Professional Documents

Culture Documents

Market Pulse Survey, May 2015

Uploaded by

C.A.R. Research & EconomicsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Pulse Survey, May 2015

Uploaded by

C.A.R. Research & EconomicsCopyright:

Available Formats

1

MARKET PULSE

May 2015

Survey Methodology

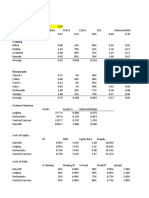

Monthly online survey of 300+ CA REALTORS

Respondents are asked about their last closed

transaction and business activity in their market area

for the previous month and the last year.

LASTTRANSACTION

MedianSale Price Down 3.3% MTM, Down 0.9%YTY

Median

$600,000

$500,000

$450,000

$435,000

$439,000

$400,000

$300,000

$200,000

$100,000

Q: What was the sale price of your last closed transaction?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

2015 YTD

2014

May-15

Apr-15

Mar-15

Feb-15

Jan-15

Dec-14

Nov-14

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

$0

4/10TransactionsClosed BelowAsking Price

Over

Below

At

60%

50%

40%

30%

20%

10%

Q: Did your last closed transaction sell over, at or below asking price?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

May-15

Apr-15

Mar-15

Feb-15

Jan-15

Dec-14

Nov-14

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

0%

Premium Paid OverAsking Price Decreased

Average

14.0%

12.0%

10%

10.0%

8.0% 8.0%

8.0%

6.5%

6.0%

4.0%

2.0%

Q: At what percentage was your last closed transaction sold over asking price?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

YTD 2015

2014

May-15

Apr-15

Mar-15

Feb-15

Jan-15

Dec-14

Nov-14

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

0.0%

Discount on Asking Price Declines

0.0%

-2.0%

-4.0%

-6.0%

-8.0%

-10.0%

-12.0%

-14.0%

Jul- Aug- Sep- Oct- Nov- Dec- Jan- Feb- Mar- Apr- May

14 14 14 14 14 14 15 15 15 15 -15

Average -5.8 -5.6 -5.8 -6.3 -12% -13% -11% -11% -11% -11% -7.0

Q: At what percentage was your last closed transaction sold below asking price?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

2015

YTD

-8.0 -10%

2014

65% of Properties Receiving MultipleOffers

80%

70%

60%

50%

40%

30%

20%

10%

Q: How many offers did the seller in your last closed transaction receive?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

May-15

Apr-15

Mar-15

Feb-15

Jan-15

Dec-14

Nov-14

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

0%

Number of Offers Received Declines

Average

4.0

3.6

3.5

3.0

2.7

2.5

2.0

1.5

1.0

0.5

0.0

Q: How many offers did your last closed transaction receive?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

2.8

10

Listing Price Reductions Down

35%

33%

30%

25% 26%

25%

20%

28%

29%

31% 31% 31%

28%

23%

20%

15%

10%

5%

0%

Q: Were there any listing price reductions before escrow opened in your last closed transaction?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

25%

11

% of Previous Renters Declining

60%

50%

40%

30%

20%

10%

Q: Was the buyer of your last closed transaction a renter immediately prior to purchasing the property?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

May-15

Apr-15

Mar-15

Feb-15

Jan-15

Dec-14

Nov-14

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

0%

12

Fewer Sellers Becoming Renters

30%

25%

20%

15%

10%

5%

Q: Did the seller of your last closed transaction become a renter immediately after selling the property?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

May-15

Apr-15

Mar-15

Feb-15

Jan-15

Dec-14

Nov-14

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

0%

13

Share of First-time Buyers Fluctuating

45%

% First-time Buyers

Long Run Average

40%

35%

30%

25%

20%

15%

10%

5%

Q: Was the buyer of your last closed transaction a first-time buyer?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

May-15

Apr-15

Mar-15

Feb-15

Jan-15

Dec-14

Nov-14

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

0%

14

Majority Purchases are Primary Residences

Vacation home

Other

10%

19%

Q: What was the intended use of the property?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Mar-15

Feb-15

Jan-15

Dec-14

Nov-14

Oct-14

Sep-14

Aug-14

Jul-14

73%

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

82%

Apr-15

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Investment

13%

79%

May-15

Primary residence

15

International Buyers Fluctuate

% International Buyers

Long Run Average

12%

10%

8%

6%

4%

2%

Q: Was the buyer an international client (one who was not a citizen or permanent resident of the U.S.)?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

May-15

Apr-15

Mar-15

Feb-15

Jan-15

Dec-14

Nov-14

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

0%

16

MARKET CONDITIONS

17

Floor Calls from Potential Clients Increased

Last Month

Down

Flat

Up

70%

60%

50%

40%

30%

20%

10%

0%

Q: Compared to last month, the number of floor calls from potential clients in your market area this month was

