Professional Documents

Culture Documents

Wind Energy in India Status and Future Prospects

Uploaded by

Kumar Gaurab JhaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wind Energy in India Status and Future Prospects

Uploaded by

Kumar Gaurab JhaCopyright:

Available Formats

See

discussions, stats, and author profiles for this publication at: http://www.researchgate.net/publication/200122206

Wind energy in India: Status and future prospects

ARTICLE in JOURNAL OF RENEWABLE AND SUSTAINABLE ENERGY JULY 2009

Impact Factor: 0.9 DOI: 10.1063/1.3156003

CITATIONS

READS

14

4,682

2 AUTHORS, INCLUDING:

Pallav Purohit

International Institute for Applied Systems A

65 PUBLICATIONS 878 CITATIONS

SEE PROFILE

Available from: Pallav Purohit

Retrieved on: 31 October 2015

JOURNAL OF RENEWABLE AND SUSTAINABLE ENERGY 1, 042701 2009

Wind energy in India: Status and future prospects

Ishan Purohit1 and Pallav Purohit2,a

1

The Energy and Resources Institute (TERI), IHC Complex, Lodhi Road, New Delhi

110003, India

2

International Institute for Applied Systems Analysis (IIASA), Schlossplatz 1, A-2361

Laxenburg, Austria

Received 9 October 2008; accepted 15 May 2009; published online 8 July 2009

Wind energy, with an average growth rate of 30%, is the fastest growing source of

renewable energy in the world. India occupies the fifth place in the world in wind

energy generation after USA, Germany, Spain, and China and has an installed

capacity of more than 9756 MW as of January 31, 2009. New technological developments in wind energy design have contributed to the significant advances in wind

energy penetration and to get optimum power from available wind. In this study, an

attempt has been made to analyze and review the development and dissemination of

wind energy in India. The diffusion prospect of wind energy generation in the

potential states of India is also analyzed. 2009 American Institute of Physics.

DOI: 10.1063/1.3156003

I. INTRODUCTION

Energy security and sustainable development are high in the global agenda due to the impact

of volatile energy prices, high demand for energy security, and concerns over environmental

sustainability and the global climate change.1 New and renewable energy technologies are considered to be one of the viable options to meet the challenge of achieving sustainable development

while conserving natural resources that have been depleted due to the rapid growth in population,

urbanization, and fossil fuel consumption.2,3 The renewable electricity generation capacity reached

an estimated 240 GW worldwide in 2007, which represents 5% of the global power capacity and

3.4% of the global power generation.4 The largest component of renewable generation capacity is

wind power, which grew by 29% worldwide in 2008 to reach an estimated 121 GW.5 The impetus

behind wind power expansion has come increasingly from the urgent need to combat global

climate change.6 Most countries now accept that greenhouse gas GHG emissions must be drastically slashed in order to avoid environmental catastrophe. Wind energy not only offers both a

power source that completely avoids the emission of carbon dioxide,7 the main GHG, but also

produces none of the other pollutants associated with either fossil fuel or nuclear generation.

The Indian renewable energy sector has shown impressive growth in the past few years and

investments into the sector have increased significantly. The share of renewable energy was 7.7%

in the cumulative installed capacity 147 403 MW of electric power plants under utilities in

India until December 2008.8 The Indian government by 2012 expects renewable energy to contribute 10% of the total power generation capacity and have 4%5% share in the electricity mix.9

From a longer-term perspective and keeping in mind the need to maximally develop domestic

supply options as well as the need to diversify energy sources, renewables remain important to

Indias energy sector. The Integrated Energy Policy Report of the Planning Commission of India

has observed that the contribution of modern renewables to Indias energy mix by 20312032,

excluding large hydro, would be around 5%6%.10 Table I presents the cumulative installed

capacity of renewable energy technologies for power generation in India. The cumulative installed

Author to whom correspondence should be addressed. Tel.: 43 2236807 336. FAX: 43 2236807 533. Electronic mail:

purohit@iiasa.ac.at.

1941-7012/2009/14/042701/19/$25.00

1, 042701-1

2009 American Institute of Physics

042701-2

I. Purohit and P. Purohit

J. Renewable Sustainable Energy 1, 042701 2009

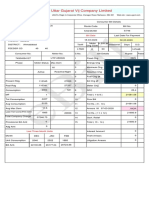

TABLE I. Power from renewables in India cumulative achievements as of January 31, 2009. See Ref. 11.

Sources/Systems

Achievements during 20082009a

Cumulative achievements

a Grid-interactive renewable power

1. Biomass power agroresidues

77.50 MW

2. Wind power

998.85 MW

3. Small hydropower up to 25 MW

163.83 MW

4. Cogeneration-bagasse

232.90 MW

5. Waste to energy

3.66 MW

6. Solar power

Subtotal in MW a

1476.74 MW

683.30 MW

9755.85 MW

2344.67 MW

1033.73 MW

58.91 MW

2.12 MW

13 878.58 MW

b Off-grid/distributed renewable power including captive/CHP plants

7. Biomass power/cogen. nonbagasse

60.92 MW

150.92 MW

8. Biomass gasifier

8.98 MWeq

160.31 MWeq

9. Waste to energy

4.36 MWeq

31.06 MWeq

10. Solar PV power plants and street lights

0.07 MWp

3.00 MWp

11. Aerogenerator/hybrid systems

0.09 MW

0.89 MW

Subtotal in MW b

74.42 MWeq

346.18 MWeq

Total a + b

1551.46 MW

14 224.76 MW

a

Up to January 31, 2009.

capacity of grid-interactive renewable energy systems for power generation was 13 879 MW until

January 2009 of which contributions of wind, small hydro, biomass including agri-residues,

bagasse cogeneration, and waste to energy, and solar were 9756, 2345, 1776, and 2.12 MW,

respectively.12 It may be noted that wind power contributes 70% of the grid-interactive renewable

power installed in the country.

India is now the fifth largest wind market in the world13 despite the fact that the total installed

capacity of wind power projects still remains far below from their respective potential 20%.

The wind energy sector in India has seen a shift in the past couple of years from a manufacturer

focused industry to one led by mainstream power developers; however, the countrys low capacity

utilization factor CUF for wind power has been an area of concern. Against the international

average of 25%35% CUF,5 Indian CUF averages around 17%.10 This study reviews the development of wind energy in India and diffusion prospects of wind energy in six Indian states. This

paper is set out as follows. Section II provides a brief assessment of the global status of wind

energy and support policies on the basis of available literature. A brief description of wind power

technology is given in Sec. III. Sections IV and V present some salient features of the Indian

program on wind energy development and potential of wind energy in India respectively. The

future growth pattern of wind energy in India and six potential states is predicted and analyzed in

Sec. VI. Section VII concludes.

