Professional Documents

Culture Documents

F7 (Int), Financial Reporting: Table 1 - Additions To F7

Uploaded by

furqanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

F7 (Int), Financial Reporting: Table 1 - Additions To F7

Uploaded by

furqanCopyright:

Available Formats

F7 (INT), FINANCIAL REPORTING

The main areas to be added or deleted from the syllabus from that date are shown in Table 1 and 2 below:

Table 1 Additions to F7

A2c

Explain and compute amounts using the

following measures:

i historical cost

ii current cost

iii net realisable value

iv present value of future cash flows

v fair value

The principles of IFRS

13, Fair Value

Measurement. have

been made more

explicit in the F7

syllabus

B5d

Indicate for the following categories of

financial instruments how they should be

measured and how any gains and losses

from subsequent measurement should be

treated in the financial statements:

i amortised cost

ii fair value through other comprehensive

income (including where an irrevocable

election has been made for equity

instruments that are not held for trading)

iii fair value through profit or loss

This change has been

made to reflect the

measurement

classifications of IFRS

9, Financial

Instruments.

B10

a Explain and apply the principles of

recognition of revenue:

i Identification of contracts

ii Identification of performance obligations

iii Determination of transaction price

iv Allocation of the price to performance

obligations

v Recognition of revenue when/as

performance obligations are satisfied.

b Explain and apply the criteria for

recognising revenue generated from

contracts where performance obligations

are satisfied over time or at a point in time.

c Describe the acceptable methods for

measuring progress towards complete

satisfaction of a performance obligation.

These changes have

been made to reflect

the principles of IFRS

15, Revenue from

contracts with

customers.

d Explain and apply the criteria for the

recognition of contract costs.

e Apply the principles of recognition of

revenue, and specifically account for the

following types of transaction:

i principal versus agent

ii repurchase agreements

iii bill and hold arrangements

iv consignments

f Prepare financial statement extracts for

contracts where performance obligations

are satisfied over time.

Table 2 Deletions to F7

There have been no deletions to the study guide for the exam year commencing 1 September 2015.

P2 (INT), CORPORATE REPORTING

Table 1 Additions to P2 (INT)

There have not been any additions to the study guide for the exam year commencing 1 September 2015. However,

there have been minor amendments to the wording of some of the study guide outcomes mainly corresponding to

changes within examinable documents.

Section and subject area

Syllabus content

Discuss and apply the criteria that

must be met before an entity can

apply the revenue recognition model

to that contract.

C1b and c

Discuss and apply the five-step

model which relates to revenue

earned from a contract with a

customer.

C3d

Apply and discuss the treatment of

the expected loss impairment model.

H3a

Discuss current issues in corporate

reporting, including:

i recent IFRSs

Section and subject area

Syllabus content

ii practice and regulatory issues

iii proposed changes to IFRS

iv problems with extant standards

(This outcome has been expanded to

clarify the range of issues that may

be tested within this subject area)

Table 2 Deletions to P2 INT

There have not been no specific deletions from the study guide for the exam year commencing 1 September 2015. A

number of outcomes have been combined or removed as detailed in the table below.

Section and subject area (in prior

year study guide)

Syllabus content

C6a and b

Outline the principal considerations in

developing a set of accounting

standards for SMEs

C8a and b

Discuss the reasons why the IFRS for

SMEs does not address certain

topics.

The syllabus must be read in conjunction with the Examinable Documents list. The main changes for the year from 1

September 2015 are the inclusion of IFRS 15Revenue from Contracts with Customers and IFRS 9 Financial

Instruments (July 2014), as well as changes in the list of exposure drafts and discussion papers that are examinable.

