Professional Documents

Culture Documents

Rectification On Financial Results For The Period Ended June 30, 2015. (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rectification On Financial Results For The Period Ended June 30, 2015. (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

,-f..A~.

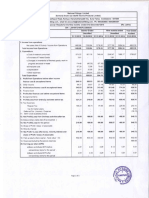

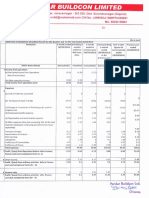

FRONTIER SPRINGS LIMITED

Regd. Off.: KM 25/4 Kalpl Road Rania ,Kanpur- Dehat 209304

Tel. No. 0512-269120708 ,Fax No. 05122691209 ,E-mail: e.s@frontlersprlngs.eo.ln ,Website: http:/www.frontlersprlngs.eo.ln

CIN: L 17119UP1981 PLC005212

STATEMENT OF UN-AUDITED FINANCIAL RESULTS

FOR THE QUARTER ENDED 30th JUNE, 2015

(Rs. In facs)

Quarter Ended

SI. NO .

1.

Particulars

th

30 June,

2015

(Un-audited)

Year Ended

30th June,

31.1 March,

2015

(Audited)

March,

2015

(Audited)

2014

(Un-audited)

(Refer note 2)

(Refer note 2)

(Refer note 2)

756.69

1305.42

592.19

3609.0 1

758.69

1305.42

692.19

3609.01

461 .50

566.64

422.46

1624 .63

(101.66)

131.53

(126.71)

(64.16)

32.23

31.73

334.88

756.68

0.21

36.25

24.30

396.45

1159.37

146.05

31.46

4U3

342.76

711.14

(16.95)

145.16.

132.61

1446.59

3487.03

121 .96

Income Irom Operation s

(a) Net Sales I income from Operations

31

'

Total Income from Operations (Net)

Expenses

2.

a)

Cost 01 Material Consumed

b)

c)

Purchase of Stockin-Trade

Changes in inventories of Fini shed Goods, Work-in-P rogress and

Stockin-Trade

d)

e)

Employee Benefit Expenses

Depreciation & Amo~isat ion Expenses

Other Expenses

Total Expenses

Profit from Operations before Other tneome, Finance Cost &

Exceptional items (1-2)

3.

4.

Other Income

4.47

3.54

2.66

21 .25

5.

Profit from Ordinary Activities before Finance Cost &

Exceptional items (3+4)

4.66

149.59

(16.07)

143.23

22 .70

(18.02)

21.41

126.18

20.24

(36.31)

66.66

56.35

(18.02)

128.18

(36.31)

56.35

6.

7.

Finance cost

Profit from Ordinary Activities after Finance cost but before

Exceptionat items (5-6)

8.

Exce ptional lIems

9.

Profit 1 (Loss) from Ordinary Activities Before Tax Expense. &

Excepttonal items (7+6)

10.

Ta~

11

Net Profit from Ordinary activities after Tax (9-10)

12.

Extraordinary items (Net of Tax Expenses)

Expenses

(10.07)

(6.78)

(15.16)

(15.70)

(28.09)

121.40

(51.49)

40.65

13.

Net Profit for the period (11+12)

(28.09)

121.40

14.

Paidup Equity Share Capital (Face value RS.101 per equity share)

396.32

.396.32

15.

Reserves (Exciliding Revaluation Reserves) as per Balance Sheet

of previous accounting year

16. (i)

(iI)

PART II

A.

1.

b)

40.65

396.32

396.32

1926.31

1954.40

Earning Per Share (EPS)

(0.71)

3.08

(1 .31)

1.03

Basic and Diluted EPS after Extraordi nary items lor the period , for

the year to date and for the previous year (not to be annualised) (In

Rs.)

(0.71)

3.08

(1.31)

1.03

No. of Shares

1945648

1945646

1945646

1945646

Percentage of shareholding

49.40%

49.40%

49.41 %

49.40%

Pledged 1 Encumbered

No. of Shares

Nil

Nil

NIL

Nil

Percentage of shares ( as a % 01 the total share holding of promoter

& promoler group)

NIL

NIL

NIL

Nil

Percentage of shares ( as a % 01 the tolal share capital of the

Company)

NIL

NIL

NIL

NIL

1992863

1992863

1992663

1992663

100%

100%

100% .

100%

50.60%

50.60%

'"

NonEncumbered

No. of Shares

Percentage 01 shares ( as a % of the total shareholding of promoter

& promoter group)

Percentage 01 shares ( as a % 01 Ihe total share capital of the

Company)

INVESTOR

COMPLAINTS

Quaner ended 30.06.2016

SI. NO.

1.

a)

b)

2.

a)

b)

i)

ii

3.

(51 .49)

Promoters and Promoter Group Shareholdlng

a)

B.

SELECT INFORMATION FOR THE QUARTER ENDED 30th JUNE 2015

PARTICULARS OF SHAREHOLDING

Public Shareholdlng

2.

