granting Eleventh Interim Application of Robinson, Bradshaw & HinsonKirk HartleyNo ratings yet

- Alberto Gonzales Files - F - Chambers JDP Sylvia Wpfiles Greenway2 JDP WPD Id Uscourts Gov-Greenway MemoDocument12 pagesAlberto Gonzales Files - F - Chambers JDP Sylvia Wpfiles Greenway2 JDP WPD Id Uscourts Gov-Greenway Memopolitix100% (1)

- In Re Beaumont, 586 F.3d 776, 10th Cir. (2009)Document12 pagesIn Re Beaumont, 586 F.3d 776, 10th Cir. (2009)Scribd Government DocsNo ratings yet

- Llorin vs. CA, G.R. No. 103592 February 4, 1993 (218 SCRA 436)Document6 pagesLlorin vs. CA, G.R. No. 103592 February 4, 1993 (218 SCRA 436)CLark Barcelon100% (1)

- US Bankruptcy Court ComplaintDocument16 pagesUS Bankruptcy Court ComplaintJames LynchNo ratings yet

- Show Public DocDocument18 pagesShow Public DocBleak NarrativesNo ratings yet

- Motion For Deficiency Judgment, (D.E. 533, FAB V SCH-16-009292, FL 15th Circuit) Aug. 27, 2020Document15 pagesMotion For Deficiency Judgment, (D.E. 533, FAB V SCH-16-009292, FL 15th Circuit) Aug. 27, 2020larry-612445No ratings yet

- Objection of US Trustee Objection To Debtor's Application of Proposed Settlement and Compromise and Memorandum in Support ThereofDocument4 pagesObjection of US Trustee Objection To Debtor's Application of Proposed Settlement and Compromise and Memorandum in Support ThereofDGWBCSNo ratings yet

- George Papadopoulos Plea AgreementDocument9 pagesGeorge Papadopoulos Plea AgreementNational Content Desk100% (3)

- TO: The Honorable Ann M. Nevins United States Bankruptcy JudgeDocument12 pagesTO: The Honorable Ann M. Nevins United States Bankruptcy Judgeefuchs160No ratings yet

- First National Bank, Lexington, Tennessee v. The United States, 846 F.2d 740, 1st Cir. (1988)Document6 pagesFirst National Bank, Lexington, Tennessee v. The United States, 846 F.2d 740, 1st Cir. (1988)Scribd Government DocsNo ratings yet

- United States Court of Appeals For The Ninth CircuitDocument14 pagesUnited States Court of Appeals For The Ninth Circuitjunkjunk876No ratings yet

- Opinion Langley v. Statebridge Company LLCDocument6 pagesOpinion Langley v. Statebridge Company LLCAdam DeutschNo ratings yet

- Valley Historic Limited Partnership v. The Bank of New York, 486 F.3d 831, 4th Cir. (2007)Document9 pagesValley Historic Limited Partnership v. The Bank of New York, 486 F.3d 831, 4th Cir. (2007)Scribd Government DocsNo ratings yet

- Response to Motion to Dismiss Challenges Bank of America's Claims to MortgageDocument20 pagesResponse to Motion to Dismiss Challenges Bank of America's Claims to MortgagecharleswaynecoxNo ratings yet

- Amended Final Judgment of Foreclosure (Supplemental Judgment)Document6 pagesAmended Final Judgment of Foreclosure (Supplemental Judgment)larry-612445No ratings yet

- Amended Rule 2019 MotionDocument318 pagesAmended Rule 2019 MotionKirk HartleyNo ratings yet

- Gens v. Resolution, 112 F.3d 569, 1st Cir. (1997)Document14 pagesGens v. Resolution, 112 F.3d 569, 1st Cir. (1997)Scribd Government DocsNo ratings yet

- United States District Court Eastern District of LouisianaDocument10 pagesUnited States District Court Eastern District of LouisianaEric GreenNo ratings yet

- Filed: Patrick FisherDocument8 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- 53 BA Finance Corp. v. Court of AppealsDocument9 pages53 BA Finance Corp. v. Court of AppealsYaz CarlomanNo ratings yet

- United States Court of Appeals, Second Circuit.: Argued: December 9, 2005. Decided: February 24, 2006Document15 pagesUnited States Court of Appeals, Second Circuit.: Argued: December 9, 2005. Decided: February 24, 2006Scribd Government DocsNo ratings yet

- Elizabeth Taft V Wells Fargo Bank, CASE 0.10-Cv-02084-SRN-FLNDocument16 pagesElizabeth Taft V Wells Fargo Bank, CASE 0.10-Cv-02084-SRN-FLNNeil GillespieNo ratings yet

- Federal Builders vs. Foudation SpecialitsDocument8 pagesFederal Builders vs. Foudation SpecialitsRonielleNo ratings yet

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionFrom EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionNo ratings yet

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)From EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)No ratings yet

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersFrom EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersRating: 3 out of 5 stars3/5 (1)