You might also like

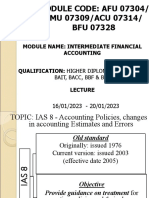

- IAS 8 Accounting Policies Changes Estimates ErrorsDocument12 pagesIAS 8 Accounting Policies Changes Estimates ErrorsVictoria GraurNo ratings yet

- IFRS Inventory Valuation and Revenue Recognition GuideDocument4 pagesIFRS Inventory Valuation and Revenue Recognition GuideMark Laurence SanchezNo ratings yet

- Comparing Financial Statements Over TimeDocument25 pagesComparing Financial Statements Over TimeHhhhhNo ratings yet

- Value Ifrs PLC 2022 Final 30 JuneDocument230 pagesValue Ifrs PLC 2022 Final 30 Junetunlinoo.067433No ratings yet

- Heather Keller Acct 3001 FASB Codification Assign.Document5 pagesHeather Keller Acct 3001 FASB Codification Assign.Heather KellerNo ratings yet

- Disclosure Initiative (Amendments To Ias 1) : International Financial Reporting Bulletin 2015/02Document6 pagesDisclosure Initiative (Amendments To Ias 1) : International Financial Reporting Bulletin 2015/02studentul1986No ratings yet

- Jennifer C. Tacadino Iv-CmaDocument26 pagesJennifer C. Tacadino Iv-CmaAngela Luz de LimaNo ratings yet

- PAS 8 Accounting PoliciesDocument7 pagesPAS 8 Accounting PoliciesrandyNo ratings yet

- IAS 1 Financial Statement Presentation OverviewDocument12 pagesIAS 1 Financial Statement Presentation OverviewRia GayleNo ratings yet

- Group-IV Paper-16: Advanced Financial Accounting & Reporting Dec 2011Document71 pagesGroup-IV Paper-16: Advanced Financial Accounting & Reporting Dec 2011pkaul1No ratings yet

- International Financial Reporting Standards: Revised Readiness ToolkitDocument40 pagesInternational Financial Reporting Standards: Revised Readiness ToolkitBikaZeeNo ratings yet

- NZ en Accounting Alertdec 2020Document15 pagesNZ en Accounting Alertdec 2020Ike FinchNo ratings yet

- Financial Reporting Environment OverviewDocument72 pagesFinancial Reporting Environment OverviewKishore borderNo ratings yet

- International Financial Reporting Standards: Revised Readiness ToolkitDocument39 pagesInternational Financial Reporting Standards: Revised Readiness ToolkitBASANTA KUMAR SAHUNo ratings yet

- BSB52415 Diploma of Marketing and Communication Assessment 3: Financial AnalysisDocument14 pagesBSB52415 Diploma of Marketing and Communication Assessment 3: Financial AnalysisASTRI CAHYANINGSIHNo ratings yet

- Homework On Presentation of Financial Statements (Ias 1)Document4 pagesHomework On Presentation of Financial Statements (Ias 1)Jazehl Joy ValdezNo ratings yet

- Tax Audit Checklist for Form 3CDDocument36 pagesTax Audit Checklist for Form 3CDKoolmindNo ratings yet

- MC Questions CH 24-1Document19 pagesMC Questions CH 24-1lynn_mach_1No ratings yet

- Chapter 5 - Accounting Policies, Changes in Accounting Estimates and Errors (Compatibility Mode)Document6 pagesChapter 5 - Accounting Policies, Changes in Accounting Estimates and Errors (Compatibility Mode)Chi Nguyễn Thị KimNo ratings yet

- Toa 123Document13 pagesToa 123fredeksdiiNo ratings yet

- 2014 Adv Dip IPFM FR SyllabusDocument10 pages2014 Adv Dip IPFM FR Syllabusa1000000000No ratings yet

- Accounting Policies SummaryDocument6 pagesAccounting Policies SummaryCaptain ObviousNo ratings yet

- AdsadsdDocument28 pagesAdsadsdTong Wilson60% (5)

- IAS & IFRS Assignments SummaryDocument6 pagesIAS & IFRS Assignments SummaryMEO lalandNo ratings yet

- Applying IFRS 15 - P&DDocument73 pagesApplying IFRS 15 - P&DMuhammad Zaid Sahak100% (1)

- IAS 8 PPT FinalDocument19 pagesIAS 8 PPT Finaljaneth pallangyoNo ratings yet

- IASB publishes revised Conceptual Framework for Financial ReportingDocument6 pagesIASB publishes revised Conceptual Framework for Financial ReportingMd Jonayed HossainNo ratings yet

