Professional Documents

Culture Documents

Motor Add On

Uploaded by

sunder_vasudevanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Motor Add On

Uploaded by

sunder_vasudevanCopyright:

Available Formats

Claims Procedure: Fast, fair and friendly

Bharti AXA General Insurance

At Bharti AXA, we promise to be at your side during your time of

Bharti AXA General Insurance is a joint venture between the

Bharti Group and AXA. Bharti AXA combines the strengths of

Bharti Enterprises, one of India's leading business groups,

and AXA, the global leader in financial protection and

wealth management.

distress. To enable us to help you, we request you to register a

claim

by

contacting

our

24-hour

Toll-Free

Helpline

on

1800-103-2292. Please intimate the help desk as soon as a

Why cant an insurance policy

protect my car / and my family?

claim occurs, so that we can provide you quick and effective

Twin assurance for you

service. You can, alternatively, also register a claim by e-mail on

AXA is one of the largest insurers in the world, with over

67 million clients worldwide and over 1,75,000 employees

working across 5 continents. AXA believes in achieving

operational excellence through product innovation, business

expertise, distribution, quality of service and productivity.

claims@bharti-axagi.co.in

While registering a claim, the following

information will help us serve you better:

Policy number

Name of the insured

Insureds/callers contact number

Date and time of accident

Location of accident

Brief details of damage

Name of the driver who was driving the vehicle

at the time of loss

Name and contact number of the workshop

where the vehicle can be inspected

Name/s of the person/s who sustained

injuries in the accident (if any)

Name/s of the hospital where the injured were

given first aid/admitted

Bharti Enterprises is one of the biggest organisations in the

country with interests in telecom, agriculture and retail. It is a

pioneering force in the telecom sector, with many firsts and

innovations to its credit, offering a powerful mix of a strong

national presence and unmatched local knowledge.

For more info:

1800 103 2292 (toll-free)

080 4357 3450 (call charges apply)

SMS <INFO> to 5667700

www.bharti-axagi.co.in

To enable us to help you, we request you to register

a claim by contacting our 24-hour toll-free helpline

on 1800-103-2292 or e-mail us at

claims@bharti-axagi.co.in

To get a hassle-free policy, call our toll-free number

1800-103-2292 or email us at

sales@bharti-axagi.co.in, clearly mentioning your

postal address.

BRO/PVTCAR-ADDON/CONT/12-09

At Bharti AXA, cashless/direct settlement is provided

to the garages of the customer's choice. On the

request of the client, the company is willing to pay to

the garage of the customer's choice across India,

provided the garage is a dealer or authorised service

station.

For more details on risk factors and

terms & conditions, please read the

sales brochure carefully before

concluding a sale.

*This leaflet is only a brief summary

of the Add-on Covers for SmartDrive

Private Car Insurance Policy. Please

contact our intermediary/sales

officer/any of our offices for the

policy wordings.

SmartDrive

Private Car

Insurance Policy

with the power of

Add-on Covers.

Bharti AXA General Insurance Co. Ltd.

First Floor, Ferns Icon, Survey No. 28, Doddanekundi, Bangalore - 560 037.

Insurance is the subject matter of the solicitation.

What does SmartDrive Private Car Insurance cover?

The policy provides cover for the following occurrences:

1. Accidental damage to motor vehicle used for social,

recreational, domestic, or professional purposes

2. Liability for third-party injury or death, and damage caused to

their property

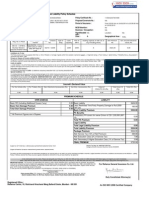

Add-on Cover Details:

The limits for the covers are as mentioned below:

Sl. No. Cover

1.

Hospital Cash Cover

2.

Medical Expenses

Rs.10,000/person

Reimbursement Cover

3.

Ambulance

Charges Cover

Rs.5,000

4.

