Professional Documents

Culture Documents

Case Digest Insurance

Uploaded by

Raffy Roncales100%(1)100% found this document useful (1 vote)

365 views4 pagesCompulsory Motor Vehicle Liability Insurance

Chapter IV

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCompulsory Motor Vehicle Liability Insurance

Chapter IV

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

365 views4 pagesCase Digest Insurance

Uploaded by

Raffy RoncalesCompulsory Motor Vehicle Liability Insurance

Chapter IV

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Group 3:

CAHUAN, Izhar

DUGUAN, Bryan Kent

MAGAHUD, Edziel James

PAHANGUIN, Debson

RONCALES, Raffy

Chapter VI

Compulsory Motor Vehicle Liability Insurance

CASE DIGEST

Shafer v. Judge of Olongapo City

167 SCRA 386 (1986)

Facts:

This is a petition for review on certiorari. Herein petitioner Shafer obtained a private policy of CTPL

from Makati Insurance Company. During the period of insurance, he met an accident and was charged

with reckless imprudence resulting in damage to property and serious physical injuries and causes

damage in the amount of P 12,345.00. The passenger of the Volkswagen also filed a separate civil

action for damages. During the trial of the criminal case the passenger Jovencio Poblete testified on his

claim for damages. Shafer then filed a third party complaint against Makati Insurance Company which

was allowed by the former presiding judge of the court. Makati Insurance Co. moved to dismiss the case

which was granted on the ground that it was premature. Stating that unless herein petitioner is found

guilty and sentenced to pay the offended party for indemnity or damages, the complaint is without

cause of action. Hence, the petition.

Issue:

WON the accused, also the third party plaintiff, has a cause of action against the third party defendant

for the enforcement of its third party liability (TPL) under the insurance contract.

Ruling:

Yes, the occurrence of the injury to the third party immediately gave rise to the liability of the insurer

under its policy. The liability of the insurance company under the Compulsory Motor Vehicle Liability

Insurance is for loss or damage. Where an insurance policy insures directly against liability, the insurer's

liability accrues immediately upon the occurrence of the injury or event upon which the liability

depends, and does not depend on the recovery of judgment by the injured party against the insured.

First Integrated Bonding and Insurance Co, Inc. vs Hernando

199 SCRA 796 (1991)

Facts:

Silverio Blanco was the owner of a passenger jeepney which he insured against liabilities for death and

injuries to third persons with First Integrated Bonding and Insurance Company, Inc. for P30,000. The

said jeepney driven by Blanco himself bumped a five-year old child, Deogracias Advincula, causing the

latter's death. The boys parents filed a complaint for damages against Blanco and First Insurance,

which was granted by the lower court. First Insurance filed a petition for certiorari contending that the

victims parents have no cause of action against it because they are not parties to the insurance

contract and that they may only proceed against the driver based on the provisions of the New Civil

Code.

Issue:

W/N an injured party for whom the contract of insurance is intended can sue directly the insurer

Held: YES

Doctrine: Where the insurance contract provides for indemnity against liability to a third party,

such third party can directly sue the insurer. The liability of the insurer to such third person is based on

contract while the liability of the insured to the third party is based on tort. It cannot evade its liability

as insurer by hiding under the cloak of the insured. Its liability is primary and not dependent on the

recovery of judgment from the insured.

.

GSIS vs. Court of Appeals

308 SCRA 559 (1997)

Facts:

NFA National Food Authority was the owner of Chevrolet truck insured by GSIS-CMVLI. Victor Uy was

the owner of Toyota Tamaraw used as PU insured by Mabuhay Insurance and Guarantee-CMVLI. On

May 9, 1979 at Tabon-Tabon, Butuan City, the two vehicles collided resulting death and injuries to

passengers of the Tamaraw.

Petitioner denies solidary liability with the NFA or the negligent operator of the cargo truck because it

claims that they are liable under different obligations. It asserts that the NFAs liability is based on quasidelict, while petitioners liability is based on the contract of insurance. Citing articles 1207 and 1208of

the Civil Code of the Philippines, petitioner asserts that the presumption is that its obligation arising

from a contract of insurance is joint.

Issue: Whether or not GSIS and NFA are jointly liable.

