Professional Documents

Culture Documents

Chapter 21 - Answer

Uploaded by

Rexon EnriquezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 21 - Answer

Uploaded by

Rexon EnriquezCopyright:

Available Formats

MANAGEMENT ACCOUNTING (VOLUME II) - Solutions Manual

CHAPTER 21

DECENTRALIZED OPERATIONS AND

SEGMENT REPORTING

I.

Questions

1. Decentralization means that decision making in an organization isnt

confined to a few top executives, but rather is spread throughout the

organization with managers at various levels making key operating

decisions relating to their sphere of responsibility.

2. The benefits include: (1) a spreading of decision-making responsibility

among managers, thereby relieving top management from day-to-day

problem solving and allowing them to focus their time on long-range

planning; (2) training in decision making for lower-level managers,

thereby preparing them to assume greater responsibility; (3) greater job

satisfaction and greater incentive for lower-level managers; (4) better

decisions, since decisions are made at the level where the problem is best

understood; and (5) a more effective basis for measuring managerial

performance through the creation of profit and investment centers.

3. The three business practices are (a) omission of some costs in the

assignment process, (b) the use of inappropriate allocation methods, and

(c) allocation of common costs to segments.

4. The contribution margin represents the portion of sales revenue

remaining after deducting variable expenses. The segment margin

represents the margin still remaining after deducting traceable fixed

expenses from the contribution margin. Generally speaking, the

contribution margin is most useful as a planning tool in the short run,

when fixed costs dont change. The segment margin is most useful as a

planning tool in the long run, when fixed costs will be changing, and as a

tool for evaluating long-run segment performance. One concept is no

more useful to management than the other; the two concepts simply relate

to different planning horizons.

II. Problems

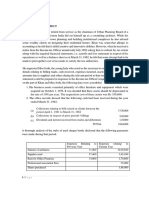

Problem 1 (Working with a Segmented Income Statement)

21-1

Chapter 21 Decentralized Operations and Segment Reporting

Requirement 1

P75,000 40% CM ratio = P30,000 increased contribution margin in Cebu.

Since the fixed costs in the office and in the company as a whole will not

change, the entire P30,000 would result in increased net operating income for

the company.

It is incorrect to multiply the P75,000 increase in sales by Cebus 25%

segment margin ratio. This approach assumes that the segments traceable

fixed expenses increase in proportion to sales, but if they did, they would not

be fixed.

Requirement 2

a. The segmented income statement follows:

Segments

Total Company

Manila

Cebu

Amount

%

Amount

%

Amount

%

Sales.............................................

P800,000 100.0% P200,000 100% P600,000 100%

Less variable expenses.................

420,000

52.5

60,000 30

360,000 60

Contribution margin....................

380,000

47.5

140,000 70

240,000 40

Less traceable fixed

expenses....................................

168,000

21.0

78,000 39

90,000 15

Office segment margin.................

212,000

26.5

P 62,000 31% P150,000 25%

Less common fixed

expenses not traceable to

segments...................................

120,000

15.0

Net operating income..................

P 92,000

11.5%

b. The segment margin ratio rises and falls as sales rise and fall due to the

presence of fixed costs. The fixed expenses are spread over a larger base

as sales increase.

In contrast to the segment ratio, the contribution margin ratio is a stable

figure so long as there is no change in either the variable expenses or the

selling price of a unit of service.

Problem 2 (Segmented Income Statement)

Requirement 1

Sales

Total Company

Amount

%

P1,500,000 100.0

21-2

East

Amount

%

P400,000 100

Geographic Market

Central

West

Amount

%

Amount

P600,000 100 P500,000

%

100

Decentralized Operations and Segment Reporting Chapter 21

Less variable expenses

Contribution margin

Less traceable fixed expenses

Geographic market segment margin

Less common fixed expenses not

traceable to geographic markets*

Net operating income (loss)

588,000

912,000

770,000

39.2

60.8

51.3

142,000

9.5

175,000

P (33,000)

11.7

(2.2)

208,000

192,000

240,000

52

48

60

180,000

420,000

330,000

30

70

55

200,000

300,000

200,000

40

60

40

P(48,000) (12) P90,000

15

P100,000

20

* P945,000 P770,000 = P175,000.

