Professional Documents

Culture Documents

FDI & FII India

Uploaded by

Kanishk MehrotraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FDI & FII India

Uploaded by

Kanishk MehrotraCopyright:

Available Formats

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

Fundamentals of

Business

Environment

(FDI AND FII IMPACT ON INDIAN ECONOMY)

SUBMITTED BY : Kanishka

Mehrotra

PRN NUMBER : 14021021049

BATCH : 2014-17 (B)

FDI & FII Impact on Indian Economy

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

SUBMITTED TO: Ms. Khushboo

Tyagi

ACKNOWLEDGEMENT

I would like to thank Ms Khushboo Tyagi,

Symbiosis Centre For Management Studies, Noida

and my fellow batchmates who advised me in the

making of this project without their cooperation I

woud not have completed the project.

Kanishka Mehrotra

Symbiosis Centre for Management Studies, Noida

FDI & FII Impact on Indian Economy

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

FDI & FII Impact on Indian Economy

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

EXECUTIVE SUMMARY

Foreign Direct Investment (FDI) and Foreign Institutional Investment (FII)

flows are usually preferred over other forms of external finance because they are nondebt creating, non-volatile and their returns depend on the performance of the projects

financed by the investors. FDI and FII also facilitates international trade and transfer

of knowledge, skills and technology. In a world of increased competition and rapid

technological change, their complimentary and catalytic role can be very valuable.

Over the years, FDI and FII inflow in the country is increasing. However,

India has tremendous potential for absorbing greater flow of FDI and FII in the

coming years. Serious efforts are being made to attract greater inflow of FDI and FII

in the country by taking several actions both on policy and implementation front. An

essential requirement of the foreign investing community in making their investment

decision is availability of timely and reliable information about the policies and

procedures governing FDI and FII in India.

Foreign direct investment (FDI) and FII in India has played an important role

in the development of the Indian economy. FDI and FII in India has - in a lot of ways

- enabled India to achieve a certain degree of financial stability, growth and

development. This money has allowed India to focus on the areas that may have

needed economic Attention, and address the various problems that continue to

challenge the country. India has continually sought to attract FDI from the worlds

major investors. In 1998 and 1999, the Indian national government announced a

number of reforms designed to encourage FDI and present a favorable scenario for

investors. FDI and FII are permitted through financial collaborations, through private

equity or preferential allotments, by way of capital markets through Euro issues, and

in joint ventures.

FDI & FII Impact on Indian Economy

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

INTRODUCTION

The Government of India has recognized the key role of the foreign direct investment

(FDI) and foreign institutional investment (FII) in its process of economic development,

not only as an addition to its own domestic capital but also as an important source of

technology and other global trade practices. In order to attract the required amount of FDI

and FII, it has bought about a number of changes in its economic policies and has put in

its practice a liberal and more transparent FDI and FII policy with a view to attract more

foreign direct institutional investment inflows into its economy. These changes have

heralded the liberalization era of the foreign investment policy regime into India and have

brought about a structural breakthrough in the volume of FDI and FII inflows in the

economy.

The influx of FIIs has indeed influenced the secondary market segment of the Indian

stock market. But the supposed linkage effects with the real economy have not worked.

Instead there has been an increased uncertainty and skepticism about the stock market in

this country. On the other hand, the surge in foreign portfolio investment in the Indian

economy has introduced some serious problems of macroeconomic management for the

policymakers like inflation, currency appreciation etc.

On the other hand FDI is what the government really needs to attract in various sectors

like infrastructure, education etc. it is much more stable than the foreign institutional

investment which comes via the stock market route, and has more accountability and

brings fundamental and tangible benefits to the economy.

In this context, this report is going to analyze the trends and patterns of foreign direct

investment (FDI) and foreign institutional investment (FII) flows into India during the

post liberalization period.

FDI & FII Impact on Indian Economy

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

FOREIGN DIRECT INVESTMENT

INTRODUCTION

Is the process whereby residents of one country (the source country) acquire ownership of

assets for the purpose of controlling the production, distribution, and other activities of a

firm in another country (the host country). The international monetary funds balance of

payment manual defines FDI as an investment that is made to acquire a lasting interest in

an enterprise operating in an economy other than that of the investor. The investors purpose

being to have an effective voice in the management of the enterprise. The united nations

1999 world investment report defines FDI as an investment involving a long term

relationship and reflecting a lasting interest and control of a resident entity in one economy

(foreign direct investor or parent enterprise) in an enterprise resident in an economy other

than that of the foreign direct investor ( FDI enterprise, affiliate enterprise or foreign

affiliate).

