Professional Documents

Culture Documents

Managerial Economics

Uploaded by

Ahmad Hirzi AzniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managerial Economics

Uploaded by

Ahmad Hirzi AzniCopyright:

Available Formats

BMME5103/MAY15/A-RR

OUM BUSINESS SCHOOL

ASSIGNMENT SUBMISSION AND ASSESSMENT

_________________________________________________________________________

BMME5103

MANAGERIAL ECONOMICS

MAY 2015

_________________________________________________________________________

INSTRUCTIONS TO STUDENTS

1. This assignment contains question that is set in English.

2. Answer in English only.

3. Your assignment should be typed using 12 point Times New Roman font and

1.5 line spacing.

4. You must submit your hardcopy assignment to your Fasilitator and ONLINE via the MyVLE. Refer to the portal for instructions on the procedures to

submit your assignment on-line. You are advised to keep a copy of your

submitted assignment and proof of the submission for personal reference.

Your assignment must be submitted before or on 12th July 2015.

5. Your assignment should be prepared individually. You should not copy another

persons assignment. You should also not plagiarise another persons work as

your own.

EVALUATION

This assignment accounts for

60% of the total marks for the course.

BMME5103/MAY15/A-RR

ASSIGNMENT QUESTION

PART 1

PURPOSE:

The purpose of PART 1 of this assignment is to enable the students to analyse

the fundamental relationship between shareholders and managers of firms.

REQUIREMENT:

Separation of ownership and control of firms often leads to the occurrence of

agency problems. In an attempt to mitigate agency problems, firms may incur

several agency costs.

1. Explain clearly what agency problem is. Focus your answer on why and

how it may occur. Give several examples based on your experience or

knowledge of its occurrence. Preferably, use local examples.

( 10 Marks)

2. Determine several agency costs firms may incur because of agency

problems. Search for examples and explain.

(10 Marks)

(Total: 20 marks)

PART 2

PURPOSE:

The purpose of this assignment is to provide the students with the skill to

estimate demand functions and to appreciate their usefulness in the real world.

REQUIREMENT:

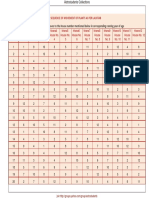

You have been presented with the following data and asked to fit statistical

demand functions:

SALES REGION

1

15.00

2

13.50

3

SALES (Y)

PROMOTION EXPENSES (A)

SELLING PRICE (P)

(X 1000 LITERS)

(X RM1000)

(RM/LITER)

160

220

150

160

140

50

190

190

130

90

16.50

4

14.50

5

17.00

BMME5103/MAY15/A-RR

160

60

200

140

150

110

210

200

190

100

16.00

7

13.00

8

18.00

9

12.00

10

15.50

You are required to do the following:

1. Develop a simple regression model with paint sales (Y) as the dependent

variable and selling price (P) as the independent variable.

a. Show the estimated regression equation.

b. Give an economic interpretation of the estimated intercept (a) and

slope (b) coefficient.

c. Test the hypothesis (at the 0.05 level of significance) that there is no

relationship (i.e., = 0) between the variables.

d. Calculate the coefficient of determination.

e. Perform an analysis of variance on the regression, including an F-test

of the overall significance of the results (at the 0.05 level).

f. Based on the regression model, determine the best estimate of paint

sales in a sales region where the selling price is RM14.50. Construct an

approximate 95 percent prediction interval.

g. Determine the price elasticity of demand at a selling price of RM14.50.

(Sub-Total: 14 Marks)

2. Suppose one is interested in developing a multiple regression model with

paint sales (Y) as the dependent variable and promotional expenditures

(A) and selling price (P) as the independent variables.

a. Show the estimated regression equation.

b. Give an economic interpretation of the estimated slope (bs) coefficients.

c. Test the hypothesis (at the 5 percent level of significance) that there is

no relationship between the dependent variable and each of the

independent variables.

d. Determine the coefficient of determination.

e. Perform an analysis of variance on the regression, including an F-test

of the overall significance of the results (at the 5 percent level).

f. Based on the regression model, determine the best estimate of paint

sales in a sales region where promotional expenditures are RM80(000)

and the selling price is RM12.50.

g. Determine the point promotional and price elasticities at the values of

promotional expenditures and selling price given in part (f).

