Professional Documents

Culture Documents

Financial Results For December 31, 2015 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results For December 31, 2015 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

Tirupati Starch gt Chemicals Ltd.

Regd. Office : Shree Rom Chombers, I't floor, l2 Agrowol Nogor, Moin Rood, INDORE - I

Phones : 2405001-2-3, 4052850, 4052888, Fox : 91-0731-2405000

E-moil : tirupoti@tirupotistorch.com

Works : Villoge-sejwoyo, Ghoio Billod, Dist. Dhor (M.P.) Phones : 107292} 277479,277280

Date: 11tt February, 20L6

To,

The Manager,

Listing Compliance,

Department of Corporate Services

Bombay Stock Exchange Limited,

P. J. Towers, Rotunda Building,

Dalal Street, Fort

Mumbai - 400 001

Ref.: - 524582, Scrip ID - TIRUSTA

Subject: Submission o.f llnaudited Financial Results and Limited Reaieut Report

Quarter and nine months endeil Sl-.L2.20L5

for the Third

Dear Sir,

Pursuant to Regulation 33 of Securities and Exchange Board of India (Listing Obligations and

Disclosure Requirements) Regulations, 2015, we wish to inJorm you that the Board of Directors

of the Company has approved Unaudited Financial Results and Limited Review Report for the

Third Quarter and nine months ended on3].12.201.5.

We are enclosing herewith a copy of the same.

This is for the information of Exchange and members thereof kindly acknowledge the receipt

and take on the record.

Thanking You.

Yours faithfully,

For,

Tirupati Starch

icals Limited

Q-c.-*'JL"n

Ramdas Goyal

DIN:00150037

Chairman and Manhgi4grDjrctor

Encl: af a

CIN No. : L15321 MP '1985 P1C003181 o website : www. tirupatistarch.com

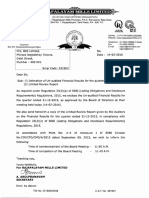

TIRUPATI STARCH AND CHEMICALS LIMITED

UNAUDITED FINANCIAL RESULTS FOR THE THIRD QUART ER AND NINE MONTHS ENDED 31ST DECEMBER,2015

lln Rs. Lakhsl

lln Rs. Lakhs)

lln Rs. Lakhs)

lln Rs. Lakhs)

lln Rs. Lakhsl

3 Month Ended

Particulars

(31.12.201s)

Corresponding

Preceeding 3

Preceeding 3

Year to date figures figures for the

Month Ended in

for Current Period Previous Year

the Previous

Month Ended

(30.0e.201s)

UnAudited

1. lncome from Ooerations

(a) Net Sales/lncome from Operations(Net of

Exclse Duty)

(b) Other OperatinA lncome

Total lncome from Opertaions (net) (1+2)

UnAudited

Previous Year

Ended

(31.03.2015)

ended (31.12.2015) Ended

Year

|3L.L2.20741

(Refer Notes Below)

In Rs. Lakhsl

Year to date

13L.L2.201,41

UnAudited

UnAudited

4,s33.8s

2927.3

7228.84

L5.O2

4.02

LL.82

4544.470

2925.32

L240.66

3702.972

2L23.29

82.52

0.000

UnAudited

11.395.569

36.62t

LL,432.197

Audited

4599.44

5977.725

73.77

57.58!

