Professional Documents

Culture Documents

Federal Debt, by Robert Eisner

Uploaded by

NamerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Federal Debt, by Robert Eisner

Uploaded by

NamerCopyright:

Available Formats

4/15/2015

FederalDebt,byRobertEisner:TheConciseEncyclopediaofEconomics|LibraryofEconomicsandLiberty

FullSite

Articles

EconLog

EconTalk

Books

Encyclopedia

RobertEisner

Guides

FederalDebt

Search

SearchCEE

byRobertEisner

AbouttheAuthor

SearchtheCEE

Home|CEE|1stedition|FederalDebt

Browsethe1steditionCEE

[Editor'snote:thisarticlewaswritteninearly1993.

Sincethen,thedebthasgrownandanumberofother

keydatadiscussedinthisarticlehavechanged.]

Everyonetalksaboutthefederaldebt,butfew,

literally,knowwhattheyaretalkingabout.Thatisall

themoretrueforthefederaldeficit,whichyearafter

yearaddstothetotaldebtoutstanding.

bytitle

byauthor

bycategory

Biographies

Browsethe2ndeditionCEE

bytitle

PRINT

EMAIL

CITE

COPYRIGHT

RelatedMaterialon

Econlib:

FederalDeficit

byauthor

bycategory

Biographies

AbouttheCEE

FrequentlyAskedQuestions

FAQsaboutSearchingCEE

EconlibResources

AboutEconlib

ContactEconlib

QuoteoftheDay

Birthdays&Commemorations

FrequentlyAskedQuestions

GetEconlibNewsletter

Perhapsthefirstthingtoknowaboutthefederaldebt,some

$4trillionattheendof1992,isthat$1trillionofitisheldby

governmentagenciesorgovernmenttrustfundssuchas

thoseforSocialSecurity.Excludingthatamountleavesthe

morerelevantfigureof"grossfederaldebtheldbythe

public"at$3trillion.

Eventhatnumberissomewhatmisleadingontwocounts.

First,becausetheFederalReservebanksaretechnically

privatecorporations,thedebt"heldbythepublic"includes

theFederalReserveholdings,whichcometoalmostaquarter

ofatrilliondollars,althoughtheinterestpaidonFederal

ReserveholdingslargelygoesrightbacktotheTreasury.

Second,"gross"debtdoesnotsubtractwhatthepublicowes

tothefederalgovernmentoritscreditagencies.Thenetdebt

thedebtowedbythegovernmenttothepublicexclusiveof

theFederalReserve,minusthedebtowedbythepublicto

thegovernmentissome20percentless.Therefore,the

actualnetdebtwasontheorderof$2.4trillionin1992,or

onlyalittlemorethanhalfthegrossdebt.

ThedebtofU.S.businesses(excludingfinancialinstitutions)

andhouseholdsis$7trillion,farlargerthanthefederaldebt.

Butbusinessdebt,itisargued,generallyfinancesincome

earningplantandequipment.Andindividualsborrowlargely

topurchasehomes,whichprovideimplicitincomebysaving

rentthatwouldotherwisebepaid.Debtthatfinancesincome

earningassetsishardlythesameasdeadweightdebtthat

mustbeservicedoutofunrelatedincome.

Thefederalgovernment,though,alsohasrealassets:

interstatehighways,publicbuildings,andfederalland,water,

andminerals.Alltheseassetscontributetothenational

incomeandhenceindirectlyifnotdirectlytothe"earnings"

ortaxreceiptsofthegovernmentitself.Privatebusinesses

computetheirnetworthbysubtractingliabilitiesfromassets.

Thesameshouldbedoneforthegovernment.Mostunofficial

estimatessuggestthatassetsdirectlyownedbythefederal

governmentprettymuchmatchtheentirefederaldebt.