Depreciation Cover

100% cover

Market First Add-on Covers

CO

M P LE

TE PROTECTION COV

ER

Adding assurance to your car insurance

Insuring your car just got more assuring. Because

now, with Bharti AXAs SmartDrive Private Car

Insurance Policy, you can opt for our special Add-on

Covers. They offer comprehensive protection for the

driver and co-passengers, apart from the third party.

The Add-on Covers include hospital & ambulance

charges and medical expenses against liabilities

in case of any unfortunate eventuality.

A truly Complete Protection Cover that offers

absolute assurance and peace of mind.

Hospital Cash Cover:

Daily hospital cash allowance arising

from injury to insured persons while

travelling in the insured vehicle

Rs.1,000 for 30 days

Higher plans available on request.

What does this policy not cover?

Some of the major exclusions under the basic policy are:

1. Consequential loss

Ambulance Charges Cover:

Charges towards transportation of

insured persons in ambulance to the

hospital, post suffering bodily injury

caused by an accident while travelling

in the insured vehicle

2. Depreciation; wear and tear

3. Mechanical and electrical breakdown; failure or breakage

4. When the vehicle is used outside the geographical area

5. When used contrary to limitations as to use

6. When driven by a person other than the driver stated in

the driver's clause

7. War perils, nuclear perils and drunken driving

Medical Expenses

Reimbursement Cover:

All medical expenses in case of

injury to the insured persons while

travelling in the insured vehicle

Lifes journey has

become more

enriching, now that

you can get

Complete Protection

Cover for your car as

well as your family, in

one smart package.

Limit/Sum Insured

This is not an exhaustive list. For a detailed list of the

exclusions, please read our policy terms and conditions.

Acceptance Guidelines

1. The Depreciation Cover is applicable to vehicles

up to 2 years old only

2. The Add-on Covers can be sold only with SmartDrive

Private Car Insurance Policy; they cannot be sold on a

stand-alone basis or for a vehicle insured with any other

insurance company

Depreciation Cover:

In case of any replacement of

part arising from accident of the

insured vehicle

What does SmartDrive Private Car Insurance cover?

The policy provides cover for the following occurrences:

1. Accidental damage to motor vehicle used for social,

recreational, domestic, or professional purposes

2. Liability for third-party injury or death, and damage caused to

their property

Add-on Cover Details:

The limits for the covers are as mentioned below:

Sl. No. Cover

1.

Hospital Cash Cover

2.

Medical Expenses

Rs.10,000/person

Reimbursement Cover

3.

Ambulance

Charges Cover

Rs.5,000

4.

Depreciation Cover

100% cover

Market First Add-on Covers

CO

M P LE

TE PROTECTION COV

ER

Adding assurance to your car insurance

Insuring your car just got more assuring. Because

now, with Bharti AXAs SmartDrive Private Car

Insurance Policy, you can opt for our special Add-on

Covers. They offer comprehensive protection for the

driver and co-passengers, apart from the third party.

The Add-on Covers include hospital & ambulance

charges and medical expenses against liabilities

in case of any unfortunate eventuality.

A truly Complete Protection Cover that offers

absolute assurance and peace of mind.

Hospital Cash Cover:

Daily hospital cash allowance arising

from injury to insured persons while

travelling in the insured vehicle

Rs.1,000 for 30 days

Higher plans available on request.

What does this policy not cover?

Some of the major exclusions under the basic policy are:

1. Consequential loss

Ambulance Charges Cover:

Charges towards transportation of

insured persons in ambulance to the

hospital, post suffering bodily injury

caused by an accident while travelling

in the insured vehicle

2. Depreciation; wear and tear

3. Mechanical and electrical breakdown; failure or breakage

4. When the vehicle is used outside the geographical area

5. When used contrary to limitations as to use

6. When driven by a person other than the driver stated in

the driver's clause

7. War perils, nuclear perils and drunken driving

Medical Expenses

Reimbursement Cover:

All medical expenses in case of

injury to the insured persons while

travelling in the insured vehicle

Lifes journey has

become more

enriching, now that

you can get

Complete Protection

Cover for your car as

well as your family, in

one smart package.