Requirement 2

Incremental sales (P600,000 15%).......................................................................

P90,000

Contribution margin ratio........................................................................................

70%

Incremental contribution margin..............................................................................

63,000

Less incremental advertising expense.......................................................................

25,000

Incremental net operating income............................................................................

P38,000

Yes, the advertising program should be initiated.

III. Multiple Choice Questions

1.

2.

3.

4.

5.

B

C

B

B

B

6.

7.

8.

9.

10.

A

C

B

D

C

11. A

12. B

21-3

You might also like

- Latif Khan PDFDocument2 pagesLatif Khan PDFGaurav AroraNo ratings yet

- Case 6 - LETA Learning SystemsDocument12 pagesCase 6 - LETA Learning Systemsmanzanojade1985No ratings yet

- OM Assignment II Baria Planning Solutions, Inc: Fixing The Sales ProcessDocument5 pagesOM Assignment II Baria Planning Solutions, Inc: Fixing The Sales ProcessSabir Kumar SamadNo ratings yet

- Chapter 1 Cost Accounting Information For Decision MakingDocument5 pagesChapter 1 Cost Accounting Information For Decision MakingLorren K GonzalesNo ratings yet

- Blocher8e EOC SM Ch18 Final StudentDocument50 pagesBlocher8e EOC SM Ch18 Final StudentKatelynNo ratings yet

- MCS Chapter 4 - Vershire Management Control System Responsibility CentersDocument3 pagesMCS Chapter 4 - Vershire Management Control System Responsibility CentersDwitya Aribawa100% (1)

- 000 Citibank Client Services 040 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 040 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AMónica M. RodríguezNo ratings yet

- Report On McDonaldsDocument34 pagesReport On McDonaldsAyaz Waris KhanNo ratings yet

- Chapter 20 - AnswerDocument4 pagesChapter 20 - AnsweragnesNo ratings yet

- ch12 TBDocument25 pagesch12 TBsofikhdyNo ratings yet

- ACC51112 Responsibility Accounting WITH ANSWERSDocument8 pagesACC51112 Responsibility Accounting WITH ANSWERSjasNo ratings yet

- A. Make Key Decisions OnlyDocument3 pagesA. Make Key Decisions OnlyKath LeynesNo ratings yet

- Session 2: Budget As A System by by Dr. Anubha SrivastavaDocument28 pagesSession 2: Budget As A System by by Dr. Anubha SrivastavaanubhaNo ratings yet

- Chapter 5 Profit CentersDocument20 pagesChapter 5 Profit Centers'Osvaldo' Rio75% (4)

- 05 - Profit CentersDocument12 pages05 - Profit CentersMuhammad Fadli Halim100% (1)

- Tarek Isteak Tonmoy-2016010000130 PDFDocument7 pagesTarek Isteak Tonmoy-2016010000130 PDFTarek Isteak TonmoyNo ratings yet

- MCS Paper Solution FinalDocument207 pagesMCS Paper Solution FinalSuhana SharmaNo ratings yet

- P5 Apc NOTEDocument248 pagesP5 Apc NOTEprerana pawarNo ratings yet

- Profit Center: Group 2: Charesareig Farrajean Freolo Justine Arboleda Jecellebuere Jeyjavier Nathalie OcanaDocument34 pagesProfit Center: Group 2: Charesareig Farrajean Freolo Justine Arboleda Jecellebuere Jeyjavier Nathalie OcanaShelvanNo ratings yet

- Performance ReportingDocument62 pagesPerformance ReportingLive LoveNo ratings yet

- Managerial AccountingDocument4 pagesManagerial AccountingAbdul Basit FastNUNo ratings yet

- Responsibilty Acctng.Document8 pagesResponsibilty Acctng.JoshNo ratings yet

- 05 - Profit CentersDocument12 pages05 - Profit CentersJason KurniawanNo ratings yet

- Divisional Performance ManagementDocument8 pagesDivisional Performance ManagementADEYANJU AKEEMNo ratings yet

- Management Reports Control Reports Performance Evaluation and ManagementDocument43 pagesManagement Reports Control Reports Performance Evaluation and ManagementTricia Marie TumandaNo ratings yet

