Professional Documents

Culture Documents

Chap 013

Uploaded by

minibodCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 013

Uploaded by

minibodCopyright:

Available Formats

Chapter 13 - Empirical Evidence on Security Returns

CHAPTER13:EMPIRICALEVIDENCEONSECURITYRETURNS

PROBLEMSETS

1.

Even if the single-factor CCAPM (with a consumption-tracking portfolio used as the

index) performs better than the CAPM, it is still quite possible that the consumption

portfolio does not capture the size and growth characteristics captured by the SMB (i.e.,

small minus big capitalization) and HML (i.e., high minus low book-to-market ratio)

factors of the Fama-French three-factor model. Therefore, it is expected that the FamaFrench model with consumption provides a better explanation of returns than does the

model with consumption alone.

2.

Wealth and consumption should be positively correlated and, therefore,

market volatility and consumption volatility should also be positively

correlated. Periods of high market volatility might coincide with

periods of high consumption volatility. The conventional CAPM

focuses on the covariance of security returns with returns for the

market portfolio (which in turn tracks aggregate wealth) while the

consumption-based CAPM focuses on the covariance of security

returns with returns for a portfolio that tracks consumption growth.

However, to the extent that wealth and consumption are correlated,

both versions of the CAPM might represent patterns in actual returns

reasonably well.

To see this formally, suppose that the CAPM and the consumptionbased model are approximately true. According to the conventional

CAPM, the market price of risk equals expected excess market return

divided by the variance of that excess return. According to the

consumption-beta model, the price of risk equals expected excess

market return divided by the covariance of R M with g, where g is the

rate of consumption growth. This covariance equals the correlation of

RM with g times the product of the standard deviations of the

variables. Combining the two models, the correlation between R M and

g equals the standard deviation of RM divided by the standard

deviation of g. Accordingly, if the correlation between R M and g is

relatively stable, then an increase in market volatility will be

accompanied by an increase in the volatility of consumption growth.

13-1

Chapter 13 - Empirical Evidence on Security Returns

Note:

For the followingproblems,thefocusisontheestimationprocedure.Tokeep

theexercisefeasible,thesamplewaslimitedtoreturnsonninestocksplusamarket

indexandasecondfactoroveraperiodof12years.Thedataweregeneratedtoconform

toatwofactorCAPMsothatactualratesofreturnequalCAPMexpectationsplus

randomnoise,andthetrueinterceptoftheSCLiszeroforallstocks.Theexercisewill

provideafeelforthepitfallsofverifyingsocialsciencemodels.However,duetothe

smallsizeofthesample,resultsarenotalwaysconsistentwiththefindingsofother

studiesasreportedinthechapter.

3.

UsingtheregressionfeatureofExcelwiththedatapresentedinthetext,thefirstpass

(SCL)estimationresultsare:

Stock:

RSquare

Observations

Alpha

Beta

tAlpha

tBeta

A

B

C

D

0.06 0.06 0.06 0.37

12

12

12

12

9.00 0.63 0.64 5.05

0.47 0.59 0.42 1.38

0.73 0.04 0.06 0.41

0.81 0.78 0.78 2.42

E

F

0.17 0.59

12

12

0.73 4.53

0.90 1.78

0.05 0.45

1.42 3.83

G

H

0.06 0.67

12

12

5.94 2.41

0.66 1.91

0.33 0.27

0.78 4.51

4.

ThehypothesesforthesecondpassregressionfortheSMLare:

Theinterceptiszero;and,

Theslopeisequaltotheaveragereturnontheindexportfolio.

5.

Thesecondpassdatafromfirstpass(SCL)estimatesare:

Average

E

x

c

e

s

s

Beta

R

e

t

u

r

n

A

5.18

0.47

B

4.19

0.59

C

2.75

0.42

D

6.15

1.38

E

8.05

0.90

13-2

I

0.70

12

5.92

2.08

0.64

4.81

Chapter 13 - Empirical Evidence on Security Returns

F

G

H

I

M

9.90

11.32

13.11

22.83

8.12

1.78

0.66

1.91

2.08

13-3

Chapter 13 - Empirical Evidence on Security Returns

Thesecondpassregressionyields:

RegressionStatistics

MultipleR

0.7074

RSquare

0.5004

AdjustedRSquare 0.4291

StandardError

4.6234

Observations

9

Intercept

Slope

Coefficients

Standard

Error

tStatistic

for=0

tStatistic

for=8.12

3.92

5.21

2.54

1.97

1.54

2.65

1.48

6.