Foreign direct investment (FDI) plays an extraordinary and growing role in global

business. It can provide a firm with new markets and marketing channels, cheaper

production facilities, access to new technology, products, skills and financing. For a host

country or the foreign firm which receives the investment, it can provide a source of new

technologies, capital, processes, products, organizational technologies and management

skills, and as such can provide a strong impetus to economic development.

Foreign direct investment, in its classic definition, is defined as a company from one

country making a physical investment into building a factory in another country. The

direct investment in buildings, machinery and equipment is in contrast with making a

portfolio investment, which is considered an indirect investment. In recent years, given

rapid growth and change in global investment patterns, the definition has been broadened

to include the acquisition of a lasting management interest in a company or enterprise

outside the investing firms home country. As such, it may take many forms, such as a

FDI & FII Impact on Indian Economy

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

direct acquisition of a foreign firm, construction of a facility, or investment in a joint

venture or strategic alliance with a local firm with attendant input of technology, licensing

of intellectual property, In the past decade, FDI has come to play a major role in the

internationalization of business.

One of the most striking developments during the last two decades is the spectacular

growth of FDI in the global economic landscape. This unprecedented growth of global FDI

in 1990 around the world make FDI an important and vital component of development

strategy in both developed and developing nations and policies are designed in order to

stimulate inward flows. Infact, FDI provides a win win situation to the host and the

home countries. Both countries are directly interested in inviting FDI, because they benefit

a lot from such type of investment. The home countries want to take the advantage of the

vast markets opened by industrial growth. On the other hand the host countries want to

acquire technological and managerial skills and supplement domestic savings and foreign

exchange. Moreover, the

paucity of all types of resources viz. financial, capital,

entrepreneurship, technological know- how, skills and practices, access to marketsabroad- in their economic development, developing nations accepted FDI as a sole visible

panacea for all their scarcities. Further, the integration of global financial markets paves

ways to this explosive growth of FDI around the globe.

The year 1991 marks a new growth phase of FDI in India with an all time high flow

of FDI. Following the Industrial Policy (1991) , a large number of foreign companies

from different parts of the world rushed into India. In this period, in addition to

thousands of foreign collaborations in India, as many as 145 foreign companies

registered in India within a span of 10 years from 1991-2000. Companies like General

Motors, Ford Motors, and IBM that divested from India in the 1950s and 1970s

reentered India during this period. A large number of Asian companies like Daewoo

Motors, Hyundai Motors and LG Electronics from S. Korea, Matsushita Television

and Honda Motors from Japan invested in India during this period.

With the legislation of the Industrial Licensing Policy, 1991, industrial licensing was

abolished except for 18 industries. FDI up to 51% equity was allowed in 34 formerly high

priority industries and the concept of phased manufacturing requirement on foreign

FDI & FII Impact on Indian Economy

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

companies was removed. Further, the tariffs on imports have been steadily reduced in

every budget since 1991.

ADVANTAGES OF FDI

1. Raising the Level of Investment: Foreign investment can fill the gap between

desired investment and locally mobilized savings. Local capital markets are often

not well developed. Thus, they cannot meet the capital requirements for large

investment projects. Besides, access to the hard currency needed to purchase

investment goods not available locally can be difficult. FDI solves both these

problems at once as it is a direct source of external capital. It can fill the gap

between desired foreign exchange requirements and those derived from net export

earnings.

2. Up gradation of Technology: Foreign investment brings with it technological

knowledge while transferring machinery and equipment to developing countries.

Production units in developing countries use out-dated equipment and techniques

that can reduce the productivity of workers and lead to the production of goods of

a lower standard.

3. Improvement in Export Competitiveness: FDI can help the host country

improve its export performance. By raising the level of efficiency and the

standards of product quality, FDI makes a positive impact on the host countrys

export competitiveness. Further, because of the international linkages of MNCs,

FDI provides to the host country better access to foreign markets. Enhanced

export possibility contributes to the growth of the host economies by relaxing

demand side constraints on growth. This is important for those countries which

FDI & FII Impact on Indian Economy

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

have a small domestic market and must increase exports vigorously to maintain

their tempo of economic growth.

4. Employment

Generation/Development:

Foreign

investment

can

create

employment in the modern sectors of developing countries. Recipients of FDI

gain training of employees in the course of operating new enterprises, which

contributes to human capital formation in the host country.

