Professional Documents

Culture Documents

E. I. Du Pont de Nemours and Co: Titanium Dioxide

Uploaded by

creedwoel0 ratings0% found this document useful (0 votes)

460 views2 pagesSummaries on Du Pont TiO2 case

Original Title

E. I. du Pont de Nemours and Co : Titanium dioxide

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSummaries on Du Pont TiO2 case

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

460 views2 pagesE. I. Du Pont de Nemours and Co: Titanium Dioxide

Uploaded by

creedwoelSummaries on Du Pont TiO2 case

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

M.

Rifki Widya Hariadi (PAMA)

ASrMP Batch 1 - 2015

E.I. du Pont de Nemours and Co. : Titanium Dioxide

E.I. du Pont de Nemours and Co. is a 17 th largest manufacturing corporation in the US

in 1971 with reported earnings of $357 million on sales of $4.4 billion which

diversified its product as manufacturers of fibers, plastics, industrial chemicals and

other specialty chemical products. Du Pont organized in to 10 industrial departments

of which pigment department was the second smallest department with sales of

approximately $180 million in 1971 and was responsible for Titanium Dioxide (TiO 2)

TiO2 is a white chemical agent used in the manufacturing of paints, paper, synthetic

fibers, plastics, ink and synthetic rubber. Acts as a whitening and opacifying agent

and has no commercially satisfactory substitute.

Between 1970 and 1971, a sudden shortage of rutile ore is occurring made the price

rose from AUD 65 per ton in 1960 to AUD 110 per ton in 1972. The economics of

high-chloride technology were altered radically. While it happening sulfate process

plant were force to make a major expenditures to comply with newly enacted

environmental protection legislation in the same period.

TiO2 is produced from either ilmenite, rutile ortitanium slag. Titanium pigment is

extracted by using either sulphuric acid (sulphate process) orchlorine (chloride

route). The sulphate process employs simpler technology than the chloride route and

can use lower grade, cheaper ores. However, it generally has higher production costs

and with acid treatment is more expensive to build than a chloride plant. But the

latter may require the construction of a chlor alkali unit.

Excess demand created capacity expansion opportunities for TiO2 producers. The

competitors had two alternative for expansion: upgrading marginally profitable

sulfate and rutile chloride plants or building ilmenite chloride plants. This alternative

require large scale facilities and extensive experience to be made economically

viable. The risk is rising up while competitors might simultaneously chose to add

capacity and flood market even though competitors only assumed risk of technical

failure, delayed startup are usual.

The strength of du Pont compared to others are easy access to ilmenite ore,

possessed operational knowledge of ilmenite chloride process making production

economically viable, exorbitant price hike in rutile ore had negligible impact on Du

Pont, other players were forced either to shut down or move to chloride ilmenite

process due to the transition in TiO2 market. So in my opinions in the matter of

leading, what supposed du Pont do are:

1. Expansion of capacity was premature and designed to exclude competitors from

expansion.

2. The expansion was designed to capture all the projected growth in demand,

foreclosing any opportunities for competitors.

3. Exploitation of its cost Easy access to ilmenite ore advantage to keep prices low

so competitors couldnt expand.

M. Rifki Widya Hariadi (PAMA)

ASrMP Batch 1 - 2015

But will the business sustain? If accepted the TiO2 growth strategy will make Du Pont

come up with massive capital expenditure program that reach half billion USD by

1985. But the economic is growing (at the moment), the rise of infrastructure

business, and the need of quality papers made the need of titanium dioxide might

sustain. So if Du Pont managed to lead the market, it will seize the moment.s

You might also like

- Uv6790 PDF EngDocument20 pagesUv6790 PDF EngRicardo BuitragoNo ratings yet

- DanforthDocument6 pagesDanforthZafar Khan100% (2)

- Allen Lane Case Write UpDocument2 pagesAllen Lane Case Write UpAndrew Choi100% (1)

- CM FinanceforUndergradsDocument5 pagesCM FinanceforUndergradsChaucer19No ratings yet

- Group-13 Case 12Document80 pagesGroup-13 Case 12Abu HorayraNo ratings yet

- Case Analysis - Compania de Telefonos de ChileDocument4 pagesCase Analysis - Compania de Telefonos de ChileSubrata BasakNo ratings yet

- Corporate Finance - PresentationDocument14 pagesCorporate Finance - Presentationguruprasadkudva83% (6)

