Professional Documents

Culture Documents

Budget Highlights 2014 Central Excise

Uploaded by

శ్రీనివాసకిరణ్కుమార్చతుర్వేదులCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget Highlights 2014 Central Excise

Uploaded by

శ్రీనివాసకిరణ్కుమార్చతుర్వేదులCopyright:

Available Formats

Central Excise - Budget 2014

Changes in Central Excise Act, 1944 ...................................................................................................... 1

Abatement in MRP provisions ................................................................................................................ 7

Abatement extended to certain goods valued under MRP provisions - Notification No.

17/2014-Central Excise (N. T.) ............................................................................................................ 7

Amendment in Advance Ruling provisions ......................................................................................... 7

Advance ruling provisions extended to Resident private limited companies - Notification No.

18/2014-Central Excise (N. T.) ............................................................................................................ 7

Amendment in Central Excise Rules, 2002 ............................................................................................ 8

Electronic payment of duty is mandatory - Notification No. 19/2014-Central Excise (N. T.) ... 8

Amendment in Central Excise Valuation (Determination of Price of Excisable Goods) Rules,

2000 ............................................................................................................................................................. 8

Sale of Excisable goods at a price less than its manufacturing cost where price is not the sole

consideration - Notification No. 20/2014-Central Excise (N. T.) .................................................... 8

Amendments in CENVAT Credit Rules, 2004 ...................................................................................... 9

Place of Removal - Notification No. 21/2014-Central Excise (N. T.) ............................................. 9

CENVAT Credit on the basis of Invoice - Notification No. 21/2014-Central Excise (N. T.) ....... 9

Eligibility for availing CENVAT Credit in case of reverse charge/joint charge - Notification

No. 21/2014-Central Excise (N. T.) ..................................................................................................... 9

CENVAT credit when export consideration received/not received - Notification No. 21/2014Central Excise (N. T.) .......................................................................................................................... 10

Procedure and facilities for large tax payer (LTU) - Notification No. 21/2014-Central Excise (N. T.) .... 10

Changes in duty payable on pan masala and pan masala containing tobacco based on production

capacity - Notification No. 22/2014-Central Excise (N. T.) ......................................................................... 10

Changes in Central Excise Act, 1944

1. Additional Reference has been made to Principal Chief Commissioner of Central

Excise and Principal Commissioner of Central Excise, wherever the reference for Chief

Page

Commissioner of Central Excise and Commissioner of Central Excise is being made.

(For private circulation to clients of Hiregange & Associates and Chartered Accountants only)

2. Section 2(b) is being amended so as to provide for inclusion of Principal Chief

Commissioner of Central Excise and Principal Commissioner of Central Excise in the

definition of the Central Excise Officer.

3. Section 15A is inserted which states that an information return shall be filed within

such time, form to such authority or agency as may be prescribed by various class of

persons who are responsible for maintaining various records and information as

under:

a. an assessee;

b. a local authority or other public body or association;

c. any authority of the State Government responsible for the collection of value

added tax or sales tax; or

d. an income tax authority appointed under the provisions of the Income-tax Act,

1961; or

e. (e) a banking company within the meaning of clause (a) of section 45A of the

Reserve Bank of India Act, 1934; or

f.

A State Electricity Board; or an electricity distribution or transmission licensee

under the Electricity Act, 2003, or any other entity entrusted, as the case may be,

with such functions by the Central Government or the State Government; or

g. The Registrar or Sub-Registrar appointed under section 6 of the Registration Act,

1908; or

h. A Registrar within the meaning of the Companies Act, 2013; or

i.

The registering authority empowered to register motor vehicles under Chapter

IV of the Motor Vehicles Act, 1988; or

j.

The Collector referred to in clause (c) of section 3 of the Right to Fair

Compensation and Transparency in Land Acquisition, Rehabilitation and

Resettlement Act, 2013; or

k. The recognised stock exchange referred to in clause (f) of section 2 of the

Securities Contracts (Regulation) Act, 1956; or

l.

