Professional Documents

Culture Documents

Income Tax - Deferred Tax Liability & Asset

Uploaded by

ImranMamajiwalaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax - Deferred Tax Liability & Asset

Uploaded by

ImranMamajiwalaCopyright:

Available Formats

6/25/2014

Meaning of Deferred Tax Liability & Asset in Simple Words

Login | Register

Member Strength 13,01,319 and growing..

CCI ONLINE COACHING

NEWS

EXPERTS

ARTICLES

FILES

FORUM

JOBS

STREAM

EVENTS

STUDENTS

JUDICIARY

MORE

Home > Articles > Accounts > Meaning of Deferred Tax Liability & Asset in Simple Words

Bitdefender Total Security 2012

Meaning of Deferred Tax Liability &

Asset in Simple Words

Vignesh Killur

on 21 March 2012

Comments

In Simple words, Deferred Tax Liability is a Provision for Future Taxation.

This is in stark Contrast to Provision for Taxation. Provision for Taxation is basically a

provision for Current year Taxation.

Deferred Tax Liability arises due to timing difference in the value of Assets as per Books of

Accounts and as per Income Tax Act.

Also we can say that Deferred Tax Liability/Asset arises due to the difference between Profit

as per Books of Accounts (P&L Account) and profit as per Income Tax Act. (Taxable

Income).

Depreciation is the main reason for difference in the profits as per books of Accounts and

Taxable profits as per Income Tax Act. Both Income Tax Act and Companies Act prescribe

different rates of Depreciation for different categories of Assets.

Featured Article Writer of the Month

Let me illustrate with a simple example. Suppose a Company purchases a Wind Turbine

Generator (Windmill). The Depreciation which can be claimed in the Books of Accounts in as

per Companies Act is let's say 20% (assumed). The Depreciation as per Income Tax Act is

Quick Links

80% for Windmill.

Submit Articles

Now a Windmill is purchased for Rs. 10,00,00,000/- (10 Crores). The Depreciation Claimed in

Browse by C ategory

the First year is:

Recent C omments

Popular Articles

Value of Windmill:

Depreciation

as

10,00,00,000/per

Books

Accounts:

of 10,00,00,000

20%=

Depreciation as per Income Tax 10,00,00,000

Act:

80%=

DIFFERENCE

DEFERRED TAX LIABILITY @ 30.9%

2,00,00,000/-

Search Articles

GO

8,00,00,000/-

-6,00,00,000/-1,85,40,000/-

(Deferred Tax Liability is created at the highest Marginal Rate of Tax i.e. 30.9%)

What is the Meaning of Creating this Deferred Tax Liability of Rs. 1,85,40,000/- (One Crore

eighty five lakhs forty thousand)

It simply means that the company will definitely have a tax Liability of that much in the

future years. This is because in the years to come the Depreciation as per Income Tax Act

will be lesser that the Depreciation as per Books of Accounts. Hence in these years the

Company will have to create a Deferred Tax Asset

http://www.caclubindia.com/articles/meaning-of-deferred-tax-liability-asset-in-simple-words-13385.asp#.U6pEjvmSxyw

Recent

Popular

C omments

The Union Budget 2014 - ICAI Propositions

Acceptance of Deposits Under Companies

Act, 2013

Denial to grant Input tax credit on Flimsy

Grounds

GST and the expectation in the Union

Budget

Tax Evasion in India - Ways, Effect and

Control

Tax & Corporate law implication on Capital

reduction

Meetings & Minutes - Key Changes under

the Co.Act, 2013

Tax (Service Tax) Implication of Freelance

1/4

6/25/2014

Meaning of Deferred Tax Liability & Asset in Simple Words

Work in India - Part 2

First Report of the Tax Administration

Reform Commission (TARC)

Kaun Banega 'Service Receiver'?

For clarity the Following Table is provided. Let's take the figures in Lakhs for Easier

Understanding:

Let Windmill Value be Rs. 100,000/Year

5*

TOTAL

Dep as per IT

Act

(80%

OF

80,000 16,000 3,200

640

160

Subscribe to Articles Feed

Enter your email address

100,000

WDV)

CAclubindia

Dep

as

per

Books

20,000 20,000 20,000

20,000

20,000

100,000

60,000 -4,000 -16,800

-19,360

-19,840

(20% SLM)

DIFFERENCE

DTL/DTA

30.9%

18,540 -1,236 -5,191.20 -5,982.24 -6,130.56 0

Like 151,624

More Subscription Options Twitter Linkedin

Browse by Category

Income Tax

Note * In year 5 as per Income tax act let's assume the entire Remaining Balance is written

off

Audit

Students

Accounts

VAT

CONCLUSIONS:

C areer

1. In Year 1 Deferred Tax Liability amounting to Rs. 18,540/- has to be created. This means

Service Tax

that

C orporate Law

in Year 1, the company has postponed its tax Liability of Rs. 18,540/- to the Future

years. This Liability will come back to the company one day or the other. (Unless 80 IA is

Info Technology

claimed)

Excise

Shares & Stock

2. In Year 2, as you can clearly see the Depreciation as per Books has gone up. This means

Others

that Depreciation as per IT act will be lesser as a result the profit as per IT Act will be more

Taxpayers

and as a result the company has to pay Rs. 1236/- more tax during this year.