- Business Strategy - Sony Case Analysis - RestructuringDocument25 pagesBusiness Strategy - Sony Case Analysis - RestructuringRavi Jain50% (4)

- Westinghouse Electric Financials and Buyout TablesDocument22 pagesWestinghouse Electric Financials and Buyout TablesGonz�lez Alonzo Juan ManuelNo ratings yet

- Fin 4150 Advanced Business Valuation Assignments Overview: Assignment 1: Class Preparation/Professionalism/ParticipationDocument21 pagesFin 4150 Advanced Business Valuation Assignments Overview: Assignment 1: Class Preparation/Professionalism/ParticipationEric McLaughlinNo ratings yet

- Apple Cash Case StudyDocument2 pagesApple Cash Case StudyJanice JingNo ratings yet

- Tire City IncDocument5 pagesTire City IncAfrin FarhanaNo ratings yet

- Hyflux Limited: Capital Structure and Financial DistressDocument11 pagesHyflux Limited: Capital Structure and Financial DistressMizanur RahmanNo ratings yet

- Fixed Income Valuation: Calculating YTM and Prices for Bonds Issued by NTT, Patriot, and NationalisteDocument1 pageFixed Income Valuation: Calculating YTM and Prices for Bonds Issued by NTT, Patriot, and NationalisteAbhishek Garg0% (2)

- Case29trx 130826040031 Phpapp02Document14 pagesCase29trx 130826040031 Phpapp02Vikash GoelNo ratings yet

- Case Study: Sun Microsystems Needs StructureDocument7 pagesCase Study: Sun Microsystems Needs StructurePam Fish PanutoNo ratings yet

- Accounting Analysis HyfluxDocument2 pagesAccounting Analysis HyfluxNicholas LumNo ratings yet

- Case 3 Nikki 111Document6 pagesCase 3 Nikki 111Mahmudur Rahman TituNo ratings yet

- Numerical Problems Assignment 3 SolutionsDocument1 pageNumerical Problems Assignment 3 Solutionsp11No ratings yet

- Jun18l1-Ep04 QDocument18 pagesJun18l1-Ep04 QjuanNo ratings yet

- Valuing Capital Investment Projects For PracticeDocument18 pagesValuing Capital Investment Projects For PracticeShivam Goyal100% (1)

- Extra Ratio Analysis Questions MBADocument3 pagesExtra Ratio Analysis Questions MBAYasser MaamounNo ratings yet

- Motorola RAZR - Case PDFDocument8 pagesMotorola RAZR - Case PDFSergio AlejandroNo ratings yet

- DuPont's Capital Structure Decision in 1983Document19 pagesDuPont's Capital Structure Decision in 1983Chuan LiuNo ratings yet

- Impairing The Microsoft - Nokia PairingDocument54 pagesImpairing The Microsoft - Nokia Pairingjk kumarNo ratings yet

- Asahi Case Final FileDocument4 pagesAsahi Case Final FileRUPIKA R GNo ratings yet

- BEA Associates - Enhanced Equity Index FundDocument17 pagesBEA Associates - Enhanced Equity Index FundKunal MehtaNo ratings yet

- New Earth mining valuation approachesDocument16 pagesNew Earth mining valuation approachesSaurabh ChhabraNo ratings yet

- Chestnut Foods: Case - 4Document8 pagesChestnut Foods: Case - 4KshitishNo ratings yet

- Case 45 Jetblue ValuationDocument12 pagesCase 45 Jetblue Valuationshawnybiha100% (1)

- Reparations 2Document2 pagesReparations 2rahulNo ratings yet

- 108 PBM #2 Winter 2015 Part 2Document5 pages108 PBM #2 Winter 2015 Part 2Ray0% (1)

- Southport SlidesDocument12 pagesSouthport SlidesAshutosh Shukla0% (1)

- Corporate Finance Case 1 (Contract Services Division)Document2 pagesCorporate Finance Case 1 (Contract Services Division)needdocs7No ratings yet

- This Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)Document52 pagesThis Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)mehar noorNo ratings yet

- Gemini Electronics: US LCD TV Giant's Growth & Financial AnalysisDocument1 pageGemini Electronics: US LCD TV Giant's Growth & Financial AnalysisSreeda PerikamanaNo ratings yet

