Professional Documents

Culture Documents

A Case Study and Discussion of Results: Table 1. Quantitative Criteria For Bank Performance Determination

Uploaded by

Anil Kumar0 ratings0% found this document useful (0 votes)

16 views2 pagesabout how measure bank efficiency

Original Title

Problem

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentabout how measure bank efficiency

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views2 pagesA Case Study and Discussion of Results: Table 1. Quantitative Criteria For Bank Performance Determination

Uploaded by

Anil Kumarabout how measure bank efficiency

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

3.

A CASE STUDY AND DISCUSSION

OF RESULTS

In this section we consider a case study of

ranking some Serbian commercial banks. In

order to perform more objective conclusions

in terms of the applicability of MCDM

methods, the influence which the weights of

criteria, the used approaches and the applied

normalization procedure have on the

selection of the most appropriate alternative

and obtained ranking orders of alternatives,

is also taken into consideration in this

section.

3.1. A Case Study: The Case of ranking

Serbian banks

In the literature, many papers have been

devoted to the ranking of banks, as well as to

determining banks' performances. Among

many, here are mentioned only a few, such

as: Ferreira et al. (2012), Stankeviciene and

Mencaite (2012), Brauers et al. (2012),

Cehulic et al. (2011), Ginevicius and

Podviezko (2011), Ginevicius et al. (2010c),

Cetin and Cetin (2010), Wu et al. (2009),

Rakocevic

and

Dragasevic

(2009),

Ginevicius and Podvezko (2008), Hunjak

and Jakocevic (2001), Yeh (1996), Sherman

and Gold (1985).

This case study presents the ranking

results of five commercial banks in Serbia,

based on objective criteria. These criteria and

their sub-criteria, adopted from Yeh (1996)

and Hunjak and Jakocevic (2001), are shown

in Table 1.

Weights of criteria, sub-criteria and the

resulting weights, obtained on the basis of

pairwise comparisons, are shown in Table 2.

Due to limited space, the calculation

procedure is omitted.

Ratings, i.e. performance ratings, of the

considered banks, in relation to selected

evaluation criteria, are shown in Table 3.

These ratings are calculated based on data

available on the web sites of the considered

banks, i.e. financial reports for 2011 year,

and data available on the website of the

National Bank of Serbia.

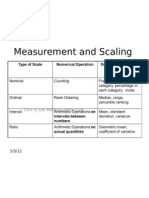

Table 1. Quantitative criteria for bank performance determination

Table 2. Relative weights of evaluation

criteria

different alternatives as the best ranked. It

might be a little confusing.

The obtained rankings orders, shown in

the column VII of Table 4, also look

confusing. By applying the same MCDM

method

and

various

normalization

procedures, different ranking orders are

obtained.

In order to resolve doubts about the best

ranked alternative, ranking of banks was

again performed using various MCDM

methods. Obtained ranking results are shown

in Table 5.

Due to easier comparison, in Table 5 are

repeated results obtained by the SAW

Table 3. Initial decision matrix banks' performances and criteria weights

Note: Table 3 does not contain information on all banks which operate in Serbia. This

table contains only performance ratings for some characteristic bank.

The ranking of banks was started using

SAW method. The results of ranking banks

obtained using SAW method and various

normalization procedures are shown in Table

4.

Based on data from Table 4, it can be

determined that SAW method, used with

various normalization procedures, gave

method used with Max and MaxMin

normalization procedures.

From Tables 4 and 5 can be seen that

there is a certain similarity in results

obtained by using so-called performancebased methods, such as ARAS, COPRAS,

MOORA(RS) and SAW method used with

Max normalization procedure.

