Professional Documents

Culture Documents

Model Caselets

Uploaded by

Manoj Kumar JoshiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Model Caselets

Uploaded by

Manoj Kumar JoshiCopyright:

Available Formats

1.

Sundaram Home Furnishings

It seemed that the entire document has been sprayed with red ink. Neelima frowned. The

balance sheet and P & L statement of Sundaram Home Furnishings, along with their

application for loan has been returned by her boss at Continental Bank with numerous

comments in red ink on practically every page! Neelima was a Management Trainee in

the Credit (Loans) department of this multinational bank. Two months into her job, she

was trying hard to learn banking and credit appraisal. On her initiative, her boss Jayantallowed her to handle loan application of Sundaram Home Furnishings. To get an idea of

financial health and profitability of the client, he had asked her to annex the financial

statements of last three years along with the application to be sent to him with remarks.

Jayant rejected the application and sent it back with a number of comments.

Neelima, disappointed at the rejection of her first solo proposal, sighed. Ok, let me find

out what went wrong- she told herself. Then she set about going through each remark

carefully. The remarks were like this:

1. Depreciation method has been changed from straight line to written down value

without assigning any reasons.

2. Every year, bad debts were being charged to Profit and Loss account. There was no

provision made, however.

3. In the year 2013-14, Rs 600000 has been debited as Miscellaneous Expenses with no

other information about them. The Sales that year were Rs 7500000.

Concept Box

This case of Sundaram Home Furnishings illustrates the importance of following

Accounting Principles, Concepts and Conventions while preparing financial statements.

4. The value of Showroom building was shown at an increased amount in 2013-14 over

previous year on account of rise in the price of land.

5. There was a loss by fire in the year 2013 (January). However, no insurance exists.

6. It was learnt from banks other clients that M/s Sundaram was involved in a court case

with Tax department. If lost, Sundaram will need to pay Rs 500000. However, the

financial statements were silent on this.

7. The salary of security guards appointed in March 2013 was charged to Profit and Loss

account of 2013-14.

8. Sale of Rs 340000 on Approval Basis has been included to compute profits for year

2012-13.

9. The balance sheet of 2013-14 had the date in caption as on 30-04-2014 and that of

2012-13 had as on 31-03-2013.

10. School fee of owners kid was debited to Profit and Loss account in the year 2013-14.

Questions:

1. Who are the users of financial statements other than the promoters of a business?

2.

Can you help Neelima by discussing with reasons which of the accounting

concepts/principles are being violated in each of the 10 remarks?

3. How do you differentiate between accounting concepts/principles/conventions?

4. Why did Jayant reject the loan application with these remarks?

Course Reference: Concept Generally Accepted Accounting Principles/ Users of

Financial Statements/Unit-1/ Subject : Financial Accounting & Management

Source/References: Authors own work.

Other Key words: True and Fair View/Interpretation/ Errors

Hints:

1. Other users of financial statements may be investors, creditors, bankers, government,

trade unions, suppliers etc.

2. 1. Consistency Concept 2. Matching, Conservatism Concept 3. Materiality Concept 4.

Historical Cost Concept 5. Conservatism Concept 6. Full Disclosure Concept 7. Matching

Concept 8. Revenue Recognition Concept 9. Accounting Period Concept 10. Business

Entity Concept

3. Accounting principles are the rules, bases, conventions and procedures adopted by

management in preparing accounting records and presenting financial statements. They

can be categorized as, (i) Accounting Concepts/Assumptions, (ii) Accounting Conventions,

and (iii) Accounting Standards. Accounting concepts are based on logical considerations

and help in recording the business transactions. Accounting conventions are based on

what is practicable and include those customs and traditions, which guide the accountant

in the preparation of financial statements. Accounting Standards are the guidelines

issued by Accounting Standards Board of a country for financial reporting. Generally,

these standards are issued to bring uniformity in financial reporting in a particular

country.

4. With violation in accounting concepts/principles and conventions the financial

statements fail to project a true and fair view of profits and financial position of the

business, therefore making any decision based on them susceptible to error.