A depository referred to in clause (e) of sub-section (1) of section 2 of the

Bank of India Act, 1934,

(For private circulation to clients of Hiregange & Associates and Chartered Accountants only)

Page

m. an officer of the Reserve Bank of India, constituted under section 3 of the Reserve

Depositories Act, 1996; or

Any defect in such return must be rectified within 30 days from the date of intimation

of such defect. The intention of the new Section is to collect information for the

purposes of the Act, such as, to identify tax evaders or recover confirmed dues etc.

4. If information return is not furnished within time-limit then the prescribed authority

shall serve a notice and in lieu of which the same needs to be submitted within 90

days from the date of service of notice failing which a penalty of Rs 100/- each day as

prescribed u/s 15 B shall be levied.

5. Under section 31(g) and section 32(1) the words Customs and central excise settlement

commission shall be now termed as Customs and central excise and service tax

settlement commission.

6. For Non-payment of additional amount of excise duty declared under settlement

commission under section 32E of Central Excise Act, 1944, interest u/s 11AA @ 18%

p.a shall be applicable instead of interest u/s 11AB.

7. One of the condition for filing the application for settlement commission is that the

periodical return needs to be filed for the period for which settlement is sought.

However, a provision has been made wherein Settlement Commission now at its

discretion accept the application if it is satisfied that the circumstances exist for not

filing the returns by recording the reasons for the same.

8. Earlier in lieu of restriction u/s 32E(2) of Central Excise Act, 1944 assessee was not

eligible to make an application under section 32E(1) to settlement commission upto

the expiry of one hundred and eighty days from the date on which books of account,

other documents have been seized under the provisions of this Act. However, such a

restriction is now relaxed by omitting sec 32(E)(2).

9. Bar on subsequent application to settlement commission u/s 32(O) on any other

penalty is on a person who made the application u/s 32E on the grounds of

concealment of particulars of duty liability from Central Excise Officer. Earlier, it was

Page

matter can be imposed if any order passed by settlement commission imposing

(For private circulation to clients of Hiregange & Associates and Chartered Accountants only)

not specified from whom such details would have been concealed therefore, now it is

specifically mentioned that if the concealment of duty liability was from Central

Excise Officer.

10. In respect of orders passed by Commissioner (Appeals), Central Board of Excise and

Customs or Board or Commissioner of Central Excise u/s 35A,the discretion lies with

appellate tribunals u/s 35B to refuse admitting an appeal in respect of such orders

where penalties or fine levied is upto Rs.50,000/-. Such limit of Rs. 50,000/- is now

extended to Rs. 2,00,000.

11. Further under section 35B Central board of excise and customs can now constitute a

committee as necessary for the purpose of this act by passing an order and it is not

required to notify the same in official gazette.

12. The time limit prescribed for the appellate tribunal under first, second and third

proviso of 35C (2A) to dispose off the stay orders is now omitted. Earlier the Appellate

Tribunal had to dispose of the appeal within a period of 180 days from the date of

such order. If such appeal is not disposed of within 180 days, then stay order shall on

the expiry of that period, stand vacated. Such stay order even could have been

extended for further 180 days by the Tribunal. This would give great relief for cases

where stay orders are passed and matter is still pending.

13. Time limit for filing of the appeal u/s 35 E by the department has been further

extended to 30 days.

14. Section 35F required appellant to make a pre-deposit of demand and penalties for

appealing against a decision or order, it also gave commissioner (appeals) or appellate

tribunal to dispense with the requirement of pre-deposit if it causes undue hardship

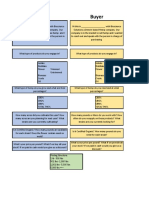

on appellant. Section 35F has now been substituted with a new provision requiring the

Amount to be pre-deposited

Commissioner (appeals) for orders passed Appellant has to deposit seven and a half

(For private circulation to clients of Hiregange & Associates and Chartered Accountants only)

Page

Order appealed to

appellant to deposit amounts as under:

by a Central Excise Officer lower in rank percent of the duty demanded or penalty

than a commissioner

imposed or both;

Appellate tribunal for orders passed by

Appellant has to deposit seven and a half

Commissioner of Central Excise

percent of the duty demanded or penalty

imposed or both;

Appellate tribunal for orders passed by

Appellant has to deposit ten percent of the

Commissioner(appeals) u/s 35A

duty demanded or penalty imposed or

both;

Note:

! However, amount to be pre-deposited under this section shall not exceed Rs. 10

crore.