(21 Marks)

(Total: 35 marks)

BMME5103/MAY15/A-RR

https://www.solutioninn.com/instant_checkout?pdid=26817386475

PART 3

PURPOSE:

The purpose of this assignment question is to enable the students to develop an

understanding on the use of mathematics in economics; in particular how it helps

managers make decisions on achieving the firmsobjectives such as profit

maximization.

REQUIREMENT:

The Lumins Lamp Company, a producer of old-style oil lamps, estimated the

following demand function for its product:

Q = 120,000 10,000P

where Q is the quantity demanded per year and P is the price per lamp. The

firms fixed costs are $12,000 and variable costs are $1.50 per lamp.

a.

b.

c.

d.

e.

Write an equation for the total revenue (TR) function in terms of Q.

Specify the marginal revenue function.

Write an equation for the total cost (TC) function in terms of Q.

Specify the marginal cost function.

Write an equation for total profits () in terms of Q. At what level of output

(Q) are total profits maximized? What price will be charged? What are total

profits at this output level?

f. Check your answers in Part (e) by equating the marginal revenue and

marginal cost functions, determined in Parts (b) and (d), and solving for Q.

g. What model of market pricing behavior has been assumed in this

problem?

(Total: 21 marks)

BMME5103/MAY15/A-RR

PART 4

PURPOSE:

The purpose of this assgnment question is to ensure that the students are able to

apply his/her knowledge on economic theories in assesing current events in the

real world. firmsevaluate levels of competitiveness in various market structures

and to introduce the correct strategies in order to obtain competitive edge in a

selected market.

REQUIREMENT:

Suppose that two Japanese companies, Hitachi and Toshiba, are the sole

producers (i.e., duopolists) of a microprocessor chip used in a number of different

brands of personal computers. Assume that total demand for the chips is fixed

and that each firm charges the same price for the chips.

Each firms market share and profits are a function of the magnitude of the

promotional campaign used to promote its version of the chip. Also assume that

only two strategies are available to each firm: a limited promotional campaign

(budget) and an extensive promotional campaign (budget). If the two firms

engage in a limited promotional campaign, each firm will earn a quarterly profit

of $7.5 million. If the two firms undertake an extensive promotional campaign,

each firm will earn a quarterly profit of $5.0 million. With this strategy

combination, market share and total sales will be the same as for a limited

promotional campaign, but promotional costs will be higher and hence profits will

be lower. If either firm engages in a limited promotional campaign; and the other

firm undertakes an extensive promotional campaign, then the firm that adopts

the extensive campaign will increase its market share and earn a profit of $9

million, whereas the firm that chooses the limited campaign will earn a profit of

only $4 million.

a. Develop a payoff matrix for this decision-making problem.

b. In the absence of a binding and enforceable agreement, determine the

dominant advertising strategy and minimum payoff for Hitachi.

c. Determine the dominant advertising strategy and minimum payoff for

Toshiba.

d. Explain why the firms may choose not to play their dominant strategies

whenever this game is repeated over multiple decision-making periods.

BMME5103/MAY15/A-RR

(24 Marks)

(GRAND TOTAL: 100 MARKS)

You might also like

- Welfare EconomicsDocument6 pagesWelfare EconomicsVincent CariñoNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Lecture Note in EconomicsDocument3 pagesLecture Note in EconomicsJohn Remmel RogaNo ratings yet

- Managerial EconomicsDocument10 pagesManagerial EconomicsDipali DeoreNo ratings yet

- BBA 1st Semester SyllabusDocument12 pagesBBA 1st Semester SyllabusBinay Tiwary80% (5)

- National IncomeDocument4 pagesNational Incomesubbu2raj3372No ratings yet

- Managerial Economics Ch3Document67 pagesManagerial Economics Ch3Ashe BalchaNo ratings yet

- Managerial Economics:: According To Spencer and SiegelmanDocument10 pagesManagerial Economics:: According To Spencer and SiegelmankwyncleNo ratings yet

- Opportunity Cost For Decision MakingDocument5 pagesOpportunity Cost For Decision MakingAthar AhmadNo ratings yet

- ECON: Practice Quizes 1-5Document37 pagesECON: Practice Quizes 1-5Audrey JacksonNo ratings yet

- Consumer Behaviour and Utility MaximizationDocument15 pagesConsumer Behaviour and Utility MaximizationBilalTariq100% (1)