Held: Petitioners position insofar as joint liability is concerned is not tenable. It is now established that

the injured or the heirs of a deceased victim of a vehicular accident may sue directly the insurer of the

vehicle. Note that common carriers are required to secure Compulsory Motor Vehicle Liability Insurance

[CMVLI] coverage as provided under Sec. 374 of the Insurance Code, precisely for the benefit of victims

of vehicular accidents and to extend them immediate relief. Compulsory Motor Vehicle Liability

Insurance is primarily intended to provide compensation for the death or bodily injuries suffered by

innocent third parties or passengers as a result of a negligent operation and use of motor vehicles. The

victims and/or their defendants [dependents] are assured of immediate financial assistance, regardless

of the financial capacity of motor vehicle owners. However, although the victim may proceed directly

against the insurer for indemnity, the third party liability is only up to the extent of the insurance policy

and those required by law.

Perla Compania de Seguros vs. Ancheta

164 SCRA 144

Facts:

There was a collision between the IH Scout (in which private respondents were riding) and a Superlines

bus. Private respondents sustained injuries. A complaint for damages was filed against Superlines, the

bus driver and petitioner insurance company, the insurer of the bus. The vehicle in which the private

respondents were riding was insured with Malayan Insurance Co. Even before summons could be

served, the judge issued an order for the Insurance Company to pay immediately within 5 days the

P5,000 under the no-fault clause as provided for in Section 378 of the Insurance Code.

Petitioner moved for the reconsideration of the order; it was denied. Petitioner contends that under

Sec. 378 of the Insurance Code, the insurer liable to pay the P5,000 is the insurer of the vehicle in which

private respondents were riding, not petitioner.

Issue:

Whether or not petitioner is the insurer liable to indemnify the private respondents under Sec. 378 of

the Insurance Code

Ruling:

Supreme Court says that the provision is clear and unambiguous. Under Sec. 378, the claim shall lie

against the insurer of the vehicle in which the occupant is riding and no other. The claimant is not free

to choose from which insurer he will claim the no fault indemnity as the law uses the term shall.

That said vehicle might not be the one that caused the accident is of no moment since the law itself

provides that the party paying the claim may recover against the owner of the vehicle responsible for

the accident.

Essence of no fault indemnity clause: to provide victims of vehicular accidents or their heirs

immediate compensation pending final determination of who is responsible for the accident.

The no fault indemnity provision is part and parcel of the Insurance Code provisions on compulsory

motor vehicle liability insurance (Secs. 373-389) and should be read together with the requirement for

compulsory passenger and/or third party liability insurance (Sec. 377).

.

Perla Cia. De Seguros, Inc. v. CA

208 SCRA 487 (1992)

FACTS:

Spouses Lim purchased a brand new red Ford Laser car from Supercars, Inc. in a sale by installment

secured by a chattel mortgage. The same car is insured with Perla Compania de Seguros (Perla). On the

same day, Supercars, Inc. assigned its rights, title and interest to FCP Credit Corporation (FCP).

On a later date, the vehicle was carnapped. Spouses Lim filed a claim for loss with Perla but this was

denied on the ground that Evelyn Lim, who was using the vehicle before it was carnapped, was in

possession of an expired drivers license at the time of the loss, in violation of the authorized driver

clause of the insurance policy.

ISSUE:

Whether or not Perla is liable despite the alleged violation of the authorized driver clause in the

insurance contract

HELD:

The Supreme Court held that Perla is liable to pay the insurance claim. The comprehensive motor car

insurance policy issued by Perla covered loss or damage to the car: (a) xxx; (b) by fire, external

explosion, self-ignition or lightning or burglary, housebreaking or theft; (c) xxx. Where a car is

admittedly unlawfully and wrongfully taken without the owners consent or knowledge, such taking

constitutes theft, and therefore, it is the THEFT clause, and not the AUTHORIZED DRIVER clause

that should apply.

The Court of Appeals was correct in holding that: Theft is an entirely different legal concept from

that of accident. Theft is committed by a person with the intent to gain or, to put it in another way, with

the concurrence of the doers will. On the other hand, accident, although it may proceed or result from

negligence, is the happening of an event without the concurrence of the will of the person by whose

agency it was caused.

