Professional Documents

Culture Documents

Bca4040 SLM Unit 1fdvsva0

Uploaded by

ParvinderSinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bca4040 SLM Unit 1fdvsva0

Uploaded by

ParvinderSinghCopyright:

Available Formats

Principles of Financial Accounting and Management

Unit 10

Unit 10

Funds Flow Analysis

Structure:

10.1 Introduction

Objectives

10.2 Meaning of Fund Flow Statement

10.3 Objectives of Fund Flow Statement

10.4 Steps in Preparation of Fund Flow Statement

10.5 Computation of changes in Working Capital and Fund from Operation

10.6 Summary

10.7 Terminal Questions

10.8 Answers

10.1 Introduction

For the purpose of fund flow statement the term fund means net working

capital. The flow of fund will occur in a business, when a transaction results

in a change i.e., increase or decrease in the amount of fund. It is a technical

device designed to highlight the changes in the financial condition of a

business enterprise between two balance sheets.

Objectives:

After standing this unit you will be able to:

Explain the meaning of Fund Flow Statement.

Explain the objectives of Fund Flow Statement.

Compute Fund from Operations.

10.2 Meaning of Fund Flow Statement

Fund may be interpreted in various ways as (a) Cash, (b) Total current

assets, (c) Net working capital, (d) Net current assets. For the purpose of

fund flow statement the term fund means net working capital. The flow of

fund will occur in a business, when a transaction results in a change

i.e., increase or decrease in the amount of fund.

According to Robert Anthony, the Fund Flow Statement describes the

sources from which additional funds were derived and the uses to which

these funds were put.

Sikkim Manipal University

Page No.: 166

Principles of Financial Accounting and Management

Unit 10

Different Names of Fund-flow Statement

A Funds Statement

A statement of sources and uses of fund

A statement of sources and application of fund

Where got and where gone statement

Inflow and outflow of fund statement

10.3 Objectives of Fund Flow Statement

The main purposes of Fund Flow Statement are:

1. To help to understand the changes in assets and asset sources which

are not readily evident in the income statement or financial statement.

2. To inform as to how the loans to the business have been used.

3. To point out the financial strengths and weaknesses of the business.

Format of Fund Flow Statement

Sources

Fund from operation

Non-trading incomes

Issue of shares

Issue of debentures

Borrowing of loans

Acceptance of deposits

Sale of fixed assets

Sale of Investments

(Long Term)

Decrease in working capital

Applications

Fund lost in operations

Non-operating expenses

Redemption of redeemable preference share

Redemption of debentures

Repayment of loans

Repayment of deposits

Purchase of fixed assets

Purchase of long term Instruments

Increase in working capital

10.4 Steps in Preparation of Fund Flow Statement

1. Preparation of schedule changes in working capital (taking current items

only).

2. Preparation of adjusted profit and loss account (to know fund from [or]

fund lost in operations).

3. Preparation of accounts for non-current items (Ascertain the hidden

information).

4. Preparation of the fund flow statement.

Sikkim Manipal University

Page No.: 167

Principles of Financial Accounting and Management

Unit 10

Format of Schedule of Changes in Working Capital

Particulars

Previous Year

Current year

Increase in

W/c

Decrease in

W/c

Current Assets

Cash in hand

Cash at bank

Bills receivable

Debtors

Inventory

Prepaid expenses

Short-term investment

(A) Total

Current Liability

Bills payable

Creditors

Outstanding expenses

Accrued expenses

Income received in advance

Bank overdraft

Cash credit from banks

Short-term loan

Short-term deposit

Provision for taxation

Proposed dividend

Provision against current assets

(B) Total

Working Capital (C)

(C = A B)

Increase in W/C

Decrease in W/C

Fund from operation can be ascertained by preparing adjusted profit and

loss account. It may be prepared in statement form or account form.

Sikkim Manipal University

Page No.: 168

Principles of Financial Accounting and Management

Unit 10

Format of Adjusted Profit and Loss Account

To Bal. B/d (P&L Account Dr. Bal.)

To Non-operating Exp.

