Professional Documents

Culture Documents

Pacific Park Grille Break-Even Analysis and Profit Projections

Uploaded by

Pham Hong HaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pacific Park Grille Break-Even Analysis and Profit Projections

Uploaded by

Pham Hong HaiCopyright:

Available Formats

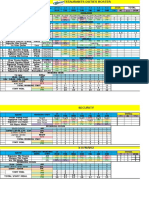

Restaurant Break-Even Calculation Worksheet

From Actual P&L's Within The Last 12 Months

Lowest

Sales

Average

Sales

Highest

Sales

Break-Even

Estimate

SALES

0.0

0.0

COST OF SALES

0.0

0.0

GROSS PROFIT

0.0

0.0

0.0

PAYROLL

Management

Hourly Personnel

Taxes & Benefits

Total Payroll

0

0

0

0

0.0

0.0

0.0

0.0

0

0

0

0

0.0

0.0

0.0

0.0

0

0

0

0

0.0

0.0

0.0

0.0

0 Fixed Cost

0 Mixed Cost

0 Mixed Cost

CONTROLLABLE EXPENSES

Direct Operating Exp.

Music & Entertain.

Marketing

Utility Services

Admin. & General

Repairs & Maint.

Total Controll. Exp.

0

0

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0

0

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0

0

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0

0

0

0

0

0

Mostly Fixed

Mostly Fixed

Mostly Fixed

Mostly Fixed

Mostly Fixed

Mostly Fixed

CONTROLL. PROFIT

0.0

0.0

0.0

OCCUPANCY COSTS

Rent

Property Taxes

Other Taxes

Property Insurance

Total Occup.Costs

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

0

0

0

0

Fixed Cost

Fixed Cost

Fixed Cost

Fixed Cost

0

0

0

0

0.0

0.0

0.0

0.0

0

0

0

0

0.0

0.0

0.0

0.0

0

0

0

0

0.0

0.0

0.0

0.0

0

0

0

0

Fixed Cost

Fixed Cost

Mostly Fixed

Mostly Fixed

0.0

0.0

0

0.0

Total Fixed Costs

Interest

Depreciation

Other Expenses

Other (Income)

INCOME BEFORE TAX

%

0.0

0.0

0.0% Variable Cost

(restaurant name here)

Break-Even & Operating Profit Model

BreakEven

Average

Sales

High

Sales

SALES

0 100.0

100.0

COST OF SALES

0.0

0.0

0.0

GROSS PROFIT

0.0

0.0

0.0

PAYROLL

Management

Hourly Personnel

Taxes & Benefits

Total Payroll

0

0

0

0

0.0

0.0

0.0

0.0

0

0

0

0

0.0

0.0

0.0

0.0

0

0

0

0

0.0

0.0

0.0

0.0

CONTROLLABLE EXPENSES

Direct Operating Exp.

Music & Entertain.

Marketing

Utility Services

Administrative & General

Repairs & Maintenance

Total Controllable Expenses

0

0

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0

0

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0

0

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

CONTROLLABLE PROFIT

0.0

0.0

0.0

OCCUPANCY COSTS

Rent

Property Taxes

Other Taxes

Property Insurance

Total Occup.Costs

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

OTHER COSTS & EXPENSES

Interest

Depreciation

Other Expenses

Other (Income)

0

0

0

0

0.0

0.0

0.0

0.0

0

0

0

0

0.0

0.0

0.0

0.0

0

0

0

0

0.0

0.0

0.0

0.0

INCOME BEFORE TAX

0.0

0.0

0.0

% Increase in Sales Over Break-Even

% of Variable Hourly Labor Cost

60%

Sales Equivalents:

Number of Periods per Year

Annual Sales

Average Weekly Sales

12

0

0

0 100.0

0.0%

0.0%

0

0

0

0

RESTAURANT CHART OF ACCOUNTS

P&L ACCOUNTS

3000

3010

3020

3030

3040

SALES

Food

Liquor

Beer

Wine

4000

4001

4002

4003

4004

4005

4006

4007

4008

4009

4020

4030

4040

4050

4060

COST OF SALES

4100

4110

4120

4130

4140

4150

4160

SALARIES & WAGES

Management

Dining Room

Bar

Kitchen

Dishroom

Office

4200

4210

4220

4230

4240

4250

4260

4270

4280

EMPLOYEE BENEFITS

Payroll Taxes

Worker's Compensation Insurance

Group Insurance

Management Meals

Employee Meals

Awards & Prizes

Employee Parties & Sports Activities

Medical Expenses

4300

4305

4310

4315

4320

4325

4330

4335

4340

4345

4350

4355

4360

4365

4370

4375

4380

4385

4390

DIRECT OPERATING EXPENSES

Auto & Truck Expense

Uniforms

Laundry & Dry Cleaning

Linen

Tableware

Silverware

Kitchen Utensils

Paper Supplies

Bar Supplies

Restaurant Supplies

Cleaning Supplies

Contract Cleaning

Menu & Wine List

Pest Control

Flowers & Decorations

Licenses & Permits

Banquet & Event Expenses

Other Operating Expenses

4400

4410

4420

4430

MUSIC & ENTERTAINMENT

Musicians & Entertainers

Cable TV/Wire Services

Royalties to ASCAP, BMI

Food Meat

Seafood

Poultry

Produce

Bakery

Dairy

Grocery & Dry Goods

Non-alcoholic Beverages

Liquor

Bar Consumables

Beer

Wine

Paper (QSR)

4500

4510

4520

4530

4540

4545

4550

MARKETING

Selling & Promotion

Advertising

Public Relations

Research

Complimentary Food & Beverages

Discounted Food & Beverages

4600

4610

4620

4630

4640

UTILITIES

Electrical

Gas

Water

Trash Removal

4700

4705

4710

4715

4720

4725

4730

4735

4740

4745

4750

4755

4760

4765

4770

4775

4780

4785

GENERAL & ADMINISTRATIVE

Office Supplies

Postage & Delivery

Telephone / Communications

Payroll Processing

Insurance - General

Dues & Subscriptions

Travel Expenses

Credit Card Discounts

Bad Debts

Cash (Over) / Short

Bank Deposit Services

Bank Charges

Accounting Services

Legal & Professional

Security / Alarm

Training

Miscellaneous

4800

4810

4820

4830

4840

4850

REPAIRS & MAINTENANCE

Maintenance Contracts

R&M - Equipment

R&M - Building

Grounds Maintenance

Parking Lot

5000

5010

5020

5030

5040

5050

5060

OCCUPANCY COSTS

Rent

Equipment Rental

Real Estate Taxes

Personal Property Taxes

Insurance-Property & Casualty

Other Municipal Taxes

6000

6010

6020

6030

DEPRECIATION & AMORTIZATION

Buildings

Furniture, Fixtures & Equipment

Amortization of Leasehold Improvements

7000

7010

7020

7030

7040

7050

7060

OTHER (INCOME) EXPENSE

Vending Commissions

Telephone Commissions

Waste Sales

Interest Expense

Officers Salaries & Expenses

Corporate Office Expenses

Restaurant Break-Even Calculation Worksheet

From Actual P&L's Within The Last 12 Months

Lowest

Sales

Average

Sales

Highest

Sales

Break-Even

Estimate

SALES

37,251 100.0

45,861

100.0

54,881 100.0

COST OF SALES

12,577

33.8

15,058

32.8

17,592

32.1

GROSS PROFIT

24,674

66.2

30,803

67.2

37,289

67.9

PAYROLL

Management

Hourly Personnel

Taxes & Benefits

Total Payroll

4,200

7,324

2,535

14,059

11.3

19.7

6.8

37.7

4,200

8,157

2,719

15,076

9.2

17.8

5.9

32.9

4,200

8,954

2,894

16,048

7.7

16.3

5.3

29.2

4,200 Fixed Cost

7,500 Mixed Cost

2,675 Mixed Cost

CONTROLLABLE EXPENSES

Direct Operating Exp.

Music & Entertain.

Marketing

Utility Services

Admin. & General

Repairs & Maint.

Total Controll. Exp.

1,351

285

965

1,524

1,158

689

5,972

3.6

0.8

2.6

4.1

3.1

1.8

16.0

1,158

280

1,125

1,425

1,254

650

5,892

2.5

0.6

2.5

3.1

2.7

1.4

12.8

1,423

280

1,395

1,258

1,058

551

5,965

2.6

0.5

2.5

2.3

1.9

1.0

10.9

1,200

280

1,125

1,450

1,250

650

Mostly Fixed

Mostly Fixed

Mostly Fixed

Mostly Fixed

Mostly Fixed

Mostly Fixed

CONTROLL. PROFIT

4,643

12.5

9,835

21.4

15,276

27.8

OCCUPANCY COSTS

Rent

Property Taxes

Other Taxes

Property Insurance

Total Occup.Costs

2,350

450

226

1,125

4,151

6.3

1.2

0.6

3.0

11.1

2,350

450

521

1,125

4,446

5.1

1.0

1.1

2.5

9.7

2,350

450

385

1,125

4,310

4.3

0.8

0.7

2.0

7.9

2,350

450

521

1,125

Fixed Cost

Fixed Cost

Fixed Cost

Fixed Cost

Interest

Depreciation

Other Expenses

Other (Income)