JEWEL VILLACORTA vs. THE INSURANCE COMMISSION

G.R. No. L-54171, 28 October 1980

100 SCRA 467

FACTS: Villacorta had her Colt Lancer car insured with Empire Insurance Company against own

damage, theft and 3rd party liability. While the car was in the repair shop, one of the employees of the

said repair shop took it out for a joyride after which it figured in a vehicular accident. This resulted to

the death of the driver and some of the passengers as well as to extensive damage to the car. Villacorta

filed a claim for total loss with the said insurance company. However, it denied the claim on the ground

that the accident did not fall within the provisions of the policy either for the Own Damage or Theft

coverage, invoking the policy provision on Authorized Driver Clause. This was upheld by the Insurance

Commission further stating that the car was not stolen and therefore not covered by the Theft Clause

because it is not evident that the person who took the car for a joyride intends to permanently deprive

the insured of his/ her car.

ISSUE: Whether or not the insurer company should pay the said claim

HELD: Yes. Where the insureds car is wrongfully taken without the insureds consent from the car

service and repair shop to whom it had been entrusted for check-up and repairs (assuming that such

taking was for a joy ride, in the course of which it was totally smashed in an accident), respondent

insurer is liable and must pay insured for the total loss of the insured vehicle under the Theft Clause of

the policy. Assuming, despite the totally inadequate evidence, that the taking was temporary and for

a joy ride, the Court sustains as the better view that which holds that when a person, either with the

object of going to a certain place, or learning how to drive, or enjoying a free ride, takes possession of a

vehicle belonging to another, without the consent of its owner, he is guilty of theft because by taking

possession of the personal property belonging to another and using it, his intent to gain is evident

since he derives therefrom utility, satisfaction, enjoyment and pleasure.

.

Palermo vs. Pyramid Insurance Co.,

161 SCRA 677 (1988)

FACTS:

On March 7, 1969, the insured, appellee Andrew Palermo, filed a complaint in the Court of First Instance

of Negros Occidental against Pyramid Insurance Co., Inc., for payment of his claim under a Private Car

Comprehensive Policy MV-1251 issued by the defendant (Exh. A). In its answer, the appellant Pyramid

Insurance Co., Inc., alleged that it disallowed the claim because at the time of the accident, the insured

was driving his car with an expired driver's license. After the trial, the court a quo rendered judgment on

October 29, 1969 ordering the defendant "to pay the plaintiff the sum of P20,000.00, value of the

insurance of the motor vehicle in question and to pay the costs." On November 26, 1969, the plaintiff

filed a "Motion for Immediate Execution Pending Appeal." It was opposed by the defendant, but was

granted by the trial court on December 15, 1969.

ISSUE: WON plaintiff was not authorized to drive the insured motor vehicle because his driver's license

had expired.

RULING:

There is no merit in the appellant's allegation that the plaintiff was not authorized to drive the insured

motor vehicle because his driver's license had expired. The driver of the insured motor vehicle at the

time of the accident was, the insured himself, hence an "authorized driver" under the policy. While the

Motor Vehicle Law prohibits a person from operating a motor vehicle on the highway without a license

or with an expired license, an infraction of the Motor Vehicle Law on the part of the insured, is not a bar

to recovery under the insurance contract. It however renders him subject to the penal sanctions of the

Motor Vehicle Law. The requirement that the driver be "permitted in accordance with the licensing or

other laws or regulations to drive the Motor Vehicle and is not disqualified from driving such motor

vehicle by order of a Court of Law or by reason of any enactment or regulation in that behalf," applies

only when the driver" is driving on the insured's order or with his permission." It does not apply when

the person driving is the insured himself.

You might also like

- Pan Malayan Insurance V CADocument1 pagePan Malayan Insurance V CAmendozaimeeNo ratings yet

- Perla Compania de Seguros, IncDocument3 pagesPerla Compania de Seguros, IncAngelie ManingasNo ratings yet

- Shafer v. Hon. Judge of RTC, 1988-FINALDocument2 pagesShafer v. Hon. Judge of RTC, 1988-FINALRandy SiosonNo ratings yet

- Malayan Insurance Co. Vs ArnaldoDocument2 pagesMalayan Insurance Co. Vs ArnaldoRenz AmonNo ratings yet

- Geagonia vs. CADocument1 pageGeagonia vs. CAOscar E ValeroNo ratings yet

- American Home Assurance CoDocument1 pageAmerican Home Assurance CoAnonymous vAVKlB1No ratings yet

