Professional Documents

Culture Documents

Federal 2016 :D

Uploaded by

Anguila Angel Anguila AngelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Federal 2016 :D

Uploaded by

Anguila Angel Anguila AngelCopyright:

Available Formats

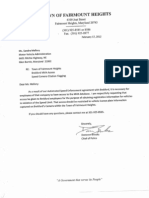

RODOLFO SANDOVAL

LOT. VALLE REAL, MORALES

IZABAL

GUATEMALA 18004

Dear RODOLFO,

Enclosed please find two copies of your 2015 federal income tax return, which you prepared through Sprintax tax

software.

File one copy with the Internal Revenue Service and retain the second copy for your records.

Tax Summary

Filing Status

Other single nonresident alien

Gross Income

$8441

Federal Adjusted Gross Income

$8441

Federal Taxable Income

$4441

Refund amount

$544

We have attached instructions detailing how to file your tax return with the IRS.

How much is my refund?

Your federal tax refund is $ 544. This will be deposited directly into your checking account.

How do I file my tax return?

Your tax return must be received by April 18th. However, we recommend you mail your federal return as soon as

possible using the United States Post Office certified mail service or an approved delivery service that will provide

proof of your mailing date, to:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215, USA

When will I receive my refund?

The IRS will take between 4 and 6 weeks to process your application.

You can check the status of your federal tax refund at any time by using Wheres My Refund?, an interactive tool

available on www.IRS.gov. You can also call the IRS TeleTax System at (800) 829-4477 or the IRS Refund Hotline

at (800) 829-1954.

When you call or visit the IRS website, youll need the following:

The first social security number shown on the federal return

Your filing status (Filing Status from Return)

The exact amount of the refund shown on your federal return ($amount of the refund)

If you have any questions, please email us at hello@sprintax.com.

Sincerely,

The Sprintax team

Federal Tax Return checklist

1. Review and sign the following forms where indicated with a pen mark

Form

Action

1040NR-EZ

W8BEN

8843

Sign on page 1

Sign on page 1 (if present)

Sign on page 2 (if present)

2. Attach copies of all your income and tax withholding statements showing the US income sources you used to

prepare your tax return:

Income Document

Quantity

W-2 form(s), Copy B *

* - If there is a difference between copies B and C, please attach Copy C to your Federal tax return.

3. Confirm that the SSN on all your W2(s) is correct.

4. If you dont have your W2(s), then copies of your final cumulative payslips will also be accepted.

If you dont have your W2(s) or payslip(s) or if the SSN is incorrect, then youll need to obtain a valid W2 from your

employer(s).

5. We recommend you mail your federal return with all necessary supporting documents and attachments as soon

as possible using the United States Post Office certified mail service or an approved delivery service that will provide

proof of your mailing date, to:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215, USA

Federal Tax Return

Frequently Asked Questions

How long will it take to process my US tax return?

The Federal tax Office will take about 6-8 weeks after receiving your paper return to process your application.

What is the April 18th deadline?

The April 18th tax deadline is the date by which all tax returns must be filed for the previous year.

If you owe the tax office money and you dont file your tax return by April 18th, the US tax authorities will impose late

filing penalties and interest on the amount you owe, so the sooner you apply the better.

How do I know whats happening with my tax return?

You can check the status of your federal tax return at any time by using Wheres My Refund?, an interactive tool

available at www.IRS.gov. You can also call the IRS TeleTax System at (800) 829-4477 or the IRS Refund Hotline at

(800) 829-1954.

When you call or visit the IRS website, youll need the following:

The first social security number shown on the federal return

Your filing status (Filing Status from Return)

The exact amount of the refund shown on your federal return ($amount of the refund)

Please allow at least 4 weeks for the IRS to process your federal tax return

What if I dont have a Social Security Number

If you never received a Social Security Number youll need to organize a temporary number. This is called an

Individual Taxpayer Identification Number (ITIN). If you did not apply for an ITIN within Sprintax, you can still apply

for it at www.taxback.com/usa-ITIN-numbers.asp.

What is a W2 form?

To claim your US tax refund, the IRS will need copies of your W2 form(s) or final payslips. The W2 form is the official

government form you receive from your employer(s) in January after the tax year ends. The W2 form shows the

amount of money you earned and the amount of tax you paid for that employer.

If youve misplaced your W2(s) / final payslips or never received it, youll need to request a new one from your

employer.

What is a 1042-S form?

If youve worked as a trainee, student, teacher or researcher in the US on a J or F visa, you might have received a

1042-S form instead of a W2 form. You should receive the 1042-S by mid-March of the following tax year.

It outlines income such as scholarships, fellowships, self-employment or grants and any income exempt from tax

because of a tax treaty. We can use either the W2 or 1042-S to apply for your tax refund.

Can I file my taxes electronically?

No. Electronic filing, known as e-filing, is only available to US nationals and residents filing 1040, 1040EZ or 1040A.

The 1040NR tax return is the form for non-residents such as J, M Q and F visa-holders, and is not available in

electronic format and so cannot be e-filed.

What tax returns can I prepare through Sprintax?

With Sprintax, you can prepare your Federal, State, FICA and local state tax returns.