MostofthefederaldebtisowedtoAmericans.Infact,the

shareofprivatelyheldpublicdebtownedbyforeignersfell

from21.2percentin1980to17.6percentin1992.The

foreignshareofthetotalgrosspublicdebtin1992was12.1

percent.Andvirtuallyallofthatdebtwasindollars,which

meansthatitcanbepaidofforboughtbackbythesimple

deviceofprintingmoneyor,inmoresophisticatedfashion,

openmarketoperationsoftheFederalReserve.

http://www.econlib.org/library/Enc1/FederalDebt.html

1/5

4/15/2015

FederalDebt,byRobertEisner:TheConciseEncyclopediaofEconomics|LibraryofEconomicsandLiberty

Whetherthatshouldbedoneraisesseriousissuesof

economicpolicy.Butifitwishes,thefederalgovernmentcan

alwayscreatewhatmoneyitneedstoserviceitsdebt.Inthis

fundamentalsense,then,federaldebtisdifferentfrom

privatedebtor,forthatmatter,thedebtofstateandlocal

governments,whichdonothavethepowertocreatemoney.

Thusthefederalgovernmenthasnoreasonevertodefaulton

itsdebtordeclarebankruptcy.

Thefederaldebtheldbythepublicdiffersinanother

fundamentalsensefromprivatedebt.Foreveryprivate

creditorthereisadebtorwhoknowsheisadebtor.Therefore

privatedebtis,fromthestandpointofaggregatewealthor

thenetworthoftheprivatesector,awashtheliabilityof

oneindividualorbusinessistheassetofanother.Thenet

debtofthefederalgovernmentheldbythepublic,however,

isanassetoftheprivatesector,ofstateandlocal

governments,oroftherestoftheworld.Butfewpeoplethink

ofthemselvesasthedebtorwhenthefederalgovernment

goesintofurtherdebtbysellingabond.Thismeansthatthe

biggerthefederaldebt,thewealthiercitizenswhoownthe

bondsfeeland,hence,themoretheyarelikelytospend.

Thusthefundamentalimportance,forgoodorforbad,ofthe

federaldebtislikelytobeitseffectonprivatespending.

Iftheeconomyisinarecessionbecauseofalackof

effectivedemandforwhatcanbeproduced,abiggerfederal

debtmaybeuseful.Thegreaterwealthitcausesintheform

ofTreasurynotes,bills,orbondsgivespeoplelessreasonto

saveand,therefore,inducesthemtoconsumemore.

Businesses,whichmayalsofeelwealthierwiththeirholdings

ofTreasurysecurities,maybeexpectedtoproducemoreto

meettheconsumerdemandandalsotoinvestmoreinthe

capacitytomeetthatdemand.

If,however,theeconomyisalreadyatfullemployment,with

fewunusedresources,consumers'attemptstospendmoreas

aconsequenceoftheirgreaterfinancialwealthcanonly

generatehigherprices.Andthere'stherub!Toohigha

federaldebt,oradeficitthatincreasesthedebtand,

consequently,causesaggregatedemandtorisefasterthan

productioncanbeincreasedtomeetthatdemand,bringson

inflation.Then,possiblyevenworse,actionsbytheFederal

Reservetocombattheinflationwillraiseinterestrates,thus

chokingoffinvestmentinnewhousing,newfactories,and

newmachinery.

Theseargumentsaboutthefederaldebt,itspowerforgood

orbad,requiretwomajorqualifications.First,thedebtmust

bemeasuredinacorrectandrelevantfashion.Thismeans,

mostimportantly,thatitmustbeadjustedforinflation.A

personwhohas$101,000inTreasurysecuritiesisnotricher

thanhewasayearagowhenheheld$100,000ifinflation

hasreducedthevalueofthedollarby3percent.Hehas,in

fact,losttheequivalentof$3,000intherealvalueofhis

securitiesfromwhatmaybecalledaninflationtax.Heis,on

balance,$2,000poorerthanhewasayearago.Thus,heis

likelytobuyfewergoods,notmore.

Justaswithindividuals,sowiththefederalgovernment.The

federaldebtmustbemeasuredinrealterms,andthereal

deficitmustbeseenasthechangeintherealvalueofthe

debt.Bythismeasuretheapparentlyhugefederaldebt

actuallydeclinedovermostofthepasthalfcentury.Even

now,afteradecadeofrelativelylargedeficits,thepercapita

federaldebtisstillmuchlessthanin1945,whenthecountry

http://www.econlib.org/library/Enc1/FederalDebt.html

2/5

4/15/2015

FederalDebt,byRobertEisner:TheConciseEncyclopediaofEconomics|LibraryofEconomicsandLiberty

anditseconomyweremuchsmaller.Inflationofonly3

percentreducesagrossdebtof$3trillionby$90billion.This

indicatesarealbudgetdeficit$90billionlessthanthatin

officialmeasures.