- Burton Ch.1 Case Summaries Book ContractsDocument30 pagesBurton Ch.1 Case Summaries Book ContractsMissy MeyerNo ratings yet

- Diamond Chemicals Merseyside ProjectDocument12 pagesDiamond Chemicals Merseyside ProjectHimanshu DubeyNo ratings yet

- Harley DavidsonDocument4 pagesHarley DavidsonExpert AnswersNo ratings yet

- Case Study: Asahi Glass LimitedDocument11 pagesCase Study: Asahi Glass LimitedRohan RoyNo ratings yet

- ASIMCODocument2 pagesASIMCOAshfaq MemonNo ratings yet

- RATIOS AnalysisDocument61 pagesRATIOS AnalysisSamuel Dwumfour100% (1)

- The Transformation of ThomsonDocument2 pagesThe Transformation of ThomsonRohit Agarwal0% (2)

- Gainesboro Machine ToolsDocument2 pagesGainesboro Machine ToolsedselNo ratings yet

- Chemalite Group - Cash Flow Statement - PBTDocument8 pagesChemalite Group - Cash Flow Statement - PBTAmit Shukla100% (1)

- M&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun KoDocument2 pagesM&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun Ko고지현No ratings yet

- FCFF and Fcfe of CVDocument2 pagesFCFF and Fcfe of CVmuktaNo ratings yet

- Chapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldDocument25 pagesChapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldPayal ChauhanNo ratings yet

- Decko Co Is A U S Firm With A Chinese Subsidiary ThatDocument1 pageDecko Co Is A U S Firm With A Chinese Subsidiary ThatM Bilal SaleemNo ratings yet

- Fin Sony Corporation Financial AnalysisDocument13 pagesFin Sony Corporation Financial Analysisapi-356604698100% (1)

- Presentation PolaroidDocument7 pagesPresentation Polaroidcristinahuma100% (2)

- Mti Case AnalysisDocument6 pagesMti Case AnalysisHimanshu TulshyanNo ratings yet

- Ambuja Cement: Measuring The Value of WaterDocument8 pagesAmbuja Cement: Measuring The Value of WaterTulika GuptaNo ratings yet

- The Case On Mergers and AcquisitionDocument10 pagesThe Case On Mergers and Acquisitionsakshi4460% (1)

- Titanium Dioxide MemoDocument13 pagesTitanium Dioxide MemoMaddie O'DoulNo ratings yet

- Harper Chemical BDocument3 pagesHarper Chemical BElizabeth KigerNo ratings yet

- MarchDocument70 pagesMarchdexter1850No ratings yet

- Abd Cca1Document9 pagesAbd Cca1sanika shikhareNo ratings yet

- KMMLDocument58 pagesKMMLRob RobNo ratings yet

- TiO2 Financial - PDF - Titanium Dioxide - Du PontDocument17 pagesTiO2 Financial - PDF - Titanium Dioxide - Du Pontsofyantiastri23No ratings yet

- The Meaning of Life Cycle by John WoodhouseDocument3 pagesThe Meaning of Life Cycle by John WoodhousecreedwoelNo ratings yet

- Setting A Good Standard For Asset Management Times 2013 PDFDocument4 pagesSetting A Good Standard For Asset Management Times 2013 PDFcreedwoelNo ratings yet

- Setting A Good Standard in AM JW Assets March 2011Document3 pagesSetting A Good Standard in AM JW Assets March 2011creedwoelNo ratings yet

- Blackberry Desktop Software-User GuideDocument37 pagesBlackberry Desktop Software-User GuideJ KhanNo ratings yet

- BoozCo Profits in A SlowdownDocument16 pagesBoozCo Profits in A SlowdowncreedwoelNo ratings yet

- If Between Friends and Partners We Were Geese... Ah!Document20 pagesIf Between Friends and Partners We Were Geese... Ah!vishal.6pNo ratings yet

- Pozzolanic Pulverized-Fuel Ash Cement: Specification ForDocument16 pagesPozzolanic Pulverized-Fuel Ash Cement: Specification ForkushanNo ratings yet

- High Purity Boehmite: Hiq - 40 Alumina Offers Due TheDocument2 pagesHigh Purity Boehmite: Hiq - 40 Alumina Offers Due TheJC Jane BarnesNo ratings yet