II. GLOBAL STATUS OF WIND ENERGY AND SUPPORT POLICIES

Wind is commercially and operationally the most viable renewable energy resource and,

accordingly, emerging as one of the largest source in this sector.14 At the end of December 2008,

worldwide capacity of wind-powered generators was 121 GW out of which more than 27 GW was

added in 2008 generating 260 TW h per annum, equaling more than 1.5% of the global electricity

consumption.13 Figure 1 presents the worldwide trend in global installations of wind power. Wind

energy continued its growth in 2008 at an increased rate of 29%.5 In 2008, the United States and

China took the lead, United States taking over the global number one position from Germany and

China getting ahead of India for the first time, taking the lead in Asia. The United States was the

fastest growing wind power market in the world for the third year in a row. The massive growth

in the United States wind market in 2008 increased the countrys total wind power generating

capacity by half. Wind development in the United States is supported by a mix of state and federal

042701-3

J. Renewable Sustainable Energy 1, 042701 2009

Wind energy in India

121.19

125

Cumulative installed capacity (GW

100

93.85

74.15

75

59.03

47.69

50

39.29

31.16

24.35

25

18.04

13.70

7.48

9.66

0

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

Year

FIG. 1. Global installed capacity of wind power source: Ref. 15.

policies.1620 At the federal level, wind power receives generous tax incentives in the form of a 10

yr production tax creditwhich, in effect, acts like a feed-in premiumand 5 yr accelerated

depreciation.14 The combination of federal tax incentives with state-level financial incentives and

renewable energy quota obligation systems was a major driver in wind power capacity additions in

the United States. Canada in 2008 surpassed the 2 GW mark for installed wind energy capacity,

ending the year with 2.4 GW.13 The provision of production incentive payments under the ecoENERGY initiative for renewable power program is stimulating wind energy deployment in

Canada.21

The European market continues its steady growth and wind power is now the fastest growing

power generation technology in the European Union. Overall, almost 8.9 GW of new wind turbines brought European wind power generation capacity up to nearly 66 GW in 2008.5 In Europe,

the group of countries with the highest effectiveness Germany, Spain, Denmark, and Portugal

used feed-in tariffs FITs to encourage wind power deployment.4,22 Their success in deploying

onshore wind stems from high investment stability guaranteed by the long term FITs, an appropriate framework with low administrative and regulatory barriers, and relatively favorable grid

access conditions. In 2005, the average remuneration levels in these countries USD

0.09 0.11/ kW h were lower than those in countries applying quota obligation systems with

tradable green certificates TGCs i.e., USD 0.13 0.17/ kW h.14 It is observed that beyond some

minimum threshold level, higher remuneration levels do not necessarily lead to greater levels of

policy effectiveness. The highest levels of remuneration on a per-unit generated basis for wind

among the countries studied are seen in Italy, Belgium, and the United Kingdom, which have all

implemented quota obligation systems with TGCs.2325 Yet none of these countries scored high

levels of deployment effectiveness. This is likely related to the existence of high noneconomic

barriers as well as to intrinsic problems with the design of TGC systems in these countries, which

cause higher investor risk premiums.

China continued its spectacular growth in 2008, once again doubling its installed capacity by

adding about 6.3 GW to reach a total of 12.2 GW.5,13 Like most European countries, China has

stipulated a series of incentive policies to encourage its technical innovation, market expansion,

and commercialization. In February 2005, Chinas Renewable Energy Law was formulated and

came into force on January 1, 2006. The law requires that power grid operators purchase a full

amount of wind power generated by registered producers. The law also offers financial incentives,

042701-4

J. Renewable Sustainable Energy 1, 042701 2009

I. Purohit and P. Purohit

120

100

Capacity (GW)

80

60

40

20

0

2000

2001

2002

2003

2004

2005

2006

2007

2008

Year

USA

Germany

Spain

China

India

Italy

France

UK

Denmark

Portugal

FIG. 2. Installed capacity of wind power in top ten countries source: Refs. 5 and 10.

such as a national fund to foster renewable energy development and discounted lending and tax

preferences for renewable energy projects.26 India is continuing its steady growth, with 1800 MW

of wind energy capacity added in 2008, bringing the total of up to 9.6 GW.13 In India, some states

with renewable portfolio standards or other policies to promote wind generation have introduced

FITs for wind generation which are higher than that for conventional electricity. Ten out of the 29

Indian states have now implemented quotas for a renewable energy share of up to 10% and have

introduced preferential tariffs for electricity produced from renewable sources.5 At the federal

level, although there is no national policy for renewable energy, there are a number of measures

that help drive wind energy development, including fiscal incentives such as income tax exemption for 10 yr, 80% accelerated depreciation, sales tax exemption, and excise duty exemption.

The clean development mechanism CDM of the Kyoto protocol has already had a substantial impact on wind energy development in China and India. The CDM also impacts to a lesser

extent other developing countries, and income from certified emission reductions can make a

substantial contribution to a projects profitability.27,28 There were more than 25 000 MW of wind

power projects in the CDM pipeline until January 2009 in which most of the projects belongs to

China 314 projects of 16 977 MW and India 270 projects of 5072 MW. The cumulative

installed capacity of wind power in top ten countries until December 2008 is shown in Fig. 2. On

the basis of accelerated development and further improved policies, a global capacity of more than

1500 GW is possible by 2020.5,13

III. WIND ENERGY TECHNOLOGY

Wind has considerable amount of kinetic energy when blowing at high speeds.29 This kinetic

energy when passing through the blades of the wind turbines is converted into mechanical energy

and rotates the wind blades30 and the connected generator, thereby producing electricity. A wind

turbine primarily consists of a main tower, blades, nacelle, hub, main shaft, gearbox, bearing and

housing, brake, and generator.7 The main tower is 50100 m high. Generally, three blades made up

of fiber reinforced polyester are mounted on the hub, while in the nacelle the major parts are

housed. Under normal operating conditions, the nacelle would be facing the upstream wind

direction.29 The hub connects the gearbox and the blades. Solid high carbon steel bars or cylinders

are used as main shaft. The gearbox is used to increase the speed ratio so that the rotor speed is

increased to the rated generator speed;30 it is the most critical component and needs regular

maintenance. Oil cooling is employed to control the heating of the gearbox. Gearboxes are

042701-5

Wind energy in India

J. Renewable Sustainable Energy 1, 042701 2009

FIG. 3. Schematic of wind turbine.

mounted over dampers to minimize vibration. Failure of gearbox may put the plant out of operation for an entire season as spares are often not available.31 Thus, new gearless configurations have

become attractive for wind plant operators. Figure 3 presents a schematic of a wind turbine.

The most dramatic improvement has been in the increasing size and performance of wind

turbines. From machines of just 25 kW 20 years ago, the commercial size range sold today is

typically from 600 up to 2.5 MW, with 80 m diameter rotors placed on 70100 m high towers. In

2003, the German company Enercon erected the first prototype of a 4.5 MW turbine with a rotor

diameter of 112 m.7 Wind turbines have a design lifetime of 2025 yr, with their operation and

maintenance costs typically about 3%5% of the cost of the turbine. At present, wind electric

042701-6

I. Purohit and P. Purohit

J. Renewable Sustainable Energy 1, 042701 2009

generators are being manufactured in the country by several manufacturers, through i joint

ventures under licensed production, ii subsidiaries of foreign companies, under licensed production, and iii Indian companies with their own technology. An indigenization level of up to 70%

has been achieved in machines of unit sizes up to 500 kW. The import content is somewhat higher

in higher capacity machines. The current annual production capacity of domestic wind turbines is

about 2500 MW, which is expected to grow by 10 000 MW until 2010.32

For grid-interactive power, two types of wind turbines, viz., stall regulated and pitch regulated, are deployed in the country. The stall regulated wind turbines have fixed rotor blades,

whereas pitch regulated wind turbines have adjustable rotor blades that change the angle of attach

depending on the wind speed. Both technologies have their own advantages and disadvantages.