Can I use an international tax treaty?

Depending on your nationality and other conditions you may be able to claim a tax refund under international tax

treaties, which are agreements between the US and other countries that allow you to claim back tax you paid while

working abroad.

Sprintax always checks if youre eligible for an international tax treaty when we prepare your US tax return. Your

eligibility depends on factors like your nationality, length of stay, stay purpose, type of income, your visa and other.

Could I owe money to the US tax authorities?

Depending on how your employer taxed you and what is the actual tax liability under the tax law, you may owe tax or

be due a tax refund. If you have a tax liability or if other particular factors apply, then you have an obligation to file a

tax return. Sprintax takes into consideration all of these factors.

Remember, if you owe money and dont file your return before the April 18th deadline, youll get penalties and fines

added to the amount you owe.

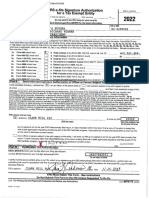

FEDERAL TAX RETURN

FOR

RODOLFO ENRIQUE SANDOVAL

2015

FEDERAL FILING COPY

SUBMIT TO THE INTERNAL REVENUE SERVICE

Form

1040NR-EZ

U.S. Income Tax Return for Certain

Nonresident Aliens With No Dependents

OMB No. 1545-0074

2015

Department of the Treasury

Information about Form 1040NR-EZ and its instructions is at www.irs.gov/form1040nrez.

Internal Revenue Service

Your first name and initial

Identifying number (see instructions)

Last name

Please print

or type.

See

separate

instructions.

Filing Status

Check only one box.

Attach

Form(s)

W-2 or

1042-S

here.

Also

attach

Form(s)

1099-R if

tax was

withheld.

Refund

Direct

deposit?

See

instructions.

Amount

You Owe

Third

Party

Designee

Sign

Here

Paid

Preparer

Use Only

SANDOVAL

085-04-6135

LOT. VALLE REAL, MORALES

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

IZABAL

Foreign country name

GUATEMALA

X Single nonresident alien

Foreign province/state/county

Foreign postal code

18004

Married nonresident alien

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18a

b

19

20

21

22

23a

b

d

e

Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . . . . . . . . . .

Taxable refunds, credits, or offsets of state and local income taxes . . . . . .

Scholarship and fellowship grants. Attach Form(s) 1042-S or required statement. .

Total income exempt by a treaty from page 2, Item J(1)(e) .

6

0

Add lines 3, 4, and 5 . . . . . . . . . . . . . . . . . . . . .

Scholarship and fellowship grants excluded . . . . .

8

0

Student loan interest deduction . . . . . . . . .

9

0

Subtract the sum of line 8 and line 9 from line 7. This is your adjusted gross income .

Itemized deductions (see instructions) . . . . . . . . . . . . . . .

Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . .

Exemption (see instructions) . . . . . . . . . . . . . . . . . . .

Taxable income. Subtract line 13 from line 12. If line 13 is more than line 12, enter -0Tax. Find your tax in the tax table in the instructions . . . . . . . . . . .

Unreported social security and Medicare tax from Form: a 4137

b 8919

Add lines 15 and 16. This is your total tax . . . . . . . . . . . . .

Federal income tax withheld from Form(s) W-2 and 1099-R

18a

987

Federal income tax withheld from Form(s) 1042-S . . .

18b

0

2015 estimated tax payments and amount applied from 2014 return

19

0

Credit for amount paid with Form 1040-C . . . . .

20

Add lines 18a through 20. These are your total payments . . . . . . . .

If line 21 is more than line 17, subtract line 17 from line 21. This is the amount you overpaid

Amount of line 22 you want refunded to you. If Form 8888 is attached, check here

Routing number 1 1 1 3 0 8 0 5 7 c Type: X Checking

Savings

Account number 4 0 4 0 9 4 8 6 4

If you want your refund check mailed to an address outside the United States not

shown above, enter that address here:

24

25

26

Amount of line 22 you want applied to your 2016 estimated tax

24

Amount you owe. Subtract line 21 from line 17. For details on how to pay, see instructions

Estimated tax penalty (see instructions) . . . . . . .

26

Do you want to allow another person to discuss this return with the IRS (see instructions)?

Designees

name

8441

8441

10

11

12

13

14

15

16

17

8441

21

22

23a

987

544

544

0

0

0

8441

4000

4441

25

Yes. Complete the following.

443

443

0

No

Personal identification

number (PIN)

Phone

no.

3

4

5

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

and belief, they are true, correct, and accurately list all amounts and sources of U.S. source income I received during the tax year. Declaration of

preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Keep a copy of

this return for

your records.

RODOLFO E

Present home address (number, street, and apt. no., or rural route). If you have a P.O. box, see instructions.

Your signature

Print/Type preparers name

Firms name

Firm's address

Date

Your occupation in the United States

02/09/2016

Intern/Trainee

Preparer's signature

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see instructions.

Date

If the IRS sent you an Identity Protection

PIN, enter it

here (see inst.)

PTIN

Check

if

self-employed

Firm's EIN

Phone no.

