Professional Documents

Culture Documents

Note and Rider 2005

Uploaded by

Tim Bryant0 ratings0% found this document useful (0 votes)

75 views8 pagesClosing version of the promissory note.

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentClosing version of the promissory note.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

75 views8 pagesNote and Rider 2005

Uploaded by

Tim BryantClosing version of the promissory note.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

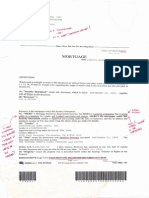

LOAN #: 114726037

InterestOnly"” ADJUSTABLE RATE NOTE

(One-Year LIBOR Index (As Published in The Wall Sireet Journal) - Rate Caps)

THIS NOTE CONTAINS PROVISIONS ALLOWING FOR A CHANGE IN MY FIXED INTEREST RATE

‘TO AN ADJUSTABLE INTEREST RATE AND FOR CHANGES IN MY MONTHLY PAYMENT. THIS

NOTE LIMITS THE AMOUNT MY ADJUSTABLE INTEREST RATE CAN CHANGE AT ANY ONE

TIME AND THE MAXIMUM RATE I MUST PAY.

PTEMBER 23, 2005 FEEDING HILLS MASSACHUSETTS

(Date [civ Ista}

80 BRADFORD DR, FEEDING HILLS, MA 01030-2728

[Propeny Adres

1, BORROWER'S PROMISE TO PAY

In return for a loan that Ihave received, I promise to pay U.S. $ 228, 000.00 (his amount is called "Principal"

plus interes, fo the onder of Lender. Lender is

COUNTRYWIDE HOME LOANS, INC.

Twill make all payments under this Note inthe form of cash, check or money order.

understand that Lender may transfer this Note. Lender or anyone who takes this Note by transfer and who

receive payments under this Note is called the "Note Holder.

entitled to

2, INTEREST

Interest will be charged on unpaid principal until the full amount of Principal has been paid. I will pay interest at a yearly

raleof 5.625%, The interest rate I will pay may change in accordance with Section 4 of this Note.

‘The interest rate required by this Section 2 and Section 4 of this Note is the rate I will pay both before and after any default

described in Section 7(B) of this Note.

PAYMENTS

(A) Time and Place of Payments

Iwill make a payment on the first dlay of every month, beginning on NOVEMBER 01, 2005

Before the First Principal and Interest Payment Due Date as described in Section 4 of this Note, my payment will consist only of

the interest due on the unpaid principal balance of this Note. Thereafter, I will pay principal and interest by making a payment

every month a provided below.

T will make my monthly payments of prinepal and interest beginning on the First Principal and Interest Payment Due Date

as described in Section 4 of this Note Iwill make these payments every month until I have paid all ofthe principal and interest

and any other charges described below that T may owe under this Note. Each monthly payment will be applied as of its

scheduled due date, and if the payment includes both principal and interest, it will be applied to interest before Principal, If, on

OCTOBER 01, 2039 [still owe amounts under this Note, I will pay those amounts in Full on that date, which is called

the “Maturity Date."

will make my monthly payments at

P.0. Box 660694, Dallas, TX 75266-0694

or at different place if required by the Note Holder.

(B) Amount of My Initial Monthly Payments

‘My monthly payment will be inthe amount of US.$ 1, 068-75 before the First Principal and Interest

Payment Duc Date, and thereafter will be in an amount sufficient to repay the principal and interest at the rate determined as

described in Section 4 of this Note in substantially equal instalments by the Maturity Date. The Note Holder will notify me

prior to the date of change in monthly payment.

(C) Monthly Payment Changes

Changes in my monthly payment wil reflect changes inthe unpaid principal of my loan and in the interest rate that I must

pay. The Note Holder will determine my new interest rate and the changed amount of my monthly payment in aecordance with

Scetion 4 oF Sof this Note

(MULTISTATE intrast Only ADJUSTABLE RATE NOTE -ONE YEAR LIOR INDEX

on05 ¥X 04t9}6), Pape 0! oats

"23901" T41472603700000Z20805"

LOAN #: 114726037

4, ADJUSTABLE INTEREST RATE AND MONTHLY PAYMENT CHANGES

(A) Change Dates

‘The initial fixed interest rate I will pay will change (© an adjustable interest rate on the first day of

OCTOBER, 2010 , and the adjustable interest rate I will pay may change on that day every 12th month thereafter. The

date on which my initial fixed interest rate changes to an adjustable interest rate, and each date on which my adjustable interest

rate could change, is called a "Change Date.

(B) The Index

Beginning with the first Change Date, my adjustable interest rate will be based on an Index. The "Index" is the average of

interbank offered rates for one-year U.S. dollat-denominated deposits in the London market (LIBOR), as published in The Wall

Street Journal. The most recent Index figure available as of the date 45 days belore each Change Date is called the "Current

Index."