INCOME BEFORE TAX

698

942

756

(225)

(1,679)

1.9

2.5

2.0

(0.6)

(4.5)

725

942

479

(442)

3,685

1.6

2.1

1.0

(1.0)

8.0

719

1.3

942

1.7

852

1.6

(325) (0.6)

8,778 16.0

Total Fixed Costs

32.5% Variable Cost

725

942

480

(400)

26,523

Fixed Cost

Fixed Cost

Mostly Fixed

Mostly Fixed

Pacific Park Grille

Break-Even & Operating Profit Model

BreakEven

Average

Sales

High

Sales

SALES

39,293 100.0

45,000

100.0

COST OF SALES

12,770

32.5

14,625

32.5

16,250

32.5

GROSS PROFIT

26,523

67.5

30,375

67.5

33,750

67.5

PAYROLL

Management

Hourly Personnel

Taxes & Benefits

Total Payroll

4,200

7,500

2,675

14,375

10.7

19.1

6.8

36.6

4,200

8,154

2,824

15,178

9.3

18.1

6.3

33.7

4,200

8,726

2,955

15,882

8.4

17.5

5.9

31.8

CONTROLLABLE EXPENSES

Direct Operating Exp.

Music & Entertain.

Marketing

Utility Services

Administrative & General

Repairs & Maintenance

Total Controllable Expenses

1,200

280

1,125

1,450

1,250

650

5,955

3.1

0.7

2.9

3.7

3.2

1.7

15.2

1,200

280

1,125

1,450

1,250

650

5,955

2.7

0.6

2.5

3.2

2.8

1.4

13.2

1,200

280

1,125

1,450

1,250

650

5,955

2.4

0.6

2.3

2.9

2.5

1.3

11.9

CONTROLLABLE PROFIT

6,193

15.8

9,242

20.5

11,913

23.8

OCCUPANCY COSTS

Rent

Property Taxes

Other Taxes

Property Insurance

Total Occup.Costs

2,350

450

521

1,125

4,446

6.0

1.1

1.3

2.9

11.3

2,350

450

521

1,125

4,446

5.2

1.0

1.2

2.5

9.9

2,350

450

521

1,125

4,446

4.7

0.9

1.0

2.3

8.9

725

942

480

(400)

1.8

2.4

1.2

(1.0)

725

942

480

(400)

1.6

2.1

1.1

(0.9)

725

942

480

(400)

1.5

1.9

1.0

(0.8)

(0)

(0.0)

3,129

7.0

5,800

11.6

OTHER COSTS & EXPENSES

Interest

Depreciation

Other Expenses

Other (Income)

INCOME BEFORE TAX

% Increase in Sales Over Break-Even

% of Variable Hourly Labor Cost

Sales Equivalents:

Number of Periods per Year

Annual Sales

Average Weekly Sales

60%

12

471,520

9,068

14.5%

540,000

10,385

50,000 100.0

27.2%

600,000

11,538

You might also like

- Chart of Accounts-Fast FoodDocument6 pagesChart of Accounts-Fast Foodgenie1970No ratings yet

- Restaurant ProjectionsDocument14 pagesRestaurant Projections*Maverick*No ratings yet

- Profit & Loss Statement: O' Lites RestaurantDocument7 pagesProfit & Loss Statement: O' Lites RestaurantNoorulain AdnanNo ratings yet

- Cafe' / Restaurant FinancialsDocument5 pagesCafe' / Restaurant Financialstmir_1No ratings yet

- Restaurant RatiosDocument1 pageRestaurant Ratiosbaha_said7397No ratings yet

- Restaurant Food Inventory Excel TemplateDocument57 pagesRestaurant Food Inventory Excel TemplateMudit Garg100% (1)

- Restaurant CostingDocument3 pagesRestaurant CostingCaracciolo Culinary100% (1)

- Restaurant MANAGER ChecklistDocument4 pagesRestaurant MANAGER ChecklistNawab ShaheenNo ratings yet

- Kitchen Opening Closing ChecklistDocument14 pagesKitchen Opening Closing ChecklistSopie Azlee100% (1)