- Accounting Change ModuleDocument3 pagesAccounting Change ModuleArnyl ReyesNo ratings yet

- Theories Discontinued, Acctg Changes, Interim, Opseg, ErrorsDocument43 pagesTheories Discontinued, Acctg Changes, Interim, Opseg, ErrorsMmNo ratings yet

- Conceptual Frame Work QBDocument15 pagesConceptual Frame Work QBnanthini nanthini100% (1)

- Revisionary Test Paper: Group IvDocument107 pagesRevisionary Test Paper: Group IvRama AnandNo ratings yet

- G4+1 1999Document37 pagesG4+1 1999David KohNo ratings yet

- IFRS Illustrative Financial StatementsDocument306 pagesIFRS Illustrative Financial Statementsjohnthorrr100% (1)

- CFAS PAS 1 10 Answer Key1Document4 pagesCFAS PAS 1 10 Answer Key1Mickey Moran86% (7)

- Intermediate Accounting I IntroductionDocument6 pagesIntermediate Accounting I IntroductionJoovs JoovhoNo ratings yet

- Review Questions Financial Accounting and Reporting PART 1Document3 pagesReview Questions Financial Accounting and Reporting PART 1Claire BarbaNo ratings yet

- 2 Financial Accounting Theory 2 Financial Accounting TheoryDocument14 pages2 Financial Accounting Theory 2 Financial Accounting TheorythankyounextNo ratings yet

- Ias 8 Ias 38 Ias 40Document6 pagesIas 8 Ias 38 Ias 40stillwinmsNo ratings yet

- Class 1 and 2 Chapter 3. Reporting Financial PerformanceDocument59 pagesClass 1 and 2 Chapter 3. Reporting Financial PerformanceTowhidul IslamNo ratings yet

- IAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFDocument20 pagesIAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFMichelle TanNo ratings yet

- Ufrs Quiz 1-3Document7 pagesUfrs Quiz 1-3Adria MeNo ratings yet

- Intermediate Accounting III ReviewerDocument3 pagesIntermediate Accounting III ReviewerRenalyn PascuaNo ratings yet

- Disclosure of Accounting Policies Standard AS 1Document6 pagesDisclosure of Accounting Policies Standard AS 1spikysanchitNo ratings yet

- EY Applying Ifrs Presentation and Disclosure Requirements of Ifrs 15 October 2017Document51 pagesEY Applying Ifrs Presentation and Disclosure Requirements of Ifrs 15 October 2017Jb AugustNo ratings yet

- Advanced Financial Accounting Under IFRS - Lecture Notes - final.2019-2020CuSol PDFDocument118 pagesAdvanced Financial Accounting Under IFRS - Lecture Notes - final.2019-2020CuSol PDFSorin GabrielNo ratings yet

- 1st PB-TADocument12 pages1st PB-TAGlenn Patrick de LeonNo ratings yet

- Ia3 Review On Notes To FSDocument11 pagesIa3 Review On Notes To FSErich Posillo AranasNo ratings yet

- Ifrs 1 - 2005Document49 pagesIfrs 1 - 2005jon_cpaNo ratings yet

- Advanced Financial Accounting Under IFRSDocument57 pagesAdvanced Financial Accounting Under IFRSAlexandra Mihaela TanaseNo ratings yet

- Tutorial 1 FA IVDocument5 pagesTutorial 1 FA IVZHUN HONG TANNo ratings yet

- As1-Diclosure of Accounting PoliciesDocument6 pagesAs1-Diclosure of Accounting PoliciesDharmesh MistryNo ratings yet

- CH 4 - Intermediate Accounting Test BankDocument51 pagesCH 4 - Intermediate Accounting Test BankCorliss Ko100% (11)

- Income Statement and Related Information: Chapter Learning ObjectivesDocument53 pagesIncome Statement and Related Information: Chapter Learning Objectivesheyhey100% (1)

