Professional Documents

Culture Documents

T 15

Uploaded by

Rajesh Kumar MamidiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

T 15

Uploaded by

Rajesh Kumar MamidiCopyright:

Available Formats

Solar-Diesel Hybrid Energy Model for Base

Transceiver Station (BTS) of Mobile Phone

Operators

Shahriar Ahmed Chowdhury1, Shakila Aziz2

1

Centre for Energy Research, United International University, Dhaka, Bangladesh.

School of Business Administration, United International University, Dhaka, Bangladesh.

1

Shahriar@eee.uiu.ac.bd

2

cactusflower_80@hotmail.com

Abstract The telecommunications industry has the greatest

coverage among all utilities. Remote areas of the country that

have no roads, grid-electricity, land line telephones or gas, still

receive network coverage from one or more telecom companies.

However, the Base Transceiver Systems (BTS) that these

companies used in off-grid areas are dependent on on-site diesel

generators, and the frequent maintenance and refueling that this

entails. This paper analyses the costs of the solar-diesel hybrid

systems, and the cost of electricity generated by such a system. It

has been found that the cost of such a system comes to US$ 0.625

per kWh of electricity, using the hybrid configuration currently

under consideration by mobile telecom operators. This

configuration assumes that the generator will run for 2.5 to 3

hours, and provide energy for 8 to 10 hours. However, increasing

the size of the panels will reduce the cost of electricity, keeping

other factors constant. Traditional capital budgeting analysis

and HOMER analysis are done to find out the energy cost and

also for sensitivity analysis.

KeywordsSolar BTS, CAPEX, NPV, IRR, HOMER

I. INTRODUCTION

Terrestrial GSM networks now cover more than 80% of the

worlds population [1]. The telecommunications industry is an

energy intensive industry, where large quantities of electrical

energy are consumed by the base transceiver stations for the

running and cooling of electrical equipment. For example,

Grameen Phone is the largest mobile phone service provider in

Bangladesh, covering 99% of the countrys polulation and 89%

of the land area. There are 13,000 base stations in 7,200 sites

around the country, as of December 2010[2]. In comparison,

only 48% of the population have access to grid electricity [3].

Just as people living in off-grid locations have in many cases

resorted to using solar home systems to access rudimentary

electricity, the communications equipment of telecom

companies can also use renewable energy for electricity. This

has been shown to not only reduce the maintenance, operating

and fuel costs, but also to prevent power outages, which results

in disrupted services and lost customers and revenues.

At present Bangladesh has six mobile phone operators

(Grameen Phone, Robi, Banglalink, Airtel, Teletalk, CityCell)

and all together they have 1762 Off grid BTS, Most of them run

using a diesel generator set with a battery backup system. If all

these BTSs change their energy system to Solar-Diesel hybrid

systems, it can all together reduce up to 84.95 million litres of

diesel and reduce emissions of 226,254 tons of CO2 by 2015.

In this paper, we will look at the technical, economic and

financial grounds for corporations to use renewable energy in

place of fossil fuels. Next, we will look at the case of a typical

BTS in Bangladesh, performing a financial analysis of its

instalment and operations, and calculating the NPV of the

project over an operating period of 20 years. In the project, we

will assume different tariff rates for electricity in the revenue

component generated from the project. We can only forecast the

costs and revenue from using the hybrid system, but we cannot

accurately predict the gains in revenue due to improved

customer service and coverage.

Furthermore, financing for emission reducing projects can be

obtained using carbon credits or emission reduction units, under

the Kyoto Protocol, but this consideration is not factored into

our analysis.

The costs of the equipment are taken from average current

market prices and operating expenses are estimated from the

reported costs the power supply companies currently incur. In

practice, telecom companies outsource the installation and

maintenance of the hybrid systems, and the capital budgeting

analysis of this paper is done from the perspective of the power

supply company.