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsFrom EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsRating: 4.5 out of 5 stars4.5/5 (12)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Simple Guide for Drafting of Civil Suits in IndiaFrom EverandSimple Guide for Drafting of Civil Suits in IndiaRating: 4.5 out of 5 stars4.5/5 (4)

- The Self-Help Guide to the Law: Contracts and Sales Agreements for Non-Lawyers: Guide for Non-Lawyers, #5From EverandThe Self-Help Guide to the Law: Contracts and Sales Agreements for Non-Lawyers: Guide for Non-Lawyers, #5No ratings yet

- Opinion - Ast - 12-08-02 Renz Attempt To Void Claim Against Chase - With Laws and Rules PDFDocument16 pagesOpinion - Ast - 12-08-02 Renz Attempt To Void Claim Against Chase - With Laws and Rules PDFdrattyNo ratings yet

- Is Chapter 20 Available Post BAPCPA PDFDocument13 pagesIs Chapter 20 Available Post BAPCPA PDFdrattyNo ratings yet

- Creating Perfect Security Interests A PremirDocument19 pagesCreating Perfect Security Interests A Premirdratty100% (1)

- Bank Failed To Produce Evidence of Adequate Protection On Lost Note PDFDocument4 pagesBank Failed To Produce Evidence of Adequate Protection On Lost Note PDFdrattyNo ratings yet

- Fed CA Opp Motion Refief From Aut Stay 08 CaporaleDocument4 pagesFed CA Opp Motion Refief From Aut Stay 08 Caporalesbhasin1No ratings yet

- Chapter 20 Lien StrippingDocument4 pagesChapter 20 Lien StrippingdrattyNo ratings yet

- Cruz V Jpmorgan No Standing Paa and Fdic Assignment Does Not Prove Ownership PDFDocument7 pagesCruz V Jpmorgan No Standing Paa and Fdic Assignment Does Not Prove Ownership PDFdrattyNo ratings yet

- America's Wholesale Lender Not NY CorporationDocument4 pagesAmerica's Wholesale Lender Not NY CorporationdrattyNo ratings yet

- Balch v. LaSalle Bank, N.A., - So. 3d - (Fla. 4th DCA 2015)Document3 pagesBalch v. LaSalle Bank, N.A., - So. 3d - (Fla. 4th DCA 2015)FloridaLegalBlogNo ratings yet

- Acidello V Jpmorgan Complaint PDFDocument64 pagesAcidello V Jpmorgan Complaint PDFdrattyNo ratings yet

- Nunez V JPMorgan Chase RESPA Violation by ChaseDocument9 pagesNunez V JPMorgan Chase RESPA Violation by ChasedrattyNo ratings yet

- A New Look at US Foreclosure Crisis PDFDocument47 pagesA New Look at US Foreclosure Crisis PDFdrattyNo ratings yet

- BAC Home Loans Servicing L.P. v. BlytheDocument13 pagesBAC Home Loans Servicing L.P. v. BlytheGlenn AugensteinNo ratings yet

- Busted - Us Trustee Asks For Sanctions Against ChaseDocument2 pagesBusted - Us Trustee Asks For Sanctions Against Chase83jjmackNo ratings yet

- Mers by Its Construction Separates The Deed From The Mortgage Note - Wilhelm Decision - Lack of StandingDocument25 pagesMers by Its Construction Separates The Deed From The Mortgage Note - Wilhelm Decision - Lack of Standing83jjmackNo ratings yet

- Assignee Liability Through the MinefieldDocument28 pagesAssignee Liability Through the MinefieldlanehoukNo ratings yet

- 67 - JBD - How To Defend Avoidance Actions in Bankruptcy Litigation - 00104494 - PDFDocument11 pages67 - JBD - How To Defend Avoidance Actions in Bankruptcy Litigation - 00104494 - PDFdrattyNo ratings yet

- Hammer V Residential Credit Solution Memo Opinion and Two Million Award PDFDocument36 pagesHammer V Residential Credit Solution Memo Opinion and Two Million Award PDFdrattyNo ratings yet

- BANK-OF-NEW-YORK-MELLON-v.-LEMAY and Dermabelle Gary Dubin PDFDocument8 pagesBANK-OF-NEW-YORK-MELLON-v.-LEMAY and Dermabelle Gary Dubin PDFdrattyNo ratings yet

- Section ADocument9 pagesSection AForeclosure Fraud75% (4)

- Abubo - 10172013 V The Bank of New York PDFDocument36 pagesAbubo - 10172013 V The Bank of New York PDFdrattyNo ratings yet

- D C O A O T S O F: Connie Yang and Frank RomeoDocument6 pagesD C O A O T S O F: Connie Yang and Frank RomeoForeclosure Fraud100% (1)

- Slorp V Lerner Sampson BA MERS Robo RICO 9 14Document28 pagesSlorp V Lerner Sampson BA MERS Robo RICO 9 14knownpersonNo ratings yet