5. Benefits to Consumers: Consumers in developing countries stand to gain from

FDI through new products, and improved quality of goods at competitive prices.

6. Revenue to Government: Profits generated by FDI contribute to corporate tax

revenues in the host country.

DISADVANTAGES OF FDI

FDI is not an unmixed blessing. Governments in developing countries have to be very

careful while deciding the magnitude, pattern and conditions of private foreign

investment. Possible adverse implications of foreign investment are the following:

1. When foreign investment is competitive with home investment, profits in

domestic industries fall, leading to fall in domestic savings.

2. Contribution of foreign firms to public revenue through corporate taxes is

comparatively less because of liberal tax concessions, investment allowances,

disguised public subsidies and tariff protection provided by the host government.

3. Foreign firms reinforce dualistic socio-economic structure and increase income

inequalities. They create a small number of highly paid modern sector executives.

FDI & FII Impact on Indian Economy

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

They divert resources away from priority sectors to the manufacture of

sophisticated products for the consumption of the local elite. As they are located in

urban areas, they create imbalances between rural and urban opportunities,

accelerating flow of rural population to urban areas.

4. Foreign firms stimulate inappropriate consumption patterns through excessive

advertising and monopolistic market power. The products made by multinationals

for the domestic market are not necessarily low in price and high in quality. Their

technology is generally capital-intensive which does not suit the needs of a laboursurplus economy.

DETERMINANTS OF FDI

To understand the scale and direction of FDI flows, it is necessary to identify their

major determinants. The relative importance of FDI determinants varies not only

between countries but also between different types of FDI. Traditionally, the

determinants of FDI include the following.

1. Size of the Market: Large developing countries provide substantial markets

where the consumers demand for certain goods far exceed the available supplies.

This demand potential is a big draw for many foreign-owned enterprises. In many

cases, the establishment of a low cost marketing operation represents the first step

by a multinational into the market of the country. This establishes a presence in

the market and provides important insights into the ways of doing business and

possible opportunities in the country.

2. Political stability: In many countries, the institutions of government are still

evolving and there are unsettled political questions. Companies are unwilling to

contribute large amounts of capital into an environment where some of the basics

political questions have not yet been resolved.

3. Macro-economic Environment: Instability in the level of prices and exchange

rate enhance the level of uncertainty, making business planning difficult. This

FDI & FII Impact on Indian Economy

10

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

increases the perceived risk of making investments and therefore adversely

affects the inflow of FDI.

4. Legal and Regulatory Framework: The transition to a market economy entails

the establishment of a legal and regulatory framework that is compatible with

private sector activities and the operation of foreign owned companies. The

relevant areas in this field include protection of property rights, ability to

repatriate profits, and a free market for currency exchange. It is important that

these rules and their administrative procedures are transparent and easily

comprehensive.

FDI Approval Route in India

Foreign direct investments in India are approved through two

routes :

1. Automatic approval by RBI

The Reserve Bank of India accords automatic approval within a period of two weeks

(subject to compliance of norms) to all proposals and permits foreign equity up to

24%; 50%; 51%; 74% and 100% is allowed depending on the category of industries

and the sectoral caps applicable. The lists are comprehensive and cover most

industries of interest to foreign companies. Investments in high priority industries or

for trading companies primarily engaged in exporting are given almost automatic

approval by the RBI.

2. The FIPB Route Processing of non-automatic approval cases

FDI in activities not covered under the automatic route requires prior approval of the

Government which are considered by the Foreign Investment Promotion Board

(FIPB), Department of Economic Affairs, Ministry of Finance. Indian companies

having foreign investment approval through FIPB route do not require any further

clearance from the Reserve Bank of India for receiving inward remittance and for the

issue of shares to the non-resident investors.

SECTOR SPECIFIC CONDITIONS ON FDI

FDI & FII Impact on Indian Economy

11

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

PROHIBITED SECTORS.

1. Retail Trading (except single brand product retailing)

2. Lottery Business including Government /private lottery, online lotteries, etc.

3. Gambling and Betting including casinos etc.

4. Chit funds

5. Nidhi company

6. Trading in Transferable Development Rights (TDRs)

7. Real Estate Business or Construction of Farm Houses

8. Manufacturing of Cigars, cheroots, cigarillos and cigarettes substitutes

9. Activities / sectors not open to private sector investment e.g. Atomic Energy

10. Railway Transport (other than Mass Rapid Transport System

PERMITTED SECTORS

Sr.