You might also like

- It Application Tools in BusinessDocument35 pagesIt Application Tools in BusinessKrisha SaltaNo ratings yet

- PostDocument5 pagesPostEldho Ca100% (1)

- C Epmbpc 11Document21 pagesC Epmbpc 11soNo ratings yet

- SAP NetWeaver Road Map PDFDocument14 pagesSAP NetWeaver Road Map PDFalbanoteNo ratings yet

- CS507 Quiz # 4 Solved by UsmanDocument24 pagesCS507 Quiz # 4 Solved by UsmanPower GirlsNo ratings yet

- SAP-PM Transaction CodesDocument1 pageSAP-PM Transaction Codestwotykes3664100% (2)

- Biraj Proposal - Bbs Forth YearDocument6 pagesBiraj Proposal - Bbs Forth YearYogesh Katwal75% (16)

- Nokia Vs SamsungDocument56 pagesNokia Vs SamsungAnkit Badnikar100% (1)

- The Single Supervisory Mechanism (SSM) - The Big Data IssueDocument12 pagesThe Single Supervisory Mechanism (SSM) - The Big Data Issuecoco4444No ratings yet

- UMTS Presentation EricssonDocument45 pagesUMTS Presentation EricssonDev SinghNo ratings yet

- E-Learning Management System Project ReportDocument67 pagesE-Learning Management System Project ReportShubham Automobiles50% (4)

- Measurement of Cost Efficiency in The European Banking IndustryDocument20 pagesMeasurement of Cost Efficiency in The European Banking IndustryMademozel MichaeNo ratings yet

- Measuring Bank Performance in NepalDocument6 pagesMeasuring Bank Performance in Nepalsabin x maniaNo ratings yet

- +comprehensive Performance Evaluation of Banking Branches A Three-Stage Slacksbased Measure (SBM) Data Envelopment AnalysisDocument34 pages+comprehensive Performance Evaluation of Banking Branches A Three-Stage Slacksbased Measure (SBM) Data Envelopment Analysispejman343444No ratings yet

- Banking Sector Profitability Analysis: Decision Tree ApproachDocument7 pagesBanking Sector Profitability Analysis: Decision Tree ApproachMirjana Pejic BachNo ratings yet

- Measuring Performance of Nepali BanksDocument12 pagesMeasuring Performance of Nepali BanksHardik JaniNo ratings yet

- Nguyen Thi Hoang Anh - Tieu Luan PPNCKH - MSSV 52210211677Document4 pagesNguyen Thi Hoang Anh - Tieu Luan PPNCKH - MSSV 52210211677HoànggAnhhNo ratings yet

- Analysis of Factors Affecting Bank Liquidity: School of Economics, Shanghai University, Shanghai, ChinaDocument4 pagesAnalysis of Factors Affecting Bank Liquidity: School of Economics, Shanghai University, Shanghai, ChinazemeNo ratings yet

- Abdel Latef AnouzeDocument22 pagesAbdel Latef AnouzeSon Go HanNo ratings yet

- Tan EconomicsDocument9 pagesTan EconomicsTouseefNo ratings yet

- Beyond Roe How To Measure Bank Performance 201009 enDocument44 pagesBeyond Roe How To Measure Bank Performance 201009 enHugo GomesNo ratings yet

- Content ServerDocument16 pagesContent ServermaryNo ratings yet

- Research Methodology ExplainedDocument39 pagesResearch Methodology ExplainedHe HNo ratings yet

- Article Rev Cost AccountingDocument3 pagesArticle Rev Cost AccountingFikir GebregziabherNo ratings yet

- 10.benjamin M.tabak 2011WPDocument19 pages10.benjamin M.tabak 2011WPMariaNo ratings yet

- Stochastic Efficiencies of Network Production Systems With Correlated Stochastic Data The Case of Taiwanese Commercial BanksDocument24 pagesStochastic Efficiencies of Network Production Systems With Correlated Stochastic Data The Case of Taiwanese Commercial Bankspejman343444No ratings yet

- 2014 MRQ Ahn - An Insight Into The Specification of The Input-Output Set For DEA-based Bank Efficiency MeasurementDocument35 pages2014 MRQ Ahn - An Insight Into The Specification of The Input-Output Set For DEA-based Bank Efficiency MeasurementWahyutri IndonesiaNo ratings yet

- Results On Banking Efficiency in Turkey 4. FindingsDocument5 pagesResults On Banking Efficiency in Turkey 4. FindingsAmna NawazNo ratings yet

- Measuring Bank Performance of Nepali Banks: A Data Envelopment Analysis (DEA) PerspectiveDocument12 pagesMeasuring Bank Performance of Nepali Banks: A Data Envelopment Analysis (DEA) PerspectiveBikashRanaNo ratings yet