Cat. No. 21534N

Form 1040NR-EZ (2015)

Page 2

Form 1040NR-EZ (2015)

Schedule OI- Other Information (see instructions)

Answer all questions

A

Of what country or countries were you a citizen or national during the tax year?

GUATEMALA

In what country did you claim residence for tax purposes during the tax year?

GUATEMALA

Have you ever applied to be a green card holder (lawful permanent resident) of the United States? .

Yes

X No

Were you ever:

1.

A U.S. citizen? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

A green card holder (lawful permanent resident) of the United States?

. . . . . . . . .

If you answer Yes to (1) or (2), see Pub. 519, chapter 4, for expatriation rules that may apply to you.

.

.

.

.

Yes

Yes

X No

X No

If you had a visa on the last day of the tax year, enter your visa type. If you did not have a visa, enter your U.S. immigration

status on the last day of the tax year.

N/A

Have you ever changed your visa type (nonimmigrant status) or U.S. immigration status? .

If you answered Yes, indicate the date and nature of the change.

List all dates you entered and left the United States during 2015 (see instructions).

Note. If you are a resident of Canada or Mexico AND commute to work in the United States at frequent

intervals, check the box for Canada or Mexico and skip to item H . . . . . . . . . . . .

Date entered United States

mm/dd/yy

Date departed United States

mm/dd/yy

01/01/2015

04/20/2015

Date entered United States

mm/dd/yy

Yes

Canada

X No

Mexico

Date departed United States

mm/dd/yy

Give number of days (including vacation, nonworkdays, and partial days) you were present in the United States during:

0

255

2013

, 2014

, and 2015 110

Did you file a U.S. income tax return for any prior year?

If Yes, give the latest year and form number you filed

X Yes

.

No

2014, 1040NR-EZ

Income Exempt from TaxIf you are claiming exemption from income tax under a U.S. income tax treaty with a foreign country,

complete (1) through (3) below. See Pub. 901 for more information on tax treaties.

1.

Enter the name of the country, the applicable tax treaty article, the number of months in prior years you claimed the

treaty benefit, and the amount of exempt income in the columns below. Attach Form 8833 if required (see instructions).

(a) Country

(b) Tax treaty

article

(d) Amount of exempt

income in current tax year

(c) Number of months

claimed in prior tax years

(e) Total. Enter this amount on Form 1040NR-EZ, line 6. Do not enter it on line 3 or line 5 . . . .

2.

Were you subject to tax in a foreign country on any of the income shown in 1(d) above?

3.

Are you claiming treaty benefits pursuant to a Competent Authority determination? . .

If Yes, attach a copy of the Competent Authority determination letter to your return.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

Yes

No

No

Form 1040NR-EZ (2015)

Form

8843

Statement for Exempt Individuals and Individuals

With a Medical Condition

OMB No. 1545-0074

2015

For use by alien individuals only.

Department of the Treasury

Internal Revenue Service

Information about Form 8843 and its instructions is at www.irs.gov/form8843.

beginning

For the year January 1December 31, 2015, or other tax year

, 2015, and ending

Your first name and initial

Last name

RODOLFO E

Fill in your

addresses only if

you are filing this

form by itself and

not with your tax

return

Part I

, 20

LOT. VALLE REAL, MORALES

GUATEMALA 18004

IZABAL

Your U.S. taxpayer identification number, if any

SANDOVAL

Address in country of residence

Attachment

Sequence No. 102

085-04-6135

Address in the United States

1112 DUNCAN ST.

PAMPA, TX

79065

General Information

1a Type of U.S. visa (for example, F, J, M, Q, etc.) and date you entered the United States

b Current nonimmigrant status and date of change (see instructions) J1

J1 04/21/2014

Of what country were you a citizen during the tax year?

GUATEMALA

What country issued you a passport?

GUATEMALA

Enter your passport number 255312121

Enter the actual number of days you were present in the United States during:

2015 110

2014 255

2013 0

b Enter the number of days in 2015 you claim you can exclude for purposes of the substantial presence test

2

3a

b

4a

Part II

110

Teachers and Trainees

For teachers, enter the name, address, and telephone number of the academic institution where you taught in 2015

For trainees, enter the name, address, and telephone number of the director of the academic or other specialized program

you participated in during 2015

MICHAEL OKEEFFE, 700 ACKERMAN RD SUITE 360, COLUMBUS, OH, 43202, 6142927720

Enter the type of U.S. visa (J or Q) you held during:

2009

2010

. If the type of visa you held during any

2011

2012

2013

2014 J1

of these years changed, attach a statement showing the new visa type and the date it was acquired.

Were you present in the United States as a teacher, trainee, or student for any part of 2 of the 6 prior

X No

calendar years (2009 through 2014)? . . . . . . . . . . . . . . . . . . . . . . . .

Yes

If you checked the Yes box on line 8, you cannot exclude days of presence as a teacher or trainee unless

you meet the Exception explained in the instructions.

Part III

9

Students

Enter the name, address, and telephone number of the academic institution you attended during 2015

10

Enter the name, address, and telephone number of the director of the academic or other specialized program you participated

in during 2015

11

Enter the type of U.S. visa (F, J, M, or Q) you held during:

2009

2010

. If the type of visa you held during any

2011

2012

2013

2014

of these years changed, attach a statement showing the new visa type and the date it was acquired.