4613.15

5974.7L4

2330.3

4151.s55

2. Expenses

a. Consumption of raw materials

b. Purchase of stock in trade

c. Changes in inventories of finished goods,

work-in-progress and stock in trade

d. Emplovee Benefit

Exoenses

-163.108

-45.93

66.46

L52.824

L97.15

62.7

8339.182

83.777

28.682

-34.7

487.47A

344.79

-425.97C

319.51

e. Depreciation and Amortisation Expenses

185_00t

L84

15

f. Other exoenses

555

65

769.197

295.877

242.5

760.O4

692.907

7076.21

487.4LC

738.420

4911.986

468.81

222.O2

3169.82

1208.27

L744.060

11847.305

4436.43

57Lt.7!3

-363.116

-244.5

32.45

-415.109

L76.72

263.001

0.00(

0.00(

-41s.10S

Items exceeding 70% of totol expenses

relotinq to continuino ooerotions

i. Power&Fuel

Total Expenses

3.Profit/Loss from Operations before Other

lncome, finance cost and exceptional items

11-21

4. Other lncome

774.27

926.160

5.Profit\(Loss) from ordinary activities

before finance cost and exceptional items (3

4l

6. Finance Cost

-353.115

-244.5

32.45

L76.72

263.001

42.609

116.86

20.95

249.469

44.94

135.30r

11.s

-564.578

9L,780

727.70L

0.000

0.00c

-664.578

9L.78

L27.707

246.92(

9t.71

-L79.279

7. Profit/ (Loss) from Ordinary Activities

fl

after Finance Cost but before Exceptional

Items (5-6)

8. Exceptional items

9. Profit /(Loss) from Ordinary Activities

before tax (7+8)

10. Tax expense

11. Net Profit / (Loss) from Ordinary

Activities after tax (9-10)

l2.Extraordinary items (net of tax expenses

Rs.

Lakhs)

13.Net Profit/ (Loss) for the period {11-12)

4. Share of Profit/(Loss) of Associates

5. Minority lnterest

16. Net Profit/(Loss) after taxes, minority

interest and share of profit/(loss)

associates (13-14-151

-40s.725

-361.36

0.00r

-405.725

-361.3(

0.00c

-40s.725

.361.36

11.5

-664.578

0.000

-405.725

-351.36

11.5

-664.578

97,78,

-tlg.2!9

-405,725

-361.35

11.5

-654.57t

9L.78

-Ltg.zLS

609.32

609.32

609.32

609.32

609.32

609.32C

606.57

606.57

606.57

606.57

606.s7

606.570

11.5

0.000

0.000

of

17. Paid-up equity share capital (face Value of

the Share shall be indicated)

18. Reserves excluding Revaluation Reserves

as per balance sheet of previous accounting

vear

19.i. Earnings Per Share (EPS) (before

extraordinary items) (of

annualised)

Rs.

each) (not

-0.666

-0.666

a) Basic

b) Diluted

-0.593

0.019

1.091

0.151

-0.196

-0.593

0.019

1.091

0.151

-0.195

0.019

0.019

1.091

0.151

-0.19

1.091

0.151

-0.19

19.ii. Earnings Per Share (EPS) (after

extraordinary items) (of Rs. _

each) (not

annualisedl

a) Basic

-0.555

-0.593

b) Diluted

-0.666

-0.s93

See accomoavine note

to Financial Results

*Not Applicoble

N

otes:

1. The above unaudited financial results were taken on record by the

Audit Committee and the Board of Directors at their respective meetings held on

11th February,2015

2. lnter-Divisional Transfer is not treated as sale and raw material consumption, in view of announcement made by lCAl on Accounting Standard - 9.

However, it is not affecting the profit and loss of the Company.

3. ThecompanyhasonlyasinglereportablesegmentintermsoftherequirementsofAccountingstandard-LT,asprescribedbythelnstituteof

Chartered Accountants of lndia.

4. Provision for taxation if any will be provided at the year end.

5. Previous Year figures have been re-grouped and re-arranged wherever necessary.

Date : 11th February,2015

Place : INDORE

For and on behalf of the Board

Qsvu.'o(t-2

Ramdas Goyal

zlff.hemr^\

trl

Y.n

DIN: 00150037

Managing Director

Qh,#

You might also like

- Me Formulas and Review ManualDocument162 pagesMe Formulas and Review ManualLynel Arianne TaborNo ratings yet

- QS IpcDocument7 pagesQS Ipcmohammad_mohiuddi_15No ratings yet

- Fabm 2 Practice SetDocument31 pagesFabm 2 Practice SetDanise PorrasNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Cosumers Perception Towards Insurance - Project ReportDocument112 pagesCosumers Perception Towards Insurance - Project Reportkamdica93% (54)