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

18

ListingAppointments/Presentations toClients

Increase

Last Month

Down

Flat

Up

70%

60%

50%

40%

30%

20%

10%

0%

Q: Compared to last month, the number of listing appointments and presentations to clients in your

market area this month was

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

19

Open HouseTraffic Up from LastYear

Last Month

Down

Flat

Up

80%

60%

40%

20%

0%

Jan-14

Apr-14

Jul-14

Oct-14

Jan-15

Jan-14

Apr-14

Jul-14

Oct-14

Jan-15

LastYear

Apr-15

80%

70%

60%

50%

40%

30%

20%

10%

0%

Q: Compared to last month/year, open house traffic in your market area this month was

Apr-15

20

Auctions Steady

Last Month

Down

80%

Flat

Up

60%

40%

20%

0%

Apr-14 May-14 Jun-14

Jul-14

Aug-14 Sep-14 Oct-14 Nov-14 Dec-14

Jan-15

Feb-15 Mar-15 Apr-15 May-15

Aug-14 Sep-14 Oct-14 Nov-14 Dec-14

Jan-15

Feb-15 Mar-15

LastYear

80%

70%

60%

50%

40%

30%

20%

10%

0%

Apr-14 May-14 Jun-14

Jul-14

Q: Compared to last month/year, the number of auctions in your market area this month was

Apr-15 May-15

21

All Cash Purchases Down

Last Month

Down

50%

Flat

Up

40%

30%

20%

10%

0%

Jun-14

Aug-14

Oct-14

Dec-14

Feb-15

Aug-14

Oct-14

Dec-14

Feb-15

Apr-15

LastYear

70%

60%

50%

40%

30%

20%

10%

0%

Jun-14

Apr-15

Q: Compared to last month/year, the number of all cash purchases in your market area this month was

22

Majority of REALTORS Expect Similar/Better

MarketConditionsOver the NextYear

Worsen

Same

Improve

70%

60%

50%

40%

30%

20%

10%

Q: What are your expectations for market conditions over the next year?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

May-15

Apr-15

Mar-15

Feb-15

Jan-15

Dec-14

Nov-14

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

0%

23

Why REALTORS Expect MarketConditions to

Worsen

There are no employment opportunities in this area, there are not many investors

either.

There are many REALTORS without a real estate license and their brokers allow

it.

Low inventory of houses.

Prices are too high and many are being priced out.

Fewer sellers entering the market; higher prices will limit opportunities for buyers.

Q: Why do you expect real estate market conditions to worsen over the next year?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

24

What are REALTORS Saying?

Inventory is still limited and buyers are hesitant to pay asking price.

Millennials dont seem to be moving to buy.

Appraisal issues continue to hurt transactions. Issues with solar panel appraisals.

Prices seem to be rising too quickly. I hope we are not in another bubble.

The market is becoming overheated in the under $600k price range.

Q: Do you have any specific comments, professional observations, or information that you would like to share

with us--such as information on multiple bidding, changing buyer preferences, mortgage credit issues, or

other topics?

25

Top 10 Counties

April 2015

May 2015

Los Angeles

Los Angeles

San Diego

San Diego

Riverside

Alameda

Orange

Riverside

San Bernardino

Santa Clara

Sacramento

Sacramento

San Mateo

Orange

Santa Clara

Fresno

Alameda

Contra Costa

10

San Francisco

San Mateo

Q: In which county do you live?

SERIES: Market Pulse Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

You might also like

- 2024-02 Monthly Housing Market OutlookDocument57 pages2024-02 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2024-03 Monthly Housing Market OutlookDocument57 pages2024-03 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2024-02 Monthly Housing Market OutlookDocument57 pages2024-02 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-12 Monthly Housing Market OutlookDocument58 pages2022-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2023-05 Monthly Housing Market OutlookDocument57 pages2023-05 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2023-12 Monthly Housing Market OutlookDocument57 pages2023-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2023-12 Monthly Housing Market OutlookDocument57 pages2023-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022 AHMS ReportDocument51 pages2022 AHMS ReportC.A.R. Research & Economics100% (1)

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2022-11 Monthly Housing Market OutlookDocument57 pages2022-11 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2023-11 Monthly Housing Market OutlookDocument57 pages2023-11 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2023-Q1 Traditional Housing Affordability Index (HAI)Document9 pages2023-Q1 Traditional Housing Affordability Index (HAI)C.A.R. Research & EconomicsNo ratings yet

- 2023-03 Monthly Housing Market OutlookDocument57 pages2023-03 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- Monthly Housing Market OutlookDocument57 pagesMonthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2022-08 Monthly Housing Market OutlookDocument57 pages2022-08 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2023-01 Monthly Housing Market OutlookDocument57 pages2023-01 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2022-07 Monthly Housing Market OutlookDocument57 pages2022-07 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2022-10 Monthly Housing Market OutlookDocument57 pages2022-10 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-09 Monthly Housing Market OutlookDocument57 pages2022-09 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-06 Monthly Housing Market OutlookDocument57 pages2022-06 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-04 Monthly Housing Market OutlookDocument56 pages2022-04 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2022-05 Monthly Housing Market OutlookDocument56 pages2022-05 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-04 Monthly Housing Market OutlookDocument9 pages2022-04 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2022-03 Monthly Housing Market OutlookDocument55 pages2022-03 Monthly Housing Market OutlookC.A.R. Research & Economics100% (2)