! The provisions of this section shall not apply to the stay applications and appeals

pending before any appellate authority prior to the commencement of the

Finance (No.2) Act, 2014.

15. Sub-section(2) to section 35L shall be inserted wherein an appeal to supreme court

relating to an order passed by the appellate tribunal pertaining to any question having

a relation to the rate of duty shall include the determination of taxability or

excisability of goods for the purpose of assessment.

16. If any Central Excise Officer has not filed an appeal in pursuance of the orders under

sub-section (1) of section 35R due to fixing of monetary limit for regulating the filing

of appeals by Central Excise Officers then in lieu of this amendment apart from

appellate Tribunal and court even Commissioner (appeals) hearing such appeal can

have regard to the circumstances under which appeal was not filed by the Central

Excise Officer in pursuance of such orders.

17. In the Pan Masala Packing Machines (Capacity Determination and Collection of Duty)

Rules, 2008, rule 8, for the first proviso has been amended to provide that where a

the highest retail sale price for the whole month.

(For private circulation to clients of Hiregange & Associates and Chartered Accountants only)

Page

prices during a month, he shall be liable to pay the duty applicable to pouch bearing

manufacturer uses an operating machine to produce pouches of different retail sale

18. As per sub-section (1) of section 5A of the Central Excise Act, NotificationNo.5/2006Central Excise, dated the 1st March, 2006 has been amended to include the following

serial number and entries shall be exempted:

(a) Under sl. no. 2C, with effect from 29th June, 2010 to 16th March, 2012 (both days

inclusive) namely:

(1) Polyester staple fibre or polyester filament yarn manufactured from plastic

scrap or plastic waste including waste polyethylene terephthalate bottles [chapter

54 or 55]

(2) Tow manufactured and captively consumed within the factory of its production

for the manufacture of goods specified in entry (1) [chapter 54 or 55]

(b) Under sl.no. 24 against Chapter no.71, with effect from 1st March, 2011 to 16th

March, 2012 (both days inclusive) namely:

(I) Articles of (a) gold, (b) silver, (c) platinum, (d) palladium, (e) rhodium, (f)

iridium, (g) osmium, or (h) ruthenium, not bearing a brand name.

Also the refund shall be made of all duty of excise which has been collected but

which would not have been so collected. For the purpose, the refund application shall

be made within 6 months from date on which Finance bill 2014 receives the assent of

President.

19. As per sub-section (1) of section 5A of the Central Excise Act, Notification No.

12/2012-Central Excise, dated the 17th March, 2012, has been amended to include the

following serial number and entries shall be exempted:

(i)

serial number 81 and the entries relating thereto, the following serial number and

entries shall be substituted and shall be deemed to have been substituted with

effect from 8th February,2013 to 10th July, 2014 (both days inclusive)

on liquefied propane and butane mixture, liquefied butane and liquefied

Page

domestic exempted category (NDEC) customers by the Indian Oil Corporation

petroleum gases (LPG) for supply to house hold domestic consumers or to non-

(For private circulation to clients of Hiregange & Associates and Chartered Accountants only)

Limited, Hindustan Petroleum Corporation Limited or Bharat Petroleum

Corporation Limited;

(ii)

serial number 172A and the entries relating thereto, the following serial number

and entries shall be substituted and shall be deemed to have been substituted

with effect from m 17th March, 2012 to 10th July, 2014 (both days inclusive)

(1) Polyester staple fibre or polyester filament yarn manufactured from plastic

scrap or plastic waste including waste polyethylene terephthalate bottles

(2) Tow manufactured and captively consumed within the factory of its

production for the manufacture of goods specified in entry (1);

Also the refund shall be made of all duty of excise which has been collected but

which would not have been so collected. For the purpose, the refund application shall

be made within 6 months from date on which Finance bill 2014 receives the assent of

President.