3. Thus in the remaining years the company will have Deferred Tax Assets And the Deferred

Tax Liability created in the first year will be reversed in the subsequent 4 years.

4. Thus when the WDV of Assets as per Books and WDV as per IT Act both become ZERO,

there is neither Deferred Tax Liability nor Deferred Tax Asset as there is no timing Difference

Deferred Tax is purely an accounting Concept. AS 22 - "Accounting for Taxes on Income

deals with Deferred Tax.

The following are the Accounting treatment and Tax treatment of Deferred Tax:

ACCOUNTING ENTRIES:

P&L A/c Dr

18,540.00

To Deferred Tax Liability A/c

18,540.00

(Being Deferred Tax Liability created in Year 1 at the Maximum Marginal Rate of Tax)

Deferred Tax is shown under Provisions in Balance Sheet.

Deferred Tax Asset

Dr

1,236.00

To P & L A/c

1,236.00

(Being Deferred Tax Liability Reversed in Year 2)

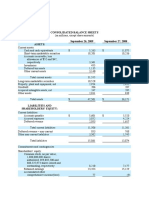

Finally at the end of Year 5 the Balance Sheet will be thus:

PROVISIONS:

Deferred Tax Liability

Less: Reversed upto year 4

18,540

Rs.Ps

12409.44

http://www.caclubindia.com/articles/meaning-of-deferred-tax-liability-asset-in-simple-words-13385.asp#.U6pEjvmSxyw

2/4

6/25/2014

Meaning of Deferred Tax Liability & Asset in Simple Words

Reversed in year 5

6130.56

18,540

TAX TREATMENT:

INCOME FROM BUSINESS:

Net Profit as per P&L A/c

XXX

Add: Deferred Tax Liability

XXX

Less: Deferred Tax Asset

XXX

Note: As Deferred Tax Liability is a Provision, it should be disallowed as an expense. Also

deferred tax asset should be deducted from Income.

As seen from the above, deferred tax liability/asset does not affect tax computation.

PURPOSE: The Purpose of DTA/DTL: More appropriate presentation of financial statements

and to make the various stakeholders aware of the tax situation of the company.

It may be noted that 80-IA (Section 80 IA of IT Act) exemption may be availed for Windmill.

That is if the company starts to claim 80-IA benefit after 5 years (80-IA benefit can be

claimed in any 10 Assessment years out of 15 A.Y's after buying windmill), then there will be

more benefits to the company as the Income in the first 5 years will be low and the company

can claim business loss as there will be huge Depreciation as per IT.

PART II: In the next part, I will explain the how deferred tax should be computed if 80IA exemption is availed for Windmill having useful life of more than 5 years. Also I will explain

the other items which cause a difference in profits as per Books and IT Act. Also I will explain

how to deal with brought forward losses.

HOPE IT WAS AN INTERESTING READ.

REGARDS

VIGGI

(I work as an Articled Assistant for a firm in Mangalore and the Information gained was during

the course of my work.)

921

Published in Accounts

Source : Various Text Books on Accounting Standards & Own Research

Views : 265879

Other Articles by Vignesh Killur

231 Comments for this Article

You need to be logged in to post comment

Soumya Prakash Rath

Wrote on 22 June 2014

Thank you lot for the said information.

kehkashan hussain

Wrote on 09 June 2014

Thanks a lot, it's very useful information.

kishor Wrote on 26 May 2014

http://www.caclubindia.com/articles/meaning-of-deferred-tax-liability-asset-in-simple-words-13385.asp#.U6pEjvmSxyw

3/4

6/25/2014

Meaning of Deferred Tax Liability & Asset in Simple Words

asm

Show more Comments

All Comments :: 231

Related Articles

Economy & Investment Relationship

Accounting Deep Discount Bonds - I GAAP & IFRS

Excise Duty & C ustoms Duty Exemptions for Supplies

C ompany Law Board & SARFAESI proceedings?

Stock Options - Measurement, Accounting & Disclosure

Last Date to Appoint C ost Auditor & Penal Provisions

Understanding deductions of section 80-IA & IB

Valuation & Reverse C harge for C onstruction Industry

Service Tax Liability on Sub-Brokers

High C ourts & Lower C ourts & few issues?

