Professional Documents

Culture Documents

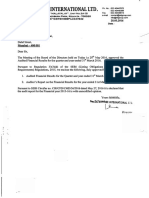

Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

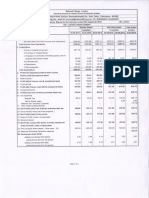

Statement of Standalone Results

for ouarler

ended 3O,O9.2015

3O.O9.2O15 3 months ended in 3 months ended

Pv.Yr.3O.O9.14 30.06.2015

NET SALES/Income from Operations

Other operating income

2.

3O.O9.2015 6 months ended in Accounting Year

Pv.

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.33

o.33

0.00

0.00

0.00

0.00

0.00

0.22

o.22

0.00

0.00

0.00

0.00

0.00

0.10

0.10

0.00

0.00

0.00

0.00

0.00

0.43

0.43

-0-33

-o.22

-0.10

-0.43

Yr.3O.O9.14 ended 31,03,2015

0.00

0.00

0.00

0.00

EXPENSES

a) (Increase)/Decrease in

stock in trade & WIP

b) Consumption of Raw Material

c) Purchases of Traded Goods

d) Employee Benefits expense

e) Depreciation & Amortisation

0.00

0.00

0.00

0.00

0.00

0.90

0.90

-0.90

-1.84

0-00

0.00

0.00

0.00

0.00

f) Other Expenses

9) TOTAL EXPENSE

Profit from Operations before other

income, finance cost & exceptional

items (1-2)

Other Income

0.00

0.00

0.00

0.00

Profit from ordinary activities before

finance cost & xceptional items (3+4)

-0.33

-0.22

-0.10

-o.43

0.46

0.44

-1.38

. Finance Cost

. Profit from ordinary activities after

0.00

0.00

0.00

0.00

0,00

0.00

finance cost but before exceptional

-0-33

-0.22

-0.10

-o.43

-4.44

-1.38

0.00

0.65

0.00

0.00

0.65

0.65

-0.33

o.43

-0.10

-0.43

o.2l

-o.73

0.00

0.00

0.00

0.00

0-00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.43

-0.10

-0.43

NlL

-0.10

NIL

-0.43

0.21

383.78

383.78

383.78

Shares)

1.84

1.84

0.46

items (5-6)

B

.

.

Exceptional Items

Profit(+)/Loss(-) from operating

activities before tax (7+B)

10 . Tax Expense

Current Tax

Deferred Tax

11 . Net Profit (+)/Loss (-)from

ordinary Activities after Tax (9-10)

I 2 . Extraordinary items (Net of Tax

expense Rs... )

13 . NET PROFIT(+)/Loss(-) for the

period (11-12)

14 . Paid up Equity Shares Capital

Face value of Rs 10 each

t5

-0.33

NIL

NIL

-0.33

0.43

383.78

383.78

Shares)

(3837800 Shares) (3837800

0.2L

NIL

(3837800 Shares) (3837800 Shares) (3837800

. Reserves excluding Revaluation

Reserves as per Balance Sheet date

16 . Earning per share (EPS)

a) Basic & Diluted EPS for

the period

/year before Extra-ordinary items

b) Basic & Diluted EPS for the

period/year after Extra - ordinary

items

17 . Public Shareholding

a) Number of Shares

b) Percentage of Shareholding

18 . Promoters and promoter group

-o.73

NIL

-0.73

383.78

(3837800 Shares)

(22.48)

0.01

-0.00

-0.01

0.01

-0.02

0.01

0.01

-0.00

-0.01

0.01

-0.02

26,96,800

26,96,800

26,96,800

26,96,800

70.27o/o

70.27o/o

70.27o/o

70.270k

0.01

26,96,800

7o.27o/o

26,96,800

70.274/o

shareholding

a) Pledged/Encumbered

-Number of shares

-Percentage of Shares(as a o/o of the

total share holding of promoter &

promoter group)

-Percentage of Shares(as a o/o of the

total share capital of the company)

b) Non encumbered

-Number of shares

-Percentage of Shares(as a o/o of the

total share holding of promoter &

promoter group)

Percentage of Shares(as a o/o of the

total share capital of the company)

NIL

NIL

NIL

NlL

NIL

N1t

NIL

NIL

NIL

NIL

NlL

NIL

tt,41,ooo

100.00o/o

79.730k

1,41,000

11,47,O00

100.00o/o

100.00o/o

29.73o/o

29.730k

1,4 1,000

100.00o/o

29.730/

?9.73o/o

29.73o/o

The above results as reviewed by the Audit Committee were taken on records in the meeting of Board of Directors

2

3

.