2.

Adidas Merges with Reebok

On August 3, 2005, Adidas-Salomon AG (Adidas), Germanys largest sporting goods maker merged with the USbased Reebok International Limited (Reebok) for US$ 3.8 billion. With this merger, Adidas and Reebok aimed to

compete against American sports goods maker Nike International Inc. (Nike).

The companies felt that the major driving force behind the merger was greater sales growth rather than just cost

savings. The annual sales of the merged entity was predicted to be US$ 11.7 billion. The merger was expected to

give Adidas products a strong push in the US market because of the link with Reebok, while Reebok would

gain a large presence in Europe and Asia with the help of Adidas.

Analysts had varied opinions about the deal. However, a few analysts warned that repositioning the two brands

would be a difficult exercise. Analysts were concerned that Adidas would have to support two separate brand

identities while rival Nike was intensely focused on a single identity. Some analysts felt that Adidas could beat

Nike to become the industry leader while others opined that it was impossible to dislodge Nike from its No. 1

position. Nike was a preferred brand because of its fashion status, colors, and combinations.

Some analysts raised doubts over the success of the merger of the companies. They were of the view that the

merger would not generate much synergy because the individual brand identities would be maintained even after

the merger. Analysts also doubted the effectiveness of the merger as a strategy to beat Nike. They felt that the

combined entity would have to work really hard to further expand its market share in the US market and

globally.

Some instances of mergers and acquisitions include the November, 2012 acquisition of India-based United

Spirits Limited (USL), owned by the UB Group by the UK-based beverages company Diageo Plc (Diageo)

where Diageo acquired a 53.4 percent stake for US$ 2.1 billion. In another instance, on August 2, 2013, USbased Internet Corporation Yahoo! Inc. (Yahoo) acquired US-based social browsing startup Rockmelt, for a

reported US$ 6070 million. The amount was paid largely in cash along with some stock incentives to the

employees of Rockmelt. The acquisition was expected to bolster Yahoos mobile and social networking efforts.

In another instance, in September 2013, US-based computing major, Microsoft Corp. (Microsoft) and Finlandbased communications company, Nokia Corporation (Nokia), entered into a transaction where Microsoft

acquired Nokias Devices & Services segment, license Nokias patents, and license and use Nokias mapping

services, for US$ 7.2 billion.

The case of the Adidas-Reebok merger highlights the rationale for the merger and whether the merger would

be successful in the long run.

Sources: Laura Petrecca and Theresa Howard, Adidas-Reebok Merger Lets Rivals Nip at Nikes Heels,

www.usatoday.com, August 4, 2005.

News Snap, Adidas to Buy Reebok; 2Q Net Profit Rises 50%, www.news.morningstar.com, August 3,

2005.

Course Reference: Concept- Amalgamation/Merger of Companies/Unit 15-Company Management and

Winding up/Subject-Business Environment

Other Keywords: Mergers and Acquisitions, Integration

DISCUSSION QUESTIONS

1.

Discuss the rationale for the Adidas-Reebok merger.

2.

Discuss the pros and cons of the merger.

3. Facebook and its Organizational Culture

Facebook, an online social networking service, was headquartered at Menlo Park,

California. Facebook was founded by Mark Zuckerberg along with Eduardo Saverin, Chris

Hughes and Dustin Moskovitz in February 2004. The company was originally known as

The Facebook and was renamed Facebook.com in August 2005. The company held its

Initial Public Offering (IPO) in May 2012. It was one of the biggest IPOs in the history of

the Internet and technology sector with a market capitalization of more than $104 billion.

It had about 890 million daily active users and nearly 1.19 billion mobile monthly active

users by December 2014.