Aswesawinthechapter,theinterceptistoohigh(3.92%peryearinsteadof0)andthe

slopeistooflat(5.21%insteadofapredictedvalueequaltothesampleaveragerisk

premium:rMrf=8.12%).Theinterceptisnotsignificantlygreaterthanzero(thet

statisticislessthan2)andtheslopeisnotsignificantlydifferentfromitstheoretical

value(thetstatisticforthishypothesisis1.48).Thislackofstatisticalsignificanceis

probablyduetothesmallsizeofthesample.

7.

ArrangingthesecuritiesinthreeportfoliosbasedonbetasfromtheSCLestimates,the

firstpassinputdataare:

Year

ABC

1

15.05

2

16.76

3

19.67

4

15.83

5

47.18

6

2.26

7

18.67

8

6.35

9

7.85

10

21.41

11

2.53

12

0.30

Average

4.04

Std.Dev. 19.30

DEG

25.86

29.74

5.68

2.58

37.70

53.86

15.32

36.33

14.08

12.66

50.71

4.99

8.51

29.47

FHI

56.69

50.85

8.98

35.41

3.25

75.44

12.50

32.12

50.42

52.14

66.12

20.10

15.28

43.96

13-4

Chapter 13 - Empirical Evidence on Security Returns

Thefirstpass(SCL)estimatesare:

ABC

0.04

12

2.58

0.18

0.42

0.62

RSquare

Observations

Alpha

Beta

tAlpha

tBeta

DEG

0.48

12

0.54

0.98

0.08

3.02

FHI

0.82

12

0.34

1.92

0.06

6.83

GroupingintoportfolioshasimprovedtheSCLestimatesasisevidentfromthehigher

RsquareforPortfolioDEGandPortfolioFHI.Thismeansthatthebeta(slope)is

measuredwithgreaterprecision,reducingtheerrorinmeasurementproblematthe

expenseofleavingfewerobservationsforthesecondpass.

Theinputsforthesecondpassregressionare:

ABC

DEH

FGI

M

Average

Excess

Return

4.04

8.51

15.28

8.12

Beta

0.18

0.98

1.92

Thesecondpassestimatesare:

Regression

Statistics

MultipleR

RSquare

AdjustedR

Square

StandardError

Observations

0.9975

0.9949

0.9899

0.5693

3

Coefficients

Intercept

Slope

2.62

6.47

Standard

Error

0.58

0.46

tStatistic

for=0

4.55

14.03

tStatistic

for=8.12

3.58

Despitethedeceaseintheinterceptandtheincreaseinslope,theinterceptisnow

significantlypositive,andtheslopeissignificantlylessthanthehypothesizedvalueby

morethanthreetimesthestandarderror.

13-5

Chapter 13 - Empirical Evidence on Security Returns

8.

Rollscritiquesuggeststhattheproblembeginswiththemarketindex,whichisnotthe

theoreticalportfolioagainstwhichthesecondpassregressionshouldhold.Hence,even

iftherelationshipisvalidwithrespecttothetrue(unknown)index,wemaynotfindit.

Asaresult,thesecondpassrelationshipmaybemeaningless.

9.

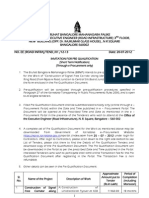

CAPITAL MARKET LINE FROM SAMPLE DATA

25

I

CML

Average Return

20

FHI

15

H

G

10

F

Market

DEG

E

A

D

B

ABC

C

0

0

10

20

30

40

50

60

70

Standard Deviation

ExceptforStockI,whichrealizedanextremelypositivesurprise,theCMLshowsthat

theindexdominatesallothersecurities,andthethreeportfoliosdominateallindividual

stocks.Thepowerofdiversificationisevidentdespitetheverysmallsamplesize.

10.