Agoodwayofjudgingthesizeofthefederaldebt,andhence

itslikelyeffectontheeconomy,is,asforanindividual,to

takeitasaratioofincome.Thefederaldebtreachedapeak

ratioof114percentofGDPafterWorldWarIIanddeclined

to26percentby1981,beforerisingagain.Butevenwiththe

subsequentdeficits,itwasstillonly51percentofGDPin

1992.True"balance"inthebudget,itmightbesuggested,

wouldentailnotazerodeficit,butonesuchthatthedebt

growsatthesamepercentagerateasGNP,thuskeepingthe

debttoGNPratioconstant.

Thesecondqualificationisthatmanyeconomistsquestion

whetherfederaldebtisrealwealthforthepublicasawhole.

Theyarguethatincreasesinthefederaldebtwillcause

peopletoexpectfutureincreasesintaxesinordertoservice

thatdebt.Ontheassumptionthatthepresentvalueofthe

increaseinexpectedfuturetaxesisequaltotheincreasein

thedebt,thereisnonetchangeinperceivedwealthand,

hence,noeffectofthedebtonoveralldemandforgoodsand

services.

Thisargumenthasbeenseverelycriticizedforclaimingtoo

muchforesightonthepartofindividualsandfordownplaying

seriousreservations.Indeed,DavidRicardo,thefamous

earlynineteenthcenturyeconomistwhofirstenunciatedthe

idea,washimselfskepticalofit.Hearguedthatmanypeople

wouldnotworryaboutfuturetaxesbecausetheymightnot

expecttobealivewhentaxeswerefinallyraised.Theanswer

thatpeoplewouldstillworryabouttheirchildrenand

grandchildrenisweakenedbythefactsthatsomehaveno

childrenandothersdon'twanttoleavemoneytothem

anyway.Otherfactorsthatweakenthe"Ricardian"argument

are:lowerborrowingcostsforthegovernmentthanthe

publictheuncertaintythattaxeswilleverberaisedorwho

willbearthemandthepossibilitythatdebtwhich,infact,

broughthigheremployment,output,andinvestmentmight

eventuallypayforitselfoutofhigherincomes.Inthatcase

taxrateswouldnothavetoincreaseinthefuture.

Finally,someeconomistsarguethatweshouldincludein

federaldebttheimplicitdebtfromthegovernment's

commitmenttopayfuturebenefitssuchasSocialSecurity.If

wedoso,shouldn'tweaddassetsintheformofthepresent

valueoffuturetaxesthatmightbereceived?Inprinciple,

theyarebothrelevant,butthereisastrongargumentthatin

viewoftheuncertainamountstobeprojectedfortaxesand

paymentsovermanydecades,itwouldbebettertoexclude

themfromourmeasuresofthedebt.

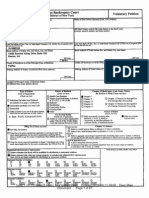

TABLE1

AlternativeMeasuresofFederalDebt

GrossFederalDebtHeldbyPublic1

Year

Billionsof

Dollars

Percentageof

GDP

PerCapitain

1992$

1945

235.2

110.9

15,487

1946

241.9

113.8

12,824

1947

224.3

100.6

10,244

http://www.econlib.org/library/Enc1/FederalDebt.html

3/5

4/15/2015

FederalDebt,byRobertEisner:TheConciseEncyclopediaofEconomics|LibraryofEconomicsandLiberty