- Bachrach v. British American InsuranceDocument3 pagesBachrach v. British American InsuranceDominique PobeNo ratings yet

- Transportation Law Digest CompilationDocument41 pagesTransportation Law Digest CompilationRafael JohnNo ratings yet

- Fgu Insurance Corporation Vs CADocument1 pageFgu Insurance Corporation Vs CACharm PedrozoNo ratings yet

- Fortune Insurance Vs CA May 23 1995Document1 pageFortune Insurance Vs CA May 23 1995Alvin-Evelyn GuloyNo ratings yet

- East Furniture vs. Globe RutgersDocument2 pagesEast Furniture vs. Globe RutgerssandrasulitNo ratings yet

- RIZAL SURETY Vs CADocument2 pagesRIZAL SURETY Vs CAJessie Albert CatapangNo ratings yet

- Sulpicio Lines V SisanteDocument1 pageSulpicio Lines V Sisanteerikha_aranetaNo ratings yet

- Filipinas Merchants Insurance Vs CADocument1 pageFilipinas Merchants Insurance Vs CAbeth_afanNo ratings yet

- Vda. de Maglana vs. Hon. ConsolacionDocument1 pageVda. de Maglana vs. Hon. ConsolacionZaira Gem GonzalesNo ratings yet

- (Insurance) Fortune vs. CADocument2 pages(Insurance) Fortune vs. CARaphael PangalanganNo ratings yet

- New Life Enterprises vs. CA, G.R. No. 94071Document9 pagesNew Life Enterprises vs. CA, G.R. No. 94071Victoria EscobalNo ratings yet

- CA upholds invalid enforcement of writ of attachmentDocument2 pagesCA upholds invalid enforcement of writ of attachmentJhobell Gamboa AtlarepNo ratings yet

- Tibay Vs CaDocument3 pagesTibay Vs CaJean Cyril Manlangit YgusguizaNo ratings yet

- 07 Manila Mahogany vs. CA 154 SCRA 650 ScraDocument6 pages07 Manila Mahogany vs. CA 154 SCRA 650 ScraJNo ratings yet

- Policy CasesDocument18 pagesPolicy CasesccsollerNo ratings yet

- Jewel Villacorta vs. Insurance Commission and Empire Insurance CompanyDocument1 pageJewel Villacorta vs. Insurance Commission and Empire Insurance CompanyCloie GervacioNo ratings yet

- Villacorta vs Insurance CommissionDocument1 pageVillacorta vs Insurance CommissionKate HizonNo ratings yet

- Insurance CasesDocument4 pagesInsurance CasesJillen SuanNo ratings yet

- 70 Malayan Insurance Co. v. ArnaldoDocument3 pages70 Malayan Insurance Co. v. ArnaldoAnthony ChoiNo ratings yet

- SATURNINO v. PHILAM LIFEDocument2 pagesSATURNINO v. PHILAM LIFETricia CornelioNo ratings yet

- Sps. Antonio Tibay and Violeta Tibay Et. Al. v. Court of Appeals G.R. No. 119655, 24 May 1996, 257 SCRA 126Document28 pagesSps. Antonio Tibay and Violeta Tibay Et. Al. v. Court of Appeals G.R. No. 119655, 24 May 1996, 257 SCRA 126Paul EsparagozaNo ratings yet

- 21 Edillon V Manila Bankers Life Insurance CorporationDocument2 pages21 Edillon V Manila Bankers Life Insurance CorporationVia Monina ValdepeñasNo ratings yet

- Manila Bankers Life Insurance vs Aban Incontestability ClauseDocument2 pagesManila Bankers Life Insurance vs Aban Incontestability Clauseglaize587100% (1)

- Makati Tuscany Condo Corp vs AHAC Payment by InstallmentDocument1 pageMakati Tuscany Condo Corp vs AHAC Payment by InstallmentsappNo ratings yet

- Baptist Association v Fieldmen's Insurance Co Theft CoverageDocument1 pageBaptist Association v Fieldmen's Insurance Co Theft CoverageEduardo AnerdezNo ratings yet

- American Home Assurance Company Vs ChuaDocument2 pagesAmerican Home Assurance Company Vs ChuaKatch Roraldo100% (1)

- Manila Bankers Cannot Deny Claim Due to Insured's AgeDocument1 pageManila Bankers Cannot Deny Claim Due to Insured's AgeSopongco Coleen100% (1)