- AFBC Slack-Based PDFDocument51 pagesAFBC Slack-Based PDFDejan DraganNo ratings yet

- Efficiency Comparison of Operational and Profitability: A Case of Hong Kong Commercial BanksDocument8 pagesEfficiency Comparison of Operational and Profitability: A Case of Hong Kong Commercial BanksImran AnwarNo ratings yet

- Banks A Decision Support System For The Evaluation The Complex International Banking SectorDocument5 pagesBanks A Decision Support System For The Evaluation The Complex International Banking SectormrakhshaniNo ratings yet

- Bayesian Data Mining, With Application To Bench Marking and Credit ScoringDocument13 pagesBayesian Data Mining, With Application To Bench Marking and Credit ScoringNedim HifziefendicNo ratings yet

- An Integrated Approach For Evaluating Hospital Service Quality With Linguistic PreferencesDocument16 pagesAn Integrated Approach For Evaluating Hospital Service Quality With Linguistic PreferencestiffanyNo ratings yet

- Success Factors in New Service Development: A Literature ReviewDocument19 pagesSuccess Factors in New Service Development: A Literature ReviewhaiquanngNo ratings yet

- Bank Branch Performance Evaluation Using FAHP and TOPSISDocument19 pagesBank Branch Performance Evaluation Using FAHP and TOPSISZach LeulNo ratings yet

- Benchmarking State-Of-The-Art Classification Algorithms For Credit Scoring: A Ten-Year UpdateDocument30 pagesBenchmarking State-Of-The-Art Classification Algorithms For Credit Scoring: A Ten-Year UpdatemahaNo ratings yet

- Open Access Under: Keywords: Banks, Financial Soundness, Performances, CAMELS Framework, RomaniaDocument4 pagesOpen Access Under: Keywords: Banks, Financial Soundness, Performances, CAMELS Framework, RomaniaMihaela TanasievNo ratings yet

- 17-25 - A Comparative Analysis ofDocument9 pages17-25 - A Comparative Analysis ofKiran JNo ratings yet

- ResearchGate FA DL-01 2019 ENG-A.zaharievDocument63 pagesResearchGate FA DL-01 2019 ENG-A.zaharievcnvb alskNo ratings yet

- American Journal of Engineering Research (AJER) : e-ISSN: 2320-0847 p-ISSN: 2320-0936 Volume-4, Issue-7, pp-170-175Document6 pagesAmerican Journal of Engineering Research (AJER) : e-ISSN: 2320-0847 p-ISSN: 2320-0936 Volume-4, Issue-7, pp-170-175AJER JOURNALNo ratings yet

- Credit riskDocument12 pagesCredit riskmalvin.makunikaNo ratings yet

- 4 Fundamental AnalysisDocument35 pages4 Fundamental Analysiselma nazilaNo ratings yet

- Applied Principles and Concepts Sources of Primary and Secondary DataDocument10 pagesApplied Principles and Concepts Sources of Primary and Secondary DataHimanshu KashyapNo ratings yet

- 2018 The Production or Intermediation ApproachDocument10 pages2018 The Production or Intermediation ApproachWahyutri IndonesiaNo ratings yet

- Assessing Data Quality: by Michael Lyon Tel: 020 7601 5466 EmailDocument2 pagesAssessing Data Quality: by Michael Lyon Tel: 020 7601 5466 EmailSimon van BentenNo ratings yet

- Bank Profitability and Efficiency in MENADocument38 pagesBank Profitability and Efficiency in MENArizwanmoulanaNo ratings yet

- Stock Selection Using A Hybrid MCDM ApproachDocument18 pagesStock Selection Using A Hybrid MCDM ApproachÖzgür Hasan AytarNo ratings yet

- 4 Importnt - DETERMINANTSOFBANKPROFITABILITY1.JordanDocument12 pages4 Importnt - DETERMINANTSOFBANKPROFITABILITY1.JordanFarooq KhanNo ratings yet

- Neretina Et Al Paper Stress TestDocument27 pagesNeretina Et Al Paper Stress TestAbdul MongidNo ratings yet

- Understanding CAMELS Bank RatingsDocument19 pagesUnderstanding CAMELS Bank RatingsShivani AgrawalNo ratings yet