Facebooks growth and success was attributed to its organizational culture (Refer to

Chart 1 for Facebooks organizational culture)

Chart 1: Components of Facebooks Organizational Culture

Companys Beliefs

1. Empower people to share and make

the world more open and connected

2. Create and build a shared identity

and vision as the company grew

Facebooks

Mission

Companys Beliefs

1. Was not considered as the sole

responsibility of the HR department

2. New employee orientation was

regarded as a serious process

The

Onboarding

Process

Companys Beliefs

1. Employees were allowed to pose a

question directly to the companys

leadership

2. Employees were allowed to even ask

controversial or sensitive questions in

Conducted

Weekly Allhands

Meetings

Companys Beliefs

1. Culture was of significance to an

organization

2. Culture grew only if tended to

Companys Beliefs

Employees were encouraged to

participate in social activities

Companys Beliefs

1. Fewer hierarchies and greater

collaboration

2. Focused on 2 aspects:

How did the company want to be known

as it grew?

What was communicated to the outside

world about working at Facebook?

Adapted from various sources

Conscious

Attention to

Culture

Encouraged

Social

Activities

Employed

Unique HR

Strategies

How was it Achieved?

Worked on the principle of move fast and break things

which allowed the company to surpass competitors in the

social-networking arena

Employees were encouraged to act quickly and take risks

irrespective of its consequences

How was it Achieved?

The new recruits directly learnt about the culture from the

companys longest-tenured employees from various

departments. These employees interacted with every new

recruit to ensure that the companys purpose and meaning

were thoroughly understood.

All employees underwent the same extensive onboarding

How was it Achieved?

Zuckerberg and the management team hosted an honest

and open Q&A session for employees

Every employee had direct access to the CEO

Employees openly expressed their frustrations or concerns

which were addressed in this public forum

How was it Achieved?

Before opening a new office, a landing team was sent to

help set up key aspects of the companys existing culture

into the new location

Created a uniform work environment. For instance, at its

India office, one of the initial activities undertaken by the

team included painting their own walls with Facebooks

How was it Achieved?

Facebook organized activities like clubs, an annual Game

Day (outdoor field day for all employees)

Introduced policies like a $600 rent subsidy per month to

those who lived within 1 mile of the office in order to

encourage a close community living culture

Had a mailing list titled social, dedicated to non-work

How was it Achieved?

Less emphasis was laid on titles to ensure unobstructed

flow of ideas .Open offices spaces were created to allow

employees to sit and interact

In 2014, Facebook offered an incentive of about $20,000 to

its top women employees in a bid to help them balance

their personal and professional lives.

Employees were eligible for nearly $4,000 as a cash

incentive whenever they became parents-biologically or by

Despite its contribution to the company, experts have raised certain concerns over

Facbooks organizational culture:

1. Incentives like paid paternal leaves for parents were often unclaimed. The

company had not revealed the proportion of employees who fully claimed the

allotted paternal leave

2. Policies like egg-freezing were viewed as incentives to discourage employee

poaching

Organizational Culture referred to a system of shared values, assumptions, beliefs and

norms that united the members of an organization. Facebook focused on fostering an

employee-friendly culture by encouraging open communication, reducing hierarchies

and encouraging

social, non-work related interactions etc. which contributed to the

Discussion

Questions

1.

Discuss

the

importance

of organizational culture.

companys growth.

(Hints: Impact on the companys revenue-Impact on the growth of the company

in the log-run)

2. What elements of Facebooks organizational culture were critical in its success?

(Hints: The onboarding process-Conscious attention to culture- Unique HR

strategies-Encouraged social activities

Sources:

Kevin Colleran, Lessons From Facebook: How Culture Leads to Growth, www.blogs.wsj.com, February 5, 2013

Joshua Brustein, Facebooks Egg Freezing Policy Isnt an Evil Plot,www.bloomberg.com, October 15, 2014

Samantha Nielson, Why Did Facebooks Shares Fall After its Initial Public Offering,www.marketrealist.com, Jan

14, 2014

Ami Sedghi, Facebook: 10 Years of Social Networking, in Numbers, www.thegaurdian.com, February 4, 2014

Course Reference: Concept- Organizational Culture /Unit 11 Effective Organizing and Organizational