Sector/Activity

FDI cap/Equity

Entry/Route

1.

Hotel & Tourism

100%

Automatic

2.

NBFC

49%

Automatic

3.

Insurance

26%

Automatic

4.

Telecommunication:

No.

Automatic

cellular, value added services

49%

ISPs with gateways, radio-paging

Electronic Mail & Voice Mail

Above

74%

49%

Govt. licence

100%

5.

Trading companies:

primarily export activities

bulk

imports,

cash

and

Power(other

than

atomic

power plants)

FDI & FII Impact on Indian Economy

Automatic

100%

Automatic

100%

Automatic

carry

wholesale trading

6.

51%

reactor

12

need

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

7.

100%

Automatic

100%

Automatic

100%

Automatic

Drugs & Pharmaceuticals

8.

Roads, Highways, Ports and Harbors

9.

Pollution Control and Management

10

Call Centers

100%

Automatic

11.

BPO

100%

Automatic

13.

Airports:

Greenfield projects

100%

Automatic

Existing projects

100%

Beyond 74% FIPB

14

Assets reconstruction company

49%

FIPB

15.

Cigars and cigarettes

100%

FIPB

16.

Courier services

100%

FIPB

17.

Investing companies in infrastructure 49%

FIPB

(other than telecom sector)

SECTORS ATTRACTING HIGHEST FDI EQUITY INFLOWS

FDI & FII Impact on Indian Economy

13

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

Note: Cumulative Sector- wise FDI equity inflows (from April 2000 to January 2012)

Source: Department of Industrial Policy & Promotion

Foreign Direct Investment in India in the last 10 Years

FDI & FII Impact on Indian Economy

14

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

It can be seen that the flow of FDI has consistent and gradually increasing over the

years. There has been an increase of 129% i.e. Rs. 13851 Crores from the year 200001 to 2005-06 while the increase from 2005-06 to 2011-12 has been a phenomenal

607% i.e. from Rs. 24584 Cr to Rs. 173947 Cr which can be attributed to relaxation of

foreign investment rules. Despite the global financial credit squeeze brought by the

recession India continues to be an attractive destination for investment as there is

tremendous potential for growth in the vast and diverse markets of our country.

The bars from 2000-01 to 2004-05 have been almost hovering the same levels but

importantly havent gone down which is because the foreign investors saw immense

potential but were not getting enough incentives to enter with huge business

propositions. The breakout came from the year 2005-06 when the investment nearly

doubled as compared to 2000-01, after which there was no looking back as consistent

economic growth, de-regulation, liberal investment rules, and operational flexibility

helped increase the inflow of Foreign Direct Investment or FDI. So much so that even

during the year 2008-09 when the recession had taken its toll on the western countries

there was no indication of falling investment via the FDI route as can be seen from the

chart. In fact during 2008-09 the chart shows that FDI breached the Rs. 1 lakh crore

marks. In percentage terms FDI inflow increased by 28% from 2007-08 to 2008-09.

FDI & FII Impact on Indian Economy

15

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

FOREIGN INSTITUTIONAL INVESTMENT (FII)

As defined by the European Union Foreign Institutional Investment is an investment

in a foreign stock market by the specialized financial intermediaries managing savings

collectively on behalf

of investors, especially small investors, towards specific

objectives in term of risk, return and maturity of claims.

SEBIs Definition of FIIs presently includes foreign pension funds, mutual funds,

charitable/endowment/university funds, asset management companies and other

money managers operating on their behalf in a foreign stock market. Foreign

institutional investment is liquid nature investment, which is motivated by

international portfolio diversification benefits for individuals and institutional

investors in industrial country.

It refers to the purchase of stocks, bonds, debentures or other securities by an FII. FIIs

include pension funds, mutual funds, investment trusts, asset management companies,

nominee companies and incorporated/institutional portfolio managers.

In contrast to FDI, FIIs do not invest with the intention of gaining controlling interest

in a company. They typically make short-term investments. These investments are

made-to- book profits. Compared to FDI, a portfolio investor can enter and exit

countries with relative ease.. Because of the very nature of such investment, FII

money is also called hot money. The rapid outflow of hot money, in the recent

past, has created exchange-rate problems in Argentina and in Southeast Asia. Since

FIIs are very sensitive, a mere change in perception about an economy can prompt

them to pull out investments from a country.