- Customer Satisfaction A Case Study On Bank Islam.1.2Document23 pagesCustomer Satisfaction A Case Study On Bank Islam.1.2yusuflat9164No ratings yet

- Project Work On Banking & InsuranceDocument13 pagesProject Work On Banking & InsuranceKR MinistryNo ratings yet

- 05 Chapter 1Document6 pages05 Chapter 1nsnhsNo ratings yet

- Financial Performance Comparison of Public and Private BanksDocument15 pagesFinancial Performance Comparison of Public and Private BanksShiny StaarNo ratings yet

- The Assessing of Financial Performance of Accepted Banks in Stock Exchange Market by Means of ELETERE TechniqueDocument6 pagesThe Assessing of Financial Performance of Accepted Banks in Stock Exchange Market by Means of ELETERE TechniqueAJER JOURNALNo ratings yet

- Theories of ProfitDocument9 pagesTheories of ProfitDeus SindaNo ratings yet

- Use of CAMEL Rating Framework: A Comparative Performance Evaluation of Selected Bangladeshi Private Commercial BanksDocument9 pagesUse of CAMEL Rating Framework: A Comparative Performance Evaluation of Selected Bangladeshi Private Commercial BanksShadabNo ratings yet

- Impact of Liquidity On ProfitabilityDocument11 pagesImpact of Liquidity On Profitabilityyashaswisharma68No ratings yet

- Banking Industry Research Papers and Service Quality ModelsDocument4 pagesBanking Industry Research Papers and Service Quality ModelsMitali JainNo ratings yet

- IMPACT OF INTEREST RATE CHANGES ON BANK PROFITABILITYDocument6 pagesIMPACT OF INTEREST RATE CHANGES ON BANK PROFITABILITYFakeha1234No ratings yet

- Efficiency of Bank Branches Empirical Evidence From A Two Phase Research ApproachDocument17 pagesEfficiency of Bank Branches Empirical Evidence From A Two Phase Research ApproachVioleta CvetkoskaNo ratings yet

- Biraj Proposal Bbs Forth Year PRDocument6 pagesBiraj Proposal Bbs Forth Year PRassignmentwritingexpertNo ratings yet

- Capital Market & Economy Role of InvestorsDocument41 pagesCapital Market & Economy Role of InvestorsShakhawatNo ratings yet

- Bank Profitability in China and the Role of InflationDocument28 pagesBank Profitability in China and the Role of InflationTouseefNo ratings yet

- Analysis of The Impact of Exogenous Factors On The Financial Performance of Romanian Commercial Banks Listed On Bucharest Stock ExchangeDocument11 pagesAnalysis of The Impact of Exogenous Factors On The Financial Performance of Romanian Commercial Banks Listed On Bucharest Stock ExchangeAnonymous p52JDZOdNo ratings yet

- A Comparison of Financial Performance in The Banking SectorDocument12 pagesA Comparison of Financial Performance in The Banking SectorandoraphNo ratings yet

- Job Satisfaction of Bank Employees after a Merger & AcquisitionFrom EverandJob Satisfaction of Bank Employees after a Merger & AcquisitionNo ratings yet

- Managing and Measuring Performance in Public and Nonprofit Organizations: An Integrated ApproachFrom EverandManaging and Measuring Performance in Public and Nonprofit Organizations: An Integrated ApproachNo ratings yet

- 4Document7 pages4Anil KumarNo ratings yet

- Data Mining PapersDocument1 pageData Mining PapersAnil KumarNo ratings yet

- Criteria For Review and EvaluationDocument1 pageCriteria For Review and EvaluationAnil KumarNo ratings yet

- December1, 2014Document2 pagesDecember1, 2014Anil KumarNo ratings yet

- You TubeDocument1 pageYou TubeAnil KumarNo ratings yet

- You TubeDocument1 pageYou TubeAnil KumarNo ratings yet

- Entrepreneurial Marketing: Rajeev RoyDocument46 pagesEntrepreneurial Marketing: Rajeev RoyAnil Kumar100% (1)

- First Author Conditions: First Version: September, 1997 Latest Version: May 1998Document22 pagesFirst Author Conditions: First Version: September, 1997 Latest Version: May 1998Anil KumarNo ratings yet