,

The Statutory Auditors have carried out a limited review of the accounts for the quarter ended on 30.09.2015

There is no complaint for the quarter endinq 30.09.2015 and further, no complaint was pending on 30.06.2015

lnterest against Secured loans of Rs.12.45 crores from IDBI Bank Ltd.,M.Gvg.,now assigned in favour of ARCIL,Mumbai

has not been provided for the quarter ending 30.O9.2074 due to NPA status of the accounts.

Previous period figures have been regrouped,rearranged,remodifled,where ever necessary.

There is no trading activity during the current relevant quarter.

Deferred tax asset on account of business loss suffered by the company & unabsorved depreciation has not been

recognized as there is no certainity that sufficient future taxable income would be available to absorue these

allowances. Similarly deferred tax on account of timinq difference of depreciation has also not been recognised as

major part of fixed block has already been sold.

.

.

6

7

11,41,000

100.00o/o

11,41,000

NIL

100.00o/o

N.ste:;

NIL

held on 21.10.2015

PLACE : Mandi Gobindgarh

DATED:21-10.2015

S. K. BHALLA & CO.

CHARTERED ACCOUNTANTS

M/S

GTROAD,KHANNA

NR.SINGH SABHA GURUDWARA

PHONE : 98151-35623,235623

E-MAIL : skbhalla24@gmail.com

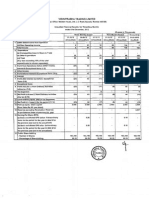

RANJEEV ALLOYS LIMITED, MANDJ GOEIIIEGABH

STATEMENT OF ASSETS & LIABILITIES AS AT 3O.O9.2O15

Year ended

No

30.09.201s

(Unaudited

ended

30.09.2014

Year

ended

31.O3.2015

(Unaudited)

(Audited)

383.78

383.78

-22.48

N]L

-21..s4

NIL

360.87

362.24

361.30

'funds

a) Share Capital

b) Reserve & Surplus

c) Money Received agst. share warants

Sub Total-Shareholders' Funds

383.78

-22.9L

NIL

2. Non Current Liabilities

a) Long-term Borrowings

b) Deferred tax Iiabilities (Net)

c) Other long term liabilities

d) Long-term provisions

Sub Total-Non Current Liabilities

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

3. Current Liabilities

a) Short-term Borrowings

1,284.O8

1,283.93

b) Trade payables

c) Other current liabilities

d) Short-term provisions

0.00

3.77

1.97

3.76

NIL

NIL

Sub Total-Current Liabilities

TOTAL EOUITY AND LIABILITIES

NIL

7,287.85

1,289.66

t,287.86

!e48J2_

-1,95:tg-

_Let9.16.

44.96

44.96

NIL

44.96

ASSETS

1. Non Current Assets

(a) Fixed Assets

(i) Tangible Assets

(ii) Intangible Assets

(iii) Capital work-in-progress

(iv) Intangible assets under development

(b) Non-current investments

(c) Deferred tax assets (net)

(d) Long-term loans and advances

(e) Other non-current assets

Sub Total-Non Current Assets

2. Current Assets

(a) Current investments

(b) Inventories

(c) Trade receivables

(d) Cash & cash equivalents

(e) Short-term loan & advances

(f) Other current assets

Sub Total-Current Assets

TOTAL ASSETS

For & On Behalf of the Board

t-

1,284.44

0.00

3.82

NIL

NIL

NIL

NIL

NIL

NIL

1,494.86

1,539.82

NIL

NIL

NIL

NlL

AIII-

NIL

NIL

NIL

L,490.78

L,535.74

NXt_

hIIL

tslt_

7.46

8.19

18.26

83.1B

18.55

NIL

NIL

NIL

NIL

f'{It_

NIL

1r-g.F.0z

1,433.O3

NIL

NIL

NIL

7.67

18.55

89.42

108.90

tt6. t6

789.97

216.13

L,&48,72

r.E5:L9q-

!,6r!9,1,0-

PLACE : Mandi Gobindgarh

Managing Director

DATED :21.7O.24L5

,{l6tr,5a

5"}i. BHALL.\ *! {ln"

{H.1ltl},ftrn .t{*t {)ti\T,ri\Ts

l\,l1s

{; I

R{_} \t_}

KH,{}\-,\

DtSI] l.tlil. PLI.r,18 - l.ltJ{ll

I'l l{ )\ f-5 : i t l&t}5oli.1},5 5 I :1S61:i

Email Id: shLh:rtlslJ a snrril.runr

1

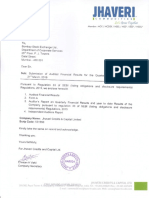

t{E},t \\' Itt.],{}RT T0'I"HE

trt}_il,InErt5 {)I.' R.{}iJEE\' ,\t_LOI',S l-ID., }I.{i}.G.

