Professional Documents

Culture Documents

Dissolution of Comp. Docs - Requirements.sss .Bir .Pagibig - Lgu

Uploaded by

jaciemOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dissolution of Comp. Docs - Requirements.sss .Bir .Pagibig - Lgu

Uploaded by

jaciemCopyright:

Available Formats

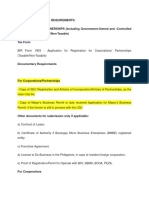

IAC/BOI Assistance to BOI Registered Enterprises in Case of Termination of Sole Proprietorship

BOI

Registered

Enterprises

Sole

Proprietorship

DTI

1. Affidavit of

Cancellation of BN

Registration with

No Financial

Obligation.

2. Surrender

Original BN

Certificate together

with the approved

Application.

3. Original

government issued

I.D. of owner (as

proof of identity).

4. Php15.00 for

Documentary

Stamp Tax for the

Certificate of

Cancellation.

SSS

DOCUMENTS REQUIRED BY THE FOLLOWING GOVERNMENT AGENCIES:

BIR

PAG-IBIG/ HDMF

PhilHealth

Approved Application for

Business Retirement from

the Municipal Treasurers

Office of the LGU.

In the absence of the

above requirement:

1. Certificate of Nonoperation of business from

the Municipality/City

Treasurers Office or BIR.

2. Lease Contract/ Joint

Affidavit of Termination of

Lease Contract.

3. Contribution Collection

List (SS Form R3) showing

the separation of its

employee/s, duly received

by the SSS within the first

ten (10) days of the month

after the applicable quarter.

4. Certificate of Cancellation

of Registration from DTI.

5. Certificate of Cancellation

of Franchise from LTFRB.

6. Certification from PCAB.

7. Death Certificate

registered with the Local

Civil Registrar or issued by

the Philippine Consul in

case of death of the owner.

1. Letter of Request for

cessation of

registration.

2. Form 1905.

3. Original certificate of

Registration with BIR.

4. Latest Mayors

Permit.

5. Latest Income Tax

Return with Financial

Statement and Auditors

Report up to time of

application for closure.

6. 3 years all Internal

Revenue Tax Payments

and tax Returns:

Registration Fee

Form 1601C

Form 1601E

Form 1604CF

Form 1604E

DST

7. Books of Accounts.

8. Supporting papers for

all deductions claimed.

9. List of inventories as

of closure date.

10. Inventory list of

unused RECEIPTS/

INVOICES.

11. Used RECEIPTS/

INVOICES.

12. RCS Cases.

1.Letter by the Owner

informing The

Membership

Department,

addressed to the

Office Manager

where the Pag-Ibig

Branch is located,

that the business has

been terminated.

2. Latest ITR.

3. Audited Financial

Statement.

4. Approved

Application for

Business Retirement

from the Municipal/

Treasurers Office

concerned.

1. Approved

Application of

Business

Retirement from

the Municipal

Treasurers

Office of the

LGU.

2. Certification of

Non-operation of

business from

the Municipal

Treasurers

Office/BIR

LGU

1. Letter request for

retirement stating

reasons.

2. Financial

Statements & ITRs

for the three (3)

preceding years of

retirement date.

3. Original Mayors

Permit and Official

Receipt of the current

calendar year.

4. Gross Income for

the current year-If

none, Affidavit of NonOperation.

5. In case there are

branches: Breakdown

of Gross

Sales/Receipts &

submit all proofs of

payments from other

branches.

6. If method of

accounting is by

Fiscal Year, convert to

Calendar Year.

7. Submit authorization letter of person

who will process the

retirement of the

business complete

with identification.

apm/Docs.requirements.SSS.PAGIBIG.LGU

You might also like

- Application For Taxpayer Identification Number (TIN)Document5 pagesApplication For Taxpayer Identification Number (TIN)iamjan_101No ratings yet

- Closure of BusinessDocument9 pagesClosure of BusinessAnonymous uMI5BmNo ratings yet

- Application For Closure of Business/Cancellation of Tin A. VenueDocument9 pagesApplication For Closure of Business/Cancellation of Tin A. VenueMa. Roa DellomasNo ratings yet

- Closing A Business-DtiDocument4 pagesClosing A Business-DtiSimon WolfNo ratings yet

- Basic Requirements For New Applicants and For Bmbes Applying For Renewal of RegistrationDocument1 pageBasic Requirements For New Applicants and For Bmbes Applying For Renewal of RegistrationReyLouiseNo ratings yet

- Close Business in The PhilippinesDocument4 pagesClose Business in The PhilippinesSimpson BueguyNo ratings yet

- Closure of Business With BirDocument2 pagesClosure of Business With Birjohn allen MarillaNo ratings yet

- Application For Registration UpdateDocument15 pagesApplication For Registration UpdateMcrislbNo ratings yet