- Asymmetric Information and Organizational DesignDocument71 pagesAsymmetric Information and Organizational Designmark yosoresNo ratings yet

- Module 5 Production TheoryDocument27 pagesModule 5 Production TheoryCharice Anne VillamarinNo ratings yet

- A Note On Welfare Propositions in EconomicsDocument13 pagesA Note On Welfare Propositions in EconomicsmkatsotisNo ratings yet

- Elasticity of DemandDocument38 pagesElasticity of DemandimadNo ratings yet

- Fundamental Theorem of Welfare EconomicsDocument8 pagesFundamental Theorem of Welfare EconomicsvincentljzNo ratings yet

- Macroeconomic ProblemsDocument14 pagesMacroeconomic ProblemsRifat MahmudNo ratings yet

- Revised Tobin's Demand For MoneyDocument4 pagesRevised Tobin's Demand For MoneySnehasish MahataNo ratings yet

- National Income AccountsDocument13 pagesNational Income AccountsPlatonicNo ratings yet

- EconomicsDocument33 pagesEconomicsghazanfar_ravians623No ratings yet

- 9.6 Keynesian MultiplierDocument23 pages9.6 Keynesian MultiplierkimmoNo ratings yet

- Financial & Managerial AccountingDocument4 pagesFinancial & Managerial AccountinguglaysianNo ratings yet

- Dfi 306 Public FinanceDocument134 pagesDfi 306 Public FinanceElizabeth MulukiNo ratings yet

- Posting and Preparation of Trial BalanceDocument15 pagesPosting and Preparation of Trial Balance愛結No ratings yet

- Explain The Functions of Price in A Market EconomyDocument6 pagesExplain The Functions of Price in A Market Economyhthomas_100% (5)

- Monopoly - Spec and Possible Essay QuestionsDocument2 pagesMonopoly - Spec and Possible Essay Questions詹堉梃No ratings yet

- Demand NumericalsDocument2 pagesDemand Numericalsmahesh kumar0% (1)

- History of Economic ThoughtDocument49 pagesHistory of Economic ThoughtMateuNo ratings yet

- Sesi 12 - Game TheoryDocument58 pagesSesi 12 - Game Theoryromi mori100% (1)

- FINC 304 Managerial EconomicsDocument21 pagesFINC 304 Managerial EconomicsJephthah BansahNo ratings yet

- Economics - Definition and Nature & Scope of Economics - Divisions of EconomicsDocument8 pagesEconomics - Definition and Nature & Scope of Economics - Divisions of EconomicsNikita 07No ratings yet

- Rostow's TheoryDocument3 pagesRostow's TheoryNazish SohailNo ratings yet

- 7 Approaches To EntrepreneurshipDocument4 pages7 Approaches To EntrepreneurshipUmair ZiaNo ratings yet

- BOPDocument36 pagesBOPAhmed MagdyNo ratings yet

- Traditional & Contemporary Issues & ChallengesDocument9 pagesTraditional & Contemporary Issues & ChallengesDanish MehmoodNo ratings yet

- Chapter 1-Nature and Scope of EconomicsDocument33 pagesChapter 1-Nature and Scope of Economicsahmed alkhajaNo ratings yet

- What Is Managerial Economics? Explain Its Nature, Scope and ItsDocument9 pagesWhat Is Managerial Economics? Explain Its Nature, Scope and Itsn13shukla85% (20)

- Chapter - 1-Introduction To Accounting and BusinessDocument49 pagesChapter - 1-Introduction To Accounting and BusinessAsaye TesfaNo ratings yet

- Business Economics - Question Bank - BBM PDFDocument5 pagesBusiness Economics - Question Bank - BBM PDFAbhijeet MenonNo ratings yet

- Describe The Basic Premise of Adam SmithDocument8 pagesDescribe The Basic Premise of Adam SmithJm B. VillarNo ratings yet

- Assignment On Intermediate Macro Economic (ECN 303) - USEDDocument6 pagesAssignment On Intermediate Macro Economic (ECN 303) - USEDBernardokpeNo ratings yet

- Probset 1Document10 pagesProbset 1Phat Minh HuynhNo ratings yet

- 001b 10 Principles of EconomicsDocument7 pages001b 10 Principles of EconomicsAbigael Esmena100% (1)