- Budget Shell in Excel For Hotel IndustryDocument97 pagesBudget Shell in Excel For Hotel IndustryJennifer Baxter75% (4)

- Restaurant KPIDocument10 pagesRestaurant KPIDylan PetersNo ratings yet

- Cost ControlDocument11 pagesCost ControlOm Singh100% (11)

- Outline For Boutique Restaurant ConceptDocument37 pagesOutline For Boutique Restaurant ConceptRestaurant_le_M64100% (1)

- Weekly Kitchen Report for Hungry Dragons 15-21 July 2019Document20 pagesWeekly Kitchen Report for Hungry Dragons 15-21 July 2019JuliaNo ratings yet

- Menu Worksheet 2009Document3 pagesMenu Worksheet 2009manishpandey1972No ratings yet

- Food & Beverage Pre-Opening ChecklistDocument6 pagesFood & Beverage Pre-Opening ChecklistCell JustinNo ratings yet

- FOOD & BEVERAGES KITCHEN SOPs HOTEL INDUSTRY - NIRUPAM ROYDocument16 pagesFOOD & BEVERAGES KITCHEN SOPs HOTEL INDUSTRY - NIRUPAM ROYFinance Ec100% (1)

- Increase Restaurant Sales: The Only 4 Ways ToDocument20 pagesIncrease Restaurant Sales: The Only 4 Ways ToeralgagaNo ratings yet

- Restaurant AuditDocument4 pagesRestaurant Auditchiahongtan100% (1)

- Restaurant Business PlanDocument33 pagesRestaurant Business Planchow100% (1)

- S O P AQUAROCKwb547ynnnw47truytuytuDocument105 pagesS O P AQUAROCKwb547ynnnw47truytuytuthananrNo ratings yet

- Business Plan of A RestaurantDocument24 pagesBusiness Plan of A RestaurantManoranjan Kumar MahtoNo ratings yet

- Food Startup Pitch Deck With AnimationDocument17 pagesFood Startup Pitch Deck With AnimationAnya VilardoNo ratings yet

- F&B Outlets ReviewDocument8 pagesF&B Outlets Reviewgm samatorNo ratings yet

- POM ProjectDocument42 pagesPOM ProjectGowtham YaramanisettiNo ratings yet

- Food Cost ManualDocument105 pagesFood Cost Manualcucucucucu72No ratings yet

- Essential Restaurant Opening ChecklistDocument50 pagesEssential Restaurant Opening Checklistmohd_shaar90% (10)

- Restaurant Operations ManagementDocument21 pagesRestaurant Operations Managementharry4sum50% (2)

- Pre-Opening Road MapDocument35 pagesPre-Opening Road MapRefinaldi TanjungNo ratings yet

- Restaurant Start Up ChecklistDocument172 pagesRestaurant Start Up ChecklistMohammad Abd Alrahim Shaar100% (1)

- Restaurant Self-Inspection ChecklistDocument4 pagesRestaurant Self-Inspection Checklistaletwenty38627100% (2)

- Cost Controlling Restaurant OperationsDocument4 pagesCost Controlling Restaurant OperationsJenny Bautista100% (1)

- Monthly End InventoryDocument12 pagesMonthly End Inventoryapi-3808900No ratings yet

- Restaurant Business Plan ExampleDocument31 pagesRestaurant Business Plan ExampleApril Ann100% (1)

- Beverage CostsDocument2 pagesBeverage Costsorientalhospitality50% (2)

- 1.06 GM Pre-Opening Check List 9pDocument1 page1.06 GM Pre-Opening Check List 9porientalhospitalityNo ratings yet

- Restaurant AnualDocument33 pagesRestaurant AnualRoddy Rodrigues100% (1)

- FNB ManagerDocument8 pagesFNB Managersujit NayakNo ratings yet

- Restaurant Start Up Checklist-1Document222 pagesRestaurant Start Up Checklist-1munyekiNo ratings yet

- Kitchen SopDocument4 pagesKitchen SopAgus Edy Cahyono57% (7)

- Checklist Opening Restaurant QSR Foodcourt Business Inthebox 23.02.2013Document33 pagesChecklist Opening Restaurant QSR Foodcourt Business Inthebox 23.02.2013Sudhakar Ganjikunta100% (1)

- Cost Control FundamentalsDocument75 pagesCost Control FundamentalsNomula Sunny GoudNo ratings yet

- Ethnic Food Restaurant Business PlanDocument6 pagesEthnic Food Restaurant Business PlanKruti SutharNo ratings yet

