Professional Documents

Culture Documents

Telecoms Reinvention-Optimising The Online Customer Experience

Uploaded by

quocircaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Telecoms Reinvention-Optimising The Online Customer Experience

Uploaded by

quocircaCopyright:

Available Formats

Telecoms reinvention—optimising the

online customer experience

February 2010

As networks, devices and media converge, telecoms companies have increasingly

complex catalogues of products and services on offer to customers who are, in

turn, becoming more aware that they can easily switch to other providers.

However, the sales process is complicated by a plethora of options , influences

from new media, Web 2.0 and social networking, as well as completely different

methods of communication and transacting. Telecoms companies need to find

ways to efficiently, effectively and consistently engage with customers to

optimise their whole experience and capitalise on these other influences rather

than lose out to them.

Rob Bamforth Clive Longbottom

Quocirca Ltd Quocirca Ltd

Tel : +44 7802 175796 Tel: +44 118 9483360

Email: Email:

rob.bamforth@quocirca.com clive.longbottom@quocirca.com

An independent report by Quocirca Ltd.

www.quocirca.com

Commissioned by ATG

© Quocirca 2010

Telecoms reinvention—optimising the online customer experience February 2010

1. The industry challenge 2. Evolution of commerce

Connectivity itself has become a commodity, so Commerce may have started as a simple transaction—

telecoms companies (telcos) can no longer rely on offering goods, agreeing on a price and then

traditional business models, channels or services as exchanging money for the goods—but there have long

sources of revenue. They still own a critical billing been other elements at play. As any given market

relationship with their customers, but need to be matures, the importance of these other factors rise.

flexible and innovative while dealing with more

complex support challenges and potentially escalating The vendor has to attract interest from prospects and

costs. existing customers through marketing and creating

awareness. As the purchaser weighs options and

However, businesses and consumers are under comes to a decision there are many factors that will

financial pressure, and the telecoms industry needs to influence the decision. After the sale, there will be a

invest in network infrastructure, technologies and longer term relationship, supporting the purchaser

capacity to meet ever-increasing customer demands through the use of the goods purchased, and the

whilst still delivering on shareholder expectations. potential of further sales, continuing the cycle.

Telcos face a number of complex dilemmas, including:

- Traditional or new services: revenues from voice

are falling, and data is typically offered in all-you-

can-eat tariffs. Operators must develop broader

catalogues and be full service providers.

- New entrants or new partners: IT players such as

Apple and Google are shifting the revenue share

balance of power. Operators need to be flexible,

innovative and less internally focussed.

- Confusion or range: Large catalogues of products

or service offerings help maximise revenues and

can be beneficial, but create sales complexity. It is

increasingly important for offers to be targeted

and personalised.

- Product or consumer led: changes to the buyers’

behaviour means that customers no longer

silently switch or make buying decisions in This cycle is well established, but technology has

isolation. Operators need to understand and changed the rules, allowing any aspect of it to be

participate in the social network revolution. conducted remotely, and involve more or different

- Consistency or channel variety: there are participants. New media offers new marketing

multiple forms of customer connection—in-store, opportunities and the street presence has been joined

online, by phone, on handset—but the by the internet presence. The channels may have

commercial experience transcends them all. evolved, but the goal remains the same—a successful

Operators need to make this consistent. sale and a satisfied customer.

- Satisfaction or support: keeping customers

satisfied is increasingly expensive as devices like Bricks to clicks

smartphones and networks become more Physical presence or store locations were traditionally

sophisticated. Operators need to keep costs the place where transactions occurred and goods

down, but maintain service satisfaction levels. supplied. The emergence of the internet as a medium

- Local or Global: markets differ—high growth in for sales led some to believe that online (‘clicks’)

emerging, low growth in established—operators would replace physical presence (‘bricks’), with

must tailor to local needs, but avoid the transactions occurring online—‘e-commerce’. For

considerable expense of completely different some sectors this has worked incredibly well, with

systems in each locale. notable large successes such as Amazon (initially a

book seller, but now selling many other things), and

The first paper in this series, “Telecoms companies re- many smaller companies that have now been able to