Wind turbines are also available with lattice, steel tubular, and concrete tubular towers. At present,

the wind industry is market driven and competitive. Most of the wind turbine manufacturers in

India provide operation and maintenance support and also monitor the field performances of the

wind turbines installed by them. With better wind data and the use of analytical tools and experience in siting wind farms, it is expected that the capacity factor for the new wind plants would

exceed 20%. The initial phase of growth of the wind industry was based on imported designs and

relatively low research and development inputs. India has a solid domestic manufacturing base,

including global leader Suzlon, accounting for over half of the market, Vestas Wind Tech and

RRB. In addition, international companies have set up production facilities in India, including

Enercon, Repower, Siemens, and LM Glasfiber and the new entrants such as ReGen Power Tech,

WinWinD, Kenersys, and Global Wind Power. Over the past few years, both the government and

the wind power industry have succeeded in injecting greater stability into the Indian market. This

has encouraged larger private and public sector enterprises to invest in wind. It has also stimulated

a stronger domestic manufacturing sector; some companies now source more than 80% of the

components for their turbines in India. Indian company Suzlon, the worlds fifth largest turbine

manufacturer, is now also well established in the international wind market beyond India, operating in 20 countries around the world and supplying turbines to projects in Asia, North and South

America, and Europe. Table II presents the wind turbines, which are available now for wind power

generation in India. Wind turbines of up to 2.5 MW are presently manufactured in India.9

IV. WIND ENERGY PROGRAM IN INDIA

The original impetus to develop wind energy in India came in the early 1980s from the

government, when the Commission for Additional Sources of Energy CASE had been set up in

1981 and upgraded to the Department of Non-Conventional Energy Sources DNES in 1982.34

This was followed in 1992 by the establishment of a full-fledged Ministry of Non-Conventional

Energy Sources MNES, renamed as Ministry of New and Renewable Energy MNRE in 2006.

The Indian Renewable Energy Development Agency IREDA was established in 1987 as a

financial arm of the Ministry to promote renewable energy technologies in the country. It provides

finances to manufacturers, consultancy services to entrepreneurs, and also assists in the development and upgradation of technologies. The original intent of these institutions was to encourage a

diversification of fuel sources away from the growing demand for coal, oil, and gas required to

meet the demand of the countrys rapid economic growth.35 The wind energy program of MNRE

was aimed at catalyzing commercialization of wind power generation on a large scale in the

country. A market-oriented strategy was adopted from inception, which has led to the successful

commercial development of the technology. The broad based national program included wind

resource assessment; research and development support; implementation of demonstration projects

to create awareness and opening up of new sites; involvement of utilities and industry; development of infrastructure capability and capacity for manufacture, installation, operation and maintenance of wind power plants; and policy support. An aggregate demonstration wind power capacity of 71 MW under the demonstration program of the Ministry has been established at 33

locations in nine states. MNRE provides support for research and development, survey and assessment of wind resources, demonstration of wind energy technologies, and has also taken fiscal

and promotional measures for implementation of private sector projects.36,37 Figure 4 presents the

042701-7

J. Renewable Sustainable Energy 1, 042701 2009

Wind energy in India

TABLE II. Indian wind turbine manufacturers. See Ref. 33.

S. No.

1

Indian manufacturers with location

NEG-MICON India, Chennai

Model

NM 48/750

RD:a 48.2 m

HH:b 45/50/55 m

Tower type: Conical steel

NM 54/950

RD: 54.5 m

HH: 44/55/70 m

Tower type: Tubular steel

NM 82/V 821.65 MW

1 speed MK II

RD: 82 m

HH: 59/68.5/70/78 m

Tower type: Tubular steel

Elecon Engineering Co. Ltd., Vidyanagar, Gujarat T60048

RD: 48 m

HH: 50/55/60 m

Tower type: Tubular

Enercon India Ltd., Mumbai

E-33

RD: 33.4 m

HH: 49.04/49.92 m

Tower type: Tubular steel

E-40/6.44/E3

RD: 44 m

HH:50 m

Tower type: Tubular steel

E48

RD: 48 m

HH: 50/57/75 m

Tower type: For HH 50/57/75 m tubular steel

and 75 m precast concrete

GE Wind Energy India, Bangalore

GE 1.5 sle 50 Hz

RD: 77.0 m

HH: 61.4 m/85 m

Tower type: Tubular steel

M/s Pioneer Asia Wind Turbines, Chennai

Gamesa Eolica

G52850 kW

50 Hz/60 Hz

RD: 52 m

HH: 44/55/65 m

Tower type: Tubular steel

G58850 kW

50 Hz/60 Hz

RD: 58 m

HH: 44/55/65 m

Tower type: Tubular steel

Suzlon Energy Ltd., Pune

Sulzon S64 /1000 kW

RD:64 m

HH:65 m

Tower type: Lattice

Sulzon S 64/1250 KW

RD: 64 m

HH: 65 m

Tower type: Lattice

Capacity

kW

750

950

1650

600

330

600

800

1500

850

1000

1250

042701-8

J. Renewable Sustainable Energy 1, 042701 2009

I. Purohit and P. Purohit

TABLE II. Continued.

S. No.

Indian manufacturers with location

Model

Sulzon S 66/1250 kW

RD: 66 m

Capacity

kW

1250

HH: 65 m

Tower type: Lattice

Sulzon S88/2100 kW

2100

RD: 88 m

Shriram E.P.C. Ltd.

M/s Vestas RRB India Ltd., New Delhi

L.M. Glasfiber, Hoskote

HH: 80 m

Tower type: Tubular steel

Sulzon 600 KW

RD: 52 m

HH: 75 m

Tower type: Lattice

S 70/1250 KW

RD: 69.1 m

HH: 75 m

Tower type: Tubular

S82

RD: 82 m

HH: 78.3 m

Tower type: Tubular

SEPC 250 T

RD: 28.5

HH: 41.2

Tower type: Lattice

V39500 kw

RD: 47 m

HH: 40/45/50 m

Tower type: For HH 40/45/50 m tubular steel

40/45/50 m lattice

Pawan Shakthi600 kW

RD: 47 m

HH: 50 m

Tower type: Lattice

Vestas V27225 kW

RD: 27 m

HH: 31.5 m

Tower type: Conical tubular

Manufacturer of blades for

wind electric generators

600

1250

600

250

500

600

225

RD: rotor diameter.

HH: hub height.

cumulative capacity of wind power installed in India over time. Recently, Gujarat has shown a

high growth in wind power installed capacity from 675 MW in 20062007 to 1255 in 20072008;

however, the rate of growth of installed capacity of wind energy in Karnataka has decreased

during 20072008 primarily due to noneconomic barriers. Karnataka added 265 MW of wind

power in 20062007, whereas the addition in the capacity came down to 166 MW in 20072008

as against the normal trend of registering a further increase. Karnataka had the potential to tap

more than 11 000 MW of wind energy, but is actually tapping less than 1100 MW, while Tamil

Nadu has the potential to harness only about 5500 MW, but the state has overshot the potential by

042701-9

Wind energy in India

J. Renewable Sustainable Energy 1, 042701 2009

10000

Annual

Capacity (MW)

8000

Cumulative

6000

4000

2000

0

up to 1992- 1993- 1994- 1995- 1996- 1997- 1998- 1999- 2000- 2001- 2002- 2003- 2004- 2005- 2006- 2007- 20081992 93

94

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

Year

FIG. 4. Installed capacity of wind power in India source: MNRE Annual Reports.

putting up windmills with a capacity of nearly 4000 MW. A notable feature of the Indian program

has been the interest among private investors/developers in setting up of commercial wind power

projects.