Indian Markets have been one of the most attractive investment places for the FII's.

India being a developing nation attracts the foreign flows looking at the growth

potential in the Indian Economy. The FII's contribute a major chunk of volumes on

the Indian bourses and this in turn impacts the market moves. In case of recession in

the world economies, the foreign investors look for saver bets and India with a rising

GDP where other nations GDP / Growth is shrinking has always offered greater

FDI & FII Impact on Indian Economy

16

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

investment avenues. Indian Markets have been the clear outperformers vis-a-vis the

global markets in the past years.

FOREIGN INSTITUTIONAL INVESTMENT IN INDIA

Foreign Institutional Investors means an institution established or incorporated

outside India which proposes to make investment in India in securities. A Working

Group for Streamlining of the Procedures relating to FIIs, constituted in April, 2003,

inter alia, recommended streamlining of SEBI registration procedure, and suggested

that dual approval process of SEBI and RBI be changed to a single approval process

of SEBI. This recommendation was implemented in December 2003.

Currently, entities eligible to invest under the FII route are as follows:

As FII: Overseas pension funds, mutual funds, investment trust, asset

management company, nominee company, bank, institutional portfolio manager,

university funds, endowments, foundations, charitable trusts, charitable societies, a

trustee or power of attorney holder incorporated or established outside India

proposing to make proprietary investments or with no single investor holding more

than 10 per cent of the shares or units of the fund.

As Sub-accounts: The Sub account is generally the underlying fund on whose behalf

the FII invests. The following entities are eligible to be registered as sub-accounts,

viz. partnership firms, private company, public company, pension fund, investment

trust, and individuals. A domestic portfolio manager or a domestic asset management

company shall also be eligible to be registered as FII to manage the funds of subaccounts.

The Government guidelines for FII of 1992 allowed, inter-alia, entities such as asset

management companies, nominee companies and incorporated/institutional portfolio

managers or their power of attorney holders (providing discretionary and nondiscretionary portfolio management services) to be registered as FIIs. While the

guidelines did not have a specific provision regarding clients, in the application form

the details of clients on whose behalf investments were being made were sought.

FDI & FII Impact on Indian Economy

17

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

FIIs are eligible to purchase shares and convertible debentures issued by Indian

companies under the Portfolio Investment Scheme.

Who can be registered as an FII ?

The applicant should be any of the following categories:

1. Pension funds

2. Mutual funds

3. Investment trust

4. Insurance or reinsurance companies

5. Endowment funds

6. University funds

7. Foundations or charitable trusts or charitable societies who propose to invest on

their own behalf and

a) Asset management companies

b) Nominee companies

c) Institutional portfolio managers

d) Trustees

e) Power of attorney holders

f) Bank

Prohibitions on Investments

Foreign Institutional Investors are not permitted to invest in equity issued by an Asset

Reconstruction Company. They are also not allowed to invest in any company which

is engaged or proposes to engage in the following activities:

Business of chit fund

Agricultural or plantation activities

Real estate business or construction of farm houses (real estate business does

not include development of townships, construction of residential/commercial

premises, roads or bridges)

FDI & FII Impact on Indian Economy

18

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

Reasons for strong flow of FIIs in India

FIIs attracted by the fast growing economy of India and strong performance of Indian

companies have been attracted towards India to an extent that India has gone on to

become the preferred investment destination.

The primary reasons for India being a preferred destination for FIIs are:

Global liquidity into the equity markets.

Improved performance and competitiveness of Indian firms.

Opening up of Indian economy.

Cheap labor and other factors of production.

Highly developed stock market and high degree of vigilance over it.

Tax Incentives.

Regulation and Trading Efficiencies

F and O Segment

Role of FIIs

The Indian stock market has come of age and has substantially aligned itself

with the international order.

Market has also witnessed a growing trend of 'institutionalization' that may be

considered as a consequence of globalization.

It is influence of the FIIs which changed the face of the Indian stock markets.

Screen based trading and depository are realities today largely because of FIIs.

FII which based the pressure on the rupee from the balance of payments

position and lowered the cost of capital to Indian business.

FIIs are the trendsetters in any market. They were the first ones to identify the

potential of Indian technology stocks. When the rest of the investors invested

in these scrips, they exited the scrips and booked profits.

Rolling settlement was introduced at the insistence of FIIs as they were

uncomfortable with the badla system.

The FIIs are playing an important role in bringing in funds needed by the

equity market.