- California Housing Affordability UpdateDocument9 pagesCalifornia Housing Affordability UpdateC.A.R. Research & EconomicsNo ratings yet

- 2022-02 Monthly Housing Market OutlookDocument55 pages2022-02 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- JAWABAN CHAPTER 17 - INVESTMENTS (Revisi)Document3 pagesJAWABAN CHAPTER 17 - INVESTMENTS (Revisi)CaratmelonaNo ratings yet

- Sbi Mutual FundsDocument57 pagesSbi Mutual FundsPavan KumarNo ratings yet

- Market Volume StopDocument14 pagesMarket Volume Stopvanthai06996No ratings yet

- Long StrangleDocument2 pagesLong StrangleAKSHAYA AKSHAYANo ratings yet

- Indian Railway Finance Corporation LTD: SubscribeDocument5 pagesIndian Railway Finance Corporation LTD: SubscribeSunnyNo ratings yet

- Multiple Choice Questions: Topic Covered Are As FollowsDocument3 pagesMultiple Choice Questions: Topic Covered Are As FollowsBikash SahuNo ratings yet

- How Startup Valuation Works - IllustratedDocument14 pagesHow Startup Valuation Works - IllustratedNikhilKrishnanNo ratings yet

- Capital Markets Explained: Key Terms and Major PlayersDocument12 pagesCapital Markets Explained: Key Terms and Major Playerschmon100% (1)

- Barrick Gold 2009 Annual ReportDocument170 pagesBarrick Gold 2009 Annual ReportBarrickGoldNo ratings yet

- FinanceDocument17 pagesFinancejackie555No ratings yet

- Diamondback Welding Fabrication Corporation Sells and Services Pipe WeldingDocument1 pageDiamondback Welding Fabrication Corporation Sells and Services Pipe Weldingtrilocksp SinghNo ratings yet

- Control Questionnaire - Insurers and ReinsurersDocument115 pagesControl Questionnaire - Insurers and ReinsurersmsrchandNo ratings yet

- BrochureURl 39Document1 pageBrochureURl 39dsheludiakovaNo ratings yet

- Prospectus Awazel Waterproofing Industries CompanyDocument282 pagesProspectus Awazel Waterproofing Industries Companymohammed abdelkawyNo ratings yet

- Fund and Other InvestmentsDocument4 pagesFund and Other InvestmentslcNo ratings yet

- Chapter-1 Techinical AnalysisDocument90 pagesChapter-1 Techinical AnalysisRajesh Insb100% (1)

- Northern RockDocument15 pagesNorthern RockÁi PhươngNo ratings yet

- Liquidity RiskDocument24 pagesLiquidity RiskTing YangNo ratings yet

- Nike Case AnalysisDocument10 pagesNike Case AnalysisFarhan SoepraptoNo ratings yet

- Earnings Per Share (EPS) : RCJ Chapter 15 (836-842)Document16 pagesEarnings Per Share (EPS) : RCJ Chapter 15 (836-842)Nikhil ShahNo ratings yet

- Leveraged Buyout (LBO) : The LBO Analysis - Main StepsDocument9 pagesLeveraged Buyout (LBO) : The LBO Analysis - Main StepsaminafridiNo ratings yet

- Chapter 8 PDFDocument43 pagesChapter 8 PDFCarlosNo ratings yet

- FMI - Adequacy of The Global Financial Safety Net. Considerations For Fund Toolkit Reform (2017)Document41 pagesFMI - Adequacy of The Global Financial Safety Net. Considerations For Fund Toolkit Reform (2017)Bautista GriffiniNo ratings yet

- ICICI Prudential Banking & PSU Debt Fund portfolioDocument68 pagesICICI Prudential Banking & PSU Debt Fund portfoliotalupurumNo ratings yet

- Marriott Cost of CapitalDocument3 pagesMarriott Cost of Capitalanmolsaini01No ratings yet

- Form A2: AnnexDocument8 pagesForm A2: Annexi dint knowNo ratings yet

- Analisis de Cuentas HQCDocument14 pagesAnalisis de Cuentas HQCAlejandro MartínezNo ratings yet

- Iress Xplan Risk Profile Question Air ReDocument11 pagesIress Xplan Risk Profile Question Air ReCara ElliottNo ratings yet

- Nifty Intra Day TradingDocument20 pagesNifty Intra Day Tradingvarun vasurendranNo ratings yet

- ROCE Vs ROICDocument2 pagesROCE Vs ROICn_setiawan100% (4)