The objective of MNRE is that 10% of grid-interactive power generation installed capacity by

2012 as well as about 4%5% of the electricity mix and 15% by 2032 should come from

renewables.38 This implies that growth in renewable energy will occur at a much faster pace than

traditional power generation, with renewables making up 20% of the 70 000 MW of the total

additional energy planned from 2008 to 2012.39 The Indian electricity industry was restructured by

the 2003 Electricity Act, which unbundled the vertically integrated electricity supply utilities in the

Indian states and set up State Regulatory Commissions SERCs in charge of setting electricity

tariffs.4042 The act also opened access to the Indian transmission system, allowing consumers to

purchase their electricity from any producer. The Electricity Act also required the SERCs to set

renewable portfolio standards for electricity production in their state, and the MNRE issued

guidelines to all state governments to create an attractive environment for the export, purchase,

wheeling, and banking of electricity generated by wind power projects.9 Ten out of the 29 Indian

states have now implemented quotas for a renewable energy share of up to 10% and have introduced preferential tariffs for electricity produced from renewable sources.5 These states are

Kerala, Rajasthan, Tamil Nadu, Karnataka, Andhra Pradesh, Maharashtra, Madhya Pradesh, West

Bengal, Gujarat, and Haryana. However, the four statesMaharashtra, Gujarat, Tamil Nadu, and

Andhra Pradesh which account for 60% of the total potentialhave 90% of the total installed

wind generation capacity.43 Though there are a set of incentives and guidelines for promotion of

wind power at the federal government level,9 the individual states follow their own policies. In

addition, several states have implemented fiscal and financial incentives for renewable energy

generation, including energy buy-back i.e., a guarantee from an electricity company that they will

buy the renewable power produced preferential grid connection and transportation charges and

electricity tax exemptions. Table III presents the summary of key state government incentives for

wind energy projects in India. At the federal level, although there is no national policy for

renewable energy, there are a number of measures that help drive wind energy development,

including fiscal incentives such as income tax exemption for 10 yr, 80% accelerated depreciation,

sales tax exemption, and excise duty exemption.5,9

Some states with renewable portfolio standards or other policies to promote wind generation

have introduced FITs for wind generation which is higher than that for conventional electricity. In

States/items Captive use Wheeling

At par with conventional

Gujarat

Allowed

Karnataka

Allowed

4% of energy

5% of energy+ Rs 1.15/ kW h

as cross subsidy

for 3dr party sale

Kerala

Allowed

To be decided by SERC

Madhya

Pradesh

Allowed

2% of energy+ transmission

charges as per ERC

Maharashtra

Allowed

2% of energy as

wheeling+ 5% as T&D loss

Allowed

Below 132 kV, 50% of normal

charges applicable to 33 kV

declared by

commission+ surcharge+ losses

Rajasthan

Rs 3.50/ kW h without any

escalation for 20 yr

Rs 3.40/ kW h without any

Allowed at 2% of escalation for 10 yr of commercial

energy input operation

Rs 3.14/ kW h without any

escalation for 20 yr

Year wise rates Rs/ kW h from

1st20th year: 1st year4.03, 2nd

year3.86, 3rd yr3.69, 4th

Not allowed

year3.52, 5th20th year3.36

Rs 3.50/ kW h first year of

commissioning. escalation of 15

12 months

paise per year for 13 yr

For Jaisalmer, Jodhpur, and Barmer

district Rs 3.60 per unit for

injection in 33 or 11 kV system

and Rs 3.71 per unit for injection

in EHV system. For other district

Rs 3.78 per unit for injection on

33 or 11 kV system and Rs 3.89

per unit for injection in EHV

6 months

system.

Not allowed

Rs 3.50/ kW h without any escalation for 10 yr as per A.P. Govt.

Policy amendment date 09.09.2008

subject to approval of APERC

Third party sale Other incentives

Alloweda

Penalty on

kVArh consumption

Rs 0.10/kVArh up to 10%

and Rs 0.25/kVArh above 10%

Alloweda

Industry Status

Electricity duty exempted,

demand cut 30% of wind

farm installed capacity

Alloweda

No electricity duty for 5 yr

Rs. 0.40/kVArh

Alloweda

Alloweda

Alloweda

No electricity duty for 5 yr

Rs 0.27/kVArh

Power evacuation arrangement,

approach road, electricity duty,

loan to cooperative societiesb Rs 0.25/kVArh

Alloweda

Exemption from electricity

duty at 50% for 7 yr

Rs 0.10/kVArh up to 10%

and Rs 0.20/kVArh above 10%

Rs 0.05/yr w.e.f. 01/04/2006

with escalation of 5%/yr

J. Renewable Sustainable Energy 1, 042701 2009

Allowed

Buy-back rate by SEB

I. Purohit and P. Purohit

Andhra

Pradesh

Banking

042701-10

TABLE III. Financial and fiscal incentives introduced/declared by the state governments for private sector wind power projects. See Ref. 44.

States/items Captive use Wheeling

Allowed

Allowed

5% of energy

7% of energy+ open

access charges

Buy-back rate by SEB

Rs 2.90/ kW h Note: TNERC has

5% 12 months proposed, Rs 3.40 in its discussion

financial year paper. However, final order is yet

April to March to be issued.

Rs 4 / kW h

Third party sale Other incentives

Alloweda

Alloweda

Penalty on

kVArh consumption

Rs 0.25/kVArh if the ratio

of kVArh drawn to kWh

exported is up to 10%

and Rs 0.50/kVArh

for more than 10%.

Wind energy in India

Tamil Nadu

West

Bengal

Banking

042701-11

TABLE III. Continued.

Allowed under Electricity Act 2003 subject to regulation framed by respective SERCs.

Other incentives in Maharashtra are a for evacuation arrangement of wind energy project, 50% amount will be given as a subsidy through Greens energy fund and 50% amount will be

given as a loan without interest to private developers. The loan will be repaid by MSEB/transmission licensees after commissioning and transferring the ownership of evacuation arrangement

to MSEB/transmission licensees in 5 equal yearly installments. b 100% expenditure for construction of approach roads will be made through Green energy fund. c No electricity duty for

5 yr for captive use. d 11% share capital will be provided to cooperative sector for setting up of wind power projects as a grant through Green energy fund.

c

4.5% for supply to consumer directly on EHV system and 8.3% for supply using distribution licensee below 132 kV.

b

J. Renewable Sustainable Energy 1, 042701 2009

042701-12

J. Renewable Sustainable Energy 1, 042701 2009

I. Purohit and P. Purohit

TABLE IV. Statewise wind power installed capacity in India. See Ref. 45.

Total capacity

MW

State

Up to

Up to

March 2006 March 2007

Total

Addition during Addition during Addition during

capacity

20062007

20072008

20082009a

MW

MW

MW

MW

Andhra Pradesh

Gujarat

121.0

338.1

121.34

674.36

0.8

328.9

0.0

580.13

0.0

179.80

122.45

1432.71

Karnataka

584.6

845.02

264.7

187.0

173.10

1184.45

2.0

40.3

2.35

56.59

0.0

17.4

8.7

69.25

12.50

0.00

23.00

187.69

1837.85

Kerala

Madhya Pradesh

Maharashtra

Rajasthan

Tamil Nadu

West Bengal

Others

Total All India

1001.3

483.6

276.075

82.00

358.1

1480.3

471.99

111.7

70.45

132.20

670.97

2892.5

1.1

3459.4

1.75

565

0.5

391.90

0.0

250.30

0.00

4132.72

1.10

1.6

1.6

5340.6

7114.6

0.0

1773

0.0

1583.505

0.00

3.20

829.90

9587.14

Until November 30, 2008.