- 5 Ramcar-vs-Millar - DigestDocument1 page5 Ramcar-vs-Millar - DigestMay Angelica TenezaNo ratings yet

- American Home Assurance Co. v. Chua, 1999Document2 pagesAmerican Home Assurance Co. v. Chua, 1999Randy SiosonNo ratings yet

- Travellers Insurance & Surety Corp. v CA Ruling on Third Party Liability InsuranceDocument1 pageTravellers Insurance & Surety Corp. v CA Ruling on Third Party Liability Insuranceramszlai33% (3)

- Insurance DigestsDocument4 pagesInsurance DigestsLesly BriesNo ratings yet

- Case Digest Del Carmen v. BacoyDocument4 pagesCase Digest Del Carmen v. BacoymagenNo ratings yet

- Oriental Assurance Vs CADocument2 pagesOriental Assurance Vs CAAthena SantosNo ratings yet

- 2) General Insurance Surety Corp. v. NG HuaDocument3 pages2) General Insurance Surety Corp. v. NG HuaVictoria EscobalNo ratings yet

- Geagonia Vs CADocument1 pageGeagonia Vs CAmackNo ratings yet

- Insurance Claim Fraud CaseDocument2 pagesInsurance Claim Fraud CaseJovelan V. EscañoNo ratings yet

- Spouses Ang v. Fulton Fire InsuranceDocument2 pagesSpouses Ang v. Fulton Fire InsurancesophiaNo ratings yet

- Areola V CADocument2 pagesAreola V CAJosef BunyiNo ratings yet

- Insurance Case Digests by LuigoDocument3 pagesInsurance Case Digests by LuigoLuigi JaroNo ratings yet

- Fortune Medicare Inc V AmorinDocument2 pagesFortune Medicare Inc V AmorinRoms RoldanNo ratings yet

- Bonifacio Bros v Mora (1967) - No Privity Between Auto Repair Shops and Insurance CoDocument2 pagesBonifacio Bros v Mora (1967) - No Privity Between Auto Repair Shops and Insurance Cocookbooks&lawbooksNo ratings yet

- Insurance Policy Prescription PeriodDocument3 pagesInsurance Policy Prescription PeriodChanel GarciaNo ratings yet

- Philippine Phoenix Surety Vs WoodworkDocument4 pagesPhilippine Phoenix Surety Vs WoodworkSamael MorningstarNo ratings yet

- Fortune Insurance and Surety Co vs. CADocument1 pageFortune Insurance and Surety Co vs. CAOscar E ValeroNo ratings yet

- Court Rules on Concealment in Insurance ApplicationDocument5 pagesCourt Rules on Concealment in Insurance ApplicationMadeleine Flores Bayani0% (1)

- 52 - Andres v. Crown Life InsuranceDocument1 page52 - Andres v. Crown Life InsuranceperlitainocencioNo ratings yet

- People vs. Umanito (2009)Document7 pagesPeople vs. Umanito (2009)isaaabelrfNo ratings yet

- Marine insurance dispute over damaged copper shipmentsDocument2 pagesMarine insurance dispute over damaged copper shipmentsButch MaatNo ratings yet

- Villanueva v. Oro - Insurance ProceedsDocument4 pagesVillanueva v. Oro - Insurance ProceedsLord AumarNo ratings yet

- Gulf Resorts Inc Vs Philippine Charter Insurance CorporationDocument1 pageGulf Resorts Inc Vs Philippine Charter Insurance CorporationKim Laurente-Alib100% (2)

- Grepalife V CADocument3 pagesGrepalife V CAMykee NavalNo ratings yet

- Finman General Assurance Corp. v. Court of AppealsDocument1 pageFinman General Assurance Corp. v. Court of AppealslealdeosaNo ratings yet

- The Young Adult Starter Kit: 12 Steps To Being A Better Person: YA Self-HelpFrom EverandThe Young Adult Starter Kit: 12 Steps To Being A Better Person: YA Self-HelpNo ratings yet

- Casualty Insurance Policy Coverage for Theft Despite Expired Driver's LicenseDocument13 pagesCasualty Insurance Policy Coverage for Theft Despite Expired Driver's LicenseronasoldeNo ratings yet