Culture/Subject-Principles of Management

Other Keywords: HRM, Organizational Behavior

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Introduction To Innovation - UNIT 1Document42 pagesIntroduction To Innovation - UNIT 1Manoj Kumar Joshi100% (1)

- IoT Emerging Technologies GuideDocument53 pagesIoT Emerging Technologies GuideManoj Kumar JoshiNo ratings yet

- Unit I ADocument30 pagesUnit I AManoj Kumar JoshiNo ratings yet

- B.tech Syllabus For BOS 13.7.2015Document50 pagesB.tech Syllabus For BOS 13.7.2015Manoj Kumar JoshiNo ratings yet

- Creative Thinking Unit - 2 IDTDocument69 pagesCreative Thinking Unit - 2 IDTManoj Kumar JoshiNo ratings yet

- Course No.: Course Title: InstructorDocument5 pagesCourse No.: Course Title: InstructorManoj Kumar Joshi100% (1)

- Reserve Bank of India: ChrschmurthyDocument31 pagesReserve Bank of India: ChrschmurthyManoj Kumar JoshiNo ratings yet

- Creative Thinking Unit - 2 IDTDocument69 pagesCreative Thinking Unit - 2 IDTManoj Kumar JoshiNo ratings yet

- Business EnvironmentDocument77 pagesBusiness EnvironmentVivek AnanthaNo ratings yet

- UPPSC Assistant Forest Conservator Sample Question Paper PDFDocument38 pagesUPPSC Assistant Forest Conservator Sample Question Paper PDFMOHIT SINGHNo ratings yet

- Food and Agri Business School (FABS) SVVR Educational Society (For PGDM (ABM), 2015-17 Batch)Document3 pagesFood and Agri Business School (FABS) SVVR Educational Society (For PGDM (ABM), 2015-17 Batch)Manoj Kumar JoshiNo ratings yet

- Information Technology and Management Information SystemsDocument2 pagesInformation Technology and Management Information SystemsManoj Kumar JoshiNo ratings yet

- Risk Management - MicrofinanceDocument53 pagesRisk Management - MicrofinanceManoj Kumar JoshiNo ratings yet

- Final Report - SADHAN - 2014Document112 pagesFinal Report - SADHAN - 2014Manoj Kumar JoshiNo ratings yet

- Managerial Economics 3Document12 pagesManagerial Economics 3Manoj Kumar JoshiNo ratings yet

- Written Analysis and Communication - II Trisemester - PGDM (Agri Business)Document3 pagesWritten Analysis and Communication - II Trisemester - PGDM (Agri Business)Manoj Kumar JoshiNo ratings yet

- Operational Self-Sufficiency of Select MFIs-30.9.2015Document31 pagesOperational Self-Sufficiency of Select MFIs-30.9.2015Manoj Kumar Joshi100% (1)

- Managerial Economics and Decision MakingDocument15 pagesManagerial Economics and Decision MakingManoj Kumar JoshiNo ratings yet

- Managerial Economics 2Document35 pagesManagerial Economics 2Manoj Kumar JoshiNo ratings yet

- Information Technology & MIS-1Document23 pagesInformation Technology & MIS-1Manoj Kumar JoshiNo ratings yet

- Solid State Physics - Detailled CurriculumDocument1 pageSolid State Physics - Detailled CurriculumManoj Kumar JoshiNo ratings yet

- Purshasing Life InsuranceDocument4 pagesPurshasing Life InsuranceManoj Kumar JoshiNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Adopt-A-Family: of The Palm Beaches, IncDocument4 pagesAdopt-A-Family: of The Palm Beaches, Incm_constantine8807No ratings yet

- Acme New RLDDocument2 pagesAcme New RLDAfaz UddinNo ratings yet

- A Report On Merchant Banking and Portfolio Management Rules: A Comparison of Bangladesh and IndiaDocument49 pagesA Report On Merchant Banking and Portfolio Management Rules: A Comparison of Bangladesh and IndiaYeasir ArafatNo ratings yet