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document13 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesConsolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Form B, Auditors Report For March 31, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Form A, Form B, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document5 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document8 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results For June 30, 2016 (Result)Document2 pagesStandalone & Consolidated Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document5 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results For June 30, 2016 (Result)Document2 pagesStandalone & Consolidated Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document2 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Eureka Project Profile-2Document28 pagesEureka Project Profile-2SarkarArdhenduRiponNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Export Incentives in IndiaDocument21 pagesExport Incentives in IndiaKarunakaran KrishnamenonNo ratings yet

- Introduction To Active Portfolio ManagementDocument31 pagesIntroduction To Active Portfolio ManagementPooja AgarwalNo ratings yet

- Cost Behavior and Cost-Volume-Profit Analysis: Opening CommentsDocument16 pagesCost Behavior and Cost-Volume-Profit Analysis: Opening CommentsNnickyle LaboresNo ratings yet

- Circular-COVID-April 2020Document2 pagesCircular-COVID-April 2020Bhavana MNo ratings yet

- Smart Summary Income Taxes CFADocument3 pagesSmart Summary Income Taxes CFAKazi HasanNo ratings yet

- Questions A B C D EDocument9 pagesQuestions A B C D EMhelveneNo ratings yet

- Transforming Nonprofit Business Models 2014Document3 pagesTransforming Nonprofit Business Models 2014winnielongNo ratings yet

- Advanced Accounting - PART 1Document6 pagesAdvanced Accounting - PART 1Akira Marantal ValdezNo ratings yet

- Dr. Domingo Clinic Chart of Accounts: Account Numbers Account Titles Current AssetsDocument2 pagesDr. Domingo Clinic Chart of Accounts: Account Numbers Account Titles Current AssetsmariaNo ratings yet

- Feasibility LecturesDocument13 pagesFeasibility Lecturesmohammad.mamdooh9472No ratings yet

- Chapter 6Document26 pagesChapter 6Annalyn MolinaNo ratings yet

- Caf 6 Tax Spring 2019Document5 pagesCaf 6 Tax Spring 2019Raza Ali SoomroNo ratings yet

- Income Tax NotesDocument16 pagesIncome Tax NotesAntonette Contreras DomalantaNo ratings yet

- 8401Document15 pages8401Naeem AnwarNo ratings yet

- Satyam Computer Services LTDDocument2 pagesSatyam Computer Services LTDManoj KarandeNo ratings yet

- RATIOS MEANING A Ratio Shows The Relationship Between Two Numbers.Document15 pagesRATIOS MEANING A Ratio Shows The Relationship Between Two Numbers.shru44No ratings yet

- Cash ManagementDocument5 pagesCash ManagementPYNJIMENEZNo ratings yet

- Chapter - 8Document17 pagesChapter - 8Maruf AhmedNo ratings yet

- Planning FmlaDocument10 pagesPlanning FmlaNoah Mzyece DhlaminiNo ratings yet

- Export Trade and DocumentationDocument248 pagesExport Trade and DocumentationSaudiDiesel SdecNo ratings yet

- Income TaxationDocument7 pagesIncome TaxationCARLOS JUAN CASACLANGNo ratings yet

- End Answers Chapter 2,3,4,7-1 Managerial Accounting Hilton PlattDocument14 pagesEnd Answers Chapter 2,3,4,7-1 Managerial Accounting Hilton PlattShivani TannuNo ratings yet

- 4 8 15 CPB2impactreport PDFDocument13 pages4 8 15 CPB2impactreport PDFShaun AdamsNo ratings yet

- China Fishery Group Limited: Rooms 3312-14, Hong Kong Plaza, 188 Connaught Road West, Hong KongDocument6 pagesChina Fishery Group Limited: Rooms 3312-14, Hong Kong Plaza, 188 Connaught Road West, Hong Kongtungaas20011No ratings yet

- 04 QuestionsDocument7 pages04 QuestionsfaizthemeNo ratings yet

- BCOM Syllabus MBB and Ram ThakurDocument4 pagesBCOM Syllabus MBB and Ram ThakurAnimeshSahaNo ratings yet