1

invention—from voice to e-service provision” , extend their reach online and, in some cases, greatly

identified underlying trends driving the need for reduce the cost of retail space.

telecoms evolution. This paper explores aspects that

operators can address using a more integrated Online sales continue to grow year-on-year for a wide

approach to e-commerce. range of goods including clothes and food as well as

© Quocirca 2010 Page 2

Telecoms reinvention—optimising the online customer experience February 2010

the early successes of books, CDs and consumer comments, feedback and unfettered tweeting on

electronics. However, competition is fierce and, Twitter.

despite improving internet search engines and a - Social selling, trading and swapping through

myriad of price comparison websites, making online marketplaces such as eBay has turned

connections to customers is increasingly difficult for them into mainstream outlets.

many small suppliers. A high street presence still - User generated support networks and forums

generates awareness and provides an accessible route deliver support messages in a way that

for pre-sales advice and sales. Despite the growth of empathises with the needs of others—suppliers

their online and telesales operations, mobile phone only need to participate with occasional expert

operators still have retail stores and channel partners comment and moderation rather than dominate.

in many cities and towns.

Just as other groups of influencers and business

Stores can complement other channels more closely partners, such as resellers, are regarded as part of the

than some operators imagine. Some may be sales channel, so too should social networks. This

franchised operations, and others may lack staff with means they should be supported, encouraged and

precise expert knowledge for what is increasingly a rewarded as are other channels. Social networking has

complex purchase. However, if the online systems are different attributes, but should be recognised for the

closely synchronised to the retail operations they can impact this highly influential informal channel has on

be used in-store either by suitably trained staff or purchasers, as it may be even more fickle and flighty

directly by customers as self service ‘kiosks’. than official ones, especially if ignored.

In addition to awareness and pre-sales influence,

there is also the possibility for customers to visit 3. A multi-channel world

stores for product pickup or support services that

have been pre-reserved online. The growing number Advances in technology have broadened the options

of successful Apple stores, which look more like making the journey to purchase more complex,

technology playgrounds and lecture halls than shops, because these options are not discrete alternatives,

indicate a shift in the value of the retail location, but interrelated paths. At one time, physical retail

providing it complements, rather than competes with, stores and telephone mail order catalogue companies

online operations. were two very different types of business, with

separate processes. Hybrid approaches from

Social networking companies such as Argos in the UK have

Another element exploited by Apple, with its long demonstrated the value of this combined model.

established and dedicated following, is people. Not

just enthusiastic staff, but also exploiting the much When moving to e-commerce, traditional companies

larger numbers of diehard fans and opinion formers initially maintained separate internet operations,

everywhere. often with an IT-led mentality, discrete from the ‘main

business’. This is no longer an effective model, as not

The internet provides a medium to bring together all only should e-commerce be regarded as just another

sorts of individuals with a common interest. The rapid channel to the overall commerce process, but

growth of online social interaction from the once advances in communications technology have led to

highly techie newsgroups and bulletin boards into the appearance of other complementary channels.

chat rooms, forums, messaging and social networks

has become a powerful influence on all aspects of

commerce:

- Awareness through viral communication. An

email, a text message, a link are so easily sent and

replicated through an entire network. It may be

less predictable than traditional marketing, and

difficult to measure, but can deliver an

outstanding positive contribution if appropriately

targeted and couched—or a negative one if

poorly thought out or implemented.