Karnataka, for instance, the tariff for wind generation is about 3.50 Rs/ kW h 5.5 Euro cent

compared to only 1.50 Rs/ kW h 2 Euro cent for coal generated power. In June 2008, the MNRE

announced a national generation based incentive scheme for grid-connected wind power projects

under 49 MW, providing an incentive of 0.5 Rs/ kW h 0.7 Euro cent in addition to the existing

state incentives. Investors, which because of their small size or lack of tax liability cannot draw

any benefit from accelerated depreciation under the Income Tax Act, can opt for this alternative

incentive instead. Table IV presents the statewise wind power installed capacity in India. Tamil

Nadu is at the first place in wind power generation among Indian states, followed by Maharashtra,

Gujarat, Karnataka, Rajasthan, etc. The total installed capacity in India was 9587 MW until

November 2008, of which Tamil Nadu with installed capacity of 4133 MW accounted for more

than 43% of wind power generation in India. In 2008, the National Action Plan on Climate Change

NAPCC released by the Indian government included a proposal for a national renewable energy

trading scheme, which would be based on National Renewable Portfolio Standard.46 In this

scheme, states would be encouraged to promote the production of renewable power to exceed the

national standard. They would then receive certificates for this surplus power, which would be

tradable with other states which fail to meet their renewable standard obligations. Since only

grid-connected electricity would be eligible for this scheme, this old particularly benefit the wind

industry. It is expected that this proposal will come into force in 2009 or 2010.

V. WIND ENERGY POTENTIAL IN INDIA

Wind in India is influenced by the strong southwest summer monsoon, which starts in May

June, when cool, humid air moves toward the land and the weaker northeast winter monsoon,

which starts in October, when cool, dry air moves toward the ocean. During the period from

March to August, the wind is uniformly strong over the whole Indian Peninsula, except the eastern

peninsular coast. Wind speeds during the period from November to March are relatively weak,

though higher winds are available during a part of the period on the Tamil Nadu coastline. In order

to tap the potential of wind energy sources, there is a need to assess the availability of the

resources spatially. A wind resource assessment program was taken up in India in 1985.47 Around

1150 wind monitoring/mapping stations were set up in 25 states and Union Territories UTs for

this purpose. Over 200 stations in 13 states and UTs with annual mean wind power density greater

than 200 W / m2 at a height of 50 m above the ground level show wind speeds suitable for wind

042701-13

Wind energy in India

J. Renewable Sustainable Energy 1, 042701 2009

TABLE V. Statewise distribution of approved wind farmable sites as of January 31, 2009. See Ref. 48.

State/union territory

Andaman and Nicobar

Andhra Pradesh

Gujarat

Karnataka

Kerala

Lakshadweep

Madhya Pradesh

Maharashtra

Orissa

Rajasthan

Tamil Nadu

Uttarakhand

West Bengal

Total

Stations with annual average

WPD 200 W / m2 at 50 m height

1

32

38

26

17

8

7

31

6

7

41

1

1

216

power generation.9 Table V presents the statewise distribution of approved wind farmable sites as

of January 31, 2009. The wind power density at a height of 50 m above the ground level is

depicted in Fig. 5.

On a regional basis, more detailed assessments have been done. Daoo et al.50 presented the

results of the analysis of wind speed data for 1995 at Trombay Hill top station about 300 m above

the mean sea level along with the wind energy potential of the site in which seasonal and diurnal

trends in the monthly averaged hourly totals of wind energy were established. The study reveals

that a low and medium power windmill can be operated at the site with annual availability factors

of about 76% and 57%, respectively. Ramachandra and Shruthi51 employed a geographical information system to map the wind energy resources of Karnataka state and analyzed their variability

considering spatial and seasonal aspects. It is estimated that a penetration supply fraction of wind

power on a large grid can be as much as 15%20% without affecting grid stability due to requirement of reactive power.52 Recently, the potential of wind power generation for grid interaction has

been estimated by the Centre for Wind Energy Technology CWET at about 48 500 MW nearly

five times than the installed capacity taking sites having wind power density greater than

250/ W m2 at 50 m hub height with 3% land availability in potential areas for setting up wind

farms at 12 ha/MW.49 The previous estimates for the wind energy potential as mentioned in

MNRE annual reports was 45 GW assuming 1% of land availability for power generation in the

potential areas.9 Considering a maximum of 20% penetration of existing capacities of the grids

through wind power in the potential states, technical potential for grid-interactive wind power is

presently limited to only 13 GW,9 which is expected to increase with augmentation of grid

capacity in potential states. Table VI presents a statewise breakup of the wind power potential in

Indian states. The Indian Wind Energy Association claims that the potential from wind energy in

India is to be as high as 65 GW; however, given that the average capacity factor realized by Indias

wind farms is only about 17%,10 the total contribution to energy from these plants would be

relatively small.

VI. PROSPECTS OF WIND ENERGY IN INDIA

Diffusion is defined as the process by which an innovation is adopted and gains acceptance by

members of a certain community.54 A number of factors interact to influence the diffusion of an

innovation. The four major factors that influence the diffusion process are the innovation itself,

how information about the innovation is communicated, time, and the nature of the social system

into which the innovation is being introduced.55 The innovation decision process theory states that

diffusion is a process that occurs over time and can be seen as having five distinct stages.55 The

042701-14

I. Purohit and P. Purohit

J. Renewable Sustainable Energy 1, 042701 2009

FIG. 5. Wind power density map of India Ref. 49. Copyright 2005 Centre for Wind Energy Technology C-WET.

Reprinted with the permission of the Centre for Wind Energy Technology C-WET.

stages in the process are knowledge, persuasion, decision, implementation, and confirmation.

According to this theory, potential adopters of an innovation must learn about the innovation, be

persuaded as to the merits of the innovation, decide to adopt, implement the innovation, and

confirm reaffirm or reject the decision to adopt the innovation. It is observed that the diffusion of

a technology measured in terms of the cumulative number of adopters usually conforms to an

exponential curve as long as the new technologies manage to become competitive with incumbent

technologies.56 The exponential growth pattern may be of three typesi simple exponential, ii

modified exponential, and iii S curve. Out of these three growth patterns, the simple exponential

pattern is not applicable for the dissemination of wind power projects, as it would imply infinite

growth.57 The modified exponential pattern with a finite upper limit is more reasonable but such

a curve may not match the growth pattern in the initial stage of diffusion.58 The uptake of

technology in the market is particularly slow during the initial phase and requires the presence of

042701-15

J. Renewable Sustainable Energy 1, 042701 2009

Wind energy in India

TABLE VI. Statewise wind power potential in India. See Ref. 53.

Gross potential

MW

State

Andhra Pradesh

Gujarat

Karnataka

Kerala

Madhya Pradesh

Maharashtra

Orissa

Rajasthan

Tamil Nadu

Total All India

8968

10 645

11 531

1171

1019

4584

255

4858

5530

48 561

marketplace innovators who are willing to experiment with new ideas. As the diffusion proceeds,

the rate of adoption increases, with a transition point corresponding to what is termed as takeoff,

as early adopters start building on the experiences of the innovators.55

Empirical studies have shown that in a variety of situations the growth of a technology over

time may conform to an S-shaped curve, which is a combination of simple and modified exponential curves.27,28 The S-shaped curves are characterized by a slow initial growth, followed by

rapid growth after a certain take-off point, and then again a slow growth toward a finite upper limit

to the dissemination.57,58 Therefore, in this study, a logistic model is used to estimate the theoretical cumulative capacity of wind power projects at different time periods. The logistic model or

logistic growth curve is continuous in time. The growth curve of a technology growing according

to logistic growth is typically characterized by three phases: an initial establishment phase in

which growth is slow, a rapid expansion phase in which the technology grows relatively quickly,

and a long entrenchment stage in which the technology is close to its limiting potential due to

intraspecies competition.