- Behavioral Portfolio TheoryDocument31 pagesBehavioral Portfolio TheoryOla AtefNo ratings yet

- Friedman's Modern Quantity Theory of MoneyDocument6 pagesFriedman's Modern Quantity Theory of MoneyNhoel RsNo ratings yet

- Difference Between Financial and Managerial AccountingDocument10 pagesDifference Between Financial and Managerial AccountingRahman Sankai KaharuddinNo ratings yet

- Public Finance - SyllabusDocument6 pagesPublic Finance - SyllabusJosh RamuNo ratings yet

- Eonomics Questions That May Be On A Business ExamDocument8 pagesEonomics Questions That May Be On A Business ExamVic Burrack100% (1)

- Module 2Document17 pagesModule 2Maxine RubiaNo ratings yet

- Chapter 1-5 PDFDocument180 pagesChapter 1-5 PDFdcold6100% (1)

- Keynesian Theory of Income DeterminationDocument15 pagesKeynesian Theory of Income DeterminationVivek SharanNo ratings yet

- Economics Questions and Answers To First Chapter - : Wealth Set Aside To Produce Further WealthDocument7 pagesEconomics Questions and Answers To First Chapter - : Wealth Set Aside To Produce Further WealthHarry Sedgwick100% (2)

- The Nature of Managerial Economics Economics EssayDocument86 pagesThe Nature of Managerial Economics Economics EssayCoke Aidenry SaludoNo ratings yet

- Chapter 3 Elasticity of Demand and Supply PDFDocument12 pagesChapter 3 Elasticity of Demand and Supply PDFLiling Cassiopeia67% (3)

- BBA 1st Sem Micro Economics NotesDocument128 pagesBBA 1st Sem Micro Economics NotesJEMALYN TURINGAN0% (1)

- ECP5702 MBA ManagerialEconomics ROMANO SPR 16Document4 pagesECP5702 MBA ManagerialEconomics ROMANO SPR 16OmerNo ratings yet

- Examining Business Potential and Growth in Textile and Apparel Industry: A Case Study in MalaysiaDocument20 pagesExamining Business Potential and Growth in Textile and Apparel Industry: A Case Study in MalaysiaAhmad Hirzi AzniNo ratings yet

- Assignment - 33773Document14 pagesAssignment - 33773Ahmad Hirzi AzniNo ratings yet

- Examining Business Potential and Growth in Textile and Apparel Industry: A Case Study in MalaysiaDocument20 pagesExamining Business Potential and Growth in Textile and Apparel Industry: A Case Study in MalaysiaAhmad Hirzi AzniNo ratings yet

- Chanthaburi Rough ProjectionDocument4 pagesChanthaburi Rough ProjectionAhmad Hirzi AzniNo ratings yet

- Managerial EconomicsDocument6 pagesManagerial EconomicsAhmad Hirzi Azni100% (1)

- Managerial EconomicsDocument6 pagesManagerial EconomicsAhmad Hirzi Azni100% (1)

- WarninglettersampleDocument1 pageWarninglettersamplemelchie palmadoNo ratings yet

- Creativity and InnovationDocument9 pagesCreativity and InnovationAhmad Hirzi AzniNo ratings yet

- Principles of MicroeconomicsDocument14 pagesPrinciples of MicroeconomicsAhmad Hirzi Azni100% (1)

- Open Distance Learning (ODL)Document7 pagesOpen Distance Learning (ODL)Ahmad Hirzi AzniNo ratings yet

- Operation Management - ToyotaDocument8 pagesOperation Management - ToyotaAhmad Hirzi AzniNo ratings yet

- Assignment - Seminar ManagementDocument15 pagesAssignment - Seminar ManagementAhmad Hirzi AzniNo ratings yet

- Assignment - Financial AccountingDocument15 pagesAssignment - Financial AccountingAhmad Hirzi AzniNo ratings yet

- Assignment - Financial AccountingDocument15 pagesAssignment - Financial AccountingAhmad Hirzi AzniNo ratings yet

- Business EconomicsDocument17 pagesBusiness EconomicsAhmad Hirzi AzniNo ratings yet

- Assignment - Financial AccountingDocument15 pagesAssignment - Financial AccountingAhmad Hirzi AzniNo ratings yet