View other articles from this category

Other Newer Articles

The Union Budget 2014 - ICAI Propositions

Acceptance of Deposits Under Companies Act, 2013

Denial to grant Input tax credit on Flimsy Grounds

GST and the expectation in the Union Budget

Tax Evasion in India - Ways, Effect and Control

Tax & Corporate law implication on Capital reduction

Meetings & Minutes - Key Changes under the Co.Act, 2013

Tax (Service Tax) Implication of Freelance Work in India - Part 2

First Report of the Tax Administration Reform Commission (TARC)

Kaun Banega 'Service Receiver'?

back to the top

Our Network Sites

About

We are Hiring

Disclaimer

Advertise

Terms of Use

Privacy Policy

Contact Us

2014 CAclubindia.com. Let us grow stronger by mutual exchange of know ledge.

http://www.caclubindia.com/articles/meaning-of-deferred-tax-liability-asset-in-simple-words-13385.asp#.U6pEjvmSxyw

4/4

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Balance SheetDocument25 pagesBalance SheetImran AhmedNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Arahan:: Bahagian Ini Mengandungi EMPAT (4) Soalan Berstruktur. Jawab SEMUA SoalanDocument11 pagesArahan:: Bahagian Ini Mengandungi EMPAT (4) Soalan Berstruktur. Jawab SEMUA Soalansi monNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Term I Report - FA - Berger PaintsDocument8 pagesTerm I Report - FA - Berger PaintsSumant IssarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Evaluation of ProductsDocument24 pagesEvaluation of ProductsRohan Sen SharmaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Business ValuationDocument52 pagesBusiness ValuationAnand SubramanianNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- MOP-Capital Theory Assignment-020310Document4 pagesMOP-Capital Theory Assignment-020310charnu1988No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Long+Quiz+6 Dec2019 KeyDocument6 pagesLong+Quiz+6 Dec2019 KeySheikh Sahil MobinNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Lbo Case StudyDocument6 pagesLbo Case StudyRishabh MishraNo ratings yet

- Nail - ModifiedDocument28 pagesNail - ModifiedFekadie TesfaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Chapter 8 MowenDocument25 pagesChapter 8 MowenRosamae PialaneNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- CH 1Document33 pagesCH 1Shopno ChuraNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- FSA Chapter 01Document40 pagesFSA Chapter 01Oktaviani Ari WardhaningrumNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Why Oil and Gas Development Company Limited (OGDCL) Should Not Be PrivatizedDocument11 pagesWhy Oil and Gas Development Company Limited (OGDCL) Should Not Be PrivatizedZohaib GondalNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Financial Accounting: A Managerial Perspective: Sixth EditionDocument15 pagesFinancial Accounting: A Managerial Perspective: Sixth EditionKARISHMA SANGHAINo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Economic Value Added (EVA) of Sample CompaniesDocument44 pagesEconomic Value Added (EVA) of Sample CompaniesRikesh Daliya83% (6)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- TRSMGT Assignment Case On Valuation of BanksDocument5 pagesTRSMGT Assignment Case On Valuation of BanksKrishna TejNo ratings yet

- Section 1 30 Marks Determine The Single Most Appropriate Response To The Following QuestionsDocument15 pagesSection 1 30 Marks Determine The Single Most Appropriate Response To The Following QuestionsHelloWorldNowNo ratings yet

- View The Un Audited Financial Results For The Second Quarter 30 September 2022 and Press Release - 0Document16 pagesView The Un Audited Financial Results For The Second Quarter 30 September 2022 and Press Release - 0Shradha mamNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Mark Scheme Summer 2009: GCE Accounting (8011-9011)Document16 pagesMark Scheme Summer 2009: GCE Accounting (8011-9011)Nooh donoNo ratings yet

- Application: Estimating Carborundum'S Cost of CapitalDocument1 pageApplication: Estimating Carborundum'S Cost of CapitalmacarenaNo ratings yet

- ACC-179 - SAS - Day-13 - Quiz PDFDocument2 pagesACC-179 - SAS - Day-13 - Quiz PDFYana Dela CernaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Chapter 13, Taped Quiz: Table 13-9Document2 pagesChapter 13, Taped Quiz: Table 13-9Jay REyNo ratings yet

- Acc Assignments QuestionDocument2 pagesAcc Assignments QuestionNUR NADHIRAH INSYIRAH NORHASMINo ratings yet

- Breakeven PointDocument11 pagesBreakeven PointEvince EarlNo ratings yet

- Correcting The Trial Balance 2022Document3 pagesCorrecting The Trial Balance 2022Charlemagne Jared RobielosNo ratings yet

- Auditing Cup - 19 Rmyc Answer Key Elimination Round EasyDocument14 pagesAuditing Cup - 19 Rmyc Answer Key Elimination Round EasyFarhana GuiandalNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- BCG Forage Core Strategy - Telco (Task 2 Additional Data)Document11 pagesBCG Forage Core Strategy - Telco (Task 2 Additional Data)Akshay rajNo ratings yet

- M12 Titman 2544318 11 FinMgt C12Document80 pagesM12 Titman 2544318 11 FinMgt C12marjsbarsNo ratings yet

- Accounting Activity 4Document2 pagesAccounting Activity 4Ar JayNo ratings yet

- JPM MCPDocument11 pagesJPM MCPmmmansfiNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)