- Peer influence, which will range from positive via

recommendation engines and reviews, through to

negative ones from unconstrained blog

© Quocirca 2010 Page 3

Telecoms reinvention—optimising the online customer experience February 2010

Social networks, as mentioned earlier, now have a There are many other combinations and paths. In the

much larger impact on all stages of the commercial past, the operator dictated the route; now it has to be

process. In addition, mobile devices and networks consumer led, and the progressive companies are

have become sufficiently powerful to allow mobile adapting their approaches to meet the new model.

interaction at any stage of the sales cycle, from simple

awareness campaigns using SMS to on-device

applications that support transactions or provide 4. Delivering consistent customer

delivery alerts.

experiences

Leaving any of these channels under the direction or

control of technical operations will mean that much of The telecoms industry, just like any other, has to take

their value is lost. The primary business functions— an integrated approach to commerce right through

marketing, sales, fulfillment and support—need to the buying cycle and must develop all channels. In

take advantage of the available channels directly. many respects, more is expected of those involved in

this industry, due to their understanding of network

To provide the best customer experience means benefits, but like unshod ‘cobbler’s children’, telcos

exploiting the best capabilities of each channel, but are often slower to exploit their own technologies.

allowing the user to choose which is most appropriate

at any given time, and to flip between them as Complexity and simplicity

necessary. There are many reasons why telcos should do more.

In particular, they have to present what is often a

large, unwieldy and complex set of products in a way

that customers can understand. So first they have to

Personalising online experience to move from a technology- or product-led sales process

increase satisfaction: to one that is customer-led. This means being able to

Major US wireless operator, AT&T, saw an identify specific customer needs and then rapidly and

opportunity to build up its reputation flexibly package services adapted to them.

based on superior customer experience. It

had to increase customer engagement by To do this, operators need to be able to look across

offering a more personal customer their entire product and service offering and create

experience. flexible bundles that are not limited by internal

divisions or product lines, but on a wider proposition.

This required eliminating home grown They then need to be able to alter pricing and billing

legacy systems and re-engineering its models in a flexible way to adapt to particular market

entire e-commerce infrastructure to be conditions, the aspirations of different demographic

fully customer relevant for its entire range groups, and even individual customer requirements.

of products and services. AT&T used ATG

as the platform for its B2B site to fulfil its Integration and differentiation

vision of a personalised and targeted The first steps involve dismantling the siloed mentality

customer experience. that exists in many organizations. One department

alone does not ‘own’ the customer; all have a part to

AT&T rolled out over 50,000 unique sites play in the customer relationship.

to its customers – all managed centrally

from the ATG platform. New customer

additions increased by nearly 100% year-

over-year and it has achieved a

significantly reduced customer churn rate.

An advertisement may be seen on a billboard at the

side of the road, discussed over a few text messages,

evaluated online through recommendations and peer

reviews, with goods ordered over the phone for pick

up in store with a notification sent via email to advise

of collection. Post sales support may be via a web-

initiated call back, an online forum or a call into an

interactive voice response system.

© Quocirca 2010 Page 4

Telecoms reinvention—optimising the online customer experience February 2010

Creating a common view of the customer across the

organisation brings benefits to all; customer service This is not simply about trying to cross-sell or make

issues can be brought to the surface earlier as some simple recommendations in the manner of early e-

will arise during marketing and sales, unmet needs commerce systems, but about making the entire cycle

unearthed during support activities can be brought to of interaction as efficient as possible.

the attention of marketing.

Complex and broad quantities of information have to

Building on the common customer view with a be streamlined, condensed and presented in an

common set of products and services, offered acceptable way, personalised to the individual.

consistently across all possible modes of commercial Unnecessary or irrelevant options should be filtered

channels, creates a number of opportunities. If this for clarity. Advice and past decisions should be noted

common business architecture can then be adapted to to prioritise future communication and sales choices.

meet specific market needs, that presents significant Intelligent routing should be applied to guide support

benefits: services.

- Thinking global, acting local: products and With a common base for managing the information,

services can be extended and tailored to appeal processes and roles, supporting a consistent business

to new regions or markets, but without the cost framework, these types of personalisation features

of creating a new infrastructure each time. can be applied irrespective of the channel or the stage

Consistency not only keeps costs down, but in the sales process. Making things straightforward,

allows a more rapid approach to gain first mover efficient and pleasant for the user will increase the

advantage. likelihood of a successful conclusion—a satisfied

- Trend surfing: the rapid success of Apple’s App customer.