- Mas 01Document8 pagesMas 01Raquel Villar DayaoNo ratings yet

- 4 Responsibility and Transfer Pricing Part 1Document10 pages4 Responsibility and Transfer Pricing Part 1Riz CanoyNo ratings yet

- Ch9 DivisionPerformDocument30 pagesCh9 DivisionPerformKieu Anh Bui LeNo ratings yet

- Chapter 21 - AnswerDocument4 pagesChapter 21 - Answerlooter198No ratings yet

- Exercise 3Document5 pagesExercise 3Mikhail Aron GorreNo ratings yet

- UntitledDocument20 pagesUntitledapriljoyguiawanNo ratings yet

- Chapter 14 - AnswerDocument24 pagesChapter 14 - AnswerAgentSkySky100% (1)

- Profit CenterDocument3 pagesProfit CenterMAHENDRA SHIVAJI DHENAKNo ratings yet

- Management Control System Profit CentreDocument5 pagesManagement Control System Profit CentrealvickyNo ratings yet

- DecentralizationDocument16 pagesDecentralizationJara LuthfiNo ratings yet

- 07 X07 A ResponsibilityDocument12 pages07 X07 A ResponsibilityJohnMarkVincentGiananNo ratings yet

- TUTORIAL 1 - WK 1Document7 pagesTUTORIAL 1 - WK 1ReenalNo ratings yet

- CH 5 Profit CentersDocument13 pagesCH 5 Profit CentersAurellia AngelineNo ratings yet

- IntroDocument37 pagesIntrowfd52muni100% (1)

- 07 X07 A ResponsibilityDocument12 pages07 X07 A ResponsibilityMark Anthony Bulahan100% (1)

- Vershire Company's Management Control System: Case Study Presentation OnDocument28 pagesVershire Company's Management Control System: Case Study Presentation OnYuva ShokeNo ratings yet

- Profit Centre PDFDocument12 pagesProfit Centre PDFalvickyNo ratings yet

- Chap 022Document8 pagesChap 022Audrey TamNo ratings yet

- Garfield Cost Accounting Chapter 2Document18 pagesGarfield Cost Accounting Chapter 2ViancaPearlAmores100% (1)

- Unit Five: Relevant Information and Decision MakingDocument39 pagesUnit Five: Relevant Information and Decision MakingEbsa AbdiNo ratings yet

- Responsibility CentresDocument9 pagesResponsibility Centresparminder261090No ratings yet

- Group 2 GroupDocument11 pagesGroup 2 GroupRupeshri PawarNo ratings yet

- MCS-Responsibility Centres & Profit CentresDocument24 pagesMCS-Responsibility Centres & Profit CentresAnand KansalNo ratings yet

- CHAPTER 2 and 3 MANAGEMENT ACCOUNTINGDocument14 pagesCHAPTER 2 and 3 MANAGEMENT ACCOUNTINGMae Ann RaquinNo ratings yet

- Lecture - Decentralization and Responsibility AcctgDocument23 pagesLecture - Decentralization and Responsibility AcctgNick JagolinoNo ratings yet

- Chapter 14 - AnswerDocument17 pagesChapter 14 - AnswerJhudzxkie VhientesaixNo ratings yet

- HACC215 - Tutorial Questions - 084429Document40 pagesHACC215 - Tutorial Questions - 084429nmutaveniNo ratings yet

- Case Citibank: Performace EvaluationDocument9 pagesCase Citibank: Performace EvaluationFun Toosh345No ratings yet

- CH 7 Cost IIDocument9 pagesCH 7 Cost IIfirewNo ratings yet

- Responsibility AccountingDocument13 pagesResponsibility AccountingSushmita SonwaniNo ratings yet

- Every SBU Is A Profit Center But Every Profit Center Is Not A SBUDocument4 pagesEvery SBU Is A Profit Center But Every Profit Center Is Not A SBUDivyesh NagarkarNo ratings yet

- EY Effective Cost Analysis For The Financial Services SectorDocument50 pagesEY Effective Cost Analysis For The Financial Services SectorHarry CerqueiraNo ratings yet

