Professional Documents

Culture Documents

E-SPLOST V One Page Flyer - FINAL - Legal Approval

Uploaded by

casiej7Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

E-SPLOST V One Page Flyer - FINAL - Legal Approval

Uploaded by

casiej7Copyright:

Available Formats

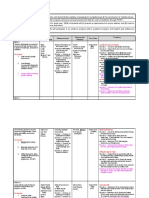

Upgrade the technology

infrastructure, replace

outdated computers,

and purchase additional

computer devices for

student use.

Construct McDonough

High & Middle Schools, a

distribution center, and

purchase land for

future growth.

Make necessary renovations

and repairs on school facilities

throughout the school system.

Construct a new facility on the

north end of the county, and

renovate the current facility.

Purchase new buses.

Construct a multipurpose/

secondary gym at each high

school.

Install synthetic turf fields

and rubberized tracks at all

high schools, and install

athletic field lighting at

three middle schools.

Construct an access

connector between Academy

for Advanced Studies to

Southern Crescent Technical

College to support dual

enrollment.

Construct/renovate central office facilities to

support maintenance, technology, and

instructional services.

Complete energy management projects for cost

savings on utilities.

When will the E-SPLOST V / Bond Referendum be held?

Voters will cast their ballots on March 1, 2016. This is the date of Georgias Presidential Preference

Primary.

Early voting for this election will begin February 8, 2016.

The deadline to register to vote in this election is February 1, 2016. For assistance, contact the

Henry County Board of Elections Office at 770-288-6448.

What is an E-SPLOST?

The Special Purpose Local Option Sales Tax for Education, also known as an E-SPLOST, is a 1 cent

sales tax on all retail sales in Henry County.

The E-SPLOST is a sales tax, not a property tax. Anyone who makes a purchase in Henry County,

including visitors, contributes to the support of local schools.

By law, an E-SPLOST can only be used for certain capital projects that support local schools. Such

funds cannot be used for the day-to-day operational expenses of a school system and cannot be

used for salaries and benefits for employees.

Is the proposed E-SPLOST a new tax? How long would the E-SPLOST be in effect?

This would NOT be a new or additional tax. The current sales tax will NOT increase.

If Henry County voters approve, the current 1 cent sales tax for schools would be continued for

another five years. The current E-SPLOST will expire at the end of 2017.

The first Henry County E-SPLOST was approved by voters in 1997. Voters passed the current

E-SPLOST in 2011.

How is a General Obligation Bond used? Will approval to sell bonds cause my taxes to increase?

The selling of bonds is a way for the Henry County Board of Education to obtain needed funding

ahead of the collection of E-SPLOST sales tax, allowing the school system to immediately begin

work on capital projects.

How will funds be used if voters approve a continuation of the 1 cent sales tax for education?

See other side of flyer for details.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- GA Trip First Letter 16-17Document2 pagesGA Trip First Letter 16-17casiej7No ratings yet

- 15-16 Ptso DatesDocument1 page15-16 Ptso Datescasiej7No ratings yet

- Relay For Life T-ShirtDocument2 pagesRelay For Life T-Shirtcasiej7No ratings yet

- Six Flags Permission SlipDocument2 pagesSix Flags Permission Slipcasiej7No ratings yet

- 2016-2017 Continuous Improvement PlanDocument12 pages2016-2017 Continuous Improvement Plancasiej7No ratings yet

- March 2016 NLDocument6 pagesMarch 2016 NLcasiej7No ratings yet

- Milestones Communication 2016Document3 pagesMilestones Communication 2016casiej7No ratings yet

- Plan On A Page 2016Document1 pagePlan On A Page 2016casiej7No ratings yet

- LibraryDocument1 pageLibrarycasiej7No ratings yet

- Pictures For BarcodeDocument3 pagesPictures For Barcodecasiej7No ratings yet

- Revised Cip LgmsDocument8 pagesRevised Cip Lgmscasiej7No ratings yet

- Will No Longer Be Allowed. If You Wish To BringDocument1 pageWill No Longer Be Allowed. If You Wish To Bringcasiej7No ratings yet

- Go PacketDocument2 pagesGo Packetcasiej7No ratings yet

- Six Flags Permission SlipDocument2 pagesSix Flags Permission Slipcasiej7No ratings yet

- 8th Grade Yearbook Ads Are On Sale NOW!: Please Follow The Instructions BelowDocument1 page8th Grade Yearbook Ads Are On Sale NOW!: Please Follow The Instructions Belowcasiej7No ratings yet

- Class of 2020 8 Grade Activities ScheduleDocument1 pageClass of 2020 8 Grade Activities Schedulecasiej7No ratings yet

- Galentines Day Parent LetterDocument1 pageGalentines Day Parent Lettercasiej7No ratings yet

- Information and Medical ReleaseDocument2 pagesInformation and Medical Releasecasiej7No ratings yet

- PULSE Is and Is NotDocument1 pagePULSE Is and Is Notcasiej7No ratings yet

- Pulse FaqDocument2 pagesPulse Faqcasiej7No ratings yet

- Valentine DanceDocument1 pageValentine Dancecasiej7No ratings yet

- Pulse FaqDocument2 pagesPulse Faqcasiej7No ratings yet

- Wildcat Rumble: LGMS 7th Graders Tour Georgia CoastDocument4 pagesWildcat Rumble: LGMS 7th Graders Tour Georgia Coastcasiej7No ratings yet