As per the logistic model, the cumulative capacity, Pt, of the wind projects disseminated up

to a particular period tth year can be expressed as57

Pt = Pmax

ea+bt

,

1 + ea+bt

where Pmax represents the estimated maximum utilization potential of the wind projects in the

country/state. The regression coefficients a and b are estimated by a linear regression of the

log-log form of the above equation.

As mentioned above, this study is carried out by using the logistic model to predict the overall

future trends of Indian wind power projects and also in six states, viz., Andhra Pradesh, Gujarat,

Karnataka, Maharastra, Rajasthan, and Tamil Nadu. All these states have high wind energy potential 4000 MW and show a rapid growth in recent years. The installed wind power capacity

data for a period of 18 yr from 19911992 to 20082009 is taken for forecasting the future trends

of wind power in India using the logistic growth model. Table VII presents the values of regression coefficients a and b of the logistic model and R2 values. The values of the regression

coefficients a and b are estimated by using the past data of wind power capacity extracted from the

annual reports of MNRE. The upper limit Pmax is calculated from the gross wind power potential

presented in Table VI. Figure 6 represents the projected time variation in the cumulative capacity

of wind power projects using the logistic model considered in the study. The projected capacity

addition every year is also depicted in the same figure. Our results indicate that in India, the

dissemination of wind power projects is not likely to reach its maximum estimated potential in

another 20 years.

042701-16

J. Renewable Sustainable Energy 1, 042701 2009

I. Purohit and P. Purohit

TABLE VII. Values of regression coefficients for logistic growth model.

Value of coefficients

S. No.

State

R2

1

2

3

4

5

6

Andhra Pradesh

Gujarat

Karnataka

Maharashtra

Rajasthan

Tamil Nadu

All India

8.6557

5.7721

10.9900

9.6073

14.5870

4.8792

6.5165

0.3175

0.2162

0.5364

0.5619

0.7267

0.3282

0.2929

0.6585

0.8386

0.9764

0.9603

0.9179

0.8867

0.9152

Figures 7 and 8 present the projected installation capacity and the capacity addition in MW

per year of the six states considered in this study. It is observed that the states of Karnataka and

Rajasthan have a growth pattern in the same pace and appears to reach the inflection point in 2012.

After this year the growth rate declines and reaches toward the saturation level. The results

indicate that the diffusion of wind energy technology may reach 99% of the maximum utilization

potential of 11 531 and 4858 MW by 2020. Table VIII presents the projected values of the

cumulative capacities of wind power projects over the given time period in high potential states of

India considered in this study. As mentioned in Sec. V, wind energy in Tamil Nadu has already

gained importance showing a good progress in the development. The inflection point for Tamil

Nadu and Maharashtra is observed in 2007 and 2009, respectively, and may reach 99% of their

maximum utilization potential by 2020. It may be noted that the states of Gujarat and Andhra

Pradesh have a growth pattern in the same pace and appears to reach the inflection point in 2018

and 2019, respectively. After 2003, Gujarat is slowly picking up and considerable growth rate has

been observed in the wind sector.59 Gujarat may achieve 94% of its potential only by 2030.

Andhra Pradesh shows a gradual and steady increase in harnessing its technical wind potential and

it can achieve 98% of its potential only by 2030.

4000

50000

45000

3500

Cumulative installed capacity (MW

40000

3000

35000

2500

30000

2000

25000

20000

1500

15000

1000

10000

500

5000

0

2000

2005

2010

2015

2020

2025

2030

2035

Year

Cumulative installations (MW)

Annual installations (MW)

FIG. 6. Time variation in wind energy projects in India using logistic growth model.

0

2040

042701-17

J. Renewable Sustainable Energy 1, 042701 2009

Wind energy in India

12000

Cumulative installed capacity (MW)

10000

8000

6000

4000

2000

0

1990

1995

2000

2005

2010

2015

2020

2025

2030

Year

Andhra Pradesh

Gujarat

Karnataka

Maharashtra

Rajasthan

Tamil Nadu

FIG. 7. Time variation in wind energy projects in six Indian states.

VII. CONCLUSIONS

In India, renewable energy sources are in abundance, which can contribute significantly to its

growing energy demand. In this study, wind energy growth pattern of India is reviewed since its

inception in 1980s. Wind energy technology is currently making a significant contribution to the

electric power generation in India; however, recently China has overtaken India to the fourth

position in the world in terms of installed wind power capacity. Therefore, if India has to match

the growth rate in the global wind energy sector, outstanding regulatory and policy issues need to

be urgently addressed. Wind power penetration is not constrained by technical problems with wind

power technology, but by regulatory, institutional, and market barriers. It is observed that the

presence of such non-economic barriers have a significant negative impact on the effectiveness of

policies to develop wind power, irrespective of the type of incentive scheme. A brief assessment of

1600

1400

Capacity addition (MW)

1200

1000

800

600

400

200

0

1990

1995

2000

2005

2010

2015

2020

2025

Year

Andhra Pradesh

Gujarat

Karnataka

Maharashtra

Rajasthan

Tamil Nadu

FIG. 8. Projected values of capacity addition of wind projects in the six Indian states.

2030

042701-18

J. Renewable Sustainable Energy 1, 042701 2009

I. Purohit and P. Purohit

TABLE VIII. Projected values of the cumulative capacities of wind power projects over the given time period

in high potential states of India.

Projected value of installation capacity

MW

Year

Andhra Pradesh

Gujarat

Karnataka

Maharashtra

Rajasthan

Tamil Nadu

2010

2015

607

2349

1695

3813

3579

10 009

3412

4491

1527

4593

4397

5267

2020

5691

6620

11 412

4578

4851

5477

2025

2030

8023

8757

8825

9949

11 523

11 530

4583

4584

4856

4858

5520

5528

global status of wind energy and support policies presented in this study indicates that a minimum

level of remuneration appears necessary to encourage wind power deployment.

At present, there are several financial and fiscal incentives provided to the wind power producers at the federal and state government level; however, unstable policies of the state governments as observed in the past and poor institutional framework increase the risk associated in the

wind sector. A preliminary assessment of the status of wind power development in potential states

of India indicates that there should be a stable and uniform national policy to make wind power

projects financially attractive across the country. CWET has recently updated its estimates for

wind energy potential in India as 48.5 GW as compared to the 45 GW before; however, the

Indian Wind Turbine Manufacturers Association IWTMA estimates indicate that the potential for

wind energy development in India is around 6570 GW. Therefore, for the large-scale penetration

of wind energy in India it is critically important to assess realistic potential estimates and identify

niche areas to exploit the wind energy resource.

It is observed that in India, even with highly favorable assumptions, the dissemination of wind

energy for power generation is not likely to reach its maximum utilization potential in another 20

years. The growth trends of wind power development in the six Indian states indicate that more

than 90% of wind energy potential in India can be exploited by 2030. Apart from the above,

installation of high-powered wind turbines in the place of old, lower capacity machines, intercropping of small windmills among bigger machines, development of offshore wind farms and development of hybrid turbines are some of the important needs toward the rapid growth of wind

industry in India.

Energy Security and Sustainable Development in Asia and the Pacific, UNESCAP, Bangkok 2008.