20. There are changes in MRP provisions wherein certain products are added and some

are substituted as per schedule seven of finance bill, 2014.

Abatement in MRP provisions

Abatement extended to certain goods valued under MRP provisions Notification No. 17/2014-Central Excise (N. T.)

Abatement @ 35% shall apply to any other type of centrifuges, including centrifugal dryers;

filtering or purifying machinery and apparatus, for liquids of gases valued at retail sale price.

Amendment in Advance Ruling provisions

Advance ruling provisions extended to Resident private limited companies Notification No. 18/2014-Central Excise (N. T.)

Advance ruling provisions are extended to the resident private limited companies wherein

private limited companies shall have the meaning assigned to it u/s 2(68) of the companies act,

Page

with sub-section (3) of section 6 of the Income-tax Act, 1961.

2013 and resident shall have the same meaning assigned to it in clause (42) of section 2 read

(For private circulation to clients of Hiregange & Associates and Chartered Accountants only)

Amendment in Central Excise Rules, 2002

Electronic payment of duty is mandatory - Notification No. 19/2014-Central

Excise (N. T.)

As per rule 8 of Central Excise Rules, 2002 Every assessee shall electronically pay duty through

internet banking w.e.f 1st October 2014 unless otherwise allowed through any other mode by

assistant commissioner or deputy commissioner.

Further sub-rule (3A) of Rule 8 of Central Excise Rules, 2002 has been substituted whereas, If

the assessee fails to pay the duty declared as payable by him in the return within a period of

one month from the due date, then the assessee is liable to pay the penalty at the rate of one per

cent on such amount of the duty not paid, for each month or part thereof calculated from the

due date, for the period during which such failure continues. The erstwhile provision requiring

the assessee to pay duty for each consignment without utilizing CENVAT credit till the whole

duty along with interest is paid has been done away with.

Amendment in Central Excise Valuation (Determination of

Price of Excisable Goods) Rules, 2000

Sale of Excisable goods at a price less than its manufacturing cost where price

is not the sole consideration - Notification No. 20/2014-Central Excise (N. T.)

Where price is not the sole consideration for sale of excisable goods and if they are sold at a

price less than manufacturing cost and profit, and no additional consideration is flowing

directly or indirectly from the buyer to such assessee, the value of such goods shall be deemed

to be the transaction value. No such provision was there prior to amend.

The amendment would nullify the judgment of Supreme Court in case of M/s. Fiat India Ltd

wherein it was held that in circumstances of sale of goods below manufacturing cost, the

revenue could reject the transaction value declared under section 4 and invoke the provisions of

the Central Excise Valuation (Determination of Price of Excisable Goods) Rules, 2000 to assess

Central Excise duty.

Page

This change would be effective from the date of publication in the official gazette.

(For private circulation to clients of Hiregange & Associates and Chartered Accountants only)

Amendments in CENVAT Credit Rules, 2004

Place of Removal - Notification No. 21/2014-Central Excise (N. T.)

Input service definition and reversal of CENVAT Credit under Rule 6(3) gives the reference to

place of removal which was not defined earlier. However, the same has been now been

defined under Rule 2(qa) of CENVAT Credit Rules, 2004 which is as under:

! A factory or any other place of production of excisable goods;

! a warehouse or any other place where goods are deposited without payment of duty;

! a depot or premise or place of consignment agent from where excisable goods are sold

after clearance from the factory.

This Rule is effective from 11th July 2014.

CENVAT Credit on the basis of Invoice - Notification No. 21/2014-Central

Excise (N. T.)

Manufacturer and Output service provider were allowed to avail CENVAT Credit on the basis

of invoice, irrespective of the date of invoice, now with the insertion of third proviso to Rule

4(1) of CENVAT Credit Rules, 2004 the same has to availed within six months from the date of

invoice, bill or challan as specified rule 9.