- AuditingDocument9 pagesAuditingAhmad Hirzi AzniNo ratings yet

- AuditingDocument9 pagesAuditingAhmad Hirzi AzniNo ratings yet

- AuditingDocument9 pagesAuditingAhmad Hirzi AzniNo ratings yet

- Financial Accounting - ZHULIANDocument8 pagesFinancial Accounting - ZHULIANAhmad Hirzi AzniNo ratings yet

- EntreprenureshipDocument17 pagesEntreprenureshipAhmad Hirzi Azni100% (1)

- Accounting Financial AnalysisDocument12 pagesAccounting Financial AnalysisAhmad Hirzi AzniNo ratings yet

- Managerial Economic 2Document20 pagesManagerial Economic 2Ahmad Hirzi AzniNo ratings yet

- ASSIGNMENT - Employment and Industrial LawDocument18 pagesASSIGNMENT - Employment and Industrial LawAhmad Hirzi Azni50% (2)

- Assignment - Mis For ProtonDocument26 pagesAssignment - Mis For ProtonAhmad Hirzi Azni0% (2)

- EntreprenureshipDocument17 pagesEntreprenureshipAhmad Hirzi Azni100% (1)

- Assignment - Mis For ProtonDocument26 pagesAssignment - Mis For ProtonAhmad Hirzi Azni0% (2)

- Business MathematicsDocument7 pagesBusiness MathematicsAhmad Hirzi AzniNo ratings yet

- Assignment July 2014 Semester: Logo UniversitiDocument17 pagesAssignment July 2014 Semester: Logo UniversitiAhmad Hirzi AzniNo ratings yet

- Aerated Concrete Production Using Various Raw MaterialsDocument5 pagesAerated Concrete Production Using Various Raw Materialskinley dorjee100% (1)

- Science, Technology and Society Module #1Document13 pagesScience, Technology and Society Module #1Brent Alfred Yongco67% (6)

- IVISOR Mentor IVISOR Mentor QVGADocument2 pagesIVISOR Mentor IVISOR Mentor QVGAwoulkanNo ratings yet

- Corometrics 170 Series BrochureDocument3 pagesCorometrics 170 Series BrochureCesar MolanoNo ratings yet

- Lalkitab Varshphal Chart PDFDocument6 pagesLalkitab Varshphal Chart PDFcalvinklein_22ukNo ratings yet

- History Homework Help Ks3Document8 pagesHistory Homework Help Ks3afetnjvog100% (1)

- 3.15.E.V25 Pneumatic Control Valves DN125-150-EnDocument3 pages3.15.E.V25 Pneumatic Control Valves DN125-150-EnlesonspkNo ratings yet

- AE HM6L-72 Series 430W-450W: Half Large CellDocument2 pagesAE HM6L-72 Series 430W-450W: Half Large CellTaso GegiaNo ratings yet

- Manual - Rapid Literacy AssessmentDocument16 pagesManual - Rapid Literacy AssessmentBaldeo PreciousNo ratings yet

- Dimmable Bulbs SamplesDocument11 pagesDimmable Bulbs SamplesBOSS BalaNo ratings yet

- 8 Lesson 13 Viking FranceDocument2 pages8 Lesson 13 Viking Franceapi-332379661No ratings yet

- Torrent - WSCC - Windows System Control Center 7.0.5.7 Commercial (x64 x86) - TeamOS - Team OS - Your Only Destination To Custom OS !!Document5 pagesTorrent - WSCC - Windows System Control Center 7.0.5.7 Commercial (x64 x86) - TeamOS - Team OS - Your Only Destination To Custom OS !!moustafaNo ratings yet

- INSTRUCTIONAL SUPERVISORY PLAN 1st Quarter of SY 2023 2024 Quezon ISDocument7 pagesINSTRUCTIONAL SUPERVISORY PLAN 1st Quarter of SY 2023 2024 Quezon ISayongaogracelyflorNo ratings yet

- Methods of Estimation For Building WorksDocument22 pagesMethods of Estimation For Building Worksvara prasadNo ratings yet

- Teaching Mathematics Content Through Explicit TeachingDocument39 pagesTeaching Mathematics Content Through Explicit Teachingronna drio100% (1)

- Electric PotentialDocument26 pagesElectric PotentialGlitchNo ratings yet

- Lecture 11 - Performance AppraisalsDocument23 pagesLecture 11 - Performance AppraisalsCard CardNo ratings yet