FDI & FII Impact on Indian Economy

19

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

The increase in the volume of activity on stock exchanges with the advent of

on screen trading coupled with operational inefficiencies of the former

settlement and clearing system led to the emergence of a new system called

the depository System.

Flow of money into Indian economy via FIIs has been increasing at a rapid

rate. This has forced economist and policy makers to consider impacts of this

inflow on the macro economic factors as well. This has resulted in deeper

analysis of factors like Interest Rate, Inflation Rate, GDP and Exchange Rate

etc. both in short term as well as long term.

Investment Conditions and Restrictions for FIIs

A Foreign Institutional Investor may invest only in the following:(a) Securities in the primary and secondary markets including shares, debentures

and warrants of companies, unlisted, listed or to be listed on a recognized stock

exchange in India.

(b) Units of schemes floated by domestic mutual funds including Unit Trust of

India, whether listed or not listed in a recognized stock exchange

(c) Dated Government securities.

(d) Derivatives traded on a recognized stock exchange.

(e) Commercial paper.

(f) Security receipts

Even investments made by FIIs in security receipts issued by securitization companies

or asset reconstruction companies under the Securitization and Reconstruction of

Financial Assets and Enforcement of Security Interest Act, 2002 are not eligible for

the investment limits mentioned above. No foreign institutional investor should invest

in security receipts on behalf of its sub-account.

FDI & FII Impact on Indian Economy

20

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

SEBI Registered FIIs

Year

Number of FIIs

2001-02

490

2002-03

502

2003-04

540

2004-05

685

2005-06

882

2006-07

996

2007-08

1219

2008-09

1334

2009-10

1729

2010-11

2011-12

1767

1758

Source: www.sebi.gov.in

2011-12 data till June 2012

The names of some prominent FIIs registered are: United Nations for and on behalf of

the United Nations Joint Staff Pension Fund, Public School Retirement System of

Missouri, Treasurer of the State North Carolina Equity Investment Fund Pooled Trust,

the Growth Fund of America, AIM Funds Management Inc, etc.

NET FII INVESTMENTS OVER THE YEARS

FDI & FII Impact on Indian Economy

21

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

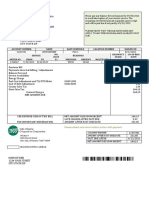

FII Activity for previous years

Gross Purchase

Gross

Net

Year

(Cr)

Sale

Investment

(Cr)

(Cr)

2012

277,696.30

235,201.50

42,494.70

611,055.60

613,770.80

-2,714.20

2011

766,283.20

633,017.10

133,266.80

2010

624,239.70

540,814.70

83,424.20

2009

721,607.00

774,594.30

-52,987.40

2008

814,877.90

743,392.00

71,486.30

2007

475,624.90

439,084.10

36,540.20

2006

286,021.40

238,840.90

47,181.90

2005

185,672.00

146,706.80

38,965.80

2004

94,412.00

63,953.50

30,459.00

2003

46,479.10

42,849.80

3,629.60

2002

SOURCE:INDIA INFOLINE Data for 2012 upto may 2012

FIIs IMPACT ON EXCHANGE RATES

To understand the implications of FII on the exchange rates we have to understand

how the value of one currency goes up (appreciates) or goes down against the other

currency. The simple way of understanding is through Demand and Supply. If say US

imports from India it is creating a demand for Rupee thus the Indian rupee appreciates

w.r.t the dollar. If India imports then the dollar appreciates w.r.t the Indian rupee.

Now considering FIIs for every dollar that they bring into the country, there is a

demand for rupee created and the RBI has to print and release the money in the

country. Since the FIIs are creating a demand for rupee, it appreciates w.r.t the dollar.

Thus if for e.g. if prior to the demand the exchange rate was 1 USD = Rs 40, it could

become 1 USD = Rs 39 after they invets. Similarly when FII withdraw the capital

from the markets, they need to earn back the U.S Dollar so that leads to a demand for

dollars the rupee depreciates. 1 USD goes back to Rs. 40. Thus FII inflows make the

currency of the country invested in appreciate and their selling and disinvestment may

lead to depreciation.