- SopDocument5 pagesSopsureshkumarj76No ratings yet

- Restaurant Banquet Manual - Complete Guide to Policies, Procedures & Service ExcellenceDocument146 pagesRestaurant Banquet Manual - Complete Guide to Policies, Procedures & Service Excellencemaryannalbert100% (4)

- Environmental Guidelines and Best Practices: December 2008Document32 pagesEnvironmental Guidelines and Best Practices: December 2008renjitinkuNo ratings yet

- 10.06 Dry Store List 12 PagesDocument26 pages10.06 Dry Store List 12 PagessadsadNo ratings yet

- Up-Selling in Restaurants: Akshay KhannaDocument39 pagesUp-Selling in Restaurants: Akshay KhannaSagar Chougule100% (1)

- Job Description Restaurant Manager PDFDocument1 pageJob Description Restaurant Manager PDFClarensia TantriNo ratings yet

- Basic Hotel Model Template: RoomsDocument10 pagesBasic Hotel Model Template: RoomsAnonymous VJd2tLNo ratings yet

- Feasibility Report On RestaurantDocument42 pagesFeasibility Report On RestaurantRasdeep Anand100% (1)

- Career Path at Hotels (Draft)Document63 pagesCareer Path at Hotels (Draft)SPHM HospitalityNo ratings yet

- Hospitality Industry Chart of Accounts PDFDocument12 pagesHospitality Industry Chart of Accounts PDFAmeliaPrisiliaNo ratings yet

- Food Cost FormatDocument110 pagesFood Cost FormatAnonymous DSToL0Y0vP100% (1)

- Restaurant Business PlanDocument9 pagesRestaurant Business PlanAneex AnjumNo ratings yet

- Restaurant Opening ChecklistDocument47 pagesRestaurant Opening ChecklistAssemNo ratings yet

- Hotel Chart of AccountsDocument2 pagesHotel Chart of Accountsmanishpandey197283% (30)

- ABC Company Income Statement for Month EndedDocument3 pagesABC Company Income Statement for Month EndedKalim Ullah KhanNo ratings yet

- Ewt 20082Document384 pagesEwt 20082JonelChavezNo ratings yet

- Generic BusinessplanDocument54 pagesGeneric BusinessplanAmrita Prashant IyerNo ratings yet

- $ 100k NichesDocument6 pages$ 100k NichesPham Hong HaiNo ratings yet

- Summer Menu 2016 - Hanoi 3.0Document9 pagesSummer Menu 2016 - Hanoi 3.0Pham Hong HaiNo ratings yet

- Lunch Menu With Selling PriceDocument25 pagesLunch Menu With Selling PricePham Hong HaiNo ratings yet

- Lunch Menu With Selling PriceDocument25 pagesLunch Menu With Selling PricePham Hong HaiNo ratings yet

- Secret Club Projected Income Statement - Year OneDocument1 pageSecret Club Projected Income Statement - Year OnePham Hong HaiNo ratings yet

- Business Plan For HotelDocument17 pagesBusiness Plan For HotelAnkita Singh100% (6)

- Financial Projections Template V 1.33Document4 pagesFinancial Projections Template V 1.33Pham Hong HaiNo ratings yet

- Restaurant Duty RosterDocument38 pagesRestaurant Duty RosterPham Hong HaiNo ratings yet

- Hotel Breakfast & Lunch Sets Under $40Document2 pagesHotel Breakfast & Lunch Sets Under $40Pham Hong HaiNo ratings yet

- Accounts Positions Initial Training Plan Training NeeedsDocument12 pagesAccounts Positions Initial Training Plan Training NeeedstaolaNo ratings yet

- Organized Crime in Central America The Northern Triangle, Report On The Americas #29 DRAFTDocument125 pagesOrganized Crime in Central America The Northern Triangle, Report On The Americas #29 DRAFTLa GringaNo ratings yet

- Anafuda Cards Koi KoiDocument5 pagesAnafuda Cards Koi Koii.margarida33No ratings yet

- Q1. What Do You Understand by Construction Management? Discuss The Historical Evolution of Construction Management?Document5 pagesQ1. What Do You Understand by Construction Management? Discuss The Historical Evolution of Construction Management?Vranda AgarwalNo ratings yet

- Security AgreementDocument5 pagesSecurity AgreementGanesh TarimelaNo ratings yet

- MEP Civil Clearance 15-July-2017Document4 pagesMEP Civil Clearance 15-July-2017Mario R. KallabNo ratings yet