Ifthe Index is no longer available, the Note Holder will choose a new index that is based upon comparable information.

‘The Note Holder will give me notice of this choice.

(C) Calculation of Changes

Before each Change Date, the Note Holder will calculate my new interest rate by adding

‘TWO & ONE-QUARTER percentage points( 2.250%) to the Current Index, The Note Holder will then

round the result of this addition to the nearest one-eighth of one percentage point (0.125%). Subject to the limits stated in

Section 4(D) below, this rounded amount will be my new interest rate until the next Change Date

‘The Note Holder will then determine the amount of the monthly payment that would be sufficient to repay the unpaid

principal that Tam expected to owe at the Change Date in full on the Maturity Date at my new interest rate in substantially equal

payments. The result of this calculation will be the new amount of my monthly payment.

(D) Limits on Interest Rate Changes

‘The interest rate 1 am required to pay at the first Change Date will not be greater than 10,625 % or less than

2.250 %. Thereafter, my adjustable interest rate will never be inereased or decreased on any single Change Date by more

than to percentage points from the rate of interest I have been paying for the preceding 12 months. My interest rate will never

begreater than 10.625. %.

(E) Effective Date of Changes

My new interest rate will become effective on each Change Date. I will pay the amount of my new monthly payment

beginning on the first monthly payment date after the Change Date until the amount of my monthly payment changes again

(F) Notice of Changes

Before the effective date of any change in my interest rate and/or monthly payment, the Note Holder will deliver or mail 10

‘me @ notice of such change. The notice will include information required by law to be given to me and also the title and

telephone number of a person who will answer any question I may have regarding the notice.

(G) Date of First Principal and Interest Payment

‘The date of my first payment consisting of both principal and interest on this Note (the "First Principal and Interest

‘Payment Due Date") shall be the first monthly payment date alter the first Change Date,

5, BORROWER'S RIGHT TO PREPAY

Thave the right to make payments of Principal at any time before they are due. A payment of Principal only is known as a

Prepayment.” When I make a Prepayment, I will tell the Note Holder in writing that T am doing so. I may not designate a

payment as a Prepayment iT have not made all the monthly payments due under this Note.

T may make a full Prepayment or partial Prepayments without paying any Prepayment charge. The Note Holder will use

my Prepayments to reduce the amount of Prineipal that I owe under this Note. However, the Note Holder may apply my

Prepayment to the accrued and unpaid interest on the Prepayment amount before applying my Prepayment to reduce the

Principal amount of the Note, If I make a partial Prepayment, there will be no changes in the due date of my monthly payments

unless the Note Holder agrees in writing to those changes. Ifthe partial Prepayment is made duting the period when my monthly

payments consist only of interest, the amount of the monthly payment will decrease for the remainder of the term when my

payments consist of only interest. If the partial Prepayment is made during the period when my payments consist of principal

and interest, my partial Prepayment may reduce the amount of my monthly payments after the first Change Date following my

partial Prepayment, However, any reduction due (o my partial Prepayment may be offset by an interest rate increase.

6. LOAN CHARGES

Ifa law, which applies to this loan andl which sets maximum loan charges, is finally interpreted so that the interes or other

loan charges collected oF to be collected in conncetion with this loan exceed the permitted limits, then: (a any such loan charge

shall be reduced by the amount necessary to reduce the charge (0 the permitted limit; and (b) any sums already collected from

‘me that exceeded permitted limits will be refunded to me, The Note Holder may choose to make this refund by reducing the

Principal I owe under this Note or by making a direct payment to me, Ifa refund reduces Principal, the reduction will be treated

as.a partial Prepayment.

7, BORROWER'S FAILURE TO PAY AS REQUIRED

(A) Late Charges for Overdue Payments

Ifthe Note Holder has not received the full amount of any monthly payment by the end of PrETEEN calendar

days after the dat itis du, I will pay a late charge to the Note Holder. The amount of the charge will be 3.000% of my

‘overdue payment of interest, during the period when my payment is interest only, and of principal and interest thereafter. 1 wil

pay this fate charge promptly but only once on each late payment,

(B) Default

IT do not pay the full amount of each monthly payment on the date itis due, T will be in default

(e MULTISTATE intros! Ony ARJUSTABLE RATE NOTE -ONE YEAR LIBOR INDEX

20805 XX (0405) Page 204 tt

You might also like

- GSMSC Certificate - Involuntary RevokationDocument2 pagesGSMSC Certificate - Involuntary RevokationTim BryantNo ratings yet