J

I

Pending

(b) Other Operating Income

~~~heu~e~~~n ng of

NIL

Received dUring the

Quarter

I DlsPose:U~~~~rlng the

50.59%

Remaining

50.60%

unre:~I:~:r.t the

NIL

IRs. In Lacs. I

Segment wise Revenue Results and Capital Em~loyed for the Quarter ended 30th JUNE 2015

31~t March,

30 th June,

31 11 March,

30th June,

Particulars

2015

2015

2014

2015

(Audited)

(Un-audited)

(AudIted)

(Un-audited)

Segment Revene (Net of Excise duty & Cess)

3567.44

Coit springs & Forging items

1263.65

692.19

693.66

Roofing Sheels

41 .57

41.57

65.23

1306.42

692.19

3609.01

758.89

Net Salesl Income from Operations

Segment Results :

ProWloss before Inlerest & Ta xes

162.G7

6.65

27.46

113.40

Coil springs & Forging ilems

(097)

(0:97)

(1.15)

ROOfing Sheets

161.10

26.31

6.65

112.43

Total

l ess:

Inlerest (net)

19.11

18.00

17.72

74.59

Unallocable expendilure net of income

34.92

25.44

104.19

25 .22

128.16

Total Profit before Tax

(18.02)

(36.311.

(66.351.

Capital Employed

Seqment Assets Less SeQment Liabilities)

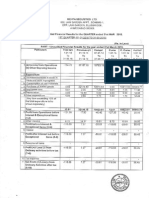

FRONTIER SPRINGS LIMITED

Regd. Off.: KM 25/4 Kalpi Road Rania ,Kanpur- Dehat 209304

CIN:L17119UP1981PLC005212

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES

FOR THE QUARTER ENDED 30th JUNE, 2015

.. _- ...

Sr.No.

Particulars

EQUITY & LIABILITIES

Shareholder's Funds

a) Share Capital

b) Reserves & Surplus

c ) Money Received Against Share Warrants

SUbtotal- Shareholder's Funds

Share Application Money pending allotment

Non-Current Liabilities

a) Long-term Borrowings

b) Deferred Tax Liability

c) Other Long-term Borrowings

d) Long-term Provisions

SUbtotal- Non-Current Liabilities

Current Liabilities

a) Short-Term Borrowings

b) Trade Payables

c) Other Current Liabilities

d) Short-Term Provisions

Subtotal- Current Liabilities

-_ .... -,

30.06.2015

Un-audited

31.03.2015

Audited

396.32

1926.31

396.32

1954.40

2322.63

2350.72

459.47

138.93

7.95

37.17

643.52

440.55

128.86

7.95

21.44

598.80

585.31

767.19

55.00

102.36

1509.86

549.12

909.89

58.29

102.51

1619.81 .

TOTAL EQUITY AND LIABILITIES

4476.01

45li9.33

ASSETS

Non-Current Assets

1

,

2257.12

2216.06

a) Fixed Assets

b) Non-Current Investments

c) Long-Term Loans & Advances

92.45

75.76

15.35

d) Other Non-Current Assets

18.16

SUbtotal- Non-Current Assets

2364.92

2309.98

2

Current Assets

a) Inventories

1356.11

1267.18

b) Trade Receivables

491.90

767.11

c) Cash & Cash Equ ivalents

164.90

146.79

d) Short-Term Loans & Advances

61.38

32.74

e) Other Current Assets

36.80

45.53

Subtotal Current Assets

2111.09

2259.35

TOTAL ASSETS

4476.01

4569.33

NOTES:

The above Un-audited Financial Results were reviewed and recommended by the Audit Committee

and approved by the Board of Directors at their meeting held on August 14, 2015 and the limited

review of the same has been carried out by the Statutory Auditors of the Company.

2

As per the requirement of Schedule II of the Companies Act 2013, effective from 01 .04 .2014, the

company has charged depreciation based on the useful life as prescribed under the Schedule.

3

Corresponding previous period's/year 's figures have been regrouped / rearranged, wherever

applicable.

For and on behalf of the

rs

I i.....

--

(K.L.Bhatia)

Chairman cum Mng. Director

...

~

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Statement of Assets & Liabilties As On September 30, 2016 (Result)Document2 pagesStatement of Assets & Liabilties As On September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- GUJARAT APOLLO INDUSTRIES LIMITED FINANCIAL RESULTSDocument2 pagesGUJARAT APOLLO INDUSTRIES LIMITED FINANCIAL RESULTSTushar PatelNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document1 pageFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Segment Reporting (Rs. in Crore)Document8 pagesSegment Reporting (Rs. in Crore)Tushar PanhaleNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Document3 pagesAnnounces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Avt Naturals (Qtly 2012 12 31)Document1 pageAvt Naturals (Qtly 2012 12 31)Karl_23No ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document22 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2015 (Standalone) (Result)Document1 pageFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- New Listing For PublicationDocument2 pagesNew Listing For PublicationAathira VenadNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2013 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNo ratings yet

- Avt Naturals (Qtly 2011 06 30) PDFDocument1 pageAvt Naturals (Qtly 2011 06 30) PDFKarl_23No ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document11 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Karnataka Bank Results Sep12Document6 pagesKarnataka Bank Results Sep12Naveen SkNo ratings yet