1948

216.3

87.7

9,074

1949

214.3

81.6

8,879

1950

219.0

82.4

8,715

1951

214.3

68.4

8,000

1952

214.8

63.1

7,766

1953

218.4

60.0

7,643

1954

224.5

61.0

7,598

1955

226.6

58.9

7,300

1956

222.2

53.4

6,802

1957

219.3

50.0

6,364

1958

226.3

50.5

6,328

1959

234.7

48.9

6,262

1960

236.8

46.9

6,123

1961

238.4

46.1

6,006

1962

248.0

44.7

6,026

1963

254.0

43.5

6,016

1964

256.8

41.1

5,890

1965

260.8

38.9

5,752

1966

263.7

35.9

5,553

1967

266.6

33.6

5,398

1968

289.5

34.2

5,520

1969

278.1

30.0

4,992

1970

283.2

28.7

4,775

1971

303.0

28.8

4,773

1972

322.4

28.1

4,818

1973

340.9

26.8

4,752

1974

343.7

24.5

4,361

1975

394.7

26.1

4,521

1976

477.4

28.3

5,105

1977

549.1

27.8

5,318

1978

607.1

28.6

5,378

1979

639.8

28.2

5,152

1980

709.3

26.8

5,148

1981

784.8

26.5

5,144

1982

919.2

29.4

5,679

1983

1,131.0

34.1

6,665

1984

1,300.0

35.2

7,268

1985

1,499.4

37.8

8,032

1986

1,736.2

41.2

8,976

1987

1,888.1

42.4

9,372

1988

2,050.2

42.6

9,675

1989

2,189.3

42.3

9,803

1990

2,410.4

44.1

10,227

1Endoffiscalyears:June30to1976September30,1977

90.

SOURCES:OfficeofManagementandBudget,Budget

Baselines,HistoricalData,andAlternativesfortheFuture,

January1993,Table7.1,p.346EconomicReportofthe

President,January1993,TableB29,p.381Bureauof

EconomicAnalysis,NationalIncomeandProductSeries

Diskette,andSurveyofCurrentBusiness,January1993

andauthor'scalculations.

AbouttheAuthor

http://www.econlib.org/library/Enc1/FederalDebt.html

4/5

4/15/2015

FederalDebt,byRobertEisner:TheConciseEncyclopediaofEconomics|LibraryofEconomicsandLiberty

RobertEisnerwastheWilliamR.KenanProfessorofEconomicsat

NorthwesternUniversityandapastpresidentoftheAmericanEconomic

Association.Hediedin1998.

FurtherReading

Barro,RobertJ."AreGovernmentBondsNetWealth?"Journalof

PoliticalEconomy82(1974):10951117.

Barro,RobertJ."TheRicardianApproachtoBudgetDeficits."Journalof

EconomicPerspectives3(1989):3754.

Bernheim,B.D."ANeoclassicalPerspectiveonBudgetDeficits."

JournalofEconomicPerspectives3(1989):5572.

Buiter,W.H.,andJ.Tobin."DebtNeutrality:ABriefReviewofDoctrine

andEvidence."InSocialSecurityVersusPrivateSaving,editedby

GeorgeM.vonFurstenberg.1979.

Eisner,Robert.HowRealIstheFederalDeficit?1986.

Eisner,Robert."BudgetDeficits:RhetoricandReality."Journalof

EconomicPerspectives3(1989):7393.

Eisner,Robert,andP.J.Pieper."ANewViewoftheFederalDebtand

BudgetDeficits."AmericanEconomicReview74(1984):1129.

Returntotop

Copyright2002

LibertyFund,Inc.

AllRightsReserved

http://www.econlib.org/library/Enc1/FederalDebt.html

ThecuneiforminscriptionintheLibertyFundlogoisthe

earliestknownwrittenappearanceoftheword"freedom"

(amagi),or"liberty."Itistakenfromaclaydocumentwritten

about2300B.C.intheSumeriancitystateofLagash.