Limit/Sum Insured

This is not an exhaustive list. For a detailed list of the

exclusions, please read our policy terms and conditions.

Acceptance Guidelines

1. The Depreciation Cover is applicable to vehicles

up to 2 years old only

2. The Add-on Covers can be sold only with SmartDrive

Private Car Insurance Policy; they cannot be sold on a

stand-alone basis or for a vehicle insured with any other

insurance company

Depreciation Cover:

In case of any replacement of

part arising from accident of the

insured vehicle

What does SmartDrive Private Car Insurance cover?

The policy provides cover for the following occurrences:

1. Accidental damage to motor vehicle used for social,

recreational, domestic, or professional purposes

2. Liability for third-party injury or death, and damage caused to

their property

Add-on Cover Details:

The limits for the covers are as mentioned below:

Sl. No. Cover

1.

Hospital Cash Cover

2.

Medical Expenses

Rs.10,000/person

Reimbursement Cover

3.

Ambulance

Charges Cover

Rs.5,000

4.

Depreciation Cover

100% cover

Market First Add-on Covers

CO

M P LE

TE PROTECTION COV

ER

Adding assurance to your car insurance

Insuring your car just got more assuring. Because

now, with Bharti AXAs SmartDrive Private Car

Insurance Policy, you can opt for our special Add-on

Covers. They offer comprehensive protection for the

driver and co-passengers, apart from the third party.

The Add-on Covers include hospital & ambulance

charges and medical expenses against liabilities

in case of any unfortunate eventuality.

A truly Complete Protection Cover that offers

absolute assurance and peace of mind.

Hospital Cash Cover:

Daily hospital cash allowance arising

from injury to insured persons while

travelling in the insured vehicle

Rs.1,000 for 30 days

Higher plans available on request.

What does this policy not cover?

Some of the major exclusions under the basic policy are:

1. Consequential loss

Ambulance Charges Cover:

Charges towards transportation of

insured persons in ambulance to the

hospital, post suffering bodily injury

caused by an accident while travelling

in the insured vehicle

2. Depreciation; wear and tear

3. Mechanical and electrical breakdown; failure or breakage

4. When the vehicle is used outside the geographical area

5. When used contrary to limitations as to use

6. When driven by a person other than the driver stated in

the driver's clause

7. War perils, nuclear perils and drunken driving

Medical Expenses

Reimbursement Cover:

All medical expenses in case of

injury to the insured persons while

travelling in the insured vehicle

Lifes journey has

become more

enriching, now that

you can get

Complete Protection

Cover for your car as

well as your family, in

one smart package.

Limit/Sum Insured

This is not an exhaustive list. For a detailed list of the

exclusions, please read our policy terms and conditions.

Acceptance Guidelines

1. The Depreciation Cover is applicable to vehicles

up to 2 years old only

2. The Add-on Covers can be sold only with SmartDrive

Private Car Insurance Policy; they cannot be sold on a

stand-alone basis or for a vehicle insured with any other

insurance company

Depreciation Cover:

In case of any replacement of

part arising from accident of the

insured vehicle

Claims Procedure: Fast, fair and friendly

Bharti AXA General Insurance

At Bharti AXA, we promise to be at your side during your time of

Bharti AXA General Insurance is a joint venture between the

Bharti Group and AXA. Bharti AXA combines the strengths of

Bharti Enterprises, one of India's leading business groups,

and AXA, the global leader in financial protection and

wealth management.

distress. To enable us to help you, we request you to register a

claim

by

contacting

our

24-hour

Toll-Free

Helpline

on

1800-103-2292. Please intimate the help desk as soon as a

Why cant an insurance policy

protect my car / and my family?