- Learning Activity Sheet # 1 Lesson / Topic: Financial Statements Learning Targets: Reference(s)Document8 pagesLearning Activity Sheet # 1 Lesson / Topic: Financial Statements Learning Targets: Reference(s)Franz Ana Marie CuaNo ratings yet

- Disclosure of Accounting PoliciesDocument7 pagesDisclosure of Accounting PoliciesSatesh Kumar KonduruNo ratings yet

- IFRS Illustrative Financial Statements (Dec 2019) FINALDocument290 pagesIFRS Illustrative Financial Statements (Dec 2019) FINALPaddireddySatyamNo ratings yet

- Audit Committee Responsibilities QuizDocument9 pagesAudit Committee Responsibilities QuizrenesanitaNo ratings yet

- Wiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Level 7 Complete Course OutlinesDocument247 pagesLevel 7 Complete Course Outlinesfurqan100% (1)

- RatioDocument1 pageRatiofurqanNo ratings yet

- Ledger AccountsDocument1 pageLedger AccountsfurqanNo ratings yet

- IAS 37 PRactice QuestionsDocument4 pagesIAS 37 PRactice Questionsfurqan83% (6)

- Pracitce Question For ABCDocument2 pagesPracitce Question For ABCfurqan100% (1)

- Control Accounts: Summarize Receivables & PayablesDocument4 pagesControl Accounts: Summarize Receivables & Payablesfurqan100% (1)

- Control Account ReconciliationsDocument3 pagesControl Account ReconciliationsfurqanNo ratings yet

- IAS 38 Practice QuestionsDocument3 pagesIAS 38 Practice Questionsfurqan67% (3)

- KPMG Review GuideDocument96 pagesKPMG Review GuideGiri Dharan67% (3)

- IAS 37 ProvisionsDocument9 pagesIAS 37 ProvisionsfurqanNo ratings yet

- Impairment of Non-Current Assets and Financial Reporting IssuesDocument3 pagesImpairment of Non-Current Assets and Financial Reporting IssuesfurqanNo ratings yet

- IAS 38 Practice QuestionsDocument3 pagesIAS 38 Practice Questionsfurqan67% (3)

- Acca Fia Fa1Document36 pagesAcca Fia Fa1furqanNo ratings yet

- Quiz - IAS 16 - Property, Plant and Equipment: (A) (B) (C) (D)Document2 pagesQuiz - IAS 16 - Property, Plant and Equipment: (A) (B) (C) (D)furqan100% (2)

- IAS 16 Property, Plant and Equipment Accounting DisclosureDocument2 pagesIAS 16 Property, Plant and Equipment Accounting Disclosurefurqan0% (1)

- IAS 12 Income Taxes Standard ExplainedDocument40 pagesIAS 12 Income Taxes Standard ExplainedfurqanNo ratings yet

- IAS 16 QuizDocument2 pagesIAS 16 Quizfurqan100% (1)

- Sa June11 Process2Document8 pagesSa June11 Process2LeoEdeOmoregieNo ratings yet

- 2015 Acca p3 Passcards BPPDocument48 pages2015 Acca p3 Passcards BPPAnonymous wJB2b3nZNo ratings yet

- HND Level 5 Assignment Feedback FormDocument3 pagesHND Level 5 Assignment Feedback FormfurqanNo ratings yet

- Fma Past Papers 1Document23 pagesFma Past Papers 1Fatuma Coco BuddaflyNo ratings yet

- Unit 3 - Personal IdentificationDocument38 pagesUnit 3 - Personal IdentificationValeska EluzenNo ratings yet

- Ifrs 15Document58 pagesIfrs 15furqanNo ratings yet

- IELTS Books TitlesDocument1 pageIELTS Books TitlesfurqanNo ratings yet

- IAS 37 ProvisionsDocument9 pagesIAS 37 ProvisionsfurqanNo ratings yet

- The Economic Impact of Cloud Computing On Business Creation, Employment and Output in EuropeDocument40 pagesThe Economic Impact of Cloud Computing On Business Creation, Employment and Output in EuropeKishore Khsgas KNo ratings yet