II. POWER CONSUMPTION OF A BTS

The power consumption of a BTS site depends on the

equipment used, area covered, location, temperature/humidity

etc. The main power consumption of BTS is due to the

following equipments: Transceiver (TRX), the power

amplifiers, combiner, the duplexer, antenna, alarm systems,

control unit, Baseband receiver unit (BBX) and cooling

systems etc. In previous times BTS used air cooling units to

keep the temperature at certain level, which consumed almost

half of the BTS energy consumption. But at present the BTS

uses IVS (Intelligent Ventilation Systems), which consumes

on an average 150~200 W. The IVS consists of cooling fans

(exhaust). The total power consumed by a BTS depends on

the number of RBS in that particular BTS. A typical BTS site

of Bangladesh consumes 1.2 kW on average. Sometimes long

towers require aircraft warning lights and so they require

some hundred additional watts. In this paper we will consider

an average BTS load 1.5 kW.

III. A FINANCIAL BASIS FOR USING RENEWABLE ENERGY

Hybrid power systems have been shown to reduce the energy

costs of a BTS by more than 50%. This is because it eliminates

the cost of diesel by upto 75%, along with the other drawbacks

of using diesel, including fuel delivery, generator maintenance,

fuel storage, greenhouse gas emissions and uncertain future

diesel prices [4].

The capital costs of a solar powered system for a BTS is 50%

more than one using diesel. However, if we use a 9% cost of

capital, the solar power system will recover the invested capital

in five years. Furthermore, the cumulative costs (NPV) of a

diesel powered system will exceed that of a solar powered

system within ten years of the projects operation. If we consider

the lifetime of the solar equipment to be 20 years, we can see

that in the long run the solar powered system is far less

expensive than the diesel powered one. The following graph

illustrates this trend, assuming 10,800Wp solar panels against a

diesel generator of 13 kW capacity [4].

Net Present Value of Costs

(US$)

Solar

9 11

year

Diesel

13

15

17

19

Fig. 1 NPV trends of solar vs diesel powered BTS.

Traditionally, financial managers have not actively included

environmental considerations into their financing or investing

decisions, and did not include environmental risk in their

investment strategies. However, this is now changing, as in

many parts of the world, fiduciaries are legally required to

address environmental risk in their financial strategies. It has

been demonstrated by the financial advisory firm Innovest that

different companies in the same industry can face significantly

different costs of CO2 regulatory costs of compliance, based on

their environmental practices. In the world of increasing

environmental awareness and regulation, companies that take

measures to reduce their carbon footprint have been shown to

have share prices 3% higher than similar companies that are

environmentally indifferent [5]

In order to assess a companys net relative financial risk

exposure to climate change, Innovest suggests a measure called

Carbon Beta, which measures carbon risk in terms of four

variables [5]:

Companies overall carbon footprint or potential risk

exposure, adjusted to reflect differing regulatory

circumstances in different countries and regions.

Their ability to manage and reduce that risk exposure

Their ability to recognize and seize climate-driven

opportunities on the upside

Their rate of improvement or regression

The entire benefit of using renewable energy cannot be

precisely measured by using a conventional capital budgeting

analysis of the project alone. Its long term benefits to the share

price of the company can come from indirect and unpredictable

sources that are not accurately estimated.

According to a report by World Resources Institute, the benefits

of using renewable energy solutions can be measured in terms

of cost factors and risk management [6]. These benefits arise

from gaining an energy cost hedge, energy reliability, brand

enhancement and tax waivers. Bangladeshi companies, being at

the mercy of irregular power supply from the grid, and

unpredictably increasing fuel prices, can benefit from all these

factors. Investments in the renewable energy sector enjoy tax

exemptions [7].