- Sodium Silicate Corrosion Inhibitors - Issues of Effectiveness and Mechanism PDFDocument19 pagesSodium Silicate Corrosion Inhibitors - Issues of Effectiveness and Mechanism PDFPeterNo ratings yet

- Thermite and IceDocument3 pagesThermite and IceAlissa GayNo ratings yet

- 7 PeglerDocument28 pages7 Peglerarshad iqbalNo ratings yet

- Royal Society of Chemistry Organometallic Chemis 048 PDFDocument468 pagesRoyal Society of Chemistry Organometallic Chemis 048 PDFpi.314153.4No ratings yet

- Aluminum Dross Waste Evaluation as Refractory Raw MaterialDocument11 pagesAluminum Dross Waste Evaluation as Refractory Raw MaterialXantos Yulian100% (1)

- The Heat Treat Doctor Explains Embrittlement Phenomena in Hardened and Tempered SteelDocument2 pagesThe Heat Treat Doctor Explains Embrittlement Phenomena in Hardened and Tempered SteelAshfaq AliNo ratings yet

- Calculation of Thermodynamic Properties of Hydrated BoratesDocument5 pagesCalculation of Thermodynamic Properties of Hydrated BoratesKary ShitoNo ratings yet

- Periodic Table MnemonicsDocument8 pagesPeriodic Table MnemonicsSignor Plaban GogoiNo ratings yet

- Metallurgy: Smelting, A Basic Step in Obtaining Usable Quantities of Most MetalsDocument8 pagesMetallurgy: Smelting, A Basic Step in Obtaining Usable Quantities of Most MetalssiswoutNo ratings yet

- Solar Installation ManualDocument13 pagesSolar Installation ManualShubham ArvikarNo ratings yet

- Assignment 2Document3 pagesAssignment 2samy.anesuNo ratings yet

- Factors influencing optimal localization of industriesDocument6 pagesFactors influencing optimal localization of industrieshabibasheikh843861No ratings yet

- Weld DefectsDocument31 pagesWeld DefectsThulasi RamNo ratings yet

- Metallurgy and CorrosionDocument16 pagesMetallurgy and CorrosionLesego MatojaneNo ratings yet

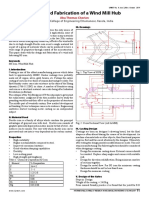

- Design and Fabrication of a Wind Mill Hub Using SG IronDocument5 pagesDesign and Fabrication of a Wind Mill Hub Using SG IronKannan Seenu100% (1)

- PDFDocument155 pagesPDFHifza shairwani100% (1)

- Ball Valve Ricos PresentationDocument16 pagesBall Valve Ricos PresentationMuhammad RidwanNo ratings yet

- Chemistry Form 4 Chapter 2Document6 pagesChemistry Form 4 Chapter 2Mur_nie91% (22)

- Acids and Bases PropertiesDocument6 pagesAcids and Bases PropertiesMirawati EfendiNo ratings yet

- Excavator SelectionDocument10 pagesExcavator SelectionMario HezkeeaNo ratings yet

- WORKSHEET MAGNETISM DESCRIBING HOW TO MAKE MAGNETDocument9 pagesWORKSHEET MAGNETISM DESCRIBING HOW TO MAKE MAGNETIca VianisyaNo ratings yet

- AL Alloy Details With WeldingDocument36 pagesAL Alloy Details With WeldingVelmohanaNo ratings yet

- Product Catalog: Pressure and Temperature MeasurementDocument286 pagesProduct Catalog: Pressure and Temperature MeasurementLay EcanNo ratings yet

- Renuka Naiduproject Home WorkDocument8 pagesRenuka Naiduproject Home Workgarikipati renukanaiduNo ratings yet

- Starwill Catalog NewDocument32 pagesStarwill Catalog NewArianto Sutarnio100% (3)

- Steel, Sheet and Strip, Hot-Rolled, Carbon, Structural, High-Strength Low-Alloy, High-Strength Low-Alloy With Improved Formability, and Ultra-High StrengthDocument7 pagesSteel, Sheet and Strip, Hot-Rolled, Carbon, Structural, High-Strength Low-Alloy, High-Strength Low-Alloy With Improved Formability, and Ultra-High StrengthfaroukNo ratings yet

- George Royal Gold PresentationDocument31 pagesGeorge Royal Gold Presentationdaniel.radz9010No ratings yet