I. Dincer, Renewable Sustainable Energy Rev. 4, 157 2000.

N. H. Afgan, D. Al Gobaisi, M. G. Carvalho, and M. Cumo, Renewable Sustainable Energy Rev. 2, 235 1998.

4

REN21, Renewables 2007 Global Status Report, Paris: REN21 Secretariat and Washington, DC, Worldwatch Institute,

2008 see http://www.ren21.net/pdf/RE2007_Global_Status_Report.pdf.

5

GWEC, 2008.

6

M. Yang, Energy Policy 35, 6546 2007.

7

P. Purohit and A. Michaelowa, Carbon Balance Manag. 2, 1 2007.

8

Ministry of Power, Government of India, New Delhi See www.powermin.nic.in accessed on March 15, 2009.

9

MNRE, 2008.

10

GOI, Integrated Energy Policy Report of the Expert Committee, Planning Commission, Government of India GOI, New

Delhi, 2006.

11

Ministry of New and Renewable Energy, Government of India, New Delhi See http://www.mnes.nic.in/ accessed on

March 12, 2009.

12

Ministry of New and Renewable Energy, Government of India, New Delhi See www.mnre.gov.in accessed on March 20,

2009.

13

WWEA, 2009.

14

IEA, Deploying Renewables: Principles for Effective Policies, International Energy Agency IEA, Paris, 2008.

15

World Wind Energy Association, Bonn See www.wwindea.org accessed on April 16, 2009.

16

L. Bird, M. Bolinger, T. Gagliano, R. Wiser, M. Brown, and B. Parsons, Energy Policy 33, 1397 2005.

17

F. C. Menz and S. Vachon, Energy Policy 34, 1786 2006.

18

J. F. Manwell, C. N. Elkinton, A. L. Rogers, and J. G. McGowan, Renewable Sustainable Energy Rev. 11, 210 2007.

19

M. Bolinger and R. Wiser, Energy Policy 37, 1061 2009.

1

2

3

042701-19

Wind energy in India

J. Renewable Sustainable Energy 1, 042701 2009

J. I. Lewis and R. H. Wiser, Energy Policy 35, 1844 2007.

ecoACTION, Government of Canada See http://www.ecoaction.gc.ca accessed on April 17, 2009.

22

M. Ringel, Renewable Energy 31, 1 2006.

23

L. Nielsen and T. Jeppesen, Energy Policy 31, 3 2003.

24

A. Ford, K. Vogstad, and H. Flynn, Energy Policy 35, 91 2007.

25

K. Verhaegen, L. Meeus, and R. Belmans, Renewable Sustainable Energy Rev. 13, 208 2009.

26

X. Changliang and S. Zhanfeng, Wind energy in China: Current scenario and future perspectives, Renewable Sustainable Energy Rev. to be published.

27

P. Purohit and A. Michaelowa, Energy Policy 35, 4779 2007.

28

P. Purohit, J. Cleaner Prod. 17, 181 2009.

29

M. R. Patel, Wind and Solar Power Systems CRC, New York, 1999.

30

T. Burton, D. Sharpe, N. Jenkins, and E. Bossanyi, Wind Energy Handbook Wiley, New York, 2001.

31

P. Purohit and T. C. Kandpal, Int. J. Global Energy Issues 21, 263 2004.

32

Indo Asian News Service IANS, Wind Power Industry Seeks Stable Policy, Better Forecasting, 2008.

33

Indian Wind Turbine Manufacturers Association See http://www.indianwindpower.com/manufac_list.htm accessed on

April 16, 2009.

34

I. Purohit and P. Purohit, International Journal of Energy Sector Management 1, 141 2007.

35

M. R. Nouni, S. C. Mullick, and T. C. Kandpal, Energy Policy 35, 2491 2007.

36

A. L. Amin, Renewable Energy 16, 977 1999.

37

A. Jagadeesh, Refocus 2, 16 2001.

38

Ministry of New and Renewable Energy MNRE, 11th Plan Proposals for New and Renewable Energy, Government of

India, New Delhi, 2006.

39

A. Tyagi, Renewable Energy Holds Promising Future in India, Ghaziabad, India, 18 April 2008 see http://

www.renewableenergyworld.com accessed on April 16, 2009.

40

S. C. Bhattacharyya, Utilities Policy 13, 260 2005.

41

R. G. Yadav, A. Roy, S. A. Khaparde, and P. Pentayya, IEEE Power and Energy Magazine 3, 39 2005.

42

A. Singh, Energy Policy 34, 2480 2006.

43

K. U. Rao and V. V. N. Kishore, Renewable Energy 34, 983 2009.

44

Wind Power Programme in India by Consolidated Energy Consultants Ltd. See http://www.windpowerindia.com/

statstate.html accessed on April 10, 2009.

45

See http://www.windpowerindia.com/statstate.html accessed on April 7, 2009.

46

GOI, National Action Plan on Climate Change, Prime Ministers Council on Climate Change, Government of India

GOI, New Delhi, 2008 see http://www.indiaenvironmentportal.org.in/sites /cse/files/7_11.pdf.

47

A. Jagadeesh, Energy Policy 28, 157 2000.

48

Centre for Wind Energy Technology C-WET, Chennai See http://www.cwet.tn.nic.in/html/departments_211wps.html

accessed on April 4, 2009.

49

Centre for Wind Energy Technology C-WET, Chennai See http://www.cwet.tn.nic.in/ accessed on April 4, 2009.

50

V. J. Daoo, N. S. Panchal, F. Sunny, V. Sitaraman, and T. M. Krishnamoorthy, Energy Convers. Manage. 39, 1351

1998.

51

T. V. Ramachandra and B. V. Shruthi, Energy Convers. Manage. 46, 1561 2005.

52

J. Beurskens and P. H. Jensen, Renewable Energy World 4, 103 2001.

53

Source http://mnes.nic.in/wpp.htm accessed on April 10, 2009.

54

D. W. Surry, Annual Conference of the Association for Educational Communications and Technology AECT, Albuquerque, NM, 1215 February 1997 unpublished.

55

E. M. Rogers, Diffusion of Innovations, 5th ed. Free, New York, 2003.

56

M. N. Islam and M. M. Haque, Technology, Planning and Control World University Service Press, Dhaka, 1994.

57

P. Purohit and T. C. Kandpal, Renewable Sustainable Energy Rev. 9, 592 2005.

58

P. Purohit, Energy Policy 36, 2000 2008.

59

M. C. Mabel and E. Fernandez, Renewable Sustainable Energy Rev. 12, 1745 2008.

20

21

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- AC UPS Sizing and Other Calaculation ProcedureDocument124 pagesAC UPS Sizing and Other Calaculation Procedureamir11601100% (1)

- Market Structures Pricing StrategyDocument73 pagesMarket Structures Pricing StrategyKumar Gaurab JhaNo ratings yet

- Stakeholder EngagementDocument20 pagesStakeholder EngagementKumar Gaurab Jha100% (1)

- Stakeholder EngagementDocument20 pagesStakeholder EngagementKumar Gaurab Jha100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- VCIC PlaybookDocument19 pagesVCIC PlaybookKumar Gaurab JhaNo ratings yet

- CBS Course in HRM OutlineDocument8 pagesCBS Course in HRM OutlineKumar Gaurab Jha100% (1)

- EON Offshore FactbookDocument60 pagesEON Offshore FactbookvijaypshindeNo ratings yet

- TS 41-24 - Final ECG Draft 10 October 2017 2Document110 pagesTS 41-24 - Final ECG Draft 10 October 2017 2Emir KamberovicNo ratings yet