- Role of Board of Directors in Corporate GovernanceDocument11 pagesRole of Board of Directors in Corporate GovernancebidhanNo ratings yet

- Organization and Environmental Factors: S.Bharathi Mca, Mba., M.Phil, PGDPM&LLDocument25 pagesOrganization and Environmental Factors: S.Bharathi Mca, Mba., M.Phil, PGDPM&LLbharathimanian100% (1)

- SidbiDocument26 pagesSidbiAnand JoshiNo ratings yet

- Atlas Copco and Sandvik Shank Adapter GuideDocument11 pagesAtlas Copco and Sandvik Shank Adapter GuideSubhash KediaNo ratings yet

- Articles of Incorporation TemplateDocument2 pagesArticles of Incorporation Templateaeron.dingli100% (1)

- National Bank of Ethiopia - WikipediaDocument16 pagesNational Bank of Ethiopia - WikipediaKal kidan100% (1)

- A Brief Summary of The Caesars Entertainment Examiner's ReportDocument5 pagesA Brief Summary of The Caesars Entertainment Examiner's ReportUH_Gaming_ResearchNo ratings yet

- Gap Fillers-Formation-Of-Limited-Companies PDFDocument2 pagesGap Fillers-Formation-Of-Limited-Companies PDFemonimtiazNo ratings yet

- Luxury Hotel in MadridDocument5 pagesLuxury Hotel in MadridNiel CabañogNo ratings yet

- Assessing SIR Consultants on Job Satisfaction and CultureDocument2 pagesAssessing SIR Consultants on Job Satisfaction and CultureRukhsar Abbas Ali .No ratings yet

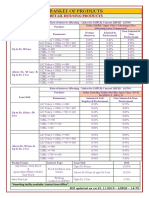

- BASKET OF RETAIL PRODUCTS RATESDocument3 pagesBASKET OF RETAIL PRODUCTS RATESVirendra K VermaNo ratings yet

- HP MTC Reply Brief (Redacted)Document9 pagesHP MTC Reply Brief (Redacted)Maddie O'DoulNo ratings yet

- Demat of Shares: Take Your First Step Into The Financial Jungle. Demat ServicesDocument71 pagesDemat of Shares: Take Your First Step Into The Financial Jungle. Demat ServicesNitesh GoruleNo ratings yet

- Organizing Genius - The Skunk WorksDocument14 pagesOrganizing Genius - The Skunk WorksAbhimanyu SinghNo ratings yet

- FM Global - Pipe Friction Loss FactorDocument64 pagesFM Global - Pipe Friction Loss Factoryunying21100% (1)

- Offshore Shell Games 2014Document56 pagesOffshore Shell Games 2014Global Financial IntegrityNo ratings yet

- Principal Adviser Principal Adviser Principal Adviser Principal Adviser Principal AdviserDocument74 pagesPrincipal Adviser Principal Adviser Principal Adviser Principal Adviser Principal AdviserCheong Wei HaoNo ratings yet

- Pricing GamesDocument5 pagesPricing Gamessubhankar daNo ratings yet

- Salary Bills (Pa)Document72 pagesSalary Bills (Pa)MD.khalilNo ratings yet

- NotesDocument75 pagesNotesJagadeesh KrishnamurthyNo ratings yet

- Auditing: Integral To The Economy: Chapter 1Document48 pagesAuditing: Integral To The Economy: Chapter 1Alain Fung Land MakNo ratings yet

- Bataan Shipyard v. PCGGDocument21 pagesBataan Shipyard v. PCGGRhoddickMagrataNo ratings yet

- Intermediate Accounting I IntroductionDocument6 pagesIntermediate Accounting I IntroductionJoovs JoovhoNo ratings yet

- Knight Frank - The Wealth Report 2019Document49 pagesKnight Frank - The Wealth Report 2019inforumdocs100% (1)

- ICICIDirect SymbolsDocument49 pagesICICIDirect SymbolsKrishnamoorthy SubramaniamNo ratings yet