- Profit Building: Cutting Costs Without Cutting PeopleFrom EverandProfit Building: Cutting Costs Without Cutting PeopleRating: 4 out of 5 stars4/5 (1)

- Achievements and Skills Showcase Made Easy: The Made Easy Series Collection, #4From EverandAchievements and Skills Showcase Made Easy: The Made Easy Series Collection, #4No ratings yet

- Chapter 20 - Answer PDFDocument6 pagesChapter 20 - Answer PDFCarmila BaltazarNo ratings yet

- Chapter 19Document16 pagesChapter 19CreeeepyChaaaaanNo ratings yet

- Chapter 18 - AnswerDocument7 pagesChapter 18 - AnswerDave Manalo100% (1)

- Chapter 17 - AnswerDocument2 pagesChapter 17 - AnswerCrisalie BocoboNo ratings yet

- Capacity Development AgendaDocument7 pagesCapacity Development AgendaApple PoyeeNo ratings yet

- FPA Candidate HandbookDocument32 pagesFPA Candidate HandbookFreddy - Marc NadjéNo ratings yet

- Ibm 5Document4 pagesIbm 5Shrinidhi HariharasuthanNo ratings yet

- Entreprunership Chapter 3Document12 pagesEntreprunership Chapter 3fitsumNo ratings yet

- Temporary Employment ContractDocument2 pagesTemporary Employment ContractLancemachang Eugenio100% (2)

- Course Outline PDFDocument2 pagesCourse Outline PDFSamiun TinyNo ratings yet

- Deepa Project FinalDocument94 pagesDeepa Project Finalsumi akterNo ratings yet

- Test Questions: True/FalseDocument50 pagesTest Questions: True/FalseThảo Ngân ĐoànNo ratings yet

- Summer Internship Report: Submitted byDocument53 pagesSummer Internship Report: Submitted byruchi mishraNo ratings yet

- Peo Scsp0508Document318 pagesPeo Scsp0508rajrudrapaa100% (1)

- Accounting TermsDocument5 pagesAccounting TermsShanti GunaNo ratings yet

- Prelim Quiz 1-Problem SolvingDocument3 pagesPrelim Quiz 1-Problem SolvingPaupauNo ratings yet

- CBU2202200910 Customer Relationship ManangementDocument2 pagesCBU2202200910 Customer Relationship ManangementSimbarashe MaringosiNo ratings yet

- HRM Assignment 1Document5 pagesHRM Assignment 1Laddie LMNo ratings yet

- Best Practices in Public-Sector Human Resources Wisconsin State Government 1Document16 pagesBest Practices in Public-Sector Human Resources Wisconsin State Government 1Mahmoud SabryNo ratings yet

- Construction Project Manager ResumeDocument2 pagesConstruction Project Manager ResumeNawed HasanNo ratings yet

- CRESDocument3 pagesCRESAvijit ChakrabortyNo ratings yet

- 10 Pitfalls March 2015 PDFDocument1 page10 Pitfalls March 2015 PDFShahid AkramNo ratings yet

- Laundry ServicesDocument40 pagesLaundry ServicesVivek VardhanNo ratings yet

- Productivity & Work Study BasicsDocument34 pagesProductivity & Work Study BasicsSangam Kadole75% (4)

- Class Discussion - Case Study IKEADocument2 pagesClass Discussion - Case Study IKEASneha SamuelNo ratings yet

- Topic 2 - Ias 16Document46 pagesTopic 2 - Ias 16jpatrickNo ratings yet

- Calgary Cooperative Funeral Services - Business PlanDocument21 pagesCalgary Cooperative Funeral Services - Business PlanastuteNo ratings yet

- Cia1002 Group Assignment 2Document23 pagesCia1002 Group Assignment 2U2003136 STUDENTNo ratings yet

- November 2021 Recent Opportunities - 1Document42 pagesNovember 2021 Recent Opportunities - 1shiv vaibhavNo ratings yet

- Toyota Shaw Vs CA DigestDocument2 pagesToyota Shaw Vs CA Digestda_sein32No ratings yet

- Human Resource Management (Case Study)Document1 pageHuman Resource Management (Case Study)Amrit Baniya0% (2)