- Application For Closure of BusinessDocument3 pagesApplication For Closure of BusinessmkabNo ratings yet

- Bir COR Application RequirementsDocument3 pagesBir COR Application RequirementsJaemar FajardoNo ratings yet

- Business ClosureDocument3 pagesBusiness ClosureCrisNo ratings yet

- Index For Application For Registration UpdateDocument14 pagesIndex For Application For Registration UpdateMelvin AndresNo ratings yet

- Requirements and Procedure For BIR RegDocument3 pagesRequirements and Procedure For BIR ReglifemandrinkNo ratings yet

- DISSOLUTION-OF-COMP.-Docs - Requirements.SSS .BIR .PAGIBIG - LGUDocument2 pagesDISSOLUTION-OF-COMP.-Docs - Requirements.SSS .BIR .PAGIBIG - LGUArthurNo ratings yet

- BIR Webinar on Primary Registration and Bookkeeping for New Business RegistrantsDocument107 pagesBIR Webinar on Primary Registration and Bookkeeping for New Business RegistrantsEdward Gan100% (1)

- The SolopreneurDocument6 pagesThe Solopreneurjun junNo ratings yet

- Barangay: RequirementsDocument4 pagesBarangay: RequirementsAlmer TanudraNo ratings yet

- Application For Registration Update - Bureau of Internal RevenueDocument14 pagesApplication For Registration Update - Bureau of Internal RevenueKristarah HernandezNo ratings yet

- Dissolution of A CorporationDocument8 pagesDissolution of A Corporationggsteph100% (1)

- Taxpayer InformationDocument2 pagesTaxpayer InformationLecel LlamedoNo ratings yet

- Closure and RegistrationDocument3 pagesClosure and RegistrationMa. Roa DellomasNo ratings yet

- BIR RegistrationDocument3 pagesBIR Registrationcara sophiaNo ratings yet

- Basic Requirements and Procedure in Registering A Sole Proprietor BusinessDocument4 pagesBasic Requirements and Procedure in Registering A Sole Proprietor BusinessAyumi Xuie MontefalcoNo ratings yet

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- STEP 1: Determine Which Classification You Belong: B. Corporati Ons and PartnershipsDocument4 pagesSTEP 1: Determine Which Classification You Belong: B. Corporati Ons and PartnershipsMaridel Mugot-DuranNo ratings yet

- Registration Process: For Registration of An Individual, The Individual MustDocument7 pagesRegistration Process: For Registration of An Individual, The Individual MustIkra MalikNo ratings yet

- BirDocument6 pagesBirbge5No ratings yet

- Bir Atp MemoDocument10 pagesBir Atp Memobge5No ratings yet

- Taxes governments use to fund expendituresDocument10 pagesTaxes governments use to fund expendituresAdriana CarinanNo ratings yet

- 1902 For Employee'sDocument8 pages1902 For Employee'sbirtaxinfoNo ratings yet

- 1901 For Self-Employed, Professional, & Single ProprietorshipDocument11 pages1901 For Self-Employed, Professional, & Single ProprietorshipbirtaxinfoNo ratings yet

- Revenue Memorandum 23-2012Document2 pagesRevenue Memorandum 23-2012Ruth CepeNo ratings yet

- Application For Closure of BusinessDocument2 pagesApplication For Closure of BusinessallanNo ratings yet

- TAX BRIEFING-NEW RegistrantsDocument57 pagesTAX BRIEFING-NEW RegistrantsPcl Nueva Vizcaya100% (3)

- Application For Closure of BusinessDocument3 pagesApplication For Closure of BusinessNorberto Cercado50% (2)

- How To Register BMBEDocument2 pagesHow To Register BMBECarlos O. TulaliNo ratings yet

- Retirement of BusinessDocument3 pagesRetirement of BusinessramiilaquintoNo ratings yet

- Primary Registration Index For Application For Taxpayer Identification Number (TIN)Document43 pagesPrimary Registration Index For Application For Taxpayer Identification Number (TIN)Chit ComisoNo ratings yet

- EO 98 - How To Apply TINDocument7 pagesEO 98 - How To Apply TINPeterSalas100% (1)

- Registration, Taxation & Accounting Compliance of Construction IndustryDocument52 pagesRegistration, Taxation & Accounting Compliance of Construction IndustryJohn Erick FernandezNo ratings yet

- Legal AspectsDocument11 pagesLegal AspectsIsaiah CruzNo ratings yet

- Corporation - BIR Registration Process in The PhilippinesDocument4 pagesCorporation - BIR Registration Process in The PhilippinesPineNo ratings yet

- TAX 103-Topic 1 - Registration & EBIR FormsDocument11 pagesTAX 103-Topic 1 - Registration & EBIR Formsmarialynnette lusterioNo ratings yet