To Depreciation on Fixed Assets

To Goodwill written-off

To Patent & trademark off

To Preliminary expenditure

To Discount on issue of shares &

Debentures

To Loss on sale of investment

To Loss on sale of Fixed Assets

To damages paid under law

To Premium on redemption of profit

Share and debentures

To Interim dividend

To Dividend declared

By Bal. B/d (P&L Account Cr. Bal.)

By Non-operating Incomes

By Profit on sale of Investment

By profit on sale of fixed asset

By Dividend on Investment

By Interest on Investment

By Rent received, gift received

By Damages received under law

By Transfer from general reserve

(A) Total

To ascertain the hidden information, we have to prepare accounts for all

non-current items of assets and liabilities (whether adjustment is given or

not) then only easier to find the inflow and outflow of funds.

I. Self Assessment Questions

1. The term fund means _______________

2. The flow of fund will occur in a business, when a transaction results in

____________

3. According to _____________ the Fund Flow Statement describes the

sources from which additional funds were derived and the uses to which

these funds were put.

4. The main purposes of Fund Flow Statement are:

A) To help to understand the changes in assets and asset sources

which are not readily evident in the income statement or financial

statement.

B) To inform as to how the loans to the business have been used.

C) To point out the financial strengths and weaknesses of the business.

D) All the above

Sikkim Manipal University

Page No.: 169

Principles of Financial Accounting and Management

Unit 10

10.5 Computation of changes in Working Capital and Fund from

Operations

Illustration 1

From the following balance sheets of Mr. M. prepare the statement of

schedule of changes in working capital.

Balance Sheet as at December 31

Liabilities

2005

Equity Capital

Debentures

2006

5,00,000 5,00,000

3,70,000 4,50,000

Tax payable

Accounts Payable

Interest payable

Dividend payable

77,000

43,000

96,000 1,92,000

37,000

45,000

50,000

35,000

11,30,000 12,65,000

Assets

2005

2006

F. assets

6,00,000

7,00,000

Long-term

2,00,000

1,00,000

Investment

Working progress

80,000

90,000

Stock-in-trade

1,50,000

2,25,000

Account receivable 70,000

1,40,000

Cash

30,000

10,000

11,30,000 12,65,000

Solution:

Statement of changes in Working Capital

Particulars

2005

Rs.

Current Assets:

Cash

30,000

Accounts Receivable

70,000

Stock-in-trade

1,50,000

Work-in-progress

80,000

Total Current Assets

3,30,000

Tax payable

77,000

Accounts payable

96,000

Interest payable

37,000

Dividend payable

50,000

Total Current Liabilities 2,60,000

Working Capital (CA-CL) 70,000

Net increase in

Working capital (B/f)

80,000

Total

Sikkim Manipal University

2006

Rs.

Effect on working capital

Increase Rs. Decrease Rs.

10,000

1,40,000

2,25,000

90,000

4,65,000

43,000

1,92,000

45,000

35,000

3,15,000

1,50,000

20,000

1,50,000 1,50,000

70,000

75,000

10,000

34,000

96,000

8,000

15,000

80,000

2,04,000

2,04,000

Page No.: 170

Principles of Financial Accounting and Management

Unit 10

Illustration 2

Calculate the fund from operation from the following details as on 31st

March, 2007.

1. Net profit for the year ended 31st March, 2007 Rs. 6,50,000.

2. Gain on sale of building Rs. 35,500.

3. Written of Goodwill 10% from the book value of Rs. 1,80,000.

4. Old machine sold for Rs. 6,500 worth Rs. 8,000.

5. Rs. 1,25,000 have been transferred to the general reserve fund.

6. Rs. 1,30,000 is provided for Depreciation.

Solution:

Adjusted Profit and Loss Account

To Goodwill

To loss on sale

of machinery

To general reserve

To depreciation

To closing balance

Rs.

18,000

1,500

By sale of building (gain)

By balance c/d

(Fund from operation)

Rs.

35,500

8,89,000

1,25,000

1,30,000

6,50,000

9,24,500

9,24,500

Fund from operational can be calculated alternatively in a statement form.