- PDFDocument8 pagesPDFAnil KumarNo ratings yet

- Consumer Switching BehaviourDocument1 pageConsumer Switching BehaviourAnil KumarNo ratings yet

- Management and Technology JournalsDocument2 pagesManagement and Technology JournalsAnil KumarNo ratings yet

- Anil PPT For Marketing ResearchDocument3 pagesAnil PPT For Marketing ResearchAnil KumarNo ratings yet

- 5th IIMA Conference Marketing Emerging Economies DeadlinesDocument1 page5th IIMA Conference Marketing Emerging Economies DeadlinesAnil KumarNo ratings yet

- RGSimple PPS199 NDocument2 pagesRGSimple PPS199 NAnil KumarNo ratings yet

- Research Topic Name in GoogleDocument1 pageResearch Topic Name in GoogleAnil KumarNo ratings yet

- Bsbpmg409 Task 2 Skills and Performance Assessment Done1.Document9 pagesBsbpmg409 Task 2 Skills and Performance Assessment Done1.Tanmay JhulkaNo ratings yet

- ROCKS - Module - Statistics (Version 2.01)Document753 pagesROCKS - Module - Statistics (Version 2.01)jgiraolewisNo ratings yet

- How To Keep Journal Entry Approval HistoryDocument8 pagesHow To Keep Journal Entry Approval HistoryKriez NamuhujaNo ratings yet

- XProtect Corporate Specification Sheet R3 2016Document17 pagesXProtect Corporate Specification Sheet R3 2016Nguyen Hoang AnhNo ratings yet

- Dynaform ManualDocument39 pagesDynaform Manualfawad hNo ratings yet

- Configuring Automatic TransportsDocument4 pagesConfiguring Automatic TransportsknischalNo ratings yet

- Pertemuan 13 Pemrograman Web 2Document6 pagesPertemuan 13 Pemrograman Web 2Rava satriyaNo ratings yet

- Getting More Knowledge (Theory) With Oracle RAC PDFDocument8 pagesGetting More Knowledge (Theory) With Oracle RAC PDFPraveen BachuNo ratings yet

- ASProtect VM AnalyzeDocument33 pagesASProtect VM AnalyzegioruwreNo ratings yet

- Noskievic 2020Document5 pagesNoskievic 2020Vahap Eyüp DOĞANNo ratings yet

- Emtech Module5 Week5 LessonDocument5 pagesEmtech Module5 Week5 LessonMa. Crisanta A. AntonioNo ratings yet

- Wireless Price ListDocument21 pagesWireless Price ListnboninaNo ratings yet

- Microsoft Visual Basic 2005 Express Edition - Build A Program NowDocument224 pagesMicrosoft Visual Basic 2005 Express Edition - Build A Program NowMuneeb Khan100% (6)

- Color IT Project Management AnalysisDocument36 pagesColor IT Project Management AnalysisGeorge EduardNo ratings yet

- MNO 4G LTE Security PerspectivesDocument9 pagesMNO 4G LTE Security PerspectivesTzvika ShechoriNo ratings yet

- Development of SERG: Spell Words, Expand Vocabulary, Spell Correctly GameDocument28 pagesDevelopment of SERG: Spell Words, Expand Vocabulary, Spell Correctly GameAnonymous fv0cNI5No ratings yet

- CSC D211 Inheritance Lab - Report Employee SalariesDocument2 pagesCSC D211 Inheritance Lab - Report Employee Salariestheomega76No ratings yet

- Firmware/OSDocument2 pagesFirmware/OSFrankuu PalapagNo ratings yet

- "Online Examination For Hawassa University Informatics Department" Project School of InformaticsDocument13 pages"Online Examination For Hawassa University Informatics Department" Project School of InformaticsAnonymous 5Hk0VoIFh100% (1)

- Cisco Call Detail Records Field DescriptionsDocument28 pagesCisco Call Detail Records Field DescriptionsDaniel TrejoNo ratings yet

- TAC+Xenta+527+NPR FeatureBlastDocument3 pagesTAC+Xenta+527+NPR FeatureBlastMihai ConstantinescuNo ratings yet

- NetSim 9 User ManualDocument40 pagesNetSim 9 User ManualJose Miguel GuzmanNo ratings yet