Depreciating currency not favorable to the FIIs: considering a simple hypothetical

example. I invested 1 USD in India at an exchange rate of 1 USD = Rs. 40. If rupee

appreciates the exchange rates become 1 USD = Rs. 20. Now if I disinvest I get 2

dollars, whereas I invested only 1 USD thereby a gain of 1 USD. (Though in real

FDI & FII Impact on Indian Economy

22

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

terms the purchasing power of my dollar might decrease as my import cost would

increase, and cost of living back home may increase, but when I do consider practical

examples there is always a gain for FII whenever the currency of the country invested

in appreciates w.r.t the home currency)

Relationship between FII inflow and Sensex

YEAR

2005

2006

2007

2008

2009

2010

2011

2012

NET FII

INVESTMENTS

47181.9

36540.2

71486.3

-52987.4

83424.2

133266.8

2714.2

42263.3

BSE SENSEX

CLOSING

9397.93

13786.91

20286.99

9647.31

17464.81

20509.1

15454.9

16950

From the above charts it is clear that net FII investments at BSE show a similar

pattern to the Yearly average closings. The net FII started declining from 2007-08 till

the middle of 2008-09 which caused a sharp fall in Sensex also which went below the

FDI & FII Impact on Indian Economy

23

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

10000 level in 2007-08 falling by almost 52% as compared to the previous year. But

the FIIs started pouring in again from the end of 2009 after the governments abroad

started providing bail-out packages, sops and various other incentives to the ailing

companies. The Sensex also rises sharply from 2008-09 after the FIIs turned into net

buyers and hence a similar pattern can be found between these two.

What does India Need - FDI or FII

FDI usually is associated with export growth. It comes only when all the criteria to

set up an export industry are met. That includes, reduced taxes, favorable labor law,

freedom to move money in and out of country, government assistance to acquire land,

full grown infrastructure, reduced bureaucratic involvement etc. IT, BPO, Auto Parts,

Pharmaceuticals, unexplored service sectors including accounting; drug testing,

medical care etc are key sectors for foreign investment. Manufacturing is a brick and

mortar investment. It is permanent and stays in the country for a very long time. Huge

investments are needed to set this industry. It provides employment potential to semi

skilled and skilled labor. On the other hand the service sector requires fewer but

highly skilled workers. Both are needed in India. If India plays its cards right India

may be the hub for the service sector. Still high end manufacturing in auto parts and

pharmaceuticals should be Indias target.

The FII (Foreign Institutional Investor) is monies, which chases the stocks in the

market place. It is not exactly brick and mortar money, but in the long run it may

translate into brick and mortar. Sudden influx of this drives the stock market up as too

much money chases too little stock. Where FDI is a bit of a permanent nature, the FII

flies away at the shortest political or economical disturbance. The Global Recession of

2008 is a key example of the latter. Once this money leaves, it leaves ruined economy

and ruined lives behind. Hence FII is to be welcomed with strict political and

economical discipline.

FDI & FII Impact on Indian Economy

24

Symbiosis Centre for Management Studies, Noida

Kanishka Mehrotra

BIBLIOGRAPHY

www.dipp.nic.in

www.sebi.gov.in

www.bseindia.com

www.rbi.org.in

www.unctad.org

www.indiainfoline.com

www.thehindu.com

THANK YOU

FDI & FII Impact on Indian Economy

25

You might also like

- Managing Bank IT SystemsDocument12 pagesManaging Bank IT SystemsKanishk MehrotraNo ratings yet

- A Bright Future For Indias Defense IndustryDocument12 pagesA Bright Future For Indias Defense IndustryKiran ChokshiNo ratings yet

- Corporate GovernanceDocument40 pagesCorporate GovernanceKanishk MehrotraNo ratings yet

- Nestle - Financial Statement Analysis ComponentDocument5 pagesNestle - Financial Statement Analysis ComponentKanishk MehrotraNo ratings yet

- Breed 090901134255 Phpapp01Document34 pagesBreed 090901134255 Phpapp01Hus KatNo ratings yet

- Business Studies Project Class XIIDocument13 pagesBusiness Studies Project Class XIIKanishk Mehrotra67% (15)

- Impact of LPGDocument1 pageImpact of LPGKanishk MehrotraNo ratings yet

- Rice Industry (Component I) - Business EnvironmentDocument16 pagesRice Industry (Component I) - Business EnvironmentKanishk MehrotraNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Pas 12 Income TaxesDocument15 pagesPas 12 Income TaxesrandyNo ratings yet

- Chapter 5 TaxationDocument3 pagesChapter 5 TaxationAngela Nicole NobletaNo ratings yet

- Land Tax Dispute Between Usufructuaries and Naked OwnersDocument2 pagesLand Tax Dispute Between Usufructuaries and Naked OwnersInter_vivos0% (1)