Store surprised many in the industry, and there

has been a rush to follow. Having the flexibility to 5. Conclusion

be able to create or exploit new commercial

models during times of rapid expansion (or adjust Telecoms companies face many challenges as their

others down in a recession), is valuable traditional business is under threat from falling

commercial agility. margins, the high cost of new investments and new

- Flexible line extension: new products and competitors—IT and internet companies like Google,

services can be introduced and withdrawn more Skype and Apple.

rapidly to meet transient market needs or one-off

events, e.g. major sporting events such as the But beyond their network inventories, they have

Olympics, movie releases or celebrity fads. perhaps a far more valuable asset; a billing

- Flexible brand extension: new lines of business relationship with customers. As connectivity becomes

can be created within a region, to appeal to new increasingly a commodity, operators have an

audiences, without undermining existing brands opportunity to nurture and extend the relationship

or incurring the costs of setting up a new with their customers. However, they have to rapidly

business. An interesting example of this is the take smarter and more incisive steps, re-organise their

social network oriented SIM-only mobile network, internal divisions to take a customer, not technology

‘giffgaff’, launched by O2. led approach.

This re-orientation around the customer, as well as

Personalisation and smarter presentation the impact with other third party relationships will

Going hand in hand with the need for a common and form the main focus of the next paper in this series on

consistent flexible underpinning is the requirement telecoms re-invention.

for information, product and service adaptation. This

tailoring is necessary at all stages in the sales cycle

References:

and should take a number of aspects into account:

- Limitations and capabilities of the mode of 1 – Quocirca “Telecoms companies re-invention—from

access—device and network voice to e-service provision” report, October 2009

- Current context of the individual—location,

access mechanism, time

- Demographic information defining the individual

- Behaviour and history of recent known actions

- Social context, group memberships and social

network interactions

© Quocirca 2010 Page 5

Telecoms reinvention—optimising the online customer experience February 2010

Recommendations for optimising the customer commerce experience

Obtain executive sponsorship. 2010 is no time to repeat the mistakes of the early internet boom, where many

companies tacked a web presence onto the side of the organisation where there was an enthusiast who acted as the

internal champion. Not only does this make it difficult to get the right level of resources, it also makes it almost

impossible to get sufficient senior buy-in in other departments where the approach may upset some internal politics

or someone else’s hidden agenda. Get senior sponsorship, ideally at board level, and it becomes a strategic

imperative with deliverable goals, rather than a ‘science project’ with vague aims.

Synchronise marketing, sales and support. Each provide and use information about customers, and yet this is often

held in separate systems, with many companies still managing multiple customer databases. Establishing a common

customer view will make it easier to correctly target marketing initiatives, enable personalised cross-selling or up-

selling, and encourage pro-active support initiatives.

Business led, not IT led. Too often technology oriented companies with complex, technical products and services

assume too much specialised knowledge in their own staff, channels and customers. Products are developed and

designed by technical experts with a multiplicity of features included, which are often presented as benefits. Most will

have merit, and will generally be assessed by the in-house technology team, but this is not the best way to design

great systems. Business needs should be identified first and used to set the design criteria.

End the ‘build versus buy’ argument. The capabilities required for enterprise-ready, multi-channel commerce

products that span differing departmental functions, from marketing through sales and support, are well beyond the

resources of even the most effective IT departments. This has become a vital foundation of the business and so

requires a professional, well-engineered approach to deliver the required solution. Developing this internally in an ad

hoc manner is no longer a suitable approach.

Select suppliers for strength in depth. There is plenty of innovation in this technology area, and new entrant start-

ups. Some will thrive and survive, but many will wither in spite of good technology. So any investment to support

common commerce processes will need long term commitments and therefore suppliers with solid financial durability

who are capable of significant R&D investment to keep up with new technologies.