claim occurs, so that we can provide you quick and effective

Twin assurance for you

service. You can, alternatively, also register a claim by e-mail on

AXA is one of the largest insurers in the world, with over

67 million clients worldwide and over 1,75,000 employees

working across 5 continents. AXA believes in achieving

operational excellence through product innovation, business

expertise, distribution, quality of service and productivity.

claims@bharti-axagi.co.in

While registering a claim, the following

information will help us serve you better:

Policy number

Name of the insured

Insureds/callers contact number

Date and time of accident

Location of accident

Brief details of damage

Name of the driver who was driving the vehicle

at the time of loss

Name and contact number of the workshop

where the vehicle can be inspected

Name/s of the person/s who sustained

injuries in the accident (if any)

Name/s of the hospital where the injured were

given first aid/admitted

Bharti Enterprises is one of the biggest organisations in the

country with interests in telecom, agriculture and retail. It is a

pioneering force in the telecom sector, with many firsts and

innovations to its credit, offering a powerful mix of a strong

national presence and unmatched local knowledge.

For more info:

1800 103 2292 (toll-free)

080 4357 3450 (call charges apply)

SMS <INFO> to 5667700

www.bharti-axagi.co.in

To enable us to help you, we request you to register

a claim by contacting our 24-hour toll-free helpline

on 1800-103-2292 or e-mail us at

claims@bharti-axagi.co.in

To get a hassle-free policy, call our toll-free number

1800-103-2292 or email us at

sales@bharti-axagi.co.in, clearly mentioning your

postal address.

BRO/PVTCAR-ADDON/CONT/12-09

At Bharti AXA, cashless/direct settlement is provided

to the garages of the customer's choice. On the

request of the client, the company is willing to pay to

the garage of the customer's choice across India,

provided the garage is a dealer or authorised service

station.

For more details on risk factors and

terms & conditions, please read the

sales brochure carefully before

concluding a sale.

*This leaflet is only a brief summary

of the Add-on Covers for SmartDrive

Private Car Insurance Policy. Please

contact our intermediary/sales

officer/any of our offices for the

policy wordings.

SmartDrive

Private Car

Insurance Policy

with the power of

Add-on Covers.

Bharti AXA General Insurance Co. Ltd.

First Floor, Ferns Icon, Survey No. 28, Doddanekundi, Bangalore - 560 037.

Insurance is the subject matter of the solicitation.

Claims Procedure: Fast, fair and friendly

Bharti AXA General Insurance

At Bharti AXA, we promise to be at your side during your time of

Bharti AXA General Insurance is a joint venture between the

Bharti Group and AXA. Bharti AXA combines the strengths of

Bharti Enterprises, one of India's leading business groups,

and AXA, the global leader in financial protection and

wealth management.

distress. To enable us to help you, we request you to register a

claim

by

contacting

our

24-hour

Toll-Free

Helpline

on

1800-103-2292. Please intimate the help desk as soon as a

Why cant an insurance policy

protect my car / and my family?

claim occurs, so that we can provide you quick and effective

Twin assurance for you

service. You can, alternatively, also register a claim by e-mail on

AXA is one of the largest insurers in the world, with over

67 million clients worldwide and over 1,75,000 employees

working across 5 continents. AXA believes in achieving

operational excellence through product innovation, business

expertise, distribution, quality of service and productivity.

claims@bharti-axagi.co.in

While registering a claim, the following

information will help us serve you better:

Policy number

Name of the insured

Insureds/callers contact number

Date and time of accident

Location of accident

Brief details of damage

Name of the driver who was driving the vehicle

at the time of loss

Name and contact number of the workshop

where the vehicle can be inspected

Name/s of the person/s who sustained

injuries in the accident (if any)

Name/s of the hospital where the injured were

given first aid/admitted

Bharti Enterprises is one of the biggest organisations in the

country with interests in telecom, agriculture and retail. It is a

pioneering force in the telecom sector, with many firsts and

innovations to its credit, offering a powerful mix of a strong

national presence and unmatched local knowledge.