- Bachelor of IT and Management CollegeDocument36 pagesBachelor of IT and Management CollegeKIST College0% (1)

- Economic Growth and DevelopmentDocument38 pagesEconomic Growth and DevelopmentHimanshu YadavNo ratings yet

- Eminent Domain and Police PowerDocument8 pagesEminent Domain and Police PowershivaNo ratings yet

- Emba55a s9 Problem1&15Document5 pagesEmba55a s9 Problem1&15Senna El0% (1)

- Roadshow Beiersdorf / Société Générale: Paris, June 11th, 2009Document17 pagesRoadshow Beiersdorf / Société Générale: Paris, June 11th, 2009Gc DmNo ratings yet

- FINA 4383 Quiz 2Document9 pagesFINA 4383 Quiz 2Samantha LunaNo ratings yet

- HW5 SolnDocument7 pagesHW5 SolnZhaohui Chen100% (1)

- Risk Management Concept Building Summary Book by CA Shivam PalanDocument125 pagesRisk Management Concept Building Summary Book by CA Shivam PalanShivanand MuleNo ratings yet

- Unit-6 Business Social Responsibility and Managerial EthicsDocument12 pagesUnit-6 Business Social Responsibility and Managerial Ethicsashish guptaNo ratings yet

- Week 7Document37 pagesWeek 7NageenNo ratings yet

- Theoretical Framework Quality Development TheoryDocument2 pagesTheoretical Framework Quality Development TheoryMiguel VienesNo ratings yet

- Risk and Return FundamentalsDocument19 pagesRisk and Return FundamentalsMariana MuñozNo ratings yet

- HRM Practices in SCB, UBL and Citi BankDocument52 pagesHRM Practices in SCB, UBL and Citi Bankhraza3No ratings yet

- Basics of Economy PDFDocument14 pagesBasics of Economy PDFtarakesh17No ratings yet

- Ba (H) 20-Sem.i-Iii-V PDFDocument14 pagesBa (H) 20-Sem.i-Iii-V PDFapoorvaNo ratings yet

- Financial Modeling ExamplesDocument8 pagesFinancial Modeling ExamplesRohit BajpaiNo ratings yet

- Chapter 12Document100 pagesChapter 12cutiee cookieyNo ratings yet

- Application For The Post Of: Career ObjectiveDocument2 pagesApplication For The Post Of: Career ObjectiveGopi KrishnaNo ratings yet

- ICAP Cost Past PaperDocument9 pagesICAP Cost Past Paperfarooqshah4uNo ratings yet

- Purchase & Materials Management QuizDocument10 pagesPurchase & Materials Management QuizMuzammil Makandar83% (6)

- Find equilibrium price and quantity algebraicallyDocument2 pagesFind equilibrium price and quantity algebraicallyJoshua S Mjinja100% (1)

- Chapter 06 Cost Behaviour ADocument86 pagesChapter 06 Cost Behaviour Ajji100% (1)

- JP Morgan - Global ReportDocument88 pagesJP Morgan - Global Reporttrinidad01No ratings yet

- Olicy Eries: Who Owns Taxi Licences?Document22 pagesOlicy Eries: Who Owns Taxi Licences?Asafo AddaiNo ratings yet

- Wage Payment SystemsDocument2 pagesWage Payment SystemsShekhar J DekaNo ratings yet

- Ch03 - The Environments of Marketing ChannelsDocument25 pagesCh03 - The Environments of Marketing ChannelsRaja Muaz67% (3)

- Grade 9 - Academic Guide SY 2016-2017Document64 pagesGrade 9 - Academic Guide SY 2016-2017happymabeeNo ratings yet

- South Africa Tyre Market Forecast and Oppertunities 2017Document8 pagesSouth Africa Tyre Market Forecast and Oppertunities 2017TechSciResearch0% (1)

- Additional Case Study Chapter 02: The Marketing Environment: Palmer: Introduction To Marketing, Third EditionDocument2 pagesAdditional Case Study Chapter 02: The Marketing Environment: Palmer: Introduction To Marketing, Third EditionBless Fenya SedinaNo ratings yet