Thefirstpass(SCL)regressionresultsaresummarizedbelow:

A

B

C

D

E

F

G

H

RSquare

0.07 0.36 0.11 0.44 0.24 0.84 0.12 0.68

Observations 12

12

12

12

12

12

12

12

Intercept

9.19 1.89 1.00 4.48 0.17 3.47 5.32 2.64

BetaM

0.47 0.58 0.41 1.39 0.89 1.79 0.65 1.91

BetaF

0.35 2.33 0.67 1.05 1.03 1.95 1.15 0.43

tIntercept

0.71 0.13 0.08 0.37 0.01 0.52 0.29 0.28

tBetaM

0.77 0.87 0.75 2.46 1.40 5.80 0.75 4.35

tBetaF

0.34 2.06 0.71 1.08 0.94 3.69 0.77 0.57

13-6

I

0.71

12

5.66

2.08

0.48

0.59

4.65

0.63

Chapter 13 - Empirical Evidence on Security Returns

11. The hypotheses for the second-pass regression for the two-factor SML

are:

Theinterceptiszero;

Themarketindexslopecoefficientequalsthemarketindexaveragereturn;and,

Thefactorslopecoefficientequalstheaveragereturnonthefactor.

(Notethatthefirsttwohypothesesarethesameasthoseforthesinglefactormodel.)

12.

Theinputsforthesecondpassregressionare:

Average

Excess

BetaM

BetaF

Return

A

5.18

0.47

0.35

B

4.19

0.58

2.33

C

2.75

0.41

0.67

D

6.15

1.39

1.05

E

8.05

0.89

1.03

F

9.90

1.79

1.95

G

11.32

0.65

1.15

H

13.11

1.91

0.43

I

22.83

2.08

0.48

M

8.12

F

0.60

Thesecondpassregressionyields:

RegressionStatistics

MultipleR

0.7234

RSquare

0.5233

AdjustedRSquare 0.3644

StandardError

4.8786

Observations

9

Coefficients

Intercept

BetaM

BetaF

3.35

5.53

0.80

Standard

Error

2.88

2.16

1.42

tStatistic

for=0

1.16

2.56

0.56

tStatistic

for=8.12

1.20

tStatistic

for=0.6

0.14

Theseresultsareslightlybetterthanthoseforthesinglefactortest;thatis,theintercept

issmallerandtheslopeonMisslightlygreater.Wecannotexpectagreatimprovement

sincethefactorweaddeddoesnotappeartocarryalargeriskpremium(averageexcess

returnislessthan1%),anditseffectonmeanreturnsisthereforesmall.Thedatadonot

rejectthesecondfactorbecausetheslopeisclosetotheaverageexcessreturnandthe

differenceislessthanonestandarderror.However,withthissamplesize,thepowerof

thistestisextremelylow.

13-7

Chapter 13 - Empirical Evidence on Security Returns

13.

Whenweusetheactualfactor,weimplicitlyassumethatinvestorscanperfectly

replicateit,thatis,theycaninvestinaportfoliothatisperfectlycorrelatedwiththe

factor.Whenthisisnotpossible,onecannotexpecttheCAPMequation(thesecond

passregression)tohold.Investorscanuseareplicatingportfolio(aproxyforthefactor)

thatmaximizesthecorrelationwiththefactor.TheCAPMequationisthenexpectedto

holdwithrespecttotheproxyportfolio.

UsingtheborderedcovariancematrixoftheninestocksandtheExcelSolverwe

produceaproxyportfolioforfactorF,denotedPF.Topreservethescale,weinclude

constraintsthatrequirethenineweightstobeintherangeof[1,1]andthatthemean

equalthefactormeanof0.60%.Theresultantweightsfortheproxyandperiodreturns

are:

ProxyPortfolioforFactorF(PF)

Weightson

PFHolding

Universe Year

Period

Stocks

Returns

A

0.14

1

33.51

B

1.00

2

62.78

C

0.95

3

9.87

D

0.35

4

153.56

E

0.16

5

200.76

F

1.00

6

36.62

G

0.13

7

74.34

H

0.19

8

10.84

I

0.06

9

28.11

10

59.51

11

59.15

12

14.22

Average 0.60

Thisproxy(PF)hasanRsquarewiththeactualfactorof0.80.