- RMC No 37-2016Document6 pagesRMC No 37-2016sandra100% (1)

- How To Close A Business in The PhilippinesDocument2 pagesHow To Close A Business in The PhilippinesMary Rose Ann CalambasNo ratings yet

- An Easy Guide To Taxation For Startup EntrepreneursDocument16 pagesAn Easy Guide To Taxation For Startup EntrepreneursChristine P. ToledoNo ratings yet

- Tax LawDocument58 pagesTax LawChit ComisoNo ratings yet

- Affidavit Cancellation 2v2018Document7 pagesAffidavit Cancellation 2v2018Francis A SalvadorNo ratings yet

- 31.it Ain't Over Till They Say So - cpc.03!27!08Document3 pages31.it Ain't Over Till They Say So - cpc.03!27!08yemaymaNo ratings yet

- Various Initial Registrations and LicensesDocument34 pagesVarious Initial Registrations and LicensesshrividhulaaNo ratings yet

- I. Documentary Requirements A. DTI Business Name Registration System - SOLE Proprietorship RegistrationDocument4 pagesI. Documentary Requirements A. DTI Business Name Registration System - SOLE Proprietorship RegistrationAdi CruzNo ratings yet

- txtn502 Part2Document21 pagestxtn502 Part2Sandra Mae Cabuenas100% (1)

- SSS Employer Data Change Request Form R-8Document2 pagesSSS Employer Data Change Request Form R-8Jolas E. Brutas50% (2)

- Awareness On Business Registration, Invoicing and BookkeepingDocument70 pagesAwareness On Business Registration, Invoicing and BookkeepingRonald Allan Valdez Miranda Jr.No ratings yet

- PCNC List of Requirements For AccreditationDocument4 pagesPCNC List of Requirements For AccreditationNCRENo ratings yet

- Barangay Micro Business Enterprise (Bmbe) Act: 13284-TOPIC 3Document16 pagesBarangay Micro Business Enterprise (Bmbe) Act: 13284-TOPIC 3kim cheNo ratings yet

- Part I: Concept of Tax AdministrationDocument22 pagesPart I: Concept of Tax AdministrationShiela Marie Sta AnaNo ratings yet

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasNo ratings yet

- LOAN PRE-REQUISITESDocument1 pageLOAN PRE-REQUISITESdavid durianNo ratings yet

- Alphabet Vocabulary Mini Cards Set 1 Lowercase PDFDocument5 pagesAlphabet Vocabulary Mini Cards Set 1 Lowercase PDFjaciemNo ratings yet

- Affidavit of Loss: Republic of The Philippines) - , - ) S.SDocument1 pageAffidavit of Loss: Republic of The Philippines) - , - ) S.SDeiz PilaNo ratings yet

- Renewal Application Adult01Document2 pagesRenewal Application Adult01scribideeNo ratings yet

- 2017 Pds GuidelinesDocument4 pages2017 Pds GuidelinesManuel J. Degyan75% (4)

- PFF108 LoyaltyCardApplicationForm V04 PDFDocument2 pagesPFF108 LoyaltyCardApplicationForm V04 PDFCircuit CulzNo ratings yet

- Perfect Mind PDFDocument67 pagesPerfect Mind PDFjaciemNo ratings yet

- Work Experience Sheet for Supervising PositionsDocument2 pagesWork Experience Sheet for Supervising PositionsCes Camello100% (1)

- After 2017Document2 pagesAfter 2017NonoyTaclino100% (1)

- Certificate of Employment - Graphic ArtistDocument2 pagesCertificate of Employment - Graphic ArtistjaciemNo ratings yet

- After 2017Document2 pagesAfter 2017NonoyTaclino100% (1)

- Step Applicant/Client Service Provider Person in Charge Fees Form Duration of Activity (Under Normal Circumstances)Document1 pageStep Applicant/Client Service Provider Person in Charge Fees Form Duration of Activity (Under Normal Circumstances)jaciemNo ratings yet

- Suspension Letter SampleDocument1 pageSuspension Letter Samplechikkieting50% (2)

- After 2017Document2 pagesAfter 2017NonoyTaclino100% (1)

- Apply for Professional ID CardDocument1 pageApply for Professional ID CardVeraNataaNo ratings yet

- Sample of Employment Contact PT EngDocument3 pagesSample of Employment Contact PT EngjaciemNo ratings yet

- Bir Form 1901Document2 pagesBir Form 1901jaciemNo ratings yet

- PROPOSED AMENDMENTS TO PHILIPPINE CORPORATION CODEDocument95 pagesPROPOSED AMENDMENTS TO PHILIPPINE CORPORATION CODEjaciemNo ratings yet

- Business Law and Taxation ReviewerDocument5 pagesBusiness Law and Taxation ReviewerJeLo ReaNdelar100% (2)