- Pred Lending Faq PDFDocument3 pagesPred Lending Faq PDFdrattyNo ratings yet

- Chase Bank Counterclaim Mortgage DisputeDocument4 pagesChase Bank Counterclaim Mortgage DisputedrattyNo ratings yet

- Section CDocument16 pagesSection CForeclosure Fraud100% (3)

- Bank of New York V RomeroDocument19 pagesBank of New York V RomeroMortgage Compliance InvestigatorsNo ratings yet

- FDIC V Citibank PDFDocument44 pagesFDIC V Citibank PDFdrattyNo ratings yet

- 11th Cir Refuses To Hold Assignee Liable Under TILA For Failing To Provide Payoff StatementDocument4 pages11th Cir Refuses To Hold Assignee Liable Under TILA For Failing To Provide Payoff StatementdrattyNo ratings yet

- IFS International BankingDocument39 pagesIFS International BankingVrinda GargNo ratings yet

- Chapter 1 Simple Interest and DiscountDocument88 pagesChapter 1 Simple Interest and DiscountFocasan Rence-Te75% (12)

- CYB1: Introduction to Cyber Crimes & Banking SecurityDocument37 pagesCYB1: Introduction to Cyber Crimes & Banking Securityanand guptaNo ratings yet

- Financial Inclusion Barriers and Strategies in IndiaDocument17 pagesFinancial Inclusion Barriers and Strategies in IndiathenosweenNo ratings yet

- Abiria Card NewsDocument2 pagesAbiria Card NewsabiriacardNo ratings yet

- Pre Closing Trial BalanceDocument1 pagePre Closing Trial BalanceEli PerezNo ratings yet

- Top Construction Companies in OmanDocument80 pagesTop Construction Companies in OmanBrave Ali Khatri100% (3)

- Credit Transactions Law Arts 1933 1961 Civil Code Usury Law Cases To ReadDocument19 pagesCredit Transactions Law Arts 1933 1961 Civil Code Usury Law Cases To ReadGene Bustos ManaoisNo ratings yet

- Resources Understanding ISO20022 NACHA Payments 2013Document121 pagesResources Understanding ISO20022 NACHA Payments 2013Rajendra PilludaNo ratings yet

- ConclusionDocument2 pagesConclusionezekiel50% (2)

- Citigroup Sued For Fraud Over $1 Billion of CDOs - Loreley Financing v. Citigroup ComplaintDocument82 pagesCitigroup Sued For Fraud Over $1 Billion of CDOs - Loreley Financing v. Citigroup Complaint83jjmackNo ratings yet

- Alfonso v. JPMorgan Chase Bank, N.A. DCA RulingDocument3 pagesAlfonso v. JPMorgan Chase Bank, N.A. DCA RulingStephen DibertNo ratings yet

- 1 Registration Process: BUET Post Graduate Registration SystemDocument5 pages1 Registration Process: BUET Post Graduate Registration SystemBit bitNo ratings yet

- AdaDocument8 pagesAdaperapericprcasNo ratings yet

- Account STMTDocument3 pagesAccount STMTDhanush KumarNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Financial Literacy Goals and Needs AssessmentDocument284 pagesFinancial Literacy Goals and Needs AssessmentindahmuliasariNo ratings yet

- Hist Panel EURIBOR Jul 2010Document12 pagesHist Panel EURIBOR Jul 2010JaphyNo ratings yet

- Marketing Strategies in Banking Sector - A Review: Seelam Jayadeva Reddy, Dr.D.SucharithaDocument7 pagesMarketing Strategies in Banking Sector - A Review: Seelam Jayadeva Reddy, Dr.D.SucharithaBhargavi MBNo ratings yet

- Chan Jun Hong No 3 Jalan Kenari 5 Taman Wawasan 85300 LABIS: Savings Account StatementDocument1 pageChan Jun Hong No 3 Jalan Kenari 5 Taman Wawasan 85300 LABIS: Savings Account StatementJunHong ChanNo ratings yet

- Credit Card StatementDocument4 pagesCredit Card StatementGurpreet SinghNo ratings yet

- Interest Rate Swaps Basics 1-08 USDocument6 pagesInterest Rate Swaps Basics 1-08 USbhagyashreeskNo ratings yet

- Singhi Advisors Corporate ProfileDocument27 pagesSinghi Advisors Corporate ProfilemarkelonnNo ratings yet

- Mobile BankingDocument17 pagesMobile Bankingankitaneema87% (15)

- Car finance schemes evolveDocument92 pagesCar finance schemes evolveneoratm100% (1)

- Teena FDHGDocument2 pagesTeena FDHGTeena VarmaNo ratings yet

- FinAccess Report 09Document76 pagesFinAccess Report 09Yatta NgukuNo ratings yet

- Vice President Director Finance in Philadelphia PA Resume Nino ToscanoDocument2 pagesVice President Director Finance in Philadelphia PA Resume Nino ToscanoNinoToscanoNo ratings yet

- Moodys BankDocument191 pagesMoodys BankDeepak Kumar Mishra0% (1)