WenextperformthefirstpassregressionsforthetwofactormodelusingPFinsteadof

P:

Rsquare

Observations

Intercept

BetaM

BetaPF

tIntercept

tBetaM

tBetaPF

A

B

C

D

E

F

0.08 0.55 0.20 0.43 0.33 0.88

12

12

12

12

12

12

9.28 2.53 1.35 4.45 0.23 3.20

0.50 0.80 0.49 1.32 1.00 1.64

0.06 0.42 0.16 0.13 0.21 0.29

0.72 0.21 0.12 0.36 0.02 0.55

0.83 1.43 0.94 2.29 1.66 6.00

0.44 3.16 1.25 0.97 1.47 4.52

G

H

0.16 0.71

12

12

4.99 2.92

0.76 1.97

0.21 0.11

0.27 0.33

0.90 4.67

1.03 1.13

I

0.72

12

5.54

2.12

0.08

0.58

4.77

0.78

NotethatthebetasoftheninestocksonMandtheproxy(PF)aredifferentfromthose

inthefirstpasswhenweusetheactualproxy.

13-8

Chapter 13 - Empirical Evidence on Security Returns

The first-pass regression for the two-factor model with the proxy yields:

A

B

C

D

E

F

G

H

I

M

PF

Average

Excess

Return

5.18

4.19

2.75

6.15

8.05

9.90

11.32

13.11

22.83

8.12

0.6

BetaM

BetaPF

0.50

0.80

0.49

1.32

1.00

1.64

0.76

1.97

2.12

0.06

0.42

0.16

0.13

0.21

0.29

0.21

0.11

0.08

Thesecondpassregressionyields:

RegressionStatistics

MultipleR

0.71

RSquare

0.51

AdjustedRSquare

0.35

StandardError

4.95

Observations

9

Coefficients

Intercept

BetaM

BetaPF

3.50

5.39

0.26

Standard

Error

2.99

2.18

8.36

tStatistic

for=0

1.17

2.48

0.03

tStatistic

for=8.12

1.25

tStatistic

for=0.6

0.04

Wecanseethattheresultsaresimilarto,butslightlyinferiorto,thosewiththeactual

factor,sincetheinterceptislargerandtheslopecoefficientsmaller.Notealsothatwe

usehereaninsampletestratherthantestswithfuturereturns,whichismoreforgiving

thananoutofsampletest.

13-9

Chapter 13 - Empirical Evidence on Security Returns

14.

We assume that the value of your labor is incorporated in the calculation of the rate of

return for your business. It would likely make sense to commission a valuation of your

business at least once each year. The resultant sequence of figures for percentage change

in the value of the business (including net cash withdrawals from the business in the

calculations) will allow you to derive a reasonable estimate of the correlation between the

rate of return for your business and returns for other assets. You would then search for

industries having the lowest correlations with your portfolio, and identify exchange

traded funds (ETFs) for these industries. Your asset allocation would then be comprised

of your business, a market portfolio ETF, and the low-correlation (hedge) industry ETFs.

Assess the standard deviation of such a portfolio with reasonable proportions of the

portfolio invested in the market and in the hedge industries. Now determine where you

want to be on the resultant CAL. If you wish to hold a less risky overall portfolio and to

mix it with the risk-free asset, reduce the portfolio weights for the market and for the

hedge industries in an efficient way.

CFAPROBLEMS

1.

(i)Betasareestimatedwithrespecttomarketindexesthatareproxiesforthetrue

marketportfolio,whichisinherentlyunobservable.

(ii)EmpiricaltestsoftheCAPMshowthataveragereturnsarenotrelatedtobetain

themannerpredictedbythetheory.TheempiricalSMLisflatterthanthetheoretical

one.

(iii)Multifactormodelsofsecurityreturnsshowthatbeta,whichisaonedimensional

measureofrisk,maynotcapturethetrueriskofthestockofportfolio.

2.

a.

The basic procedure in portfolio evaluation is to compare the returns on a managed

portfolio to the return expected on an unmanaged portfolio having the same risk,

using the SML. That is, expected return is calculated from:

E(rP ) = rf + P [E(rM ) rf ]

where rf is the risk-free rate, E(rM ) is the expected return for the unmanaged

portfolio (or the market portfolio), and P is the beta coefficient (or systematic

risk) of the managed portfolio. The performance benchmark then is the unmanaged

portfolio. The typical proxy for this unmanaged portfolio is an aggregate stock

market index such as the S&P 500.

b.