- Jobi Nicole Regidor Roncales Fundamentals of Accountancy, Business, and Management - 1 Grade 11 - Zobel de AyalaDocument1 pageJobi Nicole Regidor Roncales Fundamentals of Accountancy, Business, and Management - 1 Grade 11 - Zobel de AyalaRaffy RoncalesNo ratings yet

- Ordinance Araw NG Barangay OnseDocument3 pagesOrdinance Araw NG Barangay OnseTwinkle Joy Estardo100% (4)

- JURATDocument1 pageJURATRaffy RoncalesNo ratings yet

- Estrada V DesiertoDocument2 pagesEstrada V DesiertoRaffy RoncalesNo ratings yet

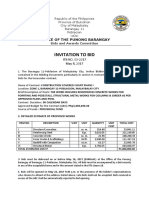

- ITB - Construction of Covred CourtDocument2 pagesITB - Construction of Covred CourtRaffy Roncales100% (1)

- Motion For LeaveDocument2 pagesMotion For LeaveRaffy RoncalesNo ratings yet

- Reorganizing Youth Development Task ForceDocument1 pageReorganizing Youth Development Task ForceRaffy RoncalesNo ratings yet

- Meadows and Mountains: RefrainDocument3 pagesMeadows and Mountains: RefrainRaffy RoncalesNo ratings yet

- David Vs Comelec Case DigestDocument2 pagesDavid Vs Comelec Case DigestRaffy Roncales100% (1)

- Abbas Vs ComelecDocument1 pageAbbas Vs ComelecRaffy RoncalesNo ratings yet

- David Vs Comelec Case DigestDocument2 pagesDavid Vs Comelec Case DigestRaffy Roncales100% (1)

- Tan Vs Comelec 142 SCRA 727Document1 pageTan Vs Comelec 142 SCRA 727Raffy Roncales100% (1)

- Abbas Vs ComelecDocument1 pageAbbas Vs ComelecRaffy RoncalesNo ratings yet

- LEGAL ETHICS BAR EXAM With Suggested Answers.Document5 pagesLEGAL ETHICS BAR EXAM With Suggested Answers.Blake Clinton Y. Dy91% (11)

- Borja Vs Comelec Case DigestDocument3 pagesBorja Vs Comelec Case DigestRaffy RoncalesNo ratings yet

- Strengthening Leadership as Youth MinisterDocument8 pagesStrengthening Leadership as Youth MinisterRaffy RoncalesNo ratings yet

- CH 09Document52 pagesCH 09Raffy RoncalesNo ratings yet

- TimeBook PayrollDocument3 pagesTimeBook PayrollRaffy Roncales40% (5)

- Station of The CrossDocument2 pagesStation of The CrossRaffy RoncalesNo ratings yet

- Songs For LentDocument2 pagesSongs For LentRaffy RoncalesNo ratings yet

- 2008 Bar Q Legal Ethics Final RequirementDocument5 pages2008 Bar Q Legal Ethics Final RequirementRaffy Roncales100% (1)

- GDPDocument37 pagesGDPRaffy Roncales100% (1)

- Working Papers Hand OutsDocument4 pagesWorking Papers Hand OutsRaffy RoncalesNo ratings yet

- Criteria For Judging SummaryDocument1 pageCriteria For Judging SummaryRaffy RoncalesNo ratings yet

- Let Heaven Rejoice - SatbDocument2 pagesLet Heaven Rejoice - SatbRaffy Roncales100% (1)

- CH 10Document47 pagesCH 10Raffy RoncalesNo ratings yet

- Soc Leg - RA 7699Document4 pagesSoc Leg - RA 7699Sherlyn Paran Paquit-SeldaNo ratings yet

- Lent 3rd Sunday 2016Document65 pagesLent 3rd Sunday 2016Raffy RoncalesNo ratings yet

- Soc Leg - RA 7699Document4 pagesSoc Leg - RA 7699Sherlyn Paran Paquit-SeldaNo ratings yet

- PornographyDocument32 pagesPornographyRaffy Roncales67% (3)

- Restitution Under Indian Contract LawDocument14 pagesRestitution Under Indian Contract LawSmita SinghNo ratings yet

- Debt Reduction Calculator V1.6Document3 pagesDebt Reduction Calculator V1.6brianfromboiseNo ratings yet

- As To Importance or Dependence of One Upon Another: NotesDocument3 pagesAs To Importance or Dependence of One Upon Another: NotesSimon Marquis LUMBERANo ratings yet