LIIlITF:11

ltl:\'lE\\'

ltflPOR

I-

i liare tL'i it'l.i'ail lltc accrrrt:itJil-\, iilr strtcnrcnt oi:\uiitcd *rrancill r'*,<iilts rll IL\tt'-rrt\'

'. I '1-1-r\'.( t ii), i\,1.,\\Dl L;(-)til\Llii.iitil

tcr iiir.' titr+r inr)ltilt! Ilu-rir,ii -,,irJiu_t -iti'i Srpt+ntbe:..

- ' :: Iltis .t:it.'rntli ii ailt' ;'cs;itlitsii.'iiii\ {rl tltc {oini};111\ j r}}.}n;l:rcn-}ri}i rrrll hi1-{ h!=*!l

.l::iri!'1.:''l l"' t1:c ll',.rrti r--J'Di:'r'ctor L'*rnriiii{*r lI i:irrirr-ri irl. l.}irt,tior.r. {)trr l'ti}ri.r;:liiri}ir1

't\

.:'''i; 'i i.il1,ir1 'rlr thesf ilrt;rtiiilr! ri*ir--iil*l]i! i:r'is*li t.rtr'r-rlir i't'\'ir--\\.

\\ q ;,:f i;i1;1li'-J rrtll !-r1 it'1\, irt urat-rr,.l;:rr* rriih lirt -t1a:t,.-l;.trei r-rn Rtr ie\\ l.ngarleit.iL-t.it

iSREll-ttlti. Ilt:Sagrirt+uls ir i{eriuu' Iiuul:ri;rl St:iternc:rls iscu(rl hr, 1}:c Instjnii.: r-rl

f ir;lltere,i r\icrrtttliltt.tti r-r!' l1liis. This *i;ilrilrrr.l rrelrrirc: iiral rir plirii uriil p*lliirrrr titi

is i,-'

l't'r

it'i\ il ubi:riti IllLiLldriliL'

\\ht'thrr rhr ilr.isrt,;iirl ilitar*trilts iitr

ilssut'i1;rtc ir5 i,.t

ti.L'c ol'

iirni;iir:l t}iissilrlrrneltts. ..\ rer ier.,' ,rl'liu:iirr{ Irrirn;rril} tr.: ir:iliiiries r.}l L..itIFLiil} pfr*\o]illL-i

Ittiil iitri-ilrii.ai pt'irc,,'rittrcl;1p1:lir,'il i* lirillnri;il rli-tin unrl Illus p1rl..i.le: I*ss it-{:jLil'i11'{ th;it.

lin l:riiiil.

\\c lraie tr,.ri pr|fi:rrtter-l

atr

;Lr-t.lit

ititd;lrfoiililtgll . uu ri$ llr.rl d\prll_\s

iil.]

ttldii

rrltilt i.)it.

lJl:-re,,l ali'I L)tll t',.:l

iclr.a{}}triilclcr!

irr l'elilr r ih.tl il:t

;15;1}i--,'ro:"

iru',trtti1l11ll.\

rtcor.it;tie ir irh irl:Iiig*[ lc

txrtliin$ ltllr cr-,ntr iit {)rtr xlteiltirltl tiurl r;Lilscs.s

in! \tlltr'i]iint c,t' iiuJitr-,.1 linlrncial

a*ci-rrrrtlilru sli*tii;i1"(l.r

lf.iri

rL,-\ulis prcpurr,il ii:

oii"r*i" rer-:r:gniz*d lrecirtrtttiir:r

1:t'liclitri iuti.i politits l:as lir'l ,.lisiloseri the ir:i-*r'rtr;rtir-rn r."rlr.:ilcr! 1i_. lrc ilisuioseij in 1**ris

t-'laluusr Ji ,.ritiru Lirtirr,: \si**nr-'ni ii-.e ir:.liu: tir,; i.urr-irrcr iir ir.lrir:ll it ir rii bc riiscl,_rsc,J

t'r i li;.li i i irrntt,

irrrr

i rr

;tit-\'

n't

;il

criil I r:t i ss1att,r.ri,;;:i.

lllt S. K. ItH.\l.L--L .t

C{J,

cl lA ti.TtIii:D .,\i,'a'i)i iN t .\i\t'\

{s.

1...