Were you present in the United States as a teacher, trainee, or student for any part of more than 5 calendar

X No

years? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

If you checked the Yes box on line 12, you must provide sufficient facts on an attached statement to

establish that you do not intend to reside permanently in the United States.

12

13

14

During 2015, did you apply for, or take other affirmative steps to apply for, lawful permanent resident status

in the United States or have an application pending to change your status to that of a lawful permanent

resident of the United States? . . . . . . . . . . . . . . . . . . . . . . . . . .

If you checked the Yes box on line 13, explain

For Paperwork Reduction Act Notice, see page 4.

Cat. No. 17227H

Yes

X No

Form 8843 (2015)

Page 2

Form 8843 (2015)

Part IV

Professional Athletes

15

Enter the name of the charitable sports event(s) in the United States in which you competed during 2015 and the dates of

competition

16

Enter the name(s) and employer identification number(s) of the charitable organization(s) that benefited from the sports

event(s)

Note. You must attach a statement to verify that all of the net proceeds of the sports event(s) were contributed to the charitable

organization(s) listed on line 16.

Part V

17a

Individuals With a Medical Condition or Medical Problem

Describe the medical condition or medical problem that prevented you from leaving the United States

b Enter the date you intended to leave the United States prior to the onset of the medical condition or medical problem described

on line 17a

c

18

Enter the date you actually left the United States

Physicians Statement:

I certify that

Name of taxpayer

was unable to leave the United States on the date shown on line 17b because of the medical condition or medical problem

described on line 17a and there was no indication that his or her condition or problem was preexisting.

Name of physician or other medical official

Physicians or other medical officials address and telephone number

Date

Physicians or other medical officials signature

Under penalties of perjury, I declare that I have examined this form and the accompanying attachments, and, to the best of my knowledge and belief,

they are true, correct, and complete.

Your signature

Sign here

only if you

are filing

this form by

itself and

not with

your tax

return

02.09.16

Date

Form 8843 (2015)

RODOLFO ENRIQUE SANDOVAL

2015

Form

1040NR-EZ

U.S. Income Tax Return for Certain

Nonresident Aliens With No Dependents

OMB No. 1545-0074

2015

Department of the Treasury

Information about Form 1040NR-EZ and its instructions is at www.irs.gov/form1040nrez.

Internal Revenue Service

Your first name and initial

Identifying number (see instructions)

Last name

Please print

or type.

See

separate

instructions.

Filing Status

Check only one box.

Attach

Form(s)

W-2 or

1042-S

here.

Also

attach

Form(s)

1099-R if

tax was

withheld.

Refund

Direct

deposit?

See

instructions.

Amount

You Owe

Third

Party

Designee

Sign

Here

Paid

Preparer

Use Only

SANDOVAL

085-04-6135

LOT. VALLE REAL, MORALES

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

IZABAL

Foreign country name

GUATEMALA

X Single nonresident alien

Foreign province/state/county

Foreign postal code

18004

Married nonresident alien

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18a

b

19

20

21

22

23a

b

d

e

Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . . . . . . . . . .

Taxable refunds, credits, or offsets of state and local income taxes . . . . . .

Scholarship and fellowship grants. Attach Form(s) 1042-S or required statement. .

Total income exempt by a treaty from page 2, Item J(1)(e) .

6

0

Add lines 3, 4, and 5 . . . . . . . . . . . . . . . . . . . . .

Scholarship and fellowship grants excluded . . . . .

8

0

Student loan interest deduction . . . . . . . . .

9

0

Subtract the sum of line 8 and line 9 from line 7. This is your adjusted gross income .

Itemized deductions (see instructions) . . . . . . . . . . . . . . .

Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . .

Exemption (see instructions) . . . . . . . . . . . . . . . . . . .

Taxable income. Subtract line 13 from line 12. If line 13 is more than line 12, enter -0Tax. Find your tax in the tax table in the instructions . . . . . . . . . . .

Unreported social security and Medicare tax from Form: a 4137

b 8919

Add lines 15 and 16. This is your total tax . . . . . . . . . . . . .

Federal income tax withheld from Form(s) W-2 and 1099-R

18a

987

Federal income tax withheld from Form(s) 1042-S . . .

18b

0

2015 estimated tax payments and amount applied from 2014 return

19

0

Credit for amount paid with Form 1040-C . . . . .

20

Add lines 18a through 20. These are your total payments . . . . . . . .

If line 21 is more than line 17, subtract line 17 from line 21. This is the amount you overpaid

Amount of line 22 you want refunded to you. If Form 8888 is attached, check here

Routing number 1 1 1 3 0 8 0 5 7 c Type: X Checking

Savings

Account number 4 0 4 0 9 4 8 6 4

If you want your refund check mailed to an address outside the United States not

shown above, enter that address here:

24

25

26

Amount of line 22 you want applied to your 2016 estimated tax

24

Amount you owe. Subtract line 21 from line 17. For details on how to pay, see instructions

Estimated tax penalty (see instructions) . . . . . . .

26

Do you want to allow another person to discuss this return with the IRS (see instructions)?