Net profit of the year

6,50,000

Add: Non-operating expenditure

Goodwill written-off

18,000

Loss on sale of machinery

1,500

General reserve

1,25,000

Depreciation

1,30,000

2,74,500

9,24,500

Less: Non-operating incomes

Gain on sale of buildings

35,500

Fund from operation

Sikkim Manipal University

8,89,000

Page No.: 171

Principles of Financial Accounting and Management

Unit 10

Illustration 3

From the following details calculate fund from operations:

Rs.

Opening balance of Profit & Loss A/c

25,000

Salaries

5,000

Discount on issue of debentures

2,000

Rent

3,000

Provision for bad debts

1,000

Transfer to G. Reserve

1,000

Refund of Tax

3,000

Profit on sale of building

5,000

Depreciation on plant

5,000

Preliminary exp. written-off

2,000

Goodwill written-off

3,000

Loss on sale of plant

2,000

Provision for tax

4,000

Dividend received

5,000

Closing balance of Profit & Loss A/c

60,000

Proposed Dividend

6,000

Solution:

Adjusted Profit and Loss Account

To balance b/d

To depreciation on plant

To provision for tax

To loss on sale of plant

To discount on issue of

debentures

To provision for bad debts

To G. reserve (transfer)

To Prel. Exp. written-off

To Goodwill written-off

To proposed dividend

60,000

5,000

4,000

2,000

2,000

1,000

1,000

2,000

3,000

6,000

86,000

Sikkim Manipal University

By profit on sale of building 5,000

By refund of tax

3,000

By dividend value

5,000

By Balance b/d

25,000

By Balance c/d

48,000

(fund from operation)

86,000

Page No.: 172

Principles of Financial Accounting and Management

Alternatively,

Net Profit (difference between opening and closing balance)

Add : Provision for bad debts

1,000

G. Reserve (transfer)

1,000

Depreciation

5,000

Provision for tax

4,000

Goodwill written-off

3,000

Prel. Exp. written-off

2,000

Discount on issue of debentures

2,000

Proposed dividend

6,000

Loss on sale of plant

2,000

Refund of Tax

Dividend received

Profit on sale of building

Fund from operation

3,000

5,000

5,000

Unit 10

35,000

26,000

61,000

13,000

48,000

Illustration 4

A company reported current profit of Rs. 70,000 after incorporating the

following:

Loss on sale of equipment

10,000

Premium on redemption of

1,500

Debentures

Discount on issue of debentures 2,000

Depreciation on machinery and 20,000

Building

Depletion of natural resources

10,000

Amortization of goodwill

30,000

Interim dividend

Gain from sale of

non-current assets

Excess provision of taxation

4,000

22,000

Dividend income

General Reserve

4,000

5,000

Preliminary expenses

Profit on revaluation of

Investment

1,000

2,500

25,000

Derive the net inflow of funds from the operation.

Sikkim Manipal University

Page No.: 173

Principles of Financial Accounting and Management

Solution

Net profit

Add : Non-Operation Expenses:

Loss on sale of equipment

Depreciation of natural resources

Discount on issue of debentures

Depreciation on machinery

Amortization of goodwill

Interim dividend

Provision for tax

G. Reserve

Prel. Exp.

Unit 10

70,000

10,000

10,000

2,000

20,000

30,000

25,000

22,000

5,000

1,000

1,25,000

1,95,000

Less : Non-operating income:

Dividend Income

Gain from sale of non-current assets

Net fund from operation

4,000

4,000

8,000

1,87,000

Illustration 5

From the following balance sheets of ABC Ltd., on 31-12-2005 and 2006

prepare a schedule of changes in working capital and fund flow statement.

Liabilities

Share Capital

General Reserve

P & L A/c

Sundry Creditors

Bills payable

Provision for tax

Provision for

Doubtful debts

2005

2006

Rs.

Rs.

1,00,000 1,00,000

14,000

18,000

16,000

13,000

8,000

5,400

1,200

800

16,000

18,000

400

600

1,55,600 1,55,800

Goodwill

Buildings

Plant

Investment

Stock

Bills receivable

Debtors

Cash at bank

Assets

2005

Rs.