IJH.\LLA)

l)i:i lnt'l-

\ lurtr. \,,

iis :s

ijl-.ll l-

i\i{ -\":'.,\,\

!r.r.i,

LI

i'r

,ii-

You might also like

- Axis Bank LTD Payslip For The Month of July - 2019Document1 pageAxis Bank LTD Payslip For The Month of July - 2019Rohit Kumar33% (3)

- Ebook Percuma Tfs Price Action TradingDocument7 pagesEbook Percuma Tfs Price Action TradingMUHAMMAD AL AMIN AZMANNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document1 pageFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Rectification On Financial Results For The Period Ended June 30, 2015. (Result)Document2 pagesRectification On Financial Results For The Period Ended June 30, 2015. (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document2 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- Updates On Financial Results For Sept 30, 2015 (Statement of Assets & Liabilities) (Result)Document5 pagesUpdates On Financial Results For Sept 30, 2015 (Statement of Assets & Liabilities) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2014 (Result)Document4 pagesFinancial Results & Limited Review For March 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For March 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document17 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Real Estate Marketing Agent Registration Form: Important InstructionsDocument7 pagesReal Estate Marketing Agent Registration Form: Important InstructionsAshok KumarNo ratings yet

- Exercises1 BFNDC002 Time Value of Money - Simon, JusthineDocument13 pagesExercises1 BFNDC002 Time Value of Money - Simon, JusthineJohn Dexter SimonNo ratings yet

- UnderwriterDocument9 pagesUnderwritermittaldivya167889No ratings yet

- HDFC Repaired 22222Document124 pagesHDFC Repaired 22222rahulsogani123No ratings yet

- Garuda Indonesia Case AnalysisDocument8 pagesGaruda Indonesia Case AnalysisPatDabz67% (3)

- OD328480839739601100Document3 pagesOD328480839739601100Rana HiralakkiNo ratings yet

- Valuation of GoodwillDocument15 pagesValuation of Goodwillbtsa1262013No ratings yet

- Change Your Life PDF FreeDocument51 pagesChange Your Life PDF FreeJochebed MukandaNo ratings yet

- Cause List Court-2 17.10.2023Document6 pagesCause List Court-2 17.10.2023divyanshu31No ratings yet

- Euro Currency Market (Unit 1)Document27 pagesEuro Currency Market (Unit 1)Manoj Bansiwal100% (1)

- A Practical Guide To GST (Chapter 15 - Transition To GST)Document43 pagesA Practical Guide To GST (Chapter 15 - Transition To GST)Sanjay DwivediNo ratings yet

- Waterways Magazine Winter 2013Document84 pagesWaterways Magazine Winter 2013Waterways MagazineNo ratings yet

- Smart ConsensusDocument1 pageSmart ConsensusKarthikKrishnanNo ratings yet

- Lecture 5.2-General Cost Classifications (Problem 2)Document2 pagesLecture 5.2-General Cost Classifications (Problem 2)Nazmul-Hassan Sumon75% (4)

- FAR 4204 (Receivables)Document10 pagesFAR 4204 (Receivables)Maximus100% (1)

- Project Proposal by Nigah-E-Nazar FatimiDocument8 pagesProject Proposal by Nigah-E-Nazar Fatiminazarfcma5523100% (3)

- Transfer of SharesDocument12 pagesTransfer of SharesromaNo ratings yet

- 2nd Asignment - BANK PEMBANGUNAN MALAYSA BERHADDocument4 pages2nd Asignment - BANK PEMBANGUNAN MALAYSA BERHADkinNo ratings yet

- HSC 2017 July Commerce Book Keeping PDFDocument5 pagesHSC 2017 July Commerce Book Keeping PDFNivesh KandwalNo ratings yet

- Franchise ConsignmentDocument2 pagesFranchise ConsignmentClarissa Atillano FababairNo ratings yet

- 2018 Business Law Question Paper by My Solution PaperDocument7 pages2018 Business Law Question Paper by My Solution PaperSuman BarmanNo ratings yet

- PitchBook PME Benchmarking MethodologyDocument10 pagesPitchBook PME Benchmarking Methodologykartikkhanna1990No ratings yet

- Investment Analysis 1Document48 pagesInvestment Analysis 1yonasteweldebrhan87No ratings yet

- Common Charter of DemandsDocument3 pagesCommon Charter of DemandsshikumamaNo ratings yet

- Project On Indian Financial MarketDocument44 pagesProject On Indian Financial MarketParag More85% (13)

- IKEADocument22 pagesIKEAKurt MarshallNo ratings yet

- Checks Issued by City of Boise Idaho - 14Document31 pagesChecks Issued by City of Boise Idaho - 14Mark ReinhardtNo ratings yet

- Chapter 2Document8 pagesChapter 2Pradeep RajNo ratings yet