Designees

name

8441

8441

10

11

12

13

14

15

16

17

8441

21

22

23a

987

544

544

0

0

0

8441

4000

4441

25

Yes. Complete the following.

443

443

0

No

Personal identification

number (PIN)

Phone

no.

3

4

5

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

and belief, they are true, correct, and accurately list all amounts and sources of U.S. source income I received during the tax year. Declaration of

preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Keep a copy of

this return for

your records.

RODOLFO E

Present home address (number, street, and apt. no., or rural route). If you have a P.O. box, see instructions.

Your signature

Print/Type preparers name

Firms name

Firm's address

Date

Your occupation in the United States

02/09/2016

Intern/Trainee

Preparer's signature

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see instructions.

Date

If the IRS sent you an Identity Protection

PIN, enter it

here (see inst.)

PTIN

Check

if

self-employed

Firm's EIN

Phone no.

Cat. No. 21534N

Form 1040NR-EZ (2015)

Page 2

Form 1040NR-EZ (2015)

Schedule OI- Other Information (see instructions)

Answer all questions

A

Of what country or countries were you a citizen or national during the tax year?

GUATEMALA

In what country did you claim residence for tax purposes during the tax year?

GUATEMALA

Have you ever applied to be a green card holder (lawful permanent resident) of the United States? .

Yes

X No

Were you ever:

1.

A U.S. citizen? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

A green card holder (lawful permanent resident) of the United States?

. . . . . . . . .

If you answer Yes to (1) or (2), see Pub. 519, chapter 4, for expatriation rules that may apply to you.

.

.

.

.

Yes

Yes

X No

X No

If you had a visa on the last day of the tax year, enter your visa type. If you did not have a visa, enter your U.S. immigration

status on the last day of the tax year.

N/A

Have you ever changed your visa type (nonimmigrant status) or U.S. immigration status? .

If you answered Yes, indicate the date and nature of the change.

List all dates you entered and left the United States during 2015 (see instructions).

Note. If you are a resident of Canada or Mexico AND commute to work in the United States at frequent

intervals, check the box for Canada or Mexico and skip to item H . . . . . . . . . . . .

Date entered United States

mm/dd/yy

Date departed United States

mm/dd/yy

01/01/2015

04/20/2015

Date entered United States

mm/dd/yy

Yes

Canada

X No

Mexico

Date departed United States

mm/dd/yy

Give number of days (including vacation, nonworkdays, and partial days) you were present in the United States during:

0

255

2013

, 2014

, and 2015 110

Did you file a U.S. income tax return for any prior year?

If Yes, give the latest year and form number you filed

X Yes

.

No

2014, 1040NR-EZ

Income Exempt from TaxIf you are claiming exemption from income tax under a U.S. income tax treaty with a foreign country,

complete (1) through (3) below. See Pub. 901 for more information on tax treaties.

1.

Enter the name of the country, the applicable tax treaty article, the number of months in prior years you claimed the

treaty benefit, and the amount of exempt income in the columns below. Attach Form 8833 if required (see instructions).

(a) Country

(b) Tax treaty

article

(d) Amount of exempt

income in current tax year

(c) Number of months

claimed in prior tax years

(e) Total. Enter this amount on Form 1040NR-EZ, line 6. Do not enter it on line 3 or line 5 . . . .

2.

Were you subject to tax in a foreign country on any of the income shown in 1(d) above?

3.

Are you claiming treaty benefits pursuant to a Competent Authority determination? . .

If Yes, attach a copy of the Competent Authority determination letter to your return.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

Yes

No

No

Form 1040NR-EZ (2015)

Form

8843

Statement for Exempt Individuals and Individuals

With a Medical Condition

OMB No. 1545-0074

2015

For use by alien individuals only.

Department of the Treasury

Internal Revenue Service

Information about Form 8843 and its instructions is at www.irs.gov/form8843.

beginning

For the year January 1December 31, 2015, or other tax year

, 2015, and ending

Your first name and initial

Last name

RODOLFO E

Fill in your

addresses only if

you are filing this

form by itself and

not with your tax

return

Part I

, 20

LOT. VALLE REAL, MORALES

GUATEMALA 18004

IZABAL

Your U.S. taxpayer identification number, if any

SANDOVAL

Address in country of residence

Attachment

Sequence No. 102

085-04-6135

Address in the United States

1112 DUNCAN ST.

PAMPA, TX

79065

General Information

1a Type of U.S. visa (for example, F, J, M, Q, etc.) and date you entered the United States

b Current nonimmigrant status and date of change (see instructions) J1

J1 04/21/2014

Of what country were you a citizen during the tax year?

GUATEMALA

What country issued you a passport?

GUATEMALA

Enter your passport number 255312121

Enter the actual number of days you were present in the United States during:

2015 110

2014 255

2013 0

b Enter the number of days in 2015 you claim you can exclude for purposes of the substantial presence test

2

3a

b

4a

Part II

110

Teachers and Trainees

For teachers, enter the name, address, and telephone number of the academic institution where you taught in 2015

For trainees, enter the name, address, and telephone number of the director of the academic or other specialized program

you participated in during 2015

MICHAEL OKEEFFE, 700 ACKERMAN RD SUITE 360, COLUMBUS, OH, 43202, 6142927720

Enter the type of U.S. visa (J or Q) you held during:

2009

2010

. If the type of visa you held during any

2011

2012

2013

2014 J1

of these years changed, attach a statement showing the new visa type and the date it was acquired.