For more info:

1800 103 2292 (toll-free)

080 4357 3450 (call charges apply)

SMS <INFO> to 5667700

www.bharti-axagi.co.in

To enable us to help you, we request you to register

a claim by contacting our 24-hour toll-free helpline

on 1800-103-2292 or e-mail us at

claims@bharti-axagi.co.in

To get a hassle-free policy, call our toll-free number

1800-103-2292 or email us at

sales@bharti-axagi.co.in, clearly mentioning your

postal address.

BRO/PVTCAR-ADDON/CONT/12-09

At Bharti AXA, cashless/direct settlement is provided

to the garages of the customer's choice. On the

request of the client, the company is willing to pay to

the garage of the customer's choice across India,

provided the garage is a dealer or authorised service

station.

For more details on risk factors and

terms & conditions, please read the

sales brochure carefully before

concluding a sale.

*This leaflet is only a brief summary

of the Add-on Covers for SmartDrive

Private Car Insurance Policy. Please

contact our intermediary/sales

officer/any of our offices for the

policy wordings.

SmartDrive

Private Car

Insurance Policy

with the power of

Add-on Covers.

Bharti AXA General Insurance Co. Ltd.

First Floor, Ferns Icon, Survey No. 28, Doddanekundi, Bangalore - 560 037.

Insurance is the subject matter of the solicitation.

You might also like

- Vehicle Insurance Policy FormatDocument4 pagesVehicle Insurance Policy Formatarunavonline_947835049% (59)

- Commercial Trucking Insurance for Veteran Truckers: How to Save Money, Time, and a Lot of HeadachesFrom EverandCommercial Trucking Insurance for Veteran Truckers: How to Save Money, Time, and a Lot of HeadachesNo ratings yet

- Property, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!From EverandProperty, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Rating: 5 out of 5 stars5/5 (1)

- 9202532312008516Document2 pages9202532312008516Roopesh KumarNo ratings yet

- DELIGHT Official e BookDocument418 pagesDELIGHT Official e BookIsis Jade100% (3)

- Sub: Release of Simple Mortgage Deed With Respect To OC: 16075/07/03/2014/C16/OCDocument2 pagesSub: Release of Simple Mortgage Deed With Respect To OC: 16075/07/03/2014/C16/OCsunder_vasudevanNo ratings yet

- Private Car Stand Alone Own Damage Add - On CoverDocument19 pagesPrivate Car Stand Alone Own Damage Add - On CoverParul SinghNo ratings yet

- Is Your Insurance Company Listening To You?Document10 pagesIs Your Insurance Company Listening To You?beingviswaNo ratings yet

- Car Insurance Policy BookletDocument28 pagesCar Insurance Policy BookletvenunainiNo ratings yet

- mh43x8786 Xylo E6Document4 pagesmh43x8786 Xylo E6Asif ShaikhNo ratings yet

- Thunderbird Twinspark Insurance2014Document4 pagesThunderbird Twinspark Insurance2014vijaybk73No ratings yet

- Earth As A PlanetDocument60 pagesEarth As A PlanetR AmravatiwalaNo ratings yet

- Motor Insurance PDS PDFDocument4 pagesMotor Insurance PDS PDFalister kellenNo ratings yet

- Rule of 72Document2 pagesRule of 72sunder_vasudevan100% (1)

- ManeDocument2 pagesManeMukesh Manwani100% (2)

- Ground-Fault Protection - All You Need To KnowDocument9 pagesGround-Fault Protection - All You Need To KnowCamila RubioNo ratings yet

- Bulk-Fill Composite RestorationsDocument9 pagesBulk-Fill Composite RestorationssusethNo ratings yet

- Gabbilam Kavyam Visalandhra PublicationsDocument68 pagesGabbilam Kavyam Visalandhra PublicationsVeena MayuriNo ratings yet

- DITA Book PDFDocument26 pagesDITA Book PDFsunder_vasudevan100% (1)