The benchmark error might occur when the unmanaged portfolio used in the

evaluation process is not optimized. That is, market indices, such as the S&P 500,

chosen as benchmarks are not on the managers ex ante mean/variance efficient

frontier.

13-10

Chapter 13 - Empirical Evidence on Security Returns

3.

c.

Your graph should show an efficient frontier obtained from actual returns, and a

different one that represents (unobserved) ex-ante expectations. The CML and

SML generated from actual returns do not conform to the CAPM predictions, while

the hypothesized lines do conform to the CAPM.

d.

The answer to this question depends on ones prior beliefs. Given a consistent track

record, an agnostic observer might conclude that the data support the claim of

superiority. Other observers might start with a strong prior that, since so many

managers are attempting to beat a passive portfolio, a small number are bound to

produce seemingly convincing track records.

e.

The question is really whether the CAPM is at all testable. The problem is that even

a slight inefficiency in the benchmark portfolio may completely invalidate any test of

the expected return-beta relationship. It appears from Rolls argument that the best

guide to the question of the validity of the CAPM is the difficulty of beating a

passive strategy.

The effect of an incorrectly specified market proxy is that the beta of Blacks portfolio is

likely to be underestimated (i.e., too low) relative to the beta calculated based on the

true market portfolio. This is because the Dow Jones Industrial Average (DJIA), and

other market proxies, are likely to have less diversification and therefore a higher

variance of returns than the true market portfolio as specified by the capital asset

pricing model. Consequently, beta computed using an overstated variance will be

underestimated. This result is clear from the following formula:

Portfolio

Cov( rPortfolio , rMarket Proxy )

2Market Proxy

An incorrectly specified market proxy is likely to produce a slope for the security market

line (i.e., the market risk premium) that is underestimated relative to the true market

portfolio. This results from the fact that the true market portfolio is likely to be more

efficient (plotting on a higher return point for the same risk) than the DJIA and similarly

misspecified market proxies. Consequently, the proxy-based SML would offer less

expected return per unit of risk.

13-11

You might also like

- Chapter 13: Empirical Evidence On Security Returns: Problem SetsDocument11 pagesChapter 13: Empirical Evidence On Security Returns: Problem SetsBiloni Kadakia100% (1)

- 3.Self-Consistent Asset Pricing ModelsDocument23 pages3.Self-Consistent Asset Pricing ModelsPeerapong NitikhetprechaNo ratings yet

- Chapter 13Document14 pagesChapter 13cutemayurNo ratings yet

- Multifactor Models and The CapmDocument6 pagesMultifactor Models and The CapmNguyễn Dương Trọng KhôiNo ratings yet

- Capm + AptDocument10 pagesCapm + AptharoonkhanNo ratings yet

- Chapte 10 Capital MarketDocument5 pagesChapte 10 Capital MarketRonaliza MallariNo ratings yet

- Capital Asset Pricing ModelDocument5 pagesCapital Asset Pricing ModelVrinda TayadeNo ratings yet

- Capital Asset Pricing ModelDocument5 pagesCapital Asset Pricing ModelRajvi SampatNo ratings yet

- Capital Asset Pricing ModelDocument13 pagesCapital Asset Pricing ModelkamransNo ratings yet

- CAPM Theory Advantages DisadvantagesDocument3 pagesCAPM Theory Advantages Disadvantageskvj292001100% (1)

- Bodie Investments 12e IM CH10Document3 pagesBodie Investments 12e IM CH10lexon_kbNo ratings yet

- Evaluating The Performance of Nearest Neighbour Algorithms When Forecasting US Industry ReturnsDocument20 pagesEvaluating The Performance of Nearest Neighbour Algorithms When Forecasting US Industry ReturnsOotam SeewoogoolamNo ratings yet

- Multi FactorDocument22 pagesMulti FactorAnanda Rea KasanaNo ratings yet

- CdoDocument25 pagesCdoleolearnNo ratings yet

- Capital Asset Pricing ModelDocument17 pagesCapital Asset Pricing ModelChrisna Joyce MisaNo ratings yet