Adopt an ‘agile’ approach. Make the assumption that things will change more often than you expect. Even when the

project appears huge, it can be split into manageable, achievable units that can be honed. Better to take an approach

when small successes can be linked together, and failures discarded, rather than an all-or-nothing, all encompassing

solution. This means getting the initial technical and business architecture right, and using that as the underpinning

for incremental and agile development on top.

Use open integration. Despite taking a strategic and business-led approach, it is unlikely that the decision making will

be perfect. Select technologies that support open standards and allow for integration to ensure that best-of-breed

enhancements can be made to the initial foundation.

Look at the entire customer engagement scenario. The customer’s commercial experience is not simply about the

sales transaction and fulfilment. Indeed, with channels that allow all aspects of the cycle to be distributed and a

growing network of other influences, arguably the actual point of sale is becoming less relevant than the

orchestration of the processes around it. It is in these areas where business is lost—through bad support experiences,

lack of adequate information for decision making, or over-complex shopping cart and delivery logistics nightmares.

With a complex array of channels, potential customer experiences should be mapped out, tested and streamlined to

ensure they work.

© Quocirca 2010 Page 6

Telecoms reinvention—optimising the online customer experience February 2010

About ATG

A trusted, global specialist in e-commerce, ATG (Art Technology Group, Inc., NASDAQ: ARTG) has spent the last

decade focused on helping the world's premier brands maximize the success of their online businesses. ATG

Commerce is the commerce platform and business user application solution top-rated by industry analysts for

powering highly personalized, efficient and effective e-commerce sites. ATG's platform-neutral optimization services

can be easily added to any Web site to increase conversions and reduce abandonment. These services include ATG

Recommendations and ATG's live help services, including ATG eStara Click to Call, and Click to Chat. The company is

headquartered in Cambridge, Massachusetts, with additional locations throughout North America and Europe. For

more information, please visit http://www.atg.com.

About Quocirca

Quocirca is a primary research and analysis company specialising in the business impact of information technology

and communications (ITC). With world-wide, native language reach, Quocirca provides in-depth insights into the

views of buyers and influencers in large, mid-sized and small organisations. Its analyst team is made up of real-world

practitioners with firsthand experience of ITC delivery who continuously research and track the industry and its real

usage in the market.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- IELTS Advantage Speaking and Listening SkillsDocument122 pagesIELTS Advantage Speaking and Listening SkillsAlba Lucía Corrales Reina100% (8)

- Basu and Dutta Accountancy Book Class 12 SolutionsDocument14 pagesBasu and Dutta Accountancy Book Class 12 SolutionsGourab Gorai23% (30)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 2.1 Understanding REACH: How Does REACH Work?Document3 pages2.1 Understanding REACH: How Does REACH Work?xixixoxoNo ratings yet

- Arc Lighting in Architecture - April-May 2019Document148 pagesArc Lighting in Architecture - April-May 2019Muhamad Zahrandika TedjoNo ratings yet

- TestDocument4 pagesTestquocircaNo ratings yet

- WANSpeak Musings - Volume VIDocument19 pagesWANSpeak Musings - Volume VIquocircaNo ratings yet

- Masters of MachinesDocument1 pageMasters of MachinesquocircaNo ratings yet

- Bow To The InevitableDocument3 pagesBow To The InevitablequocircaNo ratings yet

- Mid Term Defense Updated SlidesDocument31 pagesMid Term Defense Updated SlidesRojash ShahiNo ratings yet

- Organization and Its EnvironmentDocument20 pagesOrganization and Its EnvironmentPrasanga PriyankaranNo ratings yet

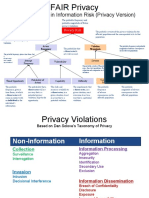

- Factor Analysis in Information Risk (Privacy Version)Document8 pagesFactor Analysis in Information Risk (Privacy Version)Otgonbayar TsengelNo ratings yet

- Md. Fazlul Haque Additional Secretary (RTD) Ex-DG, BIAM FoundationDocument14 pagesMd. Fazlul Haque Additional Secretary (RTD) Ex-DG, BIAM FoundationAbdur RofiqNo ratings yet