The Rule is effective from 1st September 2014.

Immediate Action

The manufacturers and service providers shall ascertain the CENVAT credit missed out in the

past period, if any and avail the credits immediately before 1st September 2014. It is important

to note the chances are that the limit of six months would be applicable only on the invoices

which are issued on or after 1st September 2014.

Eligibility for availing CENVAT Credit in case of reverse charge/joint charge Notification No. 21/2014-Central Excise (N. T.)

Under Reverse Charge Mechanism, expenses were whole of the service tax liability has to be

discharged by service recipient (such as sponsorship service, legal services, import of services

thereon.

(For private circulation to clients of Hiregange & Associates and Chartered Accountants only)

Page

where CENVAT can be availed only on or after payment of both value of service and service tax

etc.), CENVAT credit can be availed on or after payment of Service tax itself unlike earlier

Further, cases where the service tax liability has to be discharged by service provider or

manufacturer has not been discharged within 3 months from the date of invoice along with

value of service, then the amount of CENVAT credit availed on the basis of invoice or challan as

the case may be, has to be reversed. In case the same has been paid CENVAT Credit can be

availed provided six months has not lapsed from the date of invoice earlier to the amendment

there was no such criteria of six months from the date of invoice was specified and the same can

be availed any time.

CENVAT credit when export consideration received/not received Notification No. 21/2014-Central Excise (N. T.)

Prior to amendment, in case of export of services, if foreign currency is not received for a period

of six months or extended period allowed by RBI from the date of provision, the same will be

considered as exempted service and reversal of CENVAT credit as per Rule 6(3) of CENVAT

Credit Rules,2004 has to be made but now if the same is received after extended period but

within one year from such period, service provider can avail the amount of CENVAT credit

reversed subject to documentary evidence of such receipt which was not allowed earlier.

Procedure

and

facilities

for

large

tax

payer

(LTU)

-

Notification

No.

21/2014-

Central

Excise

(N.

T.)

Rule 12A of CENVAT Credit Rules, 2004 has been amended stating that the credit taken, on or

before the 10th July, 2014, by one of his (LTU) registered manufacturing premises or premises

providing taxable services could be transferred to other units.

After this amendment, LTU would not be in a position to transfer the credits claimed from 11th

July 2014 from one unit to other unit.

This Rule is effective from 11th July 2014.

Changes in duty payable on pan masala and pan masala containing

tobacco based on production capacity - Notification No. 22/2014-Central

Excise (N. T.)

Rules, 2008, new table as follows has been inserted. This change would be effective from the

Page

date of publication in the official gazette.

10

In Form 2 of Pan Masala Packing Machines (Capacity Determination and Collection of Duty)

(For private circulation to clients of Hiregange & Associates and Chartered Accountants only)

Sl.

Duty

No.

Duty ratio for Duty paid

Duty ratio for pan

Duty paid

pan masala

masala containing

(in rupees)

(in rupees)

tobacco

1

The

duty

leviable

the

Central

under

0.3453

0.7903

0.1294

0.0677

0.4962

0.1129

0.0194

0.0194

0.0097

0.0097

Excise Act, 1944

2

The additional duty

of

excise

leviable

under section 85 of

the Finance Act, 2005

3

National

Calamity

Contingent

Duty leviable under

section 136 of the

Finance Act, 2001 4

4

Education

Cess

leviable

section

under

91

of

the

Finance Act, 2004

5

Secondary

Higher

and

Education

Cess leviable under

section 136 of the

Finance Act, 2007

Disclaimer: This is a summary and our analysis of the budget changes this cannot be

considered as our opinion/advice, Hiregange and Associates would not be responsible for

any action taken based on this note without further consultation with Hiregange and

Associates.