- Perforadora COP 1638Document2 pagesPerforadora COP 1638Andy RiveraNo ratings yet

- Calculating Critical Path & Float For A Network Diagram: Task Name, Duration (D)Document6 pagesCalculating Critical Path & Float For A Network Diagram: Task Name, Duration (D)Kim LongNo ratings yet

- Project Planner Interview Questions: Topinterviewquestions - InfoDocument11 pagesProject Planner Interview Questions: Topinterviewquestions - InfoKumar Gaurab JhaNo ratings yet

- Answer To Chapter 11 P and A MicroeconomicsDocument14 pagesAnswer To Chapter 11 P and A MicroeconomicsVito AndoliniNo ratings yet

- Diaper Market in IndiaDocument28 pagesDiaper Market in IndiaAbhay PoddarNo ratings yet

- Observations Vs InferencesDocument10 pagesObservations Vs InferencesKumar Gaurab JhaNo ratings yet

- Expanding Your Business Relationships: MBA 2015 Claire HewitsonDocument25 pagesExpanding Your Business Relationships: MBA 2015 Claire HewitsonKumar Gaurab JhaNo ratings yet

- How To Give Feedback - KumarDocument2 pagesHow To Give Feedback - KumarKumar Gaurab JhaNo ratings yet

- Lean Planning and SchedulingDocument0 pagesLean Planning and SchedulingSukendi TanNo ratings yet

- Creating A Lean Business SystemDocument0 pagesCreating A Lean Business SystemdrustagiNo ratings yet

- 2.3 Conditional ProbabilityDocument3 pages2.3 Conditional ProbabilityKumar Gaurab JhaNo ratings yet

- 2.3 Conditional ProbabilityDocument3 pages2.3 Conditional ProbabilityKumar Gaurab JhaNo ratings yet

- 2.3 Conditional ProbabilityDocument3 pages2.3 Conditional ProbabilityKumar Gaurab JhaNo ratings yet

- Chap 001Document38 pagesChap 001Kumar Gaurab JhaNo ratings yet

- Lean Planning and SchedulingDocument0 pagesLean Planning and SchedulingSukendi TanNo ratings yet

- 3 - Supply Chain Integration CollaborationDocument42 pages3 - Supply Chain Integration CollaborationKumar Gaurab Jha0% (2)

- 22.management Constrol Systems, Transfer Pricing, and Multinational ConsiderationsDocument60 pages22.management Constrol Systems, Transfer Pricing, and Multinational ConsiderationsAstha SuriNo ratings yet

- Transfer PricingDocument25 pagesTransfer PricingKumar Gaurab JhaNo ratings yet

- Powerful and Persuasive Communication 2014 11-21-16 42Document7 pagesPowerful and Persuasive Communication 2014 11-21-16 42Kumar Gaurab JhaNo ratings yet

- NITD BTech RegulationsDocument21 pagesNITD BTech Regulationsakbisoi1No ratings yet

- (WWW - Entrance-Exam - Net) - PTU MBA Organisational Behaviour Sample Paper 1Document2 pages(WWW - Entrance-Exam - Net) - PTU MBA Organisational Behaviour Sample Paper 1Kumar Gaurab JhaNo ratings yet

- Business Benefits For CSRDocument1 pageBusiness Benefits For CSRKumar Gaurab JhaNo ratings yet

- Cbs Career Fair 2015sDocument1 pageCbs Career Fair 2015sKumar Gaurab JhaNo ratings yet

- A Primer at The PumpDocument8 pagesA Primer at The PumpKumar Gaurab JhaNo ratings yet

- MacroDocument70 pagesMacroSowmiya SanthanamNo ratings yet

- Reinjection Into Liquid-Dominated Two-Phase Geothermal SystemsDocument8 pagesReinjection Into Liquid-Dominated Two-Phase Geothermal SystemsindradepokNo ratings yet

- Press Release Solar PanamaDocument2 pagesPress Release Solar PanamaScott A. MullerNo ratings yet

- Tellerette InformationDocument1 pageTellerette InformationAdriana HernandezNo ratings yet

- Eng-An Implementation of Advanced Hybrid Technology-Arjun Vimal Raj RDocument8 pagesEng-An Implementation of Advanced Hybrid Technology-Arjun Vimal Raj RImpact JournalsNo ratings yet

- R 250 A.V.R. Regulates Voltage For Shunt AlternatorsDocument2 pagesR 250 A.V.R. Regulates Voltage For Shunt AlternatorsHoang Minh HungNo ratings yet

- V8 Gas Engine Powers Cogeneration PlantsDocument4 pagesV8 Gas Engine Powers Cogeneration PlantsKaiser IqbalNo ratings yet

- Scooter VaneDocument32 pagesScooter VaneFre Man LeOrNo ratings yet

- Digital Lab OvenDocument3 pagesDigital Lab Ovenananda_beloshe75No ratings yet

- SBI Offshore's Graess Energy Secures First Solar Power Contract in The MaldivesDocument2 pagesSBI Offshore's Graess Energy Secures First Solar Power Contract in The MaldivesWeR1 Consultants Pte LtdNo ratings yet

- UGVCL consumer bill detailsDocument1 pageUGVCL consumer bill detailsSunilNo ratings yet

- WBJEE Sample Paper-7 (WBJEE 2014 Physics Chemistry Keys Solution)Document30 pagesWBJEE Sample Paper-7 (WBJEE 2014 Physics Chemistry Keys Solution)Firdosh KhanNo ratings yet

- Pyrolysis: Mete 159: Pyrometallurgical LaboratoryDocument3 pagesPyrolysis: Mete 159: Pyrometallurgical LaboratorybartNo ratings yet

- HotspotDocument4 pagesHotspotsai kumarNo ratings yet

- 1 Site ViewDocument1 page1 Site Viewapi-302117883No ratings yet

- Gunung Megang - Final PDDDocument56 pagesGunung Megang - Final PDDbapaobaoNo ratings yet

- Leroy Somer 3434c - GB-NyDocument28 pagesLeroy Somer 3434c - GB-NyCris_eu09100% (1)

- Script in Science GROUP 3 ExhibitDocument3 pagesScript in Science GROUP 3 ExhibitLawrence ConananNo ratings yet

- 2010 Renewable Energy and Design GuideDocument211 pages2010 Renewable Energy and Design Guideapolinario mabiniNo ratings yet

- Wind Energy 6Document12 pagesWind Energy 6Shanthi RameshNo ratings yet

- Class4 Q A PDFDocument1,679 pagesClass4 Q A PDFVinaik Krishnamurthy100% (3)

- Coal Combustion Theory - Electrical4uDocument11 pagesCoal Combustion Theory - Electrical4uAarthi JayakumarNo ratings yet

- WPSAmerica Shielding Gases and Mechanical PropertiesDocument44 pagesWPSAmerica Shielding Gases and Mechanical PropertiesRameshBaskaranNo ratings yet

- Power Network Analysis Using ERACSDocument41 pagesPower Network Analysis Using ERACSAli Kaiser100% (1)

- List of Tables: Acme Thread Parameters and Symbols 21Document3 pagesList of Tables: Acme Thread Parameters and Symbols 21Inriko Rico CastilloNo ratings yet

- Irrigation Pumping Plant GuideDocument58 pagesIrrigation Pumping Plant GuideEddiemtongaNo ratings yet

- Nutraceuticals From Algae and Their Market TrendsDocument15 pagesNutraceuticals From Algae and Their Market Trendssri1311_gNo ratings yet