- ULI Europe Reshaping Retail - Final PDFDocument30 pagesULI Europe Reshaping Retail - Final PDFFong KhNo ratings yet

- B. Performance Standard The Learners Should Be Able To Participate in Activities ThatDocument9 pagesB. Performance Standard The Learners Should Be Able To Participate in Activities ThatBenmar L. OrterasNo ratings yet

- Flow Concepts: Source: Managing Business Process Flows by Anupindi, Et AlDocument7 pagesFlow Concepts: Source: Managing Business Process Flows by Anupindi, Et AlKausik KskNo ratings yet

- Clifford Clark Is A Recent Retiree Who Is Interested in PDFDocument1 pageClifford Clark Is A Recent Retiree Who Is Interested in PDFAnbu jaromiaNo ratings yet

- 8 Edsa Shangri-La Hotel Vs BF CorpDocument21 pages8 Edsa Shangri-La Hotel Vs BF CorpKyla Ellen CalelaoNo ratings yet

- Human Resources ManagementDocument18 pagesHuman Resources ManagementztrinhNo ratings yet

- Slip Form ConstructionDocument10 pagesSlip Form ConstructionAkshay JangidNo ratings yet

- AgricultureDocument7 pagesAgricultureAhmad CssNo ratings yet

- Indirect Questions BusinessDocument4 pagesIndirect Questions Businessesabea2345100% (1)

- Pedagogy of Teaching HistoryDocument8 pagesPedagogy of Teaching HistoryLalit KumarNo ratings yet

- Harmony Ville, Purok 3, Cupang, Muntinlupa CityDocument2 pagesHarmony Ville, Purok 3, Cupang, Muntinlupa CityJesmar Quirino TutingNo ratings yet

- Intestate of Luther Young v. Dr. Jose BucoyDocument2 pagesIntestate of Luther Young v. Dr. Jose BucoybearzhugNo ratings yet

- Ob Ward Timeline of ActivitiesDocument2 pagesOb Ward Timeline of Activitiesjohncarlo ramosNo ratings yet

- (Critical Criminological Perspectives) Deborah H. Drake (Auth.) - Prisons, Punishment and The Pursuit of Security-Palgrave Macmillan UK (2012)Document231 pages(Critical Criminological Perspectives) Deborah H. Drake (Auth.) - Prisons, Punishment and The Pursuit of Security-Palgrave Macmillan UK (2012)Yaeru EuphemiaNo ratings yet

- P&WC S.B. No. A1427R3Document16 pagesP&WC S.B. No. A1427R3Elmer Villegas100% (1)

- A Gateway For SIP Event Interworking: - Sasu Tarkoma & Thalainayar Balasubramanian RamyaDocument20 pagesA Gateway For SIP Event Interworking: - Sasu Tarkoma & Thalainayar Balasubramanian RamyaMadhunath YadavNo ratings yet

- Omoluabi Perspectives To Value and Chara PDFDocument11 pagesOmoluabi Perspectives To Value and Chara PDFJuan Daniel Botero JaramilloNo ratings yet

- How To Have A BEAUTIFUL MIND Edward de BDocument159 pagesHow To Have A BEAUTIFUL MIND Edward de BTsaqofy Segaf100% (1)

- Föreställningar Om Klass Och Kön I Arbetsförmedlingens Yrkesbeskrivningar?Document28 pagesFöreställningar Om Klass Och Kön I Arbetsförmedlingens Yrkesbeskrivningar?Filozófus ÖnjelöltNo ratings yet

- HSS S6a LatestDocument182 pagesHSS S6a Latestkk lNo ratings yet

- Financial Reporting Standards SummaryDocument5 pagesFinancial Reporting Standards SummaryKsenia DroNo ratings yet

- Instant Download Statistics For Business and Economics Revised 12th Edition Anderson Test Bank PDF Full ChapterDocument32 pagesInstant Download Statistics For Business and Economics Revised 12th Edition Anderson Test Bank PDF Full Chapteralicenhan5bzm2z100% (3)

- Biosphere Reserves of IndiaDocument4 pagesBiosphere Reserves of IndiaSrinivas PillaNo ratings yet

- Build - Companion - HarrimiDocument3 pagesBuild - Companion - HarrimiandrechapettaNo ratings yet

- Indian Leadership Philosophy Focused on Integrity and ServiceDocument13 pagesIndian Leadership Philosophy Focused on Integrity and ServicesapkotamonishNo ratings yet