- ASTM-A-325-02 Standard Specification For Structural Bolts. Steel, Heat Treated, 120 - 105 Ksi Minimum Tensile Strength PDFDocument8 pagesASTM-A-325-02 Standard Specification For Structural Bolts. Steel, Heat Treated, 120 - 105 Ksi Minimum Tensile Strength PDFFattahi KarimNo ratings yet

- Sully: The Untold Story Behind the Miracle on the HudsonFrom EverandSully: The Untold Story Behind the Miracle on the HudsonRating: 4 out of 5 stars4/5 (103)

- The Fabric of Civilization: How Textiles Made the WorldFrom EverandThe Fabric of Civilization: How Textiles Made the WorldRating: 4.5 out of 5 stars4.5/5 (57)

- Packing for Mars: The Curious Science of Life in the VoidFrom EverandPacking for Mars: The Curious Science of Life in the VoidRating: 4 out of 5 stars4/5 (1395)

- The Beekeeper's Lament: How One Man and Half a Billion Honey Bees Help Feed AmericaFrom EverandThe Beekeeper's Lament: How One Man and Half a Billion Honey Bees Help Feed AmericaNo ratings yet

- The Weather Machine: A Journey Inside the ForecastFrom EverandThe Weather Machine: A Journey Inside the ForecastRating: 3.5 out of 5 stars3.5/5 (31)

- Hero Found: The Greatest POW Escape of the Vietnam WarFrom EverandHero Found: The Greatest POW Escape of the Vietnam WarRating: 4 out of 5 stars4/5 (19)

- Faster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestFrom EverandFaster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestRating: 4 out of 5 stars4/5 (28)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- The End of Craving: Recovering the Lost Wisdom of Eating WellFrom EverandThe End of Craving: Recovering the Lost Wisdom of Eating WellRating: 4.5 out of 5 stars4.5/5 (80)

- 35 Miles From Shore: The Ditching and Rescue of ALM Flight 980From Everand35 Miles From Shore: The Ditching and Rescue of ALM Flight 980Rating: 4 out of 5 stars4/5 (21)

- A Place of My Own: The Architecture of DaydreamsFrom EverandA Place of My Own: The Architecture of DaydreamsRating: 4 out of 5 stars4/5 (241)

- The Future of Geography: How the Competition in Space Will Change Our WorldFrom EverandThe Future of Geography: How the Competition in Space Will Change Our WorldRating: 4.5 out of 5 stars4.5/5 (4)

- Dirt to Soil: One Family’s Journey into Regenerative AgricultureFrom EverandDirt to Soil: One Family’s Journey into Regenerative AgricultureRating: 5 out of 5 stars5/5 (124)

- Pale Blue Dot: A Vision of the Human Future in SpaceFrom EverandPale Blue Dot: A Vision of the Human Future in SpaceRating: 4.5 out of 5 stars4.5/5 (586)

- Across the Airless Wilds: The Lunar Rover and the Triumph of the Final Moon LandingsFrom EverandAcross the Airless Wilds: The Lunar Rover and the Triumph of the Final Moon LandingsNo ratings yet

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)

- Recording Unhinged: Creative and Unconventional Music Recording TechniquesFrom EverandRecording Unhinged: Creative and Unconventional Music Recording TechniquesNo ratings yet

- Einstein's Fridge: How the Difference Between Hot and Cold Explains the UniverseFrom EverandEinstein's Fridge: How the Difference Between Hot and Cold Explains the UniverseRating: 4.5 out of 5 stars4.5/5 (50)

- Reality+: Virtual Worlds and the Problems of PhilosophyFrom EverandReality+: Virtual Worlds and the Problems of PhilosophyRating: 4 out of 5 stars4/5 (24)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- Broken Money: Why Our Financial System is Failing Us and How We Can Make it BetterFrom EverandBroken Money: Why Our Financial System is Failing Us and How We Can Make it BetterRating: 5 out of 5 stars5/5 (3)

- Fallout: The Hiroshima Cover-up and the Reporter Who Revealed It to the WorldFrom EverandFallout: The Hiroshima Cover-up and the Reporter Who Revealed It to the WorldRating: 4.5 out of 5 stars4.5/5 (82)

- The Path Between the Seas: The Creation of the Panama Canal, 1870-1914From EverandThe Path Between the Seas: The Creation of the Panama Canal, 1870-1914Rating: 4.5 out of 5 stars4.5/5 (124)