12,000

40,000

37,000

10,000

30,000

2,000

18,000

6,600

2006

Rs.

12,000

36,000

36,000

11,000

23,400

3,200

19,000

15,200

1,55,600

1,55,800

Adjustments

1. Depreciation charges on plant and buildings Rs. 4,000 each.

2. Provision for taxation of Rs. 19,000 was made during the year 2006.

3. Interim dividend of Rs. 8,000 was paid during the year 2006.

Sikkim Manipal University

Page No.: 174

Principles of Financial Accounting and Management

Unit 10

Solution

Step-I

Schedule of Changes in Working Capital

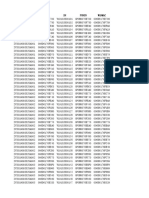

Particulars

Current Assets

Stock

B/R

Drs.

Cash

Total

Current Liabilities

Crs.

B/P

Total CL

W/C (CA CL)

W/C (+)

2005

2006

30,000

2,000

18,000

6,600

56,600

23,400

3,200

19,000

15,200

60,800

1,200

1,000

8,600

8,000

1,200

9,200

47,400

7,200

54,600

5,400

800

6,200

54,600

2,600

400

54,600

Effect on working capital

+

13,800

6,600

7,200

13,800

Increase in working capital Rs. 7,200

Step-II

To bal. b/d

To cash purchase (Bal.)

Plant A/c

Rs.

37,000

By Dep. (Ad P & L A/c)

3,000

By Bal. c/d

40,000

Rs.

4,000

36,000

40,000

Buildings A/c

Rs.

To bal. b/d

To bal. b/d

To Cash Purchase (Bal.)

Sikkim Manipal University

40,000

Rs.

By Dep. (Ad P&L a/c)

By Bal. c/d

40,000

Investments A/c

Rs.

10,000

1,000

By Bal. c/d

11,000

4,000

36,000

40,000

Rs.

11,000

11,000

Page No.: 175

Principles of Financial Accounting and Management

Unit 10

Provision for Taxation A/c

Rs.

To bal. (tax paid)

To bal. c/d

17,000

18,000

35,000

Rs.

By bal. b/d

By Ad P&L a/c (Provision)

16,000

19,000

35,000

To bal. c/d

Provision for Doubtful A/c

Rs.

600

By bal. b/d

By Ad P&L a/c (Bal.)

600

Rs.

400

200

600

To bal. c/d

General Reserve A/c

Rs.

18,000

By bal. b/d

By Ad P&L a/c (Bal.)

18,000

Rs.

14,000

4,000

18,000

Adjusted P&L A/c

Rs.

To dep. on plant

4,000

To dep. on building

4,000

To prov. for tax

19,000

To General Reserve

4,000

To provision for doubtful debts

200

To interim dividend

8,000

To bal c/d

13,000

52,200

By bal. b/d

By FFO (Bal.) (1)

Rs.

16,000

36,200

52,200

Step-IV

Fund Flow Statement

Fund Inflow

FFO (1)

Rs.

36,200

36,200

Sikkim Manipal University

Fund Outflow

Rs.

Purchase of plant (2)

3,000

Purchase of investment (3) 1,000

Payment of tax (4)

17,000

Payment of dividend (5)

8,000

Working capital

7,200

36,200

Page No.: 176

Principles of Financial Accounting and Management

Unit 10

Note: a) (5) is given in the adjustment.

b) Provision for doubtful debts may be reduced from Drs.

Alternatively.

c) Account for General Reserve may or may not prepared. We can

take the difference directly.

d) FFO means Fund From Operation

10.6 Summary

For the purpose of fund flow statement the term fund means net working

capital.

The flow of fund will occur in a business, when a transaction results in a

change i.e., increase or decrease in the amount of fund.

According to Robert Anthony, the Fund Flow Statement describes the

sources from which additional funds were derived and the uses to which

these funds were put.

The main purposes of Fund Flow Statement are:

1. To help to understand the changes in assets and asset sources

which are not readily evident in the income statement or financial

statement.