- Motor Insurance HandbookDocument10 pagesMotor Insurance HandbookdaramanishNo ratings yet

- AD 003 031 Your Car Insurance GuideDocument37 pagesAD 003 031 Your Car Insurance GuideDhar RakulNo ratings yet

- B65a RRH2x40-4R UHGC SPDocument71 pagesB65a RRH2x40-4R UHGC SPNicolás RuedaNo ratings yet

- PCP 96175276 PDFDocument3 pagesPCP 96175276 PDFpvsairam100% (5)

- 08-Purandaradasa KritisDocument38 pages08-Purandaradasa Kritissunder_vasudevanNo ratings yet

- Qualification of Analytical Instruments For Use in Pharmaceutical Industry-A Scientific ApproachDocument23 pagesQualification of Analytical Instruments For Use in Pharmaceutical Industry-A Scientific Approachmicrobioasturias100% (4)

- AD 003 033 Your Car Insurance GuideDocument37 pagesAD 003 033 Your Car Insurance GuideDhar RakulNo ratings yet

- Monitoring AlkesDocument41 pagesMonitoring AlkesEndangMiryaningAstutiNo ratings yet

- Revised List of Maharashtra HospitalsDocument16 pagesRevised List of Maharashtra Hospitalsdummy data100% (1)

- Studovaný Okruh: Physical Therapist Sample Test Questions (G5+)Document8 pagesStudovaný Okruh: Physical Therapist Sample Test Questions (G5+)AndreeaNo ratings yet

- Motor Policy - The New India Assurance Co. LTDDocument5 pagesMotor Policy - The New India Assurance Co. LTDu4rishiNo ratings yet

- Motor Policy Wording UaeDocument64 pagesMotor Policy Wording UaeBassam MustafaNo ratings yet

- PDS Motor InsuranceDocument3 pagesPDS Motor InsuranceHooter ShooterNo ratings yet

- AD 003 020 Your Car Insurance GuideDocument40 pagesAD 003 020 Your Car Insurance GuideDhar RakulNo ratings yet

- AD 003 021 Your Car Insurance GuideDocument37 pagesAD 003 021 Your Car Insurance GuideDhar RakulNo ratings yet

- Allianz General Insurance Company (Malaysia) BerhadDocument6 pagesAllianz General Insurance Company (Malaysia) BerhadSiti Nurazlin FariddunNo ratings yet

- Takaful First PartyDocument3 pagesTakaful First Partyahrafza91No ratings yet

- MSIG Motor Plus Insurance BrochureDocument24 pagesMSIG Motor Plus Insurance BrochureTai AndyNo ratings yet

- Motor Private Car BrochureDocument8 pagesMotor Private Car BrochureManju mehtaNo ratings yet

- Motorcycle Insurance: Page 1 of 9Document9 pagesMotorcycle Insurance: Page 1 of 9Scootling ScootersNo ratings yet

- ICICI Lombard General Insurance CompanyDocument7 pagesICICI Lombard General Insurance Companyanish2408No ratings yet

- Private Car Stand Alone Own Damage Add - On CoverDocument18 pagesPrivate Car Stand Alone Own Damage Add - On CoverRaj PurusothamanNo ratings yet

- Digit Private Car Stand Alone Damage Add-On Cover - WordingsDocument21 pagesDigit Private Car Stand Alone Damage Add-On Cover - Wordingsashokdas test5No ratings yet

- AD116 - Policybook - 0110Document60 pagesAD116 - Policybook - 0110johndkellyNo ratings yet

- Sompo Motor Insurance (Private Car Comprehensive Policy) : Product Disclosure SheetDocument6 pagesSompo Motor Insurance (Private Car Comprehensive Policy) : Product Disclosure SheetMuhammad Shamaran AbdullahNo ratings yet