There is empirical evidence that investing in renewable

energy can act as a hedge against fuel price increases. Unlike

contracts for gas fired electricity generation, renewable

generation is sold under long term fixed price contracts,

which can eliminate price risk for up to 20 years [8]. To

accurately compare the fixed costs of renewable energy with

fossil fuel powered conventional energy, utility companies

should use the hedged or guaranteed price of fossil fuels from

the forward markets, instead of price estimates based on the

uncertain spot price [8]. A study by Bollinger and Wiser [8]

reveals that the futures prices in the market exceed the

forecast prices for natural gas powered electricity by 0.4 to

1.7 cents/kWh. Furthermore, gas prices and the stock market

move in opposite directions, and fossil fuels have a negative

beta, favouring producers to the disadvantage of consumers

during economic downturns. Lastly, using renewable energy

reduces the demand on fossil fuels, thus leading to a decline

in its price. This price decline in fuel can offset any premium

price paid for renewable power in the long run [8].

Bazilian and Roques recommends taking a portfolio approach

to planning energy solutions. They have demonstrated that

energy portfolios benefit from diversification in a way similar

to portfolios of financial securities. This means that on a

standalone basis, renewable energy solutions may appear

more risky or have less return than conventional energy, but

when they are combined with conventional energy, the overall

energy supply portfolio can have greater risk adjusted returns

[9].

Switching to renewable energy is a way a corporation can

signal to shareholders and institutional investors that it is

mitigating climate related risk. Major corporations, like FedEx,

Johnson and Johnson, Du Pont and General Motors to name a

few, now are obtaining their electricity from renewable sources

including solar, wind and even landfill gas [10].

III. TECHNICAL CONSIDERATIONS

The average BTS load is considered to be 1.5 kW. The BTS

will be powered by solar-diesel hybrid systems. Daily average

generator run time is considered to be 2.5 hours (according to

the mode of operation is followed by local mobile phone

operators). When the generator runs, it will at the same time

provide power to the BTS equipment and charge the battery

for back up energy. The energy supplied by the solar system

is considered to last 16 hours and energy from the generator

lasts 10 hours. Two hours extra is considered as a safety

margin. No autonomy days is considered while designing the

solar-diesel hybrid system. We have taken the GHI (Global

Horizontal Irradiance) as the solar input data. However, in

practice our panels will be tilted at 23o angle (equal to the

local latitude), and this result in a higher solar radiation on the

panels. Consequently, the output energy from the solar panels

will be higher than what we have assumed here.

i. Diesel generator covers 10 hours load and also for

emergency requirement.

ii. The average radiation is 4.65 kWh/m2/day, while the

minimum radiation is 1.6 kWh/m2/day and maximum

radiation is 7 kWh/m2/day [11].

iii. The sizing of the system will be based upon the average

radiation of G=4.65 kWh/m2/day. So, in summer months

(when the radiation is higher, then generator back up time

will be less). And in winter or the rainy season, the

generator back up will be higher. But the average annual

generator runtime will not be more than 3 hours /day.

iv. The energy harnessing efficiency of the solar panel is

considered to be 95% (using the MPPT Charge controller)

(cc)

v. Battery efficiency is 85% (b) and maximum Depth of

Discharge (DOD) operation of the battery is 70%.

System Sizing

Panel

Daily Energy demand: 1.5 kW24 Hrs = 36 kWh

Solar energy contribution (16 Hours): Es=1.516= 24kWh

Average insolation G=4.65 kWh/m2/day

Battery DOD used= 70%

The required panel size is= P

Power from the panel will be directly fed into the BTS

equipment and rest will be stored in the battery. Considering

an average of 8 hours of direct feed from the panel. We get,

P

5.87

G 0.5

0.5

Es

Battery

Maximum battery energy backup will be required in the

lowest irradiation days (Lowest irradiation= 1.6 kWh/m2/day).

The battery capacity required is:

required energy for 16 hrs solar input energy

battery efficiency DOD of battery used

24 1.6 6

0.85 0.7

= 24.2 kWh

= 504 Ah (at 48 V)

At the sixth year (considering 6 years of battery life) the

battery capacity is assumed to be reduced to 80% of the initial

capacity.