- Fama-French modelsDocument3 pagesFama-French modelswaliyaNo ratings yet

- Capm Advantages and DisadvantagesDocument3 pagesCapm Advantages and DisadvantagesHasanovMirasovičNo ratings yet

- Russian DollDocument25 pagesRussian DollFernando CarvalhoNo ratings yet

- SSRN-id1108361 Assessing Sorting PortfoliiosDocument32 pagesSSRN-id1108361 Assessing Sorting PortfoliiosEduardus Henricus HauwertNo ratings yet

- Dynamic Asset Factor TimingDocument22 pagesDynamic Asset Factor TimingLydia AndersonNo ratings yet

- Capm VS AptDocument3 pagesCapm VS AptDai Siu MaiNo ratings yet

- CAPM Tutorial Solutions Skewness Returns Prediction ProblemsDocument3 pagesCAPM Tutorial Solutions Skewness Returns Prediction ProblemsNguyễn HảiNo ratings yet

- Investments Concepts and Applications 5th Edition Heaney Test BankDocument13 pagesInvestments Concepts and Applications 5th Edition Heaney Test Bankjesselact0vvk100% (32)

- Find and summarize the 5FM ModelDocument3 pagesFind and summarize the 5FM Modelwaqar HaiderNo ratings yet

- Allen Et Al 09 Asset Pricing The Fama French Factor Model and The Implications of Quantile Regression AnalysisDocument24 pagesAllen Et Al 09 Asset Pricing The Fama French Factor Model and The Implications of Quantile Regression AnalysisPeterParker1983No ratings yet

- Jurnal MK 2Document16 pagesJurnal MK 2niar196No ratings yet

- Chapter - 9 Multifactor ModelsDocument15 pagesChapter - 9 Multifactor ModelsAntora Hoque100% (1)

- R R + (R - R) + (SMB) + (HML) +Document3 pagesR R + (R - R) + (SMB) + (HML) +Dickson phiriNo ratings yet

- Arbitrage Pricing TheoryDocument2 pagesArbitrage Pricing TheoryMrDj Khan100% (1)

- DamodaranDocument3 pagesDamodaranSuraj GuhaNo ratings yet

- Spiceland 9e CH 09 SM Solutions ManualDocument83 pagesSpiceland 9e CH 09 SM Solutions ManualStephen Andrei VillanuevaNo ratings yet

- Spiceland 9e CH 09 SM Solutions ManualDocument83 pagesSpiceland 9e CH 09 SM Solutions ManualStephen Andrei VillanuevaNo ratings yet

- Risk and Return: Models Linking Risk and Expected ReturnDocument10 pagesRisk and Return: Models Linking Risk and Expected ReturnadafgsdfgNo ratings yet

- Banz On Small Firm Effect 1981 JFEDocument16 pagesBanz On Small Firm Effect 1981 JFEGelu AgutaNo ratings yet

- The Advantages of Least Squares Monte CarloDocument9 pagesThe Advantages of Least Squares Monte CarloNilabjo Kanti Paul0% (1)

- No 4Document27 pagesNo 4eeeeewwwwwwwwNo ratings yet

- CAPM Notes and Practice QuestionsDocument10 pagesCAPM Notes and Practice QuestionsShaguftaNo ratings yet

- Hamada 1972Document18 pagesHamada 1972Ivon SilvianaNo ratings yet

- Chapter 8 Portfolio Theory and The Capital Asset Pricing ModelDocument8 pagesChapter 8 Portfolio Theory and The Capital Asset Pricing ModelShekar PalaniNo ratings yet

- BKM Chapter 9Document4 pagesBKM Chapter 9Ana Nives RadovićNo ratings yet

- 2011pbfeam 112Document33 pages2011pbfeam 112Akbar Shara FujiNo ratings yet

- The EXPLOITATION of Security Mispricing inDocument13 pagesThe EXPLOITATION of Security Mispricing inJorge J MoralesNo ratings yet