- Clickworker Payment ConformationDocument1 pageClickworker Payment ConformationRekha RavaliNo ratings yet

- Government of The People'S Republic of Bangladesh: (For Values Up To Tk.1 Million/10 Lac)Document13 pagesGovernment of The People'S Republic of Bangladesh: (For Values Up To Tk.1 Million/10 Lac)Kamruz zamanNo ratings yet

- Hanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4Document3 pagesHanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4ulil alfarisyNo ratings yet

- Balance Sheet Ay 2023-24 Priyanka Gawade..Document5 pagesBalance Sheet Ay 2023-24 Priyanka Gawade..cagopalofficebackupNo ratings yet

- Smart Communications, Inc. vs. Municipality of Malvar, BatangasDocument3 pagesSmart Communications, Inc. vs. Municipality of Malvar, BatangasRaquel Doquenia100% (2)

- Polytechnic University of the Philippines Taguig Branch Income Taxation Module 4 and Chapter 1 & 2 Written ReportDocument6 pagesPolytechnic University of the Philippines Taguig Branch Income Taxation Module 4 and Chapter 1 & 2 Written ReportMarie Lyne AlanoNo ratings yet

- Extra Book - June 2015 FinalDocument84 pagesExtra Book - June 2015 Finaldanishzafar100% (1)

- 5 April 2016: Panama Papers: How Did Panama Become A Tax Haven?Document4 pages5 April 2016: Panama Papers: How Did Panama Become A Tax Haven?JasonDirntRottenNo ratings yet

- Philex Mining Corp. v. CIRDocument1 pagePhilex Mining Corp. v. CIRromelamiguel_2015No ratings yet

- TaxDocument8 pagesTaxClaire BarrettoNo ratings yet

- Mineral Taxation SystemDocument43 pagesMineral Taxation Systemgauravtiwari87No ratings yet

- PM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)Document22 pagesPM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)dodong123100% (1)

- C - L ElectricDocument1 pageC - L ElectricNoel FrömgenNo ratings yet

- Analisis Perpajakan Terhadap Bentuk Usaha Tetap Berbasis Layanan AplikasiDocument23 pagesAnalisis Perpajakan Terhadap Bentuk Usaha Tetap Berbasis Layanan AplikasiNidha NianNo ratings yet

- State - A Community of Persons More or Less Numerous, Permanently Occupying A Definite Portion ofDocument7 pagesState - A Community of Persons More or Less Numerous, Permanently Occupying A Definite Portion ofRonna MaeNo ratings yet

- Employee's Withholding Certificate 2020Document4 pagesEmployee's Withholding Certificate 2020CNBC.comNo ratings yet

- International Machine Corporation Case Analysis - International Financial ManagementDocument6 pagesInternational Machine Corporation Case Analysis - International Financial ManagementRavi JainNo ratings yet

- income From Salary-Problems, Theory and Solutions: by Prof - Augustin AmaladasDocument76 pagesincome From Salary-Problems, Theory and Solutions: by Prof - Augustin AmaladasAnkit Dhyani100% (6)

- Income Tax Book by CA Suraj Agrawal - May & Nov 2020 Exam - CompressedDocument590 pagesIncome Tax Book by CA Suraj Agrawal - May & Nov 2020 Exam - CompressedSonali Dixit100% (1)

- Contribution of Green Delta Insurance in Bangladesh's EconomyDocument19 pagesContribution of Green Delta Insurance in Bangladesh's Economyputulbou100% (2)

- CUSTOMS LAW MANUAL - NotesDocument10 pagesCUSTOMS LAW MANUAL - NotesChetanya KapoorNo ratings yet

- IMChap005Document34 pagesIMChap005cynthia dewiNo ratings yet

- UntitledDocument11 pagesUntitleddeepika devsaniNo ratings yet

- Pakistan's Fertilizer Industry: An Analysis of Key Trends and DevelopmentsDocument23 pagesPakistan's Fertilizer Industry: An Analysis of Key Trends and DevelopmentsShahzaib RazaNo ratings yet

- CTC News December 2022Document16 pagesCTC News December 2022jeetNo ratings yet

- SIE ReviewerDocument5 pagesSIE ReviewerMina G.No ratings yet

- Haritha Hotel Booking Keesaragutta PDFDocument4 pagesHaritha Hotel Booking Keesaragutta PDFRaviTeja KvsnNo ratings yet