- Motive 27Tmx: Data SheetDocument2 pagesMotive 27Tmx: Data SheetUlisesGómezNo ratings yet

- Chapter 07Document16 pagesChapter 07Elmarie RecorbaNo ratings yet

- Bohler Dcms T-MCDocument1 pageBohler Dcms T-MCFlaviu-Andrei AstalisNo ratings yet

- Rules and Fallacies For Categorical SyllogismsDocument5 pagesRules and Fallacies For Categorical SyllogismsFatima Ismael PortacioNo ratings yet

- N6867e PXLP 3000Document7 pagesN6867e PXLP 3000talaporriNo ratings yet

- WallthicknessDocument1 pageWallthicknessGabriela MotaNo ratings yet

- Pursuit of Performance Findings From The 2014 Miller Heiman Sales Best Practices StudyDocument37 pagesPursuit of Performance Findings From The 2014 Miller Heiman Sales Best Practices StudyLoredanaNo ratings yet

- 1974 - Roncaglia - The Reduction of Complex LabourDocument12 pages1974 - Roncaglia - The Reduction of Complex LabourRichardNo ratings yet

- RV900S - IB - Series 3Document28 pagesRV900S - IB - Series 3GA LewisNo ratings yet

- AIF User Guide PDFDocument631 pagesAIF User Guide PDFÖzgün Alkın ŞensoyNo ratings yet

- Kazi Shafikull IslamDocument3 pagesKazi Shafikull IslamKazi Shafikull IslamNo ratings yet

- AnimDessin2 User Guide 01Document2 pagesAnimDessin2 User Guide 01rendermanuser100% (1)

- SHAW Superdew 3 Specification SheetDocument3 pagesSHAW Superdew 3 Specification SheetGeetha ManoharNo ratings yet

- $100M Offers: How to Make Offers So Good People Feel Stupid Saying NoFrom Everand$100M Offers: How to Make Offers So Good People Feel Stupid Saying NoRating: 5 out of 5 stars5/5 (23)

- Jab, Jab, Jab, Right Hook: How to Tell Your Story in a Noisy Social WorldFrom EverandJab, Jab, Jab, Right Hook: How to Tell Your Story in a Noisy Social WorldRating: 4.5 out of 5 stars4.5/5 (18)

- $100M Leads: How to Get Strangers to Want to Buy Your StuffFrom Everand$100M Leads: How to Get Strangers to Want to Buy Your StuffRating: 5 out of 5 stars5/5 (18)

- Fascinate: How to Make Your Brand Impossible to ResistFrom EverandFascinate: How to Make Your Brand Impossible to ResistRating: 5 out of 5 stars5/5 (1)

- ChatGPT Millionaire 2024 - Bot-Driven Side Hustles, Prompt Engineering Shortcut Secrets, and Automated Income Streams that Print Money While You Sleep. The Ultimate Beginner’s Guide for AI BusinessFrom EverandChatGPT Millionaire 2024 - Bot-Driven Side Hustles, Prompt Engineering Shortcut Secrets, and Automated Income Streams that Print Money While You Sleep. The Ultimate Beginner’s Guide for AI BusinessNo ratings yet

- The Catalyst: How to Change Anyone's MindFrom EverandThe Catalyst: How to Change Anyone's MindRating: 4.5 out of 5 stars4.5/5 (274)

- Ca$hvertising: How to Use More than 100 Secrets of Ad-Agency Psychology to Make Big Money Selling Anything to AnyoneFrom EverandCa$hvertising: How to Use More than 100 Secrets of Ad-Agency Psychology to Make Big Money Selling Anything to AnyoneRating: 5 out of 5 stars5/5 (114)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeFrom EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeRating: 4 out of 5 stars4/5 (88)

- Obviously Awesome: How to Nail Product Positioning so Customers Get It, Buy It, Love ItFrom EverandObviously Awesome: How to Nail Product Positioning so Customers Get It, Buy It, Love ItRating: 4.5 out of 5 stars4.5/5 (152)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleFrom EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleRating: 4.5 out of 5 stars4.5/5 (48)

- How to Read People: The Complete Psychology Guide to Analyzing People, Reading Body Language, and Persuading, Manipulating and Understanding How to Influence Human BehaviorFrom EverandHow to Read People: The Complete Psychology Guide to Analyzing People, Reading Body Language, and Persuading, Manipulating and Understanding How to Influence Human BehaviorRating: 4.5 out of 5 stars4.5/5 (33)