- 0903 MarketDocument4 pages0903 MarketredtailgoldenNo ratings yet

- Resume CH 7 - 0098 - 0326Document5 pagesResume CH 7 - 0098 - 0326nur eka ayu danaNo ratings yet

- CH 9 Capital Asset Pricing ModelDocument25 pagesCH 9 Capital Asset Pricing ModelShantanu ChoudhuryNo ratings yet

- FINC3017 Alternative Asset Pricing Models GuideDocument3 pagesFINC3017 Alternative Asset Pricing Models GuideNguyễn HảiNo ratings yet

- Economic ModelsDocument6 pagesEconomic ModelsBellindah GNo ratings yet

- MP1 ReportDocument9 pagesMP1 ReportRachit BhagatNo ratings yet

- CAPM and Risk-Return Models ExplainedDocument15 pagesCAPM and Risk-Return Models ExplainedSAna KhAnNo ratings yet

- Project 3 CAPM and Fama-French Three Factor Model Professor Natalia Gershun Reynold D'silva Hanxiang Tang Wen GuoDocument7 pagesProject 3 CAPM and Fama-French Three Factor Model Professor Natalia Gershun Reynold D'silva Hanxiang Tang Wen GuoNiyati ShahNo ratings yet

- Irc CRMDocument43 pagesIrc CRMsureshv23No ratings yet

- E4 CAPM Theory Advantages and DisadvantagesDocument6 pagesE4 CAPM Theory Advantages and DisadvantagesTENGKU ANIS TENGKU YUSMANo ratings yet

- Alternatives To CAPM (Damodaran Blog)Document9 pagesAlternatives To CAPM (Damodaran Blog)Reena JoshiNo ratings yet

- Quantopian Risk Model: Is The Return On TimeDocument16 pagesQuantopian Risk Model: Is The Return On Timezhouh1998No ratings yet

- Literature On CapmDocument14 pagesLiterature On CapmHitesh ParmarNo ratings yet

- BKM Solution Chapter 4Document8 pagesBKM Solution Chapter 4minibodNo ratings yet

- Chap 007Document12 pagesChap 007Qayyum KhanNo ratings yet

- Chap 008Document14 pagesChap 008minibodNo ratings yet

- Chapter 20 - Options Markets: IntroductionDocument20 pagesChapter 20 - Options Markets: IntroductionminibodNo ratings yet

- Chapter 22 - Futures MarketsDocument9 pagesChapter 22 - Futures MarketsminibodNo ratings yet

- Chapter 24: Portfolio Performance Evaluation: Problem SetsDocument13 pagesChapter 24: Portfolio Performance Evaluation: Problem SetsminibodNo ratings yet

- Chapter 18 - Equity Valuation ModelsDocument17 pagesChapter 18 - Equity Valuation ModelsborritaNo ratings yet

- Chap 016Document21 pagesChap 016minibodNo ratings yet

- Investment Environment OverviewDocument6 pagesInvestment Environment OverviewArcLaiNo ratings yet

- Chap 015Document12 pagesChap 015minibodNo ratings yet

- Chap017 IseDocument15 pagesChap017 IseFahad Hasan ChowdhuryNo ratings yet

- Chap 010Document8 pagesChap 010minibodNo ratings yet

- Chap 012Document17 pagesChap 012minibodNo ratings yet

- Chap 014Document15 pagesChap 014minibodNo ratings yet

- Chap 011Document7 pagesChap 011minibodNo ratings yet

- WebvanDocument3 pagesWebvangautam_hariharan100% (1)

- Learn About Return and Risk from Historical DataDocument6 pagesLearn About Return and Risk from Historical Dataminibod100% (1)

- BKM Solution Chapter 4Document8 pagesBKM Solution Chapter 4minibodNo ratings yet

- Investment Environment OverviewDocument6 pagesInvestment Environment OverviewArcLaiNo ratings yet

- BKM Solution Chapter 3Document8 pagesBKM Solution Chapter 3minibodNo ratings yet

- BKM Solution Chapter 002Document6 pagesBKM Solution Chapter 002minibodNo ratings yet

- BKM Solution Chapter 002Document6 pagesBKM Solution Chapter 002minibodNo ratings yet

- SHARPE OPTIMAL PORTFOLIODocument4 pagesSHARPE OPTIMAL PORTFOLIOsur yonoNo ratings yet