Battery capacity required for smooth operation =

800 Ah at 48V.

= 630Ah

Generator

Generator backup is considered for 10 Hours 1.5 10

15

The generator will run for 2.5 hours, So the capacity of the

generator should be at least 6 kW

Considering the efficiency of the generation process

(ie. Rectifier loss and losses in other circuitry) 80%.

Generator size= 7.5 kW

Considering the availability and also the life time of the diesel

generator we have chosen a 8 kW ( 10kVA) generator.

Considering the aging of the generator and the declination of

the efficiency, we assume the fuel consumption per hour is

2.5 Litres. That is 3.2 kW/litre.

Rectifier

The rectifier will rectify the ac power to dc to charge the

battery as well as supply power to the BTS equipment.

Rectifier size at 48V =

166 A.

As all the BTS has existing rectifier. So, the rectifier price is

not included in the initial capital cost.

IV. FINANCIAL DESCRIPTION OF THE PROJECT

The energy supply to the BTSs in the day time will be from

PV panels and at night, partially from the energy stored in the

battery and partly from the generator. The system is

connected to a generator, so in extreme weather condition or

in emergency situations the BTS will be powered by the

generator. The size of the generator is determined by the load

supplied to the BTS and also by the charge from the battery

bank. To ensure a higher battery life, the battery is operated at

a maximum DOD of 60%. The costs and their components for

powering 1 BTS are summarized as follows (The prices are

collected from the local market/vendor/enterprises, converted

to US$):

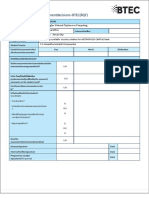

COST BREAKUP OF THE SOLAR-DIESEL HYBRID SYSTEM

TABLE I

Unit cost

($)

Equipment

Units

required

Total cost

(US$)

Solar panel

1.5 / Wp

6000

9000

Battery Bank ( 48 V, 400 AH)

0.5 /Ah

9600

Battery Rack

125

250

Junction Box for Solar Panel

350

350

Charge Controller (60 A, 48V)

500

1500

Battery Protection Box

250

250

Solar Support Structures and

associated civil works

1300

1300

Cable & Connectors

1500

1500

Generator-10 KVA

6000

6000

Energy meter with data logger

120

120

Transportation and installation

( 3% of total equipment cost)

1000

1000

Breakers, Protection and others

1000

1000

Total Cost of Equipment

31870

Annual O&M cost

1000

Annual diesel cost

0.67/L

6.25L/day

1530

We can see how the NPV and IRR values of the project

change when we use various tariffs per KWh of electricity,

starting from US$ 0.6 to 0.66.

12

IRR (%)

10

All the equipment will be newly purchased and the energy

system will be built from scratch, without considering salvage

value from existing equipment.

Under the above assumptions, the break even tariff for the

BTS system comes to US$ 0.625 per kWh.

The cost of the system will change if the cost of diesel varies

significantly from the assumed values. All the costs of the

hybrid system are known from the beginning except for the

future costs of diesel fuel. Furthermore, the electricity is sold

to the Telecom operator under a take or pay contract, and so

the minimum sales revenue is also known in advance. The

only variable that introduces risk into the system is the price

of fuel.

Diesel prices in Bangladesh are a function of world crude oil

prices, refining and distribution prices, international demand,

taxes and subsidies. This is why the price of fuel is a

significant source of volatility. Utility companies that provide

power solutions to the BTS should consider hedging the price

risk of fuel by entering into forward or futures contracts,

depending on the needs of the company, and the market price

trends.