- Development Plan: Jawaharlal Nehru Architecture and Fine Arts UniversityDocument13 pagesDevelopment Plan: Jawaharlal Nehru Architecture and Fine Arts Universityrenikunta varshiniNo ratings yet

- History of Installation Art-Arh4472C: The Art Institute of FT Lauderdale Course SyllabusDocument3 pagesHistory of Installation Art-Arh4472C: The Art Institute of FT Lauderdale Course SyllabusLily FakhreddineNo ratings yet

- Week 002-Module Political IdeologiesDocument4 pagesWeek 002-Module Political IdeologiesAlmirah MakalunasNo ratings yet

- The Importance of Npe in Intellectual AspectsDocument9 pagesThe Importance of Npe in Intellectual AspectshafirzihassanNo ratings yet

- UBD LessonDocument4 pagesUBD LessonLeahNewtonNo ratings yet

- ID Authorization Letter To AramcoDocument4 pagesID Authorization Letter To AramcoHaleemUrRashidBangash0% (1)

- GEP JD - TSO CIT - Business Analyst 2021-22Document2 pagesGEP JD - TSO CIT - Business Analyst 2021-22AlberrtodNo ratings yet

- Document A: Reconcentration Camps: US Imperialism/ Spanish American WarDocument3 pagesDocument A: Reconcentration Camps: US Imperialism/ Spanish American Warpito100% (1)

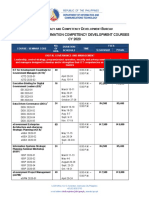

- ICT L C D B Digital Transformation Competency Development Courses CY 2020Document4 pagesICT L C D B Digital Transformation Competency Development Courses CY 2020Val BasilNo ratings yet

- 6 Février 2012 TEAM-NB Sujet: Position Des Organismes Notifiés Sur La Surveillance Et L'examen Des Implants À Haut RisqueDocument3 pages6 Février 2012 TEAM-NB Sujet: Position Des Organismes Notifiés Sur La Surveillance Et L'examen Des Implants À Haut RisqueLeMonde.frNo ratings yet

- NRLDocument69 pagesNRLanitaaimNo ratings yet

- Context Powers Knowledge Management at Dialog AxiataDocument5 pagesContext Powers Knowledge Management at Dialog AxiataMinu DemithaNo ratings yet

- A B Keith (Ed) - Speeches and Documents On Indian Policy 1750-1921 Vol IIDocument394 pagesA B Keith (Ed) - Speeches and Documents On Indian Policy 1750-1921 Vol IIfahmed3010No ratings yet

- Citizens Charter Valenzuela CityDocument591 pagesCitizens Charter Valenzuela CityEsbisiemti ArescomNo ratings yet

- Whitehead and BiosemioticsDocument22 pagesWhitehead and BiosemioticsJ PNo ratings yet

- 2020 GASTPE Orientation Letter To SchoolsDocument3 pages2020 GASTPE Orientation Letter To SchoolsAlfie Arabejo Masong LaperaNo ratings yet

- RSN Referral FormDocument1 pageRSN Referral Formapi-315905321No ratings yet

- Car Modification and Accessories Business Plan Executive SummaryDocument9 pagesCar Modification and Accessories Business Plan Executive Summaryjunaidjavaid99No ratings yet

- Chapter 1 Introduction To Business Process ManagementDocument36 pagesChapter 1 Introduction To Business Process ManagementClaudine Gratela GratilNo ratings yet

- Tourism Engagement Co-Creating Well-Bein PDFDocument349 pagesTourism Engagement Co-Creating Well-Bein PDFMariana ValcacioNo ratings yet

- Entrepreneurship and Enterprise Development Final ExamDocument3 pagesEntrepreneurship and Enterprise Development Final ExammelakuNo ratings yet

- EXTAC - 1010 - Rev - NONCOMBATANT EVACUATION OPERATIONSDocument96 pagesEXTAC - 1010 - Rev - NONCOMBATANT EVACUATION OPERATIONSAbrarNo ratings yet