2. To inform as to how the loans to the business have been used.

3. To point out the financial strengths and weaknesses of the business.

The steps involved in the preparation of Fund Flow Statement are:

1. Preparation of schedule changes in working capital.

2. Preparation of adjusted profit and loss account.

3. Preparation of accounts for non-current items.

4. Preparation of the fund flow statement.

10.7 Terminal Questions

1. What are the objectives of Fund Flow Statement?

2. Explain the different steps involved in preparation of Fund Flow

Statements.

3. Give the Format of Adjusted Profit and Loss Account.

Sikkim Manipal University

Page No.: 177

Principles of Financial Accounting and Management

Unit 10

10.8 Answers

Self Assessment Questions

1. Net working capital

2. Increase or decrease in the amount of fund

3. Robert Anthony

4. All the above

Terminal Questions

1. Refer to 10.3

2. Refer to 10.4

3. Refer to 10.5

Sikkim Manipal University

Page No.: 178

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Assignment 7 - Clarkson LumberDocument5 pagesAssignment 7 - Clarkson Lumbertesttest1No ratings yet

- CCNA'Document300 pagesCCNA'ParvinderSingh55% (11)

- The Power of Habit Summary PDFDocument18 pagesThe Power of Habit Summary PDFPatbarbellNo ratings yet

- Illustrative Ifrs Hkfrs Dec2014Document317 pagesIllustrative Ifrs Hkfrs Dec2014petitfm100% (1)

- Week 3 ModuleDocument14 pagesWeek 3 ModuleSofia Biangca M. BalderasNo ratings yet

- Modified - What Do We Know About Capital Structure Ppt-Anindya, PijushDocument51 pagesModified - What Do We Know About Capital Structure Ppt-Anindya, PijushAnindya MitraNo ratings yet

- 300 Pieces 31 January 2020 ZV2019113034A - 1500Document60 pages300 Pieces 31 January 2020 ZV2019113034A - 1500ParvinderSinghNo ratings yet

- Single Band Xpon OnuDocument21 pagesSingle Band Xpon OnuParvinderSinghNo ratings yet

- Ios Etherswitch Startup-ConfigDocument4 pagesIos Etherswitch Startup-ConfigParvinderSinghNo ratings yet

- 323 DacDocument11 pages323 DacParvinderSinghNo ratings yet

- Iou l3 Base Startup-ConfigDocument2 pagesIou l3 Base Startup-ConfigParvinderSinghNo ratings yet

- Vpcs Base ConfigDocument1 pageVpcs Base ConfigParvinderSinghNo ratings yet

- Iou l2 Base Startup-ConfigDocument3 pagesIou l2 Base Startup-ConfigParvinderSinghNo ratings yet

- Networking Class Schedule - Sheet2Document1 pageNetworking Class Schedule - Sheet2ParvinderSinghNo ratings yet

- CCNA R&S Practical EbookDocument78 pagesCCNA R&S Practical EbookParvinderSinghNo ratings yet

- Product ListDocument8 pagesProduct ListParvinderSinghNo ratings yet

- 2013 08 12 - 09 34 38 - ErrorDocument1 page2013 08 12 - 09 34 38 - ErrorParvinderSinghNo ratings yet

- V1600D Series Software Release Notes - 2Document22 pagesV1600D Series Software Release Notes - 2ParvinderSinghNo ratings yet

- CCNA R&S Practical EbookDocument78 pagesCCNA R&S Practical EbookParvinderSinghNo ratings yet

- Configuring PPPoE Server &client On Cisco RoutersDocument11 pagesConfiguring PPPoE Server &client On Cisco RoutersomegahNo ratings yet

- Colours Flashcard 4x6Document14 pagesColours Flashcard 4x6ParvinderSinghNo ratings yet

- Acctg180 w03 Problems Accounting For Retail BusinessesDocument12 pagesAcctg180 w03 Problems Accounting For Retail BusinessesAni100% (1)

- Business Math - Q2 - W1 - M1 - LDS - Commissions Down Payments Gross Balance and Current Increased BalanceCommissions - JRA RTPDocument8 pagesBusiness Math - Q2 - W1 - M1 - LDS - Commissions Down Payments Gross Balance and Current Increased BalanceCommissions - JRA RTPABMachineryNo ratings yet