IV. HOMER ANALYSIS OF THE SYSTEM

The BTS project cost is analyzed using HOMER, a renewable

energy cost analysis software developed by NREL. The

assumptions used in the HOMER model are:

8

6

4

2

0

0.6

0.62

0.64

0.66

Tariff Rate (US$)

Fig. 2 Project IRR according to tariff per kWh

6000

Fig. 4 Schematic diagram of the Solar-diesel Hybrid system

solution (HOMER Analysis)

NPV in US$

4000

2000

0

-2000

-4000

0.6

0.62

0.64

0.66

Tariff rate in US$

Fig. 3 Project NPV according to tariff per kWh

In the above analysis the tariff rate for revenue is assumed to

be constant, but the cost of diesel and operations and

maintenance costs are assumed to grow at an annual

compounded rate of 5%. The cost of capital is considered 9%.

a) The BTS load is considered as a constant 1.5 kW that is

36kWh per day.

b) The generator is chosen so that when it is operates it will

not only supply the power to the BTS equipment but will also

charge the battery. The battery charging current will be at its

maximum possible rate, so that the battery back up time from

the generator will be at a maximum.

c) The solar radiation data of Dhaka city is taken for the

analysis.

d) Annual interest rate is considered as 100% and project life

time is 20 years.

e) Component specifications:

PV panel: Capacity of the panel is 6 kW

Wp, life 20 years,

derating factor 80%, PV panel assembly iss south facing with

23o tilt angle and ground reflection is taken as 20%.

Battery: 800AH, 2 V battery with 6 years life

l (at 70% DOD)

is taken for battery input data. So, the batttery replacement is

considered in every 6th year. Battery costt is taken as USD

0.5/AH of 2 V batteries. Salvage value of

o the batteries is

considered to be 20% of the battery capital cost.

c

Generator: Generator is taken as 10 kVA raating and generator

life is considered to be 10 years. One litre diesel

d

will produce

3.2 kWh of electric energy (i.e. 0.3125 L/H

Hr/kW output). No

load fuel consumption per kWh of rated caapacity is taken as

0.2 (L/Hr/kW rated). Cost of thhe generator is 6000 USD and

replacement cost is USD 4000

f) Price of the charge controlleer is included in the converter

price, as there is no option inn HOMER to include charge

controller price. Life time of the

t controller is taken to be 5

years. No cost for converter (acc to dc) is included in the cost

as every BTS has its own rectifi

fier. System fixed capital cost is

taken USD 5770, which inclludes cost of the solar panel

structure, battery rack, energgy meter with data logger,

transportation and installation cost, cost of protection and

alarm devices, cable and connecctors,

g) Efficiency of the rectifier is considered

c

90% (ac-dc)

h) System fixed O&M cost is considered

c

USD 1000 per year.

(a)

(b)

(c)

(d)

Fig. 5 HOMER Analysis Outputs (a) Monthh wise Global Horizontal Radiation of Dhaka (also showing the clearness Index), (b)

Monthly average electric production (contriibution of energy from Solar PV and from diesel geneerator), (c) Cost wise cash flow

summary (net present cost) of the project coonsidering the project life 20 years,

(d) Componennt wise cash flow summary (net

present cost).

HOMER Output Data: The yearly energy output from PV is

proportional to the solar radiation data.

d

The energy

contribution from solar is 59% and that from diesel generator

is 41% (Renewable Fraction is 58.7%), The

T cost of energy

stands at USD 0.628. Cost wise, net presentt cost is highest for

the initial capital cost followed by fuel cosst (diesel) and then

by replacement cost (as batteries need to be

b replaced after 5

years and the generator needs to be replacced after 10 years.

Component wise cash flow is the highest for the generator

(the fuel cost is included in the generator cost). It is

mentionable that PV cost is thee second lowest among the five

types of costs.

An Analysis for cost optimization by varying the PV panel

capacity

From the above analysis it is seen that the PV cost component

is one of the lowest. We varied the size of the PV, keeping the

capacity of the other components unchanged and observed

how the energy cost varies. We have started with the PV

panel capacity from 3kWp to 14 kWp. As the capacity of the

PV panel increases obviously the renewable fraction of the

system increases. Although the increase of the PV panel size

increases the initial capital cost, but the cost of energy is

decreasing.