Were you present in the United States as a teacher, trainee, or student for any part of 2 of the 6 prior

X No

calendar years (2009 through 2014)? . . . . . . . . . . . . . . . . . . . . . . . .

Yes

If you checked the Yes box on line 8, you cannot exclude days of presence as a teacher or trainee unless

you meet the Exception explained in the instructions.

Part III

9

Students

Enter the name, address, and telephone number of the academic institution you attended during 2015

10

Enter the name, address, and telephone number of the director of the academic or other specialized program you participated

in during 2015

11

Enter the type of U.S. visa (F, J, M, or Q) you held during:

2009

2010

. If the type of visa you held during any

2011

2012

2013

2014

of these years changed, attach a statement showing the new visa type and the date it was acquired.

Were you present in the United States as a teacher, trainee, or student for any part of more than 5 calendar

X No

years? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

If you checked the Yes box on line 12, you must provide sufficient facts on an attached statement to

establish that you do not intend to reside permanently in the United States.

12

13

14

During 2015, did you apply for, or take other affirmative steps to apply for, lawful permanent resident status

in the United States or have an application pending to change your status to that of a lawful permanent

resident of the United States? . . . . . . . . . . . . . . . . . . . . . . . . . .

If you checked the Yes box on line 13, explain

For Paperwork Reduction Act Notice, see page 4.

Cat. No. 17227H

Yes

X No

Form 8843 (2015)

Page 2

Form 8843 (2015)

Part IV

Professional Athletes

15

Enter the name of the charitable sports event(s) in the United States in which you competed during 2015 and the dates of

competition

16

Enter the name(s) and employer identification number(s) of the charitable organization(s) that benefited from the sports

event(s)

Note. You must attach a statement to verify that all of the net proceeds of the sports event(s) were contributed to the charitable

organization(s) listed on line 16.

Part V

17a

Individuals With a Medical Condition or Medical Problem

Describe the medical condition or medical problem that prevented you from leaving the United States

b Enter the date you intended to leave the United States prior to the onset of the medical condition or medical problem described

on line 17a

c

18

Enter the date you actually left the United States

Physicians Statement:

I certify that

Name of taxpayer

was unable to leave the United States on the date shown on line 17b because of the medical condition or medical problem

described on line 17a and there was no indication that his or her condition or problem was preexisting.

Name of physician or other medical official

Physicians or other medical officials address and telephone number

Date

Physicians or other medical officials signature

Under penalties of perjury, I declare that I have examined this form and the accompanying attachments, and, to the best of my knowledge and belief,

they are true, correct, and complete.

Your signature

Sign here

only if you

are filing

this form by

itself and

not with

your tax

return

02.09.16

Date

Form 8843 (2015)

You might also like

- FTF 2022-03-23 1648079099327Document14 pagesFTF 2022-03-23 1648079099327Charles Goodwin100% (1)

- Abdi 2022 - TaxReturnDocument19 pagesAbdi 2022 - TaxReturnAbdu AbabiloNo ratings yet

- 2017 TaxReturnDocument7 pages2017 TaxReturntripsrealplugNo ratings yet

- Glacier Tax User GuideDocument5 pagesGlacier Tax User Guideinter4ever77No ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusKenneth Schackai100% (1)

- 2014 Form 1040 Individual Income Tax ReturnDocument9 pages2014 Form 1040 Individual Income Tax ReturnKuan ChenNo ratings yet

- FTF 2022-04-19 1650352254304Document8 pagesFTF 2022-04-19 1650352254304Charles GoodwinNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statuskenneth kittleson100% (1)

- Ralston Medina W2Document2 pagesRalston Medina W2bussinesl las100% (1)

- FTF 2023-03-20 1679339077907Document15 pagesFTF 2023-03-20 1679339077907ayogbolo100% (1)

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDocument144 pagesLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNo ratings yet

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- 2021TaxReturnPDF 221003 100736Document18 pages2021TaxReturnPDF 221003 100736Tracy SmithNo ratings yet

- Imigracion 2Document15 pagesImigracion 2erickNo ratings yet

- Show 2Document2 pagesShow 2Lexi BrownNo ratings yet

- NY CA 01-01-1953 9984 TXPRDocument98 pagesNY CA 01-01-1953 9984 TXPRAdmin OfficeNo ratings yet

- New Hire Paperwork 2021aDocument27 pagesNew Hire Paperwork 2021aTom BondalicNo ratings yet

- Beginning Practice Return Scenario 1: (Use Your Company's EFIN in Place of XX-XXXX)Document34 pagesBeginning Practice Return Scenario 1: (Use Your Company's EFIN in Place of XX-XXXX)Nancy GuerraNo ratings yet

- Income Tax Return 2019Document6 pagesIncome Tax Return 2019Cindy WheelerNo ratings yet