- Script Ins PDFDocument5 pagesScript Ins PDF4hm8dxt9ckNo ratings yet

- Digit Commercial Vehicle Package Policy (Miscellaneous and Special Types of Vehicle) Add On CoversDocument15 pagesDigit Commercial Vehicle Package Policy (Miscellaneous and Special Types of Vehicle) Add On CoversWPP 3204No ratings yet

- Motor Vehicle InsuranceDocument12 pagesMotor Vehicle InsuranceDhruv SiddarthNo ratings yet

- Insurance ArpitaDocument61 pagesInsurance ArpitavrekhavasuNo ratings yet

- AXA Plus Car Insurance: Your Policy WordingDocument56 pagesAXA Plus Car Insurance: Your Policy WordingRolyn BonghanoyNo ratings yet

- CoverPlus $100 ExcessDocument12 pagesCoverPlus $100 ExcessPerhan LauNo ratings yet

- Motor Private Car ENGDocument4 pagesMotor Private Car ENGascap77No ratings yet

- "Promotional Strategy in Life Insurance CompaniesDocument19 pages"Promotional Strategy in Life Insurance CompaniesChintan PatelNo ratings yet

- Motor Vehicle Insurance: Types of Motor Insurance in India 1. Private Car Motor Insurance PolicyDocument12 pagesMotor Vehicle Insurance: Types of Motor Insurance in India 1. Private Car Motor Insurance PolicyadititopperNo ratings yet

- Product Disclosure Sheet: Prepared For: Print DateDocument4 pagesProduct Disclosure Sheet: Prepared For: Print DatePhua Kien HanNo ratings yet

- Motor InsuranceDocument7 pagesMotor InsuranceAadi saklechaNo ratings yet

- HD PC Ap GW 11 22Document80 pagesHD PC Ap GW 11 22Hernest GaldamezNo ratings yet

- Insurance Product Information DocumentDocument2 pagesInsurance Product Information DocumentAla CocpNo ratings yet

- Motor Insurance: Presented ByDocument19 pagesMotor Insurance: Presented BymharitmsNo ratings yet

- Summary - Autoaid Breakdown Recovery: Abrkf11/13Document1 pageSummary - Autoaid Breakdown Recovery: Abrkf11/13Rishi PatelNo ratings yet

- Your Health Cover: Is Too Important To Leave BehindDocument4 pagesYour Health Cover: Is Too Important To Leave BehindNelly HNo ratings yet

- Motor InsuranceDocument30 pagesMotor InsuranceakankshaNo ratings yet

- Rac Policy BookletDocument24 pagesRac Policy Bookletkeener66No ratings yet

- UntitledDocument41 pagesUntitledpalwinder singhNo ratings yet

- Car InsurancesDocument10 pagesCar InsurancesAlex SatheeshNo ratings yet

- Auto GideDocument25 pagesAuto GidejulesjiNo ratings yet

- Risk and Insurance AssignmentDocument7 pagesRisk and Insurance AssignmentDream AudioNo ratings yet

- Digit Private Car (Bundled) - Add-OnsDocument21 pagesDigit Private Car (Bundled) - Add-OnsVrishti PrajapatiNo ratings yet

- Digit Private Car (Bundled) - Add-OnsDocument20 pagesDigit Private Car (Bundled) - Add-OnsRAVJEET SINGH LUTHRANo ratings yet

- NotesDocument10 pagesNotesgimgiNo ratings yet

- Auto-Mobile InsuranceDocument12 pagesAuto-Mobile InsuranceH-Sam PatoliNo ratings yet

- Auotmobile Insurance: HistoryDocument8 pagesAuotmobile Insurance: HistoryDeepanshu KhuranaNo ratings yet

- Product Disclosure Sheet: Pacific & Orient Insurance Co. BerhadDocument4 pagesProduct Disclosure Sheet: Pacific & Orient Insurance Co. BerhadHamzah AzizanNo ratings yet

- Executive SummaryDocument41 pagesExecutive SummaryAnonymous CgJjQiCu5ANo ratings yet

- Insurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5From EverandInsurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5No ratings yet

- Jones KinshipwithanimalsDocument7 pagesJones Kinshipwithanimalssunder_vasudevanNo ratings yet

- Lump Sum Investment (Rule of 72) - CalculatorDocument2 pagesLump Sum Investment (Rule of 72) - Calculatorsunder_vasudevanNo ratings yet

- Balaji Bala Subramania IyerDocument1 pageBalaji Bala Subramania Iyersunder_vasudevanNo ratings yet

- CSL Brochure Winter 2004Document36 pagesCSL Brochure Winter 2004bheemsinhNo ratings yet

- Capital Gains Calculation On PropertyDocument2 pagesCapital Gains Calculation On Propertysunder_vasudevanNo ratings yet

- Overheard: Steven SoderberghDocument8 pagesOverheard: Steven Soderberghsunder_vasudevanNo ratings yet

- Pelease Pequest DisbupsementDocument2 pagesPelease Pequest Disbupsementsunder_vasudevanNo ratings yet

- Extraordinary GazetteDocument10 pagesExtraordinary GazetteAdaderana OnlineNo ratings yet

- 1 Nitanshi Singh Full WorkDocument9 pages1 Nitanshi Singh Full WorkNitanshi SinghNo ratings yet

- HEYER VizOR - Product List - 1015Document7 pagesHEYER VizOR - Product List - 1015kalandorka92No ratings yet

- Sedation and Analgesia in Critically Ill Neurologic PatientsDocument24 pagesSedation and Analgesia in Critically Ill Neurologic PatientsrazaksoedNo ratings yet

- Kes MahkamahDocument16 pagesKes Mahkamahfirdaus azinunNo ratings yet

- Umur Ekonomis Mesin RevDocument3 pagesUmur Ekonomis Mesin Revrazali akhmadNo ratings yet

- Sesion 2 - Copia-1Document14 pagesSesion 2 - Copia-1Maeva FigueroaNo ratings yet

- Hasil Pemeriksaan Laboratorium: Laboratory Test ResultDocument1 pageHasil Pemeriksaan Laboratorium: Laboratory Test ResultsandraNo ratings yet

- 4th Summative Science 6Document2 pages4th Summative Science 6brian blase dumosdosNo ratings yet

- For Hand Grip Strength: NormsDocument7 pagesFor Hand Grip Strength: NormsPraneethaNo ratings yet

- Module 2: Environmental Science: EcosystemDocument8 pagesModule 2: Environmental Science: EcosystemHanna Dia MalateNo ratings yet

- Biomolecules ExtractionDocument6 pagesBiomolecules ExtractionBOR KIPLANGAT ISAACNo ratings yet

- People vs. MediosDocument10 pagesPeople vs. MediostheresagriggsNo ratings yet

- SAT Subject Chemistry SummaryDocument25 pagesSAT Subject Chemistry SummaryYoonho LeeNo ratings yet

- Editorship, Dr. S.A. OstroumovDocument4 pagesEditorship, Dr. S.A. OstroumovSergei OstroumovNo ratings yet

- Depression List of Pleasant ActivitiesDocument3 pagesDepression List of Pleasant ActivitiesShivani SinghNo ratings yet

- Fin e 59 2016Document10 pagesFin e 59 2016Brooks OrtizNo ratings yet

- Group 7 Worksheet No. 1 2Document24 pagesGroup 7 Worksheet No. 1 2calliemozartNo ratings yet

- TS802 - Support StandardDocument68 pagesTS802 - Support StandardCassy AbulenciaNo ratings yet

- Richard Teerlink and Paul Trane - Part 1Document14 pagesRichard Teerlink and Paul Trane - Part 1Scratch HunterNo ratings yet

- Qi Gong & Meditation - Shaolin Temple UKDocument5 pagesQi Gong & Meditation - Shaolin Temple UKBhuvnesh TenguriaNo ratings yet