- Revised Financial Results For March 31, 2016 (Result)Document10 pagesRevised Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Reliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003Document3 pagesReliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003ak47ichiNo ratings yet

- BEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Document3 pagesBEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Kapil SharmaNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Avt Naturals (Qtly 2011 12 31) PDFDocument1 pageAvt Naturals (Qtly 2011 12 31) PDFKarl_23No ratings yet

- Avt Naturals (Qtly 2010 03 31) PDFDocument1 pageAvt Naturals (Qtly 2010 03 31) PDFKarl_23No ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- June 2015Document2 pagesJune 2015Aarush VermaNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results For June 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- FinancialResult 30062012Document3 pagesFinancialResult 30062012Raghu NathNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Public Financial Management Systems—Sri Lanka: Key Elements from a Financial Management PerspectiveFrom EverandPublic Financial Management Systems—Sri Lanka: Key Elements from a Financial Management PerspectiveNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Statement Analysis - NestleDocument18 pagesFinancial Statement Analysis - NestleLukshman Rao Rao75% (4)

- MCK 13Document5 pagesMCK 13chandumicrocosm1986No ratings yet

- Ratio Analysis TemplateDocument3 pagesRatio Analysis TemplateTom CatNo ratings yet

- Full Set - Investment AnalysisDocument17 pagesFull Set - Investment AnalysismaiNo ratings yet

- Tutorial 1 A172 Interco TransactionDocument5 pagesTutorial 1 A172 Interco TransactionNisrina NSNo ratings yet

- Level III of CFA Program Mock Exam 3 June, 2019 Revision 1Document65 pagesLevel III of CFA Program Mock Exam 3 June, 2019 Revision 1Yohan CruzNo ratings yet

- Pel ReportDocument98 pagesPel Reportmr_hailian786100% (2)

- Tingalpa Green New Townhouse Development BrochureDocument12 pagesTingalpa Green New Townhouse Development BrochureMick MillanNo ratings yet

- TAXATION OF INCOME UNDER THE MALAYSIAN INCOME TAX ACTDocument7 pagesTAXATION OF INCOME UNDER THE MALAYSIAN INCOME TAX ACTVincent ChenNo ratings yet

- Proyecto Wind La Ventosa MexicoDocument42 pagesProyecto Wind La Ventosa MexicoOscar MoralesNo ratings yet

- Chapter 02Document22 pagesChapter 02Kaveh ArabpourNo ratings yet

- Russell US Indexes 1Document2 pagesRussell US Indexes 1Jaihind PatilNo ratings yet

- Navneet Publications India Ltd Company ProfileDocument19 pagesNavneet Publications India Ltd Company ProfileYash Khanore0% (2)

- Index Investing & Financial Independence For Expats: Getting Started GuideDocument54 pagesIndex Investing & Financial Independence For Expats: Getting Started GuideAmr Mustafa ToradNo ratings yet

- Managerial Accounting Formula SummaryDocument4 pagesManagerial Accounting Formula Summaryمنیر ساداتNo ratings yet

- Office Style Manual, in Section 11.7 It Says, "Names of Vessels Are Quoted in MattersDocument9 pagesOffice Style Manual, in Section 11.7 It Says, "Names of Vessels Are Quoted in MattersFreeman Lawyer100% (1)

- Appraisal - GallagherDocument42 pagesAppraisal - GallagherScott GalvinNo ratings yet

- In Venture Growth & Securities Ltd.Document424 pagesIn Venture Growth & Securities Ltd.adhavvikasNo ratings yet

- Inventory Management Study at Rubber CompanyDocument4 pagesInventory Management Study at Rubber CompanyKarthiga VvsNo ratings yet

- Analysis of Opto Circuits Annual Report 2012 PDFDocument20 pagesAnalysis of Opto Circuits Annual Report 2012 PDFPrudent Investor100% (2)

- Capital Market Theory-Topic FiveDocument62 pagesCapital Market Theory-Topic FiveRita NyairoNo ratings yet

- Ashish Srivastava ProjectDocument112 pagesAshish Srivastava ProjectSachin LeeNo ratings yet

- NNN Bank Report Q1 2019Document3 pagesNNN Bank Report Q1 2019netleaseNo ratings yet

- Accounting ManualDocument5 pagesAccounting Manualnarasi64No ratings yet

- CIR Vs Japan AirlinesDocument1 pageCIR Vs Japan AirlinesJR BillonesNo ratings yet

- Ebook: Financial Advice With Robo Advisors (English)Document25 pagesEbook: Financial Advice With Robo Advisors (English)BBVA Innovation CenterNo ratings yet

- Forward MarketDocument18 pagesForward MarketsachinremaNo ratings yet

- HDFC FMP One PagerDocument1 pageHDFC FMP One PagerDrashti Investments100% (1)

- ReconciliationDocument15 pagesReconciliationManisha AmudaNo ratings yet

- Mange Finances: BSBFIM601 Assessment - 3Document9 pagesMange Finances: BSBFIM601 Assessment - 3Nayab Arshad100% (2)