- 2021 Tax Return Prepared OnlineDocument6 pages2021 Tax Return Prepared OnlineSolomonNo ratings yet

- W2 Preview titleDocument1 pageW2 Preview titlemrs merle westonNo ratings yet

- Ka/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Document4 pagesKa/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Jonathan Seagull LivingstonNo ratings yet

- STF 2023-03-20 1679339081483Document4 pagesSTF 2023-03-20 1679339081483ayogboloNo ratings yet

- MLFA Form 990 - 2016Document25 pagesMLFA Form 990 - 2016MLFANo ratings yet

- Frantz Raymond TaxDocument1 pageFrantz Raymond Taxjoseph GRAND-PIERRENo ratings yet

- Printing H - FORMFLOW - SF3107.FRPDocument10 pagesPrinting H - FORMFLOW - SF3107.FRPKeller Brown JnrNo ratings yet

- USCIS Form I-9: Employment Eligibility VerificationDocument2 pagesUSCIS Form I-9: Employment Eligibility VerificationL vallejo15No ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusBrianNo ratings yet

- Fext 2022-04-17 1650241773772 PDFDocument2 pagesFext 2022-04-17 1650241773772 PDFFera PetersonNo ratings yet

- Young Acc 137 Kongai, Tsate 1040Document26 pagesYoung Acc 137 Kongai, Tsate 1040Kathy YoungNo ratings yet

- Hynum Greg Angela - 20i - CCDocument76 pagesHynum Greg Angela - 20i - CCAdmin OfficeNo ratings yet

- Rs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Document17 pagesRs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Moysés Isper NetoNo ratings yet

- 16 540-SignedDocument5 pages16 540-Signedapi-352277890No ratings yet

- Zambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Document15 pagesZambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Yaidhyt PradoNo ratings yet

- 2016 540 California Resident Income Tax ReturnDocument34 pages2016 540 California Resident Income Tax Returnapi-3512139760% (1)

- Planilla Federal Keyla 2021Document2 pagesPlanilla Federal Keyla 2021Keyla VelezNo ratings yet

- RTMF 990Document49 pagesRTMF 990Craig MaugerNo ratings yet

- Mart1552 21i FCDocument23 pagesMart1552 21i FCOlga M.No ratings yet

- FIRE 2011 Form 990Document36 pagesFIRE 2011 Form 990FIRENo ratings yet

- Review of Some SMS Verification Services and Virtual Debit/Credit Cards Services for Online Accounts VerificationsFrom EverandReview of Some SMS Verification Services and Virtual Debit/Credit Cards Services for Online Accounts VerificationsNo ratings yet

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513No ratings yet

- 2010 Psztur R Form 1040 Individual Tax ReturnDocument20 pages2010 Psztur R Form 1040 Individual Tax ReturnJaqueline LeslieNo ratings yet

- Federal Electronic Filing Instructions: Tax Year 2018Document13 pagesFederal Electronic Filing Instructions: Tax Year 2018Adonis TorrefielNo ratings yet

- Marylynn Huggins - Clifden Ut State Tax Return 2013Document4 pagesMarylynn Huggins - Clifden Ut State Tax Return 2013api-2573405260% (1)

- Victor Benji Wemh Intuit Tax ReturnDocument41 pagesVictor Benji Wemh Intuit Tax ReturnEmo RockstarNo ratings yet

- LG FFDocument1 pageLG FFfeem743No ratings yet

- Payment GatewayTestingDocument8 pagesPayment GatewayTestingkumar314100% (1)

- Captura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Document4 pagesCaptura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Adriana AnsurezNo ratings yet

- AlaAL ZAALIG2011Document5 pagesAlaAL ZAALIG2011Ala AlzaaligNo ratings yet

- VA Attendant EnrollmentDocument2 pagesVA Attendant EnrollmentJeannie ArringtonNo ratings yet

- 2022 Schedule 3 (Form 1040)Document2 pages2022 Schedule 3 (Form 1040)Riley CareNo ratings yet

- 033 Bob StatementDocument7 pages033 Bob StatementSmarty Jaiswal from news of indiaNo ratings yet

- Amrit Placement Services Pvt. LTD.: Salary Slip For The Month of September 2021Document1 pageAmrit Placement Services Pvt. LTD.: Salary Slip For The Month of September 2021Anil SharmaNo ratings yet

- Statement 20141230Document15 pagesStatement 20141230adam sandsNo ratings yet

- 2013 Tax Return (Shep-Ty DBA Embrace)Document24 pages2013 Tax Return (Shep-Ty DBA Embrace)Game ChangerNo ratings yet

- 2021 - TaxReturn 2pagessignedDocument3 pages2021 - TaxReturn 2pagessignedDedrick RiversNo ratings yet

- Fall 2023 - Tax ProjectDocument4 pagesFall 2023 - Tax Projectacwriters123No ratings yet

- P010 636211442428322820 T14385011dupD1 PDFDocument1 pageP010 636211442428322820 T14385011dupD1 PDFAnonymous pY5EUXUpaNo ratings yet

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingDocument3 pagesTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezNo ratings yet

- Tax - 2020-2021 PDFDocument2 pagesTax - 2020-2021 PDFShanto ChowdhuryNo ratings yet