- Early Childhoon in Calamba and BiñanDocument2 pagesEarly Childhoon in Calamba and BiñanjaciemNo ratings yet

- Business Organization ReviewerDocument7 pagesBusiness Organization ReviewerRozel L Reyes100% (2)

- Midwifery ExamDocument1 pageMidwifery ExamjaciemNo ratings yet

- 28 Nakshatras - The Real Secrets of Vedic Astrology (An E-Book)Document44 pages28 Nakshatras - The Real Secrets of Vedic Astrology (An E-Book)Karthik Balasundaram88% (8)

- Year 7 Depth Study 2a 2020 5Document6 pagesYear 7 Depth Study 2a 2020 5api-508928238No ratings yet

- Labor DoctrinesDocument22 pagesLabor DoctrinesAngemeir Chloe FranciscoNo ratings yet

- Shah Wali Ullah Syed Haji Shariat Ullah Ahmad Barelvi (Notes)Document2 pagesShah Wali Ullah Syed Haji Shariat Ullah Ahmad Barelvi (Notes)Samreen KapasiNo ratings yet

- Inmarsat M2M Terminal ComparisonDocument2 pagesInmarsat M2M Terminal Comparisonmaruka33No ratings yet

- FCC TechDocument13 pagesFCC TechNguyen Thanh XuanNo ratings yet

- Slope StabilityDocument11 pagesSlope StabilityAhmed MohebNo ratings yet

- Additional Practice Questions on Bonding and Mechanical Properties of MaterialsDocument26 pagesAdditional Practice Questions on Bonding and Mechanical Properties of MaterialsYeo JosephNo ratings yet

- Giai Thich Ngu Phap Tieng Anh - Mai Lan Huong (Ban Dep)Document9 pagesGiai Thich Ngu Phap Tieng Anh - Mai Lan Huong (Ban Dep)Teddylove11No ratings yet

- Income Tax BotswanaDocument15 pagesIncome Tax BotswanaFrancisNo ratings yet

- Conduct effective meetings with the right typeDocument5 pagesConduct effective meetings with the right typeRio AlbaricoNo ratings yet

- Groundwater Control For Cross PassagesDocument6 pagesGroundwater Control For Cross PassageskrainajackaNo ratings yet

- Geometry First 9 Weeks Test Review 1 2011Document6 pagesGeometry First 9 Weeks Test Review 1 2011esvraka1No ratings yet

- Ict Lesson 2 Lesson PlanDocument3 pagesIct Lesson 2 Lesson Planapi-279616721No ratings yet

- Ar 318Document88 pagesAr 318Jerime vidadNo ratings yet

- HIstory of PerfumeDocument3 pagesHIstory of PerfumebetselevenNo ratings yet

- Samonte Vs CADocument7 pagesSamonte Vs CAMaricel Caranto FriasNo ratings yet

- Shell Rimula R7 AD 5W-30: Performance, Features & Benefits Main ApplicationsDocument2 pagesShell Rimula R7 AD 5W-30: Performance, Features & Benefits Main ApplicationsAji WibowoNo ratings yet

- Pinto Pm2 Ch01Document21 pagesPinto Pm2 Ch01Mia KulalNo ratings yet

- Manoj KR - KakatiDocument5 pagesManoj KR - Kakatimanoj kakatiNo ratings yet

- Volleyball ReflectionDocument1 pageVolleyball ReflectionJake Santos100% (1)

- The Names & Atributes of Allah - Abdulillah LahmamiDocument65 pagesThe Names & Atributes of Allah - Abdulillah LahmamiPanthera_No ratings yet

- CAE-NUST College Aeronautical Engineering AssignmentDocument3 pagesCAE-NUST College Aeronautical Engineering AssignmentBahram TahirNo ratings yet

- Solving Problems Involving Simple Interest: Lesson 2Document27 pagesSolving Problems Involving Simple Interest: Lesson 2Paolo MaquidatoNo ratings yet

- Chemical Reaction Engineering: Cap Iii: Rate Laws and StoichiometryDocument53 pagesChemical Reaction Engineering: Cap Iii: Rate Laws and StoichiometryMarthaAlbaGuevaraNo ratings yet

- History I.M.PeiDocument26 pagesHistory I.M.PeiVedasri RachaNo ratings yet

- Summer 2019 English Reinforcement LessonsDocument31 pagesSummer 2019 English Reinforcement LessonsAizalonica GalangNo ratings yet

- Organizational Transformations: Population Ecology TheoryDocument25 pagesOrganizational Transformations: Population Ecology TheoryTurki Jarallah100% (2)

- Isavasya UpanishadDocument5 pagesIsavasya UpanishadskmrrlNo ratings yet

- Laporan Keuangan Tahun 2018Document264 pagesLaporan Keuangan Tahun 2018Weni PatandukNo ratings yet