- BBMP Signal Free Corridor Construction PrequalificationDocument3 pagesBBMP Signal Free Corridor Construction PrequalificationPrasanna VswamyNo ratings yet

- Black Book Online Trading and Stock BrokingDocument53 pagesBlack Book Online Trading and Stock BrokingAditya LokareNo ratings yet

- Chapter 8: Assessing New Venture's Financial StrengthDocument22 pagesChapter 8: Assessing New Venture's Financial StrengthHossain RajuNo ratings yet

- Vietnam Banks: The Sector To Own Significant Potential Upside in The Next 12 MonthsDocument56 pagesVietnam Banks: The Sector To Own Significant Potential Upside in The Next 12 MonthsViet HoangNo ratings yet

- Time Value of Money 1Document27 pagesTime Value of Money 1Namaku ImaNo ratings yet

- Exercises 2Document2 pagesExercises 2truelied50% (2)

- Finance Homework 1Document6 pagesFinance Homework 1Ardian Widi100% (1)

- Notes On Cash and Cash EquivalentsDocument1 pageNotes On Cash and Cash EquivalentsMariz Julian Pang-aoNo ratings yet

- Tech Sector Update 01122022Document4 pagesTech Sector Update 01122022VictorioNo ratings yet

- Financial Accounting Fact Sheet PDFDocument3 pagesFinancial Accounting Fact Sheet PDFharoldpsb100% (1)

- Chapter 1Document94 pagesChapter 1Siva KasiNo ratings yet

- Mutual Fund ReportDocument106 pagesMutual Fund Reportromil.opti100% (1)

- Early Illinois Paper MoneyDocument36 pagesEarly Illinois Paper MoneyJustin100% (1)

- Isr Guidance and Forms TPLDocument11 pagesIsr Guidance and Forms TPLParag SaxenaNo ratings yet

- Cash Flow - Alpa Beta GammaDocument26 pagesCash Flow - Alpa Beta GammaAnuj Rakheja67% (3)

- Insurance OperationsDocument12 pagesInsurance OperationsIsunni AroraNo ratings yet

- SEBI's Disclosures and Investor Protection Guidelines Explained! Do You FeelDocument2 pagesSEBI's Disclosures and Investor Protection Guidelines Explained! Do You Feelabhisheksh100% (2)

- PCGG Right to Vote Sequestered SMC SharesDocument19 pagesPCGG Right to Vote Sequestered SMC SharesolofuzyatotzNo ratings yet

- Arundel case analysisDocument8 pagesArundel case analysisJoep Teulings100% (1)

- WEF Alternative Investments 2020 FutureDocument59 pagesWEF Alternative Investments 2020 FutureR. Mega MahmudiaNo ratings yet

- Capped Outperformance Certificate On London Gold MarketDocument1 pageCapped Outperformance Certificate On London Gold Marketapi-25889552No ratings yet

- Management Accounting (Volume I) - Solutions Manual Chapter 5 Financial Statements Analysis - IIDocument29 pagesManagement Accounting (Volume I) - Solutions Manual Chapter 5 Financial Statements Analysis - IIMar-ramos Ramos50% (6)

- Accounting for PartnershipsDocument36 pagesAccounting for Partnershipsedo100% (2)

- ANALYSIS OF FINANCIAL STATEMENTS of UNILEVER PAKISTANDocument11 pagesANALYSIS OF FINANCIAL STATEMENTS of UNILEVER PAKISTANSyed Saad67% (3)

- Final Exam Questions on Financial ManagementDocument3 pagesFinal Exam Questions on Financial ManagementAnaSolitoNo ratings yet

- Trish Joy Foundation 990: 2016Document22 pagesTrish Joy Foundation 990: 2016Tony OrtegaNo ratings yet

- List of Investment BanksDocument10 pagesList of Investment BanksSKNYUYNo ratings yet

- Sharekhan Internship ProjectDocument74 pagesSharekhan Internship Projectayush goyalNo ratings yet

- Class Notes #4 Investor Buying Distressed Tech CompanyDocument30 pagesClass Notes #4 Investor Buying Distressed Tech CompanyJohn Aldridge Chew100% (2)