- Wildcat Wit & Wisdom: Adventures in HollywoodDocument4 pagesWildcat Wit & Wisdom: Adventures in Hollywoodcasiej7No ratings yet

- Athletic FormsDocument9 pagesAthletic Formscasiej70% (1)

- Food For FinesDocument1 pageFood For Finescasiej7No ratings yet

- PULSE Parent LetterDocument1 pagePULSE Parent Lettercasiej7No ratings yet

- Locust Grove Middle School 3315 South Ola Road Locust Grove, GA 30248 770-957-6055Document8 pagesLocust Grove Middle School 3315 South Ola Road Locust Grove, GA 30248 770-957-6055casiej7No ratings yet

- November NewsletterDocument8 pagesNovember Newslettercasiej7No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- QQ Reference List (July 2010)Document11 pagesQQ Reference List (July 2010)gabox707No ratings yet

- 4.4 Understanding The Gas LawsDocument43 pages4.4 Understanding The Gas LawsNur HidayatiNo ratings yet

- SERIES AC CIRCUIT PROBLEMSDocument4 pagesSERIES AC CIRCUIT PROBLEMSHubert Semeniano100% (1)

- Can Your Roof Handle The Weight of Solar Panels?Document2 pagesCan Your Roof Handle The Weight of Solar Panels?Princess Joan UlitNo ratings yet

- Hydraulic efficiency η h= Power output Energy available ∈the jet PDocument3 pagesHydraulic efficiency η h= Power output Energy available ∈the jet Pkimlouie petateNo ratings yet

- Contractor instrument pressure piping hook-up documentDocument35 pagesContractor instrument pressure piping hook-up documentTahir100% (1)

- Exer 2 - PH and BuffersDocument4 pagesExer 2 - PH and BuffersAsi JenNo ratings yet

- Assignment-Research 2-MJD-MALLARIDocument9 pagesAssignment-Research 2-MJD-MALLARIMark MallariNo ratings yet

- Plumbing Systems For BuildingsDocument62 pagesPlumbing Systems For BuildingsDileep Kumar100% (1)

- To Access The Fuel Oil Management Plan Sample TemplateDocument35 pagesTo Access The Fuel Oil Management Plan Sample TemplateΦοίβος ΖούκηςNo ratings yet

- Master Plumber Review Material 2Document4 pagesMaster Plumber Review Material 2Marvin KalnganNo ratings yet

- Electrical Machines DC Motor NewDocument27 pagesElectrical Machines DC Motor NewPranav MahadikNo ratings yet

- Nerc Sra 2022Document46 pagesNerc Sra 2022The Western Journal100% (1)

- V. S. Wolkenstein - Problems in General Physics (1971, Mir Publishers)Document379 pagesV. S. Wolkenstein - Problems in General Physics (1971, Mir Publishers)lol88745No ratings yet

- Spe 131758 Ms - GL and EspDocument11 pagesSpe 131758 Ms - GL and EspSamuel VmNo ratings yet

- LM1117Document20 pagesLM1117Shahril RizalNo ratings yet

- 1 s2.0 S0165237019300294 Main PDFDocument11 pages1 s2.0 S0165237019300294 Main PDFNatashaA.CuencaSchillingNo ratings yet

- Especificaciones de valvulasDIDocument4 pagesEspecificaciones de valvulasDIAlejandro ValenzuelaNo ratings yet

- Mike Busch on Engines What Every Aircraft Owner Needs to Know About the Design Operation Condition Monitoring Maintenance and Troubleshooting of Piston Aircraft Engines 1nbsped 1718608950 9781718608955 CompressDocument509 pagesMike Busch on Engines What Every Aircraft Owner Needs to Know About the Design Operation Condition Monitoring Maintenance and Troubleshooting of Piston Aircraft Engines 1nbsped 1718608950 9781718608955 CompressHugo HernandNo ratings yet

- Effinet Service Manual1Document63 pagesEffinet Service Manual1Willian Santiago CardenasNo ratings yet

- Electrochemistry NotesDocument16 pagesElectrochemistry NotesRandomNo ratings yet

- 08 Redox NotesDocument12 pages08 Redox NotesAwais BodlaNo ratings yet

- LPG Parts Diagram BreakdownDocument43 pagesLPG Parts Diagram BreakdownناصرقوجيلNo ratings yet

- A380-LEVEL III - ATA 26 Fire - Smoke DetectionDocument42 pagesA380-LEVEL III - ATA 26 Fire - Smoke DetectionAbolfazl Mazloomi100% (2)

- Manual TW enDocument5 pagesManual TW enRobertoNo ratings yet

- Pressue CompensatorDocument2 pagesPressue CompensatorMahmud MaherNo ratings yet

- Electromagnetic Relays - ManiDocument17 pagesElectromagnetic Relays - ManipraveenaprabhuNo ratings yet

- Home Automation and Surveillance: A ReviewDocument4 pagesHome Automation and Surveillance: A ReviewATSNo ratings yet

- SKF TIH 030M - 230V SpecificationDocument3 pagesSKF TIH 030M - 230V SpecificationÇAĞATAY ÇALIŞKANNo ratings yet