- Summary: Dotcom Secrets: The Underground Playbook for Growing Your Company Online with Sales Funnels by Russell Brunson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: Dotcom Secrets: The Underground Playbook for Growing Your Company Online with Sales Funnels by Russell Brunson: Key Takeaways, Summary & Analysis IncludedRating: 5 out of 5 stars5/5 (2)

- Summary: Traction: Get a Grip on Your Business: by Gino Wickman: Key Takeaways, Summary, and AnalysisFrom EverandSummary: Traction: Get a Grip on Your Business: by Gino Wickman: Key Takeaways, Summary, and AnalysisRating: 5 out of 5 stars5/5 (10)

- Create Once, Distribute Forever: How Great Creators Spread Their Ideas and How You Can TooFrom EverandCreate Once, Distribute Forever: How Great Creators Spread Their Ideas and How You Can TooNo ratings yet

- Understanding Digital Marketing: Marketing Strategies for Engaging the Digital GenerationFrom EverandUnderstanding Digital Marketing: Marketing Strategies for Engaging the Digital GenerationRating: 4 out of 5 stars4/5 (22)

- Invisible Influence: The Hidden Forces that Shape BehaviorFrom EverandInvisible Influence: The Hidden Forces that Shape BehaviorRating: 4.5 out of 5 stars4.5/5 (131)

- Pre-Suasion: Channeling Attention for ChangeFrom EverandPre-Suasion: Channeling Attention for ChangeRating: 4.5 out of 5 stars4.5/5 (278)

- Visibility Marketing: The No-Holds-Barred Truth About What It Takes to Grab Attention, Build Your Brand, and Win New BusinessFrom EverandVisibility Marketing: The No-Holds-Barred Truth About What It Takes to Grab Attention, Build Your Brand, and Win New BusinessRating: 4.5 out of 5 stars4.5/5 (7)

- Launch: An Internet Millionaire's Secret Formula to Sell Almost Anything Online, Build a Business You Love, and Live the Life of Your DreamsFrom EverandLaunch: An Internet Millionaire's Secret Formula to Sell Almost Anything Online, Build a Business You Love, and Live the Life of Your DreamsRating: 4.5 out of 5 stars4.5/5 (123)

- Summary: $100M Leads: How to Get Strangers to Want to Buy Your Stuff by Alex Hormozi: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: $100M Leads: How to Get Strangers to Want to Buy Your Stuff by Alex Hormozi: Key Takeaways, Summary & Analysis IncludedRating: 3 out of 5 stars3/5 (6)

- The Power of Why: Breaking Out In a Competitive MarketplaceFrom EverandThe Power of Why: Breaking Out In a Competitive MarketplaceRating: 4 out of 5 stars4/5 (5)

- How to Get a Meeting with Anyone: The Untapped Selling Power of Contact MarketingFrom EverandHow to Get a Meeting with Anyone: The Untapped Selling Power of Contact MarketingRating: 4.5 out of 5 stars4.5/5 (28)

- Scientific Advertising: "Master of Effective Advertising"From EverandScientific Advertising: "Master of Effective Advertising"Rating: 4.5 out of 5 stars4.5/5 (163)

- Yes!: 50 Scientifically Proven Ways to Be PersuasiveFrom EverandYes!: 50 Scientifically Proven Ways to Be PersuasiveRating: 4 out of 5 stars4/5 (153)

- How To Win Customers And Keep Them For Life: An Action-Ready Blueprint for Achieving the Winner's Edge!From EverandHow To Win Customers And Keep Them For Life: An Action-Ready Blueprint for Achieving the Winner's Edge!Rating: 4.5 out of 5 stars4.5/5 (23)

- Marketing Made Simple: A Step-by-Step StoryBrand Guide for Any BusinessFrom EverandMarketing Made Simple: A Step-by-Step StoryBrand Guide for Any BusinessRating: 5 out of 5 stars5/5 (203)

- 100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziFrom Everand100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziNo ratings yet

- Summary: Range: Why Generalists Triumph in a Specialized World by David Epstein: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: Range: Why Generalists Triumph in a Specialized World by David Epstein: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (6)