- General Instructions For Forms W-2 and W-3: (Including Forms W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2c, and W-3c)Document35 pagesGeneral Instructions For Forms W-2 and W-3: (Including Forms W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2c, and W-3c)tarles666No ratings yet

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDocument7 pages2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisNo ratings yet

- Tax ReturnDocument26 pagesTax ReturnjoshuaharaldNo ratings yet

- Fairmount Heights - Documents 1 PDFDocument88 pagesFairmount Heights - Documents 1 PDFAri AsheNo ratings yet

- Animal VertebradoDocument2 pagesAnimal VertebradoAnguila Angel Anguila AngelNo ratings yet

- Choco Pop Morales IzabalDocument2 pagesChoco Pop Morales IzabalAnguila Angel Anguila AngelNo ratings yet

- AbecedarioDocument27 pagesAbecedarioAnguila Angel Anguila AngelNo ratings yet

- AbecedarioDocument27 pagesAbecedarioAnguila Angel Anguila AngelNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument32 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceKkunal gulatiNo ratings yet

- DRC 03Document2 pagesDRC 03HSCL BacheliNo ratings yet

- Web Generated Bill: Feeder: Islamia Park Sub Division: Islamia Park Division: Civil LineDocument1 pageWeb Generated Bill: Feeder: Islamia Park Sub Division: Islamia Park Division: Civil LineAkhtar AliNo ratings yet

- ACT Invoice for ACER LOGISTICS SOLUTIONSDocument2 pagesACT Invoice for ACER LOGISTICS SOLUTIONSThulasi Ram0% (1)

- DCLG Letter Re Second Homes and Empty Homes Sept 14Document2 pagesDCLG Letter Re Second Homes and Empty Homes Sept 14LeedsCommunityHomesNo ratings yet

- 060 Air Canada V CIR PDFDocument3 pages060 Air Canada V CIR PDFBeata CarolinoNo ratings yet

- I PM Clearing Format Error Numbers and Messages 201910Document456 pagesI PM Clearing Format Error Numbers and Messages 201910rh007No ratings yet

- NTS 4.7 Selection TrialDocument3 pagesNTS 4.7 Selection TrialNicholasFCheongNo ratings yet

- Taxation Case Summaries - 3-Manresa 2018-2019: Distribution of Dividends or Assets by Corporations.Document2 pagesTaxation Case Summaries - 3-Manresa 2018-2019: Distribution of Dividends or Assets by Corporations.Ergel Mae Encarnacion RosalNo ratings yet

- Apauline IciciDocument41 pagesApauline Icicihalotog831No ratings yet

- DRC 03 Letters-1Document2 pagesDRC 03 Letters-1anjani deviNo ratings yet

- Stuvia 695663 Silke Prescribed Book .Document1,177 pagesStuvia 695663 Silke Prescribed Book .ConradeNo ratings yet

- Invoice PBT3722A00855050Document1 pageInvoice PBT3722A00855050m.gowri shankarNo ratings yet

- Solar water heater proforma invoiceDocument1 pageSolar water heater proforma invoicevani energyNo ratings yet

- Salary Tax - Sonali SecuritiesDocument19 pagesSalary Tax - Sonali Securitieslimon islamNo ratings yet

- Hello Michael Ray,: Your Bill at A GlanceDocument3 pagesHello Michael Ray,: Your Bill at A GlancegarrettloehrNo ratings yet

- ETHIOPIAN CUSTOMS PROCEDURE CODESDocument9 pagesETHIOPIAN CUSTOMS PROCEDURE CODESYeGizate LijNo ratings yet

- Case Digest 2013Document35 pagesCase Digest 2013Jane Flandes Nobleza AbellaNo ratings yet

- Mary Joy P. Junio, Cpa Notre Dame of Midsayap College Midsayap, CotabatoDocument15 pagesMary Joy P. Junio, Cpa Notre Dame of Midsayap College Midsayap, CotabatoJonathan JunioNo ratings yet

- Acct Statement - XX4542 - 11012023Document3 pagesAcct Statement - XX4542 - 11012023Prachi JoshiNo ratings yet

- Lecture 3 Income Tax JurisdictionDocument22 pagesLecture 3 Income Tax JurisdictionAmsalu BelayNo ratings yet

- Dhaka Power Distribution Company Ltd. (DPDC) : Payment Short Ledger (Post-Paid)Document6 pagesDhaka Power Distribution Company Ltd. (DPDC) : Payment Short Ledger (Post-Paid)sagor islamNo ratings yet

- Ym Fo CSG 8 TF 4 WV4 enDocument14 pagesYm Fo CSG 8 TF 4 WV4 enAbhimanyuNo ratings yet

- P21 Balancing Statement 2023 1224447900015Document3 pagesP21 Balancing Statement 2023 1224447900015nathansilva2022No ratings yet

- SOC Islamic July Dec 2022 1Document60 pagesSOC Islamic July Dec 2022 1Syed Rafay HashmiNo ratings yet

- Case Study For 1st AssignmentDocument17 pagesCase Study For 1st AssignmentMaher Ahmed100% (1)