Page

or sudhir@hiregange.com)

11

(For any queries or feedback please mail to mhiregange@gmail.com; rajesh@hiregnage.com

(For private circulation to clients of Hiregange & Associates and Chartered Accountants only)

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Account Summary Payment Information: New Balance $1,339.26Document6 pagesAccount Summary Payment Information: New Balance $1,339.26donghyuck leeNo ratings yet

- 5 MW Solar PV Power Project in Sivagangai Village, Sivaganga District, Tamil NaduDocument32 pages5 MW Solar PV Power Project in Sivagangai Village, Sivaganga District, Tamil NaduAshok Kumar Thanikonda60% (5)

- Question Paper With Answers - Treasury Management-Final ExamDocument7 pagesQuestion Paper With Answers - Treasury Management-Final ExamHarsh MaheshwariNo ratings yet

- The Markets in Crypto-Assets Regulation (MICA)Document33 pagesThe Markets in Crypto-Assets Regulation (MICA)Eve AthanasekouNo ratings yet

- Tax Compliance MonitoringDocument44 pagesTax Compliance MonitoringAcademe100% (2)

- Strategic Alliance v. Radstock DigestDocument9 pagesStrategic Alliance v. Radstock DigestLeighNo ratings yet

- 8638 EPCG SchemeDocument2 pages8638 EPCG SchemePriyank KohliNo ratings yet

- Invoice: Original Duplicate Triplicate QuadruplicateDocument2 pagesInvoice: Original Duplicate Triplicate Quadruplicateశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- PF E-Return ManualDocument24 pagesPF E-Return Manualchirag bhojakNo ratings yet

- Ait ActDocument93 pagesAit Actశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- UserManual Ver1.4 Employers New PDFDocument41 pagesUserManual Ver1.4 Employers New PDFAmitKumarNo ratings yet

- QTR Return Reg DealersDocument1 pageQTR Return Reg Dealersశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Invoice: Original Duplicate Triplicate QuadruplicateDocument2 pagesInvoice: Original Duplicate Triplicate Quadruplicateశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Are 1Document5 pagesAre 1kal74No ratings yet

- Form E.R.-8 Original/DuplicateDocument4 pagesForm E.R.-8 Original/Duplicateశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Proforma of b1 BondDocument1 pageProforma of b1 Bondశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Before The Customs and Central Excise Settlement Commission - Bench at - Form of Application For Settlement of A Case Under Section 32EDocument3 pagesBefore The Customs and Central Excise Settlement Commission - Bench at - Form of Application For Settlement of A Case Under Section 32Eశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Form Ct-1 Certificate For Procurement of Specified Goods Without Payment of Duty From EOUDocument3 pagesForm Ct-1 Certificate For Procurement of Specified Goods Without Payment of Duty From EOUPrassanna KumariNo ratings yet

- QTR Return Reg DealersDocument1 pageQTR Return Reg Dealersశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Manual CINDocument41 pagesManual CINkrishna_1238No ratings yet

- Central ExciseDocument157 pagesCentral ExciseDilip SinghNo ratings yet

- 5 Eou Compliance Check ListDocument4 pages5 Eou Compliance Check ListPrassanna Kumari100% (1)

- CX Gen25 29Document5 pagesCX Gen25 29శ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- 45 Cash Flow FormatDocument1 page45 Cash Flow FormatSunil MehtaNo ratings yet

- Formats & Procedures: Import of Capital GoodsDocument16 pagesFormats & Procedures: Import of Capital Goodsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Cenvat Credit PDFDocument38 pagesCenvat Credit PDFsaumitra_mNo ratings yet

- Mothers Name On PAN CardDocument2 pagesMothers Name On PAN Cardశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Materials ManagementDocument3 pagesMaterials Managementశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Cenvat Credit: V S DateyDocument44 pagesCenvat Credit: V S Dateyశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Cenvat Credit PDFDocument38 pagesCenvat Credit PDFsaumitra_mNo ratings yet