- Q3 Lesson 1 WEEK 1Document3 pagesQ3 Lesson 1 WEEK 1Irish CedeñoNo ratings yet

- Business Plan and ExecutionDocument25 pagesBusiness Plan and ExecutionMary Rose OleaNo ratings yet

- US Debt Rating DowngradedDocument3 pagesUS Debt Rating DowngradedmonarchadvisorygroupNo ratings yet

- A Review On SME's MarketingDocument6 pagesA Review On SME's MarketingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 19286711Document8 pages19286711suruth242100% (1)

- Econ NeustDocument91 pagesEcon NeustJohn vincent SalazarNo ratings yet

- Principles of Cost Accounting. Chief Examiner's Reportfor Wassce (SC) 2023Document14 pagesPrinciples of Cost Accounting. Chief Examiner's Reportfor Wassce (SC) 2023abrahabrima4No ratings yet

- B.tech Economics For Engineers (MGMT-201)Document2 pagesB.tech Economics For Engineers (MGMT-201)Dev PopliNo ratings yet

- Power of Attorney - Poa (Voluntary) : Duly StampedDocument3 pagesPower of Attorney - Poa (Voluntary) : Duly StampedNaren AnkamNo ratings yet

- BM 2023 Fact Sheet (Eng) - 20230614Document3 pagesBM 2023 Fact Sheet (Eng) - 20230614AliChNo ratings yet

- Executive Mba Programme Ii Year Assignment Question Papers 2010-2011 201: Business Policy and Strategic ManagementDocument21 pagesExecutive Mba Programme Ii Year Assignment Question Papers 2010-2011 201: Business Policy and Strategic ManagementLarin V JosephNo ratings yet

- Payback Period Analysis: Cost of Project Annual Cash Inflow Payback PeriodDocument2 pagesPayback Period Analysis: Cost of Project Annual Cash Inflow Payback PeriodAngga PramadaNo ratings yet

- Mutual Fund Financial Performance Analysis:a Comparative Study On Equity Diversified Schemes and Equity Mid-Cap SchemesDocument11 pagesMutual Fund Financial Performance Analysis:a Comparative Study On Equity Diversified Schemes and Equity Mid-Cap SchemesSravani DvNo ratings yet

- Lesson 2 Financial Statement AnalysisDocument81 pagesLesson 2 Financial Statement AnalysisRovic OrdonioNo ratings yet

- Bank Performance Measurement & Analysis & PCADocument46 pagesBank Performance Measurement & Analysis & PCAVenkatsubramanian R IyerNo ratings yet

- Fama FrenchDocument47 pagesFama FrenchHamid UllahNo ratings yet

- Valuation-Deal Making PDFDocument17 pagesValuation-Deal Making PDFSandeep KumarNo ratings yet

- Lesson 4 - Supply and Demand DynamicsDocument6 pagesLesson 4 - Supply and Demand DynamicsViktoria YumangNo ratings yet

- Gotham GSJ S 2020 - 3Document11 pagesGotham GSJ S 2020 - 3Gotham Insights100% (3)

- Adjudication Order in Respect of Onelife Capital Advisors Limited, Pandoo Naig and TKP Naig in The Matter of Onelife Capital Advisors LimitedDocument60 pagesAdjudication Order in Respect of Onelife Capital Advisors Limited, Pandoo Naig and TKP Naig in The Matter of Onelife Capital Advisors LimitedShyam SunderNo ratings yet

- Disruptive Innovations Start in Low-End or Emerging MarketsDocument2 pagesDisruptive Innovations Start in Low-End or Emerging MarketsMichael YohannesNo ratings yet

- 01.an Introduction To Security Valuation I PDFDocument10 pages01.an Introduction To Security Valuation I PDFMaria SyNo ratings yet

- Charles Winnick (Matrix Capital Management)Document3 pagesCharles Winnick (Matrix Capital Management)Justin ChanNo ratings yet

- Largest Risks Facing The International Banking SystemDocument24 pagesLargest Risks Facing The International Banking SystemflichuchaNo ratings yet