Cost of Energy (US$)

0.8

Renewable fraction

100

80

0.7

60

40

0.6

20

0

0.5

2

Renewable Fraction (%)

Cost of Energy

7

12

PV panel size (kWp)

Fig. 6 Variation of cost of energy and renewable fraction of

the system with the variation of PV panel capacity.

The optimum size of the PV panels is 10kWp considering the

1.5 kW constant load. From the above sensitivity curve it is

seen that the cost of energy (CoE) decreases with the increase

in panel size from 3kWp. At 10 kWp the CoE is minimum

and that is US$ 0.575/kWh. The renewable fraction increases

with the increase of panel size.

V. CONCLUSIONS

Using the model that is currently under consideration by

mobile operators in Bangladesh, the cost of electricity in a

solar diesel hybrid energy system for a BTS comes to US$

0.63 per unit of electricity, for a 36kWh BTS using a

generator runtime for 2.5~3 hours a day. However, the cost of

electricity can be reduced by increasing the panel size while

keeping other factors constant. In fact, without using a storage

system, PV energy is cheaper than the diesel generator for

small systems like BTS. This implies that during daytime use,

without storage PV energy is more economic than a diesel

generator based energy.

The nominal cost of using a solar diesel hybrid is higher than

that of a diesel powered BTS, but this is only so under current

market conditions and prices. A significant part of the cost of

diesel power comes from the price of diesel, which is highly

variable and unpredictable. In fact, diesel may appear

affordable now, but price volatility may change this in favour

of solar power at any time in the near future (On the other

hand the price of the solar panel is continuously decling). The

dependence on solar energy, where the investment occurs in

the beginning of the project, has the additional advantage of

removing unknown costs in the near and distant future. This

will remove financial and operational risk, and create a more

dependable source of power in the long term.

REFERENCES

[1]

GSM world network on http://www.gsm.org/technology/gsm, Retrieved

on October, 2011

[2]

http://investor-relations.grameenphone.com/Company-Facts.

html,

accessed 27th September 2011.

[3]

Annual Report 2009-2010, Bangladesh Power development Board, 2011

[4]

John Willson, Energy & Emissions at Cellular Base Stations Smart Cell

Site Design for Energy Efficiency & Reduced Carbon Footprint WireIE

Holdings International Inc. 2009

[5]

Carbon Beta and Equity Performance: An Empirical Analysis,

Innovest Strategic Value Advisors, 2007

[6]

T. C. Hassett, K. L. Borgerson, Harnessing Natures Power:

Deploying and Financing On-Site Renewable Energy, World

Resources Institute, 2009.

[7]

Renewable Energy Policy of Bangladesh, Power division,Ministry of

Power Energy and Mineral Resources, Government of Peoples

Republic of Bangladesh, 2008

[8]

Mark Bolinger and Ryan Wiser, The Value of Renewable Energy as a

Hedge Against Fuel Price Risk: Analytic Contributions from Economic

and Finance Theory Analytical Methods for Energy Diversity and

Security: Portfolio Optimization in the Energy Sector: A Tribute to the

work of Dr. Shimon Awerbuch, 2008.

[9] M. Bazilian and F. Roques, Using Portfolio Theory to Value Power

Generation Investments, Analytical Methods for Energy Diversity

and Security: Portfolio Optimization in the Energy Sector: A Tribute to

the work of Dr. Shimon Awerbuch, 2008.