- Lever Brother Co. vs. Kalaw Ng Khe trademark infringement caseDocument1 pageLever Brother Co. vs. Kalaw Ng Khe trademark infringement caseloschudentNo ratings yet

- IIFM Interbank Unrestricted Master Investment Wakalah AgreementDocument26 pagesIIFM Interbank Unrestricted Master Investment Wakalah Agreementkarim meddebNo ratings yet

- Metrobank vs S.F. Naguiat EnterprisesDocument9 pagesMetrobank vs S.F. Naguiat EnterprisesAnty CastilloNo ratings yet

- Rodriguez Vs FranciscoDocument1 pageRodriguez Vs FranciscoLeo TumaganNo ratings yet

- Rural Bank fails due diligenceDocument2 pagesRural Bank fails due diligenceGillian Caye Geniza BrionesNo ratings yet

- Security Services Contract HQ SisalanaDocument61 pagesSecurity Services Contract HQ SisalanaMwasamani GundaNo ratings yet

- 06-20-23 Goba Capital LOI Factoring Zigma Comercializadora S.A.S - SignedDocument5 pages06-20-23 Goba Capital LOI Factoring Zigma Comercializadora S.A.S - SignedTechnology sports ColombiaNo ratings yet

- Memorandum of Agreement 2017Document4 pagesMemorandum of Agreement 2017Mapulang Lupa Valenzuela City100% (1)

- Manila Hotel Ruling - NLRC Lacked JurisdictionDocument4 pagesManila Hotel Ruling - NLRC Lacked JurisdictionSean GalvezNo ratings yet

- PEC Standard JVDocument21 pagesPEC Standard JVShahab KhanNo ratings yet

- Case No. 5 Union Bank VS DBPDocument2 pagesCase No. 5 Union Bank VS DBPBabes Aubrey DelaCruz AquinoNo ratings yet

- Sales Agency Agreement (Broker and Seller)Document4 pagesSales Agency Agreement (Broker and Seller)Legal Forms100% (2)

- PRIVATE EQUITY VALUATION METHODOLOGIESDocument46 pagesPRIVATE EQUITY VALUATION METHODOLOGIESAniket JainNo ratings yet

- Agreement For Sale of Apartment: WhereasDocument6 pagesAgreement For Sale of Apartment: WhereasharipriyaNo ratings yet

- Marine Insurance Case DigestsDocument16 pagesMarine Insurance Case DigestsCarla January OngNo ratings yet

- Special Power of Attorney Tits Peht - VernonDocument4 pagesSpecial Power of Attorney Tits Peht - VernonJairus RubioNo ratings yet

- Advocates For Truth Vs Bangko SentralDocument2 pagesAdvocates For Truth Vs Bangko SentralSamuel Terseis100% (4)

- MCQ's On Partnership Act, 1932Document10 pagesMCQ's On Partnership Act, 1932Farjana AkterNo ratings yet

- Applause Tester NDA 2020-SignedDocument4 pagesApplause Tester NDA 2020-SignedAzeddine DjeNo ratings yet

- How To Obtain ProbateDocument7 pagesHow To Obtain ProbatepacecurranbtinternetNo ratings yet

- PCIB Vs EscolinDocument170 pagesPCIB Vs EscolinChristelle Ayn BaldosNo ratings yet

- Motor Vehicle InsuranceDocument24 pagesMotor Vehicle InsuranceAmit GroverNo ratings yet

- SALES and LEASE Reviewer - DioryDocument74 pagesSALES and LEASE Reviewer - DioryMaria Diory Rabajante95% (22)

- Discharge of TortsDocument12 pagesDischarge of TortsDaksh PooniaNo ratings yet

- Credtrans MTG 1Document25 pagesCredtrans MTG 1Jona Phoebe MangalindanNo ratings yet

- Supreme Court rules RTC lacks jurisdiction in estate dispute caseDocument2 pagesSupreme Court rules RTC lacks jurisdiction in estate dispute caseRamon T. Conducto IINo ratings yet

- Gmail - FWD - Flipkart Launches GRiD 3.0 - 7 Days Left For Registration!!Document2 pagesGmail - FWD - Flipkart Launches GRiD 3.0 - 7 Days Left For Registration!!Arjun P PNo ratings yet