- Registration Form: Dr. Radha RaghuramapatruniDocument2 pagesRegistration Form: Dr. Radha Raghuramapatruniశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Cold ChainDocument7 pagesCold Chainశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- CLM-Logistics at LargeDocument21 pagesCLM-Logistics at Largeశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Explanation of CBEC and Non-CBEC Currency CalculationsDocument28 pagesExplanation of CBEC and Non-CBEC Currency Calculationsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- RV3 PDFDocument1 pageRV3 PDFTam SimeonNo ratings yet

- Ug Scholarships at Iit KGPDocument5 pagesUg Scholarships at Iit KGPPriyank AgrawalNo ratings yet

- AMCO-11006822-V1-Prosus N V ProspectusDocument426 pagesAMCO-11006822-V1-Prosus N V ProspectussuedelopeNo ratings yet

- Sick Unit ProjectsDocument62 pagesSick Unit ProjectsPratik Shah100% (1)

- Saving, Investment and The Financial SystemDocument47 pagesSaving, Investment and The Financial SystemKaifNo ratings yet

- Advance Paper Corp. vs. Arma Traders Corp., Et - Al. (G.R. No. 176897, Dec. 11, 2013)Document8 pagesAdvance Paper Corp. vs. Arma Traders Corp., Et - Al. (G.R. No. 176897, Dec. 11, 2013)Michelle CatadmanNo ratings yet

- Government Expenditure: Economy of MalaysiaDocument17 pagesGovernment Expenditure: Economy of MalaysiaTk Kendrick LauNo ratings yet

- Insurance and Risk Management AssignmentDocument14 pagesInsurance and Risk Management AssignmentKazi JunayadNo ratings yet

- Towers Watson 500 Largest Asset ManagersDocument20 pagesTowers Watson 500 Largest Asset ManagersAdam TanNo ratings yet

- Micro Finance in BrazilDocument7 pagesMicro Finance in BrazilguptarohanNo ratings yet

- Combinatorial Mathematics Business Mathematics Special Theory of Relativity-I Computational Mathematics Lab-IDocument13 pagesCombinatorial Mathematics Business Mathematics Special Theory of Relativity-I Computational Mathematics Lab-IBurnwal RNo ratings yet

- SMI OCBC Report (May17)Document4 pagesSMI OCBC Report (May17)Douglas LimNo ratings yet

- Chapter 9 Saving, Investment and The Financial SystemDocument24 pagesChapter 9 Saving, Investment and The Financial SystemPhan Minh Hiền NguyễnNo ratings yet

- Sbi Balance SheetDocument5 pagesSbi Balance SheetNirmal BhagatNo ratings yet

- Ardia Et Al (2018) - Forecasting Risk With Markov-Switching GARCH Models. A Large-Scale Performance StudyDocument15 pagesArdia Et Al (2018) - Forecasting Risk With Markov-Switching GARCH Models. A Large-Scale Performance StudyLuciano BorgoglioNo ratings yet

- FBL3N - GL Account Line Item DisplayDocument4 pagesFBL3N - GL Account Line Item DisplayP RajendraNo ratings yet

- UntitledDocument84 pagesUntitledMary Jenel Nodalo ColotNo ratings yet

- Ratio AnalysisDocument42 pagesRatio AnalysiskanavNo ratings yet

- ValuationDocument20 pagesValuationNirmal ShresthaNo ratings yet

- Sunedison MemoDocument67 pagesSunedison MemoAnonymous 5Ukh0DZNo ratings yet

- Fundamentals of Corporate Finance 7th Edition Brealey Test BankDocument54 pagesFundamentals of Corporate Finance 7th Edition Brealey Test BankEmilyJohnsonfnpgb100% (13)

- Mbaproject - Kotak Sec PDFDocument63 pagesMbaproject - Kotak Sec PDFNAWAZ SHAIKHNo ratings yet

- United States Bankruptcy Court For The District of DelawareDocument9 pagesUnited States Bankruptcy Court For The District of DelawareChapter 11 DocketsNo ratings yet

- Invoice: Orange Bio Science Products Private Limited Bill ToDocument1 pageInvoice: Orange Bio Science Products Private Limited Bill ToTanmoy Sarkar GhoshNo ratings yet