[10] C. Hanson, The Business Case for Using Renewable Energy, World

Resources Institute Corporate Guide to Green Power Markets,

Installment

7

[online]

Available

at:

pdf.wri.org/greenpower_corporate8.pdf

[11] Final Report of Solar and Wind Energy Resource Assessment

(SWERA)- Bangladesh, Renewable Energy Research Centre (RERC),

University of Dhaka, Bangladesh, February, 2007.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BSBWOR403: Assessment Task-1Document17 pagesBSBWOR403: Assessment Task-1Ashiqur Rahman100% (1)

- Providing a Security Solution for METROPOLIS CAPITAL BankDocument52 pagesProviding a Security Solution for METROPOLIS CAPITAL BankHasantha Indrajith100% (2)

- Buildchamp Construction Company (BCC)Document26 pagesBuildchamp Construction Company (BCC)Ikram100% (1)

- GT Solar Inverters for Multi-Megawatt Solar Power PlantsDocument8 pagesGT Solar Inverters for Multi-Megawatt Solar Power PlantsRajesh Kumar MamidiNo ratings yet

- Janis Yue X140 Final PaperDocument6 pagesJanis Yue X140 Final PaperJanis YNo ratings yet

- Ecpe Multilevel SchweizerDocument30 pagesEcpe Multilevel SchweizerRajesh Kumar MamidiNo ratings yet

- Preemie SolidsDocument3 pagesPreemie SolidsRajesh Kumar MamidiNo ratings yet

- Preemie SolidsDocument3 pagesPreemie SolidsRajesh Kumar MamidiNo ratings yet

- 1456299215list of Candidates Who Attended The Chartered Engineers Skill Development Program at NISE - Feb2016 (Posted On 18-02-2016)Document1 page1456299215list of Candidates Who Attended The Chartered Engineers Skill Development Program at NISE - Feb2016 (Posted On 18-02-2016)Rajesh Kumar MamidiNo ratings yet

- Zerosequence ImpedanceDocument16 pagesZerosequence ImpedancecisnatelNo ratings yet

- WACO 5106 Digital Insulation Tester 5000VDocument2 pagesWACO 5106 Digital Insulation Tester 5000VRajesh Kumar Mamidi100% (1)

- High Paying Business Certifications 2Document26 pagesHigh Paying Business Certifications 2David SubelianiNo ratings yet

- EAs 1 ADocument12 pagesEAs 1 ARajesh Kumar MamidiNo ratings yet

- Intelec October Conference Publication No. lEEDocument5 pagesIntelec October Conference Publication No. lEERajesh Kumar MamidiNo ratings yet

- T 8Document6 pagesT 8Rajesh Kumar MamidiNo ratings yet

- T 11Document5 pagesT 11Rajesh Kumar MamidiNo ratings yet

- T 14Document7 pagesT 14Rajesh Kumar MamidiNo ratings yet

- EPRI - Vanadium Redox Flow Batteries 2007Document102 pagesEPRI - Vanadium Redox Flow Batteries 2007Rajesh Kumar MamidiNo ratings yet

- ICICI RecruitmentDocument2 pagesICICI RecruitmentRajesh Kumar MamidiNo ratings yet

- Corrigedum For SSC Prasar BharatiDocument2 pagesCorrigedum For SSC Prasar BharatiVikram Singh AdhikariNo ratings yet

- Biodiesel Production From Heterotrophic Micro Algal OilDocument6 pagesBiodiesel Production From Heterotrophic Micro Algal Oilmarrakamasutras100% (1)

- Rural Water Engineering Subordinate ServiceDocument17 pagesRural Water Engineering Subordinate Servicechanjaneyulu9No ratings yet

- JNTU Kakinada EEE SyllabusDocument85 pagesJNTU Kakinada EEE SyllabusRajesh Kumar MamidiNo ratings yet

- 7 RmuDocument16 pages7 Rmujoydeep_d3232No ratings yet

- BP RAO Interview (1) - 1Document1 pageBP RAO Interview (1) - 1Rajesh Kumar MamidiNo ratings yet

- Estimating Manual: Department For Infrastructure and TransportDocument107 pagesEstimating Manual: Department For Infrastructure and TransportErwin AriolaNo ratings yet