- EFF - DocuColor Tracking Dot Decoding GuideDocument6 pagesEFF - DocuColor Tracking Dot Decoding GuideTim BryantNo ratings yet

- Print Over SignatureDocument2 pagesPrint Over SignatureTim Bryant100% (2)

- Extracting Signatures From Bank Checks - 2003Document10 pagesExtracting Signatures From Bank Checks - 2003Tim BryantNo ratings yet

- MWG GuidanceDocument73 pagesMWG Guidancejordimon1234No ratings yet

- Mortgages Notes Deeds and Loans in Crime-Gary MichaelsDocument15 pagesMortgages Notes Deeds and Loans in Crime-Gary MichaelsTim Bryant100% (2)

- Affidavits of Title - EXECUTED - 06 26 2015Document10 pagesAffidavits of Title - EXECUTED - 06 26 2015Tim BryantNo ratings yet

- BofA To Nationstar 07 30 2013-80 BradfordDocument1 pageBofA To Nationstar 07 30 2013-80 BradfordTim BryantNo ratings yet

- FRB Report - 100517-Clearing Banks As Loan Funders-BONYDocument43 pagesFRB Report - 100517-Clearing Banks As Loan Funders-BONYTim BryantNo ratings yet

- Harmon Notice of Foreclosure Sale - 05 22 2015 - HIGHLIGHTEDDocument10 pagesHarmon Notice of Foreclosure Sale - 05 22 2015 - HIGHLIGHTEDTim BryantNo ratings yet

- 2013 Copy of Note - HarmonLaw - BryantDocument6 pages2013 Copy of Note - HarmonLaw - BryantTim BryantNo ratings yet

- Pinti V Emigrant 2015-Sjc-11742Document44 pagesPinti V Emigrant 2015-Sjc-11742Tim BryantNo ratings yet

- Mortgage Page 10 - Line Through SignatureDocument1 pageMortgage Page 10 - Line Through SignatureTim BryantNo ratings yet

- MA OCR - Mortgage Lending in Licensed Name Only-Summary of Selected Opinion 99-026Document1 pageMA OCR - Mortgage Lending in Licensed Name Only-Summary of Selected Opinion 99-026Tim BryantNo ratings yet

- Bryant Mortgage 2005 - RODDocument16 pagesBryant Mortgage 2005 - RODTim BryantNo ratings yet

- 2015 Copy of Note - HarmonLaw - BryantDocument6 pages2015 Copy of Note - HarmonLaw - BryantTim Bryant100% (2)

- GSAA Home Equity Trust 2005-15 / Received Mortgage Assignment 7 Yrs After Closing Date of The Trust.Document1 pageGSAA Home Equity Trust 2005-15 / Received Mortgage Assignment 7 Yrs After Closing Date of The Trust.Tim BryantNo ratings yet

- GS Mortgage Securities Corp Not Authorized To Do Business in NYDocument1 pageGS Mortgage Securities Corp Not Authorized To Do Business in NYTim BryantNo ratings yet

- MERS To BAC Assignment 05 11 2011Document1 pageMERS To BAC Assignment 05 11 2011Tim BryantNo ratings yet

- Bryant Mortgage PG 2Document1 pageBryant Mortgage PG 2Tim BryantNo ratings yet

- GSAA HET 2005 15 Not Registered To Do Business in MADocument2 pagesGSAA HET 2005 15 Not Registered To Do Business in MATim BryantNo ratings yet

- DBNT Not Registered To Do Business in NYDocument1 pageDBNT Not Registered To Do Business in NYTim BryantNo ratings yet

- Paths of Notes and Mortgages - Loan 114726037Document24 pagesPaths of Notes and Mortgages - Loan 114726037Tim BryantNo ratings yet

- Closing Version Mortgage-Rider 2005 BryantDocument16 pagesClosing Version Mortgage-Rider 2005 BryantTim BryantNo ratings yet

- Nationstar Poa For HSBC Gsaa Het 2005-15-2014 HcrodDocument7 pagesNationstar Poa For HSBC Gsaa Het 2005-15-2014 HcrodTim BryantNo ratings yet

- Deutsche Bank National Trust Is Not Registered To Do Business in MADocument1 pageDeutsche Bank National Trust Is Not Registered To Do Business in MATim BryantNo ratings yet

- A0T0CZ - GSAA Home Equity Trust 2005-15 Bond - 0.437% Until 01-25-2036 - FinanzenDocument3 pagesA0T0CZ - GSAA Home Equity Trust 2005-15 Bond - 0.437% Until 01-25-2036 - FinanzenTim BryantNo ratings yet

- GSAA HET 2005 15 Not Registered To Do Business in NYDocument1 pageGSAA HET 2005 15 Not Registered To Do Business in NYTim BryantNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)