Contact

SiteMap

PrivacyandLegal

http://www.econlib.org

5/5

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Amended Answer, Defenses, Counterclaim (Bell)Document5 pagesAmended Answer, Defenses, Counterclaim (Bell)smithjust2A100% (1)

- Equifax FACT RPT 01152013Document21 pagesEquifax FACT RPT 01152013NextSecOfficial100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ny Title InsuranceDocument1,185 pagesNy Title InsurancemarlontteeNo ratings yet

- (JP Morgan) All You Ever Wanted To Know About Corporate Hybrids But Were Afraid To AskDocument20 pages(JP Morgan) All You Ever Wanted To Know About Corporate Hybrids But Were Afraid To Ask00aa100% (2)

- Tata Motors Acquisition of Daewoo Commercial VehiclesDocument8 pagesTata Motors Acquisition of Daewoo Commercial VehiclesRanjan Bhagat100% (1)

- Page - 1Document18 pagesPage - 1Julian Adam Pagal75% (4)

- Corporate Value "Integrity"Document17 pagesCorporate Value "Integrity"rizalstarz100% (1)

- Legal Aspects of Loan DocumentsDocument10 pagesLegal Aspects of Loan Documentsdonn3No ratings yet

- Type of Director Duties Based On Enron CaseDocument20 pagesType of Director Duties Based On Enron Casemisseiza100% (2)

- A Responsible Approach To Insolvency: A. Read The Article Below and Answer These QuestionsDocument2 pagesA Responsible Approach To Insolvency: A. Read The Article Below and Answer These QuestionsMaria Heniko HalimaNo ratings yet

- Burton v. Smith, 38 U.S. 464 (1839)Document24 pagesBurton v. Smith, 38 U.S. 464 (1839)Scribd Government DocsNo ratings yet

- Invoice 07281905228Document1 pageInvoice 07281905228Jevenzi VironNo ratings yet

- Insolvency DRAFT NOTES by Isaac C. Lubogo BESTDocument48 pagesInsolvency DRAFT NOTES by Isaac C. Lubogo BESTChloeNo ratings yet

- WorkingCapitalManagement OmaxeDocument100 pagesWorkingCapitalManagement OmaxeAshish MathewNo ratings yet

- Ecf Doc 1 8198028Document67 pagesEcf Doc 1 8198028asdfdsafdsaNo ratings yet

- Objection Deadline: September 4, 2012 at 4:00 P.M. (ET) Hearing Date: September 20, 2012 at 2:00 P.M. (ET)Document19 pagesObjection Deadline: September 4, 2012 at 4:00 P.M. (ET) Hearing Date: September 20, 2012 at 2:00 P.M. (ET)Chapter 11 DocketsNo ratings yet

- PFR Case Valenzuela vs. Court of AppealDocument2 pagesPFR Case Valenzuela vs. Court of AppealNover Keithley Mente100% (1)

- Financial Accounting Mock Test PaperDocument7 pagesFinancial Accounting Mock Test PaperBharathFrnzbookNo ratings yet

- 6th Zenith 2021 Moot PropositionDocument10 pages6th Zenith 2021 Moot PropositionSparsh AgrawalNo ratings yet

- Bart Coffee KiosksDocument28 pagesBart Coffee KioskskatherinestechNo ratings yet

- Alternative Dispute ResolutionDocument3 pagesAlternative Dispute ResolutionJannat TaqwaNo ratings yet

- Legal Flash CardsDocument398 pagesLegal Flash CardsJonathan Evans100% (1)

- How Does A Company Reduce Their Paid-Up Share CapitalDocument4 pagesHow Does A Company Reduce Their Paid-Up Share CapitalFakhrul Azman NawiNo ratings yet

- Case SolutionDocument4 pagesCase SolutionAbdulla Khan HimelNo ratings yet

- Case Law AnalysisDocument3 pagesCase Law AnalysisAadyaNo ratings yet

- An Analysis of Winding Up of Companies Under Indian Companies Act 2013Document6 pagesAn Analysis of Winding Up of Companies Under Indian Companies Act 2013AkashNo ratings yet

- Chambering Students Booklet1Document19 pagesChambering Students Booklet1Aini RoslieNo ratings yet

- Chapter Three: Dissolution and Winding UpDocument2 pagesChapter Three: Dissolution and Winding UpJoshua DaarolNo ratings yet

- Contracts Presentation 270918 Rev.01Document81 pagesContracts Presentation 270918 Rev.01Dale McBurnie100% (1)

- Guideline Answers: Final ExaminationDocument66 pagesGuideline Answers: Final Examinationkumar_anil666No ratings yet