- The Theory of Stock Market EfficiencyDocument21 pagesThe Theory of Stock Market EfficiencyMario Andres Rubiano RojasNo ratings yet

- Due DiligenceDocument18 pagesDue DiligenceAlesha Horn100% (1)

- HR Risk ManagementDocument18 pagesHR Risk ManagementomsharatNo ratings yet

- Chapter 1-Activity 1 (Minglana, Mitch T.)Document6 pagesChapter 1-Activity 1 (Minglana, Mitch T.)Mitch Tokong MinglanaNo ratings yet

- People and Participation FinalDocument61 pagesPeople and Participation Finalgilbertociro100% (2)

- Gar Meaar 2022Document302 pagesGar Meaar 2022Oleksiy KuntsevychNo ratings yet

- Happiness ExpressDocument3 pagesHappiness ExpressHeni Oktavianti100% (3)

- 探险之旅风险承担同意书 (VIP)Document2 pages探险之旅风险承担同意书 (VIP)Xin yiNo ratings yet

- Learning Activity Sheets 8, Quarter 2 For Business Finance Grade 12 Business FinanceDocument9 pagesLearning Activity Sheets 8, Quarter 2 For Business Finance Grade 12 Business FinanceMatt Yu EspirituNo ratings yet

- Fundamentals of Project FinanceDocument5 pagesFundamentals of Project FinanceChiranjib ParialNo ratings yet

- A Thesis Proposal: Risk and Return Analysis Nic Asia Bank LimitedDocument7 pagesA Thesis Proposal: Risk and Return Analysis Nic Asia Bank LimitedSuman ShresthaNo ratings yet

- Baseline Risk Assessment MatrixDocument1 pageBaseline Risk Assessment Matrixpawan pandeyNo ratings yet

- India's IT Infrastructure ServicesDocument27 pagesIndia's IT Infrastructure Servicesmartand86No ratings yet

- 3210AFE Week 2Document64 pages3210AFE Week 2Jason WestNo ratings yet

- CPCCCA3003 - Appendix 4Document14 pagesCPCCCA3003 - Appendix 4Aditya Sharma100% (1)

- Praesidio Report - Exploring Effective Prevention Education Responses To Dangerous Online ChallengesDocument38 pagesPraesidio Report - Exploring Effective Prevention Education Responses To Dangerous Online ChallengesTechCrunch100% (1)

- Prospective, Retrospective, and Cross-Sectional Studies: Patrick BrehenyDocument17 pagesProspective, Retrospective, and Cross-Sectional Studies: Patrick BrehenyGracie RobbieNo ratings yet

- PROBLEM PRIORITY SETTING (Acob)Document3 pagesPROBLEM PRIORITY SETTING (Acob)Audrey Ann AcobNo ratings yet

- SMBC Trade Finance Almanac PDFDocument260 pagesSMBC Trade Finance Almanac PDFanwar187100% (1)

- GRC Seminar - Okt 2010Document4 pagesGRC Seminar - Okt 2010Athanasios PapanikolaouNo ratings yet

- AudTheo Reporting Chapter 3Document58 pagesAudTheo Reporting Chapter 3Tuya Dayom100% (1)

- Tcs GCP Whitepaper Technology and Wealth Management Best PracticeDocument19 pagesTcs GCP Whitepaper Technology and Wealth Management Best PracticeSoma DewanganNo ratings yet

- Israel Railways LTD.: Railway Buffer Stops Planning GuidelinesDocument40 pagesIsrael Railways LTD.: Railway Buffer Stops Planning GuidelinesShahryarNo ratings yet

- Cannabisandman PDFDocument178 pagesCannabisandman PDFReplay MotishNo ratings yet

- Lesson-Plan-In-Identifying-Hazards-And-Risks TLE 7Document4 pagesLesson-Plan-In-Identifying-Hazards-And-Risks TLE 7Ruwiyna Kai Wheng100% (6)